Key Insights

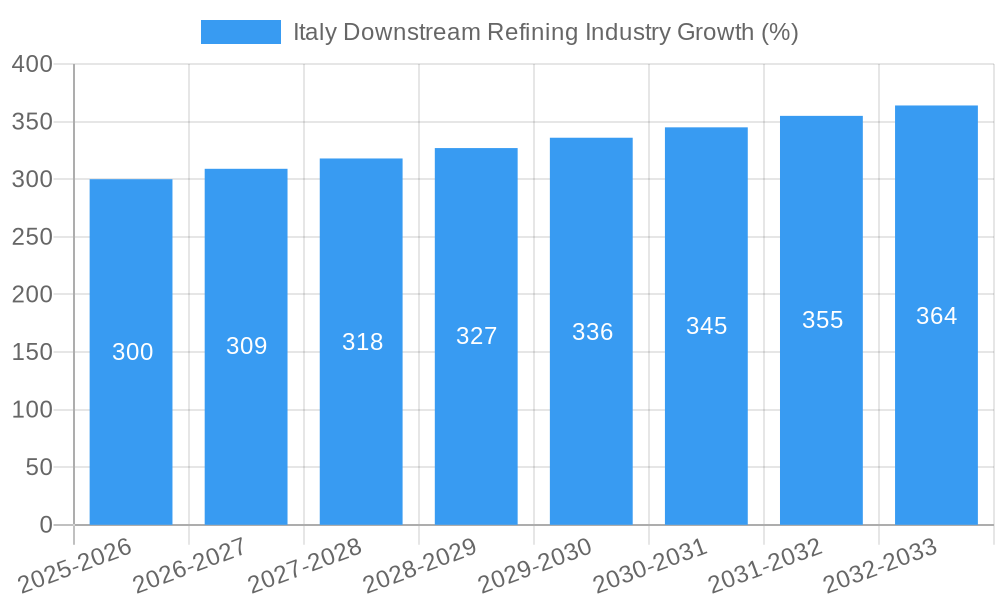

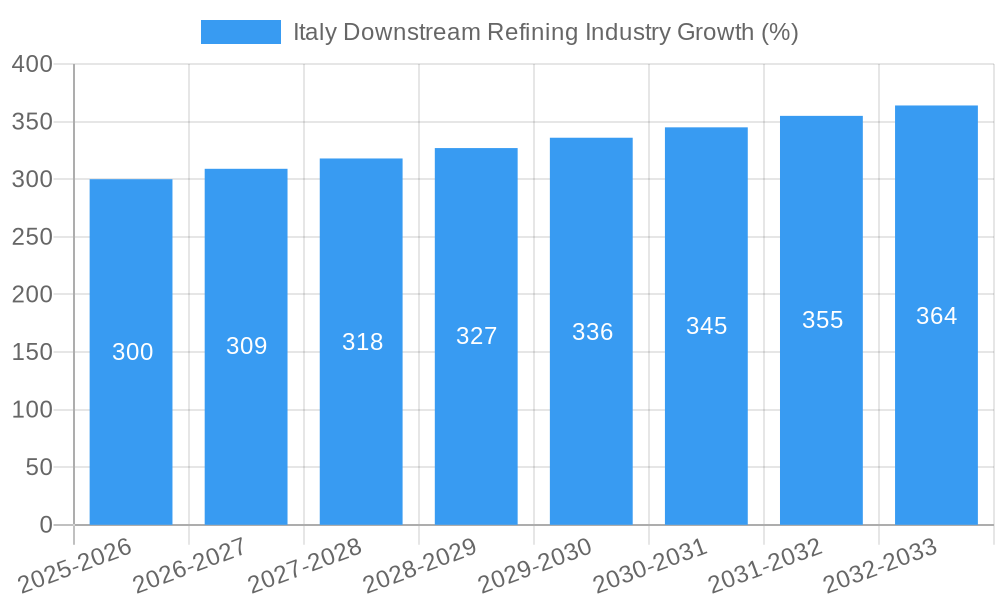

The Italy downstream refining industry, analyzed over the period 2019-2033, reveals a dynamic market influenced by global energy transitions and evolving consumer demands. The historical period (2019-2024) likely witnessed moderate growth, impacted by fluctuating crude oil prices and the global pandemic. The base year of 2025 serves as a crucial benchmark, reflecting a market size likely shaped by post-pandemic recovery and ongoing adjustments to the energy landscape. Factors such as the increasing adoption of electric vehicles and renewable energy sources will continue to exert pressure on fuel demand, potentially leading to a slower, yet steady, growth trajectory in the forecast period (2025-2033). However, the industry's resilience stems from its pivotal role in supplying transportation fuels and petrochemicals, ensuring continued, albeit potentially moderated, demand. Furthermore, strategic investments in refining technologies aimed at improving efficiency and reducing emissions, along with potential government incentives for sustainable fuel production, could influence the overall growth rate. The industry is expected to demonstrate adaptability to shifting market dynamics, focusing on value-added products and operational efficiency to maintain profitability.

The projected Compound Annual Growth Rate (CAGR) from 2025 to 2033, though not explicitly stated, can be reasonably estimated, considering typical growth patterns in mature refining markets and global energy trends. A conservative CAGR estimate, factoring in the mentioned pressures and potential positive influences, might fall within the range of 1-3%. This implies a gradual expansion of the market, reflecting a mature industry adapting to a changing environment. This moderate growth will likely be driven by factors such as population growth, economic activity, and demand for petrochemical products, offsetting the downward pressure from the energy transition. The Italian government's policies concerning energy security and environmental regulations will play a significant role in shaping the trajectory of this growth.

Italy Downstream Refining Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Italy downstream refining industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, and future trajectory. Leveraging rigorous data analysis and expert insights, this report is your essential guide to navigating the complexities of this dynamic sector.

Italy Downstream Refining Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of Italy's downstream refining industry, examining market concentration, innovation drivers, regulatory influences, and key industry activities. The study period spans 2019-2033, with 2025 as the base and estimated year.

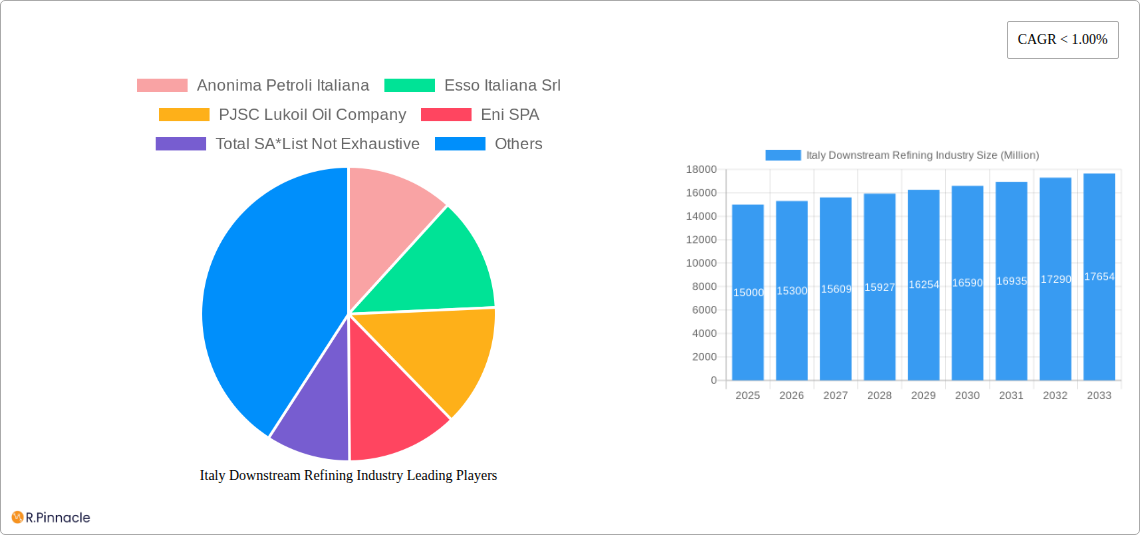

Market Concentration: The Italian downstream refining market exhibits a moderate level of concentration, with several major players holding significant market share. Eni SPA and Total SA are among the prominent players. Precise market share data for each company varies yearly but consistently places Eni among the top players. Market share fluctuations are influenced by M&A activities, operational efficiencies, and fluctuating crude oil prices.

Innovation Drivers: The push towards cleaner fuels, driven by stricter environmental regulations, is a key innovation driver. This necessitates investments in upgrading existing refineries and adopting new technologies to reduce emissions. Further advancements in process optimization and automation are also contributing to innovation.

Regulatory Framework: Stringent environmental regulations and emission standards significantly impact industry operations. Compliance costs and the need for technological upgrades represent considerable investment requirements. Government policies relating to energy security and diversification also influence industry dynamics.

Product Substitutes: The emergence of biofuels and other alternative energy sources presents a growing competitive threat to traditional refined petroleum products. The pace of adoption for these substitutes varies depending on pricing and government incentives.

End-User Demographics: The end-user base comprises various sectors, including transportation, industrial manufacturing, and residential heating. Shifts in these sectors' energy demands affect overall refined product consumption.

M&A Activities: The industry has witnessed several M&A activities in recent years, although the total deal value is fluctuating and not readily available at this time. However, the impact is noted in the shifting market shares amongst major players. Such activities lead to increased efficiency and market consolidation.

Italy Downstream Refining Industry Market Dynamics & Trends

This section details the market's growth trajectory, technological advancements, and evolving consumer behavior. The CAGR (Compound Annual Growth Rate) for the forecast period (2025-2033) is estimated at xx%. Market penetration of alternative fuels is projected to reach xx% by 2033.

The Italian downstream refining industry is undergoing significant transformation, influenced by various factors. Economic growth and the corresponding demand for refined products are key growth drivers. However, the transition toward cleaner energy sources and increased environmental awareness creates challenges. Technological disruptions, specifically in automation and process optimization, are reshaping refinery operations, resulting in efficiency gains. Consumer preferences are evolving, with increasing demand for higher-quality fuels and cleaner alternatives. The competitive dynamics are shaped by the interplay of established players and emerging market entrants.

Dominant Regions & Segments in Italy Downstream Refining Industry

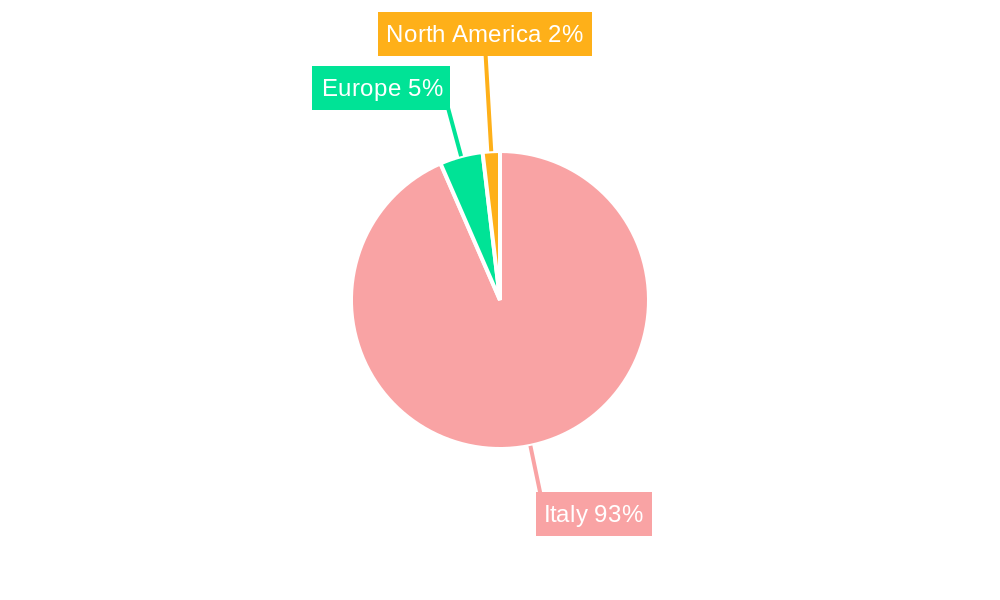

This section identifies the leading regions and segments within the Italian downstream refining industry.

Refineries: The majority of refining capacity is concentrated in Northern Italy. Key drivers for this regional dominance include proximity to major ports, access to efficient transportation networks, and a higher concentration of end-users.

- Key Drivers for Northern Italy:

- Established infrastructure.

- Proximity to major ports facilitating crude oil import.

- Strong industrial base and energy demand.

Petrochemicals Plants: Similar to refineries, the petrochemicals sector is concentrated in Northern Italy for the same infrastructural and logistical advantages.

- Key Drivers for Northern Italy:

- Access to feedstock from refineries.

- Strong domestic demand for petrochemicals.

- Proximity to major consumer markets.

Italy Downstream Refining Industry Product Innovations

The Italian downstream refining industry is witnessing significant product innovation, driven by the need to meet increasingly stringent environmental regulations and consumer demand for cleaner fuels. This includes the development of low-sulfur fuels, biofuels, and other specialty products optimized for specific applications. This is also impacting the competitive advantage of companies that are able to offer higher-quality products.

Report Scope & Segmentation Analysis

This report segments the Italian downstream refining industry into refineries and petrochemicals plants. Each segment undergoes detailed analysis of market size, growth projections, and competitive dynamics. Refineries demonstrate a relatively stable market size with fluctuations based on global crude oil prices. Petrochemicals plants' growth trajectory depends heavily on demand from downstream industries. The competitive dynamics in both segments are intense, marked by pricing pressures and the pursuit of operational efficiency.

Key Drivers of Italy Downstream Refining Industry Growth

Several factors drive growth in the Italian downstream refining industry. Economic expansion and corresponding increases in energy consumption are primary drivers. Government policies promoting energy security and infrastructure development also play crucial roles. Technological advancements in refinery operations increase efficiency and production capacity.

Challenges in the Italy Downstream Refining Industry Sector

The Italian downstream refining industry faces several challenges, including stringent environmental regulations that impose significant compliance costs. The price volatility of crude oil significantly impacts profitability. Competition from alternative fuel sources and the integration of renewable energy also pose considerable challenges. Additionally, supply chain disruptions and logistics difficulties add complexity to industry operations. The exact quantifiable impact of these challenges varies yearly, requiring continued monitoring.

Emerging Opportunities in Italy Downstream Refining Industry

Emerging opportunities include the increasing demand for sustainable and renewable fuels. The sector's integration with the circular economy also presents significant potential. Investing in advanced technologies for emissions reduction and adopting innovative refinery processes are further promising avenues.

Leading Players in the Italy Downstream Refining Industry Market

- Anonima Petroli Italiana

- Esso Italiana Srl

- PJSC Lukoil Oil Company

- Eni SPA

- Total SA

- List Not Exhaustive

Key Developments in Italy Downstream Refining Industry Industry

- 2022 Q4: Eni SPA announced a significant investment in upgrading its refinery to comply with stricter emission standards.

- 2023 Q1: A new petrochemical plant commenced operations in Northern Italy, expanding the region's production capacity.

- 2024 Q2: Total SA completed an acquisition of a smaller refining asset, bolstering its market share.

- Further developments to be detailed in the full report.

Future Outlook for Italy Downstream Refining Industry Market

The future of the Italian downstream refining industry hinges on adaptation to evolving consumer preferences and stricter environmental regulations. Investing in advanced technologies, optimizing operations, and diversifying product portfolios will be essential for long-term success. The increasing demand for cleaner fuels presents both challenges and opportunities for growth. Strategic partnerships and collaborations will likely play an important role in navigating the future dynamics of this competitive sector.

Italy Downstream Refining Industry Segmentation

-

1. Refineries

-

1.1. Overview

- 1.1.1. Existing Infrastructure

- 1.1.2. Projects in Pipeline

- 1.1.3. Upcoming Projects

-

1.1. Overview

-

2. Petrochemicals Plants

-

2.1. Overview

- 2.1.1. Existing Infrastructure

- 2.1.2. Projects in Pipeline

- 2.1.3. Upcoming Projects

-

2.1. Overview

Italy Downstream Refining Industry Segmentation By Geography

- 1. Italy

Italy Downstream Refining Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Availability of abundant natural gas reserves and the lower cost compared to other fossil fuel types4.; Growing investments to increase production to fulfill global demand

- 3.3. Market Restrains

- 3.3.1. 4.; The global shift toward renewable sources for electricity generation

- 3.4. Market Trends

- 3.4.1. Oil Refining Capacity to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Downstream Refining Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 5.1.1. Overview

- 5.1.1.1. Existing Infrastructure

- 5.1.1.2. Projects in Pipeline

- 5.1.1.3. Upcoming Projects

- 5.1.1. Overview

- 5.2. Market Analysis, Insights and Forecast - by Petrochemicals Plants

- 5.2.1. Overview

- 5.2.1.1. Existing Infrastructure

- 5.2.1.2. Projects in Pipeline

- 5.2.1.3. Upcoming Projects

- 5.2.1. Overview

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Anonima Petroli Italiana

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Esso Italiana Srl

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PJSC Lukoil Oil Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eni SPA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Total SA*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Anonima Petroli Italiana

List of Figures

- Figure 1: Italy Downstream Refining Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy Downstream Refining Industry Share (%) by Company 2024

List of Tables

- Table 1: Italy Downstream Refining Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy Downstream Refining Industry Revenue Million Forecast, by Refineries 2019 & 2032

- Table 3: Italy Downstream Refining Industry Revenue Million Forecast, by Petrochemicals Plants 2019 & 2032

- Table 4: Italy Downstream Refining Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Italy Downstream Refining Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Italy Downstream Refining Industry Revenue Million Forecast, by Refineries 2019 & 2032

- Table 7: Italy Downstream Refining Industry Revenue Million Forecast, by Petrochemicals Plants 2019 & 2032

- Table 8: Italy Downstream Refining Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Downstream Refining Industry?

The projected CAGR is approximately < 1.00%.

2. Which companies are prominent players in the Italy Downstream Refining Industry?

Key companies in the market include Anonima Petroli Italiana, Esso Italiana Srl, PJSC Lukoil Oil Company, Eni SPA, Total SA*List Not Exhaustive.

3. What are the main segments of the Italy Downstream Refining Industry?

The market segments include Refineries, Petrochemicals Plants.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Availability of abundant natural gas reserves and the lower cost compared to other fossil fuel types4.; Growing investments to increase production to fulfill global demand.

6. What are the notable trends driving market growth?

Oil Refining Capacity to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The global shift toward renewable sources for electricity generation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Downstream Refining Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Downstream Refining Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Downstream Refining Industry?

To stay informed about further developments, trends, and reports in the Italy Downstream Refining Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence