Key Insights

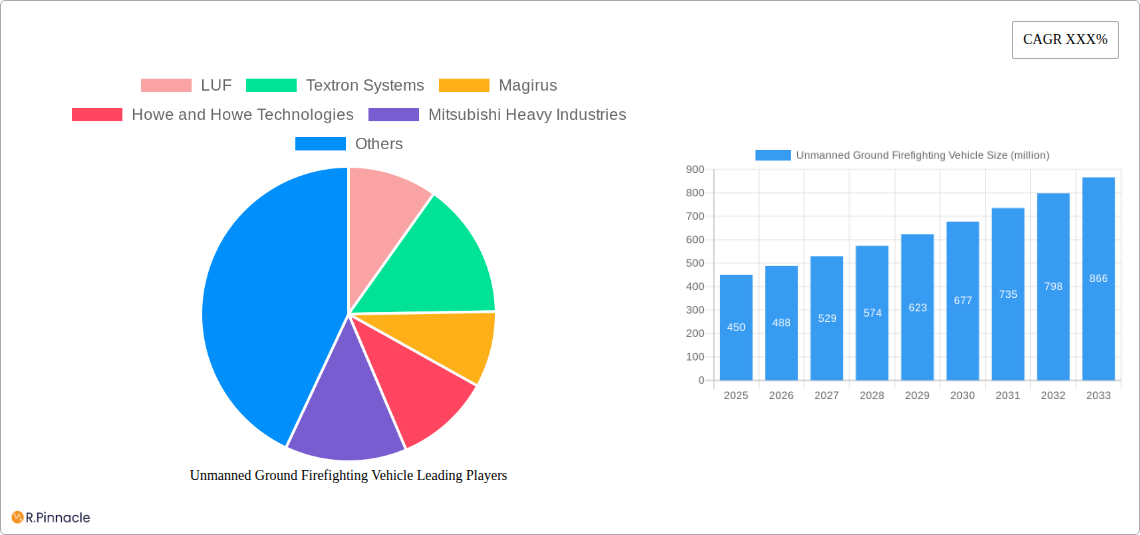

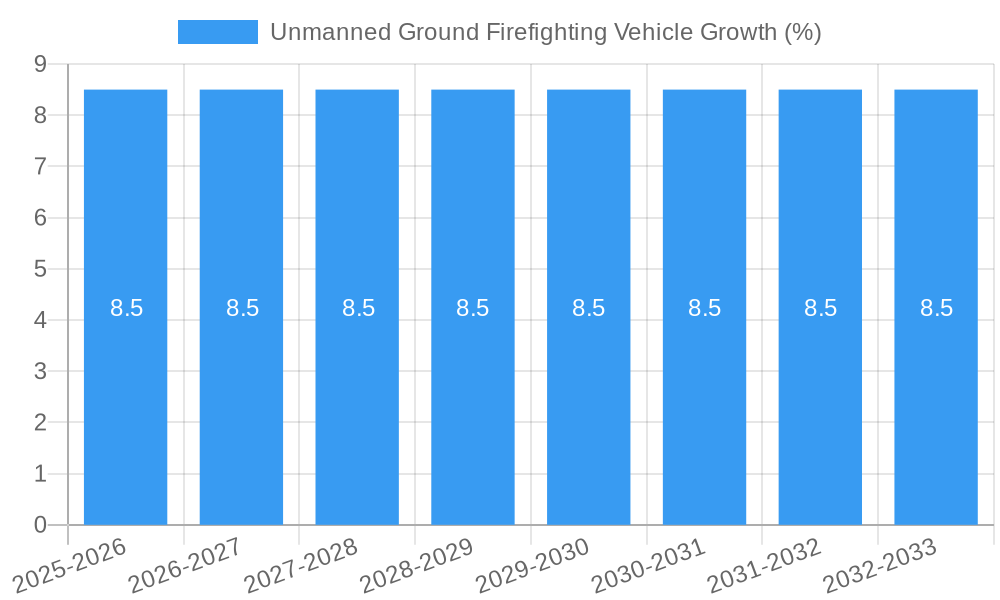

The global Unmanned Ground Firefighting Vehicle market is poised for significant expansion, with an estimated market size of approximately $450 million in 2025, projected to grow at a robust Compound Annual Growth Rate (CAGR) of around 8.5% through 2033. This upward trajectory is primarily driven by the increasing demand for enhanced safety in hazardous environments, such as industrial facilities, chemical plants, and forested areas, where traditional firefighting methods pose significant risks to human personnel. The growing adoption of advanced robotics and AI-powered solutions is also a key catalyst, enabling these unmanned vehicles to perform critical tasks like reconnaissance, water/foam deployment, and emergency response with greater precision and efficiency. Furthermore, stringent government regulations and the rising awareness of the economic and human costs associated with major fire incidents are compelling organizations across various sectors to invest in cutting-edge firefighting technologies. The market is segmented by application into Domesticity, Outdoor Forest, and Chemical sectors, with the Chemical and Outdoor Forest segments expected to lead in terms of adoption due to their inherent high-risk nature.

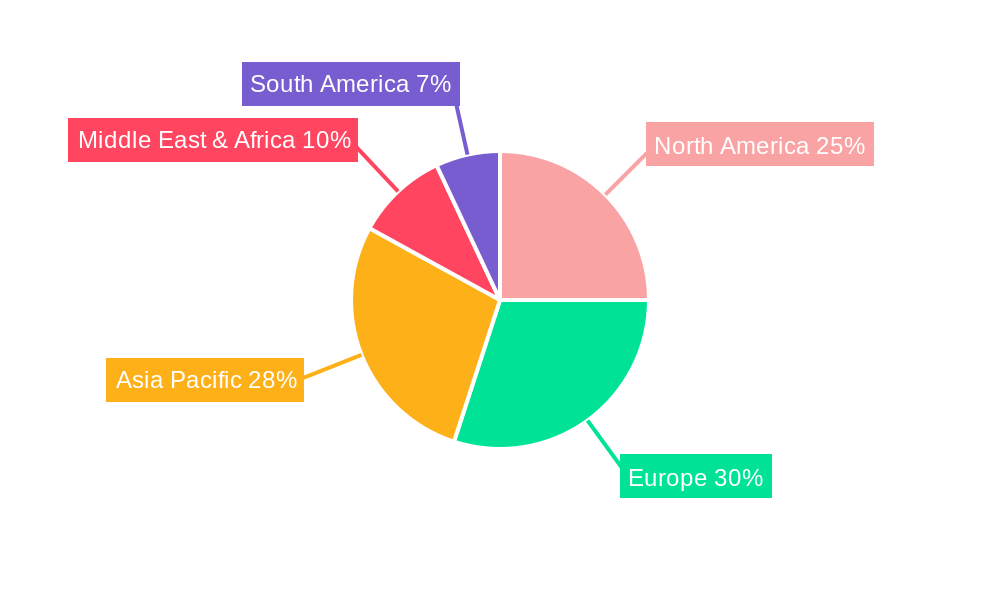

The market's growth, however, is not without its challenges. Restraints such as the high initial investment costs associated with these sophisticated vehicles, coupled with the need for specialized training and infrastructure for their operation and maintenance, could temper rapid widespread adoption in certain regions or smaller organizations. Nevertheless, the persistent trend towards automation and remote operation, especially in complex and dangerous scenarios, is creating substantial opportunities. Vehicular (moving) and Stationed (unit) types of unmanned firefighting vehicles are both witnessing innovation, with vehicular units offering greater mobility and coverage, while stationed units provide constant surveillance and rapid response capabilities. Major players like LUF, Textron Systems, Magirus, and Mitsubishi Heavy Industries are at the forefront of innovation, introducing advanced features and expanding their product portfolios to cater to diverse application needs. The Asia Pacific region, particularly China, is expected to emerge as a significant growth hub, driven by rapid industrialization and increasing investments in public safety infrastructure.

Unmanned Ground Firefighting Vehicle Market Structure & Innovation Trends

The Unmanned Ground Firefighting Vehicle (UGFV) market is characterized by a moderate to high level of concentration, with key players like LUF, Textron Systems, and Magirus leading innovation. The study period from 2019 to 2033, with a base year of 2025, reveals a dynamic landscape driven by advancements in robotics, AI, and remote operation technologies. Regulatory frameworks are evolving to accommodate these new firefighting solutions, although their impact varies by region. Product substitutes, such as enhanced manned vehicles and drone-based firefighting systems, exist but UGFVs offer distinct advantages in hazardous environments. End-user demographics span municipal fire departments, industrial facilities (chemical plants), and large outdoor areas (forests), all seeking enhanced safety and efficiency. Mergers and acquisitions (M&A) are becoming more prevalent as larger companies aim to integrate UGFV technology into their portfolios. While specific M&A deal values are not publicly disclosed for all transactions, the strategic importance of acquiring UGFV capabilities is evident in recent industry movements. Anticipated market share shifts will be influenced by the pace of technological adoption and cost-effectiveness improvements.

Unmanned Ground Firefighting Vehicle Market Dynamics & Trends

The Unmanned Ground Firefighting Vehicle market is poised for substantial growth, driven by an escalating demand for safer and more efficient firefighting solutions, particularly in high-risk environments. The historical period from 2019 to 2024 has witnessed a nascent but growing interest, with pilot programs and early deployments showcasing the potential of these autonomous systems. The base year of 2025 serves as a crucial benchmark, with significant technological breakthroughs expected to accelerate adoption. Market growth drivers include the increasing frequency and severity of wildfires, the inherent dangers associated with chemical fires, and the need to protect personnel in domestic and industrial settings. Technological disruptions, such as advancements in artificial intelligence for autonomous navigation, sophisticated sensor integration for real-time hazard assessment, and enhanced communication systems for remote control, are redefining operational capabilities. Consumer preferences are shifting towards solutions that minimize human exposure to extreme heat, toxic fumes, and structural collapse risks. The competitive dynamics are intensifying, with both established firefighting equipment manufacturers and emerging robotics companies vying for market share. Companies like Howe and Howe Technologies, Mitsubishi Heavy Industries, and Brokk are investing heavily in research and development to offer robust and versatile UGFVs. The market penetration is expected to rise sharply during the forecast period of 2025–2033, with a projected Compound Annual Growth Rate (CAGR) of approximately 15-20%, reaching a market size estimated in the billions of dollars by the end of the forecast period. The operational advantages, including the ability to operate continuously, cover larger areas, and access confined or unstable spaces, are key factors influencing this upward trajectory.

Dominant Regions & Segments in Unmanned Ground Firefighting Vehicle

North America is emerging as a dominant region in the Unmanned Ground Firefighting Vehicle market, largely propelled by a robust economy, significant investment in technological innovation, and a proactive approach to addressing wildfire threats. The United States, in particular, is a key market, driven by extensive forest coverage prone to devastating fires and a growing awareness of the limitations and risks of traditional firefighting methods. Government initiatives and funding for advanced emergency response technologies further bolster this dominance. Economically, the ability of U.S. municipalities and agencies to invest in high-value technological solutions like UGFVs is a significant factor.

- Key Drivers of Regional Dominance:

- Intense Wildfire Activity: Frequent and severe wildfires in regions like California and the Pacific Northwest necessitate advanced, resilient firefighting capabilities.

- Technological Adoption & R&D Investment: Strong government and private sector support for research and development in robotics and AI fosters innovation.

- Industrial Safety Regulations: Stringent safety regulations in chemical and petrochemical industries mandate the adoption of technologies that minimize human risk.

- Infrastructure Development: Investment in smart city initiatives and emergency response infrastructure supports the integration of autonomous systems.

In terms of application segments, Outdoor Forest firefighting is currently the most significant driver, accounting for a substantial portion of the market. The sheer scale of forest fires and the inherent danger to firefighters make UGFVs an attractive and increasingly necessary solution. The ability of these vehicles to navigate challenging terrain, endure extreme heat, and deploy large volumes of water or retardant autonomously or remotely offers unparalleled advantages.

- Dominance of Outdoor Forest Application:

- Vast Scale of Operations: UGFVs can cover extensive areas of forest fires more efficiently than manned units.

- Reduced Risk to Personnel: Eliminates the need for firefighters to operate in the immediate vicinity of dangerous flames and smoke.

- Endurance and Robustness: Designed to withstand harsh environmental conditions and operate for extended periods.

- Accessibility: Can reach remote and inaccessible areas often difficult for traditional firefighting crews.

The Vehicular (moving) type segment also holds considerable sway. These mobile UGFVs offer flexibility and mobility, allowing them to be deployed quickly to various incident sites and to adapt their position dynamically to changing fire conditions. Their ability to traverse uneven terrain and integrate advanced extinguishing systems makes them highly versatile.

- Key Factors for Vehicular (moving) Type Dominance:

- Mobility and Rapid Deployment: Crucial for responding to the dynamic nature of fires.

- Adaptability: Can be redeployed across different scenarios and terrains.

- Onboard Capabilities: Integration of water tanks, pumps, and extinguishing agents for immediate action.

- Remote Operation Efficiency: Allows operators to control movement and extinguishing actions from a safe distance.

The Chemical application segment, while smaller than outdoor forest firefighting, represents a high-value niche with significant growth potential. The extreme hazards associated with chemical fires demand specialized equipment that can operate in highly toxic and explosive environments, making UGFVs a critical asset. Companies like CITIC Heavy Industry Kaicheng Intelligent Equipment Co.,Ltd., Shandong Guoxing Intelligent Technology Co.,Ltd., Anhui Huning Intelligent Technology Co.,Ltd., Beijing Lingtian Intelligent Equipment Group Co.,Ltd., Nanyang Zhongtian Explosion-proof Electric Co.,Ltd., Shanghai Wujin Fire Safety Equipment Co.,Ltd., and Shanghai Qiangshi Fire Equipment Co.,Ltd. are actively developing solutions tailored for these demanding applications. The growth of industrial sectors and the increasing emphasis on workplace safety further fuel demand in this segment.

Unmanned Ground Firefighting Vehicle Product Innovations

Recent product innovations in the Unmanned Ground Firefighting Vehicle sector focus on enhancing autonomy, intelligence, and operational capabilities. Developers are integrating advanced AI for navigation and decision-making, sophisticated sensor suites (thermal imaging, gas detectors) for real-time threat assessment, and more powerful extinguishing systems. Competitive advantages are being built through improved maneuverability on difficult terrains, increased payload capacity for water and foam, and enhanced remote control interfaces for intuitive operation. Technological trends highlight a move towards modular designs for customization and easier maintenance, as well as the development of specialized UGFVs for specific applications like forest fires, industrial incidents, and confined space firefighting.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Unmanned Ground Firefighting Vehicle market, segmenting it by application and type. The Application segments include Domesticity, focusing on urban and residential areas where UGFVs can assist in structural fires, Outdoor Forest, addressing the critical need for wildfire suppression, and Chemical, catering to high-risk industrial environments. The Type segments cover Vehicular (moving), encompassing mobile autonomous or remote-controlled firefighting platforms, and Stationed (unit), referring to fixed, deployable firefighting modules.

- Domesticity: This segment, though currently smaller, is projected for steady growth as cities invest in advanced emergency response for residential fires, aiming to reduce casualties and property damage.

- Outdoor Forest: This segment is anticipated to experience the highest growth rate due to increasing global wildfire incidents and the proven efficacy of UGFVs in such scenarios.

- Chemical: This high-value segment, driven by stringent industrial safety regulations and the need for extreme hazard mitigation, is expected to see significant investment and technological advancement.

- Vehicular (moving): This segment will likely continue to dominate due to its inherent flexibility and rapid deployment capabilities across various firefighting scenarios.

- Stationed (unit): While more niche, this segment is poised for growth in areas requiring localized, continuous protection, such as critical infrastructure or high-risk industrial zones.

Key Drivers of Unmanned Ground Firefighting Vehicle Growth

The growth of the Unmanned Ground Firefighting Vehicle sector is primarily fueled by technological advancements, increasing safety concerns, and evolving regulatory landscapes. Innovations in AI, robotics, and sensor technology are enabling more autonomous and effective firefighting operations. The rising global incidence of wildfires and the inherent dangers of chemical fires are driving demand for solutions that minimize human exposure. Furthermore, supportive government policies and stricter safety regulations in industries are compelling organizations to invest in advanced firefighting equipment like UGFVs. The increasing operational efficiency and cost-effectiveness over the long term also contribute to their adoption.

Challenges in the Unmanned Ground Firefighting Vehicle Sector

Despite the promising growth, the Unmanned Ground Firefighting Vehicle sector faces several challenges. High initial procurement costs remain a significant barrier for smaller fire departments and organizations. Regulatory hurdles and the need for standardized operational protocols can slow down widespread adoption. Public perception and trust in autonomous firefighting systems also need to be addressed. Supply chain disruptions for specialized components and the requirement for skilled technicians for maintenance and operation present additional complexities. Furthermore, cybersecurity threats to remote control systems pose a potential risk that requires robust mitigation strategies.

Emerging Opportunities in Unmanned Ground Firefighting Vehicle

Emerging opportunities in the Unmanned Ground Firefighting Vehicle market are abundant, driven by ongoing technological innovation and the expanding applications. The development of smaller, more agile UGFVs for urban and indoor firefighting presents a significant new market. Integration with smart city infrastructure and IoT networks offers enhanced real-time data sharing and coordinated response capabilities. The growing demand for sustainable and environmentally friendly firefighting solutions also opens avenues for UGFVs utilizing advanced extinguishing agents. Furthermore, the global expansion into developing regions with increasing industrialization and a higher risk of wildfires provides substantial untapped market potential.

Leading Players in the Unmanned Ground Firefighting Vehicle Market

- LUF

- Textron Systems

- Magirus

- Howe and Howe Technologies

- Mitsubishi Heavy Industries

- Brokk

- DOK-ING

- POK

- CITIC Heavy Industry Kaicheng Intelligent Equipment Co.,Ltd.

- Shandong Guoxing Intelligent Technology Co.,Ltd.

- Anhui Huning Intelligent Technology Co.,Ltd.

- Beijing Lingtian Intelligent Equipment Group Co.,Ltd.

- Nanyang Zhongtian Explosion-proof Electric Co.,Ltd.

- Shanghai Wujin Fire Safety Equipment Co.,Ltd.

- Shanghai Qiangshi Fire Equipment Co.,Ltd.

Key Developments in Unmanned Ground Firefighting Vehicle Industry

- 2023/Early 2024: Increased deployment of UGFVs in large-scale wildfire suppression efforts globally, demonstrating enhanced capabilities in extreme conditions.

- 2023: Major manufacturers unveil next-generation UGFVs with advanced AI-driven autonomous navigation and multi-spectrum sensor integration.

- 2022/2023: Growing interest and investment in UGFVs for chemical plant safety and hazardous material incident response.

- 2021/2022: Expansion of UGFV applications into urban firefighting, focusing on structural integrity and personnel safety in dense environments.

- 2020/2021: Advancements in battery technology and power management enabling longer operational durations for UGFVs.

- 2019/2020: Introduction of modular UGFV designs allowing for customization and rapid adaptation to specific mission requirements.

Future Outlook for Unmanned Ground Firefighting Vehicle Market

The future outlook for the Unmanned Ground Firefighting Vehicle market is exceptionally bright, characterized by sustained innovation and expanding adoption across diverse sectors. Continued advancements in AI, sensor technology, and materials science will lead to more intelligent, resilient, and versatile UGFVs. The increasing awareness of the risks associated with traditional firefighting, coupled with supportive government policies and the undeniable operational advantages, will drive significant market growth. Strategic opportunities lie in developing specialized UGFVs for niche applications, integrating them with broader emergency response networks, and expanding their presence in emerging economies. The market is projected to witness a transformative period, solidifying UGFVs as indispensable tools in global fire safety and disaster management.

Unmanned Ground Firefighting Vehicle Segmentation

-

1. Application

- 1.1. Domesticity

- 1.2. Outdoor Forest

- 1.3. Chemical

-

2. Type

- 2.1. Vehicular (moving)

- 2.2. Stationed (unit)

Unmanned Ground Firefighting Vehicle Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Unmanned Ground Firefighting Vehicle REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Unmanned Ground Firefighting Vehicle Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Domesticity

- 5.1.2. Outdoor Forest

- 5.1.3. Chemical

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Vehicular (moving)

- 5.2.2. Stationed (unit)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Unmanned Ground Firefighting Vehicle Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Domesticity

- 6.1.2. Outdoor Forest

- 6.1.3. Chemical

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Vehicular (moving)

- 6.2.2. Stationed (unit)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Unmanned Ground Firefighting Vehicle Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Domesticity

- 7.1.2. Outdoor Forest

- 7.1.3. Chemical

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Vehicular (moving)

- 7.2.2. Stationed (unit)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Unmanned Ground Firefighting Vehicle Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Domesticity

- 8.1.2. Outdoor Forest

- 8.1.3. Chemical

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Vehicular (moving)

- 8.2.2. Stationed (unit)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Unmanned Ground Firefighting Vehicle Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Domesticity

- 9.1.2. Outdoor Forest

- 9.1.3. Chemical

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Vehicular (moving)

- 9.2.2. Stationed (unit)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Unmanned Ground Firefighting Vehicle Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Domesticity

- 10.1.2. Outdoor Forest

- 10.1.3. Chemical

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Vehicular (moving)

- 10.2.2. Stationed (unit)

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 LUF

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Textron Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Magirus

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Howe and Howe Technologies

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mitsubishi Heavy Industries

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Brokk

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DOK-ING

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 POK

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CITIC Heavy Industry Kaicheng Intelligent Equipment Co.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ltd.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Shandong Guoxing Intelligent Technology Co.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ltd.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Anhui Huning Intelligent Technology Co.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Ltd.

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Beijing Lingtian Intelligent Equipment Group Co.

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Ltd.

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Nanyang Zhongtian Explosion-proof Electric Co.

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Ltd.

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Shanghai Wujin Fire Safety Equipment Co.

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Ltd.

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Shanghai Qiangshi Fire Equipment Co.

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Ltd.

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 LUF

List of Figures

- Figure 1: Global Unmanned Ground Firefighting Vehicle Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Unmanned Ground Firefighting Vehicle Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Unmanned Ground Firefighting Vehicle Revenue (million), by Application 2024 & 2032

- Figure 4: North America Unmanned Ground Firefighting Vehicle Volume (K), by Application 2024 & 2032

- Figure 5: North America Unmanned Ground Firefighting Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Unmanned Ground Firefighting Vehicle Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Unmanned Ground Firefighting Vehicle Revenue (million), by Type 2024 & 2032

- Figure 8: North America Unmanned Ground Firefighting Vehicle Volume (K), by Type 2024 & 2032

- Figure 9: North America Unmanned Ground Firefighting Vehicle Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Unmanned Ground Firefighting Vehicle Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Unmanned Ground Firefighting Vehicle Revenue (million), by Country 2024 & 2032

- Figure 12: North America Unmanned Ground Firefighting Vehicle Volume (K), by Country 2024 & 2032

- Figure 13: North America Unmanned Ground Firefighting Vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Unmanned Ground Firefighting Vehicle Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Unmanned Ground Firefighting Vehicle Revenue (million), by Application 2024 & 2032

- Figure 16: South America Unmanned Ground Firefighting Vehicle Volume (K), by Application 2024 & 2032

- Figure 17: South America Unmanned Ground Firefighting Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Unmanned Ground Firefighting Vehicle Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Unmanned Ground Firefighting Vehicle Revenue (million), by Type 2024 & 2032

- Figure 20: South America Unmanned Ground Firefighting Vehicle Volume (K), by Type 2024 & 2032

- Figure 21: South America Unmanned Ground Firefighting Vehicle Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Unmanned Ground Firefighting Vehicle Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Unmanned Ground Firefighting Vehicle Revenue (million), by Country 2024 & 2032

- Figure 24: South America Unmanned Ground Firefighting Vehicle Volume (K), by Country 2024 & 2032

- Figure 25: South America Unmanned Ground Firefighting Vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Unmanned Ground Firefighting Vehicle Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Unmanned Ground Firefighting Vehicle Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Unmanned Ground Firefighting Vehicle Volume (K), by Application 2024 & 2032

- Figure 29: Europe Unmanned Ground Firefighting Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Unmanned Ground Firefighting Vehicle Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Unmanned Ground Firefighting Vehicle Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Unmanned Ground Firefighting Vehicle Volume (K), by Type 2024 & 2032

- Figure 33: Europe Unmanned Ground Firefighting Vehicle Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Unmanned Ground Firefighting Vehicle Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Unmanned Ground Firefighting Vehicle Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Unmanned Ground Firefighting Vehicle Volume (K), by Country 2024 & 2032

- Figure 37: Europe Unmanned Ground Firefighting Vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Unmanned Ground Firefighting Vehicle Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Unmanned Ground Firefighting Vehicle Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Unmanned Ground Firefighting Vehicle Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Unmanned Ground Firefighting Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Unmanned Ground Firefighting Vehicle Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Unmanned Ground Firefighting Vehicle Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Unmanned Ground Firefighting Vehicle Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Unmanned Ground Firefighting Vehicle Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Unmanned Ground Firefighting Vehicle Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Unmanned Ground Firefighting Vehicle Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Unmanned Ground Firefighting Vehicle Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Unmanned Ground Firefighting Vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Unmanned Ground Firefighting Vehicle Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Unmanned Ground Firefighting Vehicle Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Unmanned Ground Firefighting Vehicle Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Unmanned Ground Firefighting Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Unmanned Ground Firefighting Vehicle Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Unmanned Ground Firefighting Vehicle Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Unmanned Ground Firefighting Vehicle Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Unmanned Ground Firefighting Vehicle Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Unmanned Ground Firefighting Vehicle Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Unmanned Ground Firefighting Vehicle Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Unmanned Ground Firefighting Vehicle Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Unmanned Ground Firefighting Vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Unmanned Ground Firefighting Vehicle Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Unmanned Ground Firefighting Vehicle Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Unmanned Ground Firefighting Vehicle Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Unmanned Ground Firefighting Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Unmanned Ground Firefighting Vehicle Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Unmanned Ground Firefighting Vehicle Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Unmanned Ground Firefighting Vehicle Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Unmanned Ground Firefighting Vehicle Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Unmanned Ground Firefighting Vehicle Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Unmanned Ground Firefighting Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Unmanned Ground Firefighting Vehicle Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Unmanned Ground Firefighting Vehicle Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Unmanned Ground Firefighting Vehicle Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Unmanned Ground Firefighting Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Unmanned Ground Firefighting Vehicle Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Unmanned Ground Firefighting Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Unmanned Ground Firefighting Vehicle Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Unmanned Ground Firefighting Vehicle Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Unmanned Ground Firefighting Vehicle Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Unmanned Ground Firefighting Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Unmanned Ground Firefighting Vehicle Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Unmanned Ground Firefighting Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Unmanned Ground Firefighting Vehicle Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Unmanned Ground Firefighting Vehicle Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Unmanned Ground Firefighting Vehicle Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Unmanned Ground Firefighting Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Unmanned Ground Firefighting Vehicle Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Unmanned Ground Firefighting Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Unmanned Ground Firefighting Vehicle Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Unmanned Ground Firefighting Vehicle Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Unmanned Ground Firefighting Vehicle Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Unmanned Ground Firefighting Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Unmanned Ground Firefighting Vehicle Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Unmanned Ground Firefighting Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Unmanned Ground Firefighting Vehicle Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Unmanned Ground Firefighting Vehicle Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Unmanned Ground Firefighting Vehicle Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Unmanned Ground Firefighting Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Unmanned Ground Firefighting Vehicle Volume K Forecast, by Country 2019 & 2032

- Table 81: China Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Unmanned Ground Firefighting Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Unmanned Ground Firefighting Vehicle Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Unmanned Ground Firefighting Vehicle?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Unmanned Ground Firefighting Vehicle?

Key companies in the market include LUF, Textron Systems, Magirus, Howe and Howe Technologies, Mitsubishi Heavy Industries, Brokk, DOK-ING, POK, CITIC Heavy Industry Kaicheng Intelligent Equipment Co., Ltd., Shandong Guoxing Intelligent Technology Co., Ltd., Anhui Huning Intelligent Technology Co., Ltd., Beijing Lingtian Intelligent Equipment Group Co., Ltd., Nanyang Zhongtian Explosion-proof Electric Co., Ltd., Shanghai Wujin Fire Safety Equipment Co., Ltd., Shanghai Qiangshi Fire Equipment Co., Ltd..

3. What are the main segments of the Unmanned Ground Firefighting Vehicle?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Unmanned Ground Firefighting Vehicle," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Unmanned Ground Firefighting Vehicle report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Unmanned Ground Firefighting Vehicle?

To stay informed about further developments, trends, and reports in the Unmanned Ground Firefighting Vehicle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence