Key Insights

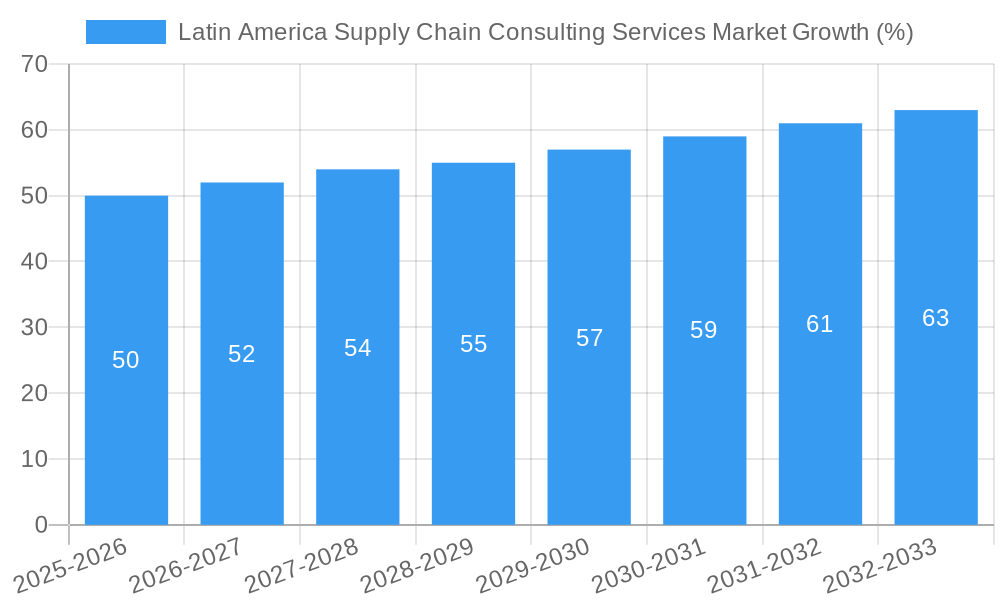

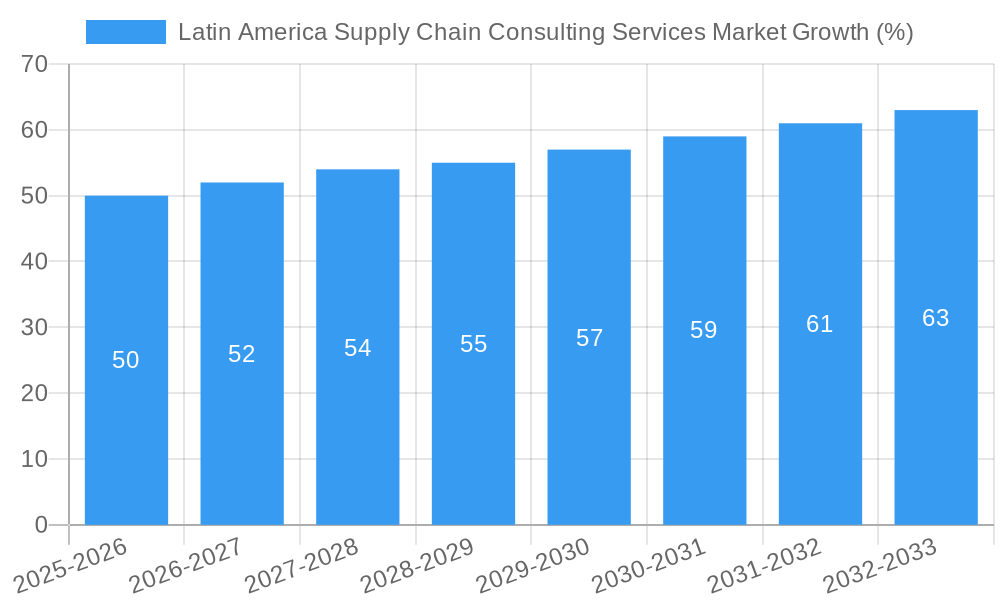

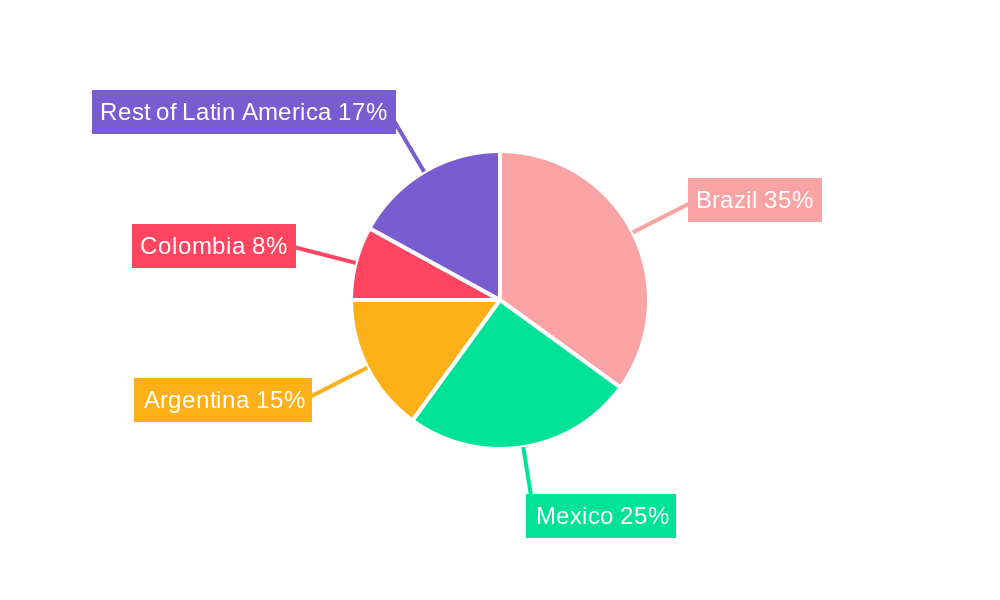

The Latin America Supply Chain Consulting Services market is experiencing steady growth, projected to reach a significant value by 2033. A Compound Annual Growth Rate (CAGR) of 3.31% indicates a consistent expansion driven by several key factors. The increasing adoption of digital technologies within supply chains, coupled with the rising need for enhanced efficiency and resilience in the face of global disruptions, is fueling demand for specialized consulting services. Manufacturing, life sciences and healthcare, and IT and telecommunication sectors are major contributors to market growth, demanding optimization strategies to manage complex logistics, improve inventory management, and enhance overall supply chain visibility. Furthermore, governmental initiatives promoting industrial modernization and economic diversification across Latin American nations are also bolstering the market. While economic fluctuations and varying levels of digital infrastructure adoption across the region present some challenges, the overall market outlook remains positive. Brazil, Mexico, and Argentina are currently leading the market, reflecting their larger economies and more established business landscapes. However, significant growth potential exists in other Latin American countries as they continue to develop their industrial sectors and embrace advanced supply chain management practices. The presence of numerous multinational and regional consulting firms underscores the market's competitiveness and its ability to attract significant investment.

The market segmentation by organization size (SMEs and large enterprises) reveals distinct growth patterns. Large enterprises are currently the larger segment due to their greater resources and higher complexity needs. However, SMEs are experiencing faster growth rates as they recognize the value proposition of streamlined operations and cost optimization offered by supply chain consulting. This trend, combined with the expanding reach of digital solutions making such services more accessible to smaller businesses, will likely contribute to the continued expansion of this segment in the coming years. The geographical distribution of the market highlights significant opportunities for expansion beyond the leading nations. Countries like Peru and Chile are expected to experience accelerated growth fueled by foreign direct investment and ongoing infrastructure development. The competitive landscape is characterized by a mix of global giants and regional players, indicating a dynamic market with opportunities for both established firms and new entrants.

Latin America Supply Chain Consulting Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America Supply Chain Consulting Services market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence on market size, growth drivers, challenges, and emerging opportunities. The report covers key segments, including organization size (SMEs and large enterprises), end-user industries (manufacturing, life sciences and healthcare, IT and telecommunication, government, energy, and others), and key countries (Brazil, Mexico, Argentina, Colombia, and the Rest of Latin America).

Latin America Supply Chain Consulting Services Market Structure & Innovation Trends

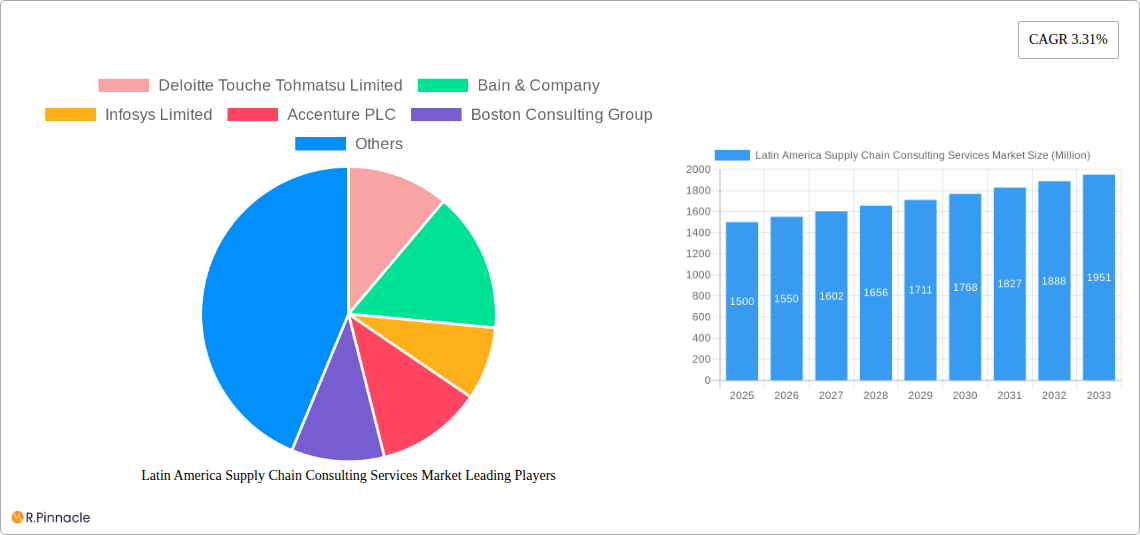

The Latin American supply chain consulting services market exhibits a moderately concentrated structure, with a few major players holding significant market share. Deloitte, Bain & Company, Accenture, and McKinsey & Company are among the leading firms, commanding a combined market share estimated at xx%. However, a considerable portion of the market is occupied by smaller, specialized firms catering to niche segments. Innovation is driven by technological advancements such as AI, blockchain, and advanced analytics, enabling more efficient and data-driven solutions. Regulatory frameworks, particularly those related to data privacy and trade, significantly influence market dynamics. The market witnesses frequent M&A activity, with deal values ranging from xx Million to xx Million annually, as larger firms seek to expand their service portfolios and geographic reach. The increasing adoption of cloud-based solutions and the rising demand for sustainable supply chain practices further fuel innovation in the market.

- Market Concentration: Moderately concentrated, with top players holding xx% market share.

- Innovation Drivers: AI, blockchain, advanced analytics, cloud computing, sustainability initiatives.

- Regulatory Factors: Data privacy regulations, trade agreements, and environmental policies.

- M&A Activity: Frequent acquisitions and mergers, with deal values in the range of xx Million - xx Million.

- Product Substitutes: Internal resource allocation, open-source software solutions.

- End-user Demographics: Large enterprises account for a larger share compared to SMEs; manufacturing and IT and telecommunication sectors are leading end-users.

Latin America Supply Chain Consulting Services Market Dynamics & Trends

The Latin American supply chain consulting services market is experiencing robust growth, driven by factors such as increasing globalization, rising e-commerce adoption, and the expanding manufacturing sector. The CAGR during the forecast period (2025-2033) is projected to be xx%, exceeding the global average. Technological disruptions, such as the implementation of Industry 4.0 technologies and the rise of digital supply chains, are significantly impacting market dynamics. Consumer preferences are shifting towards sustainable and ethically sourced products, necessitating the adoption of responsible supply chain practices by businesses. Competitive dynamics are marked by intense rivalry among established players, coupled with the emergence of agile start-ups that offer innovative, cost-effective solutions. Market penetration of advanced analytics and AI-based solutions is rising steadily, with a predicted xx% increase in adoption rate by 2033.

Dominant Regions & Segments in Latin America Supply Chain Consulting Services Market

Brazil and Mexico are the dominant markets in Latin America, accounting for a combined xx% of the total market revenue. This dominance is attributable to their larger economies, advanced infrastructure, and strong manufacturing bases. Large enterprises constitute a larger portion of the market compared to SMEs, due to their greater investment capacity and complex supply chain needs. Among end-user industries, manufacturing, life sciences and healthcare, and IT and telecommunications are the key segments, fueled by increased demand for supply chain optimization.

Key Drivers for Brazil and Mexico:

- Robust economies

- Well-developed infrastructure

- Large manufacturing sectors

- Growing adoption of advanced technologies

Large Enterprises Dominance: Higher investment capacity, complex supply chain needs.

Leading End-user Industries: Manufacturing, Life Sciences & Healthcare, IT & Telecommunications.

Argentina and Colombia: Show promising growth potential driven by government initiatives and economic reforms, although market size remains smaller compared to Brazil and Mexico. The "Rest of Latin America" segment exhibits a slower growth rate due to factors such as limited infrastructure and economic development.

Latin America Supply Chain Consulting Services Market Product Innovations

Recent innovations include AI-powered solutions for route optimization and real-time visibility, blockchain technologies for enhancing supply chain transparency and traceability, and cloud-based platforms for streamlined data management. These innovations offer significant competitive advantages by improving efficiency, reducing costs, and enhancing supply chain resilience. The market shows a strong inclination towards integrating sustainable practices into supply chain solutions, appealing to environmentally conscious businesses and meeting regulatory requirements.

Report Scope & Segmentation Analysis

This report segments the Latin American supply chain consulting services market by organization size (SMEs and Large Enterprises), end-user industry (Manufacturing, Life Sciences and Healthcare, IT and Telecommunication, Government, Energy, Other End-user Industries), and country (Brazil, Mexico, Argentina, Colombia, Rest of Latin America). The growth projections for each segment vary based on market dynamics and economic factors. Market size and competitive landscapes are detailed for each segment, showing varying degrees of concentration and innovation activity.

Key Drivers of Latin America Supply Chain Consulting Services Market Growth

The market's growth is propelled by several factors: increasing globalization, the rise of e-commerce, growing adoption of digital technologies (like AI and blockchain), and the need for enhanced supply chain resilience and sustainability. Government initiatives aimed at promoting economic growth and investment in infrastructure also contribute significantly. The expanding manufacturing sector, especially in Brazil and Mexico, fuels the demand for supply chain optimization services.

Challenges in the Latin America Supply Chain Consulting Services Market Sector

The market faces several challenges: infrastructure limitations in certain regions, economic volatility in some Latin American countries, a lack of skilled talent in certain areas, and regulatory complexities. These factors can lead to increased costs, delays, and disruptions to supply chains. The competition from established international and emerging local players also presents a significant challenge.

Emerging Opportunities in Latin America Supply Chain Consulting Services Market

Significant opportunities exist in areas such as the adoption of Industry 4.0 technologies, the growing demand for sustainable supply chain solutions, and the expansion into less-penetrated segments, especially SMEs in the “Rest of Latin America.” The increasing adoption of cloud-based solutions and the development of new digital tools present considerable potential for growth.

Leading Players in the Latin America Supply Chain Consulting Services Market Market

- Deloitte Touche Tohmatsu Limited

- Bain & Company

- Infosys Limited

- Accenture PLC

- Boston Consulting Group

- Capgemini SE

- Ernst & Young Services Limited

- Alvarez & Marsal Inc

- KPMG

- Global Eprocure Limited

- Tata Consultancy Services

- Cognizant Technology Solutions Corporation

- McKinsey & Company

Key Developments in Latin America Supply Chain Consulting Services Market Industry

- May 2023: RoutEasy, a Brazilian logistics company, invested in AI-based solutions, achieving an 8% reduction in travel distance, a 7.5% reduction in CO2 emissions, and an 80% reduction in overtime for a major energy distributor.

- April 2023: Arado, a Brazilian agribusiness marketplace, raised USD 12 Million in Series A funding to expand its market presence and develop technological offerings for farmers and retailers.

Future Outlook for Latin America Supply Chain Consulting Services Market Market

The Latin American supply chain consulting services market is poised for sustained growth, driven by continued technological advancements, increasing adoption of digital tools, and the growing focus on sustainability and resilience. The market's future potential is substantial, presenting significant opportunities for both established players and new entrants. Strategic partnerships, investment in innovative technologies, and a focus on meeting evolving customer needs will be crucial for success.

Latin America Supply Chain Consulting Services Market Segmentation

-

1. Organization Size

- 1.1. SMEs

- 1.2. Large Enterprises

-

2. End-user Industry

- 2.1. Manufacturing

- 2.2. Life Sciences and Healthcare

- 2.3. IT and Telecommunication

- 2.4. Government

- 2.5. Energy

- 2.6. Other End-user Industries

Latin America Supply Chain Consulting Services Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Supply Chain Consulting Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.31% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need for better visibility and Control in Supply Chain Operations; Reduction of Wastage and Delays through Optimization

- 3.3. Market Restrains

- 3.3.1. Shift in the Consulting Marketplace

- 3.4. Market Trends

- 3.4.1. SMEs Segment to Witness the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Supply Chain Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 5.1.1. SMEs

- 5.1.2. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Manufacturing

- 5.2.2. Life Sciences and Healthcare

- 5.2.3. IT and Telecommunication

- 5.2.4. Government

- 5.2.5. Energy

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 6. Brazil Latin America Supply Chain Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Supply Chain Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Supply Chain Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Supply Chain Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Supply Chain Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Supply Chain Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Deloitte Touche Tohmatsu Limited

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Bain & Company

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Infosys Limited

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Accenture PLC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Boston Consulting Group

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Capgemini SE

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Ernst & Young Services Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Alvarez & Marsal Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 KPMG

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Global Eprocure Limited

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Tata Consultancy Services

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Cognizant Technology Solutions Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 McKinsey & Company

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Deloitte Touche Tohmatsu Limited

List of Figures

- Figure 1: Latin America Supply Chain Consulting Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Supply Chain Consulting Services Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Supply Chain Consulting Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Supply Chain Consulting Services Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 3: Latin America Supply Chain Consulting Services Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Latin America Supply Chain Consulting Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Latin America Supply Chain Consulting Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Latin America Supply Chain Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina Latin America Supply Chain Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Latin America Supply Chain Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Peru Latin America Supply Chain Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile Latin America Supply Chain Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Latin America Latin America Supply Chain Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Latin America Supply Chain Consulting Services Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 13: Latin America Supply Chain Consulting Services Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: Latin America Supply Chain Consulting Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Latin America Supply Chain Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Latin America Supply Chain Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Chile Latin America Supply Chain Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Colombia Latin America Supply Chain Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico Latin America Supply Chain Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Peru Latin America Supply Chain Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Venezuela Latin America Supply Chain Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ecuador Latin America Supply Chain Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Bolivia Latin America Supply Chain Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Paraguay Latin America Supply Chain Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Supply Chain Consulting Services Market?

The projected CAGR is approximately 3.31%.

2. Which companies are prominent players in the Latin America Supply Chain Consulting Services Market?

Key companies in the market include Deloitte Touche Tohmatsu Limited, Bain & Company, Infosys Limited, Accenture PLC, Boston Consulting Group, Capgemini SE, Ernst & Young Services Limited, Alvarez & Marsal Inc, KPMG, Global Eprocure Limited, Tata Consultancy Services, Cognizant Technology Solutions Corporation, McKinsey & Company.

3. What are the main segments of the Latin America Supply Chain Consulting Services Market?

The market segments include Organization Size, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Need for better visibility and Control in Supply Chain Operations; Reduction of Wastage and Delays through Optimization.

6. What are the notable trends driving market growth?

SMEs Segment to Witness the Growth.

7. Are there any restraints impacting market growth?

Shift in the Consulting Marketplace.

8. Can you provide examples of recent developments in the market?

May 2023 - RoutEasy, a Brazilian logistic company, invested in developing advanced AI-based solutions to expand its business while also evaluating the possibilities of new technologies based on upcoming AI platforms. ChatGPT can assist in real-time analysis of traffic information, weather, and peak hours in specific areas to make route adjustments depending on these critical elements for logistics and operations. According to the company, RoutEasy'stechnology helped in an 8% reduction in the distance traveled by one of Brazil's leading gas and electric power distributors. According to the company, the startup's software also resulted in a 7.5% reduction in CO2 emissions and an 80% reduction in overtime for the distributor's team.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Supply Chain Consulting Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Supply Chain Consulting Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Supply Chain Consulting Services Market?

To stay informed about further developments, trends, and reports in the Latin America Supply Chain Consulting Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence