Key Insights

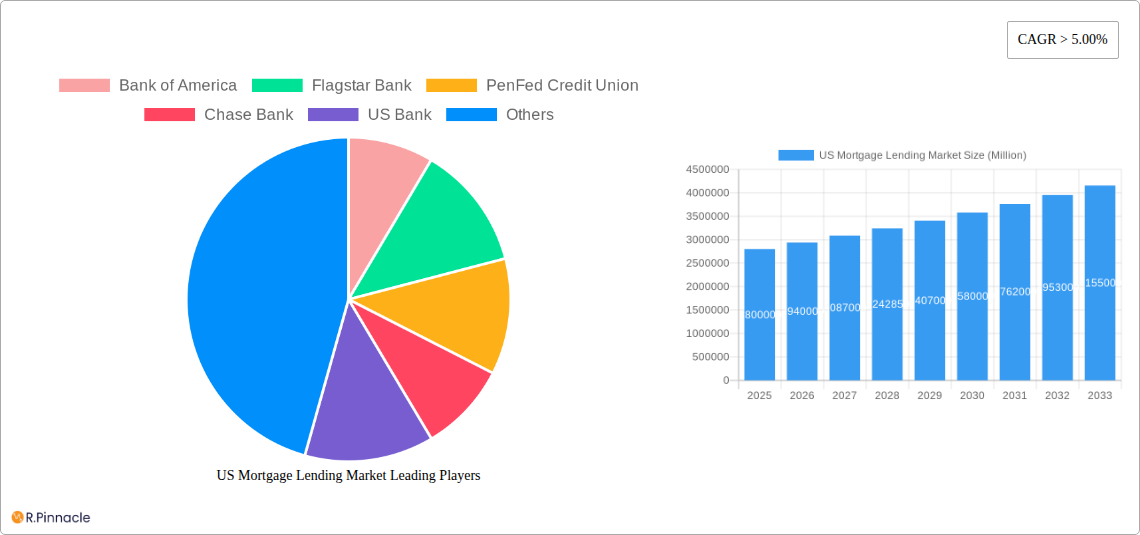

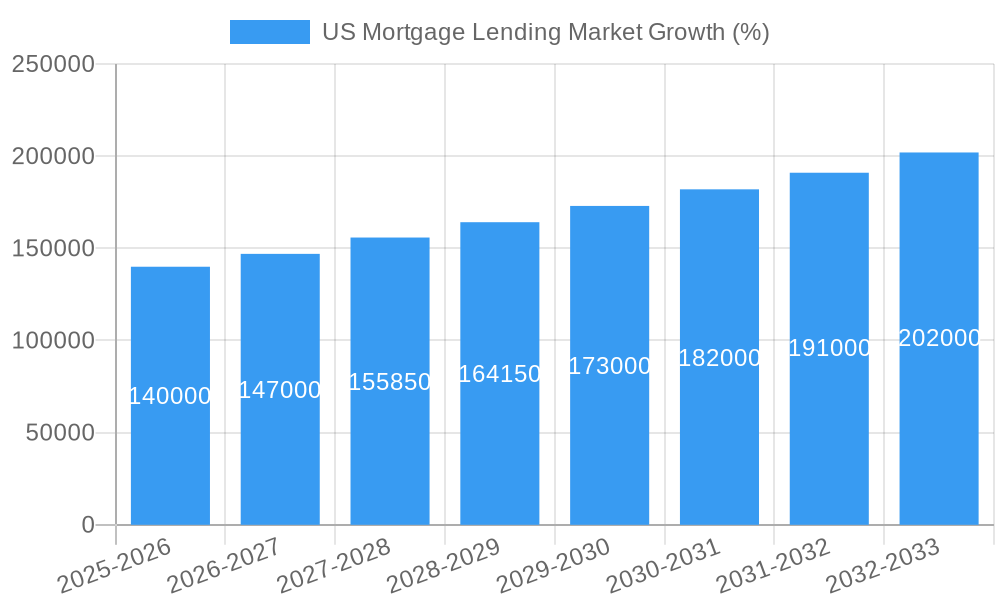

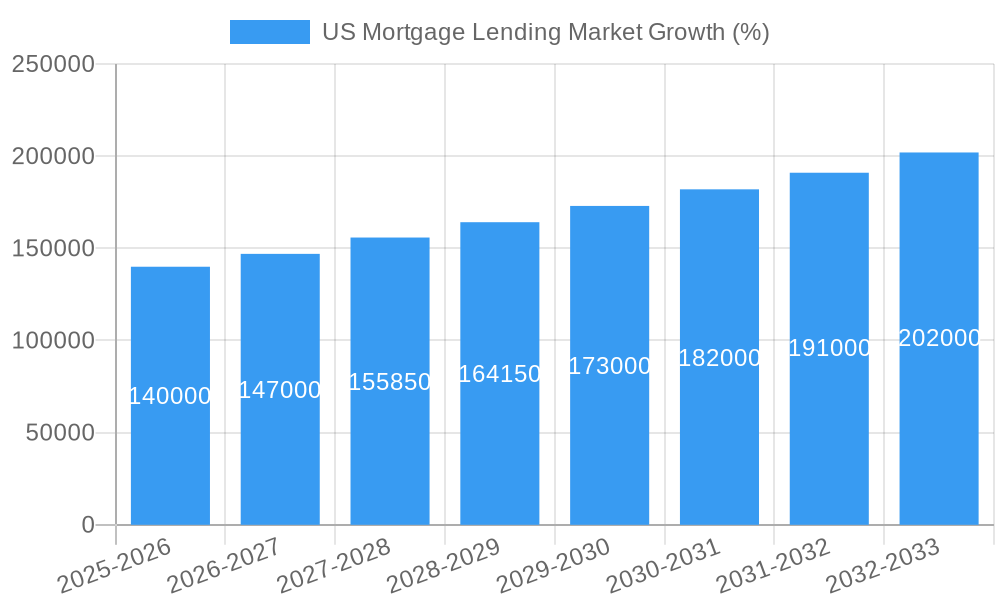

The US mortgage lending market is a substantial and dynamic sector, exhibiting robust growth potential. While precise market size figures for 2025 aren't provided, considering a CAGR exceeding 5% from a presumed base year (let's assume 2019), and considering fluctuations in interest rates and housing market activity, we can estimate the 2025 market size to be in the range of $2.5 trillion to $3 trillion. Key drivers include a growing population, increasing urbanization, and favorable government policies supporting homeownership. Emerging trends like the rise of fintech lending platforms, digital mortgage applications, and the increasing adoption of data analytics for credit scoring are reshaping the industry landscape. However, constraints such as rising interest rates, potential economic downturns impacting consumer confidence, and stricter lending regulations could moderate growth. The market is segmented by loan type (e.g., conventional, FHA, VA), loan purpose (e.g., purchase, refinance), and borrower characteristics (e.g., credit score, income). Major players like Bank of America, Chase Bank, and US Bank hold significant market share, but the competitive landscape is also influenced by regional and smaller banks, credit unions (such as PenFed and Navy Federal), and increasingly, innovative fintech companies.

The forecast period (2025-2033) presents opportunities for growth despite the inherent cyclical nature of the mortgage market. Continued technological advancements, particularly in areas like AI-powered underwriting and personalized lending solutions, will likely be a major factor determining future market performance. Understanding regional variations in housing markets and economic conditions will be crucial for lenders to optimize their strategies and manage risk effectively. Furthermore, navigating evolving regulatory environments and adapting to shifts in consumer preferences will be vital for sustained success within this competitive market. The market's overall health is intrinsically linked to broader macroeconomic factors, and monitoring indicators such as inflation, employment rates, and interest rate movements will be key to accurate forecasting and effective risk management.

US Mortgage Lending Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the US Mortgage Lending Market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, and future potential. The report leverages robust data and analysis to highlight key trends, challenges, and opportunities shaping this dynamic sector.

US Mortgage Lending Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, regulatory environment, and market dynamics within the US mortgage lending market. The study period spans from 2019-2024 (historical) and projects to 2033 (forecast). The base year is 2025, and the estimated year is also 2025.

Market Concentration: The US mortgage lending market exhibits a moderately concentrated structure with a few major players holding significant market share. Bank of America, Chase Bank, and US Bank are among the dominant players, collectively accounting for an estimated xx% of the market in 2025. Smaller regional and community banks, as well as credit unions like PenFed Credit Union and Navy Federal, also contribute significantly but with smaller individual market shares. The market share distribution indicates potential for further consolidation through mergers and acquisitions (M&A).

Innovation Drivers: Technological advancements, particularly in fintech, are driving significant innovation. The rise of digital lending platforms, automated underwriting processes, and AI-powered risk assessment tools are reshaping the industry. Regulatory changes, including those aimed at improving consumer protection and promoting financial inclusion, also play a key role in shaping innovation.

Regulatory Framework: The mortgage lending industry operates under a complex and evolving regulatory framework, impacting lending practices, risk management, and compliance costs. Changes to regulations can significantly influence market dynamics and the strategies of market participants.

Product Substitutes: Alternative financing options, such as home equity loans and lines of credit, are increasingly competing with traditional mortgages, influencing consumer choice and market dynamics.

End-User Demographics: The report analyzes the demographic profile of mortgage borrowers, including age, income, location, and homeownership status.

M&A Activities: The US mortgage lending market has seen significant M&A activity in recent years, driven by efforts to gain market share, enhance technological capabilities, and expand geographic reach. Deal values have ranged from tens to hundreds of Millions. For example, the recent acquisition of Spring EQ (see Key Developments section) highlights this trend.

US Mortgage Lending Market Market Dynamics & Trends

This section examines the growth drivers, technological disruptions, consumer preferences, and competitive dynamics influencing the US mortgage lending market. The analysis includes projected Compound Annual Growth Rates (CAGR) and market penetration rates.

The US mortgage lending market is expected to witness a CAGR of xx% during the forecast period (2025-2033), driven by factors including steady population growth, increasing urbanization, favorable government policies, and shifting consumer preferences towards homeownership. Technological disruptions such as the increasing use of AI and Machine Learning for credit scoring and risk assessment are altering the mortgage origination process. The increasing adoption of digital lending platforms has enhanced convenience and efficiency for consumers. Competitive dynamics are shaped by the increasing rivalry among large banks, smaller lenders, and fintech companies. The market penetration of digital lending platforms is anticipated to grow from xx% in 2025 to xx% by 2033.

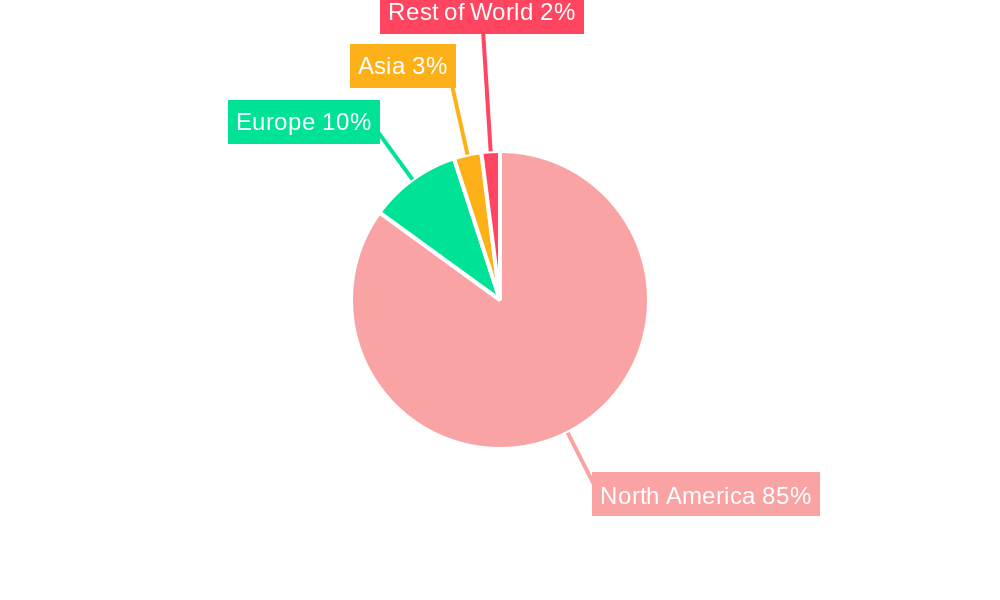

Dominant Regions & Segments in US Mortgage Lending Market

This section identifies the leading regions and segments within the US mortgage lending market.

Key Drivers: The dominance of specific regions and segments can be attributed to several factors:

- Economic Policies: Favorable government policies supporting homeownership, such as tax incentives and low-interest rates, can drive growth in certain regions.

- Infrastructure Development: Areas with strong infrastructure development and job markets often experience higher demand for mortgages.

- Population Growth: Regions with robust population growth naturally see increased demand for housing and subsequently, mortgages.

Dominance Analysis: While the entire US market is analyzed, specific regional variations in growth and market share are examined. For instance, regions with higher population density and stronger economic activity may exhibit higher mortgage lending volumes compared to other regions. Detailed analysis of these variations is included in the complete report.

US Mortgage Lending Market Product Innovations

This section summarizes recent product developments, focusing on technological trends and market fit. The mortgage lending industry is seeing innovations in product offerings including personalized mortgage solutions based on AI-driven risk assessment and the increasing use of blockchain technology for secure and efficient transaction processing. These innovations aim to improve the customer experience while streamlining processes, potentially leading to higher approval rates and reduced processing times.

Report Scope & Segmentation Analysis

The report segments the US mortgage lending market by various parameters to provide a comprehensive view. The segmentation includes: Loan type (conventional, FHA, VA, etc.), loan purpose (purchase, refinance), borrower type (first-time homebuyer, repeat buyer), and geographic location. Each segment's market size, growth projections, and competitive landscape are analyzed separately, presenting a granular picture of the market.

Key Drivers of US Mortgage Lending Market Growth

Several key factors fuel the growth of the US mortgage lending market: a growing population requiring housing, favorable interest rates, government initiatives boosting homeownership, and technological advancements enabling more efficient lending processes. These factors are detailed in the complete report with quantifiable examples.

Challenges in the US Mortgage Lending Market Sector

The US mortgage lending market faces several challenges: fluctuating interest rates, stringent regulatory compliance requirements, economic downturns impacting borrower affordability, and increasing competition from alternative lenders and fintech companies. The impact of these challenges on market growth is quantified in the complete report.

Emerging Opportunities in US Mortgage Lending Market

The report highlights several promising opportunities, including the expansion of digital lending platforms, the growth of the home equity lending market, the development of innovative mortgage products catering to specific customer needs, and the rise of sustainable mortgage offerings that support environmentally conscious practices. These opportunities are expected to create new avenues for growth in the coming years.

Leading Players in the US Mortgage Lending Market Market

- Bank of America

- Flagstar Bank

- PenFed Credit Union

- Chase Bank

- US Bank

- PNC Bank

- Navy Federal

- NBKC Bank

- Creditaid

- Citizens Commerce Bank (List Not Exhaustive)

Key Developments in US Mortgage Lending Market Industry

August 2023: Spring EQ's acquisition by Cerberus Capital Management signals increased investment in the home equity financing market. This development is likely to enhance Spring EQ's offerings and market position.

June 2023: The partnership between VIU by HUB and Unison facilitates easier access to insurance for homeowners using home equity sharing, potentially boosting this segment's growth.

Future Outlook for US Mortgage Lending Market Market

The future of the US mortgage lending market appears promising, driven by continued population growth, sustained demand for housing, and ongoing technological innovations. Strategic opportunities exist for lenders who can effectively leverage technology, offer personalized services, and adapt to evolving consumer preferences. The market is expected to exhibit steady growth, driven by both organic expansion and M&A activity.

US Mortgage Lending Market Segmentation

-

1. Type

- 1.1. Fixed rate loan

- 1.2. Home equity lines of credit

-

2. Service Providers

- 2.1. Commercial banks

- 2.2. Financial Institutions

- 2.3. Credit Unions

- 2.4. Other creditors

-

3. Mode

- 3.1. Online

- 3.2. Offline

US Mortgage Lending Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Mortgage Lending Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Home Renovation Trends are Driving the Market

- 3.3. Market Restrains

- 3.3.1. Home Renovation Trends are Driving the Market

- 3.4. Market Trends

- 3.4.1. Home Equity Lending Market is Being Stimulated By Rising Home Prices

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Mortgage Lending Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed rate loan

- 5.1.2. Home equity lines of credit

- 5.2. Market Analysis, Insights and Forecast - by Service Providers

- 5.2.1. Commercial banks

- 5.2.2. Financial Institutions

- 5.2.3. Credit Unions

- 5.2.4. Other creditors

- 5.3. Market Analysis, Insights and Forecast - by Mode

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America US Mortgage Lending Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fixed rate loan

- 6.1.2. Home equity lines of credit

- 6.2. Market Analysis, Insights and Forecast - by Service Providers

- 6.2.1. Commercial banks

- 6.2.2. Financial Institutions

- 6.2.3. Credit Unions

- 6.2.4. Other creditors

- 6.3. Market Analysis, Insights and Forecast - by Mode

- 6.3.1. Online

- 6.3.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America US Mortgage Lending Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fixed rate loan

- 7.1.2. Home equity lines of credit

- 7.2. Market Analysis, Insights and Forecast - by Service Providers

- 7.2.1. Commercial banks

- 7.2.2. Financial Institutions

- 7.2.3. Credit Unions

- 7.2.4. Other creditors

- 7.3. Market Analysis, Insights and Forecast - by Mode

- 7.3.1. Online

- 7.3.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe US Mortgage Lending Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fixed rate loan

- 8.1.2. Home equity lines of credit

- 8.2. Market Analysis, Insights and Forecast - by Service Providers

- 8.2.1. Commercial banks

- 8.2.2. Financial Institutions

- 8.2.3. Credit Unions

- 8.2.4. Other creditors

- 8.3. Market Analysis, Insights and Forecast - by Mode

- 8.3.1. Online

- 8.3.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa US Mortgage Lending Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fixed rate loan

- 9.1.2. Home equity lines of credit

- 9.2. Market Analysis, Insights and Forecast - by Service Providers

- 9.2.1. Commercial banks

- 9.2.2. Financial Institutions

- 9.2.3. Credit Unions

- 9.2.4. Other creditors

- 9.3. Market Analysis, Insights and Forecast - by Mode

- 9.3.1. Online

- 9.3.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific US Mortgage Lending Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Fixed rate loan

- 10.1.2. Home equity lines of credit

- 10.2. Market Analysis, Insights and Forecast - by Service Providers

- 10.2.1. Commercial banks

- 10.2.2. Financial Institutions

- 10.2.3. Credit Unions

- 10.2.4. Other creditors

- 10.3. Market Analysis, Insights and Forecast - by Mode

- 10.3.1. Online

- 10.3.2. Offline

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Bank of America

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Flagstar Bank

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PenFed Credit Union

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Chase Bank

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 US Bank

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 PNC Bank

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Navy Federal

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NBKC Bank

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Creditaid

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Citizens Commerce Bank**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bank of America

List of Figures

- Figure 1: Global US Mortgage Lending Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America US Mortgage Lending Market Revenue (Million), by Type 2024 & 2032

- Figure 3: North America US Mortgage Lending Market Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America US Mortgage Lending Market Revenue (Million), by Service Providers 2024 & 2032

- Figure 5: North America US Mortgage Lending Market Revenue Share (%), by Service Providers 2024 & 2032

- Figure 6: North America US Mortgage Lending Market Revenue (Million), by Mode 2024 & 2032

- Figure 7: North America US Mortgage Lending Market Revenue Share (%), by Mode 2024 & 2032

- Figure 8: North America US Mortgage Lending Market Revenue (Million), by Country 2024 & 2032

- Figure 9: North America US Mortgage Lending Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America US Mortgage Lending Market Revenue (Million), by Type 2024 & 2032

- Figure 11: South America US Mortgage Lending Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America US Mortgage Lending Market Revenue (Million), by Service Providers 2024 & 2032

- Figure 13: South America US Mortgage Lending Market Revenue Share (%), by Service Providers 2024 & 2032

- Figure 14: South America US Mortgage Lending Market Revenue (Million), by Mode 2024 & 2032

- Figure 15: South America US Mortgage Lending Market Revenue Share (%), by Mode 2024 & 2032

- Figure 16: South America US Mortgage Lending Market Revenue (Million), by Country 2024 & 2032

- Figure 17: South America US Mortgage Lending Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe US Mortgage Lending Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe US Mortgage Lending Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe US Mortgage Lending Market Revenue (Million), by Service Providers 2024 & 2032

- Figure 21: Europe US Mortgage Lending Market Revenue Share (%), by Service Providers 2024 & 2032

- Figure 22: Europe US Mortgage Lending Market Revenue (Million), by Mode 2024 & 2032

- Figure 23: Europe US Mortgage Lending Market Revenue Share (%), by Mode 2024 & 2032

- Figure 24: Europe US Mortgage Lending Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe US Mortgage Lending Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Middle East & Africa US Mortgage Lending Market Revenue (Million), by Type 2024 & 2032

- Figure 27: Middle East & Africa US Mortgage Lending Market Revenue Share (%), by Type 2024 & 2032

- Figure 28: Middle East & Africa US Mortgage Lending Market Revenue (Million), by Service Providers 2024 & 2032

- Figure 29: Middle East & Africa US Mortgage Lending Market Revenue Share (%), by Service Providers 2024 & 2032

- Figure 30: Middle East & Africa US Mortgage Lending Market Revenue (Million), by Mode 2024 & 2032

- Figure 31: Middle East & Africa US Mortgage Lending Market Revenue Share (%), by Mode 2024 & 2032

- Figure 32: Middle East & Africa US Mortgage Lending Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Middle East & Africa US Mortgage Lending Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Asia Pacific US Mortgage Lending Market Revenue (Million), by Type 2024 & 2032

- Figure 35: Asia Pacific US Mortgage Lending Market Revenue Share (%), by Type 2024 & 2032

- Figure 36: Asia Pacific US Mortgage Lending Market Revenue (Million), by Service Providers 2024 & 2032

- Figure 37: Asia Pacific US Mortgage Lending Market Revenue Share (%), by Service Providers 2024 & 2032

- Figure 38: Asia Pacific US Mortgage Lending Market Revenue (Million), by Mode 2024 & 2032

- Figure 39: Asia Pacific US Mortgage Lending Market Revenue Share (%), by Mode 2024 & 2032

- Figure 40: Asia Pacific US Mortgage Lending Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia Pacific US Mortgage Lending Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global US Mortgage Lending Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global US Mortgage Lending Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global US Mortgage Lending Market Revenue Million Forecast, by Service Providers 2019 & 2032

- Table 4: Global US Mortgage Lending Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 5: Global US Mortgage Lending Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global US Mortgage Lending Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Global US Mortgage Lending Market Revenue Million Forecast, by Service Providers 2019 & 2032

- Table 8: Global US Mortgage Lending Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 9: Global US Mortgage Lending Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United States US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Canada US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Mexico US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global US Mortgage Lending Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Global US Mortgage Lending Market Revenue Million Forecast, by Service Providers 2019 & 2032

- Table 15: Global US Mortgage Lending Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 16: Global US Mortgage Lending Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Brazil US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of South America US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global US Mortgage Lending Market Revenue Million Forecast, by Type 2019 & 2032

- Table 21: Global US Mortgage Lending Market Revenue Million Forecast, by Service Providers 2019 & 2032

- Table 22: Global US Mortgage Lending Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 23: Global US Mortgage Lending Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United Kingdom US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Germany US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: France US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Italy US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Spain US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Russia US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Benelux US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Nordics US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Europe US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global US Mortgage Lending Market Revenue Million Forecast, by Type 2019 & 2032

- Table 34: Global US Mortgage Lending Market Revenue Million Forecast, by Service Providers 2019 & 2032

- Table 35: Global US Mortgage Lending Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 36: Global US Mortgage Lending Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Turkey US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Israel US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: GCC US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: North Africa US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: South Africa US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Middle East & Africa US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global US Mortgage Lending Market Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Global US Mortgage Lending Market Revenue Million Forecast, by Service Providers 2019 & 2032

- Table 45: Global US Mortgage Lending Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 46: Global US Mortgage Lending Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: China US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: ASEAN US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Oceania US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific US Mortgage Lending Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Mortgage Lending Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the US Mortgage Lending Market?

Key companies in the market include Bank of America, Flagstar Bank, PenFed Credit Union, Chase Bank, US Bank, PNC Bank, Navy Federal, NBKC Bank, Creditaid, Citizens Commerce Bank**List Not Exhaustive.

3. What are the main segments of the US Mortgage Lending Market?

The market segments include Type, Service Providers, Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Home Renovation Trends are Driving the Market.

6. What are the notable trends driving market growth?

Home Equity Lending Market is Being Stimulated By Rising Home Prices.

7. Are there any restraints impacting market growth?

Home Renovation Trends are Driving the Market.

8. Can you provide examples of recent developments in the market?

August 2023: Spring EQ, a provider of home equity financing solutions, has entered into a definitive agreement to be acquired by an affiliate of Cerberus Capital Management, L.P., a global leader in alternative investing. The main aim of the partnership is to support Spring EQ's mission to deliver offerings and expand its leadership in the home equity financing market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Mortgage Lending Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Mortgage Lending Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Mortgage Lending Market?

To stay informed about further developments, trends, and reports in the US Mortgage Lending Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence