Key Insights

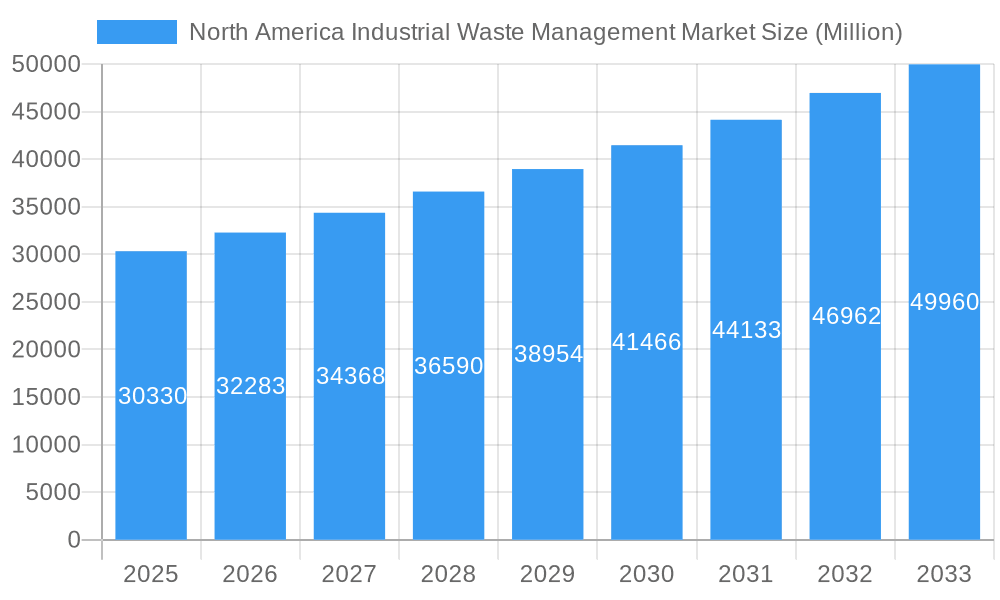

The North America industrial waste management market, valued at $30.33 billion in 2025, is projected to experience robust growth, driven by increasing industrial activity, stringent environmental regulations, and a rising focus on sustainable waste disposal practices. The market's Compound Annual Growth Rate (CAGR) of 6.35% from 2025 to 2033 indicates a significant expansion over the forecast period. Key growth drivers include the burgeoning manufacturing sector, particularly in automotive, electronics, and food processing, which generate substantial volumes of industrial waste. Furthermore, government initiatives promoting recycling and waste reduction, coupled with increasing corporate social responsibility commitments, are fostering the adoption of advanced waste management technologies and services. The market faces challenges such as fluctuating raw material prices and the need for continuous technological innovation to handle diverse waste streams effectively. However, opportunities exist in developing sustainable waste-to-energy solutions and expanding the circular economy model within industrial settings.

North America Industrial Waste Management Market Market Size (In Billion)

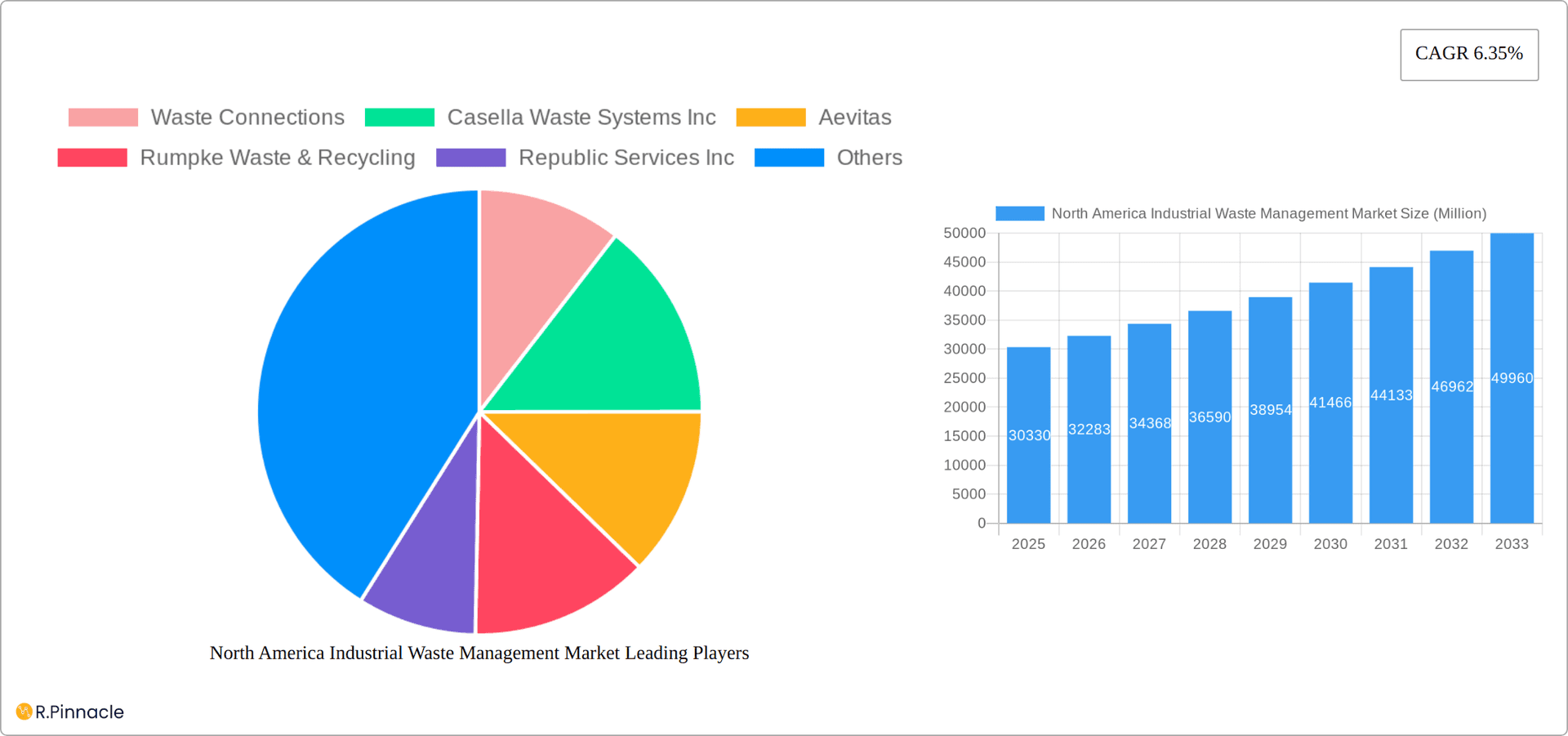

The market's segmentation reveals a competitive landscape with several large players, including Waste Connections, Republic Services Inc., Waste Management Inc., and Veolia North America, among others. These companies are actively investing in infrastructure upgrades, acquisitions, and technological advancements to enhance their service offerings and maintain a strong market position. The geographical distribution of the market is likely concentrated in regions with high industrial activity, such as the US Midwest and Northeast. While precise regional data is unavailable, projecting based on existing industrial concentrations and historical growth patterns suggests a significant share for these regions within the North American market. The market's future growth trajectory hinges on effective regulatory frameworks, technological progress, and the ability of waste management companies to adapt to evolving industrial demands and sustainability goals. The increasing focus on reducing landfill reliance and improving recycling rates will further drive market expansion throughout the forecast period.

North America Industrial Waste Management Market Company Market Share

North America Industrial Waste Management Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Industrial Waste Management market, offering crucial insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, dominant players, and future outlook. The report leverages extensive data analysis and expert insights to deliver actionable strategies for navigating this dynamic sector.

North America Industrial Waste Management Market Structure & Innovation Trends

The North American industrial waste management market is characterized by a moderately concentrated landscape, with several large players holding significant market share. Key players include Waste Connections, Casella Waste Systems Inc, Aevitas, Rumpke Waste & Recycling, Republic Services Inc, FCC Environment Limited, Biffa, Stericycle, Veolia North America, Waste Management Inc, Covanta, and Clean Harbors Inc. (List not exhaustive). Market share data for 2024 indicates Waste Management Inc and Republic Services Inc hold approximately xx% and xx% respectively, while other major players command shares ranging from xx% to xx%.

Innovation in this sector is driven by stringent environmental regulations, increasing waste generation from industrial activities, and the rising demand for sustainable waste management solutions. The regulatory framework varies across North American regions, influencing the adoption of advanced technologies and waste management strategies. Technological advancements, such as AI-powered waste sorting systems and advanced recycling technologies, are driving efficiency improvements and cost reductions. Furthermore, the increasing availability of substitute materials and the circular economy movement are impacting market dynamics. Significant M&A activity, as evidenced by recent acquisitions (detailed in the "Key Developments" section), points to market consolidation and expansion strategies among leading players. Deal values for major acquisitions over the past three years have ranged from USD 219 Million (Casella Waste Systems acquisition in June 2023) to xx Million, reflecting the significant investment in market expansion and technological upgrades.

- Market Concentration: Moderately Concentrated

- Innovation Drivers: Stringent Regulations, Increasing Waste Generation, Sustainable Solutions Demand

- Regulatory Frameworks: Vary by Region

- Product Substitutes: Growing Availability of Sustainable Alternatives

- End-User Demographics: Diverse, encompassing manufacturing, automotive, and various industrial sectors.

- M&A Activity: Significant consolidation and expansion efforts observed.

North America Industrial Waste Management Market Dynamics & Trends

The North American industrial waste management market is projected to experience robust growth during the forecast period (2025-2033). The market’s Compound Annual Growth Rate (CAGR) is estimated at xx% between 2025 and 2033, driven primarily by the increasing industrial output across North America and tightening environmental regulations promoting responsible waste management practices. Technological advancements like AI-powered waste sorting and advanced recycling methods are further boosting market growth. Market penetration of sustainable waste management solutions continues to increase, exceeding xx% in 2024 and projected to reach xx% by 2033. However, economic fluctuations and potential shifts in government policies could influence market growth trajectories. The competitive landscape is intense, with major players focusing on strategic acquisitions, technological innovation, and expanding service offerings to maintain their market positions. A growing emphasis on the circular economy and waste-to-energy solutions is reshaping industry dynamics, creating both opportunities and challenges for existing players and new entrants.

Dominant Regions & Segments in North America Industrial Waste Management Market

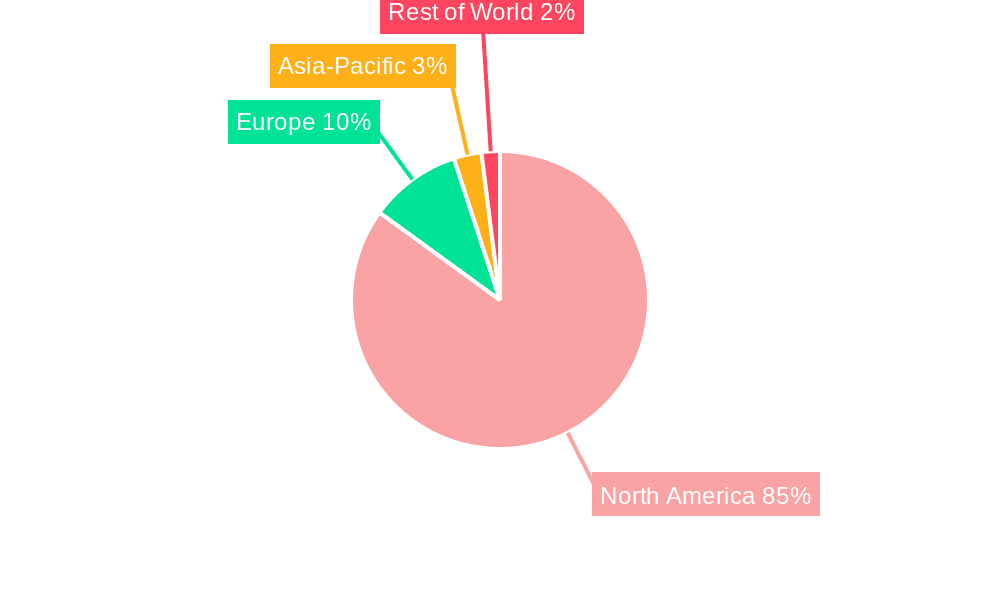

The United States currently holds the largest market share in North America’s industrial waste management sector. This dominance is primarily attributed to its large industrial base, robust manufacturing sector, and substantial waste generation.

- Key Drivers for U.S. Dominance:

- Large industrial base and extensive manufacturing activities.

- Stringent environmental regulations driving adoption of advanced waste management solutions.

- Significant investments in waste management infrastructure.

- High levels of private and public sector funding for research and development in the waste management sector.

Canada, while smaller than the U.S. market, exhibits significant growth potential, driven by increasing industrial activity and government initiatives promoting sustainable waste management practices. Other regions like Mexico display considerable market potential due to their growing industrialization and rising environmental awareness. Within the market, hazardous waste management currently accounts for the largest revenue share, followed by non-hazardous waste management and recycling services. This reflects stricter regulations governing hazardous waste disposal and growing focus on resource recovery and circular economy models. The market segmentation is dynamic, influenced by both waste type (hazardous, non-hazardous, recyclable) and service offerings (collection, processing, disposal, recycling).

North America Industrial Waste Management Market Product Innovations

The North American industrial waste management market is experiencing a wave of innovation driven by the need for improved efficiency, reduced environmental impact, and enhanced resource recovery. This includes the development and deployment of sophisticated technologies such as AI-powered waste sorting systems that significantly boost recycling rates. Advanced hazardous waste treatment and disposal methods are also gaining traction, minimizing environmental risks and ensuring compliance with increasingly stringent regulations. Furthermore, innovative waste-to-energy solutions are emerging as a viable alternative, transforming waste into a valuable resource and reducing reliance on landfills. These technological advancements not only improve operational efficiency and reduce costs but also contribute significantly to improved environmental sustainability, making them highly attractive to environmentally conscious industrial clients. The market is also witnessing the rise of integrated waste management solutions, offering comprehensive, customized services tailored to the unique needs and operational challenges of individual industries and businesses. These integrated solutions often encompass waste characterization, optimized collection strategies, and innovative processing and disposal methods, providing a holistic approach to waste management.

Report Scope & Segmentation Analysis

This report segments the North America industrial waste management market based on several key factors:

- Waste Type: Hazardous waste, Non-hazardous waste, Recyclable waste

- Service Type: Collection, Processing, Disposal, Recycling, Treatment

- End-use Industry: Manufacturing, Automotive, Chemicals, Construction, Others.

- Geography: United States, Canada, Mexico, and other relevant regions.

Each segment exhibits unique growth projections and competitive dynamics, detailed within the full report. Market sizes for each segment are provided for the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering a comprehensive understanding of market trends and growth potential.

Key Drivers of North America Industrial Waste Management Market Growth

The robust growth of the North America industrial waste management market is fueled by a confluence of key factors:

- Stringent Environmental Regulations and Policies: The increasing stringency of environmental regulations and policies concerning waste disposal and pollution control is a primary driver, compelling industries to adopt more responsible and sustainable waste management practices. This includes stricter emission limits, enhanced reporting requirements, and increased penalties for non-compliance.

- Growing Industrialization and Economic Activity: The continued expansion of various industrial sectors, coupled with robust economic activity across North America, leads to a corresponding increase in waste generation, thereby necessitating efficient and scalable waste management solutions.

- Technological Advancements and Automation: Innovations in waste processing, recycling, and treatment technologies, along with increasing automation, are enhancing efficiency, reducing operational costs, and improving the overall sustainability of waste management operations.

- Focus on the Circular Economy and Sustainable Practices: The growing global emphasis on resource recovery, waste minimization, and the principles of the circular economy is driving demand for innovative and sustainable waste management solutions that prioritize resource reuse and recycling.

- Corporate Social Responsibility (CSR) Initiatives: Many companies are increasingly incorporating environmental sustainability into their CSR initiatives, leading to a greater focus on responsible waste management and a willingness to invest in greener technologies and practices.

Challenges in the North America Industrial Waste Management Market Sector

Despite its growth potential, the North American industrial waste management market faces several significant challenges:

- Fluctuating Raw Material Prices and Market Volatility: Volatility in the prices of recyclable materials, influenced by global commodity markets and economic conditions, directly impacts the profitability of recycling operations and can create uncertainty for investors.

- High Infrastructure Costs and Capital Investments: The establishment of new waste management facilities and the implementation of advanced technologies require substantial capital investments, potentially hindering market entry for smaller players and impacting overall profitability.

- Complex and Evolving Regulatory Landscape: Navigating the complex and often evolving regulatory landscape across different states and provinces can create operational complexities, increase compliance costs, and necessitate significant legal and administrative expertise.

- Intense Competition and Market Consolidation: The market is characterized by intense competition among large, established players, leading to price pressures and the need for strategic differentiation and cost optimization to maintain a competitive edge. Consolidation is also a trend, with larger companies acquiring smaller firms.

- Public Perception and Waste Management Education: Raising public awareness about the importance of proper waste disposal and promoting responsible waste management practices among both businesses and consumers remains a significant challenge.

Emerging Opportunities in North America Industrial Waste Management Market

The North American industrial waste management market presents several compelling opportunities:

- Waste-to-Energy Solutions: The adoption of waste-to-energy technologies offers both environmental and economic benefits.

- Advanced Recycling Technologies: Innovations in plastics and electronic waste recycling are expected to gain traction.

- Sustainable Packaging Solutions: Increasing demand for eco-friendly packaging is creating opportunities for companies offering sustainable waste management solutions.

- Digitalization and Data Analytics: The integration of data analytics and digital tools can significantly improve operational efficiency and resource allocation in waste management operations.

Leading Players in the North America Industrial Waste Management Market Market

- Waste Connections

- Casella Waste Systems Inc

- Aevitas

- Rumpke Waste & Recycling

- Republic Services Inc

- FCC Environment Limited

- Biffa

- Stericycle

- Veolia North America

- Waste Management Inc

- Covanta

- Clean Harbors Inc (List not exhaustive)

Key Developments in North America Industrial Waste Management Market Industry

- October 2023: Veolia North America completed the acquisition of U.S. Industrial Technologies, expanding its U.S. market share in industrial waste management and strengthening its position in the provision of comprehensive industrial waste services.

- June 2023: Casella Waste Systems, Inc. acquired the assets of Consolidated Waste Services, LLC for approximately USD 219 Million, strengthening its market position and geographic reach within the North American industrial waste management sector.

- [Add other recent developments with dates and brief descriptions]

Future Outlook for North America Industrial Waste Management Market Market

The future outlook for the North American industrial waste management market is positive, driven by increasing environmental awareness, technological innovation, and supportive government policies. The market is poised for continued growth, with opportunities arising from the growing adoption of sustainable practices, advancements in waste-to-energy and recycling technologies, and the increasing demand for integrated waste management solutions. Strategic acquisitions and partnerships will likely continue to shape the market landscape, leading to further consolidation and specialization within the sector. Companies that effectively leverage technological advancements, adapt to evolving regulations, and provide innovative, sustainable solutions will be well-positioned for success in this dynamic market.

North America Industrial Waste Management Market Segmentation

-

1. Type

- 1.1. Construction and Demolition Waste

- 1.2. Manufacturing Waste

- 1.3. Oil and Gas Waste

- 1.4. Other Wa

-

2. Service

- 2.1. Recycling

- 2.2. Landfill

- 2.3. Incineration

- 2.4. Other Services

North America Industrial Waste Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Industrial Waste Management Market Regional Market Share

Geographic Coverage of North America Industrial Waste Management Market

North America Industrial Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Government Regulations; Increasing Number of Industries

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations; Increasing Number of Industries

- 3.4. Market Trends

- 3.4.1. Oil and gas Production is Expected to Dominated the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Construction and Demolition Waste

- 5.1.2. Manufacturing Waste

- 5.1.3. Oil and Gas Waste

- 5.1.4. Other Wa

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Recycling

- 5.2.2. Landfill

- 5.2.3. Incineration

- 5.2.4. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Waste Connections

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Casella Waste Systems Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aevitas

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rumpke Waste & Recycling

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Republic Services Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FCC Environment Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Biffa

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Stericylce

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Veolia North America

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Waste Management Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Covanta

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Clean Harbors Inc **List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Waste Connections

List of Figures

- Figure 1: North America Industrial Waste Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Industrial Waste Management Market Share (%) by Company 2025

List of Tables

- Table 1: North America Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: North America Industrial Waste Management Market Revenue Million Forecast, by Service 2020 & 2033

- Table 4: North America Industrial Waste Management Market Volume Billion Forecast, by Service 2020 & 2033

- Table 5: North America Industrial Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Industrial Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: North America Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: North America Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: North America Industrial Waste Management Market Revenue Million Forecast, by Service 2020 & 2033

- Table 10: North America Industrial Waste Management Market Volume Billion Forecast, by Service 2020 & 2033

- Table 11: North America Industrial Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: North America Industrial Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States North America Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States North America Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Industrial Waste Management Market?

The projected CAGR is approximately 6.35%.

2. Which companies are prominent players in the North America Industrial Waste Management Market?

Key companies in the market include Waste Connections, Casella Waste Systems Inc, Aevitas, Rumpke Waste & Recycling, Republic Services Inc, FCC Environment Limited, Biffa, Stericylce, Veolia North America, Waste Management Inc, Covanta, Clean Harbors Inc **List Not Exhaustive.

3. What are the main segments of the North America Industrial Waste Management Market?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Stringent Government Regulations; Increasing Number of Industries.

6. What are the notable trends driving market growth?

Oil and gas Production is Expected to Dominated the Market.

7. Are there any restraints impacting market growth?

Stringent Government Regulations; Increasing Number of Industries.

8. Can you provide examples of recent developments in the market?

October 2023: Veolia North America, one of the leading integrated providers of environmental services in the U.S. and Canada, announced that it completed the acquisition of U.S. Industrial Technologies, a Michigan-based provider of total waste and recycling services that managed industrial waste streams for automakers as well as other large manufacturers, medium and small businesses and governments and municipalities since 1996. The acquisition was likely to expand the U.S. market share for Veolia’s Environmental Solutions and Services (ESS) division, which is already recognized for its ability to provide customized integrated services for the management and treatment of hazardous, non-hazardous and recyclable waste for thousands of U.S. industrial, commercial and government customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Industrial Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Industrial Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Industrial Waste Management Market?

To stay informed about further developments, trends, and reports in the North America Industrial Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence