Key Insights

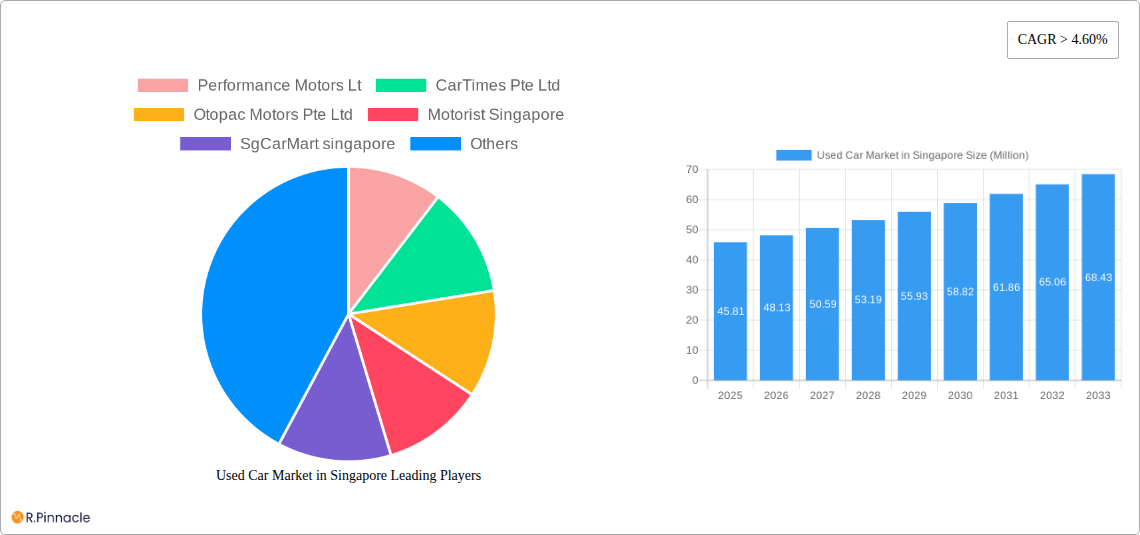

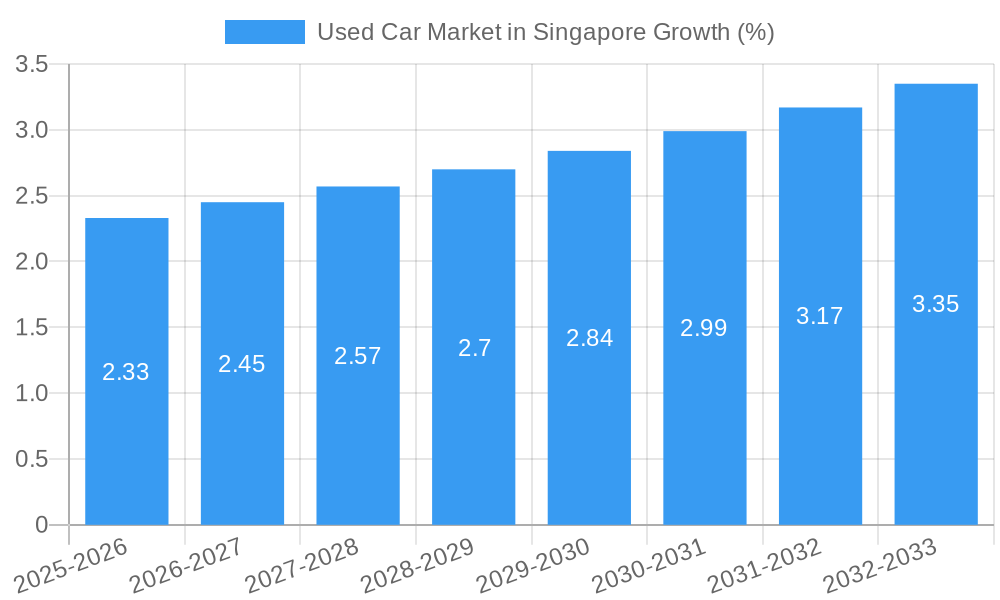

The Singaporean used car market, valued at $45.81 million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 4.60% from 2025 to 2033. This growth is fueled by several key factors. Increasing vehicle ownership amongst a growing population and a preference for more affordable transportation options compared to new cars are significant drivers. Furthermore, the convenience and accessibility of online car buying platforms, like those offered by CarTimes Pte Ltd, SgCarMart Singapore, and Carsome Singapore, are transforming the market and expanding its reach. The market is segmented by vehicle type (hatchbacks, sedans, SUVs, MPVs), vendor type (organized and unorganized dealers), booking type (online and offline), and fuel type (gasoline, diesel, and others). The organized sector, encompassing established dealerships like Performance Motors Ltd and Eurokars Group, is expected to maintain a significant market share, though the unorganized sector, characterized by individual sellers, continues to be a considerable presence. The preference for SUVs and MPVs, reflecting changing family structures and lifestyle choices, also contributes to the market's dynamism. While challenges such as fluctuating fuel prices and government regulations on vehicle imports could pose some restraints, the overall outlook for the Singaporean used car market remains positive, driven by consistent demand and evolving consumer preferences.

The competitive landscape includes both established players and emerging online marketplaces. Companies like Carro (Trusty Cars Pte Ltd) and Directcars Pte Ltd are leveraging technology to enhance the buying experience, contributing to increased market transparency and efficiency. The continued expansion of e-commerce and digital marketing strategies will further solidify the online booking segment’s growth. Market segmentation provides opportunities for targeted marketing and specialized services, allowing vendors to cater to specific consumer needs and preferences. This is important for understanding market penetration strategies. Forecasting future market values requires considering macroeconomic factors such as economic growth, interest rates, and government policies impacting car ownership and related costs. Sustained growth is anticipated given Singapore's economic stability and the enduring demand for affordable and reliable used vehicles.

Used Car Market in Singapore: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the used car market in Singapore, covering market structure, dynamics, key players, and future outlook from 2019 to 2033. Leveraging extensive data analysis and expert insights, this report is essential for industry professionals, investors, and anyone seeking a deep understanding of this dynamic market. The report includes detailed segmentation analysis, market size estimations (in millions of SGD), and growth projections, offering actionable intelligence for strategic decision-making. The Base Year for this report is 2025, with the Forecast Period spanning 2025-2033, encompassing both the Historical Period (2019-2024) and the Study Period (2019-2033).

Used Car Market in Singapore Market Structure & Innovation Trends

This section analyzes the competitive landscape of Singapore's used car market, examining market concentration, key innovation drivers, regulatory frameworks, and the impact of mergers and acquisitions (M&A) activity. The report details the market share held by major players, including Performance Motors Ltd, CarTimes Pte Ltd, Otopac Motors Pte Ltd, Motorist Singapore, SgCarMart Singapore, Directcars Pte Ltd, Trusty Cars Pte Ltd (Carro), Cosmo Automobiles Pte Ltd, Carsome Singapore Pte Ltd, Eurokars Group of Companies, and Vincar Pte Ltd. The analysis considers the influence of various factors, including government regulations, technological advancements, and consumer preferences, on market structure and innovation.

- Market Concentration: The report quantifies market concentration using metrics such as the Herfindahl-Hirschman Index (HHI) and assesses the competitive intensity within different segments. xx% of the market is controlled by the top 5 players in 2025.

- Innovation Drivers: Factors driving innovation, such as advancements in online platforms, financing options, and vehicle inspection technologies, are discussed.

- Regulatory Framework: The impact of government policies and regulations on market growth and player activities are assessed.

- Product Substitutes: Analysis of substitute products or services that compete with used car purchases, like ride-hailing services, are covered.

- End-User Demographics: The report profiles the key demographic segments driving demand for used cars in Singapore.

- M&A Activities: A detailed analysis of recent M&A activities, including deal values (in millions of SGD), and their impact on market consolidation is presented. For example, the USD 150 million acquisition of sgCarMart is discussed in detail.

Used Car Market in Singapore Market Dynamics & Trends

This section delves into the dynamic forces shaping the Singaporean used car market. The report examines key growth drivers, such as rising disposable incomes and changing consumer preferences towards used vehicles as a cost-effective alternative. It further analyzes technological disruptions (e.g., online marketplaces, digital inspection tools), consumer preferences regarding vehicle types and fuel types, and the competitive dynamics between organized and unorganized vendors.

The report will detail the Compound Annual Growth Rate (CAGR) of the used car market during the forecast period (2025-2033) and the market penetration of online platforms. It will also explore challenges such as fluctuating fuel prices and evolving government regulations. The impact of these factors on market growth and the strategies employed by key players to navigate this evolving landscape will also be discussed.

Dominant Regions & Segments in Used Car Market in Singapore

This section identifies the leading segments within the used car market based on vehicle type, vendor type, booking type, and fuel type.

- By Vehicle Type: The dominance of specific vehicle types (Hatchbacks, Sedans, SUVs, MPVs) is assessed based on sales volume and market share. Analysis will determine which type holds the largest market share in 2025 and projects future growth. The report will include reasons for the dominance of the specific vehicle type.

- By Vendor Type: A comparative analysis of the organized and unorganized sectors is conducted, considering their respective market shares, growth trajectories, and competitive advantages.

- By Booking Type: The report examines the market share of online versus offline transactions and the factors influencing consumer choices.

- By Fuel Type: The report assesses the dominance of gasoline, diesel, and other fuel types, considering factors like government regulations and fuel price fluctuations. The changing market share projections for 2033 are included.

Each segment's dominance is analyzed using factors like economic policies, infrastructural development, and consumer preferences. The report will include factors and projections that will significantly influence the segment’s performance during the forecast period.

Used Car Market in Singapore Product Innovations

This section summarizes recent product innovations in the used car market, including advancements in online platforms, vehicle inspection technology, financing options, and warranty programs. The analysis highlights the competitive advantages offered by these innovations and their market fit within the context of evolving consumer preferences and technological trends.

Report Scope & Segmentation Analysis

This section provides a detailed breakdown of the report's scope and the various market segmentations analyzed. Each segment (by Vehicle Type, Vendor Type, Booking Type, and Fuel Type) will be covered in detail, with growth projections, market size estimates for 2025 (in millions of SGD), and competitive dynamics described for each. For example, it will cover the projected growth of the SUV segment or the competitive landscape of online versus offline car sales.

Key Drivers of Used Car Market in Singapore Growth

Key growth drivers for the used car market in Singapore are identified in this section. These drivers will include factors such as the increasing affordability of used vehicles, strong economic growth, and the ongoing development of supportive government policies. The impact of technological advancements, including the rise of online marketplaces and innovative financing options, will also be considered. Specific examples will be provided to illustrate the importance of each driver.

Challenges in the Used Car Market in Singapore Sector

This section analyzes the challenges faced by the used car market in Singapore. The analysis includes regulatory hurdles, which might include emission standards or import restrictions, supply chain disruptions, and the intensifying competition from both domestic and international players. The quantifiable impacts of these challenges on market growth will be discussed.

Emerging Opportunities in Used Car Market in Singapore

This section explores emerging opportunities within the Singaporean used car market. The opportunities may include the expansion of online platforms, the adoption of innovative technologies (such as AI-powered valuation tools), or the growth of niche markets (like electric or hybrid used vehicles). It will also consider the potential for market expansion into new demographics or geographical areas.

Leading Players in the Used Car Market in Singapore Market

- Performance Motors Ltd

- CarTimes Pte Ltd

- Otopac Motors Pte Ltd

- Motorist Singapore (If a website link is available, it would be inserted here)

- SgCarMart Singapore (If a website link is available, it would be inserted here)

- Directcars Pte Ltd (If a website link is available, it would be inserted here)

- Trusty Cars Pte Ltd (Carro) (If a website link is available, it would be inserted here)

- Cosmo Automobiles Pte Ltd (If a website link is available, it would be inserted here)

- Carsome Singapore Pte Ltd (If a website link is available, it would be inserted here)

- Eurokars Group of Companies (If a website link is available, it would be inserted here)

- Vincar Pte Ltd (If a website link is available, it would be inserted here)

Key Developments in Used Car Market in Singapore Industry

- February 2022: A consortium led by Toyota Financial Services Singapore purchased sgCarMart from Singapore Press Holdings for USD 150 million. This acquisition significantly reshaped the market landscape.

- March 2022: Carsome's acquisition of a 51% stake in Car Times Group intensified competition with Carro.

- May 2022: The formation of Porsche Singapore Pte Ltd by Eurokars Group and Porsche signaled a shift towards innovative customer-centric retail models.

Future Outlook for Used Car Market in Singapore Market

The Singaporean used car market is poised for continued growth, driven by several factors. These factors include increasing urbanization, rising disposable incomes among younger demographics, and the ongoing development of robust online platforms. The evolving technological landscape, with the advent of new inspection and financing technologies, will also play a key role in shaping the market's future trajectory. This creates substantial opportunities for existing players and potential new entrants to innovate and capture market share. Government regulations concerning electric vehicles and environmental concerns may impact future growth trajectory.

Used Car Market in Singapore Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedans

- 1.3. Sports U

-

2. Vendor Type

- 2.1. Organized

- 2.2. UnOrganized

-

3. Booking Type

- 3.1. Online

- 3.2. Offline

-

4. Fuel Type

- 4.1. Gasoline

- 4.2. Diesel

- 4.3. Other Fuel Types

Used Car Market in Singapore Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Used Car Market in Singapore REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increasing Use of Online Platforms

- 3.3. Market Restrains

- 3.3.1. Stringent Governmental Regulations and Import Taxes

- 3.4. Market Trends

- 3.4.1. Organized Segment Expected to Hold Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Used Car Market in Singapore Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedans

- 5.1.3. Sports U

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. UnOrganized

- 5.3. Market Analysis, Insights and Forecast - by Booking Type

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Fuel Type

- 5.4.1. Gasoline

- 5.4.2. Diesel

- 5.4.3. Other Fuel Types

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Used Car Market in Singapore Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Hatchbacks

- 6.1.2. Sedans

- 6.1.3. Sports U

- 6.2. Market Analysis, Insights and Forecast - by Vendor Type

- 6.2.1. Organized

- 6.2.2. UnOrganized

- 6.3. Market Analysis, Insights and Forecast - by Booking Type

- 6.3.1. Online

- 6.3.2. Offline

- 6.4. Market Analysis, Insights and Forecast - by Fuel Type

- 6.4.1. Gasoline

- 6.4.2. Diesel

- 6.4.3. Other Fuel Types

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. South America Used Car Market in Singapore Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Hatchbacks

- 7.1.2. Sedans

- 7.1.3. Sports U

- 7.2. Market Analysis, Insights and Forecast - by Vendor Type

- 7.2.1. Organized

- 7.2.2. UnOrganized

- 7.3. Market Analysis, Insights and Forecast - by Booking Type

- 7.3.1. Online

- 7.3.2. Offline

- 7.4. Market Analysis, Insights and Forecast - by Fuel Type

- 7.4.1. Gasoline

- 7.4.2. Diesel

- 7.4.3. Other Fuel Types

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Europe Used Car Market in Singapore Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Hatchbacks

- 8.1.2. Sedans

- 8.1.3. Sports U

- 8.2. Market Analysis, Insights and Forecast - by Vendor Type

- 8.2.1. Organized

- 8.2.2. UnOrganized

- 8.3. Market Analysis, Insights and Forecast - by Booking Type

- 8.3.1. Online

- 8.3.2. Offline

- 8.4. Market Analysis, Insights and Forecast - by Fuel Type

- 8.4.1. Gasoline

- 8.4.2. Diesel

- 8.4.3. Other Fuel Types

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East & Africa Used Car Market in Singapore Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Hatchbacks

- 9.1.2. Sedans

- 9.1.3. Sports U

- 9.2. Market Analysis, Insights and Forecast - by Vendor Type

- 9.2.1. Organized

- 9.2.2. UnOrganized

- 9.3. Market Analysis, Insights and Forecast - by Booking Type

- 9.3.1. Online

- 9.3.2. Offline

- 9.4. Market Analysis, Insights and Forecast - by Fuel Type

- 9.4.1. Gasoline

- 9.4.2. Diesel

- 9.4.3. Other Fuel Types

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Asia Pacific Used Car Market in Singapore Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Hatchbacks

- 10.1.2. Sedans

- 10.1.3. Sports U

- 10.2. Market Analysis, Insights and Forecast - by Vendor Type

- 10.2.1. Organized

- 10.2.2. UnOrganized

- 10.3. Market Analysis, Insights and Forecast - by Booking Type

- 10.3.1. Online

- 10.3.2. Offline

- 10.4. Market Analysis, Insights and Forecast - by Fuel Type

- 10.4.1. Gasoline

- 10.4.2. Diesel

- 10.4.3. Other Fuel Types

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Performance Motors Lt

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CarTimes Pte Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Otopac Motors Pte Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Motorist Singapore

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SgCarMart singapore

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Directcars Pte Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Trusty Cars Pte Ltd (Carro)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Merchant logo Cosmo Automobiles Pte Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Carsome Singapore Pte Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eurokars Group of Companies

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Vincar Pte Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Performance Motors Lt

List of Figures

- Figure 1: Global Used Car Market in Singapore Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Singapore Used Car Market in Singapore Revenue (Million), by Country 2024 & 2032

- Figure 3: Singapore Used Car Market in Singapore Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Used Car Market in Singapore Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 5: North America Used Car Market in Singapore Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 6: North America Used Car Market in Singapore Revenue (Million), by Vendor Type 2024 & 2032

- Figure 7: North America Used Car Market in Singapore Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 8: North America Used Car Market in Singapore Revenue (Million), by Booking Type 2024 & 2032

- Figure 9: North America Used Car Market in Singapore Revenue Share (%), by Booking Type 2024 & 2032

- Figure 10: North America Used Car Market in Singapore Revenue (Million), by Fuel Type 2024 & 2032

- Figure 11: North America Used Car Market in Singapore Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 12: North America Used Car Market in Singapore Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Used Car Market in Singapore Revenue Share (%), by Country 2024 & 2032

- Figure 14: South America Used Car Market in Singapore Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 15: South America Used Car Market in Singapore Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 16: South America Used Car Market in Singapore Revenue (Million), by Vendor Type 2024 & 2032

- Figure 17: South America Used Car Market in Singapore Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 18: South America Used Car Market in Singapore Revenue (Million), by Booking Type 2024 & 2032

- Figure 19: South America Used Car Market in Singapore Revenue Share (%), by Booking Type 2024 & 2032

- Figure 20: South America Used Car Market in Singapore Revenue (Million), by Fuel Type 2024 & 2032

- Figure 21: South America Used Car Market in Singapore Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 22: South America Used Car Market in Singapore Revenue (Million), by Country 2024 & 2032

- Figure 23: South America Used Car Market in Singapore Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe Used Car Market in Singapore Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 25: Europe Used Car Market in Singapore Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 26: Europe Used Car Market in Singapore Revenue (Million), by Vendor Type 2024 & 2032

- Figure 27: Europe Used Car Market in Singapore Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 28: Europe Used Car Market in Singapore Revenue (Million), by Booking Type 2024 & 2032

- Figure 29: Europe Used Car Market in Singapore Revenue Share (%), by Booking Type 2024 & 2032

- Figure 30: Europe Used Car Market in Singapore Revenue (Million), by Fuel Type 2024 & 2032

- Figure 31: Europe Used Car Market in Singapore Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 32: Europe Used Car Market in Singapore Revenue (Million), by Country 2024 & 2032

- Figure 33: Europe Used Car Market in Singapore Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East & Africa Used Car Market in Singapore Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 35: Middle East & Africa Used Car Market in Singapore Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 36: Middle East & Africa Used Car Market in Singapore Revenue (Million), by Vendor Type 2024 & 2032

- Figure 37: Middle East & Africa Used Car Market in Singapore Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 38: Middle East & Africa Used Car Market in Singapore Revenue (Million), by Booking Type 2024 & 2032

- Figure 39: Middle East & Africa Used Car Market in Singapore Revenue Share (%), by Booking Type 2024 & 2032

- Figure 40: Middle East & Africa Used Car Market in Singapore Revenue (Million), by Fuel Type 2024 & 2032

- Figure 41: Middle East & Africa Used Car Market in Singapore Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 42: Middle East & Africa Used Car Market in Singapore Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa Used Car Market in Singapore Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific Used Car Market in Singapore Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 45: Asia Pacific Used Car Market in Singapore Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 46: Asia Pacific Used Car Market in Singapore Revenue (Million), by Vendor Type 2024 & 2032

- Figure 47: Asia Pacific Used Car Market in Singapore Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 48: Asia Pacific Used Car Market in Singapore Revenue (Million), by Booking Type 2024 & 2032

- Figure 49: Asia Pacific Used Car Market in Singapore Revenue Share (%), by Booking Type 2024 & 2032

- Figure 50: Asia Pacific Used Car Market in Singapore Revenue (Million), by Fuel Type 2024 & 2032

- Figure 51: Asia Pacific Used Car Market in Singapore Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 52: Asia Pacific Used Car Market in Singapore Revenue (Million), by Country 2024 & 2032

- Figure 53: Asia Pacific Used Car Market in Singapore Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Used Car Market in Singapore Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Used Car Market in Singapore Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Global Used Car Market in Singapore Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 4: Global Used Car Market in Singapore Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 5: Global Used Car Market in Singapore Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 6: Global Used Car Market in Singapore Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Used Car Market in Singapore Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global Used Car Market in Singapore Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 9: Global Used Car Market in Singapore Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 10: Global Used Car Market in Singapore Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 11: Global Used Car Market in Singapore Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 12: Global Used Car Market in Singapore Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Used Car Market in Singapore Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 17: Global Used Car Market in Singapore Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 18: Global Used Car Market in Singapore Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 19: Global Used Car Market in Singapore Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 20: Global Used Car Market in Singapore Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of South America Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Used Car Market in Singapore Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 25: Global Used Car Market in Singapore Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 26: Global Used Car Market in Singapore Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 27: Global Used Car Market in Singapore Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 28: Global Used Car Market in Singapore Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United Kingdom Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Germany Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: France Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Italy Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Spain Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Russia Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Benelux Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Nordics Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Used Car Market in Singapore Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 39: Global Used Car Market in Singapore Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 40: Global Used Car Market in Singapore Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 41: Global Used Car Market in Singapore Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 42: Global Used Car Market in Singapore Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Turkey Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Israel Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: GCC Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: North Africa Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East & Africa Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Used Car Market in Singapore Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 50: Global Used Car Market in Singapore Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 51: Global Used Car Market in Singapore Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 52: Global Used Car Market in Singapore Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 53: Global Used Car Market in Singapore Revenue Million Forecast, by Country 2019 & 2032

- Table 54: China Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Japan Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: ASEAN Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Oceania Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Asia Pacific Used Car Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Car Market in Singapore?

The projected CAGR is approximately > 4.60%.

2. Which companies are prominent players in the Used Car Market in Singapore?

Key companies in the market include Performance Motors Lt, CarTimes Pte Ltd, Otopac Motors Pte Ltd, Motorist Singapore, SgCarMart singapore, Directcars Pte Ltd, Trusty Cars Pte Ltd (Carro), Merchant logo Cosmo Automobiles Pte Ltd, Carsome Singapore Pte Ltd, Eurokars Group of Companies, Vincar Pte Ltd.

3. What are the main segments of the Used Car Market in Singapore?

The market segments include Vehicle Type, Vendor Type, Booking Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 45.81 Million as of 2022.

5. What are some drivers contributing to market growth?

The Increasing Use of Online Platforms.

6. What are the notable trends driving market growth?

Organized Segment Expected to Hold Significant Share in the Market.

7. Are there any restraints impacting market growth?

Stringent Governmental Regulations and Import Taxes.

8. Can you provide examples of recent developments in the market?

May 2022: Eurokars Group and Porsche announced the formation of Porsche Singapore Pte Ltd, a new venture with a focus to explore emerging automotive retail concepts that will continue to create customer-centric experiences in Singapore.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Used Car Market in Singapore," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Used Car Market in Singapore report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Used Car Market in Singapore?

To stay informed about further developments, trends, and reports in the Used Car Market in Singapore, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence