Key Insights

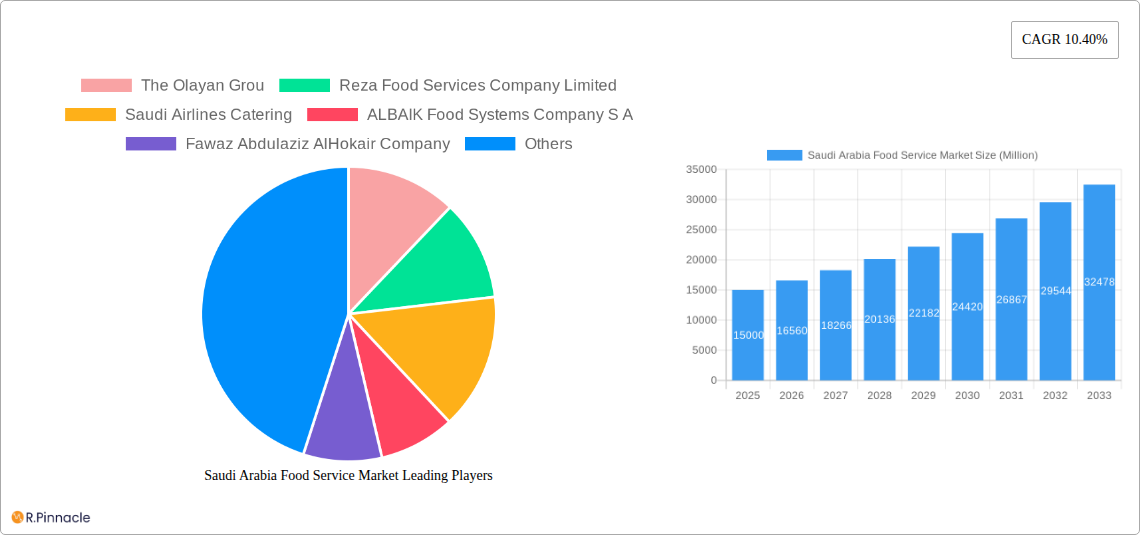

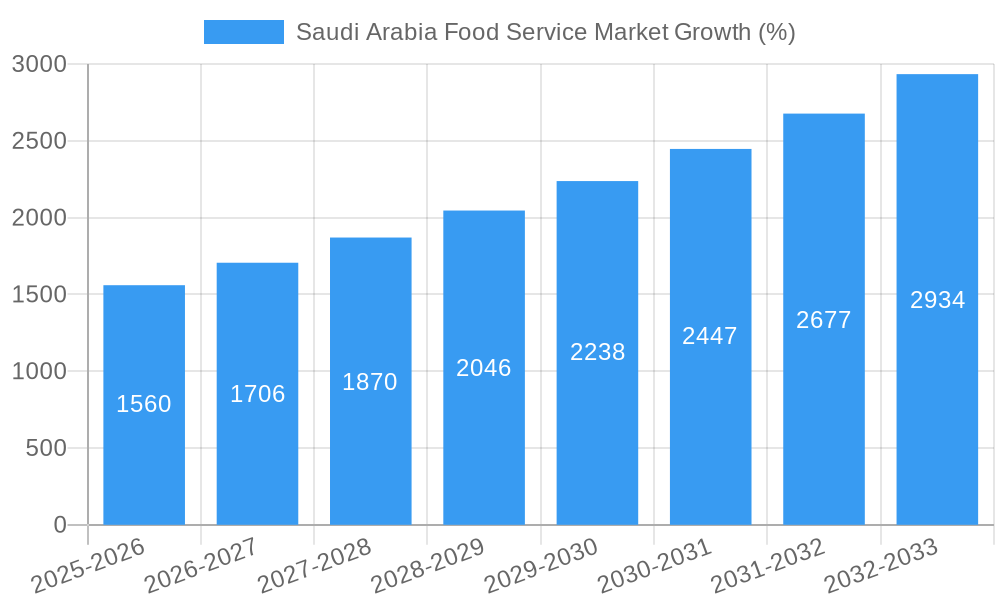

The Saudi Arabian food service market, valued at approximately $XX million in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 10.40% from 2025 to 2033. This expansion is fueled by several key drivers. A burgeoning young population with increasing disposable incomes is driving demand for diverse and convenient food options. The rise of quick-service restaurants (QSRs), cafes, and upscale dining experiences caters to this evolving consumer preference. Tourism's significant contribution to the Saudi economy further boosts the food service sector, as both domestic and international travelers contribute to increased spending. Furthermore, government initiatives promoting economic diversification and attracting foreign investment contribute positively to the market's growth trajectory. The market is segmented by outlet type (chained vs. independent), location (leisure, lodging, retail, standalone, travel, foodservice), and foodservice type (cafes & bars). While the specific market share of each segment requires further data, it's reasonable to expect that chained outlets, leveraging economies of scale and brand recognition, will hold a significant share. Similarly, locations within high-traffic areas like retail centers and travel hubs are expected to experience higher growth rates. Challenges remain, including potential inflationary pressures affecting food costs and labor, and the need for consistent quality control across a diverse range of establishments.

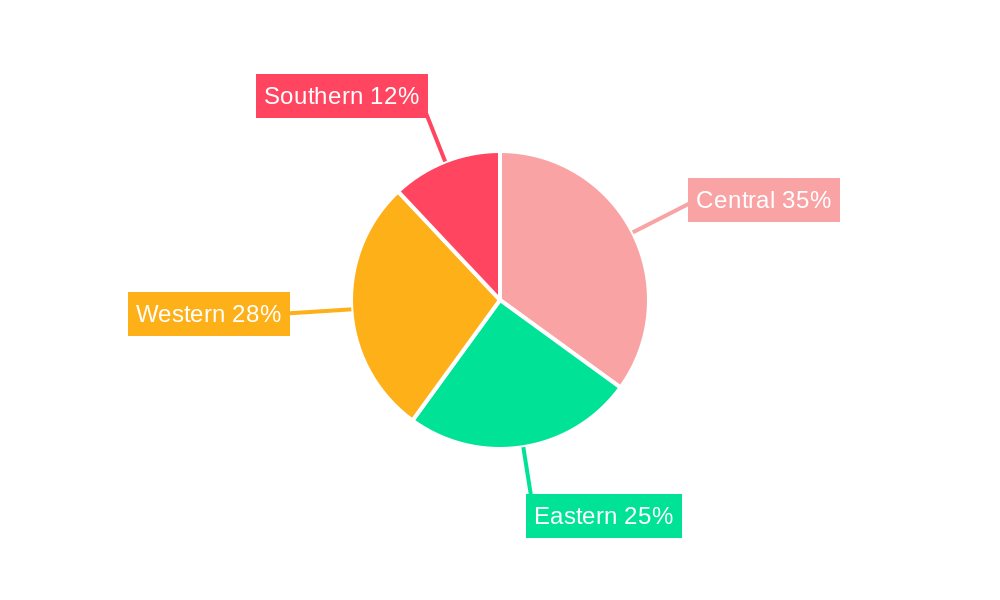

The competitive landscape is characterized by a mix of international and domestic players, ranging from large multinational corporations like Americana Restaurants International PLC and M H Alshaya Co WLL to local favorites like ALBAIK Food Systems Company S A and Herfy Food Service Company. These companies employ diverse strategies to cater to varying consumer preferences and price points, driving innovation and competition within the market. Regional variations in consumption patterns are likely, influenced by factors such as local culinary traditions and population density. Regions with higher population concentrations, such as the central and western regions of Saudi Arabia, are likely to experience higher market penetration. Further analysis focusing on the specific regional distribution of market share and revenue would provide a more granular understanding of the market's dynamics within each area. The forecast period (2025-2033) presents numerous opportunities for growth, particularly for businesses offering innovative food concepts, efficient delivery services, and a focus on enhancing customer experience.

Saudi Arabia Food Service Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Saudi Arabia food service market, offering invaluable insights for industry professionals, investors, and strategic planners. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a robust understanding of current market dynamics and future growth potential. The report leverages extensive data analysis to project a market size of xx Million by 2033, providing crucial information for informed decision-making.

Saudi Arabia Food Service Market Structure & Innovation Trends

The Saudi Arabian food service market exhibits a diverse structure, encompassing both large multinational chains and numerous independent outlets. Market concentration is moderate, with several key players holding significant market share, but a large number of smaller businesses also contributing significantly. Key players such as Americana Restaurants International PLC and ALBAIK Food Systems Company S A command substantial market share, however, the market displays healthy competition across various segments. The market’s innovation is driven by evolving consumer preferences, technological advancements (e.g., online ordering, delivery platforms), and government initiatives promoting food safety and diversification.

- Market Concentration: Moderate, with top players commanding xx% market share.

- Innovation Drivers: Consumer preferences, technological advancements, government regulations.

- Regulatory Framework: Focus on food safety and hygiene standards.

- Product Substitutes: Home-cooked meals, meal delivery services.

- End-User Demographics: Growing young population with increased disposable income.

- M&A Activities: Recent years have witnessed a number of mergers and acquisitions (M&A) deals, valued at approximately xx Million in the past five years. The Nathan & Nathan KSA and Fawaz Abdulaziz Al Hokair & Sons partnership (March 2023) exemplifies this trend.

Saudi Arabia Food Service Market Dynamics & Trends

The Saudi Arabia food service market is experiencing robust growth, driven by several factors. A burgeoning young population with rising disposable incomes fuels demand for diverse and convenient food options. Urbanization and tourism are also major contributors, with a significant increase in the number of restaurants and food outlets across various locations. The market is witnessing a shift in consumer preferences towards healthier options, international cuisines, and customized dining experiences. Technological advancements, including online food ordering and delivery platforms, are transforming the industry's landscape, enhancing convenience and reach. The market is expected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration in key segments showing significant upward trends. Competitive dynamics are intense, with both established players and new entrants vying for market share through innovation, branding, and strategic partnerships.

Dominant Regions & Segments in Saudi Arabia Food Service Market

The Saudi Arabia food service market displays strong regional variations in growth and dominance. Major cities like Riyadh, Jeddah, and Dammam dominate the market due to high population density, thriving tourism, and robust infrastructure. However, other regions are also witnessing growth owing to government investment in infrastructure and economic diversification initiatives. Within the market segments, chained outlets hold a significant share compared to independent outlets, reflecting the increasing popularity of branded food experiences. The retail and leisure segments are exceptionally strong due to increased consumer spending and tourism.

Key Drivers for Dominant Regions:

- High population density

- Strong tourism

- Well-developed infrastructure

- Government investments

Dominant Segments:

- Outlet: Chained Outlets hold a larger market share than Independent Outlets due to brand recognition and consistency.

- Location: Retail and Leisure locations dominate due to high foot traffic and consumer spending.

- Foodservice Type: Cafes & Bars represent a significant segment, showcasing the evolving preferences of the Saudi Arabian population.

Saudi Arabia Food Service Market Product Innovations

The Saudi Arabian food service market is witnessing significant product innovation, driven by consumer demand for diverse and convenient options. This includes the rise of personalized meal options, healthier choices, and international cuisines. Technological advancements, such as food delivery apps and automated ordering systems, are enhancing efficiency and customer experience. The market is also seeing increasing adoption of sustainable practices, focusing on reducing waste and sourcing locally produced ingredients.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation analysis of the Saudi Arabia food service market, encompassing various dimensions:

- Outlet: Chained Outlets (Growth Projection: xx%; Market Size: xx Million; Competitive Dynamics: High) and Independent Outlets (Growth Projection: xx%; Market Size: xx Million; Competitive Dynamics: Moderate).

- Location: Leisure (Growth Projection: xx%; Market Size: xx Million; Competitive Dynamics: High), Lodging (Growth Projection: xx%; Market Size: xx Million; Competitive Dynamics: Moderate), Retail (Growth Projection: xx%; Market Size: xx Million; Competitive Dynamics: High), Standalone (Growth Projection: xx%; Market Size: xx Million; Competitive Dynamics: Moderate), Travel (Growth Projection: xx%; Market Size: xx Million; Competitive Dynamics: High).

- Foodservice Type: Cafes & Bars (Growth Projection: xx%; Market Size: xx Million; Competitive Dynamics: High).

Key Drivers of Saudi Arabia Food Service Market Growth

The Saudi Arabia food service market is experiencing strong growth propelled by several factors. These include a young and growing population with increasing disposable incomes, rapid urbanization leading to higher demand for convenient food options, and the influx of tourists seeking diverse dining experiences. Government initiatives supporting the hospitality sector and investments in infrastructure further contribute to the market's expansion. The rise of technology, such as online food ordering and delivery platforms, also greatly enhances market growth.

Challenges in the Saudi Arabia Food Service Market Sector

The Saudi Arabia food service market faces several challenges. Stringent food safety regulations require significant investment and compliance efforts. Supply chain disruptions can impact the availability and cost of ingredients. Intense competition from both established and new players creates pressure on profit margins. Furthermore, fluctuating oil prices and economic conditions can impact consumer spending on food services.

Emerging Opportunities in Saudi Arabia Food Service Market

The Saudi Arabia food service market presents many opportunities. The increasing preference for healthier and customizable food options creates a niche for specialized restaurants and catering services. The expansion of e-commerce and online food delivery platforms presents significant growth potential. Furthermore, the government's focus on tourism development offers opportunities for food service providers targeting international visitors.

Leading Players in the Saudi Arabia Food Service Market Market

- The Olayan Group

- Reza Food Services Company Limited

- Saudi Airlines Catering

- ALBAIK Food Systems Company S A

- Fawaz Abdulaziz AlHokair Company

- Galadari Ice Cream Co Ltd LLC

- Americana Restaurants International PLC

- Kudu Company For Food And Catering

- M H Alshaya Co WLL

- LuLu Group International

- Herfy Food Service Company

- Apparel Group

- AlAmar Foods Company

- Al Tazaj Fakeih

Key Developments in Saudi Arabia Food Service Market Industry

- March 2023: Nathan & Nathan KSA partnered with Fawaz Abdulaziz Al Hokair & Sons, aiming to expand market reach and service offerings.

- February 2023: Alshaya Group inaugurated a new production facility in Saudi Arabia to cater to its Starbucks outlets, enhancing distribution efficiency.

- January 2023: Fawaz Abdulaziz AlHokair Company planned to expand its Cinnabon, Mamma Bunz, and Shawarma Al Muhalhel brands through a sub-franchise model.

Future Outlook for Saudi Arabia Food Service Market Market

The Saudi Arabia food service market is poised for continued growth, driven by factors such as population expansion, rising incomes, and ongoing modernization. Strategic opportunities exist in catering to evolving consumer preferences, embracing technological advancements, and leveraging government initiatives promoting economic diversification. The market's future success depends on adapting to changing consumer demands, ensuring operational efficiency, and maintaining compliance with evolving regulations.

Saudi Arabia Food Service Market Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Juice/Smoothie/Desserts Bars

- 1.1.1.2. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

Saudi Arabia Food Service Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Food Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use

- 3.3. Market Restrains

- 3.3.1. Increasing Shift Toward Plant-Based Protein

- 3.4. Market Trends

- 3.4.1. Rising popularity of Asian cuisines and growing interest in international cuisines fuelling the market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Food Service Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Juice/Smoothie/Desserts Bars

- 5.1.1.1.2. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. Central Saudi Arabia Food Service Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Food Service Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Food Service Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Food Service Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 The Olayan Grou

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Reza Food Services Company Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Saudi Airlines Catering

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 ALBAIK Food Systems Company S A

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Fawaz Abdulaziz AlHokair Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Galadari Ice Cream Co Ltd LLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Americana Restaurants International PLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Kudu Company For Food And Catering

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 M H Alshaya Co WLL

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 LuLu Group International

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Herfy Food Service Company

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Apparel Group

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 AlAmar Foods Company

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Al Tazaj Fakeih

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 The Olayan Grou

List of Figures

- Figure 1: Saudi Arabia Food Service Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Food Service Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 3: Saudi Arabia Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: Saudi Arabia Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: Saudi Arabia Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Saudi Arabia Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Central Saudi Arabia Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Eastern Saudi Arabia Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Western Saudi Arabia Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Southern Saudi Arabia Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Saudi Arabia Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 12: Saudi Arabia Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 13: Saudi Arabia Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 14: Saudi Arabia Food Service Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Food Service Market?

The projected CAGR is approximately 10.40%.

2. Which companies are prominent players in the Saudi Arabia Food Service Market?

Key companies in the market include The Olayan Grou, Reza Food Services Company Limited, Saudi Airlines Catering, ALBAIK Food Systems Company S A, Fawaz Abdulaziz AlHokair Company, Galadari Ice Cream Co Ltd LLC, Americana Restaurants International PLC, Kudu Company For Food And Catering, M H Alshaya Co WLL, LuLu Group International, Herfy Food Service Company, Apparel Group, AlAmar Foods Company, Al Tazaj Fakeih.

3. What are the main segments of the Saudi Arabia Food Service Market?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use.

6. What are the notable trends driving market growth?

Rising popularity of Asian cuisines and growing interest in international cuisines fuelling the market growth.

7. Are there any restraints impacting market growth?

Increasing Shift Toward Plant-Based Protein.

8. Can you provide examples of recent developments in the market?

March 2023: Nathan & Nathan KSA partnered with Fawaz Abdulaziz Al Hokair & Sons. This partnership is expected to bring the expertise and resources of both companies together, accelerate the growth of the active customer bases of both groups, and support the development of future opportunities to provide unparalleled professional services to clients throughout the Kingdom.February 2023: Alshaya Group inaugurated a new production facility in Saudi Arabia to produce freshly baked and packaged food for 400 Starbucks stores in the country. Alshaya Group, which operates more than 1,000 Starbucks stores across the Middle East, has been planning to enhance the distribution reach of the site to over 500 Starbucks outlets by the end of 2023.January 2023: Fawaz Abdulaziz AlHokair Company has planned to set up around 45-50 new branches, specifically for Cinnabon and Mamma Bunz. It is expected to expand the footprint of its home-grown concept, "Shawarma Al Muhalhel." Furthermore, the company is planning to expedite the expansion of its store network for existing brands, such as Cinnabon, Mamma Bunz, Crepe Affaire, and Shawarma Al Muhalhel, through a sub-franchise model.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Food Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Food Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Food Service Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Food Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence