Key Insights

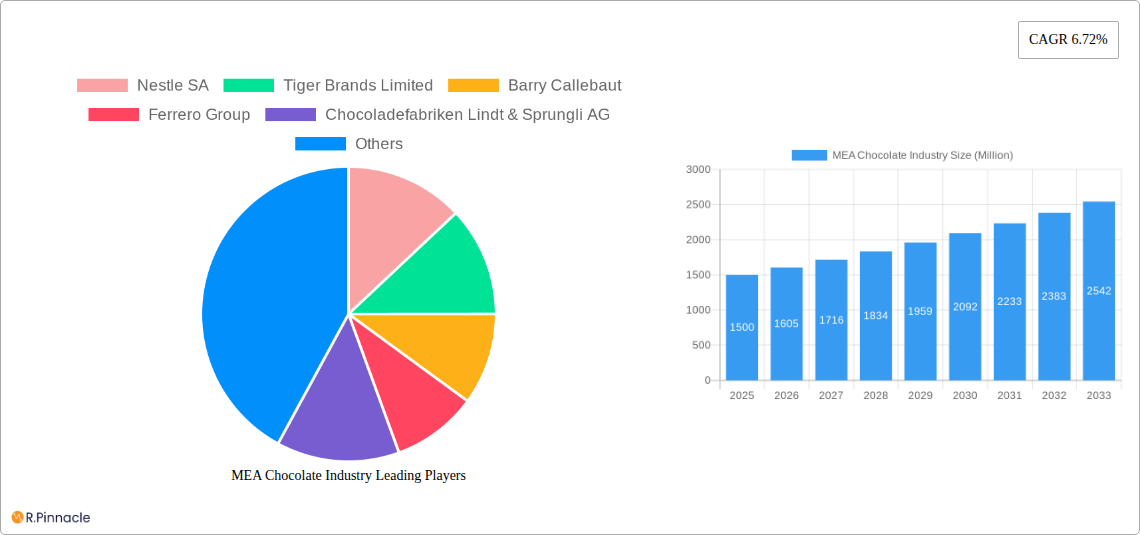

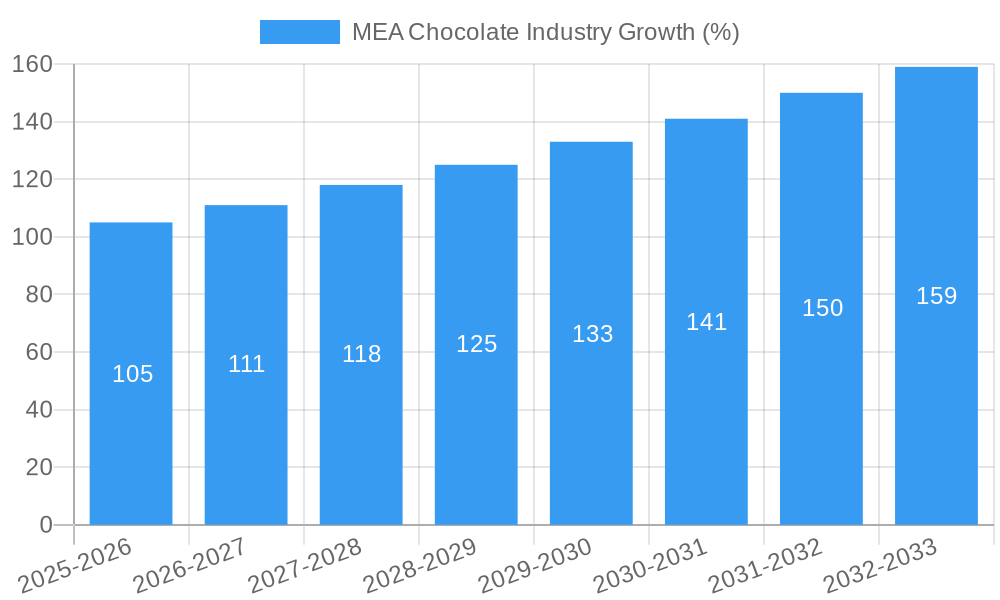

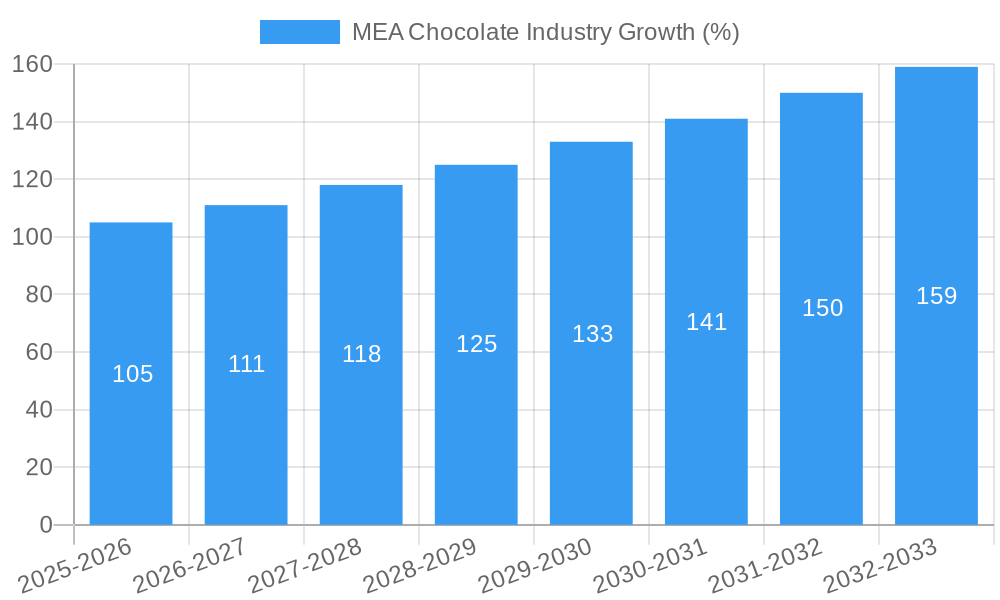

The Middle East and Africa (MEA) chocolate market, valued at approximately $X million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.72% from 2025 to 2033. This expansion is driven by several key factors. Rising disposable incomes, particularly within the burgeoning middle class across the region, fuel increased spending on premium confectionery products, including chocolate. Furthermore, the growing popularity of Westernized diets and lifestyles is contributing to higher chocolate consumption rates. The increasing presence of international chocolate brands and the expansion of retail channels, including online stores and specialty shops, are also fueling market expansion. However, challenges remain, including fluctuations in raw material prices (cocoa beans, sugar) and varying levels of economic stability across different MEA nations. Successful market players are likely to focus on product diversification, catering to diverse preferences with offerings like dark chocolate, milk chocolate, white chocolate, and a variety of formats (boxed assortments, countlines, seasonal chocolates). Strategic partnerships with local distributors are crucial for effective market penetration within geographically dispersed and culturally diverse MEA markets.

Segmentation analysis reveals strong demand for both dark and milk/white chocolate across various distribution channels. Supermarkets and hypermarkets maintain a significant market share, but the burgeoning online retail segment represents a significant growth opportunity. The presence of established international players like Nestlé, Ferrero, and Mars, alongside local chocolate manufacturers, indicates a competitive yet dynamic landscape. Future growth will likely hinge on innovating product offerings, employing effective marketing strategies targeting specific consumer segments, and navigating the complexities of the regional supply chain and regulatory environment. Specific attention to seasonal promotions and culturally relevant product variations will be key for maximizing sales and brand penetration.

MEA Chocolate Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report provides a detailed analysis of the Middle East and Africa (MEA) chocolate industry, covering market structure, dynamics, leading players, and future growth prospects. The report utilizes data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033) to deliver actionable insights for industry professionals. With a focus on key segments and regional variations, this report is an essential resource for strategic decision-making. The report's findings reveal a dynamic market characterized by innovation, evolving consumer preferences, and significant growth potential.

MEA Chocolate Industry Market Structure & Innovation Trends

This section analyzes the MEA chocolate market's competitive landscape, highlighting key players, market concentration, and innovation drivers. The report examines the regulatory environment, substitute products, end-user demographics, and mergers & acquisitions (M&A) activities shaping the industry.

Market Concentration: The MEA chocolate market is characterized by a mix of multinational giants and smaller regional players. Nestle SA, Mars Incorporated, Mondelez International Inc., and Ferrero Group hold significant market share. However, the presence of local and artisanal brands indicates a diverse competitive landscape. The exact market share for each player is currently under xx Million.

Innovation Drivers: Innovation in the MEA chocolate market is driven by consumer demand for premium products, unique flavors, and healthier options. This is reflected in the increasing popularity of dark chocolate, artisanal chocolates, and products with reduced sugar content. Furthermore, technological advancements in chocolate production and packaging are contributing to innovation.

Regulatory Frameworks: The regulatory environment in different MEA countries influences the production, labeling, and distribution of chocolate products. This report analyzes relevant regulations impacting the industry.

Product Substitutes: The MEA chocolate market faces competition from other confectionery products and healthy snacks. However, the strong cultural affinity for chocolate in many MEA countries limits the impact of these substitutes.

End-User Demographics: This section details the demographic trends influencing chocolate consumption in the MEA region, including age, income level, and cultural preferences.

M&A Activities: The report examines recent M&A activities in the MEA chocolate industry, including deal values and their impact on market consolidation. The total value of M&A deals over the study period is estimated at xx Million.

MEA Chocolate Industry Market Dynamics & Trends

This section delves into the market's growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The analysis includes specific metrics such as compound annual growth rate (CAGR) and market penetration to provide a comprehensive understanding of the market's evolution.

The MEA chocolate market has experienced significant growth over the past few years, driven by factors such as rising disposable incomes, increasing urbanization, and changing consumer preferences towards premium and artisanal products. Technological advancements in chocolate manufacturing and packaging are also contributing to growth. However, factors such as economic instability and fluctuations in cocoa prices represent potential challenges. The CAGR for the forecast period (2025-2033) is estimated at xx%. Market penetration is anticipated to reach xx% by 2033. The competitive landscape is dynamic, with both established multinational players and local brands vying for market share.

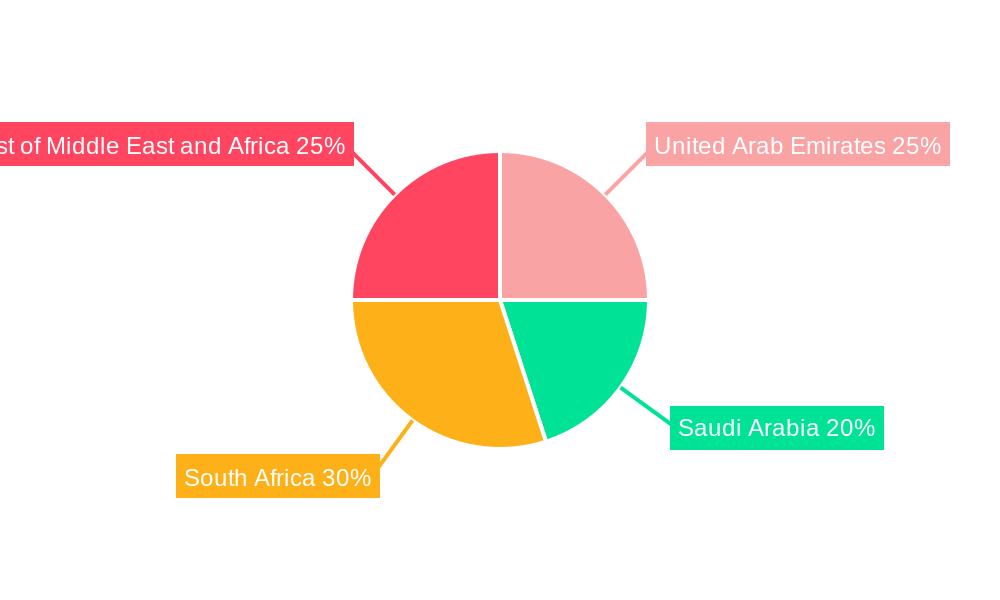

Dominant Regions & Segments in MEA Chocolate Industry

This section identifies the leading regions, countries, and product segments within the MEA chocolate industry. Key drivers behind the dominance of specific regions and segments are explored through detailed analysis.

Leading Region: xx currently holds the largest market share in the MEA region due to factors such as higher disposable income and a strong preference for chocolate.

Leading Country: xx is leading in terms of market size.

Dominant Product Segments: The report details the leading segments across product types (dark, milk, white chocolate) and distribution channels (supermarkets, specialty stores, online retail).

Key Drivers (using bullet points):

- Strong consumer demand for premium chocolate products

- Increasing investments in marketing and distribution

- Growing presence of international chocolate brands

- Favorable economic conditions in specific regions

This dominance analysis helps identify key opportunities for investment and growth within the MEA chocolate industry.

MEA Chocolate Industry Product Innovations

This section summarizes recent product developments, highlighting technological trends and market fit. The focus is on innovations that address changing consumer preferences and competitive pressures.

Recent innovations in the MEA chocolate market include the introduction of healthier chocolate options (e.g., reduced sugar, higher cacao percentage), artisanal chocolates with unique flavors and designs, and convenient packaging formats. These innovations reflect a growing demand for premium, healthier, and more experiential chocolate products. The integration of technology in production and packaging also contributes to innovation.

Report Scope & Segmentation Analysis

This section provides a detailed overview of the market segmentation by product type and distribution channel, including growth projections and competitive dynamics.

Product Segmentation: The report segments the market based on product type: Dark Chocolate, Milk/White Chocolate, Boxed Assortments, Countlines, Seasonal Chocolates, Molded Chocolates, and Other Product Types. Each segment's market size, growth projection, and competitive landscape are analyzed.

Distribution Channel Segmentation: The market is segmented by distribution channels: Supermarkets/Hypermarkets, Specialty Stores, Convenience/Grocery Stores, Online Retail Stores, and Other Distribution Channels. Each channel's market size, growth projection, and competitive landscape are analyzed.

Key Drivers of MEA Chocolate Industry Growth

This section outlines the key factors driving growth in the MEA chocolate industry, focusing on technological, economic, and regulatory factors.

Growth in the MEA chocolate industry is propelled by several factors including rising disposable incomes, increasing urbanization, and a growing preference for premium chocolate products. Technological advancements in production and packaging improve efficiency and expand product offerings. Favorable regulatory environments and supportive government policies further stimulate growth.

Challenges in the MEA Chocolate Industry Sector

This section identifies and analyzes the key challenges faced by the MEA chocolate industry, including regulatory hurdles, supply chain issues, and competitive pressures.

Key challenges include fluctuations in cocoa prices, the increasing cost of raw materials, and competition from other confectionery products. Supply chain disruptions and regulatory complexities in certain markets also pose challenges.

Emerging Opportunities in MEA Chocolate Industry

This section highlights emerging trends and opportunities in the MEA chocolate industry, emphasizing new markets, technologies, and consumer preferences.

Emerging opportunities include tapping into the growing demand for healthier chocolate options, exploring new flavors and product formats, and leveraging digital channels for marketing and distribution. Expanding into underserved markets and catering to niche consumer preferences present significant growth potential.

Leading Players in the MEA Chocolate Industry Market

- Nestle SA

- Tiger Brands Limited

- Barry Callebaut

- Ferrero Group

- Chocoladefabriken Lindt & Sprungli AG

- Mars Incorporated

- Mondelez International Inc

- Cocoa Processing Company Limited

- Kees Beyers Chocolate CC

- The Hershey Company

Key Developments in MEA Chocolate Industry Industry

- March 2022: Barry Callebaut launched its line of whole-fruit chocolates in the UAE, featuring 40% less sugar than conventional dark chocolate.

- February 2022: Made By Two, a Dubai-based boutique, launched its collection of glazed luxury chocolates.

- October 2021: Barry Callebaut opened a new Chocolate Academy in Dubai, aiming to boost innovation in the premium chocolate market.

Future Outlook for MEA Chocolate Industry Market

The MEA chocolate industry is poised for continued growth, driven by increasing consumer demand, product innovation, and expanding distribution channels. Opportunities exist for companies to capitalize on evolving consumer preferences for healthier and more sustainable products, and to leverage technological advancements to enhance efficiency and product offerings. This presents a positive outlook for industry players.

MEA Chocolate Industry Segmentation

-

1. Product

- 1.1. Dark Chocolate

- 1.2. Milk/ White Chocolate

-

2. Type

- 2.1. Boxed Assortments

- 2.2. Countlines

- 2.3. Seasonal Chocolates

- 2.4. Molded Chocolates

- 2.5. Other Product Types

-

3. Distribution Channel

- 3.1. Supermarkets/ Hypermarkets

- 3.2. Specialty Stores

- 3.3. Convenience/Grocery Stores

- 3.4. Online Retail Stores

- 3.5. Other Distribution Channels

-

4. Geography

- 4.1. South Africa

- 4.2. Saudi Arabia

- 4.3. United Arab Emirates

- 4.4. Rest of Middle-East and Africa

MEA Chocolate Industry Segmentation By Geography

- 1. South Africa

- 2. Saudi Arabia

- 3. United Arab Emirates

- 4. Rest of Middle East and Africa

MEA Chocolate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.72% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives and E-commerce Penetration

- 3.3. Market Restrains

- 3.3.1. Detrimental Health Impact of Caffeine Intake

- 3.4. Market Trends

- 3.4.1. Countlines and Premium Dark Chocolates Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Chocolate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Dark Chocolate

- 5.1.2. Milk/ White Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Boxed Assortments

- 5.2.2. Countlines

- 5.2.3. Seasonal Chocolates

- 5.2.4. Molded Chocolates

- 5.2.5. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/ Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Convenience/Grocery Stores

- 5.3.4. Online Retail Stores

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. South Africa

- 5.4.2. Saudi Arabia

- 5.4.3. United Arab Emirates

- 5.4.4. Rest of Middle-East and Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Africa

- 5.5.2. Saudi Arabia

- 5.5.3. United Arab Emirates

- 5.5.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. South Africa MEA Chocolate Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Dark Chocolate

- 6.1.2. Milk/ White Chocolate

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Boxed Assortments

- 6.2.2. Countlines

- 6.2.3. Seasonal Chocolates

- 6.2.4. Molded Chocolates

- 6.2.5. Other Product Types

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/ Hypermarkets

- 6.3.2. Specialty Stores

- 6.3.3. Convenience/Grocery Stores

- 6.3.4. Online Retail Stores

- 6.3.5. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. South Africa

- 6.4.2. Saudi Arabia

- 6.4.3. United Arab Emirates

- 6.4.4. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Saudi Arabia MEA Chocolate Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Dark Chocolate

- 7.1.2. Milk/ White Chocolate

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Boxed Assortments

- 7.2.2. Countlines

- 7.2.3. Seasonal Chocolates

- 7.2.4. Molded Chocolates

- 7.2.5. Other Product Types

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/ Hypermarkets

- 7.3.2. Specialty Stores

- 7.3.3. Convenience/Grocery Stores

- 7.3.4. Online Retail Stores

- 7.3.5. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. South Africa

- 7.4.2. Saudi Arabia

- 7.4.3. United Arab Emirates

- 7.4.4. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. United Arab Emirates MEA Chocolate Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Dark Chocolate

- 8.1.2. Milk/ White Chocolate

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Boxed Assortments

- 8.2.2. Countlines

- 8.2.3. Seasonal Chocolates

- 8.2.4. Molded Chocolates

- 8.2.5. Other Product Types

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/ Hypermarkets

- 8.3.2. Specialty Stores

- 8.3.3. Convenience/Grocery Stores

- 8.3.4. Online Retail Stores

- 8.3.5. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. South Africa

- 8.4.2. Saudi Arabia

- 8.4.3. United Arab Emirates

- 8.4.4. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Rest of Middle East and Africa MEA Chocolate Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Dark Chocolate

- 9.1.2. Milk/ White Chocolate

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Boxed Assortments

- 9.2.2. Countlines

- 9.2.3. Seasonal Chocolates

- 9.2.4. Molded Chocolates

- 9.2.5. Other Product Types

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets/ Hypermarkets

- 9.3.2. Specialty Stores

- 9.3.3. Convenience/Grocery Stores

- 9.3.4. Online Retail Stores

- 9.3.5. Other Distribution Channels

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. South Africa

- 9.4.2. Saudi Arabia

- 9.4.3. United Arab Emirates

- 9.4.4. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. United Arab Emirates MEA Chocolate Industry Analysis, Insights and Forecast, 2019-2031

- 11. Saudi Arabia MEA Chocolate Industry Analysis, Insights and Forecast, 2019-2031

- 12. South Africa MEA Chocolate Industry Analysis, Insights and Forecast, 2019-2031

- 13. Rest of Middle East and Africa MEA Chocolate Industry Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Nestle SA

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Tiger Brands Limited

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Barry Callebaut

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Ferrero Group

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Chocoladefabriken Lindt & Sprungli AG

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Mars Incorporated

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Mondelez International Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Cocoa Processing Company Limited

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Kees Beyers Chocolate CC*List Not Exhaustive

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 The Hershey Company

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Nestle SA

List of Figures

- Figure 1: Global MEA Chocolate Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: MEA MEA Chocolate Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: MEA MEA Chocolate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: South Africa MEA Chocolate Industry Revenue (Million), by Product 2024 & 2032

- Figure 5: South Africa MEA Chocolate Industry Revenue Share (%), by Product 2024 & 2032

- Figure 6: South Africa MEA Chocolate Industry Revenue (Million), by Type 2024 & 2032

- Figure 7: South Africa MEA Chocolate Industry Revenue Share (%), by Type 2024 & 2032

- Figure 8: South Africa MEA Chocolate Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 9: South Africa MEA Chocolate Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 10: South Africa MEA Chocolate Industry Revenue (Million), by Geography 2024 & 2032

- Figure 11: South Africa MEA Chocolate Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 12: South Africa MEA Chocolate Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: South Africa MEA Chocolate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Saudi Arabia MEA Chocolate Industry Revenue (Million), by Product 2024 & 2032

- Figure 15: Saudi Arabia MEA Chocolate Industry Revenue Share (%), by Product 2024 & 2032

- Figure 16: Saudi Arabia MEA Chocolate Industry Revenue (Million), by Type 2024 & 2032

- Figure 17: Saudi Arabia MEA Chocolate Industry Revenue Share (%), by Type 2024 & 2032

- Figure 18: Saudi Arabia MEA Chocolate Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 19: Saudi Arabia MEA Chocolate Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 20: Saudi Arabia MEA Chocolate Industry Revenue (Million), by Geography 2024 & 2032

- Figure 21: Saudi Arabia MEA Chocolate Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 22: Saudi Arabia MEA Chocolate Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Saudi Arabia MEA Chocolate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: United Arab Emirates MEA Chocolate Industry Revenue (Million), by Product 2024 & 2032

- Figure 25: United Arab Emirates MEA Chocolate Industry Revenue Share (%), by Product 2024 & 2032

- Figure 26: United Arab Emirates MEA Chocolate Industry Revenue (Million), by Type 2024 & 2032

- Figure 27: United Arab Emirates MEA Chocolate Industry Revenue Share (%), by Type 2024 & 2032

- Figure 28: United Arab Emirates MEA Chocolate Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 29: United Arab Emirates MEA Chocolate Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 30: United Arab Emirates MEA Chocolate Industry Revenue (Million), by Geography 2024 & 2032

- Figure 31: United Arab Emirates MEA Chocolate Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 32: United Arab Emirates MEA Chocolate Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: United Arab Emirates MEA Chocolate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of Middle East and Africa MEA Chocolate Industry Revenue (Million), by Product 2024 & 2032

- Figure 35: Rest of Middle East and Africa MEA Chocolate Industry Revenue Share (%), by Product 2024 & 2032

- Figure 36: Rest of Middle East and Africa MEA Chocolate Industry Revenue (Million), by Type 2024 & 2032

- Figure 37: Rest of Middle East and Africa MEA Chocolate Industry Revenue Share (%), by Type 2024 & 2032

- Figure 38: Rest of Middle East and Africa MEA Chocolate Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 39: Rest of Middle East and Africa MEA Chocolate Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 40: Rest of Middle East and Africa MEA Chocolate Industry Revenue (Million), by Geography 2024 & 2032

- Figure 41: Rest of Middle East and Africa MEA Chocolate Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 42: Rest of Middle East and Africa MEA Chocolate Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Rest of Middle East and Africa MEA Chocolate Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global MEA Chocolate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global MEA Chocolate Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global MEA Chocolate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global MEA Chocolate Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Global MEA Chocolate Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Global MEA Chocolate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global MEA Chocolate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United Arab Emirates MEA Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia MEA Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Africa MEA Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Middle East and Africa MEA Chocolate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global MEA Chocolate Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 13: Global MEA Chocolate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Global MEA Chocolate Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Global MEA Chocolate Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: Global MEA Chocolate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Global MEA Chocolate Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 18: Global MEA Chocolate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global MEA Chocolate Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: Global MEA Chocolate Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Global MEA Chocolate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global MEA Chocolate Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 23: Global MEA Chocolate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Global MEA Chocolate Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 25: Global MEA Chocolate Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: Global MEA Chocolate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global MEA Chocolate Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 28: Global MEA Chocolate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 29: Global MEA Chocolate Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 30: Global MEA Chocolate Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 31: Global MEA Chocolate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Chocolate Industry?

The projected CAGR is approximately 6.72%.

2. Which companies are prominent players in the MEA Chocolate Industry?

Key companies in the market include Nestle SA, Tiger Brands Limited, Barry Callebaut, Ferrero Group, Chocoladefabriken Lindt & Sprungli AG, Mars Incorporated, Mondelez International Inc, Cocoa Processing Company Limited, Kees Beyers Chocolate CC*List Not Exhaustive, The Hershey Company.

3. What are the main segments of the MEA Chocolate Industry?

The market segments include Product, Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives and E-commerce Penetration.

6. What are the notable trends driving market growth?

Countlines and Premium Dark Chocolates Hold a Major Market Share.

7. Are there any restraints impacting market growth?

Detrimental Health Impact of Caffeine Intake.

8. Can you provide examples of recent developments in the market?

In March 2022, Barry Callebaut launched its line of whole-fruit chocolates under the Cacao Barry brand in the United Arab Emirates. The product has 40% less sugar than conventional dark chocolate and is made from 100% pure cacao fruit. The company partnered with Cabosse Naturals, who work closely with local cacao fruit farmers in Ecuador, to source the upcycled cacao fruit pulp and peels for the product.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Chocolate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Chocolate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Chocolate Industry?

To stay informed about further developments, trends, and reports in the MEA Chocolate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence