Key Insights

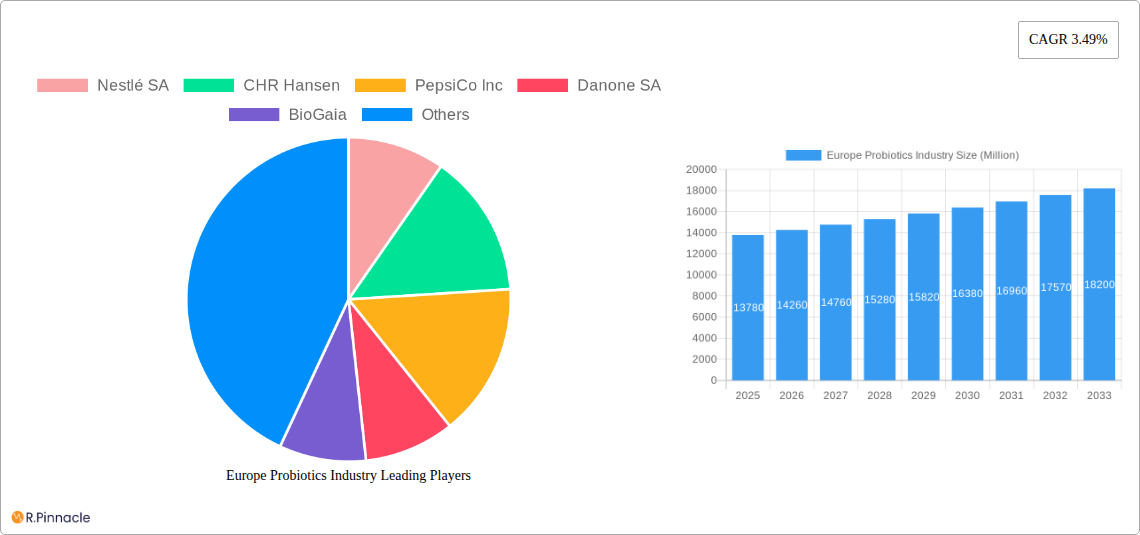

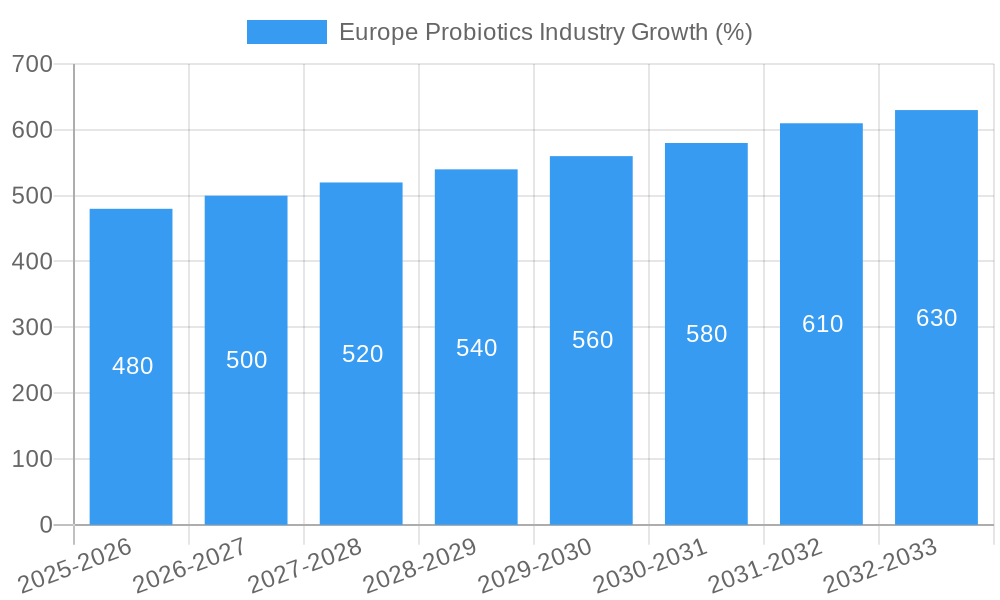

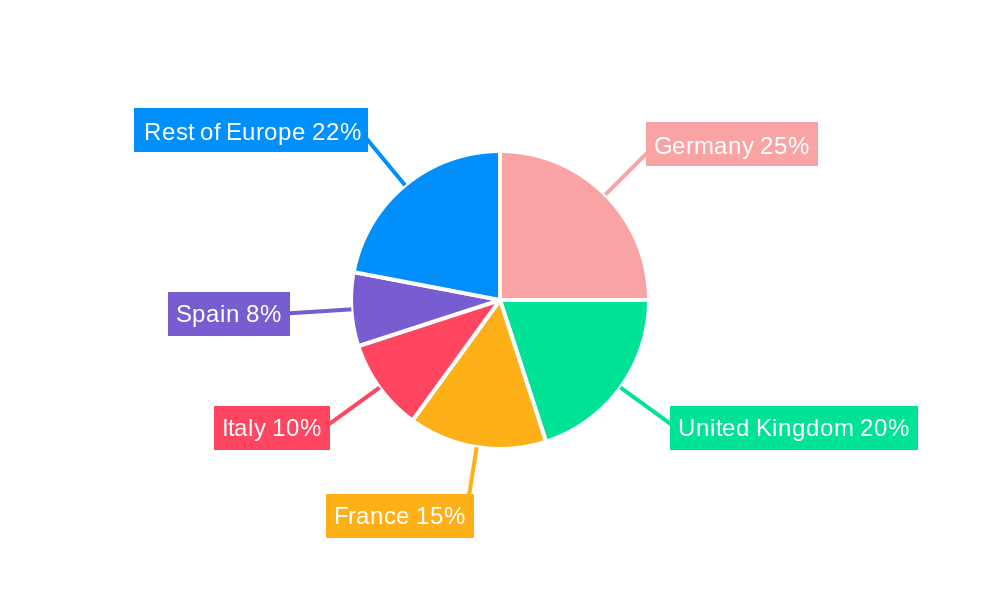

The European probiotics market, valued at €13.78 billion in 2025, is projected to experience steady growth, driven by increasing consumer awareness of gut health and the associated benefits of probiotics. The market's Compound Annual Growth Rate (CAGR) of 3.49% from 2025 to 2033 indicates a consistent expansion, fueled by several key factors. The rising prevalence of gastrointestinal disorders, coupled with a growing preference for natural health solutions, significantly contributes to the market's upward trajectory. Furthermore, the increasing incorporation of probiotics into functional foods and beverages, along with dietary supplements and even animal feed, broadens the market's reach and appeal across diverse consumer segments. Germany, the United Kingdom, France, and other major European economies represent significant market shares, indicating a robust and geographically diverse consumer base. Competition among major players like Nestlé SA, Chr. Hansen, and Danone SA further stimulates innovation and product development, ensuring a dynamic market landscape. The distribution channels, encompassing supermarkets, pharmacies, and convenience stores, provide ample opportunities for market penetration and expansion.

However, challenges remain. Pricing pressures and the need to ensure consistent product quality and efficacy might affect growth. Regulatory hurdles and concerns related to probiotic strain standardization and efficacy claims could also pose obstacles. Despite these challenges, the long-term outlook for the European probiotics market remains positive, propelled by continued consumer interest in gut health and wellness, along with ongoing research and innovation in the field. The market segmentation, including product type (functional food & beverage, dietary supplements, animal feed) and distribution channels, offers diverse opportunities for players to establish their presence and capitalize on specific consumer needs and preferences across various European countries. This detailed understanding of market dynamics is crucial for strategic decision-making and effective market positioning.

Europe Probiotics Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the European probiotics industry, covering the period from 2019 to 2033. It offers invaluable insights for industry professionals, investors, and strategic decision-makers seeking to understand market trends, opportunities, and challenges within this dynamic sector. The report leverages extensive data analysis to provide accurate forecasts and actionable intelligence.

Europe Probiotics Industry Market Structure & Innovation Trends

The European probiotics market is characterized by a moderately concentrated structure, with key players like Nestlé SA, Chr. Hansen, PepsiCo Inc., Danone SA, and BioGaia holding significant market share. However, numerous smaller players and emerging brands contribute to a competitive landscape. Market share data for 2025 estimates Nestlé SA at approximately 15%, Chr. Hansen at 12%, Danone SA at 10%, and the remaining market share distributed amongst other players and smaller niche brands. Innovation is driven by the increasing demand for functional foods and beverages, dietary supplements with enhanced health benefits, and specialized animal feed formulations. Regulatory frameworks, such as those governing food safety and health claims, significantly influence product development and market access. Product substitutes, such as prebiotics and other dietary supplements, also pose competitive challenges. End-user demographics, particularly the growing health-conscious consumer base and aging population, fuel market growth. The report analyzes recent M&A activities, including deal values exceeding €xx Million in the past five years, highlighting strategic shifts and consolidation trends within the industry. The report details a strong emphasis on R&D and collaborative efforts which drives the innovation in the probiotic market.

Europe Probiotics Industry Market Dynamics & Trends

The European probiotics market is experiencing robust growth, driven by several factors. The increasing awareness of gut health and its impact on overall well-being fuels consumer demand for probiotic products. Technological advancements in strain development and production processes enable the creation of more effective and stable probiotic formulations. The market witnessed a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Consumer preferences are shifting towards natural and organic products, impacting product development strategies. Competitive dynamics are shaped by innovation, brand positioning, and distribution network reach. Market penetration of probiotics in various product categories, such as functional foods, dietary supplements, and animal feed, varies significantly across different European countries, influenced by factors such as consumer awareness, purchasing power, and regulatory landscape.

Dominant Regions & Segments in Europe Probiotics Industry

Germany, the United Kingdom, and France represent the leading markets within Europe, accounting for approximately 60% of the total market value in 2025.

- Key Drivers for Germany: Strong consumer awareness of health and wellness, robust regulatory framework supporting the industry, significant investment in research and development.

- Key Drivers for the United Kingdom: High disposable income, widespread availability of probiotic products across various retail channels, growing consumer interest in natural health solutions.

- Key Drivers for France: Similar to Germany, a large market size and significant consumer awareness.

The Functional Food and Beverage segment is currently the largest, owing to its widespread availability and appeal to a broad consumer base. Supermarkets/Hypermarkets are the dominant distribution channel, offering convenient access to probiotic products for consumers. However, Pharmacies/Health Stores are witnessing growing importance as consumers seek expert advice and specialized products. The animal feed segment is also experiencing considerable growth as probiotics find increasing applications in livestock production. The remaining segments also offer significant opportunities.

Europe Probiotics Industry Product Innovations

Recent product innovations focus on enhanced strain efficacy, improved shelf life, and targeted health benefits. Technological advancements, such as precision fermentation and advanced encapsulation techniques, improve product quality and consumer experience. New product formats, such as convenient single-serve packaging and customized probiotic blends, cater to diverse consumer needs. These innovations enhance competitive advantages by offering superior efficacy, convenience, and targeted health benefits, thereby driving market expansion.

Report Scope & Segmentation Analysis

This report segments the European probiotics market by product type (Functional Food and Beverage, Dietary Supplements, Animal Feed), distribution channel (Supermarkets/Hypermarkets, Pharmacies/Health Stores, Convenience Stores, Other Distribution Channels), and country (Germany, United Kingdom, France, Russia, Italy, Spain, Rest of Europe). Each segment is analyzed in detail, providing market size estimations, growth projections, and competitive dynamics for the forecast period (2025-2033). The analysis shows significant growth across all segments.

Key Drivers of Europe Probiotics Industry Growth

Several factors drive the growth of the European probiotics market. Increased consumer awareness of gut health and its connection to overall well-being, coupled with growing demand for natural and functional foods, are key factors. Technological advancements in strain development and production methods, enabling improved efficacy and shelf life, significantly propel market expansion. Supportive regulatory frameworks and increasing health insurance coverage for preventive health measures encourage market adoption.

Challenges in the Europe Probiotics Industry Sector

The European probiotics industry faces several challenges. Regulatory complexities concerning health claims and labeling requirements can hinder market access for new products. Supply chain disruptions and ingredient sourcing challenges can impact production costs and product availability. Intense competition from existing and emerging players puts pressure on pricing strategies and profit margins.

Emerging Opportunities in Europe Probiotics Industry

The European probiotics market presents several emerging opportunities. The growing demand for personalized nutrition and tailored probiotic solutions opens avenues for customized product offerings. Expansion into niche markets, such as infant nutrition and specialized medical applications, offers significant potential. Technological advancements in strain engineering and targeted delivery systems are paving the way for more effective and precise probiotic therapies.

Leading Players in the Europe Probiotics Industry Market

- Nestlé SA

- Chr. Hansen

- PepsiCo Inc.

- Danone SA

- BioGaia

- Lifeway Foods Inc

- Archer Daniels Midland

- Yakult Honsha

- Daflorn MLM5 Ltd

- Bio-K Plus International Inc

Key Developments in Europe Probiotics Industry

- September 2022: BioGaia announced a partnership with Skinome to develop a probiotic concentrate for skin health.

- August 2022: BioGaia expanded its product line with new bacterial strains developed in collaboration with its subsidiary MetaboGen.

- February 2021: Perrigo and Probi signed a pan-European agreement to launch premium probiotic products in 14 countries.

Future Outlook for Europe Probiotics Industry Market

The European probiotics market is poised for continued expansion, driven by sustained consumer demand, technological innovations, and supportive regulatory environments. Strategic partnerships, product diversification, and expansion into new markets will be key to capturing growth opportunities. The market is expected to witness a significant increase in the demand for personalized probiotic solutions, driving the development of targeted products catering to specific health needs and individual consumer preferences. The overall outlook is positive, indicating a substantial market expansion throughout the forecast period.

Europe Probiotics Industry Segmentation

-

1. Product Type

- 1.1. Functional Food and Beverage

- 1.2. Dietary Supplements

- 1.3. Animal Feed

-

2. Distribution Channel

- 2.1. Supermarkets/ Hypermarkets

- 2.2. Pharmacies/Health Stores

- 2.3. Convenience Stores

- 2.4. Other Distribution Channels

Europe Probiotics Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Probiotics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.49% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Demand for Specialty

- 3.2.2 Organic

- 3.2.3 and Green Coffee; Growing In-House Production of Coffee in the Country

- 3.3. Market Restrains

- 3.3.1. Change in Climatic Conditions Impacting Coffee Plantations

- 3.4. Market Trends

- 3.4.1. Growing Demand for Functional Food and Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Functional Food and Beverage

- 5.1.2. Dietary Supplements

- 5.1.3. Animal Feed

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/ Hypermarkets

- 5.2.2. Pharmacies/Health Stores

- 5.2.3. Convenience Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Nestlé SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 CHR Hansen

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 PepsiCo Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Danone SA

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 BioGaia

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Lifeway Foods Inc *List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Archer Daniels Midland

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Yakult Honsha

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Daflorn MLM5 Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Bio-K Plus International Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Nestlé SA

List of Figures

- Figure 1: Europe Probiotics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Probiotics Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Probiotics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Probiotics Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Europe Probiotics Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Europe Probiotics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Probiotics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Probiotics Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Europe Probiotics Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Europe Probiotics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Probiotics Industry?

The projected CAGR is approximately 3.49%.

2. Which companies are prominent players in the Europe Probiotics Industry?

Key companies in the market include Nestlé SA, CHR Hansen, PepsiCo Inc, Danone SA, BioGaia, Lifeway Foods Inc *List Not Exhaustive, Archer Daniels Midland, Yakult Honsha, Daflorn MLM5 Ltd, Bio-K Plus International Inc.

3. What are the main segments of the Europe Probiotics Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Specialty. Organic. and Green Coffee; Growing In-House Production of Coffee in the Country.

6. What are the notable trends driving market growth?

Growing Demand for Functional Food and Beverages.

7. Are there any restraints impacting market growth?

Change in Climatic Conditions Impacting Coffee Plantations.

8. Can you provide examples of recent developments in the market?

September 2022: BioGaia announced its partnership with Skinome to research and develop a probiotic concentrate with living bacteria that will support the skin microbiome and improve skin health.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Probiotics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Probiotics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Probiotics Industry?

To stay informed about further developments, trends, and reports in the Europe Probiotics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence