Key Insights

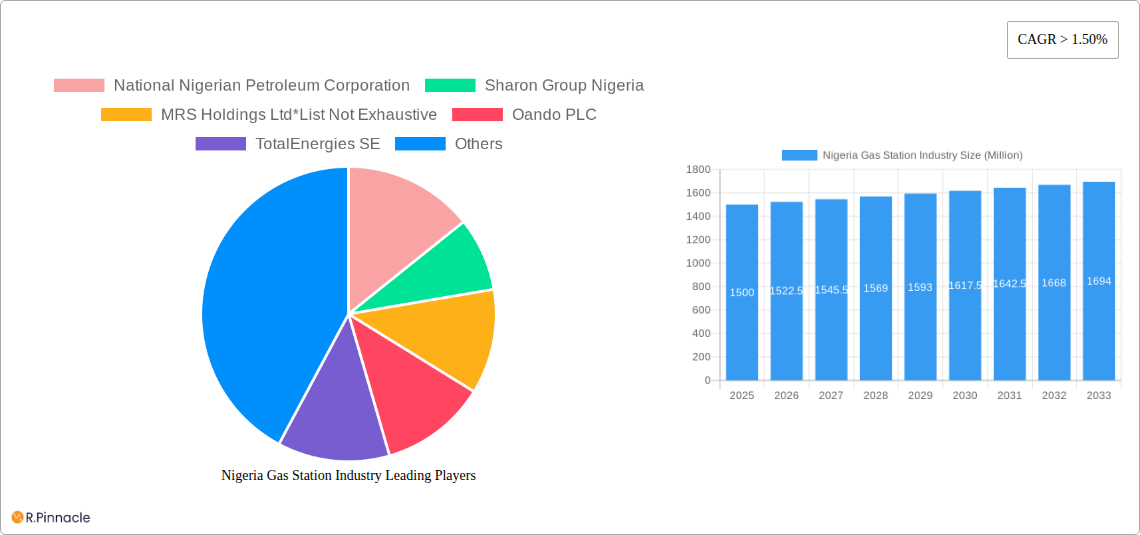

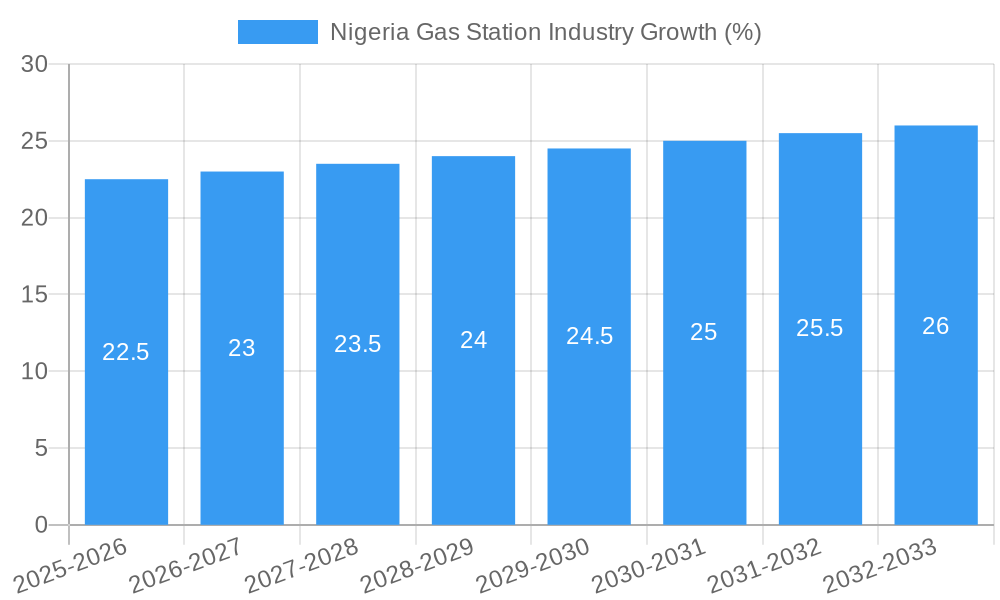

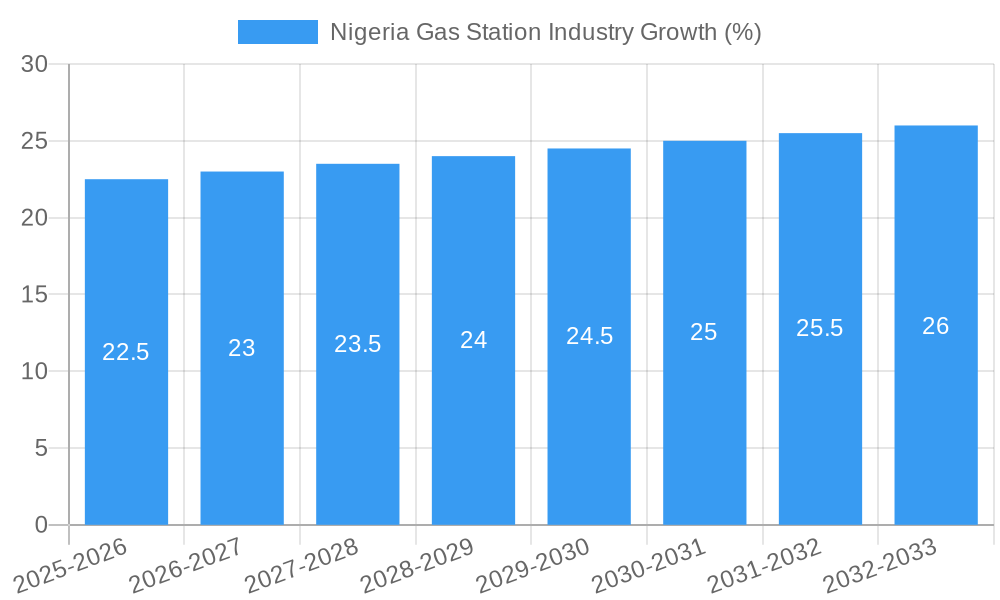

The Nigerian gas station industry, currently valued at approximately $XX million (estimated based on provided CAGR and market trends), is poised for significant growth over the next decade. A compound annual growth rate (CAGR) exceeding 1.5% projects a substantial increase in market size by 2033. This expansion is driven by several factors, including Nigeria's burgeoning automotive sector, increasing urbanization, and rising disposable incomes leading to greater fuel consumption. The transportation segment dominates the market, fueled by the expanding road network and growing demand for personal and commercial vehicles. However, the industry also faces challenges, including infrastructure limitations, inconsistent fuel supply, and regulatory hurdles. The government's focus on infrastructure development and initiatives to improve fuel distribution will significantly influence the industry's trajectory. Key players like National Nigerian Petroleum Corporation, Sharon Group Nigeria, MRS Holdings Ltd, Oando PLC, TotalEnergies SE, and Almoner Petroleum and Gas Limited are actively shaping the market landscape through strategic investments and expansion plans. The emergence of LNG terminals represents a significant growth opportunity, enhancing the efficiency and sustainability of fuel distribution networks. While the storage segment plays a vital role, ensuring efficient fuel storage and distribution remains critical for sustained growth. The forecast period, 2025-2033, presents a window of opportunity for both established players and new entrants to capitalize on the expanding market.

The segmentation of the Nigerian gas station industry into transportation, storage, and LNG terminals offers insights into its multifaceted structure. The transportation sector's robust growth signifies the increasing reliance on road transportation across Nigeria. The storage segment's performance is intricately linked to the efficiency and reliability of the fuel supply chain. Finally, the expansion of LNG terminals promises to enhance the industry's long-term sustainability and address existing infrastructure limitations. Competition among existing players and potential new entrants will likely intensify as the market expands, making strategic partnerships and technological innovation crucial for success. Ongoing regulatory reforms and investments in infrastructure improvements will further influence the industry's trajectory, driving both opportunities and challenges for stakeholders in the coming years.

Nigeria Gas Station Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the Nigerian gas station industry, covering market structure, dynamics, key players, and future outlook from 2019 to 2033. The study period encompasses historical data (2019-2024), a base year (2025), and a forecast period (2025-2033). This report is crucial for industry professionals, investors, and stakeholders seeking insights into this dynamic market.

Nigeria Gas Station Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Nigerian gas station industry, examining market concentration, innovation drivers, regulatory frameworks, and mergers & acquisitions (M&A) activities. The report delves into the impact of these factors on market share and profitability.

Market Concentration: The Nigerian gas station market exhibits a moderately concentrated structure, with major players like National Nigerian Petroleum Corporation, Sharon Group Nigeria, MRS Holdings Ltd, Oando PLC, TotalEnergies SE, and Almoner Petroleum and Gas Limited holding significant market share. However, a large number of smaller independent operators also contribute to the overall market size. The exact market share for each player varies, with NNPC likely holding the largest share due to its government-backed presence. Further breakdown is available in the full report.

Innovation Drivers: Innovation is driven by the need for improved efficiency, enhanced customer experience, and compliance with stricter environmental regulations. This includes investments in digital technologies, such as mobile payment systems and loyalty programs, as well as the adoption of cleaner fuels.

Regulatory Framework: The Department of Petroleum Resources (DPR) plays a significant role in regulating the industry, impacting market entry, pricing, and safety standards. Changes in regulatory policies can significantly influence market dynamics.

Product Substitutes: While direct substitutes are limited, increased use of electric vehicles could potentially impact the long-term demand for gasoline and diesel.

End-User Demographics: The report analyzes the end-user demographics and their impact on fuel consumption patterns. The distribution of private vs. commercial vehicles will be a factor.

M&A Activities: Significant M&A activity has been observed. For example, Ardova PLC's acquisition of Enyo Retail and Supply Limited in November 2021 added 90 filling stations and 100,000 customers. Rainoil Limited's acquisition of a 61% stake in Eterna Oil PLC also reflects this trend. The report will provide a detailed analysis of such deals, including their value and impact on market consolidation. The total value of these M&A transactions in the last five years is estimated at XX Million.

Nigeria Gas Station Industry Market Dynamics & Trends

This section examines the factors driving market growth, technological disruptions, consumer preferences, and competitive dynamics within the Nigerian gas station industry. The analysis includes specific metrics like compound annual growth rate (CAGR) and market penetration. The market is expected to experience robust growth driven by increasing vehicle ownership and economic expansion, although fluctuating oil prices present a major challenge.

The report projects a CAGR of xx% for the forecast period (2025-2033), with market penetration projected to reach xx% by 2033. Technological advancements, such as the introduction of alternative fuels and smart technologies in gas stations, are shaping the future of the market. Changing consumer preferences toward convenience and value-added services will influence the strategic directions of market players. Intense competition among existing players and the potential entry of new players will further shape the market.

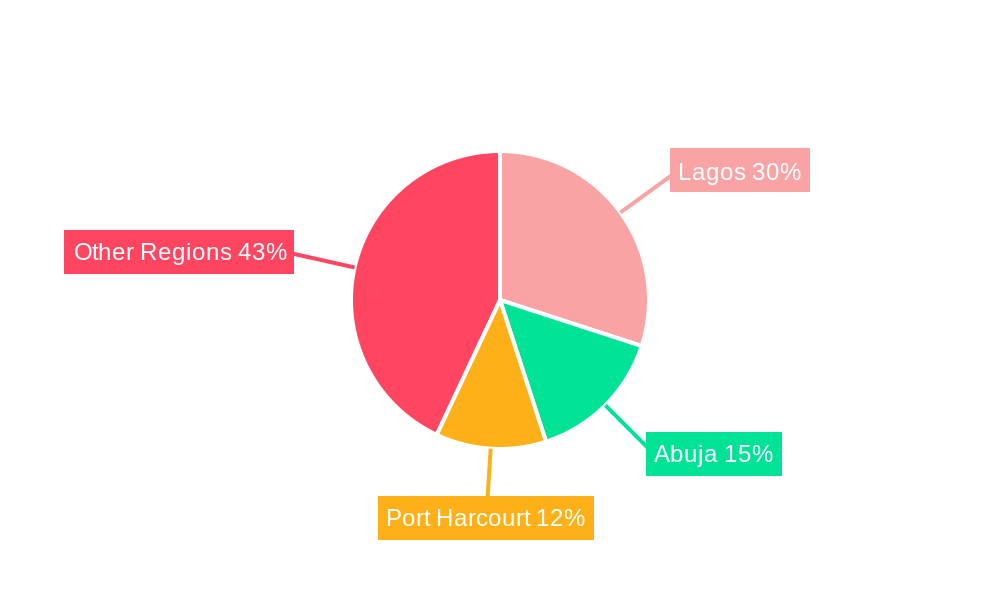

Dominant Regions & Segments in Nigeria Gas Station Industry

This section identifies the leading regions and segments within the Nigerian gas station industry (Transportation, Storage, LNG Terminals).

Transportation Segment: This segment dominates the market due to the high number of vehicles on the road. Growth is fueled by increasing urbanization, population growth, and economic development. The concentration of gas stations in urban areas further underscores the dominance of the transportation segment.

Storage Segment: This segment plays a vital role in the supply chain, ensuring fuel availability. Growth in this segment is influenced by government regulations on fuel storage capacity and safety standards. Investments in upgrading and expanding storage infrastructure are expected to drive this market segment's expansion.

LNG Terminals: This segment is relatively smaller compared to transportation and storage but growing rapidly due to increasing demand for LNG as a cleaner alternative fuel. Government incentives and investment in LNG infrastructure are key drivers for growth in this sector.

The report provides a detailed analysis of each segment, including growth projections, market size estimations, and competitive dynamics, taking into consideration relevant economic policies and infrastructure development in different regions of Nigeria.

Nigeria Gas Station Industry Product Innovations

This section summarizes recent product developments and technological trends impacting the Nigerian gas station industry. The focus is on how these innovations provide competitive advantages and meet evolving market needs.

The industry is witnessing the introduction of new fuel blends, improved retail technologies, and enhanced customer loyalty programs. These innovations aim to improve efficiency, lower environmental impact, and enhance the overall customer experience. The adoption of digital payment systems and improved inventory management systems is also contributing to efficiency improvements.

Report Scope & Segmentation Analysis

This report segments the Nigerian gas station industry by Type: Transportation, Storage, and LNG Terminals. Each segment is analyzed based on its growth projections, market size, and competitive dynamics.

Transportation: This segment, which constitutes the largest share of the market, is expected to show consistent growth, fueled by the increase in the number of vehicles on the road.

Storage: The storage segment plays a crucial role in the fuel supply chain and is expected to grow in line with rising fuel demand.

LNG Terminals: The LNG terminal segment is still relatively small but is anticipated to experience significant growth driven by the increasing adoption of LNG as an alternative fuel.

Key Drivers of Nigeria Gas Station Industry Growth

Several factors contribute to the growth of the Nigerian gas station industry. Increasing vehicle ownership due to population growth and economic expansion is a significant driver. Government investments in infrastructure, such as road networks, and the expansion of the country's transportation sector, also positively impact the market. Furthermore, the development of the country's industrial sector increases demand for fuel in various sectors.

Challenges in the Nigeria Gas Station Industry Sector

The Nigerian gas station industry faces numerous challenges. Fluctuations in global oil prices and foreign exchange rates create pricing volatility and profitability concerns. Infrastructure limitations, including inadequate power supply, affect operational efficiency and cost structures. Furthermore, regulatory hurdles and competition from smaller, independent operators also pose a significant challenge. These factors collectively impact the industry's overall performance. The estimated cost of these challenges annually is approximately xx Million.

Emerging Opportunities in Nigeria Gas Station Industry

Despite the challenges, significant opportunities exist for the Nigerian gas station industry. The increasing adoption of alternative fuels, such as Compressed Natural Gas (CNG) and Liquefied Petroleum Gas (LPG), presents growth opportunities for forward-looking companies. The expansion of rural road networks opens up new markets, while advancements in digital technologies provide avenues for enhancing customer service and operational efficiency.

Leading Players in the Nigeria Gas Station Industry Market

- National Nigerian Petroleum Corporation

- Sharon Group Nigeria

- MRS Holdings Ltd

- Oando PLC

- TotalEnergies SE

- Almoner Petroleum and Gas Limited

Key Developments in Nigeria Gas Station Industry

- November 2021: Ardova PLC acquires Enyo Retail and Supply Limited, adding 90 filling stations.

- November 2021: Rainoil Limited acquires a 61% stake in Eterna Oil PLC.

- August 2021: The DPR reopens five filling stations closed by LASBCA.

Future Outlook for Nigeria Gas Station Industry Market

The Nigerian gas station industry is poised for continued growth, driven by sustained economic expansion, urbanization, and rising vehicle ownership. However, navigating the challenges of oil price volatility and regulatory changes will be crucial for sustained success. Strategic investments in infrastructure, technological upgrades, and diversification into alternative fuels will play a vital role in shaping the future of the industry. The report provides detailed forecasts and strategic recommendations for industry players.

Nigeria Gas Station Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Nigeria Gas Station Industry Segmentation By Geography

- 1. Niger

Nigeria Gas Station Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Usage of Pipelines for Fuel Transportation 4.; Increasing Production and Consumption of Natural Gas and Refined Petroleum Products

- 3.3. Market Restrains

- 3.3.1. 4.; Environmental Concerns Regarding New Pipelines and Transportation Infrastructure

- 3.4. Market Trends

- 3.4.1. Smuggling of Crude Oil and Refined Products is expected to Restrain the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Gas Station Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 National Nigerian Petroleum Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sharon Group Nigeria

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MRS Holdings Ltd*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Oando PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TotalEnergies SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Almoner Petroleum and Gas Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 National Nigerian Petroleum Corporation

List of Figures

- Figure 1: Nigeria Gas Station Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Nigeria Gas Station Industry Share (%) by Company 2024

List of Tables

- Table 1: Nigeria Gas Station Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Nigeria Gas Station Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 3: Nigeria Gas Station Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Nigeria Gas Station Industry Volume K Units Forecast, by Production Analysis 2019 & 2032

- Table 5: Nigeria Gas Station Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Nigeria Gas Station Industry Volume K Units Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Nigeria Gas Station Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Nigeria Gas Station Industry Volume K Units Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Nigeria Gas Station Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Nigeria Gas Station Industry Volume K Units Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Nigeria Gas Station Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Nigeria Gas Station Industry Volume K Units Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Nigeria Gas Station Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Nigeria Gas Station Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 15: Nigeria Gas Station Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Nigeria Gas Station Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 17: Nigeria Gas Station Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 18: Nigeria Gas Station Industry Volume K Units Forecast, by Production Analysis 2019 & 2032

- Table 19: Nigeria Gas Station Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 20: Nigeria Gas Station Industry Volume K Units Forecast, by Consumption Analysis 2019 & 2032

- Table 21: Nigeria Gas Station Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 22: Nigeria Gas Station Industry Volume K Units Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 23: Nigeria Gas Station Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 24: Nigeria Gas Station Industry Volume K Units Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 25: Nigeria Gas Station Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 26: Nigeria Gas Station Industry Volume K Units Forecast, by Price Trend Analysis 2019 & 2032

- Table 27: Nigeria Gas Station Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Nigeria Gas Station Industry Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Gas Station Industry?

The projected CAGR is approximately > 1.50%.

2. Which companies are prominent players in the Nigeria Gas Station Industry?

Key companies in the market include National Nigerian Petroleum Corporation, Sharon Group Nigeria, MRS Holdings Ltd*List Not Exhaustive, Oando PLC, TotalEnergies SE, Almoner Petroleum and Gas Limited.

3. What are the main segments of the Nigeria Gas Station Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Usage of Pipelines for Fuel Transportation 4.; Increasing Production and Consumption of Natural Gas and Refined Petroleum Products.

6. What are the notable trends driving market growth?

Smuggling of Crude Oil and Refined Products is expected to Restrain the Market.

7. Are there any restraints impacting market growth?

4.; Environmental Concerns Regarding New Pipelines and Transportation Infrastructure.

8. Can you provide examples of recent developments in the market?

In November 2021, Energy firm Ardova PLC announced the completion of a complete acquisition of Enyo Retail and Supply Limited. The takeover of Enyo Retail and Supply Limited has automatically transferred the 90 filling stations and about 100,000 customers maintained by Enyo's former owner to the Ardova Group.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Gas Station Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Gas Station Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Gas Station Industry?

To stay informed about further developments, trends, and reports in the Nigeria Gas Station Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence