Key Insights

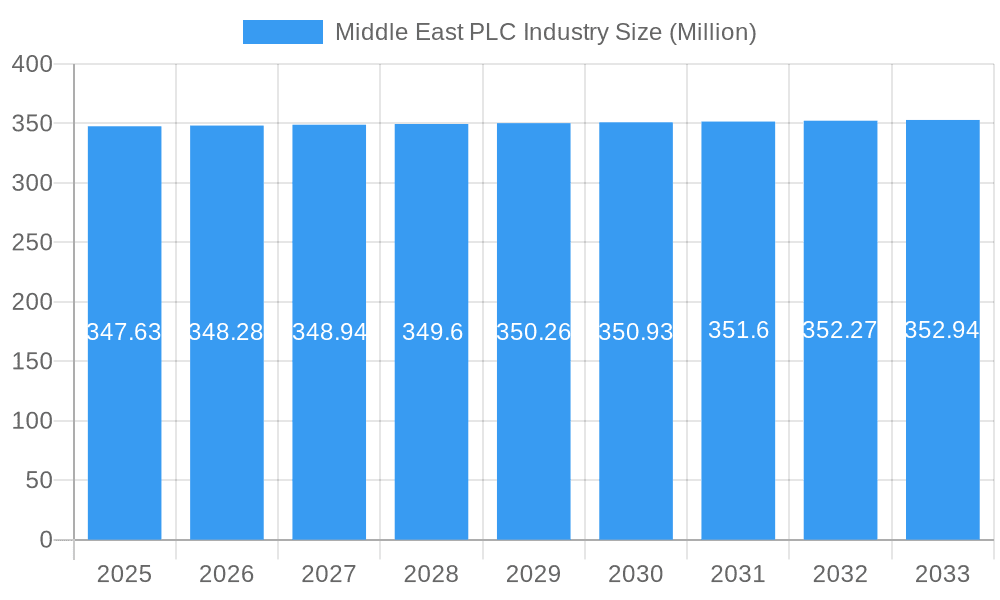

The Middle East programmable logic controller (PLC) market, valued at $347.63 million in 2025, exhibits a steady growth trajectory, projected by a Compound Annual Growth Rate (CAGR) of 0.17% from 2025 to 2033. This relatively modest CAGR reflects a mature market with established players. However, several factors contribute to sustained, albeit slow, growth. The expanding industrial automation sector across diverse end-user industries like food and beverage, automotive, and petrochemicals, fueled by regional infrastructure development and industrial diversification initiatives (e.g., Vision 2030 in Saudi Arabia), are key drivers. Increased adoption of smart manufacturing and Industry 4.0 technologies, along with the rising demand for enhanced process control and efficiency, further contribute to market expansion. While the market is not experiencing explosive growth, the steady demand for reliable and advanced PLC systems ensures continued market stability and opportunities for established and emerging players. The regional segmentation highlights the United Arab Emirates and Saudi Arabia as dominant markets, reflecting their comparatively advanced industrial sectors. However, potential exists for growth in other Middle Eastern countries as their economies develop and industrial automation adoption increases. Competitive pressures from established international vendors and the need for continuous technological innovation represent significant challenges for sustained market growth.

Middle East PLC Industry Market Size (In Million)

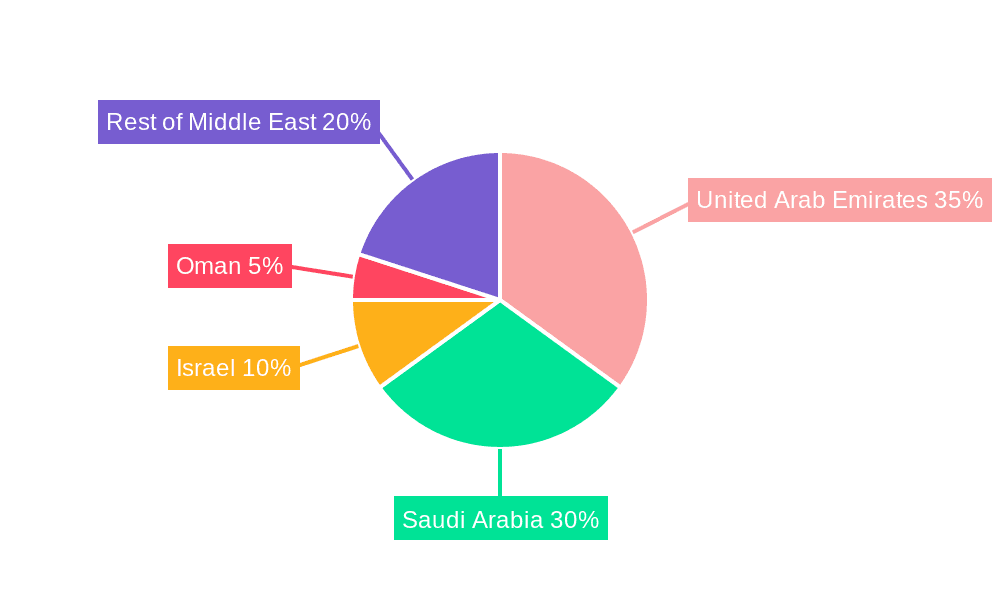

The market segmentation reveals that hardware accounts for the largest share, reflecting the fundamental need for physical PLC units. However, the software and services segments are expected to show relatively faster growth compared to hardware, driven by increasing demand for advanced functionalities and remote monitoring capabilities. Within the end-user industries, the food, tobacco, and beverage sector is likely to maintain its dominant position due to the ongoing growth in food processing and packaging industries. The chemical and petrochemical sector also presents substantial growth potential. From a geographical perspective, the UAE and Saudi Arabia will likely continue to be the largest consumers of PLCs, while Israel and Oman are expected to showcase moderate growth driven by their expanding industrial base. This highlights the importance of targeted market strategies for vendors wishing to capitalize on regional nuances. The overall growth will be moderate, mirroring the mature nature of the PLC market and the specific economic realities of the Middle East.

Middle East PLC Industry Company Market Share

Middle East PLC Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East Programmable Logic Controller (PLC) industry, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report unravels market dynamics, growth drivers, and future trends, empowering informed decision-making. The report incorporates detailed segmentation by type (Hardware, Software, Services), end-user industry (Food & Beverage, Automotive, Chemical & Petrochemical, Energy & Utilities, Pharmaceutical, Oil & Gas, Other), and country (UAE, Saudi Arabia, Israel, Oman, Rest of Middle East). The market size is projected to reach xx Million by 2033.

Middle East PLC Industry Market Structure & Innovation Trends

The Middle East PLC market demonstrates a moderately concentrated structure, with prominent players like Rockwell Automation, Honeywell International Inc, ABB Ltd, and Siemens AG holding substantial market share. While precise figures for 2025 are unavailable, their collective dominance is undeniable. Innovation is significantly driven by the accelerating adoption of Industry 4.0 technologies, encompassing the Internet of Things (IoT), cloud computing, artificial intelligence (AI), and advanced data analytics. This surge in demand is fueling the market for sophisticated PLC solutions capable of handling the complexities of modern industrial operations. Stringent regulatory frameworks emphasizing safety and cybersecurity are increasingly shaping the competitive landscape, demanding robust and secure solutions from vendors. While alternative technologies like distributed control systems (DCS) exist, PLCs maintain a strong competitive edge due to their cost-effectiveness and adaptability across diverse applications. The end-user demographics, particularly within the oil & gas and chemical sectors, heavily influence market trends, demonstrating a persistent preference for durable and reliable PLCs designed to withstand challenging operational conditions. Mergers and acquisitions (M&A) activity has been notable, with a significant total deal value observed over the past five years primarily focused on market consolidation and the acquisition of specialized technologies that enhance existing product portfolios and capabilities.

Middle East PLC Industry Market Dynamics & Trends

The Middle East PLC market is experiencing robust and sustained growth, propelled by factors such as large-scale industrialization initiatives, particularly within the energy and petrochemical sectors, alongside extensive ongoing infrastructure development projects across the region. While a precise CAGR for the forecast period (2025-2033) is unavailable, the market trajectory indicates a positive outlook. Technological advancements, notably centered around the convergence of Information Technology (IT) and Operational Technology (OT), are stimulating the adoption of intelligent PLCs equipped with advanced analytics and predictive maintenance capabilities. This allows for optimized efficiency and reduced downtime. Consumer preferences are demonstrably shifting towards energy-efficient solutions that seamlessly integrate into existing and emerging industrial ecosystems. Competitive dynamics remain intense, with established multinational corporations and emerging local companies vying for market share. Although market penetration for advanced PLC features such as cloud connectivity and robust cybersecurity protocols remains relatively low at present, it presents a substantial opportunity for growth and innovation in the coming years.

Dominant Regions & Segments in Middle East PLC Industry

Dominant Region: The UAE and Saudi Arabia currently dominate the Middle East PLC market due to their robust industrial sectors and substantial investments in infrastructure development.

Dominant Segments:

- By Type: The Hardware segment holds the largest market share, driven by the significant demand for PLCs from various end-user industries.

- By End-User Industry: The Oil and Gas and Chemical and Petrochemical sectors are the leading end-user industries due to their extensive automation needs and high capital expenditure. The Food and Beverage sector also shows substantial growth potential.

- By Country: The UAE benefits from a well-established industrial infrastructure and government support for technology adoption. Saudi Arabia's Vision 2030 initiative also contributes significantly to the industry's growth.

Key Drivers: Robust economic growth across the Middle East, particularly in the UAE and Saudi Arabia, fuelled by high oil prices and government diversification initiatives, coupled with the growing focus on smart city projects and industrial automation are significantly driving the PLC market. Investments in infrastructure projects and supportive government policies are also pivotal.

Middle East PLC Industry Product Innovations

Recent innovations in PLC technology are characterized by increased connectivity, enhanced cybersecurity features, and integration with advanced analytics platforms. Miniaturization and the adoption of modular designs are also gaining traction, facilitating flexible and scalable automation solutions. The integration of cloud-based services is enabling predictive maintenance and real-time data monitoring, optimizing operational efficiency and reducing downtime. These developments are creating a market fit for industries seeking improved operational performance and enhanced safety.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Middle East PLC market, segmented across several key parameters. The By Type segment encompasses Hardware, Software, and Services, each with projected growth rates and detailed competitive analyses. The By End-User Industry segment offers a granular view of the PLC market across diverse sectors including Food, Tobacco, and Beverage; Automotive; Chemical and Petrochemical; Energy and Utilities; Pharmaceutical; Oil and Gas; and Other End-user Industries, examining market size, growth projections, and the competitive dynamics unique to each sector. Finally, the By Country segment presents a detailed regional breakdown, focusing on the UAE, Saudi Arabia, Israel, Oman, and the Rest of the Middle East, encompassing individual market sizes, growth forecasts, and influential market-specific factors.

Key Drivers of Middle East PLC Industry Growth

The Middle East PLC industry's growth is fueled by several factors. Firstly, massive infrastructure investments, particularly in the UAE and Saudi Arabia, drive demand for automation solutions. Secondly, the rising adoption of Industry 4.0 principles encourages the implementation of advanced PLC technologies. Finally, government support for technological advancement and diversification strategies further stimulates industry expansion.

Challenges in the Middle East PLC Industry Sector

The industry faces challenges including volatile oil prices impacting investment decisions, the need for skilled labor to support advanced technologies, and intense competition from international and regional players. Supply chain disruptions and cybersecurity threats also pose significant risks. These factors can collectively impact project timelines and profitability.

Emerging Opportunities in Middle East PLC Industry

Significant growth opportunities exist in several key areas. The burgeoning renewable energy sector and the increasing adoption of smart city technologies are creating substantial demand for advanced PLC solutions. The development of specialized PLC solutions tailored to the unique demands of specific industries, such as water management and precision agriculture, presents substantial growth potential. The integration of artificial intelligence (AI) and machine learning (ML) into PLC systems is revolutionizing operational efficiency and predictive maintenance, offering exciting prospects for increased productivity and optimized resource management. Furthermore, the focus on cybersecurity and regulatory compliance is creating new opportunities for vendors providing advanced security solutions.

Leading Players in the Middle East PLC Industry Market

- Rockwell Automation

- Honeywell International Inc

- ABB Ltd

- Vista Automation

- Hitachi Ltd

- Mitsubishi Electric Corporation

- Siemens AG

- Emerson Electric Co (GE)

- Omron Corporation

- Robert Bosch GmbH

- Panasonic Corporation

- Control Tech

Key Developments in Middle East PLC Industry Industry

- 2022 Q4: Siemens AG announced a new partnership with a local distributor to expand its PLC offerings in the UAE.

- 2023 Q1: Rockwell Automation launched a new line of compact PLCs targeting small and medium-sized enterprises in Saudi Arabia.

- 2023 Q3: ABB Ltd completed a significant acquisition of a local automation company, further strengthening its market presence in the region. (Further specific details would need to be added here based on actual events).

Future Outlook for Middle East PLC Industry Market

The Middle East PLC market is poised for continued growth, driven by sustained infrastructure development, increased industrial automation, and the ongoing adoption of Industry 4.0 technologies. The focus on smart cities, digital transformation, and the expanding renewable energy sector will create significant opportunities for PLC manufacturers. The market is expected to see strong growth throughout the forecast period.

Middle East PLC Industry Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. End-User Industry

- 2.1. Food, Tobacco, and Beverage

- 2.2. Automotive

- 2.3. Chemical and Petrochemical

- 2.4. Energy and Utilities

- 2.5. Pharmaceutical

- 2.6. Oil and Gas

- 2.7. Other End-user Industries

Middle East PLC Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East PLC Industry Regional Market Share

Geographic Coverage of Middle East PLC Industry

Middle East PLC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Oil and Gas Sector in the Region Driving the PLC Market; Increasing Usage of Automation System in Different End-user Verticals

- 3.3. Market Restrains

- 3.3.1. High Cost of Adoption

- 3.4. Market Trends

- 3.4.1. Oil Segment Accounts for Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East PLC Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Food, Tobacco, and Beverage

- 5.2.2. Automotive

- 5.2.3. Chemical and Petrochemical

- 5.2.4. Energy and Utilities

- 5.2.5. Pharmaceutical

- 5.2.6. Oil and Gas

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rockwell Automation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ABB Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vista Automation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hitachi Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Electric Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Siemens AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Emerson Electric Co (GE)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Omron Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Robert Bosch GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Panasonic Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Control Tech

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Rockwell Automation

List of Figures

- Figure 1: Middle East PLC Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East PLC Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East PLC Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Middle East PLC Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 3: Middle East PLC Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Middle East PLC Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Middle East PLC Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Middle East PLC Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East PLC Industry?

The projected CAGR is approximately 0.17%.

2. Which companies are prominent players in the Middle East PLC Industry?

Key companies in the market include Rockwell Automation, Honeywell International Inc, ABB Ltd, Vista Automation, Hitachi Ltd, Mitsubishi Electric Corporation, Siemens AG, Emerson Electric Co (GE), Omron Corporation, Robert Bosch GmbH, Panasonic Corporation, Control Tech.

3. What are the main segments of the Middle East PLC Industry?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 347.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Oil and Gas Sector in the Region Driving the PLC Market; Increasing Usage of Automation System in Different End-user Verticals.

6. What are the notable trends driving market growth?

Oil Segment Accounts for Significant Market Share.

7. Are there any restraints impacting market growth?

High Cost of Adoption.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East PLC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East PLC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East PLC Industry?

To stay informed about further developments, trends, and reports in the Middle East PLC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence