Key Insights

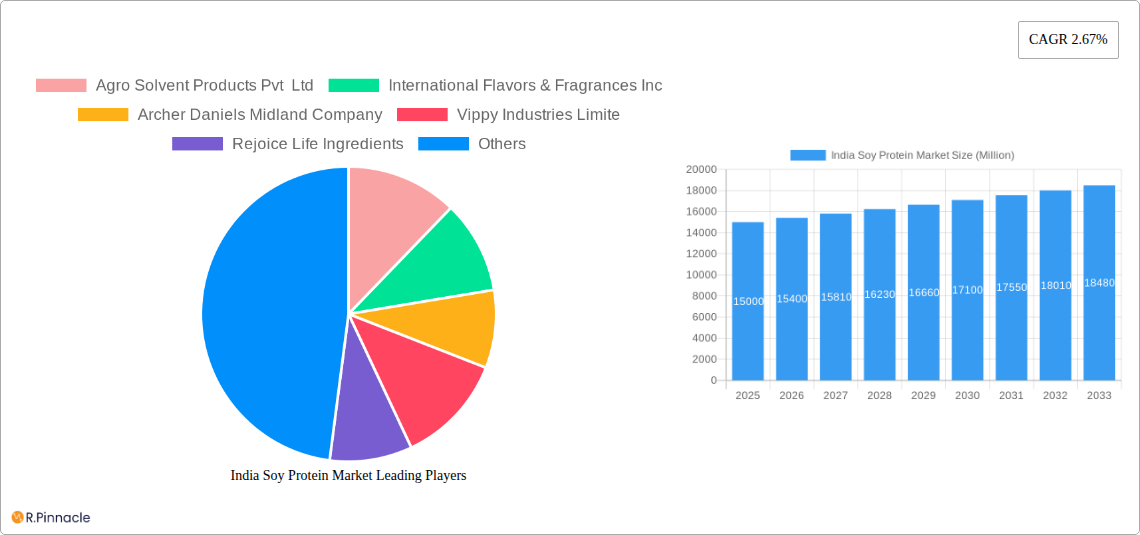

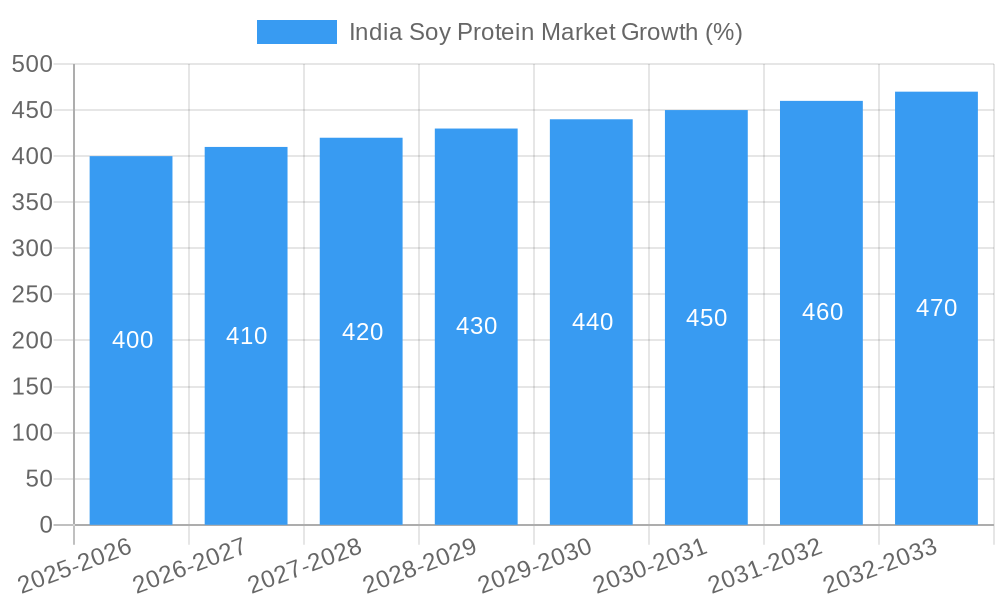

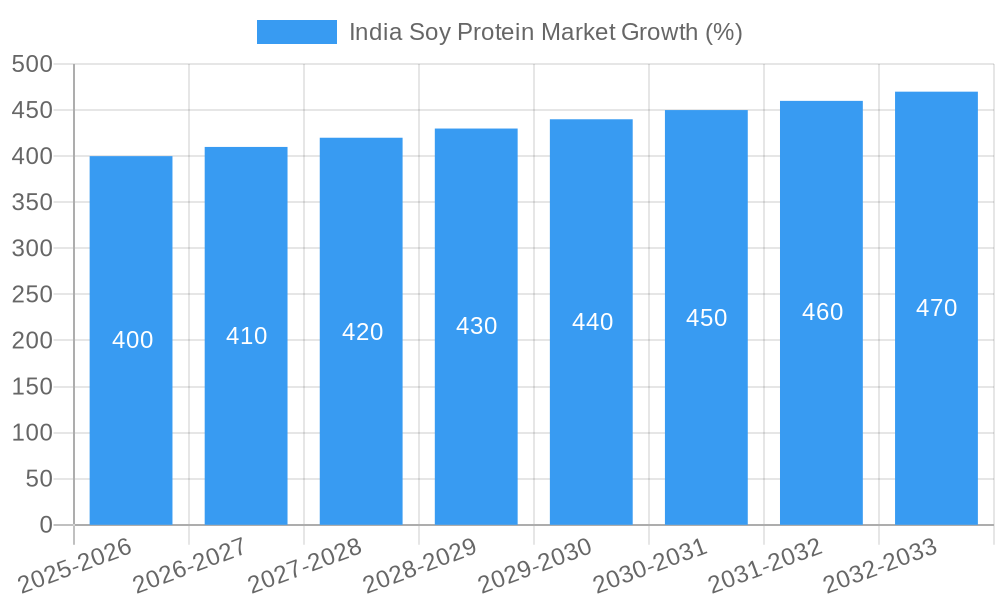

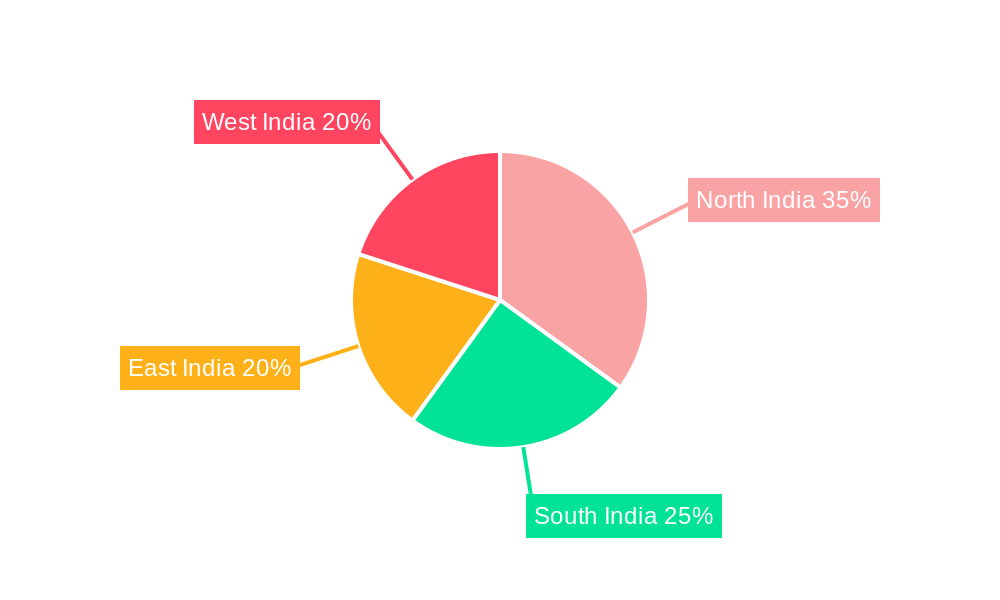

The India soy protein market, valued at approximately ₹15 billion (estimated based on provided CAGR and market size) in 2025, is projected to experience steady growth, driven by increasing demand from the animal feed, food and beverage, and sports nutrition sectors. The rising awareness of the health benefits of soy protein, its versatility as a plant-based protein source, and the growing adoption of vegetarian and vegan diets are key factors fueling this expansion. Concentrates currently dominate the market, owing to their cost-effectiveness. However, isolates and textured/hydrolyzed soy proteins are witnessing increased adoption in specialized applications due to their superior functionalities. The animal feed segment accounts for the largest share, reflecting the significant use of soy protein as a cost-effective and high-protein feed ingredient for livestock. Regional variations exist within India, with North and West India exhibiting relatively higher consumption rates due to factors such as stronger agricultural infrastructure and greater awareness of soy protein benefits. However, the market in South and East India presents significant growth opportunities, particularly given increasing disposable incomes and changing dietary patterns.

The forecasted CAGR of 2.67% for the period 2025-2033 indicates a relatively conservative yet consistent growth trajectory. This growth rate is influenced by various factors, including fluctuations in raw material prices, competition from other protein sources, and government regulations related to food safety and labeling. Key market players, including both international giants like Archer Daniels Midland Company and Kraft Heinz, and domestic players such as Agro Solvent Products Pvt Ltd and Soy Protein Ltd, are actively shaping market dynamics through product innovation, expansion of distribution networks, and strategic partnerships. The market is expected to witness further consolidation in the coming years, with larger players acquiring smaller companies to enhance their market share and product portfolio. This, along with increasing investments in research and development focused on enhancing the functionality and nutritional profile of soy protein, will ensure that the market maintains its steady growth momentum.

India Soy Protein Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India soy protein market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, segmentation, key players, and future growth prospects. The report is structured to provide actionable intelligence, facilitating informed strategies and improved market performance.

India Soy Protein Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Indian soy protein market, including market concentration, innovation drivers, regulatory frameworks, product substitutes, and M&A activities. The report identifies key players and assesses their market share, highlighting the impact of mergers and acquisitions on market consolidation. We delve into the influence of regulatory changes on market dynamics and explore the role of product substitution in shaping market trends. The analysis incorporates end-user demographics to understand market demand and identify growth opportunities.

- Market Concentration: The market exhibits a [Describe level of concentration, e.g., moderately concentrated] structure with [Number] major players holding approximately [Percentage]% of the market share.

- Innovation Drivers: Growing demand for plant-based proteins, coupled with technological advancements in soy protein processing and formulation, are key innovation drivers.

- Regulatory Framework: Government regulations pertaining to food safety and labeling significantly influence market operations.

- Product Substitutes: [Mention key substitutes like pea protein, whey protein, etc., and their market impact]

- M&A Activities: Recent M&A activity has involved [mention specific deals and their approximate values if available, otherwise use "xx Million USD"]. These activities indicate [conclude on implications of M&A e.g., a trend towards consolidation].

India Soy Protein Market Dynamics & Trends

This section examines the forces shaping the India soy protein market, encompassing market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The report details market size and growth projections, providing a comprehensive understanding of past, present, and future market performance. Key metrics such as CAGR and market penetration rates are included to support investment decisions.

[Insert a 600-word analysis of market dynamics, including specific metrics like CAGR and market penetration. This section should discuss factors like increasing demand for plant-based foods, health consciousness, rising disposable incomes, and changing dietary habits. It should also address challenges such as price fluctuations in raw materials, supply chain vulnerabilities, and competition from other protein sources. The analysis should be detailed and comprehensive, providing a well-rounded view of the market's evolution.]

Dominant Regions & Segments in India Soy Protein Market

This section pinpoints the leading regions and segments within the Indian soy protein market, dissecting the factors that contribute to their dominance. We analyze performance across various segments (Form: Concentrates, Isolates, Textured/Hydrolyzed; End User: Animal Feed, Food and Beverages, Sport/Performance Nutrition), identifying key regional disparities and growth potential.

- Leading Region: [Specify the leading region - e.g., South India] due to [Explain reasons – e.g., higher concentration of food processing industries, strong consumer demand].

- Dominant Segment (Form): [Specify dominant form, e.g., Soy Protein Isolates] driven by [Explain reasons – e.g., its high protein content and versatility in various applications].

- Dominant Segment (End User): [Specify the dominant end-user segment, e.g., Animal Feed] primarily because of [Explain reasons – e.g., increasing livestock population and growing demand for cost-effective animal feed].

[Insert detailed paragraphs (around 600 words) analyzing the dominance of the identified regions and segments. The analysis should include market size, growth rates, specific drivers (economic policies, infrastructure development), and competitive landscape for each segment and region.]

India Soy Protein Market Product Innovations

This section summarizes recent product developments, highlighting their applications and competitive advantages. It examines technological trends that are shaping product innovation and assesses the market fit of new products.

[Insert a 100-150-word summary of product innovations, focusing on technological advancements in soy protein processing, new product formulations, and improvements in product quality and functionality.]

Report Scope & Segmentation Analysis

This report segments the India soy protein market by form (Concentrates, Isolates, Textured/Hydrolyzed) and end-user (Animal Feed, Food and Beverages, Sport/Performance Nutrition). Each segment's market size, growth projections, and competitive dynamics are analyzed separately.

- Form: [Paragraph describing each form (Concentrates, Isolates, Textured/Hydrolyzed) – their market size, growth projections, and competitive dynamics. Include market size estimations in Million.]

- End-User: [Paragraph describing each end-user segment (Animal Feed, Food and Beverages, Sport/Performance Nutrition) – their market size, growth projections, and competitive dynamics. Include market size estimations in Million.]

Key Drivers of India Soy Protein Market Growth

This section outlines the key factors driving the growth of the India soy protein market.

[Insert 150 words on growth drivers, including factors like increasing health consciousness, growing demand for plant-based protein, government initiatives to promote sustainable agriculture, and expanding food processing industry.]

Challenges in the India Soy Protein Market Sector

This section identifies the challenges faced by the India soy protein market.

[Insert 150 words on market challenges, such as fluctuating raw material prices, dependence on imports, stringent regulatory compliance, and competition from other protein sources.]

Emerging Opportunities in India Soy Protein Market

This section highlights emerging opportunities in the India soy protein market.

[Insert 150 words on emerging opportunities, such as increasing demand for functional foods, growth of the sports nutrition segment, potential for soy protein in novel food applications, and expansion into new geographical regions.]

Leading Players in the India Soy Protein Market Market

- Archer Daniels Midland Company

- International Flavors & Fragrances Inc

- Kraft Heinz

- Bunge Limited

- Agro Solvent Products Pvt Ltd

- Vippy Industries Limite

- Rejoice Life Ingredients

- Sonic Biochem Extractions Pvt Ltd

- Soy Protein Ltd

- Prolactal

Key Developments in India Soy Protein Market Industry

- February 2020: Vippy Industries Limited invested a CAPEX of USD 271.84 Million toward setting up a new plant in Dewas, Madhya Pradesh, for manufacturing soybean-based value-added products. This significantly boosted production capacity within the Indian soy protein market.

- March 2020: Sun Nutrafood launched soy protein isolate variants with a protein range of 90% or more, catering to the rising demand for high-protein food products. This launch enhanced the product portfolio available within the market.

- July 2020: DuPont Nutrition & Biosciences (DuPont), a subsidiary of IFF, launched the Danisco Planit range, offering a broad assortment of ingredients for plant-based product development. This strengthened the ingredient supply chain for plant-based food manufacturers within the country.

Future Outlook for India Soy Protein Market Market

The India soy protein market is poised for significant growth driven by increasing consumer demand for plant-based protein sources, supportive government policies, and technological advancements in soy protein processing and formulation. Strategic investments in research and development, coupled with innovative product development initiatives, are expected to fuel market expansion and create new opportunities for market participants in the years to come. The market's future trajectory promises substantial growth potential.

India Soy Protein Market Segmentation

-

1. Form

- 1.1. Concentrates

- 1.2. Isolates

- 1.3. Textured/Hydrolyzed

-

2. End User

- 2.1. Animal Feed

-

2.2. Food and Beverages

-

2.2.1. By Sub End User

- 2.2.1.1. Bakery

- 2.2.1.2. Breakfast Cereals

- 2.2.1.3. Condiments/Sauces

- 2.2.1.4. Dairy and Dairy Alternative Products

- 2.2.1.5. Meat/Poultry/Seafood and Meat Alternative Products

- 2.2.1.6. RTE/RTC Food Products

- 2.2.1.7. Snacks

-

2.2.1. By Sub End User

-

2.3. Supplements

- 2.3.1. Baby Food and Infant Formula

- 2.3.2. Elderly Nutrition and Medical Nutrition

- 2.3.3. Sport/Performance Nutrition

India Soy Protein Market Segmentation By Geography

- 1. India

India Soy Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.67% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Organic Plant Proteins; Increasing Application of Pea Protein in Food and Beverages

- 3.3. Market Restrains

- 3.3.1. Presence of Alternative protein sources

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Soy Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Concentrates

- 5.1.2. Isolates

- 5.1.3. Textured/Hydrolyzed

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. By Sub End User

- 5.2.2.1.1. Bakery

- 5.2.2.1.2. Breakfast Cereals

- 5.2.2.1.3. Condiments/Sauces

- 5.2.2.1.4. Dairy and Dairy Alternative Products

- 5.2.2.1.5. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.2.1.6. RTE/RTC Food Products

- 5.2.2.1.7. Snacks

- 5.2.2.1. By Sub End User

- 5.2.3. Supplements

- 5.2.3.1. Baby Food and Infant Formula

- 5.2.3.2. Elderly Nutrition and Medical Nutrition

- 5.2.3.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. North India India Soy Protein Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Soy Protein Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Soy Protein Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Soy Protein Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Agro Solvent Products Pvt Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 International Flavors & Fragrances Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Archer Daniels Midland Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Vippy Industries Limite

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Rejoice Life Ingredients

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Sonic Biochem Extractions Pvt Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Soy Protein Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Kraft Heinz

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Bunge Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Prolactal

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Agro Solvent Products Pvt Ltd

List of Figures

- Figure 1: India Soy Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Soy Protein Market Share (%) by Company 2024

List of Tables

- Table 1: India Soy Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Soy Protein Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: India Soy Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 4: India Soy Protein Market Volume K Tons Forecast, by Form 2019 & 2032

- Table 5: India Soy Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: India Soy Protein Market Volume K Tons Forecast, by End User 2019 & 2032

- Table 7: India Soy Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Soy Protein Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: India Soy Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: India Soy Protein Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: North India India Soy Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North India India Soy Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: South India India Soy Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South India India Soy Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: East India India Soy Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: East India India Soy Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: West India India Soy Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: West India India Soy Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: India Soy Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 20: India Soy Protein Market Volume K Tons Forecast, by Form 2019 & 2032

- Table 21: India Soy Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 22: India Soy Protein Market Volume K Tons Forecast, by End User 2019 & 2032

- Table 23: India Soy Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: India Soy Protein Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Soy Protein Market?

The projected CAGR is approximately 2.67%.

2. Which companies are prominent players in the India Soy Protein Market?

Key companies in the market include Agro Solvent Products Pvt Ltd, International Flavors & Fragrances Inc, Archer Daniels Midland Company, Vippy Industries Limite, Rejoice Life Ingredients, Sonic Biochem Extractions Pvt Ltd, Soy Protein Ltd , Kraft Heinz , Bunge Limited , Prolactal.

3. What are the main segments of the India Soy Protein Market?

The market segments include Form, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Organic Plant Proteins; Increasing Application of Pea Protein in Food and Beverages.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of Alternative protein sources.

8. Can you provide examples of recent developments in the market?

July 2020: DuPont Nutrition & Biosciences (DuPont), a subsidiary of IFF, offers the industry's broadest assortment of ingredients for plant-based product development with the new Danisco Planit range. Danisco Planit is a global launch that includes services, expertise, and an unparalleled ingredient portfolio for plant-based food and beverages, including plant proteins, hydrocolloids, cultures, probiotics, fibers, food protection, antioxidants, natural extracts, emulsifiers, and enzymes, as well as tailor-made systems.March 2020: Sun Nutrafood launched soy protein isolate variants with a protein range of 90% or more, mainly for protein fortification in the food sector for various applications.February 2020: Vippy Industries Limited invested a CAPEX of USD 271.84 million toward setting up a new plant in Dewas, Madhya Pradesh, for manufacturing soybean-based value-added products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Soy Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Soy Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Soy Protein Market?

To stay informed about further developments, trends, and reports in the India Soy Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence