Key Insights

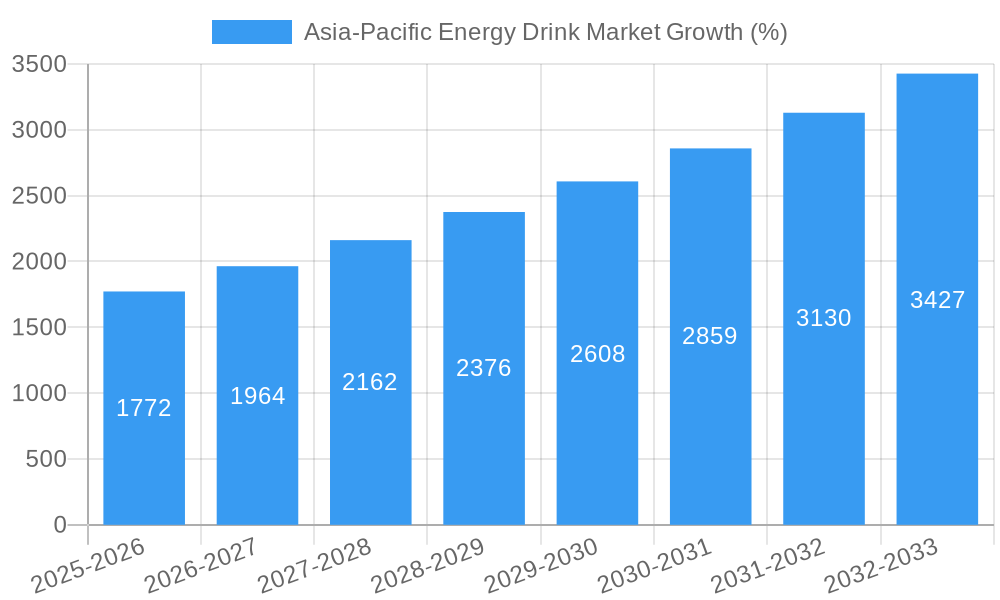

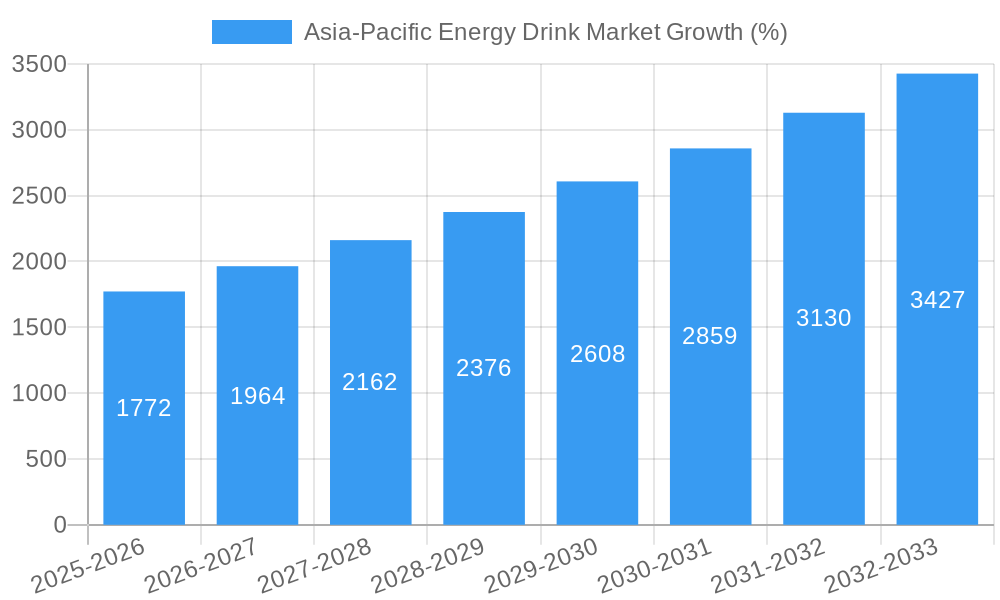

The Asia-Pacific energy drink market, currently valued at approximately $XX million (estimated based on provided CAGR and market trends), is experiencing robust growth, projected to reach $YY million by 2033, exhibiting a compound annual growth rate (CAGR) of 11.55%. This surge is driven by several key factors. Rising disposable incomes, particularly amongst young adults and working professionals in rapidly developing economies like China, India, and Indonesia, fuel demand for convenient and functional beverages. Health and wellness trends are also impacting the market, leading to increased popularity of natural and organic energy drinks, as well as sugar-free or low-calorie options. Furthermore, aggressive marketing campaigns by major players like Red Bull, Monster, and Coca-Cola, coupled with strategic distribution partnerships across both on-trade (restaurants, bars) and off-trade (retail stores) channels, are significantly boosting market penetration. The diversification of packaging types, including PET bottles, metal cans, and glass bottles, caters to diverse consumer preferences and enhances product accessibility.

However, the market faces challenges. Increasing health concerns regarding high sugar content and artificial additives in traditional energy drinks are prompting regulatory scrutiny and influencing consumer choices. Fluctuations in raw material prices and potential trade restrictions could also impact profitability. Market segmentation reveals a strong preference for convenient packaging like PET bottles and cans, while the energy shot segment and natural/organic variants represent promising growth opportunities. Geographical analysis indicates China, India, and other Southeast Asian nations as key growth drivers due to their burgeoning populations and evolving consumption patterns. Competitive landscape analysis suggests an intense rivalry among established multinational corporations and local brands, necessitating continuous product innovation and marketing strategies to maintain market share. The forecast period (2025-2033) presents ample opportunities for companies to capitalize on the market's sustained growth trajectory through strategic product development and targeted marketing efforts.

This comprehensive report provides a detailed analysis of the Asia-Pacific energy drink market, offering invaluable insights for industry professionals, investors, and strategists. With a focus on market dynamics, segmentation, key players, and future trends, this report covers the period from 2019 to 2033, with a base year of 2025. The report leverages extensive data analysis to forecast market growth and identify lucrative opportunities within this rapidly expanding sector.

Asia-Pacific Energy Drink Market Structure & Innovation Trends

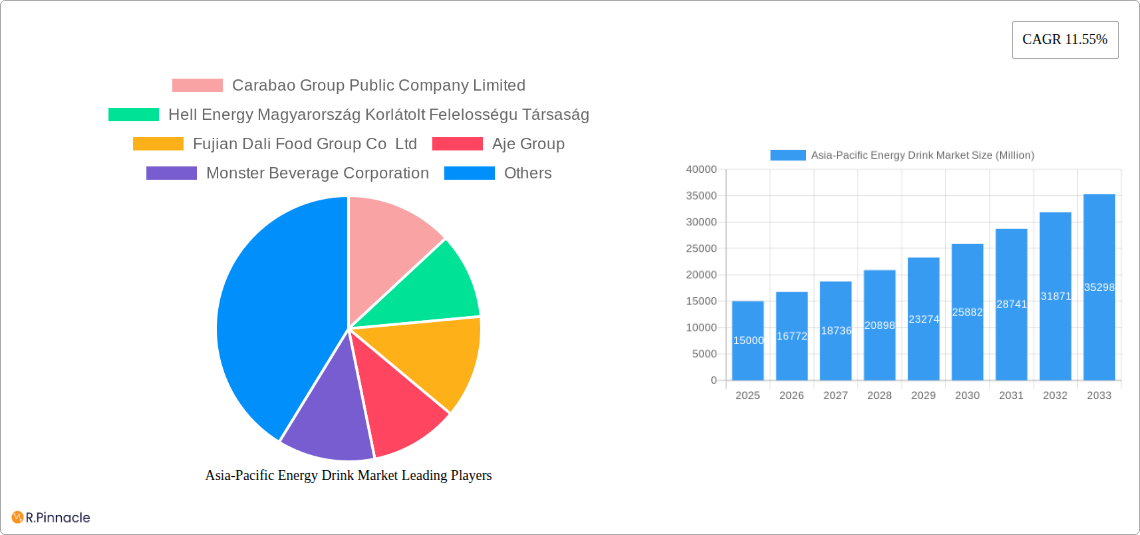

The Asia-Pacific energy drink market is characterized by a dynamic interplay of established giants and emerging players. Market concentration is moderate, with key players like Red Bull GmbH, Monster Beverage Corporation, and PepsiCo Inc. holding significant market share, estimated at xx% collectively in 2025. However, regional players like Carabao Group Public Company Limited and Osotspa Public Company Limited are also gaining traction, particularly in their respective domestic markets. Innovation is a key driver, with companies focusing on product diversification, including sugar-free/low-calorie options, natural/organic blends, and functional energy drinks. Regulatory frameworks vary across countries, influencing product formulations and marketing strategies. The market also faces competition from substitute beverages such as coffee, tea, and sports drinks. End-user demographics are shifting towards younger consumers, with significant growth in online distribution. M&A activity has been relatively moderate in recent years, with deal values averaging around xx Million in the period 2019-2024.

- Market Concentration: Moderate, with top players holding xx% market share in 2025.

- Innovation Drivers: Product diversification (sugar-free, natural, functional), technological advancements in formulations.

- Regulatory Frameworks: Vary across countries, impacting product composition and marketing.

- Product Substitutes: Coffee, tea, sports drinks.

- End-User Demographics: Predominantly younger consumers, increasing online purchasing.

- M&A Activity: Moderate, with average deal values of xx Million (2019-2024).

Asia-Pacific Energy Drink Market Dynamics & Trends

The Asia-Pacific energy drink market is experiencing robust growth, driven by several factors. Rising disposable incomes, especially amongst young adults, fuel demand for premium and functional beverages. Urbanization and changing lifestyles contribute to increased consumption of convenient and energizing drinks. Technological advancements in product formulation, packaging, and distribution further enhance market expansion. Consumer preferences are shifting towards healthier options, with a growing demand for sugar-free, low-calorie, and natural energy drinks. The competitive landscape remains intense, with established players investing heavily in marketing, product innovation, and distribution networks to maintain market share. The Compound Annual Growth Rate (CAGR) for the Asia-Pacific energy drink market is projected to be xx% during the forecast period (2025-2033), with market penetration increasing from xx% in 2025 to xx% in 2033.

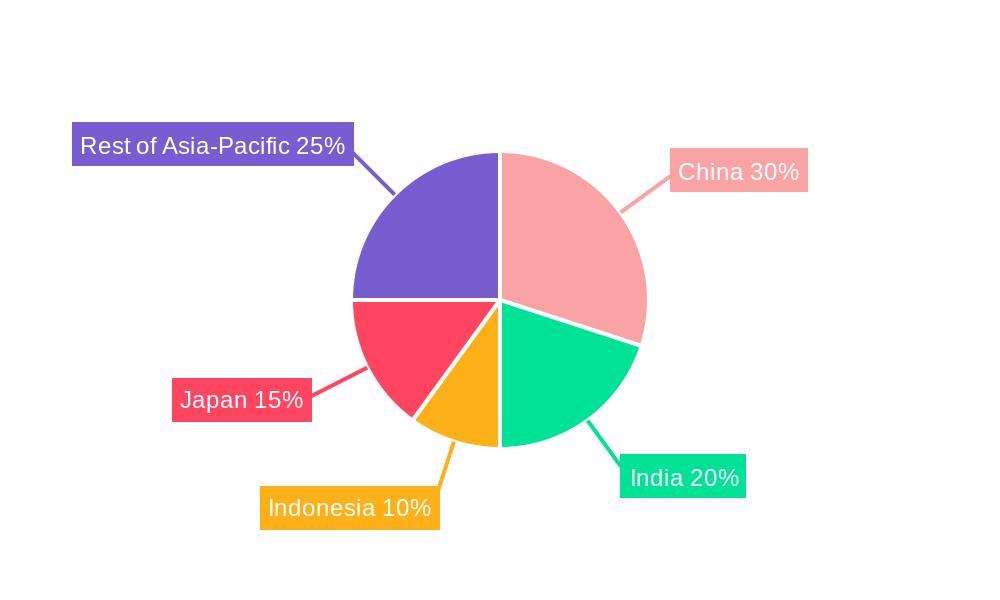

Dominant Regions & Segments in Asia-Pacific Energy Drink Market

China, India, and Japan are the dominant markets within the Asia-Pacific region, owing to their large populations, robust economies, and evolving consumer preferences. Within the segment breakdown:

- Leading Regions: China, India, and Japan.

- Leading Soft Drink Types: Traditional energy drinks hold the largest market share, followed by sugar-free/low-calorie options. Growth in natural/organic energy drinks is expected.

- Leading Packaging Types: Metal cans are the dominant packaging type, offering convenience and shelf stability. PET bottles are also widely used.

- Dominant Distribution Channel: Off-trade channels (retail stores, supermarkets) have a larger market share than on-trade (restaurants, bars).

Key Drivers for Dominant Regions:

- China: Strong economic growth, rising disposable incomes, urbanization.

- India: Young and growing population, increasing awareness of energy drinks.

- Japan: Established market with mature consumer preferences, focus on innovation.

Asia-Pacific Energy Drink Market Product Innovations

Recent innovations within the Asia-Pacific energy drink market highlight a strong focus on catering to evolving consumer demands. Companies are introducing healthier formulations with reduced sugar content, natural ingredients, and functional benefits, such as enhanced hydration or improved cognitive function. Technological advancements in packaging are also observed, including sustainable and eco-friendly options. This innovation drives competitive advantage, attracting health-conscious consumers while also complying with stricter regulatory standards across the region.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Asia-Pacific energy drink market, segmented by soft drink type (Energy Shots, Natural/Organic Energy Drinks, Sugar-free or Low-calories Energy Drinks, Traditional Energy Drinks, Other Energy Drinks), packaging type (Glass Bottles, Metal Can, PET Bottles, Others), country (Australia, China, India, Indonesia, Japan, Malaysia, South Korea, Thailand, Vietnam, Rest of Asia-Pacific), and distribution channel (Off-trade, On-trade). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail. For example, the Traditional Energy Drinks segment is projected to maintain a significant market share driven by existing consumer preference, while the Sugar-free/Low-calorie segment showcases high growth potential.

Key Drivers of Asia-Pacific Energy Drink Market Growth

Several key factors are driving the growth of the Asia-Pacific energy drink market. These include rising disposable incomes, a young and expanding population, increasing urbanization, changing lifestyles that favor convenient beverages, and a growing preference for functional beverages with added health benefits. Technological advancements in product formulation and packaging are also significant contributors to market expansion.

Challenges in the Asia-Pacific Energy Drink Market Sector

The Asia-Pacific energy drink market faces several challenges. These include fluctuating raw material prices, stringent regulations on sugar content and marketing, intense competition amongst both established and emerging players, and concerns regarding the health implications of high sugar and caffeine intake. These challenges pose significant impacts on profitability and sustainable growth.

Emerging Opportunities in Asia-Pacific Energy Drink Market

Emerging opportunities in the Asia-Pacific energy drink market include the growing demand for healthier options, such as natural and organic energy drinks, and the increasing popularity of functional beverages that offer additional benefits beyond energy boosts. Expansion into untapped markets and the exploration of innovative packaging and distribution channels also represent significant growth opportunities.

Leading Players in the Asia-Pacific Energy Drink Market Market

- Carabao Group Public Company Limited

- Hell Energy Magyarország Korlátolt Felelosségu Társaság

- Fujian Dali Food Group Co Ltd

- Aje Group

- Monster Beverage Corporation

- PepsiCo Inc

- The Coca-Cola Company

- Red Bull GmbH

- Henan Zhongwo Beverage Co Ltd

- Eastroc Beverage(Group) Co Ltd

- T C Pharmaceutical Industries Company Limited

- Taisho Pharmaceutical Holdings Co Ltd

- Congo Brands

- Osotspa Public Company Limited

Key Developments in Asia-Pacific Energy Drink Market Industry

- September 2023: PepsiCo India launched a limited-edition flavor of its Sting Energy drink, Sting Blue Current, expanding its product portfolio and targeting a broader consumer base.

- April 2023: Prime Energy's release introduces a new competitor with a zero-sugar, high-electrolyte formulation, likely affecting market share in the healthy energy drink segment.

- January 2023: Monster Beverage Corporation announced plans for an affordable energy drink expansion in Asia, aiming to increase accessibility and potentially capture a larger market share.

Future Outlook for Asia-Pacific Energy Drink Market Market

The future outlook for the Asia-Pacific energy drink market remains positive, driven by continuous product innovation, expanding consumer base, and evolving health and wellness trends. Strategic partnerships, targeted marketing campaigns, and the adoption of sustainable practices will further shape the industry's growth trajectory. The market's potential is significant, with continued expansion expected across various segments and regions.

Asia-Pacific Energy Drink Market Segmentation

-

1. Soft Drink Type

- 1.1. Energy Shots

- 1.2. Natural/Organic Energy Drinks

- 1.3. Sugar-free or Low-calories Energy Drinks

- 1.4. Traditional Energy Drinks

- 1.5. Other Energy Drinks

-

2. Packaging Type

- 2.1. Glass Bottles

- 2.2. Metal Can

- 2.3. PET Bottles

-

3. Distribution Channel

-

3.1. Off-trade

- 3.1.1. Convenience Stores

- 3.1.2. Online Retail

- 3.1.3. Supermarket/Hypermarket

- 3.1.4. Others

- 3.2. On-trade

-

3.1. Off-trade

Asia-Pacific Energy Drink Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Energy Drink Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Energy Drink Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 5.1.1. Energy Shots

- 5.1.2. Natural/Organic Energy Drinks

- 5.1.3. Sugar-free or Low-calories Energy Drinks

- 5.1.4. Traditional Energy Drinks

- 5.1.5. Other Energy Drinks

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Glass Bottles

- 5.2.2. Metal Can

- 5.2.3. PET Bottles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Off-trade

- 5.3.1.1. Convenience Stores

- 5.3.1.2. Online Retail

- 5.3.1.3. Supermarket/Hypermarket

- 5.3.1.4. Others

- 5.3.2. On-trade

- 5.3.1. Off-trade

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6. China Asia-Pacific Energy Drink Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Energy Drink Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Energy Drink Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Energy Drink Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Energy Drink Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Energy Drink Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Energy Drink Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Carabao Group Public Company Limited

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hell Energy Magyarország Korlátolt Felelosségu Társaság

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Fujian Dali Food Group Co Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Aje Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Monster Beverage Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 PepsiCo Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 The Coca-Cola Compan

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Red Bull GmbH

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Henan Zhongwo Beverage Co Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Eastroc Beverage(Group) Co Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 T C Pharmaceutical Industries Company Limited

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Taisho Pharmaceutical Holdings Co Ltd

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Congo Brands

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Osotspa Public Company Limited

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.1 Carabao Group Public Company Limited

List of Figures

- Figure 1: Asia-Pacific Energy Drink Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Energy Drink Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Energy Drink Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Energy Drink Market Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 3: Asia-Pacific Energy Drink Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 4: Asia-Pacific Energy Drink Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Asia-Pacific Energy Drink Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia-Pacific Energy Drink Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia-Pacific Energy Drink Market Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 15: Asia-Pacific Energy Drink Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 16: Asia-Pacific Energy Drink Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: Asia-Pacific Energy Drink Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: New Zealand Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Indonesia Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Malaysia Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Singapore Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Thailand Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Vietnam Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Philippines Asia-Pacific Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Energy Drink Market?

The projected CAGR is approximately 11.55%.

2. Which companies are prominent players in the Asia-Pacific Energy Drink Market?

Key companies in the market include Carabao Group Public Company Limited, Hell Energy Magyarország Korlátolt Felelosségu Társaság, Fujian Dali Food Group Co Ltd, Aje Group, Monster Beverage Corporation, PepsiCo Inc, The Coca-Cola Compan, Red Bull GmbH, Henan Zhongwo Beverage Co Ltd, Eastroc Beverage(Group) Co Ltd, T C Pharmaceutical Industries Company Limited, Taisho Pharmaceutical Holdings Co Ltd, Congo Brands, Osotspa Public Company Limited.

3. What are the main segments of the Asia-Pacific Energy Drink Market?

The market segments include Soft Drink Type, Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

September 2023: PepsiCo India launched a limited edition flavor of its Sting Energy drink, called Sting Blue Current. Sting Blue Current is available at 200 ml in single-serve packs across India.April 2023: Prime has released a new energy drink, Prime Energy, containing 200mg of caffeine and zero sugar.The new drinks hold 300mg of electrolytes and contain ten calories, and come in blue raspberry, tropical punch, lemon lime, orange mango and strawberry watermelon flavours.January 2023: Monster is innovating its enery drinks and announced to launch affordable energy drink expansion to drive Asia growth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Energy Drink Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Energy Drink Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Energy Drink Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Energy Drink Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence