Key Insights

The Indian used car market, valued at ₹31.62 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 15.10% from 2025 to 2033. This surge is driven by several factors. Increasing affordability compared to new cars, a wider variety of choices across segments (hatchbacks, sedans, and SUVs), and the expanding presence of organized players like CARS24, Mahindra First Choice, and others offering certified pre-owned vehicles are key contributors. Furthermore, evolving consumer preferences towards shorter ownership cycles and the convenience of online platforms facilitate seamless transactions, boosting market expansion. However, the market also faces challenges, including concerns around vehicle history and maintenance, and the presence of a large unorganized sector lacking standardized quality checks. Regional variations exist, with potential for significant growth in less penetrated markets. The shift towards fuel-efficient vehicles (petrol and diesel) continues to influence buyer choices. The organized sector is expected to gain market share steadily due to its emphasis on transparency and trust, attracting a larger portion of the increasingly discerning customer base.

Used Car Market In India Market Size (In Billion)

The forecast period (2025-2033) promises continued expansion. The CAGR of 15.10% suggests a substantial increase in market size by 2033. To illustrate, assuming a consistent CAGR, the market size could reach approximately ₹130 billion by 2033 (this is a projection based on the given CAGR and not an exact figure). Further growth hinges on the successful expansion of organized players, stricter regulatory oversight enhancing consumer trust in the used car market, and sustained economic growth driving overall vehicle demand. Continued improvements in online platforms will streamline the purchase process, encouraging wider participation from both buyers and sellers. Government initiatives aimed at promoting responsible used car sales practices could also positively impact the market's future trajectory.

Used Car Market In India Company Market Share

Used Car Market In India: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning used car market in India, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Spanning the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, identifies key players, and forecasts future growth. We delve into market segmentation by vehicle type (Hatchbacks, Sedans, SUVs), vendor type (Organized, Unorganized), and fuel type (Petrol, Diesel), providing a granular understanding of this dynamic sector.

Used Car Market In India Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Indian used car market, encompassing market concentration, innovation drivers, regulatory frameworks, and significant M&A activities. The report examines the market share held by key players and analyzes the financial impact of mergers and acquisitions. The organized sector, dominated by players like Maruti True Value and Mahindra First Choice Wheels, accounts for approximately xx Million of the total market value, while the unorganized sector constitutes the remaining xx Million. Innovation is primarily driven by technological advancements in online platforms, AI-powered inspection tools, and enhanced customer service. Regulatory frameworks, while evolving, impact market transparency and consumer protection. The total M&A deal value within the study period is estimated at xx Million, influencing market consolidation and technological adoption.

- Market Concentration: Highly fragmented, with organized players gaining market share.

- Innovation Drivers: Technological advancements in online platforms and AI-powered inspection.

- Regulatory Frameworks: Evolving regulations focused on transparency and consumer protection.

- Product Substitutes: Limited direct substitutes, primarily newer models at higher price points.

- End-User Demographics: Growing middle class and increasing vehicle ownership fuels demand.

- M&A Activities: Significant consolidation observed in recent years, with deal values totaling xx Million.

Used Car Market In India Market Dynamics & Trends

The Indian used car market exhibits robust growth, driven by rising disposable incomes, increasing urbanization, and a preference for cost-effective transportation options. Technological advancements, particularly in online marketplaces and digital financing, are significantly impacting market penetration and consumer behavior. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected at xx%, exceeding the historical CAGR of xx%. Market penetration is also rising, with a projected xx% of total vehicle sales expected to be in the used car segment by 2033. Competitive dynamics are intense, with both organized and unorganized players vying for market share. Consumer preferences are shifting towards newer models, certified pre-owned vehicles, and enhanced warranty options.

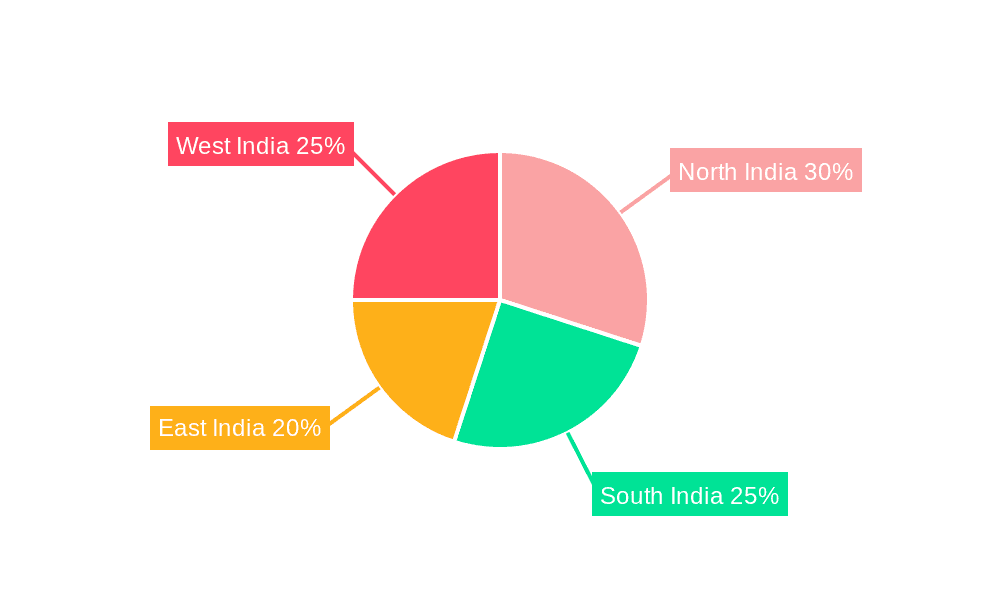

Dominant Regions & Segments in Used Car Market In India

The report identifies key regions and segments within the Indian used car market, highlighting their dominance and the factors contributing to their success. While detailed regional data requires further analysis, we note a significant market presence in metropolitan areas with high vehicle density.

- By Vehicle Type: SUVs are experiencing the highest growth, driven by increased affordability and changing consumer preferences. Sedans maintain a significant market share, while hatchbacks remain popular in certain segments.

- By Vendor Type: Organized players, benefiting from established brand recognition, technological capabilities, and customer service, are steadily gaining market share, though the unorganized sector remains substantial.

- By Fuel Type: Petrol vehicles hold a larger market share currently, although diesel vehicles retain importance in certain segments. The growth of electric vehicles and their impact on the used car market requires further study.

Key Drivers:

- Economic Policies: Government initiatives aimed at promoting vehicle ownership influence market growth.

- Infrastructure: Improved road networks and transportation infrastructure support increased vehicle usage.

- Consumer Preferences: Shifting preferences towards specific vehicle types and fuel types impact market dynamics.

Used Car Market In India Product Innovations

The used car market is witnessing significant innovation, primarily through the adoption of online platforms, AI-powered vehicle inspection tools, and enhanced financing options. These advancements improve transparency, streamline the buying process, and enhance customer experience. The introduction of certified pre-owned programs by manufacturers also builds consumer confidence. These innovations directly improve market efficiency and increase consumer trust, promoting growth.

Report Scope & Segmentation Analysis

This report segments the Indian used car market by vehicle type (Hatchbacks, Sedans, SUVs), vendor type (Organized, Unorganized), and fuel type (Petrol, Diesel). Each segment's growth projection, market size, and competitive dynamics are detailed within the report. Further analysis showcases the evolution of each segment over the study period, providing insights into growth rates and market share distribution across different vehicle types, vendor structures, and fuel preferences.

Key Drivers of Used Car Market In India Growth

The growth of the Indian used car market is driven by a confluence of factors. Rising disposable incomes and an expanding middle class fuel demand. Technological advancements in online marketplaces and financing options have improved accessibility and transparency. Government initiatives promoting vehicle ownership, though indirectly impacting the new car market, also contribute positively to the used car segment. Additionally, the increasing affordability of used vehicles makes them a viable alternative to new vehicles for a large segment of the population.

Challenges in the Used Car Market In India Sector

Despite its growth trajectory, the used car market faces several challenges. The unorganized sector's lack of transparency and inconsistent quality pose risks to consumers. Supply chain inefficiencies and logistical hurdles can impact vehicle availability and pricing. Moreover, the need for standardized quality checks and stricter regulations to address issues of vehicle history and authenticity remain significant challenges impacting consumer confidence. The total estimated financial impact of these challenges in 2025 is projected to be xx Million.

Emerging Opportunities in Used Car Market In India

The used car market presents several compelling opportunities. The expansion of online platforms and digital financing offers significant growth potential. The increasing demand for certified pre-owned vehicles presents opportunities for organized players. Moreover, the emergence of the used electric vehicle market represents a new frontier with substantial future growth potential. Finally, there is a growing demand for specialized services such as vehicle refurbishment and customization, creating further opportunities within the sector.

Leading Players in the Used Car Market In India Market

- CARS

- Hyundai H Promise

- CarTrade

- Honda Auto Terrace

- BMW Premium Selection

- Big Boy Toyz

- Mercedes-Benz Certified

- Audi Approved Plus

- Toyota U Trust

- Mahindra First Choice Wheels

- Ford Assured

- OLX

- Maruti True Value

Key Developments in Used Car Market In India Industry

- August 2021: Mahindra First Choice Wheels (MFCW) partners with CamCom for AI-powered vehicle inspections, enhancing efficiency and accuracy.

- August 2021: Mercedes-Benz India launches a direct customer-to-customer platform ("Marketplace") for pre-owned luxury vehicles.

- August 2022: Lexus India launches its Lexus Certified Programme, boosting resale value and accessibility for Lexus vehicles.

Future Outlook for Used Car Market In India Market

The Indian used car market is poised for continued strong growth, fueled by increasing urbanization, rising disposable incomes, and technological advancements. The expansion of organized players, coupled with the evolution of online platforms and enhanced customer services, will further accelerate market expansion. Strategic acquisitions and technological innovations will redefine market dynamics, fostering healthy competition and ultimately benefitting consumers. The market's future hinges on addressing existing challenges through regulatory enhancements and technological advancements to enhance transparency and consumer confidence.

Used Car Market In India Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedans

- 1.3. Sports Utility Vehicles (SUV)

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Fuel Type

- 3.1. Petrol

- 3.2. Diesel

Used Car Market In India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Used Car Market In India Regional Market Share

Geographic Coverage of Used Car Market In India

Used Car Market In India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Diverse Selection Among Car Models Is Anticipated To Drive The Market Growth

- 3.3. Market Restrains

- 3.3.1. Counterfeit and Illegally Imported Vehicles Is Restraining The Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Middle Class and Young Population

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Used Car Market In India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedans

- 5.1.3. Sports Utility Vehicles (SUV)

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Petrol

- 5.3.2. Diesel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Used Car Market In India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Hatchbacks

- 6.1.2. Sedans

- 6.1.3. Sports Utility Vehicles (SUV)

- 6.2. Market Analysis, Insights and Forecast - by Vendor Type

- 6.2.1. Organized

- 6.2.2. Unorganized

- 6.3. Market Analysis, Insights and Forecast - by Fuel Type

- 6.3.1. Petrol

- 6.3.2. Diesel

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. South America Used Car Market In India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Hatchbacks

- 7.1.2. Sedans

- 7.1.3. Sports Utility Vehicles (SUV)

- 7.2. Market Analysis, Insights and Forecast - by Vendor Type

- 7.2.1. Organized

- 7.2.2. Unorganized

- 7.3. Market Analysis, Insights and Forecast - by Fuel Type

- 7.3.1. Petrol

- 7.3.2. Diesel

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Europe Used Car Market In India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Hatchbacks

- 8.1.2. Sedans

- 8.1.3. Sports Utility Vehicles (SUV)

- 8.2. Market Analysis, Insights and Forecast - by Vendor Type

- 8.2.1. Organized

- 8.2.2. Unorganized

- 8.3. Market Analysis, Insights and Forecast - by Fuel Type

- 8.3.1. Petrol

- 8.3.2. Diesel

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East & Africa Used Car Market In India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Hatchbacks

- 9.1.2. Sedans

- 9.1.3. Sports Utility Vehicles (SUV)

- 9.2. Market Analysis, Insights and Forecast - by Vendor Type

- 9.2.1. Organized

- 9.2.2. Unorganized

- 9.3. Market Analysis, Insights and Forecast - by Fuel Type

- 9.3.1. Petrol

- 9.3.2. Diesel

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Asia Pacific Used Car Market In India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Hatchbacks

- 10.1.2. Sedans

- 10.1.3. Sports Utility Vehicles (SUV)

- 10.2. Market Analysis, Insights and Forecast - by Vendor Type

- 10.2.1. Organized

- 10.2.2. Unorganized

- 10.3. Market Analysis, Insights and Forecast - by Fuel Type

- 10.3.1. Petrol

- 10.3.2. Diesel

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CARS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hyundai H Promise

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Car Trade

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honda Auto Terrace

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BMW Premium Selection

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Big Boy Toyz

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mercedes-Benz Certified

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Audi Approved Plus

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Toyota U Trust

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mahindra First Choice Wheels

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ford Assured

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 OL

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Maruti True Value

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 CARS

List of Figures

- Figure 1: Global Used Car Market In India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Used Car Market In India Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Used Car Market In India Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Used Car Market In India Revenue (Million), by Vendor Type 2025 & 2033

- Figure 5: North America Used Car Market In India Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 6: North America Used Car Market In India Revenue (Million), by Fuel Type 2025 & 2033

- Figure 7: North America Used Car Market In India Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 8: North America Used Car Market In India Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Used Car Market In India Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Used Car Market In India Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 11: South America Used Car Market In India Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: South America Used Car Market In India Revenue (Million), by Vendor Type 2025 & 2033

- Figure 13: South America Used Car Market In India Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 14: South America Used Car Market In India Revenue (Million), by Fuel Type 2025 & 2033

- Figure 15: South America Used Car Market In India Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 16: South America Used Car Market In India Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Used Car Market In India Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Used Car Market In India Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 19: Europe Used Car Market In India Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Europe Used Car Market In India Revenue (Million), by Vendor Type 2025 & 2033

- Figure 21: Europe Used Car Market In India Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 22: Europe Used Car Market In India Revenue (Million), by Fuel Type 2025 & 2033

- Figure 23: Europe Used Car Market In India Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 24: Europe Used Car Market In India Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Used Car Market In India Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Used Car Market In India Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Middle East & Africa Used Car Market In India Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Middle East & Africa Used Car Market In India Revenue (Million), by Vendor Type 2025 & 2033

- Figure 29: Middle East & Africa Used Car Market In India Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 30: Middle East & Africa Used Car Market In India Revenue (Million), by Fuel Type 2025 & 2033

- Figure 31: Middle East & Africa Used Car Market In India Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 32: Middle East & Africa Used Car Market In India Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Used Car Market In India Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Used Car Market In India Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 35: Asia Pacific Used Car Market In India Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 36: Asia Pacific Used Car Market In India Revenue (Million), by Vendor Type 2025 & 2033

- Figure 37: Asia Pacific Used Car Market In India Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 38: Asia Pacific Used Car Market In India Revenue (Million), by Fuel Type 2025 & 2033

- Figure 39: Asia Pacific Used Car Market In India Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 40: Asia Pacific Used Car Market In India Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Used Car Market In India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Used Car Market In India Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Used Car Market In India Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 3: Global Used Car Market In India Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 4: Global Used Car Market In India Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Used Car Market In India Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Used Car Market In India Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 7: Global Used Car Market In India Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 8: Global Used Car Market In India Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Used Car Market In India Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global Used Car Market In India Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 14: Global Used Car Market In India Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 15: Global Used Car Market In India Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Used Car Market In India Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 20: Global Used Car Market In India Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 21: Global Used Car Market In India Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 22: Global Used Car Market In India Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Used Car Market In India Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 33: Global Used Car Market In India Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 34: Global Used Car Market In India Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 35: Global Used Car Market In India Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Used Car Market In India Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 43: Global Used Car Market In India Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 44: Global Used Car Market In India Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 45: Global Used Car Market In India Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Car Market In India?

The projected CAGR is approximately 15.10%.

2. Which companies are prominent players in the Used Car Market In India?

Key companies in the market include CARS, Hyundai H Promise, Car Trade, Honda Auto Terrace, BMW Premium Selection, Big Boy Toyz, Mercedes-Benz Certified, Audi Approved Plus, Toyota U Trust, Mahindra First Choice Wheels, Ford Assured, OL, Maruti True Value.

3. What are the main segments of the Used Car Market In India?

The market segments include Vehicle Type, Vendor Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 31.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Diverse Selection Among Car Models Is Anticipated To Drive The Market Growth.

6. What are the notable trends driving market growth?

Rising Middle Class and Young Population.

7. Are there any restraints impacting market growth?

Counterfeit and Illegally Imported Vehicles Is Restraining The Market Growth.

8. Can you provide examples of recent developments in the market?

In August 2022, Lexus, which is owned by Toyota, has launched its Lexus Certified Programme in the Indian market. Lexus India hopes that by launching this initiative, existing Lexus vehicle owners will be able to get a higher resale value for their vehicles, while also making Lexus models more accessible and affordable to new customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Used Car Market In India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Used Car Market In India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Used Car Market In India?

To stay informed about further developments, trends, and reports in the Used Car Market In India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence