Key Insights

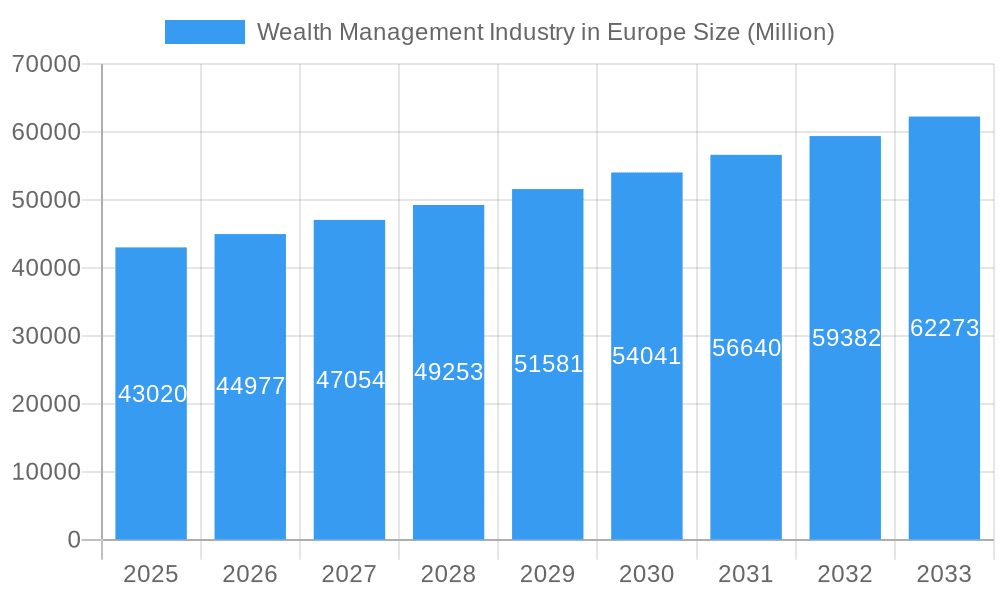

The European wealth management market, valued at €43.02 billion in 2025, is projected to experience robust growth, driven by several key factors. A rising high-net-worth individual (HNWI) population, coupled with increasing affluence among the mass affluent segment, fuels demand for sophisticated wealth management services. Technological advancements, including robo-advisors and digital platforms, are streamlining operations and enhancing client experiences, further stimulating market expansion. The market is segmented by client type (HNWIs, retail/individuals, mass affluent, others) and wealth management firm (private bankers, family offices, others), reflecting the diverse service offerings catering to varying client needs and risk profiles. Competition amongst established players like Allianz, Schroders PLC, UBS Group, HSBC Holdings, Amundi, AXA Group, BNP Paribas, Aegon N.V., Credit Suisse, and Legal & General, is intense, pushing innovation and service improvements. However, regulatory changes, economic uncertainty, and geopolitical risks pose potential restraints to market growth. The UK, Germany, France, and Italy represent the largest national markets within Europe, reflecting established financial hubs and substantial wealth concentrations. The projected compound annual growth rate (CAGR) of 4.41% from 2025 to 2033 suggests a consistently expanding market over the forecast period, with sustained demand for wealth preservation, investment management, and financial planning services.

Wealth Management Industry in Europe Market Size (In Billion)

Geographic expansion strategies by wealth management firms, focusing on underserved markets within Europe, are expected to drive further growth. The increasing importance of sustainable and responsible investing further shapes the market landscape, requiring firms to adapt their offerings and investment strategies. The demand for personalized financial advice and tailored wealth solutions will continue to be a crucial driver, emphasizing the need for firms to build strong client relationships and leverage technological advancements to deliver exceptional service. Competition will continue to be fierce, incentivizing companies to enhance their technology, expand their product offerings, and strengthen their brand presence to capture a greater market share. The long-term outlook for the European wealth management market remains positive, with continued expansion predicated on favorable economic conditions and consistent demand for specialized financial services.

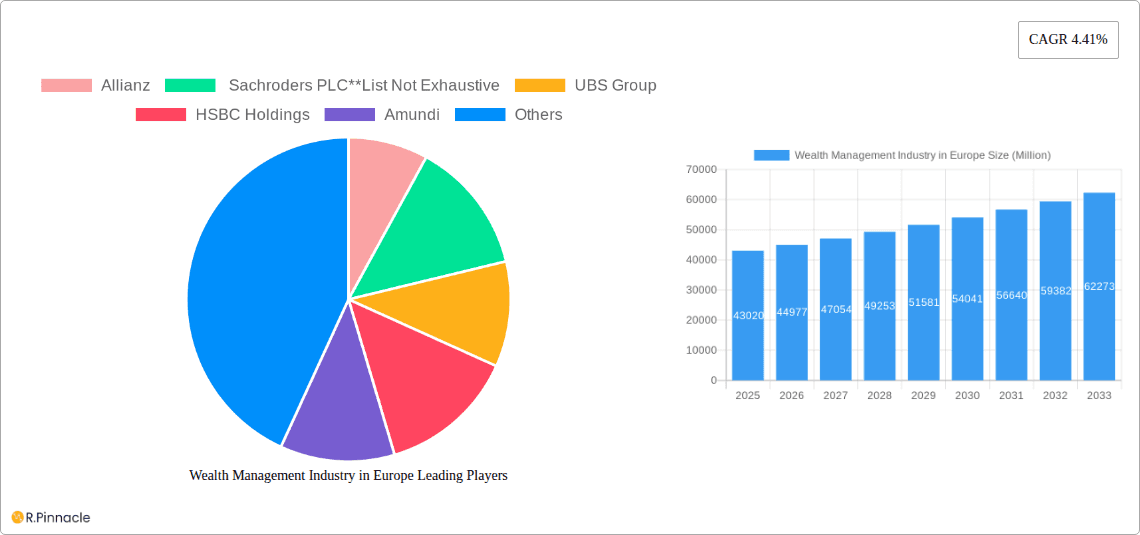

Wealth Management Industry in Europe Company Market Share

Wealth Management Industry in Europe: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the European wealth management industry, covering market structure, dynamics, key players, and future outlook. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive data analysis to offer actionable insights for industry professionals, investors, and strategic decision-makers. Discover key trends, emerging opportunities, and potential challenges shaping this dynamic sector.

Wealth Management Industry in Europe Market Structure & Innovation Trends

This section analyzes the European wealth management market's competitive landscape, innovation drivers, and regulatory environment. We examine market concentration, highlighting the market share of key players such as Allianz, Schroders PLC, UBS Group, HSBC Holdings, Amundi, AXA Group, BNP Paribas, Aegon N.V., Credit Suisse, and Legal & General (list not exhaustive). The report also explores the impact of mergers and acquisitions (M&A) activity, including deals with an estimated value of xx Million. Innovation drivers, such as technological advancements and evolving client preferences, are analyzed alongside regulatory frameworks impacting industry operations. The role of product substitutes and end-user demographics is also explored, providing a holistic view of the market structure.

- Market Concentration: Analysis of market share held by top players.

- M&A Activity: Review of significant deals and their impact on market dynamics (e.g., the abandoned UBS-Wealthfront deal). Total M&A deal value estimated at xx Million.

- Regulatory Framework: Examination of key regulations and their influence on market structure.

- Innovation Drivers: Identification of key drivers pushing innovation in the sector.

- Product Substitutes: Analysis of alternative investment options affecting market share.

- End-User Demographics: Assessment of changing client profiles and their influence on demand.

Wealth Management Industry in Europe Market Dynamics & Trends

This section delves into the market's growth trajectory, examining key drivers, technological disruptions, evolving consumer preferences, and the competitive dynamics at play. The report analyzes the Compound Annual Growth Rate (CAGR) and market penetration rates across various segments. Specific market growth drivers, such as increased disposable income and the growth of high-net-worth individuals (HNWIs), are discussed. The impact of technological advancements like robo-advisors and digital platforms on the market is also assessed. Further exploration includes examining shifts in consumer preferences and the resulting competitive strategies employed by market participants.

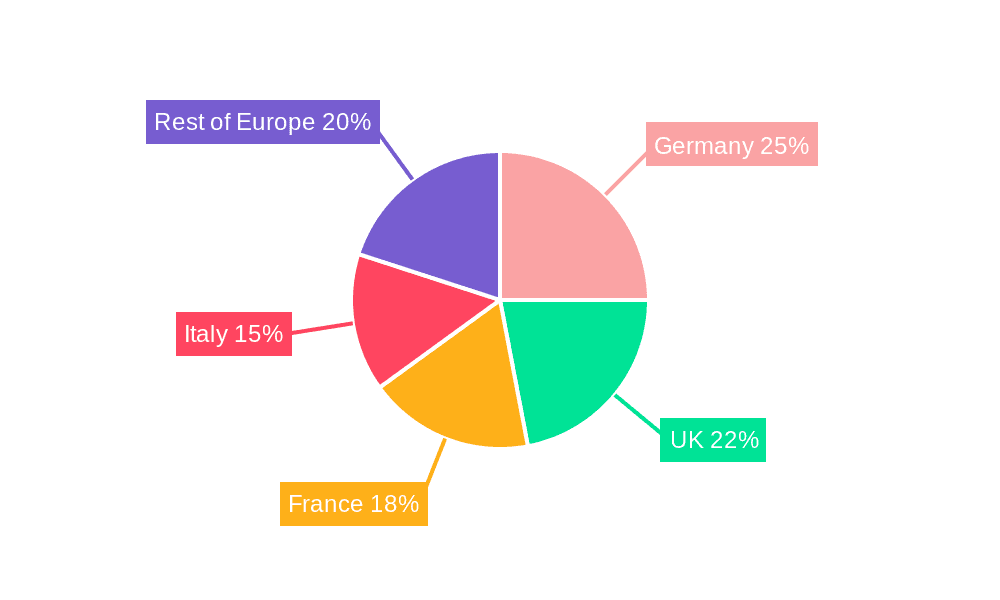

Dominant Regions & Segments in Wealth Management Industry in Europe

This section identifies the leading geographical regions and market segments within the European wealth management industry. Dominance analysis considers factors like economic policies, infrastructure development, and regulatory landscapes. Segments are analyzed by client type (HNWIs, retail/individuals, mass affluent, other) and by wealth management firm (private bankers, family offices, other).

By Client Type:

- HNWIs: Key drivers of growth in this segment.

- Retail/Individuals: Market size and growth projections.

- Mass Affluent: Analysis of market trends and characteristics.

- Other Client Types: Examination of niche client segments.

By Wealth Management Firm:

- Private Bankers: Analysis of their market share and competitive advantages.

- Family Offices: Examination of this specialized segment’s role and growth.

- Other Wealth Management Firms: Analysis of smaller firms and their contribution to the market.

Wealth Management Industry in Europe Product Innovations

This section summarizes recent product developments in the European wealth management industry. We highlight innovative products, their applications, and competitive advantages. The focus is on technological trends, emphasizing the market fit of new solutions, and their impact on efficiency, cost reduction, and improved client service. Examples of innovative applications include automated investment platforms, personalized financial planning tools, and enhanced digital client portals.

Report Scope & Segmentation Analysis

This report segments the European wealth management market by client type (HNWIs, retail/individuals, mass affluent, other) and by wealth management firm (private bankers, family offices, other). For each segment, the report provides growth projections, estimated market sizes (in Millions), and competitive dynamics. Each segment's analysis considers the unique characteristics, growth drivers, and competitive landscape, providing a comprehensive view of the industry's structure.

Key Drivers of Wealth Management Industry in Europe Growth

The growth of the European wealth management industry is driven by several factors. Technological advancements, including artificial intelligence (AI) and big data analytics, are improving efficiency and personalization. Favorable economic conditions, such as increasing disposable incomes and rising asset values, also contribute to growth. Furthermore, supportive regulatory environments and increased financial literacy among the population play significant roles in market expansion.

Challenges in the Wealth Management Industry in Europe Sector

The European wealth management industry faces challenges such as increasing regulatory scrutiny, cybersecurity threats, and intense competition. These factors can lead to increased operational costs and pressure on profit margins. The impact of these challenges is quantified in terms of potential market share loss or reduced profitability.

Emerging Opportunities in Wealth Management Industry in Europe

The European wealth management sector presents significant opportunities. Growth is expected in sustainable and impact investing, catering to the increasing demand for ethical investment options. The expansion of digital wealth management solutions and the rise of the fintech sector offer additional avenues for growth and innovation. The expansion into underserved markets also presents potential.

Leading Players in the Wealth Management Industry in Europe Market

Key Developments in Wealth Management Industry in Europe Industry

- September 2022: UBS and Wealthfront terminated their proposed acquisition deal. This highlights the challenges and complexities involved in M&A activities in the wealth management sector.

- 2021: Legal & General launched the ONIX platform, a next-generation online quote-and-buy platform for group income protection, showcasing the industry's ongoing digital transformation.

Future Outlook for Wealth Management Industry in Europe Market

The European wealth management industry is poised for continued growth, driven by factors such as increasing affluence, technological innovation, and evolving client expectations. Strategic opportunities exist for firms that can successfully adapt to changing market dynamics, leverage technology effectively, and cater to the evolving needs of diverse client segments. The market's future potential is substantial, especially in areas such as sustainable finance and digital wealth management.

Wealth Management Industry in Europe Segmentation

-

1. Client Type

- 1.1. HNWIs

- 1.2. Retail/ Individuals

- 1.3. Mass Affluent

- 1.4. Other Client Types

-

2. Wealth Management Firm

- 2.1. Private Bankers

- 2.2. Family Offices

- 2.3. Other Wealth Management Firms

Wealth Management Industry in Europe Segmentation By Geography

- 1. Italy

- 2. Germany

- 3. France

- 4. United Kingdom

- 5. Rest of Europe

Wealth Management Industry in Europe Regional Market Share

Geographic Coverage of Wealth Management Industry in Europe

Wealth Management Industry in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Guaranteed Protection Drives The Market

- 3.3. Market Restrains

- 3.3.1. Long and Costly Legal Procedures

- 3.4. Market Trends

- 3.4.1. Growth In Millionaire Wealth Leading to the European Wealth Management Market Uptrend

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 5.1.1. HNWIs

- 5.1.2. Retail/ Individuals

- 5.1.3. Mass Affluent

- 5.1.4. Other Client Types

- 5.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 5.2.1. Private Bankers

- 5.2.2. Family Offices

- 5.2.3. Other Wealth Management Firms

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.3.2. Germany

- 5.3.3. France

- 5.3.4. United Kingdom

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 6. Italy Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 6.1.1. HNWIs

- 6.1.2. Retail/ Individuals

- 6.1.3. Mass Affluent

- 6.1.4. Other Client Types

- 6.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 6.2.1. Private Bankers

- 6.2.2. Family Offices

- 6.2.3. Other Wealth Management Firms

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 7. Germany Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 7.1.1. HNWIs

- 7.1.2. Retail/ Individuals

- 7.1.3. Mass Affluent

- 7.1.4. Other Client Types

- 7.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 7.2.1. Private Bankers

- 7.2.2. Family Offices

- 7.2.3. Other Wealth Management Firms

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 8. France Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 8.1.1. HNWIs

- 8.1.2. Retail/ Individuals

- 8.1.3. Mass Affluent

- 8.1.4. Other Client Types

- 8.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 8.2.1. Private Bankers

- 8.2.2. Family Offices

- 8.2.3. Other Wealth Management Firms

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 9. United Kingdom Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 9.1.1. HNWIs

- 9.1.2. Retail/ Individuals

- 9.1.3. Mass Affluent

- 9.1.4. Other Client Types

- 9.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 9.2.1. Private Bankers

- 9.2.2. Family Offices

- 9.2.3. Other Wealth Management Firms

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 10. Rest of Europe Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 10.1.1. HNWIs

- 10.1.2. Retail/ Individuals

- 10.1.3. Mass Affluent

- 10.1.4. Other Client Types

- 10.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 10.2.1. Private Bankers

- 10.2.2. Family Offices

- 10.2.3. Other Wealth Management Firms

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Allianz

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sachroders PLC**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 UBS Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HSBC Holdings

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Amundi

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AXA Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BNP Paribas

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aegon N V

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Credit Suisse

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Legal and General

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Allianz

List of Figures

- Figure 1: Wealth Management Industry in Europe Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Wealth Management Industry in Europe Share (%) by Company 2025

List of Tables

- Table 1: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 2: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 3: Wealth Management Industry in Europe Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 5: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 6: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 8: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 9: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 11: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 12: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 14: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 15: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 17: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 18: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wealth Management Industry in Europe?

The projected CAGR is approximately 4.41%.

2. Which companies are prominent players in the Wealth Management Industry in Europe?

Key companies in the market include Allianz, Sachroders PLC**List Not Exhaustive, UBS Group, HSBC Holdings, Amundi, AXA Group, BNP Paribas, Aegon N V, Credit Suisse, Legal and General.

3. What are the main segments of the Wealth Management Industry in Europe?

The market segments include Client Type, Wealth Management Firm.

4. Can you provide details about the market size?

The market size is estimated to be USD 43.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Guaranteed Protection Drives The Market.

6. What are the notable trends driving market growth?

Growth In Millionaire Wealth Leading to the European Wealth Management Market Uptrend.

7. Are there any restraints impacting market growth?

Long and Costly Legal Procedures.

8. Can you provide examples of recent developments in the market?

September 2022: UBS was set to acquire the Millennial and Gen Z-focused Wealthfront. UBS and wealth management platform Wealthfront have pulled out of a proposed acquisition deal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wealth Management Industry in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wealth Management Industry in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wealth Management Industry in Europe?

To stay informed about further developments, trends, and reports in the Wealth Management Industry in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence