Key Insights

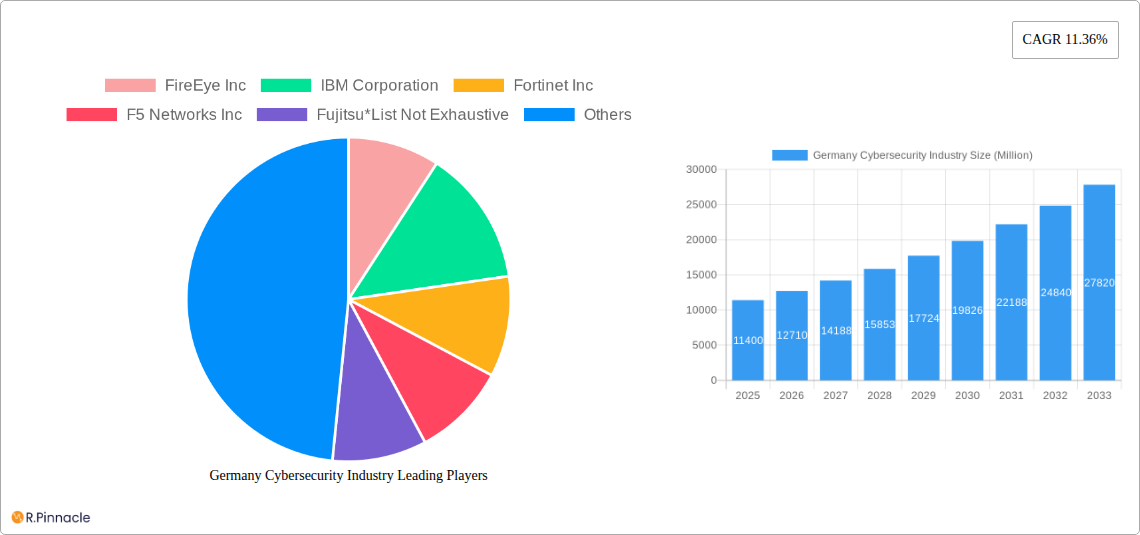

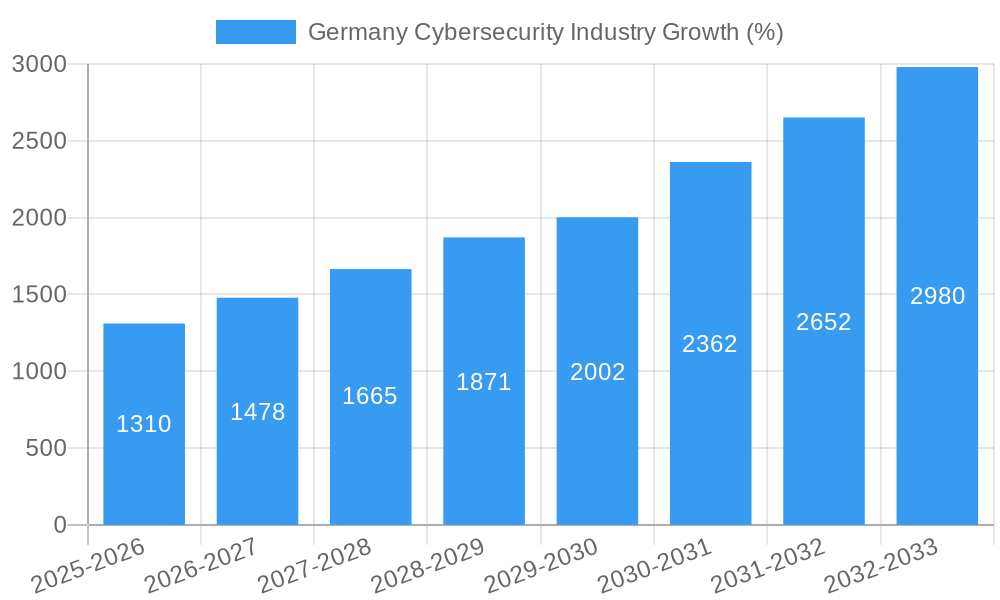

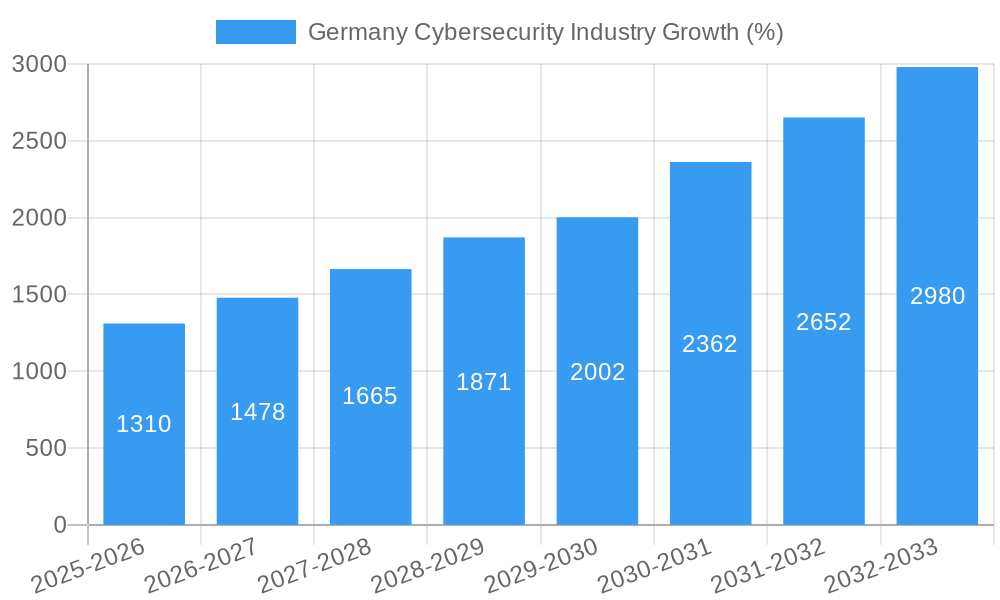

The German cybersecurity market, valued at €11.40 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 11.36% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing digitization of German businesses across sectors like BFSI, healthcare, and manufacturing necessitates robust cybersecurity infrastructure. Furthermore, stringent data privacy regulations like GDPR are compelling organizations to invest heavily in security solutions to mitigate compliance risks and potential breaches. The rise of sophisticated cyber threats, including ransomware and targeted attacks, further exacerbates the need for advanced security measures. The market is segmented by offering (security software and services), deployment (cloud and on-premise), and end-user industry. The cloud-based segment is expected to witness significant growth, driven by its scalability and cost-effectiveness. While on-premise solutions continue to hold a market share, the transition towards cloud-based cybersecurity is a prominent trend. The BFSI sector is a major contributor to market revenue due to the high sensitivity of financial data and stringent regulatory requirements. Leading players like FireEye, IBM, Fortinet, and Cisco are actively competing in this dynamic market, constantly innovating and expanding their product portfolios to cater to evolving security needs. The strong presence of these global players combined with a thriving domestic technology sector contributes to Germany's position as a significant European cybersecurity hub.

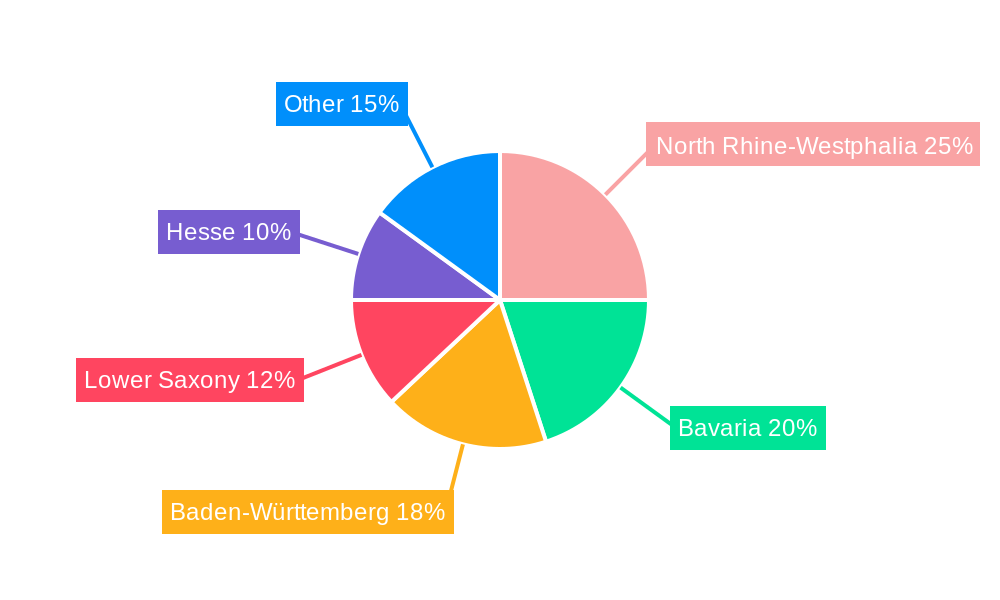

The regional distribution within Germany shows a concentration of cybersecurity activity in economically strong states such as North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse. These states house major industrial hubs and financial centers, attracting significant investments in cybersecurity infrastructure. However, the market also presents challenges. The shortage of skilled cybersecurity professionals is a significant restraint on growth, hindering the ability of organizations to effectively implement and manage security solutions. Addressing this skills gap through targeted training initiatives and educational programs is crucial for sustained market expansion. Another factor to consider is the evolving nature of cyber threats, which necessitates continuous adaptation and investment in advanced security technologies and strategies. The forecast period (2025-2033) promises substantial growth opportunities for cybersecurity vendors, but success will require strategic alignment with evolving technological trends and the specific requirements of various industry sectors within Germany.

Germany Cybersecurity Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report provides a detailed analysis of the German cybersecurity industry, offering invaluable insights for industry professionals, investors, and strategic planners. Leveraging extensive market research conducted over the study period (2019-2024), with a base year of 2025 and forecast period extending to 2033, this report unveils the market's dynamics, growth drivers, challenges, and future prospects. The report features an estimated market size of €XX Million in 2025 and projects a Compound Annual Growth Rate (CAGR) of XX% during the forecast period.

Germany Cybersecurity Industry Market Structure & Innovation Trends

The German cybersecurity market exhibits a moderately consolidated structure with several multinational players and a growing number of domestic firms. Key players such as FireEye Inc, IBM Corporation, Fortinet Inc, F5 Networks Inc, Fujitsu, Cisco Systems Inc, AVG Technologies, Intel Security (Intel Corporation), and Dell Technologies Inc hold significant market share, though precise figures vary depending on the segment. The estimated combined market share of these companies in 2025 is approximately XX%.

Innovation is driven by factors including:

- Increasing cyber threats: Sophisticated attacks necessitate constant technological advancement in security solutions.

- Stringent data privacy regulations: GDPR and other regulations propel investment in compliance-focused security technologies.

- Digital transformation: The increasing reliance on cloud computing and IoT devices creates new vulnerabilities and opportunities for cybersecurity providers.

- Government initiatives: Government support for cybersecurity infrastructure development and awareness programs fuels market growth.

Mergers and acquisitions (M&A) activity is robust. Significant deals in recent years have involved transactions valued at €XX Million, primarily focusing on expanding service offerings and geographic reach. This activity reflects the desire of established players to consolidate market share and gain access to innovative technologies. The fragmented nature of certain niche segments creates many potential opportunities for future M&A activity. End-user demographics are diverse, encompassing BFSI, Healthcare, Manufacturing, Government & Defense, IT & Telecommunication, and other sectors, each with unique cybersecurity needs.

Germany Cybersecurity Industry Market Dynamics & Trends

The German cybersecurity market is characterized by strong growth driven by several factors. The rising frequency and sophistication of cyberattacks across all sectors are significantly impacting organizations. This is further exacerbated by the growing adoption of cloud computing, the expanding Internet of Things (IoT) ecosystem, and increasing reliance on digital infrastructure. The CAGR for the market from 2025 to 2033 is projected to be XX%, driven mainly by increasing demand for advanced security solutions such as Endpoint Detection and Response (EDR) and Security Information and Event Management (SIEM). Market penetration is also influenced by government initiatives promoting cybersecurity awareness and adoption of best practices. However, challenges remain including skills shortages within the cybersecurity workforce and the evolving nature of cyber threats. This demands continuous innovation and adaptation from vendors to remain competitive. Consumer preference is shifting towards comprehensive, integrated security solutions rather than individual point solutions, driving consolidation and the emergence of managed security services providers (MSSPs). Competitive dynamics are intense, particularly among the major international players vying for market share, often based on pricing, innovation, and service quality.

Dominant Regions & Segments in Germany Cybersecurity Industry

While detailed regional breakdown requires further analysis, it is anticipated that urban centers and economically robust regions of Germany will show the highest concentration of cybersecurity adoption and spending, driven by higher digitalization and larger concentrations of businesses that are particularly vulnerable to cyberattacks.

By Offering: The Security Type segment (e.g., network security, endpoint security, cloud security) is projected to hold the largest market share, followed by the Services segment (e.g., managed security services, security consulting). This dominance is driven by the crucial need for comprehensive protection across various attack vectors.

By Deployment: The Cloud segment is witnessing the most rapid growth due to the expanding cloud adoption rate across businesses, while On-premise solutions remain significant for legacy systems and critical infrastructure.

By End User: The BFSI (Banking, Financial Services, and Insurance) and Government & Defense sectors are dominant due to the high value of their data and critical infrastructure and the associated regulatory demands for robust cybersecurity. Healthcare is also a rapidly growing segment due to stringent patient data protection regulations and the increasing digitization of healthcare systems.

- Key Drivers for BFSI: Strict regulatory compliance, protection of sensitive financial data.

- Key Drivers for Government & Defense: Protection of national infrastructure and sensitive government information.

- Key Drivers for Healthcare: HIPAA compliance, protection of patient data.

Germany Cybersecurity Industry Product Innovations

Recent product developments focus on Artificial Intelligence (AI) and Machine Learning (ML) for threat detection and response, automated security orchestration, and extended detection and response (XDR) solutions to consolidate security monitoring and response across multiple endpoints and cloud environments. These innovative solutions offer improved threat detection capabilities, automation of security operations, and reduced response times. The market fit is strong, driven by the need for efficient and effective security solutions in the face of increasingly sophisticated cyberattacks.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the German cybersecurity market across key segments:

By Offering: Security Type (e.g., network security, endpoint security, cloud security, data security, application security) and Services (e.g., managed security services, consulting, security auditing, training). The Security Type segment is projected to dominate, with a XX% share in 2025, driven by its critical role in preventing attacks. Services are seeing strong growth fuelled by increasing outsourcing of cybersecurity functions.

By Deployment: Cloud and On-premise. The Cloud segment shows faster growth, driven by the increasing adoption of cloud-based services. On-premise solutions remain important for data sovereignty and critical infrastructure.

By End User: BFSI, Healthcare, Manufacturing, Government & Defense, IT & Telecommunication, and Other End Users. BFSI and Government & Defense are currently the largest segments, with Healthcare demonstrating rapid growth potential.

Key Drivers of Germany Cybersecurity Industry Growth

The growth of the German cybersecurity industry is primarily fueled by:

- Increasing Cyberattacks: The rising frequency and severity of cyberattacks across all sectors are driving increased demand for security solutions.

- Stringent Data Privacy Regulations: The GDPR and other regulations mandate robust cybersecurity measures, increasing compliance-related spending.

- Digital Transformation: The expanding use of cloud computing, IoT, and digital transformation initiatives creates new attack surfaces and security requirements.

Challenges in the Germany Cybersecurity Industry Sector

Key challenges include:

- Skills Shortage: A significant shortage of qualified cybersecurity professionals limits the industry's growth potential.

- Evolving Threat Landscape: The constantly changing nature of cyber threats demands continuous adaptation and innovation.

- High Implementation Costs: Implementing comprehensive cybersecurity measures can be expensive, posing a barrier for some organizations.

Emerging Opportunities in Germany Cybersecurity Industry

Emerging opportunities include:

- Growth of AI/ML in Cybersecurity: AI and ML are revolutionizing threat detection and response, presenting significant opportunities for innovation.

- Expansion of Managed Security Services: The increasing demand for outsourced security expertise fuels the growth of MSSPs.

- Focus on IoT Security: The proliferation of IoT devices necessitates specialized security solutions, opening new market segments.

Leading Players in the Germany Cybersecurity Industry Market

- FireEye Inc

- IBM Corporation

- Fortinet Inc

- F5 Networks Inc

- Fujitsu

- Cisco Systems Inc

- AVG Technologies

- Intel Security (Intel Corporation)

- Dell Technologies Inc

Key Developments in Germany Cybersecurity Industry

- 2022-Q4: Launch of a new AI-powered threat detection platform by [Company Name].

- 2023-Q1: Merger between two major cybersecurity firms, creating a larger market player. (Further details on specific mergers require additional data.)

Future Outlook for Germany Cybersecurity Industry Market

The German cybersecurity market is poised for continued growth, driven by the persistent threat landscape, increasing digitalization, and stricter data protection regulations. Strategic opportunities lie in developing innovative AI-powered solutions, expanding managed security services, and catering to the specific cybersecurity needs of various industry sectors. The increasing adoption of cloud-based security solutions and growing awareness of cybersecurity risks among businesses and individuals will further stimulate market expansion.

Germany Cybersecurity Industry Segmentation

-

1. Offering

-

1.1. Security Type

- 1.1.1. Cloud Security

- 1.1.2. Data Security

- 1.1.3. Identity Access Management

- 1.1.4. Network Security

- 1.1.5. Consumer Security

- 1.1.6. Infrastructure Protection

- 1.1.7. Other Types

- 1.2. Services

-

1.1. Security Type

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premise

-

3. End User

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Manufacturing

- 3.4. Government & Defense

- 3.5. IT and Telecommunication

- 3.6. Other End Users

Germany Cybersecurity Industry Segmentation By Geography

- 1. Germany

Germany Cybersecurity Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.36% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Demand for Digitalization and Scalable IT Infrastructure; Need to tackle risks from various trends such as third-party vendor risks

- 3.2.2 the evolution of MSSPs

- 3.2.3 and adoption of cloud-first strategy

- 3.3. Market Restrains

- 3.3.1. Lack of Cybersecurity Professionals; High Reliance on Traditional Authentication Methods and Low Preparedness

- 3.4. Market Trends

- 3.4.1. Cloud Adoption is one of the Factor Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Security Type

- 5.1.1.1. Cloud Security

- 5.1.1.2. Data Security

- 5.1.1.3. Identity Access Management

- 5.1.1.4. Network Security

- 5.1.1.5. Consumer Security

- 5.1.1.6. Infrastructure Protection

- 5.1.1.7. Other Types

- 5.1.2. Services

- 5.1.1. Security Type

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Manufacturing

- 5.3.4. Government & Defense

- 5.3.5. IT and Telecommunication

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. North Rhine-Westphalia Germany Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 FireEye Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IBM Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fortinet Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 F5 Networks Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fujitsu*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cisco Systems Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AVG Technologies

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Intel Security (Intel Corporation)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dell Technologies Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 FireEye Inc

List of Figures

- Figure 1: Germany Cybersecurity Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Cybersecurity Industry Share (%) by Company 2024

List of Tables

- Table 1: Germany Cybersecurity Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Cybersecurity Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 3: Germany Cybersecurity Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: Germany Cybersecurity Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Germany Cybersecurity Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Germany Cybersecurity Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North Rhine-Westphalia Germany Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Bavaria Germany Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Baden-Württemberg Germany Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Lower Saxony Germany Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Hesse Germany Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Cybersecurity Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 13: Germany Cybersecurity Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 14: Germany Cybersecurity Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 15: Germany Cybersecurity Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Cybersecurity Industry?

The projected CAGR is approximately 11.36%.

2. Which companies are prominent players in the Germany Cybersecurity Industry?

Key companies in the market include FireEye Inc, IBM Corporation, Fortinet Inc, F5 Networks Inc, Fujitsu*List Not Exhaustive, Cisco Systems Inc, AVG Technologies, Intel Security (Intel Corporation), Dell Technologies Inc.

3. What are the main segments of the Germany Cybersecurity Industry?

The market segments include Offering, Deployment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Digitalization and Scalable IT Infrastructure; Need to tackle risks from various trends such as third-party vendor risks. the evolution of MSSPs. and adoption of cloud-first strategy.

6. What are the notable trends driving market growth?

Cloud Adoption is one of the Factor Driving the Market.

7. Are there any restraints impacting market growth?

Lack of Cybersecurity Professionals; High Reliance on Traditional Authentication Methods and Low Preparedness.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Cybersecurity Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Cybersecurity Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Cybersecurity Industry?

To stay informed about further developments, trends, and reports in the Germany Cybersecurity Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence