Key Insights

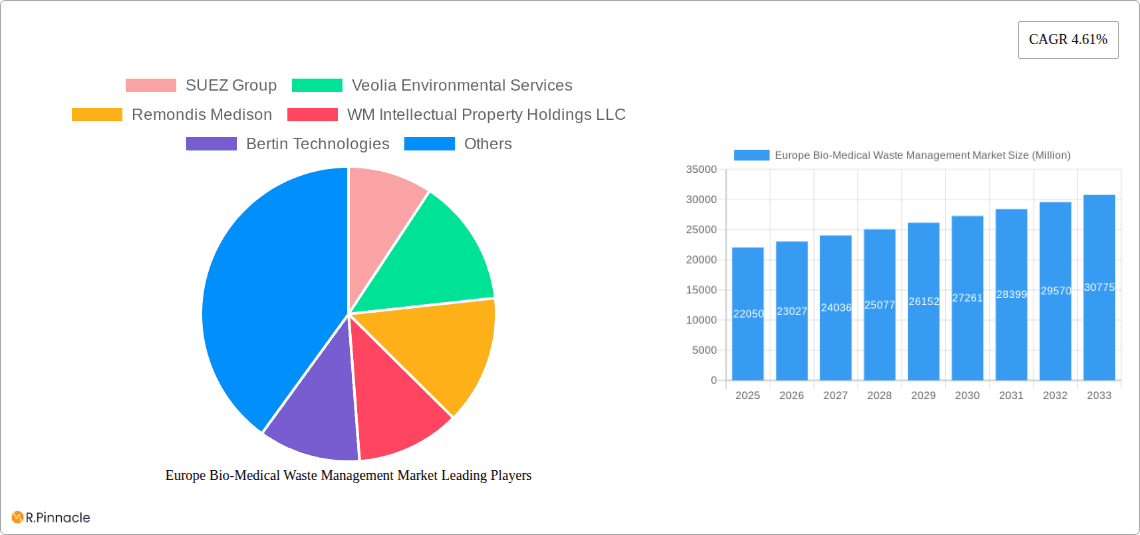

The European bio-medical waste management market, valued at €22.05 billion in 2025, is projected to experience robust growth, driven by several key factors. Increasing healthcare expenditure across Europe, coupled with stricter regulations concerning the environmentally sound disposal of medical waste, are primary catalysts. The rising prevalence of chronic diseases and an aging population contribute significantly to the volume of bio-medical waste generated, fueling market expansion. Technological advancements, such as advanced sterilization techniques and efficient waste-to-energy solutions, are further enhancing the market's growth trajectory. The market's segmentation reflects this complexity, with diverse service offerings catering to hospitals, clinics, research facilities, and pharmaceutical companies. While challenges such as high infrastructure costs and the need for specialized expertise exist, the overall market outlook remains positive.

Europe Bio-Medical Waste Management Market Market Size (In Billion)

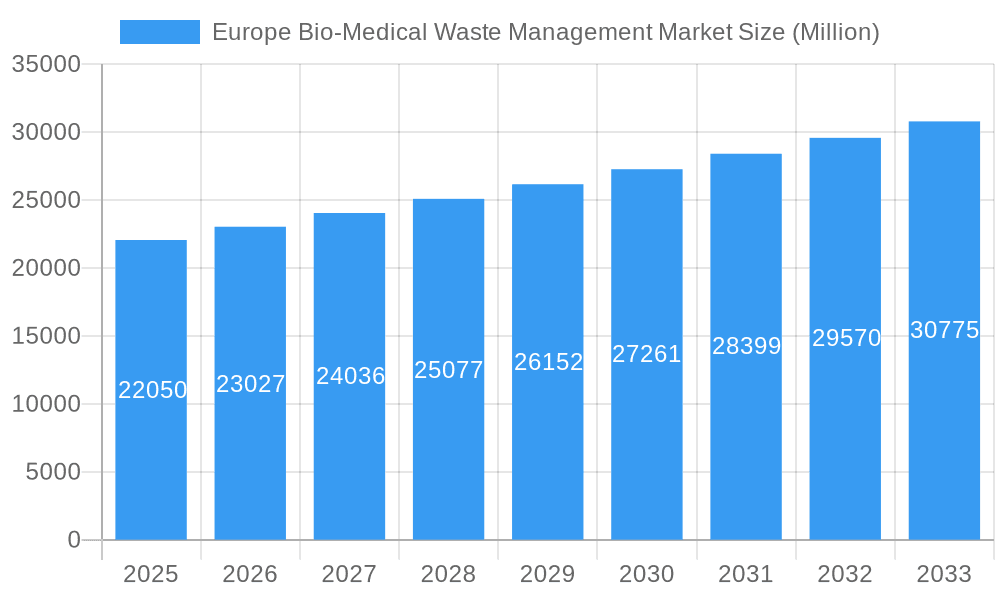

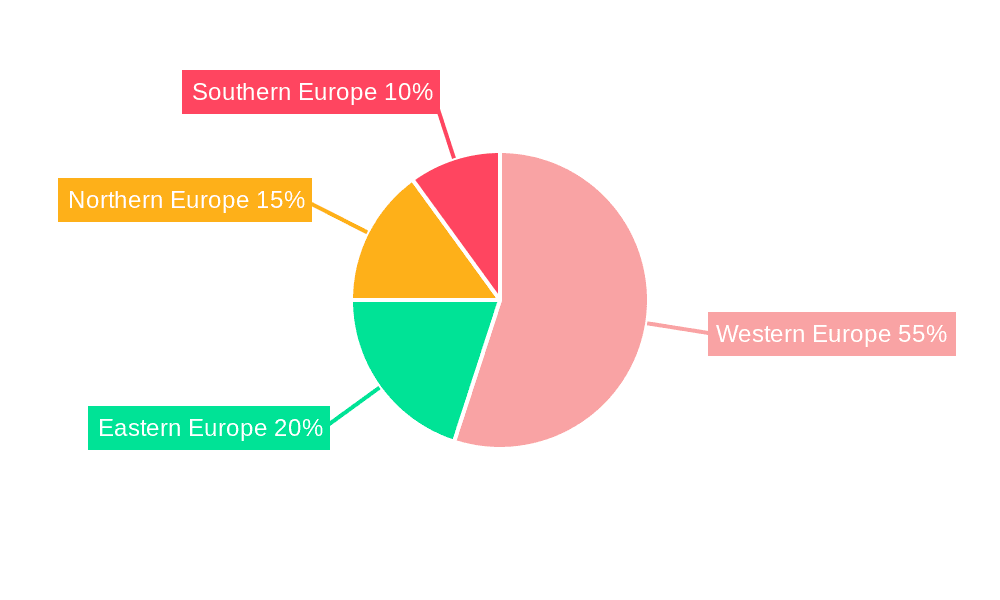

The projected Compound Annual Growth Rate (CAGR) of 4.61% from 2025 to 2033 suggests a steady and sustained expansion of the market. This growth will likely be fueled by continuous improvements in waste management technologies, increasing environmental awareness, and government initiatives promoting sustainable waste disposal practices. Competitive landscape analysis reveals the presence of major players like SUEZ Group, Veolia, and Remondis, indicating a market characterized by both established players and emerging companies vying for market share. The regional distribution of market share likely reflects population density and healthcare infrastructure development across various European nations, with potentially higher concentrations in Western Europe given their advanced healthcare systems.

Europe Bio-Medical Waste Management Market Company Market Share

Europe Bio-Medical Waste Management Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Bio-Medical Waste Management Market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, competitive landscapes, and future growth prospects. The report leverages extensive data analysis to provide actionable intelligence and facilitate informed business strategies.

Europe Bio-Medical Waste Management Market Structure & Innovation Trends

The European bio-medical waste management market is characterized by a moderately concentrated structure, with several large multinational corporations holding significant market share. Key players such as SUEZ Group, Veolia Environmental Services, and Remondis Medison dominate the landscape, alongside regional and specialized operators. Market concentration is influenced by factors like economies of scale, technological capabilities, and regulatory compliance. The market share of the top 5 players is estimated at xx%, indicating a competitive yet consolidated market.

Innovation Drivers:

- Stringent environmental regulations driving investment in advanced treatment technologies.

- Growing awareness of infection control and public health concerns.

- Increasing demand for sustainable waste management solutions.

- Technological advancements in waste-to-energy and recycling technologies.

Regulatory Frameworks: EU directives and national regulations significantly influence market practices, particularly concerning waste treatment standards, disposal methods, and hazardous waste management.

Product Substitutes: While direct substitutes are limited, the market faces indirect competition from alternative waste disposal methods, such as incineration with energy recovery.

End-User Demographics: The market is driven by hospitals, clinics, research institutions, pharmaceutical companies, and veterinary practices.

M&A Activities: The recent acquisition of Stericycle by Waste Management Inc. for USD 7.2 Billion (including debt) in June 2024 highlights the significant consolidation trend in the industry, emphasizing the attractiveness of this sector to large players. This activity boosts market share and expands service offerings.

Europe Bio-Medical Waste Management Market Dynamics & Trends

The European bio-medical waste management market is projected to experience a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors:

- Rising Healthcare Expenditure: Increasing healthcare spending across Europe directly translates to higher volumes of medical waste, driving demand for efficient management solutions.

- Stringent Regulatory Compliance: Stricter environmental regulations necessitate the adoption of advanced and compliant waste management technologies.

- Technological Advancements: Innovations in waste treatment, sterilization, and recycling technologies are improving efficiency and sustainability.

- Growing Awareness of Infection Control: Public health concerns related to infectious diseases necessitate robust waste management systems to prevent the spread of pathogens.

- Increased Focus on Sustainability: The rising environmental consciousness among healthcare providers and governments is promoting sustainable waste management practices.

Market penetration of advanced technologies, such as autoclaves and plasma gasification, is gradually increasing, although traditional methods like incineration remain prevalent. Competitive dynamics are shaped by pricing strategies, technological capabilities, and service offerings. Larger players leverage economies of scale, while smaller companies focus on niche segments or specialized services.

Dominant Regions & Segments in Europe Bio-Medical Waste Management Market

Germany is anticipated to be the leading market in Europe, followed by the UK and France. This dominance is attributed to:

- Germany: Strong regulatory frameworks, a well-established healthcare infrastructure, and a high concentration of healthcare facilities contribute to its leading market position.

- UK: Significant healthcare expenditure and the presence of major waste management companies fuel market growth.

- France: A developing focus on sustainable waste management practices, coupled with a robust healthcare sector, contributes to its market share.

Key Drivers for Dominant Regions:

- Robust Healthcare Infrastructure: High density of hospitals and healthcare facilities fuels waste generation and demand for management services.

- Stringent Environmental Regulations: Stricter regulatory frameworks compel the adoption of efficient and compliant waste handling techniques.

- Government Initiatives: Government support for sustainable waste management and investment in advanced technologies stimulate market expansion.

Europe Bio-Medical Waste Management Market Product Innovations

Recent product innovations highlight a shift toward sustainable and efficient waste management. LabCycle's pilot plant demonstrates significant progress in plastic lab waste recycling, while Bertin Medical Waste's Sterilwave solution, recognized by UNIDO, showcases advanced sterilization technology. These innovations emphasize the growing importance of reducing landfill waste and minimizing environmental impact. The market is witnessing an increasing integration of automation, digitalization, and data analytics in waste management processes, further improving efficiency and traceability.

Report Scope & Segmentation Analysis

This report segments the European bio-medical waste management market based on several key parameters:

Waste Type: This includes sharps, infectious waste, pharmaceutical waste, and other medical waste streams. Each segment exhibits unique treatment requirements and growth trajectories. Infectious waste is currently the largest segment, driven by growing healthcare expenditure.

Treatment Method: This covers incineration, autoclaving, plasma gasification, chemical treatment, and other methods. Each method offers specific advantages and limitations in terms of cost, efficiency, and environmental impact.

End-User: This includes hospitals, clinics, research institutions, pharmaceutical companies, and other healthcare facilities. The growth of each segment is dependent on the specific healthcare landscape in each country.

Geography: The report covers key European countries, analyzing regional variations in market size, growth rates, and competitive dynamics.

Key Drivers of Europe Bio-Medical Waste Management Market Growth

The market's expansion is propelled by a confluence of factors, including:

- Stringent Regulations: EU directives and national regulations mandate safe and environmentally sound waste management practices.

- Technological Advancements: Innovations in waste treatment, sterilization, and recycling technologies enhance efficiency and sustainability.

- Rising Healthcare Expenditure: Increased healthcare spending directly translates into greater volumes of medical waste.

- Growing Environmental Awareness: Increased public and governmental awareness of environmental concerns drives demand for eco-friendly solutions.

Challenges in the Europe Bio-Medical Waste Management Market Sector

Several challenges hinder the market's growth:

- High Initial Investment Costs: Implementing advanced waste management technologies often requires significant upfront capital investment.

- Regulatory Complexity: Navigating diverse and evolving regulations across different countries poses challenges for operators.

- Supply Chain Disruptions: The market can be vulnerable to disruptions in the supply of raw materials and equipment.

- Competition: The market is characterized by both large multinational corporations and smaller specialized operators, creating intense competition.

Emerging Opportunities in Europe Bio-Medical Waste Management Market

Emerging opportunities include:

- Expansion of Recycling Technologies: Increased focus on waste recycling and resource recovery creates new avenues for growth.

- Adoption of Digitalization and Data Analytics: Integrating advanced technologies can improve waste management efficiency and traceability.

- Development of Sustainable Solutions: Demand for eco-friendly and sustainable waste management solutions is growing steadily.

- Expansion into Untapped Markets: Certain regional markets present significant growth potential.

Leading Players in the Europe Bio-Medical Waste Management Market Market

- SUEZ Group

- Veolia Environmental Services

- Remondis Medison

- WM Intellectual Property Holdings LLC

- Bertin Technologies

- Cleansing Service Group (CSG)

- Rhenus Group

- Initial Medical Services

- Biffa

- Cannon Hygiene

- Cleanaway

- Grundon Waste Management

- Viridor

Key Developments in Europe Bio-Medical Waste Management Market Industry

- June 2024: Waste Management Inc. acquires Stericycle for USD 7.2 Billion, significantly expanding its presence in the medical waste management sector.

- September 2023: LabCycle launches a pilot plant for recycling plastic lab waste, showcasing advancements in waste recycling technologies.

- January 2023: Bertin Medical Waste's Sterilwave solution receives UNIDO recognition for its innovative approach to medical waste treatment.

Future Outlook for Europe Bio-Medical Waste Management Market Market

The future of the European bio-medical waste management market appears promising, driven by sustained growth in healthcare expenditure, stringent environmental regulations, and technological advancements. The market is poised for continued consolidation, with larger players acquiring smaller companies to expand their service offerings and geographical reach. The focus on sustainability and resource recovery will further drive innovation and shape the market landscape in the coming years. Significant opportunities exist for companies offering innovative and sustainable solutions that meet the evolving needs of the healthcare industry and comply with stringent regulations.

Europe Bio-Medical Waste Management Market Segmentation

-

1. Waste Type

- 1.1. Hazardous

- 1.2. Non-hazardous

-

2. Service Type

- 2.1. Collection

- 2.2. Transportation and Storage

- 2.3. Treatment and Disposal

- 2.4. Other Service Types

Europe Bio-Medical Waste Management Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Bio-Medical Waste Management Market Regional Market Share

Geographic Coverage of Europe Bio-Medical Waste Management Market

Europe Bio-Medical Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surging Demand for Healthcare Services; Rise in Surgical Procedures

- 3.3. Market Restrains

- 3.3.1. Surging Demand for Healthcare Services; Rise in Surgical Procedures

- 3.4. Market Trends

- 3.4.1. The Bio-medical Waste Management Market is Set for Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Bio-Medical Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste Type

- 5.1.1. Hazardous

- 5.1.2. Non-hazardous

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Collection

- 5.2.2. Transportation and Storage

- 5.2.3. Treatment and Disposal

- 5.2.4. Other Service Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Waste Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SUEZ Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Veolia Environmental Services

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Remondis Medison

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 WM Intellectual Property Holdings LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bertin Technologies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cleansing Service Group (CSG)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rhenus Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Initial Medical Services

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Biffa

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cannon Hygiene

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Cleanaway

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Grundon Waste Management

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Viridor*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 SUEZ Group

List of Figures

- Figure 1: Europe Bio-Medical Waste Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Bio-Medical Waste Management Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Bio-Medical Waste Management Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 2: Europe Bio-Medical Waste Management Market Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 3: Europe Bio-Medical Waste Management Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Europe Bio-Medical Waste Management Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 5: Europe Bio-Medical Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Bio-Medical Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Europe Bio-Medical Waste Management Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 8: Europe Bio-Medical Waste Management Market Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 9: Europe Bio-Medical Waste Management Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 10: Europe Bio-Medical Waste Management Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 11: Europe Bio-Medical Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Bio-Medical Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Bio-Medical Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Bio-Medical Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Bio-Medical Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Bio-Medical Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Bio-Medical Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Bio-Medical Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Bio-Medical Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Bio-Medical Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Bio-Medical Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Bio-Medical Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Bio-Medical Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Bio-Medical Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Bio-Medical Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Bio-Medical Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Bio-Medical Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Bio-Medical Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Bio-Medical Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Bio-Medical Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Bio-Medical Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Bio-Medical Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Bio-Medical Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Bio-Medical Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Bio-Medical Waste Management Market?

The projected CAGR is approximately 4.61%.

2. Which companies are prominent players in the Europe Bio-Medical Waste Management Market?

Key companies in the market include SUEZ Group, Veolia Environmental Services, Remondis Medison, WM Intellectual Property Holdings LLC, Bertin Technologies, Cleansing Service Group (CSG), Rhenus Group, Initial Medical Services, Biffa, Cannon Hygiene, Cleanaway, Grundon Waste Management, Viridor*List Not Exhaustive.

3. What are the main segments of the Europe Bio-Medical Waste Management Market?

The market segments include Waste Type, Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Surging Demand for Healthcare Services; Rise in Surgical Procedures.

6. What are the notable trends driving market growth?

The Bio-medical Waste Management Market is Set for Significant Growth.

7. Are there any restraints impacting market growth?

Surging Demand for Healthcare Services; Rise in Surgical Procedures.

8. Can you provide examples of recent developments in the market?

June 2024: Waste Management Inc. and Stericycle confirmed a definitive agreement, with Waste Management acquiring all outstanding shares of Stericycle at USD 62.00 per share in cash. This deal, totaling approximately USD 7.2 billion, accounts for Stericycle's net debt of around USD 1.4 billion. With this acquisition, Waste Management is expected to broaden its environmental solutions portfolio by incorporating Stericycle's prominent assets in the lucrative medical waste and secure information destruction industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Bio-Medical Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Bio-Medical Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Bio-Medical Waste Management Market?

To stay informed about further developments, trends, and reports in the Europe Bio-Medical Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence