Key Insights

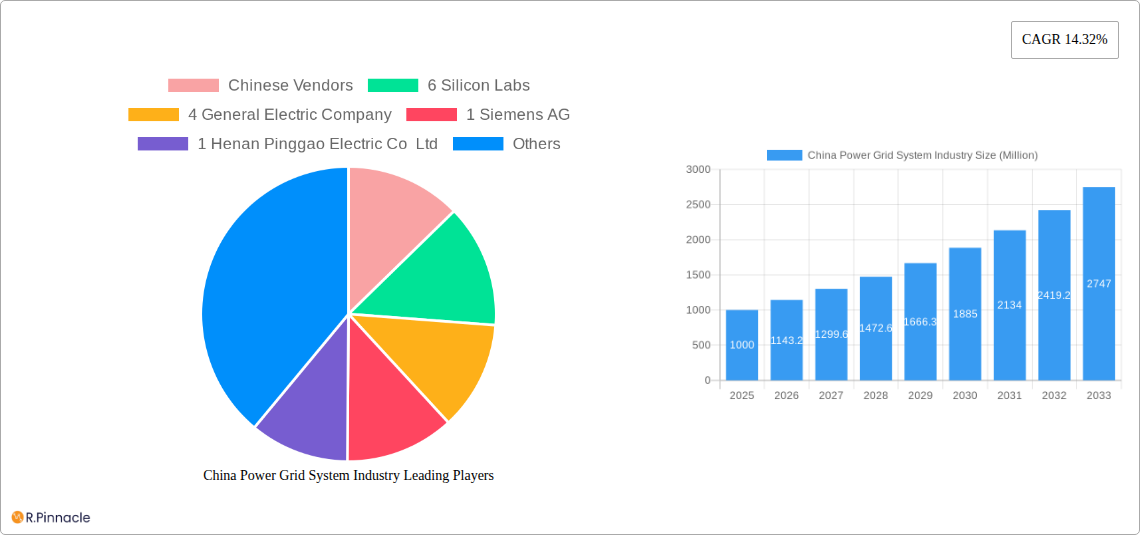

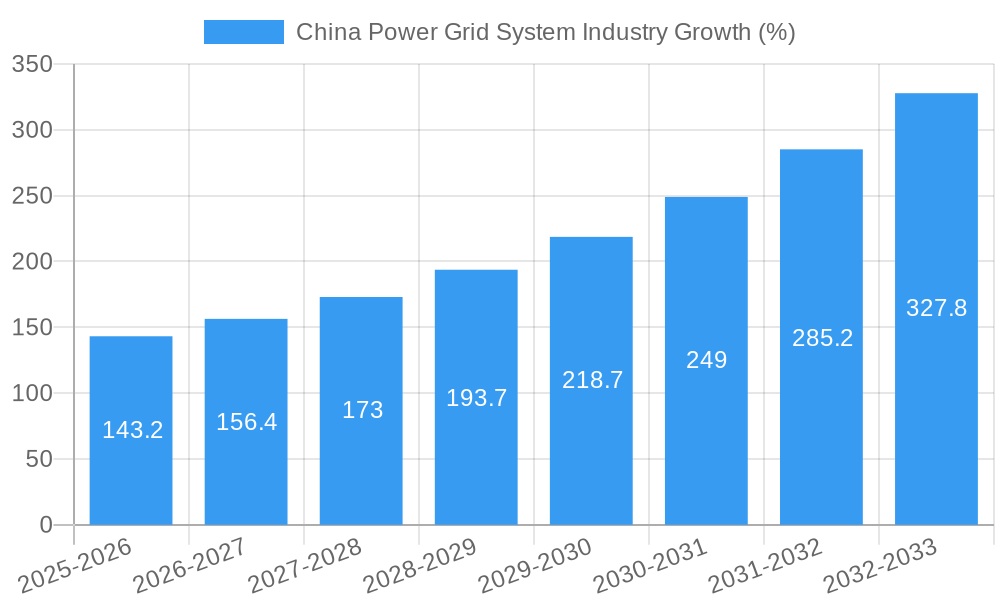

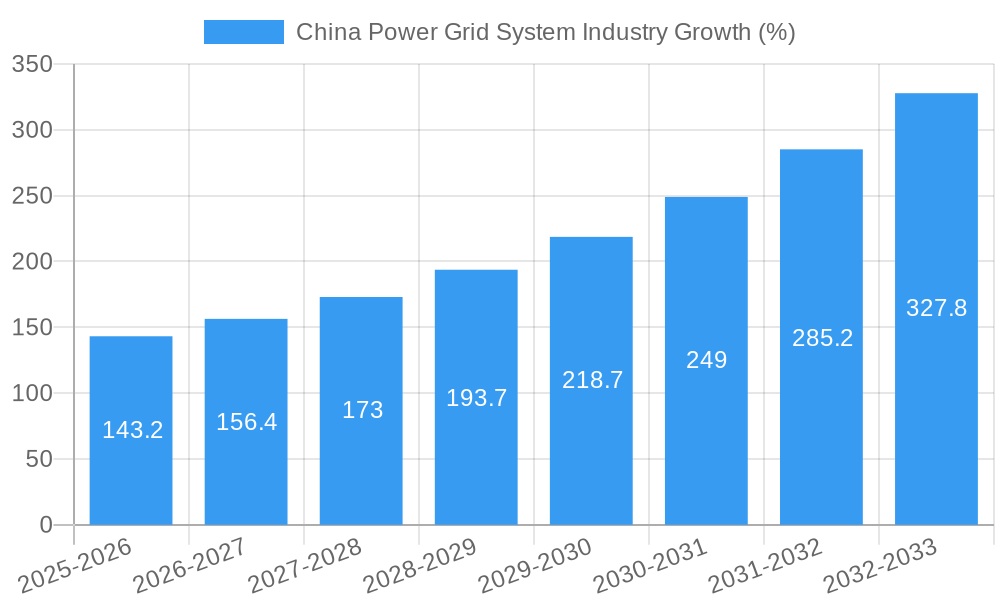

The China power grid system industry is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 14.32% from 2025 to 2033. This expansion is fueled by several key drivers: China's ongoing urbanization and industrialization initiatives necessitate significant investments in expanding and modernizing its power grid infrastructure to support increasing energy demand. The government's commitment to renewable energy integration, including solar and wind power, further stimulates market growth as the grid needs upgrading to handle intermittent energy sources effectively. Technological advancements, such as the adoption of smart grid technologies and advanced metering infrastructure (AMI), are driving efficiency improvements and creating new opportunities for market players. Finally, growing investments in high-voltage direct current (HVDC) transmission lines are enhancing grid stability and long-distance power transfer capabilities.

However, challenges remain. The industry faces constraints related to the significant upfront capital investment required for grid modernization and expansion projects. Competition from both domestic and international vendors can intensify pricing pressures. Furthermore, ensuring grid security and resilience against cyber threats is a crucial ongoing concern. Despite these challenges, the market segmentation reveals strong growth potential across various product categories, including transformers, substations, transmission lines, and cables. The end-user segments – industrial, commercial, and residential – all contribute significantly to the overall market demand. The dominance of Chinese vendors in the market highlights the country's strong manufacturing capabilities and technological advancements in this sector. However, international players continue to maintain a presence, competing primarily on technological innovation and expertise. Given the continued emphasis on infrastructure development and renewable energy integration, the China power grid system industry is poised for sustained growth in the coming years.

China Power Grid System Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the China Power Grid System Industry, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report delivers crucial data and forecasts to navigate the complexities of this rapidly evolving market. The report uses USD Million for all values.

China Power Grid System Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the China power grid system industry, encompassing market concentration, innovation drivers, regulatory frameworks, and mergers and acquisitions (M&A) activities. The market is characterized by a mix of established international players and rapidly growing domestic Chinese vendors. Key metrics like market share and M&A deal values are presented to illustrate market dynamics. The industry is witnessing significant innovation driven by government policies promoting renewable energy integration and smart grid technologies. Regulatory frameworks, while supportive of growth, also present certain compliance challenges. Product substitution is a factor, with increasing adoption of advanced materials and smart grid solutions impacting traditional technologies. The end-user demographic is shifting towards a greater emphasis on industrial and commercial sectors, driven by increased electricity demand.

- Market Concentration: The market exhibits a moderately concentrated structure with a few dominant players holding significant market share. The exact figures are unavailable for a precise calculation of concentration ratios (e.g., CR4, CR8).

- Innovation Drivers: Government incentives for renewable energy integration, smart grid development, and digitalization initiatives are primary drivers.

- M&A Activity: M&A activity has been relatively high in recent years, with deal values exceeding xx Million in the period 2019-2024. These transactions involve both domestic and international players seeking to expand their market reach and product portfolios.

- Regulatory Frameworks: The regulatory environment is generally supportive, but compliance requirements can pose challenges, particularly for smaller companies.

- End-User Demographics: Industrial and commercial segments are expected to drive future growth, surpassing residential consumption in the forecast period.

China Power Grid System Industry Market Dynamics & Trends

This section explores the key dynamics and trends shaping the China power grid system industry. The market is experiencing robust growth, driven by factors such as increasing energy demand, expanding urbanization, and government investment in infrastructure development. Technological disruptions, such as the integration of renewable energy sources and smart grid technologies, are fundamentally altering the industry landscape. Consumer preferences are shifting towards more reliable, efficient, and sustainable power solutions. Competitive dynamics are characterized by both cooperation and competition between domestic and international players.

The Compound Annual Growth Rate (CAGR) for the market during the forecast period (2025-2033) is projected at xx%. Market penetration of smart grid technologies is steadily increasing, with xx% penetration expected by 2033. Significant investments are being made to modernize and expand the grid infrastructure to accommodate increasing energy demand and the integration of renewable energy sources. The ongoing digital transformation of the industry is creating new opportunities for companies specializing in IoT solutions, data analytics, and cybersecurity.

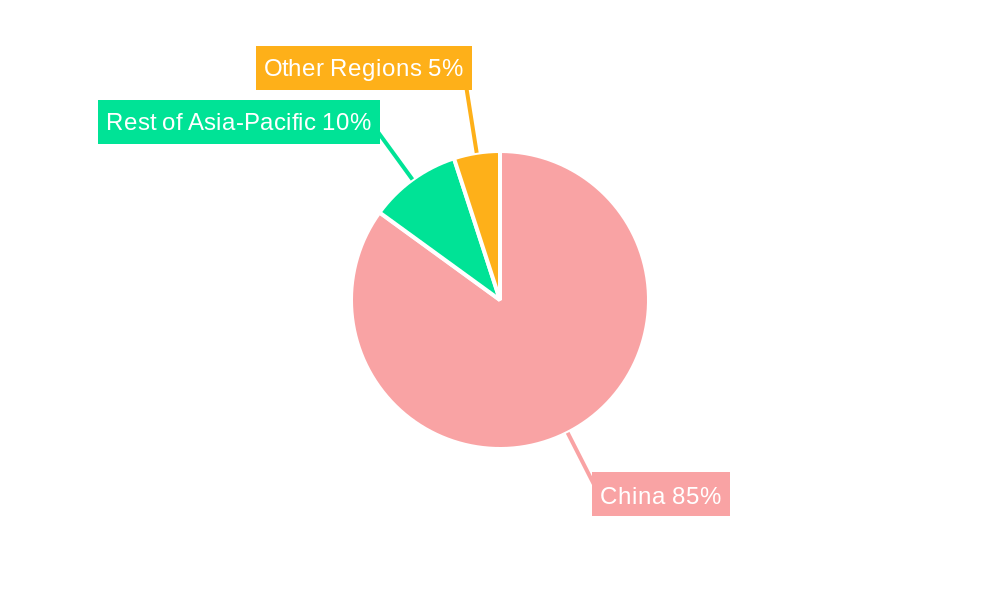

Dominant Regions & Segments in China Power Grid System Industry

This section identifies the leading regions, countries, and segments within the China power grid system industry. The analysis considers segmentation by product (transformers, substations, transmission lines, cables), end-user (industrial, commercial, residential), and application (distribution, transmission, generation).

Dominant Regions: Coastal provinces and major metropolitan areas are expected to continue to be the dominant regions due to high electricity demand and infrastructure development. Precise market share figures are unavailable at the regional level but coastal areas generally show higher consumption and development than inland regions.

Dominant Segments (By Product):

- Transformers: This segment holds a significant market share, driven by the constant need for upgrading and expanding transmission and distribution networks.

- Substations: Growth in this segment is fueled by the increasing need for efficient power distribution and grid modernization.

- Transmission Lines: Expansion of transmission lines to accommodate renewable energy sources and address regional imbalances in electricity supply.

- Cables: High demand for cables due to the ongoing expansion and upgrades of the power grid.

Dominant Segments (By End-User): The industrial sector is expected to remain the dominant end-user due to its higher energy consumption. However, the commercial sector's growth rate is likely to be higher in the forecast period.

Dominant Segments (By Application): The distribution segment is expected to experience significant growth due to increasing urbanization and expansion of electricity networks. Transmission and generation segments will witness growth driven by renewable energy integration and capacity expansion.

Key Drivers: Government policies supporting infrastructure development, robust economic growth, and rising energy demand are key drivers for the growth of all segments.

China Power Grid System Industry Product Innovations

The China power grid system industry is witnessing significant product innovation, driven by technological advancements and increasing demand for efficient and reliable power solutions. Smart grid technologies, including advanced metering infrastructure (AMI), grid automation, and energy storage solutions, are gaining traction. The integration of renewable energy sources is prompting the development of new products and solutions for efficient power transmission and distribution. Companies are focusing on developing products with enhanced reliability, efficiency, and sustainability features to meet the evolving needs of the market. These innovations lead to improvements in grid stability, reduced transmission losses, and increased integration of renewable energy sources.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the China Power Grid System Industry, segmented by product, end-user, and application.

By Product: The market is segmented into transformers, substations, transmission lines, and cables. Growth projections vary across these segments depending on government infrastructure plans.

By End-User: The report analyzes the market by industrial, commercial, and residential end-users. Each segment exhibits different growth trajectories and market dynamics.

By Application: The market is further segmented by application, including distribution, transmission, and generation. Growth projections are provided for each application segment, reflecting the anticipated changes in the energy mix and grid infrastructure development.

Market sizes and competitive dynamics are presented for each segment, providing insights into market share, growth projections, and competitive pressures.

Key Drivers of China Power Grid System Industry Growth

The growth of the China power grid system industry is propelled by several key factors. Government initiatives promoting renewable energy integration and grid modernization play a significant role. Rapid economic growth and urbanization fuel rising electricity demand. Investments in infrastructure development, particularly in the power sector, are crucial for expansion. Technological advancements, such as the adoption of smart grid technologies, further drive market growth by enhancing efficiency and reliability.

Challenges in the China Power Grid System Industry Sector

The China power grid system industry faces various challenges. Maintaining grid stability and security amidst increasing renewable energy integration is a significant concern. Supply chain disruptions can impact the availability of critical components. Intense competition, especially from domestic vendors, requires companies to constantly innovate and offer cost-effective solutions. Regulatory hurdles and compliance requirements can pose challenges for smaller businesses.

Emerging Opportunities in China Power Grid System Industry

The China power grid system industry presents many opportunities. The expanding adoption of smart grid technologies creates significant potential for growth. Increasing demand for renewable energy integration offers opportunities for companies developing related technologies and solutions. The growth of electric vehicles (EVs) and other electrified transportation presents opportunities for charging infrastructure development. Investment in upgrading and expanding the existing power grid infrastructure will create sustained opportunities over the next decade.

Leading Players in the China Power Grid System Industry Market

The China power grid system industry is dominated by a mix of Chinese and international vendors.

- Chinese Vendors (6):

- Huawei Technologies Co Ltd

- ZTE Corporation

- Shenzhen Clou Electronics Co

- Jiangsu Linyang Energy Co Ltd

- Henan Pinggao Electric Co Ltd

- Nigbo Sanxing Electric Co

- Silicon Labs (4)

- General Electric Company (1)

- Siemens AG (1)

- International Vendors (5):

- Waision Group Holdings Limited

- ABB Ltd

- Landis+Gyr Group AG

- International Business Machines Corporation

Key Developments in China Power Grid System Industry

June 2022: The State Grid Corporation of China announced a record investment of over USD 74.5 Billion in power grid projects for 2022, signaling a significant boost to market growth and infrastructure development.

October 2022: The State Grid Corporation of China (SGCC) announced the deployment of a Nokia solution for real-time monitoring of power production and distribution using IoT sensors, highlighting the industry's ongoing digital transformation.

Future Outlook for China Power Grid System Industry Market

The future outlook for the China power grid system industry remains positive. Continued government investment in infrastructure, coupled with the growing demand for electricity, will drive significant growth. The increasing adoption of smart grid technologies and renewable energy integration will further propel market expansion. Companies that can adapt to the evolving technological landscape and meet the demands of a rapidly changing market will be well-positioned for success. The market is expected to witness sustained growth throughout the forecast period, presenting significant opportunities for both domestic and international players.

China Power Grid System Industry Segmentation

- 1. Transmission Upgrades

- 2. Substation Automation

- 3. Advance Metering Infrastructure (AMI)

- 4. Distribution Automation

China Power Grid System Industry Segmentation By Geography

- 1. China

China Power Grid System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Vehicle Ownership4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Increasing Investment Plans and Upcoming Smart Grid Projects Driving the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Power Grid System Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Transmission Upgrades

- 5.2. Market Analysis, Insights and Forecast - by Substation Automation

- 5.3. Market Analysis, Insights and Forecast - by Advance Metering Infrastructure (AMI)

- 5.4. Market Analysis, Insights and Forecast - by Distribution Automation

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.1. Market Analysis, Insights and Forecast - by Transmission Upgrades

- 6. China China Power Grid System Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan China Power Grid System Industry Analysis, Insights and Forecast, 2019-2031

- 8. India China Power Grid System Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea China Power Grid System Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan China Power Grid System Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia China Power Grid System Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific China Power Grid System Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Chinese Vendors

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 6 Silicon Labs

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 4 General Electric Company

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 1 Siemens AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 1 Henan Pinggao Electric Co Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 2 ZTE Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 6 Shenzhen Clou Electronics Co

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 4 Jiangsu Linyang Energy Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 5 International Business Machines Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 International Vendors

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 5 Waision Group Holdings Limited

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 3 ABB Ltd

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 2 Landis+Gyr Group AG

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 3 Huawei Technologies Co Ltd

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 7 Nigbo Sanxing Electric Co

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.1 Chinese Vendors

List of Figures

- Figure 1: China Power Grid System Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Power Grid System Industry Share (%) by Company 2024

List of Tables

- Table 1: China Power Grid System Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Power Grid System Industry Revenue Million Forecast, by Transmission Upgrades 2019 & 2032

- Table 3: China Power Grid System Industry Revenue Million Forecast, by Substation Automation 2019 & 2032

- Table 4: China Power Grid System Industry Revenue Million Forecast, by Advance Metering Infrastructure (AMI) 2019 & 2032

- Table 5: China Power Grid System Industry Revenue Million Forecast, by Distribution Automation 2019 & 2032

- Table 6: China Power Grid System Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: China Power Grid System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China China Power Grid System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Japan China Power Grid System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India China Power Grid System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Korea China Power Grid System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Taiwan China Power Grid System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Australia China Power Grid System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Asia-Pacific China Power Grid System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: China Power Grid System Industry Revenue Million Forecast, by Transmission Upgrades 2019 & 2032

- Table 16: China Power Grid System Industry Revenue Million Forecast, by Substation Automation 2019 & 2032

- Table 17: China Power Grid System Industry Revenue Million Forecast, by Advance Metering Infrastructure (AMI) 2019 & 2032

- Table 18: China Power Grid System Industry Revenue Million Forecast, by Distribution Automation 2019 & 2032

- Table 19: China Power Grid System Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Power Grid System Industry?

The projected CAGR is approximately 14.32%.

2. Which companies are prominent players in the China Power Grid System Industry?

Key companies in the market include Chinese Vendors, 6 Silicon Labs, 4 General Electric Company, 1 Siemens AG, 1 Henan Pinggao Electric Co Ltd, 2 ZTE Corporation, 6 Shenzhen Clou Electronics Co, 4 Jiangsu Linyang Energy Co Ltd, 5 International Business Machines Corporation, International Vendors, 5 Waision Group Holdings Limited, 3 ABB Ltd, 2 Landis+Gyr Group AG, 3 Huawei Technologies Co Ltd, 7 Nigbo Sanxing Electric Co.

3. What are the main segments of the China Power Grid System Industry?

The market segments include Transmission Upgrades, Substation Automation, Advance Metering Infrastructure (AMI), Distribution Automation.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Vehicle Ownership4.; Government Initiatives.

6. What are the notable trends driving market growth?

Increasing Investment Plans and Upcoming Smart Grid Projects Driving the Market Demand.

7. Are there any restraints impacting market growth?

4.; Volatile Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

June 2022: The State Grid Corporation of China announced that the company would invest an all-time high of more than USD 74.5 billion in power grid projects in 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Power Grid System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Power Grid System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Power Grid System Industry?

To stay informed about further developments, trends, and reports in the China Power Grid System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence