Key Insights

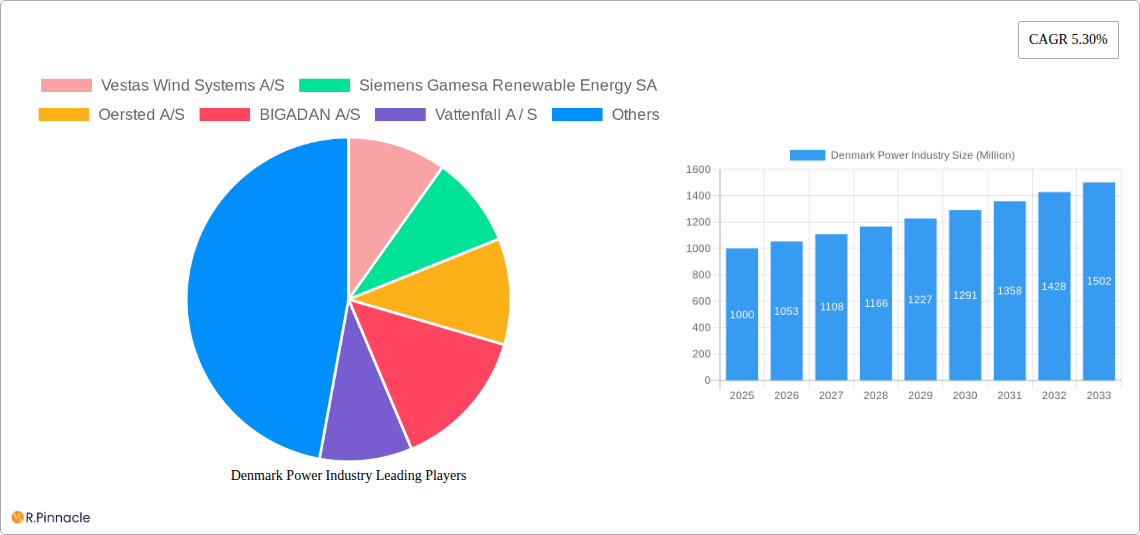

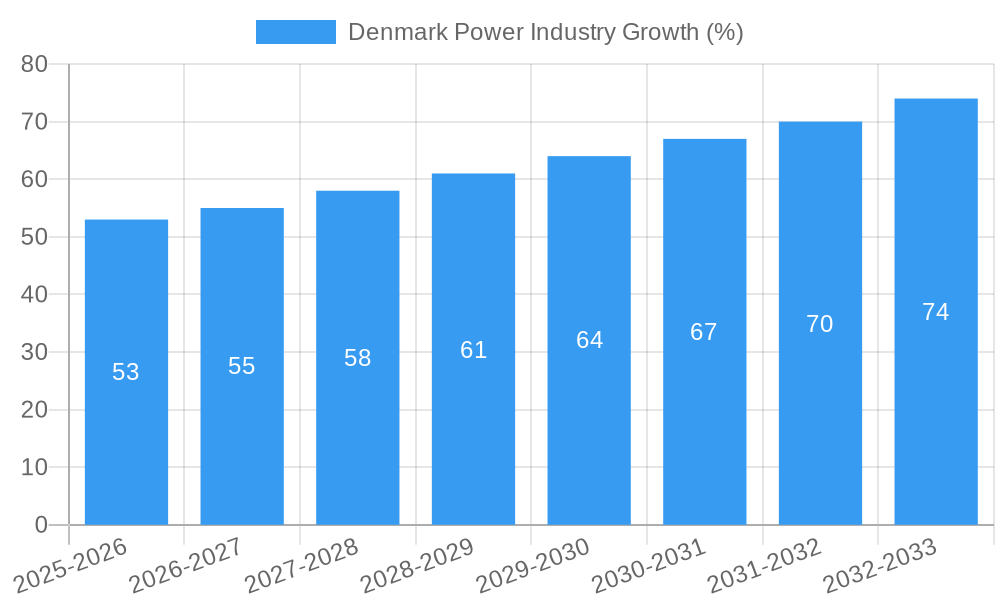

The Denmark power industry, currently valued at approximately €X million (estimated based on the provided CAGR and market trends), is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) of 5.30% from 2025 to 2033. This growth is driven primarily by increasing demand for renewable energy sources, driven by government initiatives targeting carbon neutrality and a growing awareness of climate change among consumers and businesses. Significant investments in wind and solar power infrastructure are fueling this expansion, as evidenced by the active participation of major players like Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy SA, and Ørsted A/S. The residential sector is expected to show strong growth, boosted by government incentives for rooftop solar installations and energy efficiency upgrades. However, the industry faces certain challenges, including the intermittency of renewable sources and the need for grid modernization to accommodate the influx of renewable energy. Maintaining grid stability and efficiently integrating intermittent renewable sources remains crucial for sustainable industry growth.

The segmentation of the Danish power market reveals a clear shift towards renewable energy. While coal continues to play a role, its contribution is declining significantly in favor of wind and solar power. The industrial sector, a large energy consumer, is a key driver of the demand for reliable and sustainable energy, increasingly favoring power purchase agreements (PPAs) with renewable energy providers. The dominance of major players indicates a consolidated market, but there is also space for smaller companies specializing in niche technologies or regional energy solutions. Future growth hinges on continued investment in renewable energy infrastructure, smart grid technologies, and effective policies promoting energy efficiency and sustainability. The country's commitment to ambitious climate goals and the supportive regulatory environment bode well for the continued expansion of the Danish power sector.

Denmark Power Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Denmark power industry, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, and future outlook, highlighting key players and significant developments.

Denmark Power Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Danish power industry, examining market concentration, innovation drivers, regulatory frameworks, and key trends shaping its evolution. The Danish power market shows a notable concentration with a few dominant players, particularly in the wind energy sector. Vestas Wind Systems A/S holds a significant market share, followed by other key players like Siemens Gamesa Renewable Energy and Ørsted A/S. The market share of these top three players is estimated to be around xx%.

Market Concentration & Innovation:

- High concentration in wind energy generation.

- Significant investment in R&D drives innovation in wind turbine technology and smart grid solutions.

- Stringent environmental regulations push for renewable energy sources.

- Growing adoption of energy storage solutions, driving market diversification.

- The value of M&A deals in the sector totalled approximately €xx Million in the historical period, with a predicted value of €xx Million for 2025.

Regulatory Frameworks & Product Substitutes:

- Supportive government policies incentivize renewable energy development.

- Emphasis on energy efficiency and grid modernization.

- Limited presence of coal-fired power plants, indicating a shift towards cleaner energy sources.

- Natural gas serves as a transitional fuel source before complete renewable energy adoption.

End-User Demographics & M&A Activity:

- Residential, commercial, and industrial sectors are key end-users.

- Industrial users account for the largest share of total energy consumption.

- Recent M&A activity focuses on consolidating renewable energy assets and expanding geographical reach.

Denmark Power Industry Market Dynamics & Trends

This section dives deep into the market's growth trajectory, technological advancements, consumer behavior, and competitive landscape. The Danish power industry is experiencing robust growth, primarily driven by the country's ambitious renewable energy targets and the increasing global demand for sustainable energy solutions.

The compound annual growth rate (CAGR) for the overall market is projected to be xx% during the forecast period (2025-2033). Wind power continues to dominate the generation segment, with a market penetration rate exceeding xx% in 2024. However, solar power is showing significant growth, driven by decreasing costs and supportive government policies. The increasing adoption of smart grid technologies and energy storage solutions is further transforming the industry. Competitive dynamics are characterized by fierce competition among major players, particularly in the wind turbine manufacturing and offshore wind farm development sectors. Consumer preferences are increasingly shifting towards renewable energy sources, reflected in the growing demand for green electricity.

Dominant Regions & Segments in Denmark Power Industry

Denmark's power industry is characterized by a geographically concentrated market, with a significant proportion of generation and consumption happening in its main urban centers and coastal regions. Wind power constitutes the dominant generation segment, followed by other renewable sources like solar and biomass, while the share of coal is declining. The industrial sector is the largest end-user, representing xx% of total electricity consumption.

Key Drivers for Wind Power Dominance:

- Favorable wind resources and geographical location.

- Strong government support and substantial investments in offshore wind projects.

- Technological advancements leading to cost reductions in wind turbine technology.

- Development of large-scale offshore wind farms.

Key Drivers for Industrial Sector Dominance:

- High energy intensity of various industries.

- Government incentives for energy efficiency in the industrial sector.

- Strategic location of major industries near power generation facilities.

Solar Power Growth:

- Increasing deployment of rooftop solar panels.

- Government incentives and feed-in tariffs support solar PV installations.

- Technological advances leading to improved efficiency and cost reduction.

Denmark Power Industry Product Innovations

The Danish power industry is at the forefront of innovation, particularly in wind turbine technology. Recent advancements include increased turbine capacity, improved blade designs, and the integration of smart grid technologies for enhanced efficiency and grid stability. These innovations aim to improve energy yield, reduce operational costs, and facilitate greater integration of renewable energy sources into the national grid. The industry also witnesses progress in energy storage solutions to overcome the intermittency challenges of renewable sources.

Report Scope & Segmentation Analysis

This report segments the Danish power market based on generation type (Wind, Solar, Coal, Others) and end-user (Residential, Commercial, Industrial). The wind segment is projected to experience the highest growth rate due to ongoing investments in offshore wind projects. The solar segment, while currently smaller, is predicted to show strong growth fueled by cost reductions and supportive government policies. The coal segment is expected to decline continuously, given the policy shift towards renewable energy and the environmental concerns associated with coal. The residential, commercial, and industrial sectors account for different proportions of overall energy consumption, with the industrial sector holding the largest share.

Key Drivers of Denmark Power Industry Growth

The growth of Denmark's power industry is primarily propelled by ambitious renewable energy targets, significant government investments in renewable energy infrastructure, and a supportive regulatory environment. Technological advancements in wind and solar technologies reduce costs and improve efficiency, further stimulating industry growth. Furthermore, the increasing global focus on climate change mitigation is pushing for a transition to clean energy sources, bolstering the growth of the Danish power industry.

Challenges in the Denmark Power Industry Sector

The Danish power industry faces challenges including the intermittency of renewable energy sources, the need for grid modernization to handle increased renewable energy integration, and the potential for supply chain disruptions. Balancing the transition to renewable energy with grid stability and affordability requires careful planning and coordination. Furthermore, the high initial investment costs for renewable energy projects, including offshore wind farms, pose a significant financial hurdle. The industry also faces competition from other energy markets and countries.

Emerging Opportunities in Denmark Power Industry

Opportunities exist in the development and deployment of advanced energy storage solutions, smart grid technologies, and energy efficiency solutions. The growing demand for green energy creates significant opportunities for renewable energy developers, manufacturers, and technology providers. Moreover, the integration of renewable energy into sectors like transportation and heating presents new market entry points.

Leading Players in the Denmark Power Industry Market

- Vestas Wind Systems A/S

- Siemens Gamesa Renewable Energy SA

- Ørsted A/S

- BIGADAN A/S

- Vattenfall A/S

- Arcon-Sunmark A/S

- General Electric Company

- List Not Exhaustive

Key Developments in Denmark Power Industry

- October 2022: Ørsted announced plans to develop four new offshore wind farms, aiming to double wind power production. This move reduces reliance on Russian gas and oil. Partnership with Copenhagen Infrastructure Partners (CIP) for approximately 5.2 GW of capacity.

- June 2022: Denmark and Germany agreed to finalize the Bornholm Energy Island project (3 GW capacity), providing green electricity to 3.3-4.5 Million households by 2030. This significantly expands renewable energy capacity.

Future Outlook for Denmark Power Industry Market

The Danish power industry is poised for continued growth driven by strong government support, technological advancements, and the global shift towards sustainable energy. The increasing adoption of renewable energy sources, coupled with smart grid technologies and energy storage solutions, will shape the sector's future. The country's commitment to achieving carbon neutrality makes it an attractive market for renewable energy investments and innovation.

Denmark Power Industry Segmentation

-

1. Generation

- 1.1. Wind

- 1.2. Solar

- 1.3. Coal

- 1.4. Others

- 2. Transmission and Distribution

Denmark Power Industry Segmentation By Geography

- 1. Denmark

Denmark Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Integration of Renewable Energy4.; Supportive government policies in Power Plants

- 3.3. Market Restrains

- 3.3.1. 4.; Limited Land Availability

- 3.4. Market Trends

- 3.4.1. Wind Energy to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Denmark Power Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Generation

- 5.1.1. Wind

- 5.1.2. Solar

- 5.1.3. Coal

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Transmission and Distribution

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Denmark

- 5.1. Market Analysis, Insights and Forecast - by Generation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Vestas Wind Systems A/S

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Siemens Gamesa Renewable Energy SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Oersted A/S

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BIGADAN A/S

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vattenfall A / S

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Arcon-Sunmark A/S

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 General Electric Company*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Vestas Wind Systems A/S

List of Figures

- Figure 1: Denmark Power Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Denmark Power Industry Share (%) by Company 2024

List of Tables

- Table 1: Denmark Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Denmark Power Industry Volume megawatt Forecast, by Region 2019 & 2032

- Table 3: Denmark Power Industry Revenue Million Forecast, by Generation 2019 & 2032

- Table 4: Denmark Power Industry Volume megawatt Forecast, by Generation 2019 & 2032

- Table 5: Denmark Power Industry Revenue Million Forecast, by Transmission and Distribution 2019 & 2032

- Table 6: Denmark Power Industry Volume megawatt Forecast, by Transmission and Distribution 2019 & 2032

- Table 7: Denmark Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Denmark Power Industry Volume megawatt Forecast, by Region 2019 & 2032

- Table 9: Denmark Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Denmark Power Industry Volume megawatt Forecast, by Country 2019 & 2032

- Table 11: Denmark Power Industry Revenue Million Forecast, by Generation 2019 & 2032

- Table 12: Denmark Power Industry Volume megawatt Forecast, by Generation 2019 & 2032

- Table 13: Denmark Power Industry Revenue Million Forecast, by Transmission and Distribution 2019 & 2032

- Table 14: Denmark Power Industry Volume megawatt Forecast, by Transmission and Distribution 2019 & 2032

- Table 15: Denmark Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Denmark Power Industry Volume megawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Denmark Power Industry?

The projected CAGR is approximately 5.30%.

2. Which companies are prominent players in the Denmark Power Industry?

Key companies in the market include Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy SA, Oersted A/S, BIGADAN A/S, Vattenfall A / S, Arcon-Sunmark A/S, General Electric Company*List Not Exhaustive.

3. What are the main segments of the Denmark Power Industry?

The market segments include Generation, Transmission and Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Integration of Renewable Energy4.; Supportive government policies in Power Plants.

6. What are the notable trends driving market growth?

Wind Energy to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Limited Land Availability.

8. Can you provide examples of recent developments in the market?

October 2022: Orsted, a Danish energy company, announced its intentions to develop four new offshore wind farms, aiming to increase the country's wind power production twofold. This strategic move is part of Denmark's efforts to reduce its reliance on Russian gas and oil. Orsted partnered with investment fund Copenhagen Infrastructure Partners (CIP) to collaborate on developing approximately 5.2 GW of offshore wind capacity across four projects in Denmark, as stated in their official statement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in megawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Denmark Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Denmark Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Denmark Power Industry?

To stay informed about further developments, trends, and reports in the Denmark Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence