Key Insights

The Canadian Metal Fabrication Equipment market is projected for robust expansion, with an estimated Compound Annual Growth Rate (CAGR) of 1.6% through 2033. This growth is propelled by significant investments in infrastructure development, particularly within the construction and energy sectors, alongside escalating demand for bespoke metal components across automotive, aerospace, and building industries. The accelerating adoption of advanced automation technologies is further enhancing productivity and operational efficiency within fabrication processes. The market encompasses diverse equipment types, including laser cutting, bending, and welding machinery, with both domestic and international manufacturers actively participating. Leading entities like BTD Manufacturing, Colfax, Komaspec, and Atlas Copco are instrumental in shaping market trends through innovation and strategic collaborations. Despite potential headwinds from supply chain disruptions and volatile raw material costs, the long-term outlook remains optimistic, supported by sustained government initiatives and the persistent need for high-quality, efficient metal fabrication solutions.

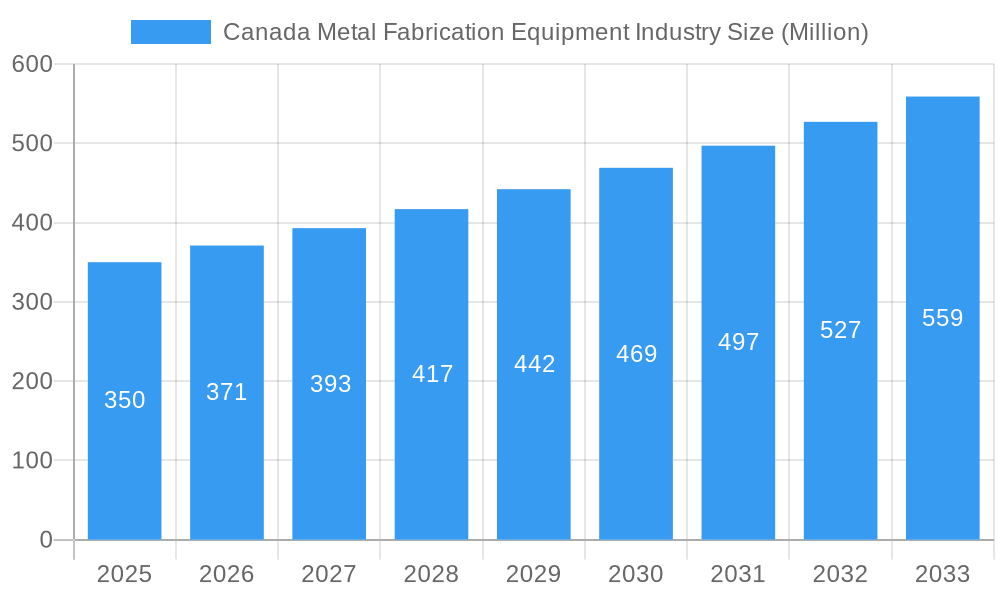

Canada Metal Fabrication Equipment Industry Market Size (In Billion)

The market size was valued at approximately 6.5 billion in the 2025 base year. The forecast period of 2025-2033 anticipates sustained expansion, primarily driven by ongoing infrastructure projects and consistent demand from critical industries. The strong performance of key market players signifies a dynamic and competitive landscape marked by continuous innovation and strategic adaptation to evolving market demands. Future growth opportunities are anticipated from the widespread integration of Industry 4.0 technologies within the fabrication sector, coupled with an increasing emphasis on sustainable manufacturing practices and the utilization of eco-friendly materials. While granular regional data requires further investigation, market concentration is expected within Canada's major urban and industrial hubs, aligning with the geographical distribution of industrial activities and infrastructure investments.

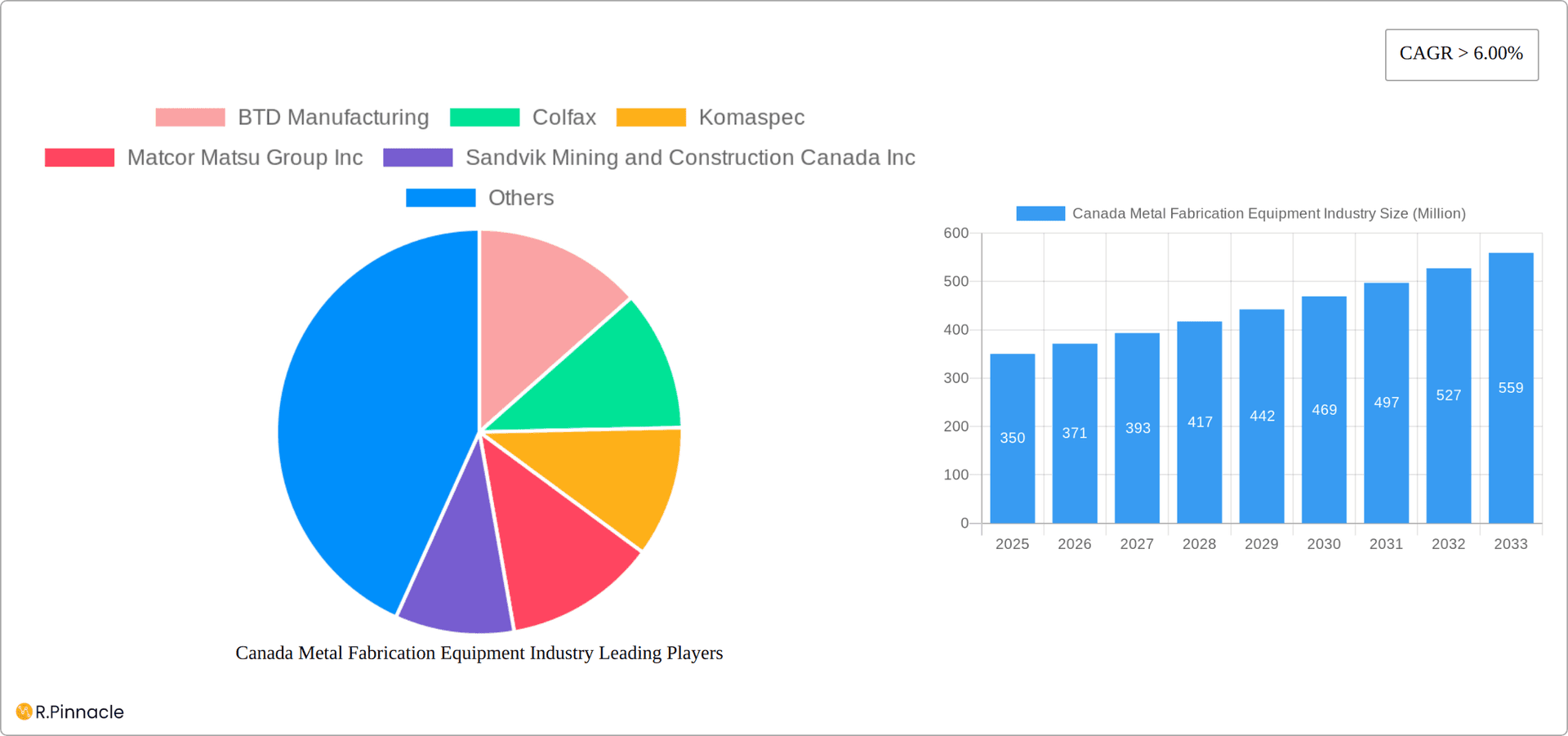

Canada Metal Fabrication Equipment Industry Company Market Share

Canada Metal Fabrication Equipment Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canadian metal fabrication equipment industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive market research to provide a detailed understanding of market dynamics, growth drivers, and future opportunities within this crucial sector. Discover key trends, competitive landscapes, and strategic implications impacting the Canadian metal fabrication equipment market valued at xx Million.

Canada Metal Fabrication Equipment Industry Market Structure & Innovation Trends

The Canadian metal fabrication equipment industry is a dynamic sector characterized by a diverse competitive landscape. It comprises a mix of established multinational corporations and agile, specialized smaller firms, each contributing to the market's overall structure. Key factors influencing this market include evolving innovation drivers, a robust regulatory environment, and strategic mergers and acquisitions that reshape its competitive dynamics.

-

Market Concentration: The market demonstrates moderate concentration, with a handful of dominant players capturing a significant portion of market share. While precise individual company figures are not publicly disclosed, it's estimated that the top five enterprises collectively hold approximately [Insert Estimated Percentage]% of the market. This leaves ample room for specialized providers and smaller businesses to thrive, fostering a competitive ecosystem.

-

Innovation Drivers: The relentless pursuit of enhanced efficiency, superior precision, and optimized production costs is the primary engine of innovation. Technological advancements in areas such as industrial automation, advanced robotics, and the integration of digital technologies (Industry 4.0) are crucial drivers. These advancements are not only improving existing processes but also paving the way for entirely new fabrication methodologies.

-

Regulatory Frameworks: Strict Canadian regulations pertaining to workplace safety, environmental protection, and emissions control significantly influence the industry. Adherence to these standards mandates careful consideration in equipment design, the selection of materials, and the optimization of operational procedures, often leading to the development of more sophisticated and compliant technologies.

-

Product Substitutes: While direct substitutes for metal fabrication equipment are limited, the emergence of alternative manufacturing processes, such as advanced additive manufacturing (3D printing), presents potential long-term competition. These technologies are gradually carving out market share in specific, high-value niche applications.

-

End-User Demographics: The demand for metal fabrication equipment is intrinsically linked to the health and investment cycles of its diverse end-user sectors. Key industries relying on these machines include automotive, construction, aerospace, and energy. Economic fluctuations and strategic investments within these sectors directly impact the market's performance.

-

M&A Activities: The Canadian metal fabrication equipment landscape has witnessed notable consolidation. Recent strategic acquisitions, such as Arrow Machine and Fabrication Group's integration of Steelcraft (February 2022) and AGI's acquisition of Eastern Fabricators (January 2022), underscore a trend towards expanding capabilities and market reach. These transactions, collectively valued at an estimated [Insert Estimated Million Dollar Amount], highlight the industry's drive for synergistic growth and market consolidation.

Canada Metal Fabrication Equipment Industry Market Dynamics & Trends

This section explores the market dynamics shaping the Canadian metal fabrication equipment industry, including growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The market is experiencing steady growth, driven by factors such as increasing industrialization, infrastructure development, and rising demand for customized metal products.

The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration is currently estimated at xx%, with significant potential for expansion in underserved regions and market segments. Technological disruptions, such as the rise of additive manufacturing and Industry 4.0 technologies, are reshaping the competitive landscape, leading to increased efficiency and production flexibility. Consumer preferences are shifting towards sustainable and energy-efficient metal fabrication processes, driving demand for eco-friendly equipment and technologies. The competitive dynamics are characterized by intense competition among major players, with pricing strategies and product innovation playing key roles in market share acquisition.

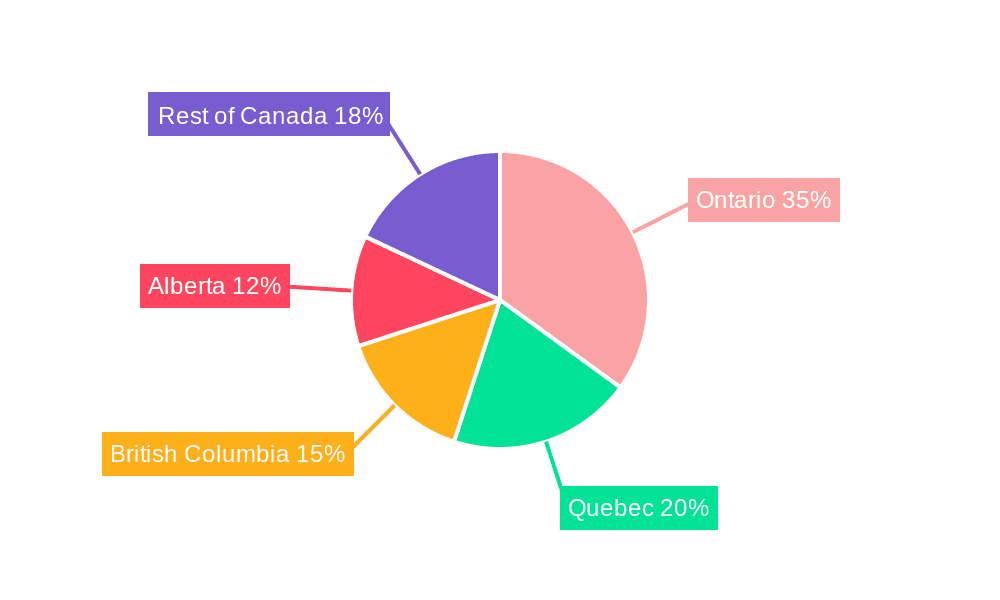

Dominant Regions & Segments in Canada Metal Fabrication Equipment Industry

Ontario and Quebec represent the dominant regions for metal fabrication equipment in Canada due to their established manufacturing bases and proximity to key industrial sectors. This dominance is driven by factors such as:

- Strong Manufacturing Base: Established industrial clusters and a skilled workforce provide a favorable environment for the metal fabrication industry.

- Government Support: Provincial and federal government initiatives promoting manufacturing and industrial development create a supportive ecosystem.

- Proximity to Key End-Users: Geographic proximity to major industrial sectors, such as automotive and aerospace, facilitates efficient supply chains.

The automotive and construction sectors are significant segments within the Canadian metal fabrication equipment market, accounting for a combined xx% of total market demand. These sectors' growth prospects influence overall market growth.

Canada Metal Fabrication Equipment Industry Product Innovations

The industry is witnessing significant product innovations, with a focus on automation, precision, and efficiency. New products incorporate advanced technologies such as laser cutting, robotic welding, and automated material handling systems. These innovations enhance production speed, accuracy, and overall quality while reducing labor costs. The market fit for these products is strong, driven by increasing demand for higher-quality, customized metal products and the need for improved production efficiency within various end-user industries.

Report Scope & Segmentation Analysis

This comprehensive report provides an in-depth analysis of the Canadian metal fabrication equipment market, meticulously segmented by key parameters. These include equipment type (e.g., laser cutting machines, bending machines, welding equipment), end-user industry (e.g., automotive, construction, aerospace, energy), and geographical region (e.g., Ontario, Quebec, British Columbia). Each segment is examined for its unique growth trajectory and competitive dynamics. While growth projections vary across these segments, equipment related to automation is anticipated to experience the most significant expansion. Detailed market size estimates for each segment are comprehensively presented within the full report.

Key Drivers of Canada Metal Fabrication Equipment Industry Growth

Growth in the Canadian metal fabrication equipment industry is fueled by a confluence of factors:

- Infrastructure Development: Government investments in infrastructure projects, including transportation and energy, are driving demand for metal fabrication services.

- Automotive Industry Growth: Expansion of the automotive sector and related manufacturing activities necessitates advanced metal fabrication equipment.

- Technological Advancements: The adoption of Industry 4.0 technologies, like automation and robotics, increases efficiency and drives demand for new equipment.

Challenges in the Canada Metal Fabrication Equipment Industry Sector

The Canadian metal fabrication equipment industry navigates several significant challenges that impact its operational efficiency and growth prospects:

- Supply Chain Disruptions: Global supply chain vulnerabilities continue to pose a threat, leading to potential shortages of critical components and raw materials. This can result in production delays and escalating costs, with an estimated industry loss of [Insert Estimated Million Dollar Loss] in the past year attributable to these disruptions.

- High Energy Costs: The rising cost of energy directly translates into increased operating expenses for metal fabrication businesses, impacting profitability and competitiveness.

- Skilled Labor Shortages: A persistent deficit in skilled labor poses a considerable barrier to production capacity and limits the industry's potential for expansion and adoption of advanced technologies.

Emerging Opportunities in Canada Metal Fabrication Equipment Industry

Despite the challenges, the Canadian metal fabrication equipment sector is ripe with emerging opportunities:

- Additive Manufacturing: The increasing adoption and refinement of 3D printing and other additive manufacturing technologies are creating entirely new market segments and applications for specialized equipment and services.

- Sustainable Manufacturing: A growing global imperative for environmentally conscious production methods is driving demand for eco-friendly metal fabrication processes and, consequently, for manufacturers of sustainable equipment.

- Specialized Fabrication: The escalating demand for highly specialized metal fabrication services within niche sectors, such as medical device manufacturing, presents significant and lucrative growth potential for agile and expert providers.

Leading Players in the Canada Metal Fabrication Equipment Industry Market

- BTD Manufacturing

- Colfax

- Komaspec

- Matcor Matsu Group Inc

- Sandvik Mining and Construction Canada Inc

- STANDARD IRON & WIRE WORKS INC

- TRUMPF Canada Inc

- Atlas Copco

- AMADA Canada

- DMG MORI Canada (List Not Exhaustive)

Key Developments in Canada Metal Fabrication Equipment Industry Industry

- February 2022: Arrow Machine and Fabrication Group acquired Steelcraft, expanding its global reach and manufacturing capacity.

- January 2022: Ag Growth International Inc. (AGI) acquired Eastern Fabricators, strengthening its position in the food processing equipment market.

Future Outlook for Canada Metal Fabrication Equipment Industry Market

The Canadian metal fabrication equipment market is projected for sustained growth, propelled by the ongoing integration of technological advancements, significant infrastructure development initiatives across the country, and robust demand from key end-user industries. Strategic investments in automation technologies, the development and adoption of sustainable manufacturing solutions, and a concerted focus on skilled workforce development will be paramount in capitalizing on future market potential. Overall, the market's future outlook remains highly positive, offering substantial opportunities for both established industry leaders and innovative new entrants.

Canada Metal Fabrication Equipment Industry Segmentation

-

1. Service Type

- 1.1. Machining and Cutting

- 1.2. Forming

- 1.3. Welding

- 1.4. Other Service Type

-

2. Product Type

- 2.1. Automatic

- 2.2. Semi-automatic

- 2.3. Manual

-

3. End User Industry

- 3.1. Manufacturing

- 3.2. Power and Utilities

- 3.3. Construction

- 3.4. Oil and Gas

- 3.5. Other End-user Industries

Canada Metal Fabrication Equipment Industry Segmentation By Geography

- 1. Canada

Canada Metal Fabrication Equipment Industry Regional Market Share

Geographic Coverage of Canada Metal Fabrication Equipment Industry

Canada Metal Fabrication Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Construction Industry Offers Immense Demand for the Metal Fabrication Equipment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Metal Fabrication Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Machining and Cutting

- 5.1.2. Forming

- 5.1.3. Welding

- 5.1.4. Other Service Type

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Automatic

- 5.2.2. Semi-automatic

- 5.2.3. Manual

- 5.3. Market Analysis, Insights and Forecast - by End User Industry

- 5.3.1. Manufacturing

- 5.3.2. Power and Utilities

- 5.3.3. Construction

- 5.3.4. Oil and Gas

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BTD Manufacturing

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Colfax

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Komaspec

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Matcor Matsu Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sandvik Mining and Construction Canada Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 STANDARD IRON & WIRE WORKS INC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TRUMPF Canada Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Atlas Copco

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AMADA Canada

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DMG MORI Canada**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BTD Manufacturing

List of Figures

- Figure 1: Canada Metal Fabrication Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Metal Fabrication Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 4: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 6: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 8: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Metal Fabrication Equipment Industry?

The projected CAGR is approximately 1.6%.

2. Which companies are prominent players in the Canada Metal Fabrication Equipment Industry?

Key companies in the market include BTD Manufacturing, Colfax, Komaspec, Matcor Matsu Group Inc, Sandvik Mining and Construction Canada Inc, STANDARD IRON & WIRE WORKS INC, TRUMPF Canada Inc, Atlas Copco, AMADA Canada, DMG MORI Canada**List Not Exhaustive.

3. What are the main segments of the Canada Metal Fabrication Equipment Industry?

The market segments include Service Type, Product Type, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.5 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Construction Industry Offers Immense Demand for the Metal Fabrication Equipment.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2022: Arrow Machine and Fabrication Group of Guelph, Ontario, announced the acquisition of Steelcraft, a Kitchener, Ontario, steel design, engineering, and fabrication firm. This acquisition expands Arrow's global customer base and manufacturing footprint. It also further promotes the company's strategy of partnering with leading operator-run machining and fabrication organizations to leverage their collective capabilities, solve customer problems, and develop deeper supply chain interactions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Metal Fabrication Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Metal Fabrication Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Metal Fabrication Equipment Industry?

To stay informed about further developments, trends, and reports in the Canada Metal Fabrication Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence