Key Insights

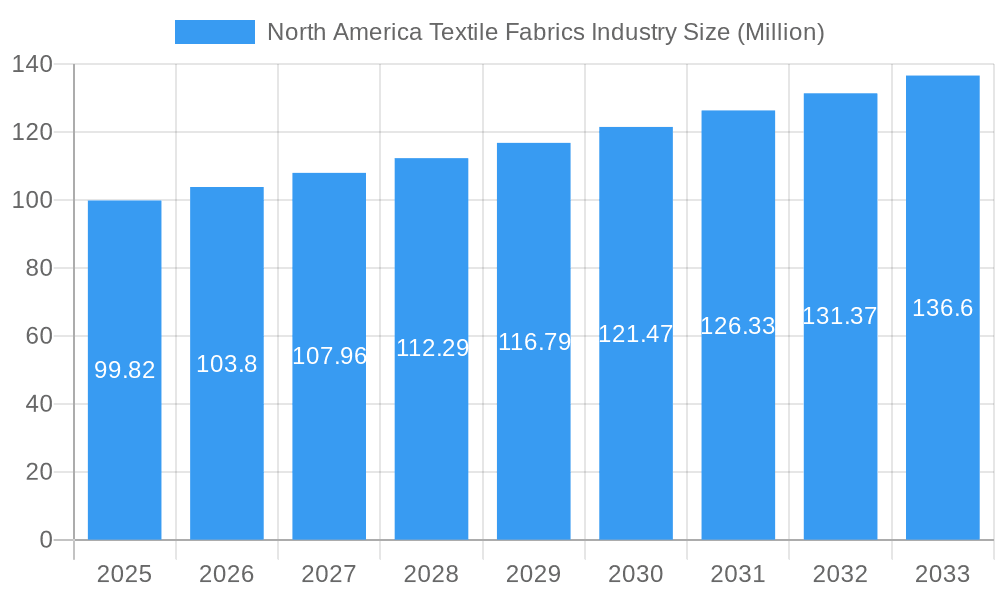

The North American textile fabrics industry, valued at $99.82 million in 2025, is projected to experience steady growth, driven by several key factors. The increasing demand for comfortable and sustainable apparel and home furnishings fuels market expansion. Consumer preference for natural fibers like organic cotton and recycled materials is a significant trend, pushing manufacturers to innovate and adopt eco-friendly production methods. Furthermore, technological advancements in textile manufacturing, such as advanced weaving techniques and smart fabrics, are enhancing product quality and functionality, contributing to market growth. While rising raw material costs and intense competition from international players pose challenges, the industry's resilience is evident in its continued expansion. The robust growth in e-commerce and the increasing popularity of athleisure wear further contribute to the positive outlook for the sector. Major players like Nike, Levi Strauss & Co., and others are investing heavily in research and development to maintain their market share and tap into emerging trends. The segmentation within the industry, while not fully detailed in the provided data, likely includes categories like apparel fabrics, home furnishing fabrics, and industrial textiles, each with its own growth trajectory. The forecast period of 2025-2033 suggests continued positive growth, although the precise rate will depend on macroeconomic conditions and evolving consumer preferences.

North America Textile Fabrics Industry Market Size (In Million)

The projected Compound Annual Growth Rate (CAGR) of 3.85% indicates a gradual but consistent expansion of the market. This moderate growth reflects the maturity of the industry, with companies focusing on innovation and efficiency to maintain profitability. The historical period of 2019-2024 likely showcased varying growth rates depending on economic cycles and external factors. Successful companies within this space are those that can effectively balance sustainability initiatives with cost-effectiveness, catering to the growing demand for eco-conscious products while remaining competitive on price. The North American market benefits from a relatively strong domestic consumer base and established supply chains, providing a foundation for continued growth in the coming years. Further analysis of regional variations within North America (e.g., US, Canada, Mexico) would offer a more nuanced understanding of market dynamics.

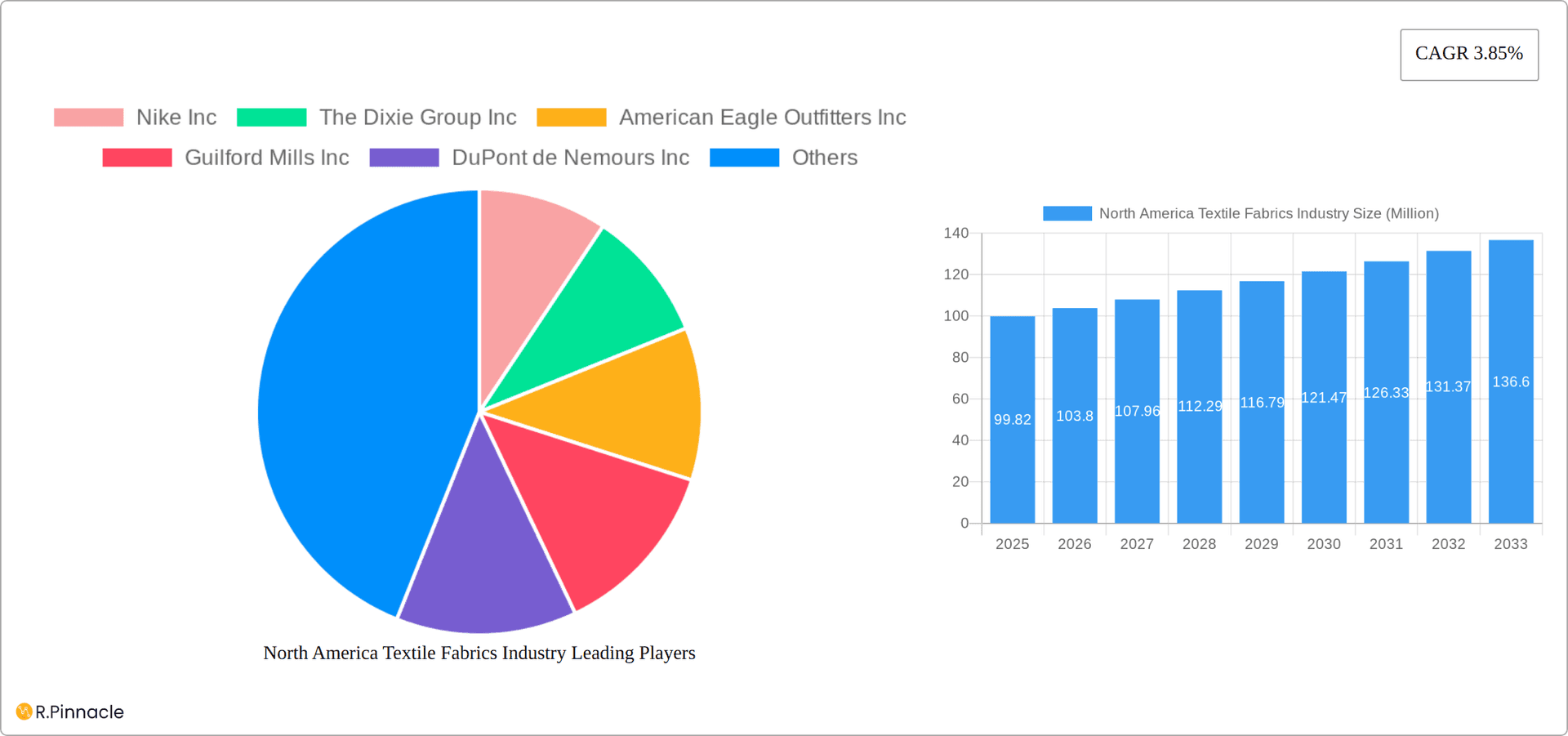

North America Textile Fabrics Industry Company Market Share

North America Textile Fabrics Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North American textile fabrics industry, covering market size, growth drivers, challenges, and future opportunities from 2019 to 2033. The report leverages data from the historical period (2019-2024), base year (2025), and estimated year (2025) to forecast market trends until 2033. Key players like Nike Inc, The Dixie Group Inc, and DuPont de Nemours Inc are profiled, offering crucial insights for industry professionals.

North America Textile Fabrics Industry Market Structure & Innovation Trends

The North American textile fabrics market presents a dynamic landscape shaped by competitive pressures, innovative advancements, and evolving regulatory landscapes. This analysis delves into the market's structure, identifying key players and their influence, examining mergers and acquisitions (M&A) activity, and exploring the impact of regulatory frameworks, substitute products, and shifting consumer demographics. The interplay of these factors significantly influences market dynamics and future growth trajectories.

- Market Concentration and Competitive Landscape: The North American textile fabrics market shows a moderately concentrated structure with several dominant players commanding significant market share. However, a competitive fringe of smaller, specialized firms also contributes significantly to innovation and niche market segments. The full report provides detailed market share data for prominent companies and analyzes the competitive intensity within various fabric types and end-use applications.

- Innovation Drivers: Sustainable and High-Performance Fabrics: Sustainability is a paramount driver, pushing innovation towards recycled materials, bio-based fibers, and reduced environmental impact throughout the supply chain. Simultaneously, advancements in fiber technology are creating high-performance fabrics with enhanced durability, water resistance, breathability, and other specialized properties catering to diverse end-use needs. Consumer demand for these innovative fabrics fuels continuous R&D investments.

- Regulatory Landscape and Compliance: Stringent environmental regulations concerning waste reduction, water usage, and chemical emissions are transforming manufacturing processes. Worker safety standards and stringent product labeling requirements necessitate compliance, impacting operational costs and driving the adoption of sustainable practices. The full report provides a detailed overview of relevant regulations and their influence on industry players.

- M&A Activity and Market Consolidation: Recent M&A activity reflects industry consolidation trends. The USD 593 million acquisition of Huntsman Corporation's Textile Effects division by Archroma in February 2023 exemplifies this trend, illustrating strategies for expanding market share and integrating technological capabilities. The full report provides a comprehensive analysis of recent transactions, including deal values, strategic rationale, and implications for market competition.

- Product Substitutes and Material Alternatives: The emergence of plant-based and other alternative materials presents both challenges and opportunities. While these substitutes pose competitive threats to traditional fabrics, they also foster innovation through material blending and the development of hybrid products with enhanced performance and sustainability characteristics.

- End-User Demographics and Shifting Preferences: Consumer preferences, influenced by fashion trends, technological advancements, and an increasing awareness of ethical sourcing, profoundly impact fabric demand. The full report provides a detailed analysis of evolving demographics and their implications for fabric preferences, including a regional breakdown of consumer trends.

North America Textile Fabrics Industry Market Dynamics & Trends

This section delves into the key factors influencing market growth, including technological disruptions, evolving consumer preferences, and competitive dynamics. The analysis will reveal the compound annual growth rate (CAGR) and market penetration rate for various segments within the industry during the study period (2019-2033). We'll explore the impact of macroeconomic factors on industry performance, examining market growth drivers and challenges in detail.

(Detailed analysis of market growth drivers, technological disruptions, consumer preferences, and competitive dynamics will be provided in the full report, including specific CAGR and market penetration figures.)

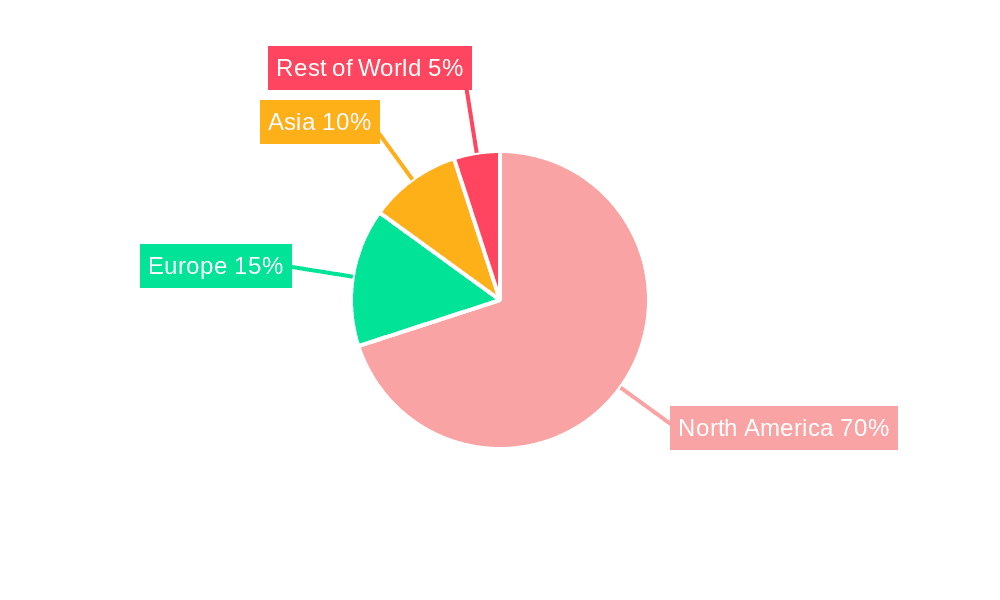

Dominant Regions & Segments in North America Textile Fabrics Industry

This section identifies the key geographical regions and product segments driving the North American textile fabrics market. The analysis explores the underlying factors contributing to regional dominance, encompassing economic conditions, infrastructure development, skilled labor availability, and access to raw materials. Government incentives and policies play a significant role in shaping regional competitiveness.

- Leading Region/Country: The full report identifies the dominant region(s) within North America and provides a detailed analysis, exploring market size, growth rates, and key contributing factors. This includes a comparative analysis of leading states or provinces.

- Key Drivers of Regional Dominance:

- Favorable Economic Policies and Incentives

- Robust Infrastructure and Logistics Networks

- Skilled Labor Pool and Workforce Availability

- Access to Raw Materials and Efficient Supply Chains

- Government Support and Investment in the Textile Industry

- Proximity to Key End-Use Markets

The full report includes a detailed breakdown of dominant segments, such as apparel fabrics, home furnishings, industrial textiles, and technical textiles, providing a comprehensive analysis of market size, growth potential, and key players within each segment.

North America Textile Fabrics Industry Product Innovations

This section summarizes the latest innovations in textile fabrics, highlighting new product developments, applications, and their competitive advantages. The focus will be on technological advancements and market fit, analyzing how these innovations address evolving consumer needs and industry trends. (Detailed analysis of product innovations will be included in the full report).

Report Scope & Segmentation Analysis

This report segments the North American textile fabrics market based on several key factors, including fiber type, fabric type, application, and end-use industry. Each segment's growth projections, market size, and competitive dynamics are analyzed, offering a granular understanding of market performance. (Detailed breakdown of market segments and their respective market sizes, growth projections, and competitive dynamics will be provided in the full report.)

Key Drivers of North America Textile Fabrics Industry Growth

The growth trajectory of the North American textile fabrics industry is propelled by a confluence of factors. Technological advancements in fiber production enable the creation of high-performance and sustainable fabrics. Positive economic conditions stimulate consumer spending on apparel and home furnishings. Favorable government policies that encourage domestic manufacturing and investment also contribute significantly. The full report offers a detailed quantitative analysis of these drivers and their relative impacts.

Challenges in the North America Textile Fabrics Industry Sector

The industry faces significant challenges, including fluctuating raw material costs, intensified global competition, and the increasing demand for sustainable and ethically sourced products. Supply chain disruptions caused by global events and evolving regulatory compliance requirements add further complexity. The full report quantifies the impact of these challenges and provides a detailed analysis of their implications for industry players.

Emerging Opportunities in North America Textile Fabrics Industry

Despite the challenges, the North American textile fabrics industry presents several exciting opportunities. The growing demand for sustainable and recycled fabrics, coupled with technological advancements in fiber production and fabric manufacturing, creates new avenues for growth. Emerging markets and shifting consumer preferences towards innovative and functional fabrics further contribute to this potential. (Specific examples and opportunities will be elaborated in the full report.)

Leading Players in the North America Textile Fabrics Industry Market

- Nike Inc

- The Dixie Group Inc

- American Eagle Outfitters Inc

- Guilford Mills Inc

- DuPont de Nemours Inc

- Levi Strauss & Co

- Hennes & Mauritz AB

- WestPoint Home Inc

- Welspun India Ltd

- Standard Textile Co Inc

- Mohawk Industries Inc

- Elevate Textiles Inc (List Not Exhaustive)

Key Developments in North America Textile Fabrics Industry Industry

- February 2023: Huntsman Corporation (NYSE: HUN) completed the sale of its Textile Effects division to Archroma for USD 593 Million (USD 540 Million net after-tax cash proceeds), significantly impacting market consolidation.

- December 2022: India and Canada's FTA negotiations hold potential for increased trade in textiles, although the final agreement's impact remains uncertain.

- August 2022: Archroma's acquisition of Huntsman Corporation's Textile Effects business was announced, signaling further industry consolidation.

Future Outlook for North America Textile Fabrics Industry Market

The North American textile fabrics market holds substantial growth potential, driven by continuous innovation in sustainable and high-performance fabrics, coupled with consistent consumer demand. Strategic investments in research and development (R&D), coupled with resilient supply chain management and effective adaptation to evolving consumer preferences, will be critical for companies to capitalize on future market opportunities. The full report provides detailed forecasts and scenario planning for various market segments.

North America Textile Fabrics Industry Segmentation

-

1. Application

- 1.1. Clothing

- 1.2. Industrial/Technical Applications

- 1.3. Household Applications

-

2. Material Type

- 2.1. Cotton

- 2.2. Jute

- 2.3. Silk

- 2.4. Synthetics

- 2.5. Wool

-

3. Process

- 3.1. Woven

- 3.2. Non-woven

North America Textile Fabrics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Textile Fabrics Industry Regional Market Share

Geographic Coverage of North America Textile Fabrics Industry

North America Textile Fabrics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for clothing and accessories; Availability of raw materials at low prices for textile manufacturers

- 3.3. Market Restrains

- 3.3.1. Increasing demand for clothing and accessories; Availability of raw materials at low prices for textile manufacturers

- 3.4. Market Trends

- 3.4.1. Increasing demand for North America's apparels driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Textile Fabrics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Clothing

- 5.1.2. Industrial/Technical Applications

- 5.1.3. Household Applications

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Cotton

- 5.2.2. Jute

- 5.2.3. Silk

- 5.2.4. Synthetics

- 5.2.5. Wool

- 5.3. Market Analysis, Insights and Forecast - by Process

- 5.3.1. Woven

- 5.3.2. Non-woven

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nike Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Dixie Group Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 American Eagle Outfitters Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Guilford Mills Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DuPont de Nemours Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Levi Strauss & Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hennes & Mauritz AB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 WestPoint Home Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Welspun India Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Standard Textile Co Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Mohawk Industries Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Elevate Textiles Inc **List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Nike Inc

List of Figures

- Figure 1: North America Textile Fabrics Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Textile Fabrics Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Textile Fabrics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: North America Textile Fabrics Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 3: North America Textile Fabrics Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 4: North America Textile Fabrics Industry Volume Billion Forecast, by Material Type 2020 & 2033

- Table 5: North America Textile Fabrics Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 6: North America Textile Fabrics Industry Volume Billion Forecast, by Process 2020 & 2033

- Table 7: North America Textile Fabrics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Textile Fabrics Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 9: North America Textile Fabrics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: North America Textile Fabrics Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 11: North America Textile Fabrics Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 12: North America Textile Fabrics Industry Volume Billion Forecast, by Material Type 2020 & 2033

- Table 13: North America Textile Fabrics Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 14: North America Textile Fabrics Industry Volume Billion Forecast, by Process 2020 & 2033

- Table 15: North America Textile Fabrics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Textile Fabrics Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States North America Textile Fabrics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States North America Textile Fabrics Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada North America Textile Fabrics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Textile Fabrics Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Textile Fabrics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America Textile Fabrics Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Textile Fabrics Industry?

The projected CAGR is approximately 3.85%.

2. Which companies are prominent players in the North America Textile Fabrics Industry?

Key companies in the market include Nike Inc, The Dixie Group Inc, American Eagle Outfitters Inc, Guilford Mills Inc, DuPont de Nemours Inc, Levi Strauss & Co, Hennes & Mauritz AB, WestPoint Home Inc, Welspun India Ltd, Standard Textile Co Inc, Mohawk Industries Inc, Elevate Textiles Inc **List Not Exhaustive.

3. What are the main segments of the North America Textile Fabrics Industry?

The market segments include Application, Material Type, Process.

4. Can you provide details about the market size?

The market size is estimated to be USD 99.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for clothing and accessories; Availability of raw materials at low prices for textile manufacturers.

6. What are the notable trends driving market growth?

Increasing demand for North America's apparels driving the market.

7. Are there any restraints impacting market growth?

Increasing demand for clothing and accessories; Availability of raw materials at low prices for textile manufacturers.

8. Can you provide examples of recent developments in the market?

February 2023: Huntsman Corporation (NYSE: HUN) announced that it has completed the sale of its Textile Effects division to Archroma, a portfolio company of SK Capital Partners. The agreed purchase price was USD 593 million in cash plus assumed pension liabilities. Huntsman expects the net after-tax cash proceeds to be approximately USD 540 million before customary post-closing adjustments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Textile Fabrics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Textile Fabrics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Textile Fabrics Industry?

To stay informed about further developments, trends, and reports in the North America Textile Fabrics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence