Key Insights

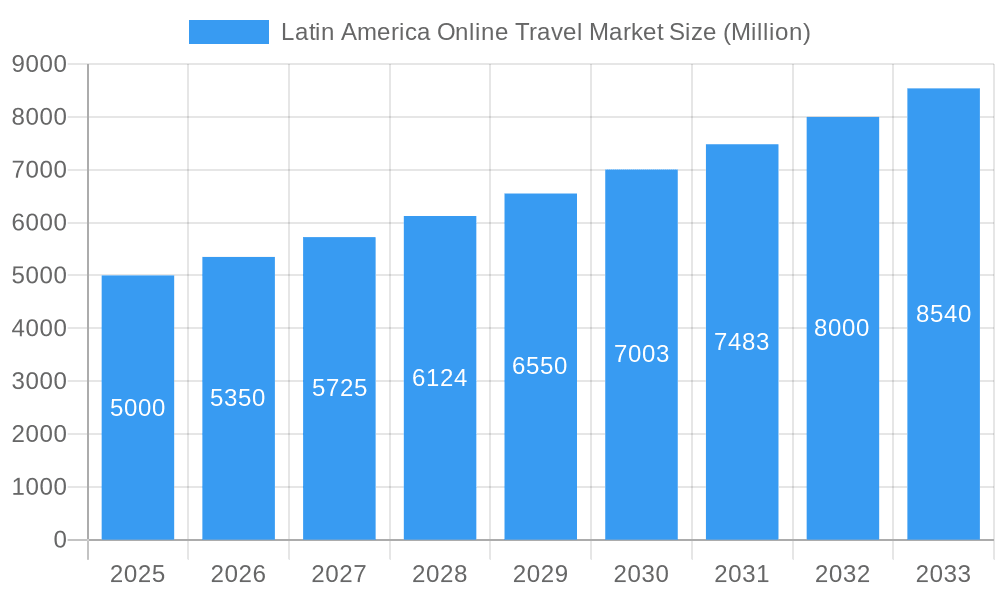

The Latin American online travel market is experiencing robust growth, driven by increasing internet and smartphone penetration, a burgeoning middle class with greater disposable income, and a preference for convenient online booking platforms. The market, currently valued in the billions (a precise figure requires more data, but considering a CAGR of 7% and a stated value unit of millions, a reasonable estimate places it well into the billions), is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of 7% from 2025 to 2033. This expansion is fueled by several key factors: the rising popularity of mobile booking platforms, a shift towards personalized travel experiences catered to diverse preferences, and the increasing adoption of innovative technologies like AI-powered travel recommendations and virtual reality tours. Competition is fierce, with established international players like Booking Holdings and Airbnb vying for market share alongside strong regional companies such as Despegar and CVC Corp. Growth is particularly pronounced in segments such as holiday package bookings, reflecting a demand for comprehensive and convenient travel solutions. However, challenges remain, including economic volatility in some Latin American countries, concerns about online security, and the need for improved internet infrastructure in certain regions.

Latin America Online Travel Market Market Size (In Billion)

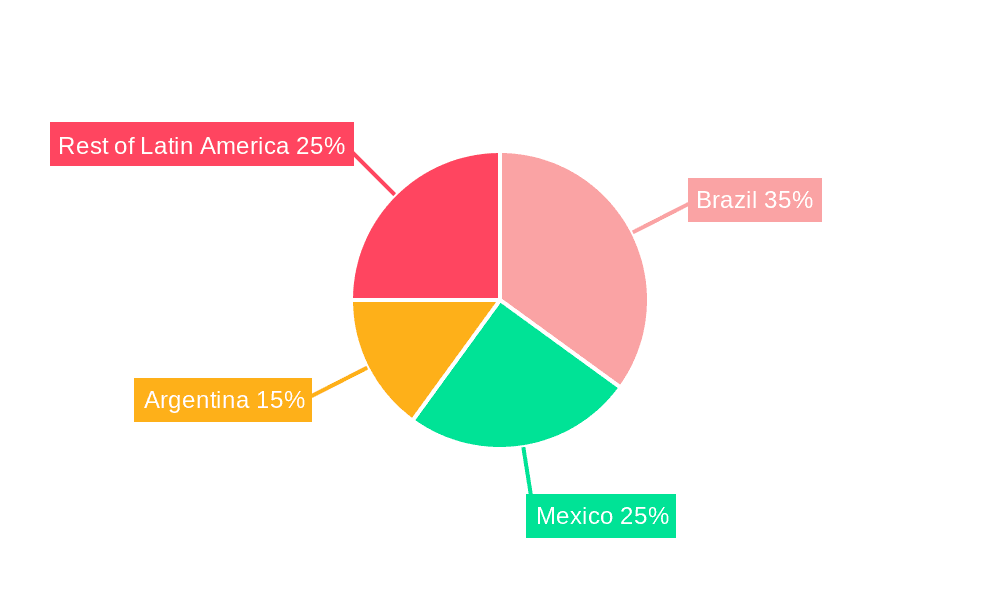

The segmentation of the market reveals interesting trends. While direct bookings are gaining popularity, travel agents continue to play a significant role, particularly for complex itineraries or specialized travel needs. The mobile/tablet segment is showing rapid growth, surpassing desktop bookings as the preferred method for most users. Brazil, Mexico, and Argentina constitute the largest markets within the region, but growth opportunities exist across all countries, particularly in those with rising middle classes and improving digital infrastructure. The continued expansion of the online travel market in Latin America hinges on addressing challenges related to infrastructure, security, and economic stability while capitalizing on the increasing adoption of digital technologies and changing consumer preferences. Further research into specific market segments will be crucial for investors and businesses seeking to capitalize on this dynamic market.

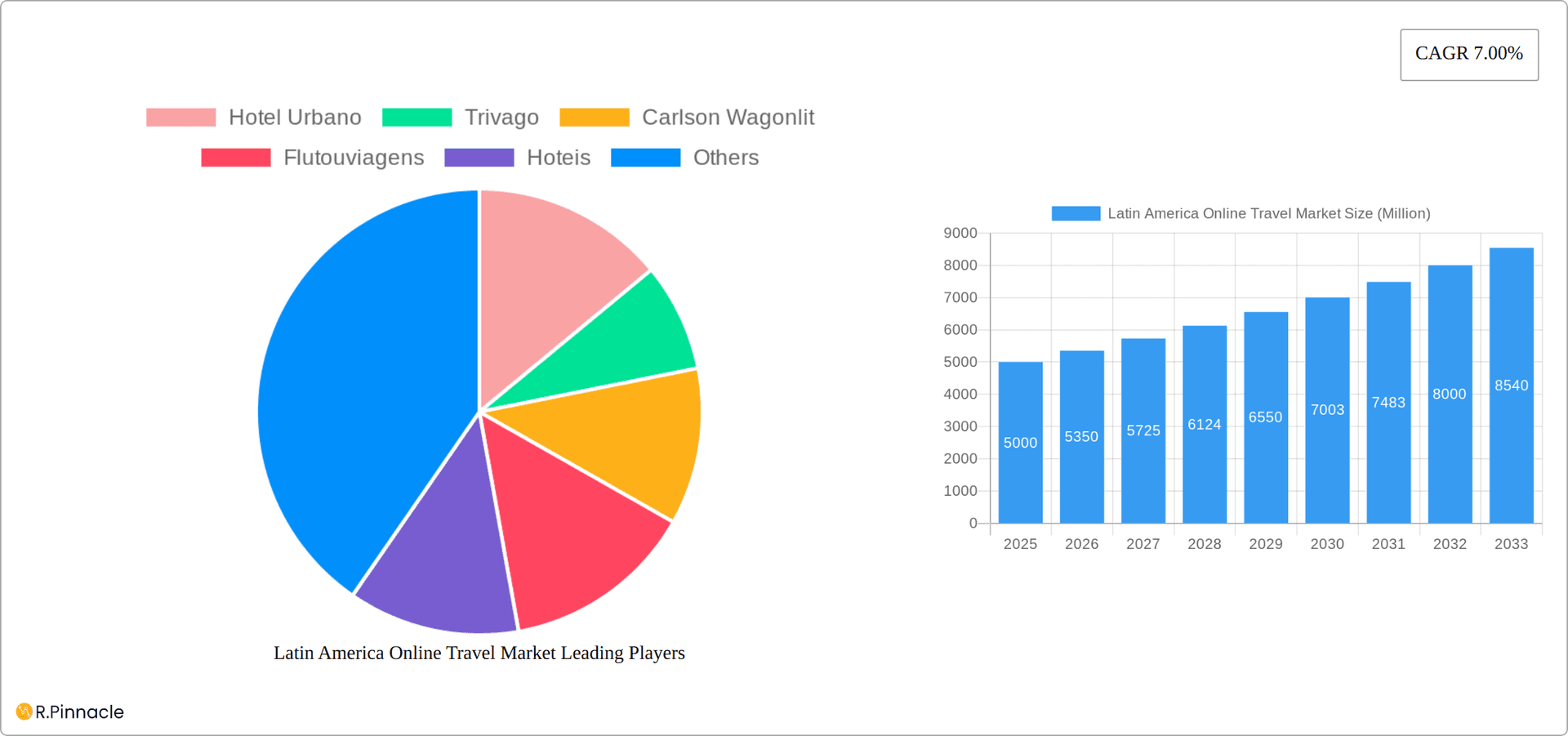

Latin America Online Travel Market Company Market Share

Latin America Online Travel Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America online travel market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, segmentation, key players, and future growth potential. The market is projected to reach xx Million by 2033, exhibiting a significant CAGR of xx% during the forecast period (2025-2033).

Latin America Online Travel Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Latin American online travel market, focusing on market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market exhibits a moderately concentrated structure, with key players like Booking Holdings, Despegar, and CVC Corp holding significant market share. However, the presence of numerous smaller players, including Hotel Urbano, Trivago, and Decolar, indicates a dynamic competitive environment.

- Market Concentration: Booking Holdings and Despegar command a combined xx% market share in 2025, while the remaining players share the rest.

- Innovation Drivers: Increasing smartphone penetration, advancements in mobile booking technology, and the rise of travel-focused social media platforms are driving innovation.

- Regulatory Frameworks: Varying regulations across Latin American countries influence market access and operations for online travel agencies (OTAs).

- Product Substitutes: Traditional travel agencies and offline booking methods represent some level of competition, though their market share is diminishing.

- M&A Activities: Recent notable transactions include Despegar's acquisition of Viajanet in May 2022 for approximately US$15 Million, highlighting consolidation trends in the market. The proposed acquisition of Etraveli by Booking Holdings, currently under investigation, signifies further potential consolidation and a potential increase in market barriers.

- End-User Demographics: The market is driven by a growing middle class with increased disposable income and a preference for online booking convenience.

Latin America Online Travel Market Dynamics & Trends

The Latin American online travel market is experiencing robust growth, fueled by several key factors. Rising internet and smartphone penetration rates are significantly increasing online booking adoption. The burgeoning middle class, coupled with a growing preference for convenient and cost-effective travel arrangements, is significantly contributing to market expansion. Technological disruptions, such as AI-powered travel recommendations and personalized booking experiences, are further enhancing market growth. Competition among established players and the emergence of innovative startups are driving both innovation and price competition. The market's growth is characterized by a high degree of seasonality, influenced by tourism peaks and holidays. The overall market is expected to show a CAGR of xx% from 2025 to 2033. Market penetration is expected to rise from xx% in 2025 to xx% by 2033, driven mainly by increased mobile adoption.

Dominant Regions & Segments in Latin America Online Travel Market

Brazil and Mexico represent the dominant markets within the Latin American online travel sector, accounting for xx% and xx% of the total market value, respectively, in 2025. This dominance is attributed to factors such as larger populations, higher disposable incomes, and well-developed tourism infrastructures.

- By Service Type: Accommodation booking holds the largest market share, followed by travel tickets and holiday packages. Other services, such as travel insurance and activity booking, are also growing rapidly.

- By Mode of Booking: Direct booking via OTAs is the prevailing method, surpassing bookings made through travel agents.

- By Booking Platform: Mobile/tablet bookings are increasingly dominant, exceeding desktop bookings as the preferred mode of booking.

Key Drivers of Regional Dominance:

- Brazil: Large population, strong domestic tourism market, and relatively advanced digital infrastructure contribute to its leading position.

- Mexico: Significant inbound tourism, a growing middle class, and increasing smartphone adoption fuel its substantial market share.

Latin America Online Travel Market Product Innovations

The Latin American online travel market is experiencing a rapid evolution, fueled by groundbreaking product innovations and the pervasive influence of technology. Leading this charge are AI-powered recommendation engines that offer hyper-personalized travel suggestions, dynamically crafting unique itineraries based on individual preferences and past travel behavior. Virtual and augmented reality experiences are also emerging, allowing travelers to virtually explore destinations before booking, thereby enhancing the decision-making process and building anticipation. Furthermore, the user experience is being significantly elevated by a commitment to mobile-first design principles, ensuring intuitive navigation and effortless booking on any device. This is complemented by the integration of seamless, secure, and diverse payment gateways, including the growing adoption of local and alternative payment methods, which are paramount for capturing a broader customer base and maintaining a competitive edge in this vibrant digital landscape.

Report Scope & Segmentation Analysis

This report segments the Latin American online travel market across several key parameters.

- By Service Type: Accommodation booking, Travel Tickets Booking, Holiday Package Booking, and Other Service Types. Each segment shows distinct growth trajectories based on consumer preferences and technological developments.

- By Mode of Booking: Direct Booking (through OTAs) and Travel Agents, reflecting the evolving balance between online and offline booking channels.

- By Booking Platform: Desktop and Mobile/Tablet, highlighting the shift towards mobile-dominated booking preferences.

Key Drivers of Latin America Online Travel Market Growth

Several factors are driving the growth of the Latin American online travel market. The expanding middle class with increased disposable income is a major force, enabling more people to afford leisure travel. Technological advancements such as faster internet and affordable smartphones have increased access and ease of use. Supportive government policies promoting tourism and infrastructure development further facilitate market expansion.

Challenges in the Latin America Online Travel Market Sector

The Latin American online travel market faces several challenges. Fluctuating currency exchange rates and economic instability in certain regions pose risks to revenue predictability. Infrastructure limitations in some areas can hinder online accessibility and booking processes. Security concerns related to online transactions and data privacy also impact consumer trust and market growth.

Emerging Opportunities in Latin America Online Travel Market

The dynamic Latin American online travel market presents a fertile ground for numerous emerging opportunities. The accelerating adoption of mobile payment solutions and a broader embrace of alternative payment methods, such as local e-wallets and buy-now-pay-later (BNPL) services, represent a significant and largely untapped avenue for market expansion. Simultaneously, the burgeoning global consciousness towards responsible travel is creating a robust niche for sustainable and eco-friendly tourism. This demand for conscious travel experiences opens doors for specialized product offerings, from eco-lodges and community-based tourism initiatives to carbon-neutral travel packages. Beyond these consumer-driven trends, there remains substantial untapped potential in less-penetrated regional markets within Latin America, where the digital infrastructure and online travel adoption are still in their nascent stages, offering considerable growth prospects for early entrants and innovative service providers.

Leading Players in the Latin America Online Travel Market Market

- Hotel Urbano

- Trivago

- Carlson Wagonlit Travel (CWT)

- FlixBus (formerly FlixBus)

- Expedia Group

- CVC Corp

- Airbnb

- Booking Holdings (including Booking.com, Agoda)

- Decolar (Despegar)

- Pricetravel Holding

- TripAdvisor

Key Developments in Latin America Online Travel Market Industry

- November 2022: The European Commission initiated a thorough investigation into Booking Holdings' proposed acquisition of Etraveli Group, focusing on potential impacts on competition within the online travel agency sector.

- May 2022: Despegar, a prominent online travel agency in Latin America, successfully acquired Viajanet for approximately US$15 Million, significantly strengthening its market position and expanding its service portfolio.

- Ongoing: Increased investment in mobile-first strategies and the integration of advanced AI for personalized customer experiences are becoming standard practice among leading OTAs.

- Emerging Trend: A growing focus on sustainable tourism options and the development of platforms catering to environmentally conscious travelers.

Future Outlook for Latin America Online Travel Market Market

The Latin American online travel market is on an accelerated trajectory for sustained and robust growth. This upward trend is underpinned by several pivotal factors: the rapidly increasing smartphone penetration across the region, the steady expansion of the middle class with greater disposable income, and the continuous wave of technological advancements that are reshaping how travel is discovered, booked, and experienced. To capitalize on this immense potential, strategic partnerships will be paramount, fostering collaboration and expanding reach. A diversification of travel offerings, moving beyond traditional flights and accommodations to include unique experiences, local tours, and niche travel segments, will be crucial for meeting evolving consumer demands. Furthermore, aggressive expansion into underserved regional markets, coupled with a deep understanding of local nuances and preferences, will pave the way for sustained success. The market's future potential is truly immense, with industry projections indicating a significant market value, potentially reaching [Insert specific projected value, e.g., over US$50 Billion] by 2033, signaling a period of unprecedented opportunity and transformation.

Latin America Online Travel Market Segmentation

-

1. Service Type

- 1.1. Accommodation Booking

- 1.2. Travel Tickets Booking

- 1.3. Holiday Package Booking

- 1.4. Other Service Types

-

2. Mode of Booking

- 2.1. Direct Booking

- 2.2. Travel Agents

-

3. Booking Platform

- 3.1. Desktop

- 3.2. Mobile/Tablet

-

4. Geography

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Argentina

- 4.4. Rest of Latin America

Latin America Online Travel Market Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Argentina

- 4. Rest of Latin America

Latin America Online Travel Market Regional Market Share

Geographic Coverage of Latin America Online Travel Market

Latin America Online Travel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements

- 3.2.2 the online booking industry is undergoing significant transformation

- 3.3. Market Restrains

- 3.3.1. Booking Cancellation

- 3.4. Market Trends

- 3.4.1. Growing Tourism Sector is Helping the Market to Grow Further

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Accommodation Booking

- 5.1.2. Travel Tickets Booking

- 5.1.3. Holiday Package Booking

- 5.1.4. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 5.2.1. Direct Booking

- 5.2.2. Travel Agents

- 5.3. Market Analysis, Insights and Forecast - by Booking Platform

- 5.3.1. Desktop

- 5.3.2. Mobile/Tablet

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Mexico

- 5.4.2. Brazil

- 5.4.3. Argentina

- 5.4.4. Rest of Latin America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Mexico

- 5.5.2. Brazil

- 5.5.3. Argentina

- 5.5.4. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Mexico Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Accommodation Booking

- 6.1.2. Travel Tickets Booking

- 6.1.3. Holiday Package Booking

- 6.1.4. Other Service Types

- 6.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 6.2.1. Direct Booking

- 6.2.2. Travel Agents

- 6.3. Market Analysis, Insights and Forecast - by Booking Platform

- 6.3.1. Desktop

- 6.3.2. Mobile/Tablet

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Mexico

- 6.4.2. Brazil

- 6.4.3. Argentina

- 6.4.4. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Brazil Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Accommodation Booking

- 7.1.2. Travel Tickets Booking

- 7.1.3. Holiday Package Booking

- 7.1.4. Other Service Types

- 7.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 7.2.1. Direct Booking

- 7.2.2. Travel Agents

- 7.3. Market Analysis, Insights and Forecast - by Booking Platform

- 7.3.1. Desktop

- 7.3.2. Mobile/Tablet

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Mexico

- 7.4.2. Brazil

- 7.4.3. Argentina

- 7.4.4. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Argentina Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Accommodation Booking

- 8.1.2. Travel Tickets Booking

- 8.1.3. Holiday Package Booking

- 8.1.4. Other Service Types

- 8.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 8.2.1. Direct Booking

- 8.2.2. Travel Agents

- 8.3. Market Analysis, Insights and Forecast - by Booking Platform

- 8.3.1. Desktop

- 8.3.2. Mobile/Tablet

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Mexico

- 8.4.2. Brazil

- 8.4.3. Argentina

- 8.4.4. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Rest of Latin America Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Accommodation Booking

- 9.1.2. Travel Tickets Booking

- 9.1.3. Holiday Package Booking

- 9.1.4. Other Service Types

- 9.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 9.2.1. Direct Booking

- 9.2.2. Travel Agents

- 9.3. Market Analysis, Insights and Forecast - by Booking Platform

- 9.3.1. Desktop

- 9.3.2. Mobile/Tablet

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Mexico

- 9.4.2. Brazil

- 9.4.3. Argentina

- 9.4.4. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Hotel Urbano

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Trivago

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Carlson Wagonlit

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Flutouviagens

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hoteis

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 CVC Corp

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Airbnb

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Booking Holdings

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Decolar

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Pricetravel**List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Despegar

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Hotel Urbano

List of Figures

- Figure 1: Latin America Online Travel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Online Travel Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 3: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 4: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Latin America Online Travel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 8: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 9: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Latin America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 12: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 13: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 14: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Latin America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 17: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 18: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 19: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Latin America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 22: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 23: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 24: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: Latin America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Online Travel Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Latin America Online Travel Market?

Key companies in the market include Hotel Urbano, Trivago, Carlson Wagonlit, Flutouviagens, Hoteis, CVC Corp, Airbnb, Booking Holdings, Decolar, Pricetravel**List Not Exhaustive, Despegar.

3. What are the main segments of the Latin America Online Travel Market?

The market segments include Service Type, Mode of Booking, Booking Platform, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements. the online booking industry is undergoing significant transformation.

6. What are the notable trends driving market growth?

Growing Tourism Sector is Helping the Market to Grow Further.

7. Are there any restraints impacting market growth?

Booking Cancellation.

8. Can you provide examples of recent developments in the market?

In November 2022, The European Commission has opened an investigation into the proposed acquisition of Sweden's Flugo Group Holdings AB which operates as Etraveli by Booking Holdings Inc.. The proposed transaction would allow Booking to strengthen its position in the market for online travel agencies, and increase the barrier to entry and expansion for rivals

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Online Travel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Online Travel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Online Travel Market?

To stay informed about further developments, trends, and reports in the Latin America Online Travel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence