Key Insights

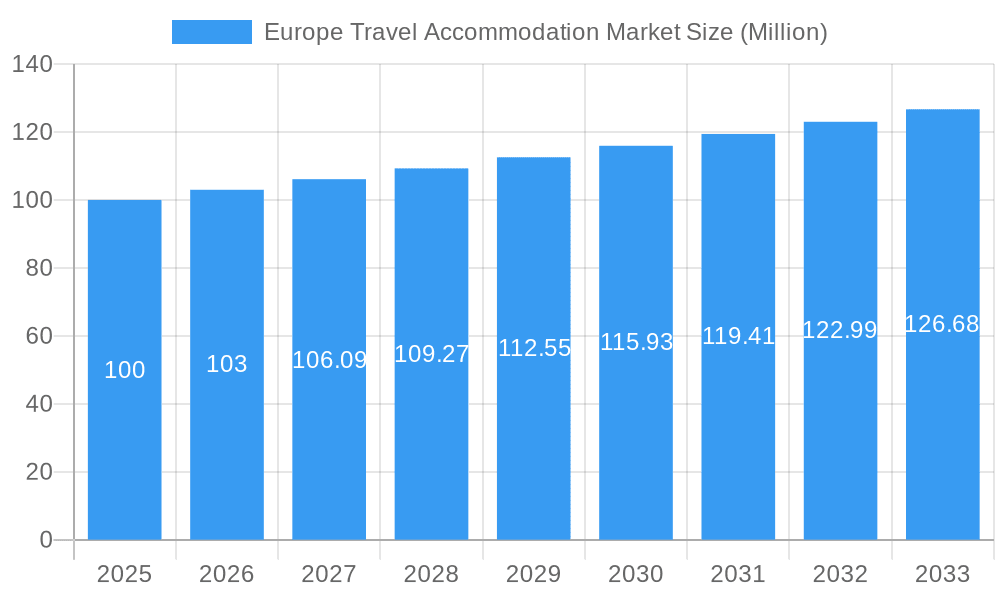

The European travel accommodation market is projected to reach $7.32 billion by 2025, with an anticipated compound annual growth rate (CAGR) of 15.29% between 2025 and 2033. This expansion is propelled by rising disposable incomes, increasing demand for experiential travel, and the widespread adoption of online booking platforms and mobile applications. The diverse array of accommodation choices, from budget hostels to luxury resorts and vacation rentals, further supports market growth. Potential challenges include economic downturns, geopolitical instability, and pronounced seasonality. Intense competition necessitates continuous innovation and adaptation from market players.

Europe Travel Accommodation Market Market Size (In Billion)

Key market trends include the dominance of online travel agencies (OTAs) in bookings, reflecting the digital shift in the travel industry. Major markets within Europe include the United Kingdom, Germany, France, and Italy, driven by strong tourism sectors and economies. While Hotels & Resorts remain a significant segment, vacation rentals and package holidays are gaining traction, indicating a consumer preference for flexible and personalized travel. The growing use of mobile booking applications highlights the importance of user-friendly mobile interfaces. Strategic collaborations and acquisitions are actively reshaping the competitive landscape, leading to market consolidation and broadened service offerings. Sustained growth hinges on adapting to evolving consumer preferences, embracing technological advancements, and navigating economic and geopolitical uncertainties.

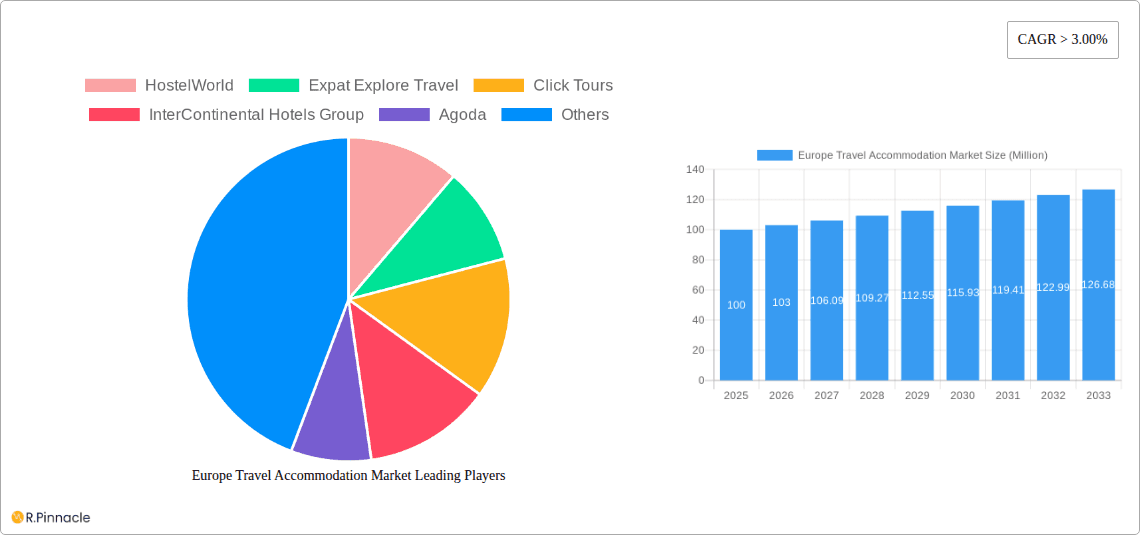

Europe Travel Accommodation Market Company Market Share

Europe Travel Accommodation Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Travel Accommodation Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, dominant players, and future outlook. The report utilizes a robust methodology incorporating historical data (2019-2024), current estimates (2025), and future projections (2025-2033) to provide a clear picture of this dynamic sector. The total market size in 2025 is estimated at xx Million.

Europe Travel Accommodation Market Market Structure & Innovation Trends

The European travel accommodation market is characterized by a diverse landscape of players, ranging from large multinational hotel chains to smaller boutique hotels and vacation rental providers. Market concentration is moderate, with a few dominant players holding significant market share, while numerous smaller players compete for niche segments. Key players include Booking.com, InterContinental Hotels Group, Agoda, HostelWorld, and Vrbo, although their individual market shares vary across segments. The market is also characterized by significant M&A activity, with deal values in recent years reaching xx Million annually. These mergers and acquisitions are primarily driven by the need to expand geographical reach, enhance product offerings, and improve operational efficiencies. Innovation in this space is propelled by technological advancements such as AI-powered booking platforms, personalized travel recommendations, and the rise of the sharing economy. Regulatory frameworks vary across European countries, impacting licensing, taxation, and consumer protection. Product substitutes include alternative accommodation options like camping and home-staying. End-user demographics reveal a diverse market with travelers across age groups, income levels, and travel styles.

- Market Concentration: Moderate, with a few major players and numerous smaller firms.

- Innovation Drivers: Technological advancements, changing consumer preferences, and M&A activity.

- M&A Activity: xx Million in deal value annually (average over the last 5 years).

- Regulatory Frameworks: Vary across countries, influencing market dynamics.

- Product Substitutes: Camping, homestays, and other alternative accommodation options.

- End-user Demographics: Diverse across age, income, and travel preferences.

Europe Travel Accommodation Market Market Dynamics & Trends

The European travel accommodation market exhibits robust growth, driven by several key factors. Increased disposable incomes, rising demand for leisure travel, and the growing popularity of experiential tourism fuel consistent growth. Technological disruptions, such as the proliferation of online travel agencies (OTAs) and mobile booking apps, have revolutionized how consumers plan and book their accommodations. Consumer preferences are shifting towards unique and personalized travel experiences, impacting demand across different accommodation types. Competitive dynamics are intense, with companies continuously striving for differentiation through innovation and customer-centric strategies. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected at xx%, with market penetration of xx% for online bookings.

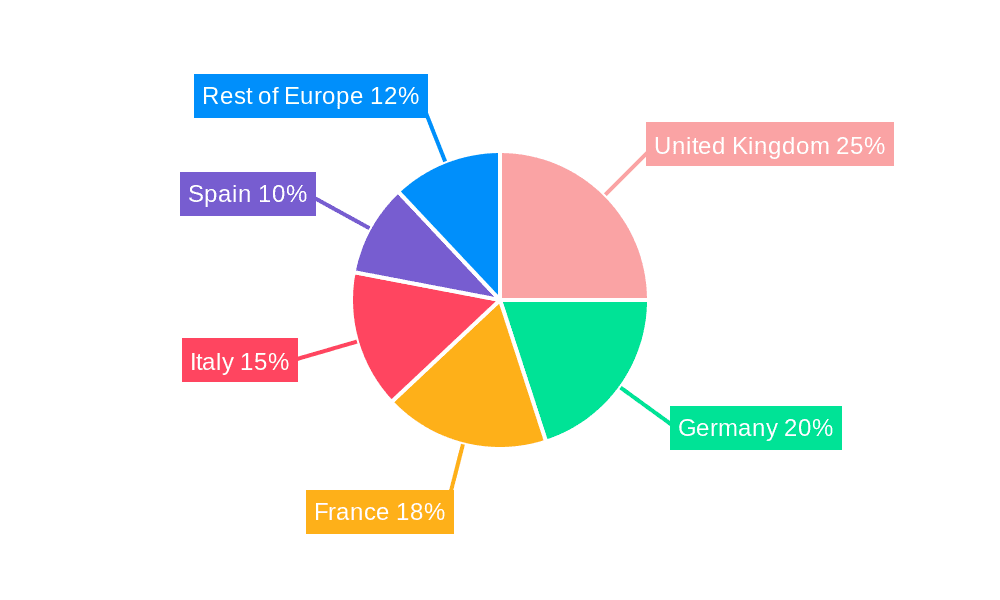

Dominant Regions & Segments in Europe Travel Accommodation Market

The United Kingdom, Germany, France, and Spain represent the most significant national markets within the European travel accommodation sector. The dominance of these regions stems from several key drivers:

- Strong Economic Performance: These countries have historically exhibited strong economic performance, fostering consumer spending on travel.

- Developed Tourism Infrastructure: Well-established tourist infrastructure, including transportation networks and attractions, supports a high volume of tourism.

- Attractive Tourist Destinations: These countries offer a diverse range of attractive destinations.

By Mode of Booking: Third-party online portals/OTAs dominate the market share. By Country: The United Kingdom stands as the leading market, closely followed by Germany, France and Spain. By Type: Hotels & Resorts maintain the largest segment of the market. By Platform: Mobile applications are experiencing rapid growth, though websites still maintain a considerable share.

Europe Travel Accommodation Market Product Innovations

The market is experiencing rapid innovation, with a focus on enhanced user experiences and personalized services. New technologies, such as AI-powered chatbots for customer support and dynamic pricing models, are being adopted. There's a growing emphasis on sustainable and eco-friendly accommodation options, catering to the rising environmental consciousness of travelers. The integration of technology with existing services leads to improved booking processes, personalized recommendations, and enhanced customer service.

Report Scope & Segmentation Analysis

This report segments the European travel accommodation market across several key parameters:

By Mode of Booking: Third-party Online Portals/OTAs (e.g., Booking.com) and Direct/Captive Portals (e.g., hotel websites) are considered separately to analyse growth.

By Country: The market is analyzed for the United Kingdom, Italy, Germany, France, Spain, and the Rest of Europe. Each country's analysis includes specific market size and projected growth.

By Type: Hotels & Resorts, Package Holidays, Vacation Rentals (e.g., Airbnb, Vrbo), and Others (e.g., hostels, guesthouses) are assessed based on their market contribution and growth rates.

By Platform: Market segmentation based on booking via Mobile Application and Website is evaluated for user trends.

Each segment's growth projection and competitive landscape is detailed within the full report.

Key Drivers of Europe Travel Accommodation Market Growth

Several factors contribute to the market's growth:

- Rising Disposable Incomes: Increased purchasing power fuels higher spending on leisure travel.

- Technological Advancements: Online travel agencies and mobile apps simplify booking and enhance user experience.

- Government Tourism Initiatives: Government investment in tourism infrastructure and promotion of tourism boosts the sector.

Challenges in the Europe Travel Accommodation Market Sector

The sector faces challenges such as:

- Seasonality: Tourism demand fluctuates significantly throughout the year.

- Economic Downturns: Economic recessions can lead to reduced travel spending.

- Increased Competition: The intense competition necessitates continuous innovation and marketing efforts.

Emerging Opportunities in Europe Travel Accommodation Market

Emerging opportunities include:

- Sustainable Tourism: Growing demand for eco-friendly accommodation options presents a significant opportunity.

- Experiential Travel: The rising trend of immersive and unique travel experiences is driving demand for diverse accommodation options.

- Bleisure Travel: The combination of business and leisure travel creates additional market opportunities.

Leading Players in the Europe Travel Accommodation Market Market

- HostelWorld

- Expat Explore Travel

- Click Tours

- InterContinental Hotels Group

- Agoda

- Booking.com

- HRS

- Trafalgar

- Travel Talk

- Topdeck

- eDreams

- G- Adventures

- Hotelbeds Group SL

- Vrbo

Key Developments in Europe Travel Accommodation Market Industry

- August 2023: IHG Hotels & Resorts partnered with RB Leipzig, expanding its global partnerships.

- May 2023: Hotelbeds witnessed a surge in luxury travel demand, leading to new partnerships, including The Lux Collective.

Future Outlook for Europe Travel Accommodation Market Market

The future outlook for the European travel accommodation market remains positive, driven by continued growth in tourism, technological advancements, and the evolving preferences of travelers. Strategic opportunities exist for companies that can leverage technology to enhance customer experiences, focus on sustainable practices, and offer unique and personalized travel options. The market is expected to continue its steady growth trajectory over the forecast period (2025-2033).

Europe Travel Accommodation Market Segmentation

-

1. Type

- 1.1. Hotels & Resorts

- 1.2. Package Holidays

- 1.3. Vacation Rentals

- 1.4. Others

-

2. Platform

- 2.1. Mobile Application

- 2.2. Website

-

3. Mode Of Booking

- 3.1. Third Pa

- 3.2. Direct / Captive portals

Europe Travel Accommodation Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Travel Accommodation Market Regional Market Share

Geographic Coverage of Europe Travel Accommodation Market

Europe Travel Accommodation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Luxury Hotels are booming the market

- 3.3. Market Restrains

- 3.3.1. Data Security

- 3.4. Market Trends

- 3.4.1. Increasing Internet Penetration is Augmenting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hotels & Resorts

- 5.1.2. Package Holidays

- 5.1.3. Vacation Rentals

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Mobile Application

- 5.2.2. Website

- 5.3. Market Analysis, Insights and Forecast - by Mode Of Booking

- 5.3.1. Third Pa

- 5.3.2. Direct / Captive portals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 HostelWorld

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Expat Explore Travel

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Click Tours

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 InterContinental Hotels Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Agoda

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Booking com

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 HRS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trafalgar

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Travel Talk

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Topdeck**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 eDreams

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 G- Adventures

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Hotelbeds Group SL

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Vrbo

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 HostelWorld

List of Figures

- Figure 1: Europe Travel Accommodation Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Travel Accommodation Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Travel Accommodation Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Travel Accommodation Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 3: Europe Travel Accommodation Market Revenue billion Forecast, by Mode Of Booking 2020 & 2033

- Table 4: Europe Travel Accommodation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Travel Accommodation Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Europe Travel Accommodation Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 7: Europe Travel Accommodation Market Revenue billion Forecast, by Mode Of Booking 2020 & 2033

- Table 8: Europe Travel Accommodation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Travel Accommodation Market?

The projected CAGR is approximately 15.29%.

2. Which companies are prominent players in the Europe Travel Accommodation Market?

Key companies in the market include HostelWorld, Expat Explore Travel, Click Tours, InterContinental Hotels Group, Agoda, Booking com, HRS, Trafalgar, Travel Talk, Topdeck**List Not Exhaustive, eDreams, G- Adventures, Hotelbeds Group SL, Vrbo.

3. What are the main segments of the Europe Travel Accommodation Market?

The market segments include Type, Platform, Mode Of Booking.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.32 billion as of 2022.

5. What are some drivers contributing to market growth?

Luxury Hotels are booming the market.

6. What are the notable trends driving market growth?

Increasing Internet Penetration is Augmenting the Market.

7. Are there any restraints impacting market growth?

Data Security.

8. Can you provide examples of recent developments in the market?

In August 2023, IHG Hotels & Resorts continued to grow its roster of partnerships across the globe and announced a new partnership with leading German football club, RB Leipzig, to become the Official Partner for the club during the 2023 - 2024 season.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Travel Accommodation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Travel Accommodation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Travel Accommodation Market?

To stay informed about further developments, trends, and reports in the Europe Travel Accommodation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence