Key Insights

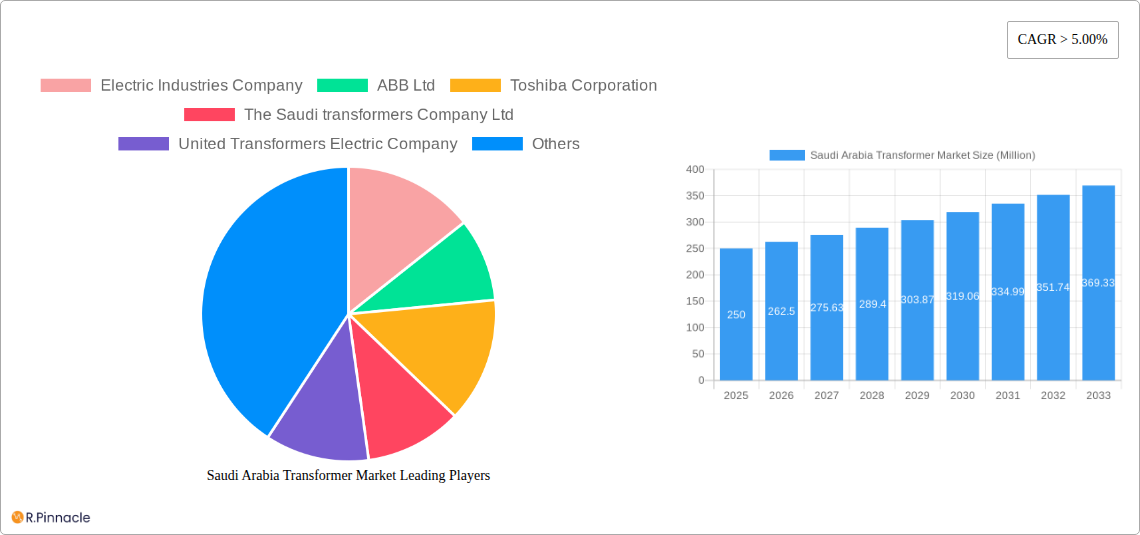

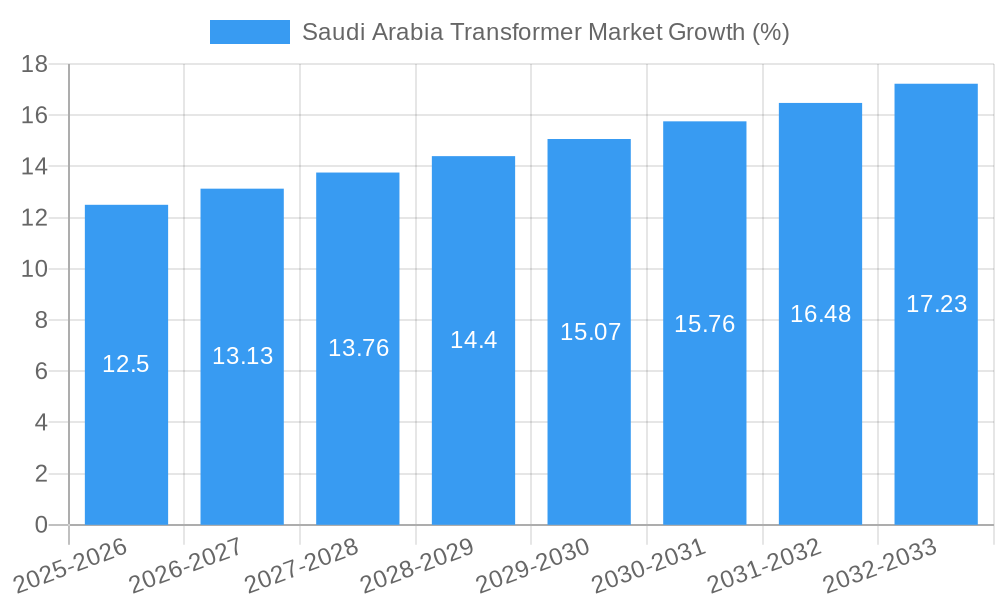

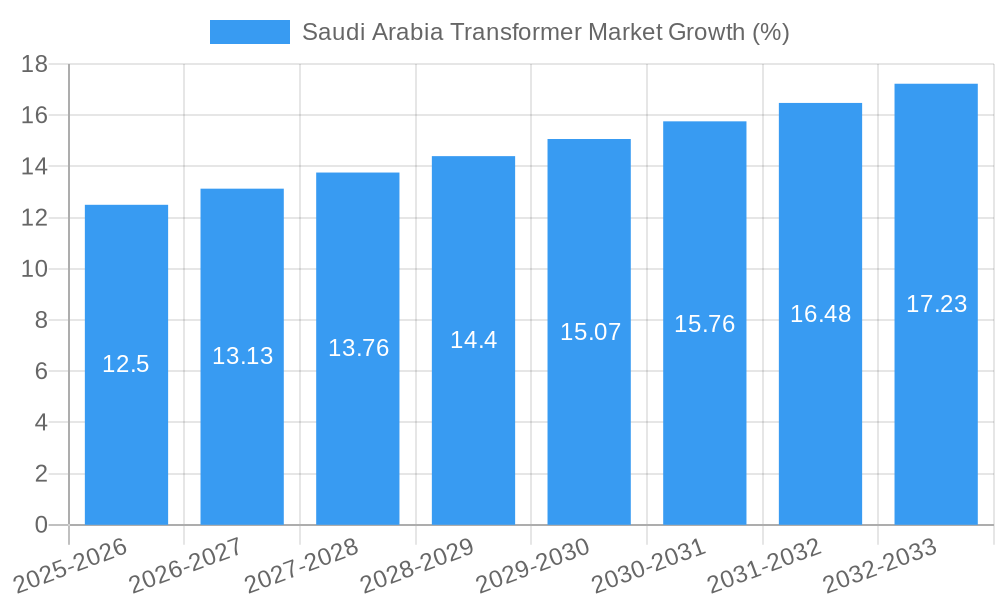

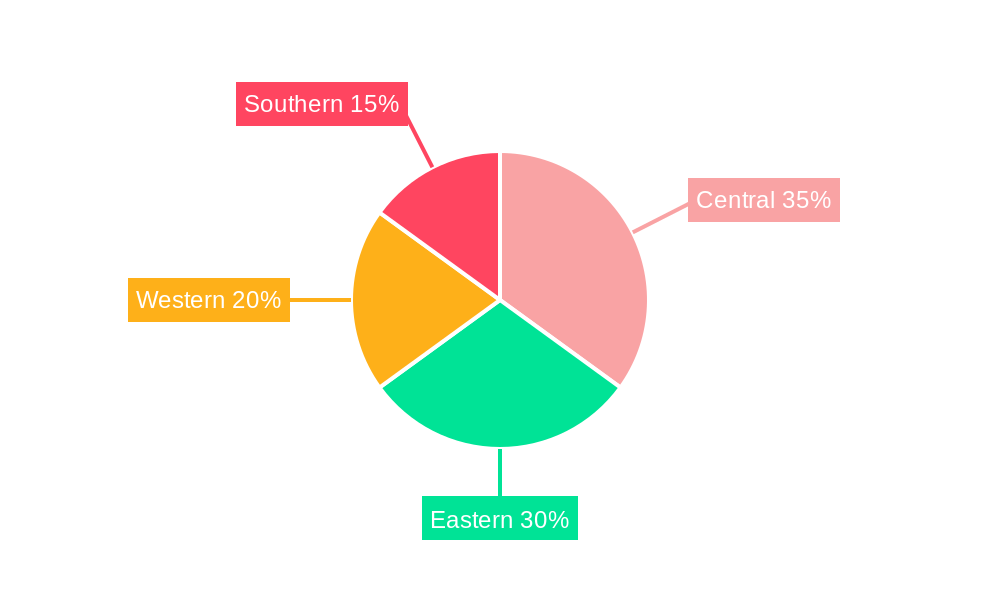

The Saudi Arabian transformer market, valued at approximately $250 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is primarily fueled by the Kingdom's ambitious infrastructure development plans, including large-scale power generation projects and the ongoing expansion of its electricity grid to support economic diversification initiatives like Vision 2030. The increasing demand for renewable energy sources, coupled with the modernization of existing power infrastructure, further contributes to market growth. The market is segmented by transformer type, with power transformers and distribution transformers representing significant portions. Power transformers dominate, driven by the needs of large-scale power plants and industrial facilities. The regional distribution reflects the uneven development across Saudi Arabia, with central and eastern regions showcasing higher demand due to concentrated population centers and industrial hubs. Key players, such as ABB Ltd, Siemens AG, and Mitsubishi Electric Corporation, are actively competing in this dynamic market, leveraging their technological expertise and established presence to secure contracts. The market faces challenges including fluctuating oil prices impacting overall government spending and the need for robust infrastructure to support the integration of renewable energy technologies. However, long-term prospects remain positive, driven by consistent government investment in the energy sector.

The competitive landscape is characterized by both international giants and local players. International companies benefit from advanced technology and established supply chains, while local companies leverage their understanding of the regional market and government regulations. However, the entry of new players is likely to increase competition and drive innovation. Future market developments will be closely tied to the success of Vision 2030 and the ongoing energy sector reforms. The focus on enhancing energy efficiency and integrating smart grid technologies will likely create new opportunities for advanced transformer solutions. The market's growth trajectory is expected to remain strong, driven by ongoing infrastructure development, the increasing adoption of renewable energy, and a continued focus on upgrading the power grid's resilience and capacity.

Saudi Arabia Transformer Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Saudi Arabia transformer market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, key players, and future growth potential. The report leverages extensive data analysis to forecast market trends and provide actionable recommendations for navigating this rapidly evolving landscape.

Saudi Arabia Transformer Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the Saudi Arabia transformer market. The market exhibits a moderately concentrated structure, with key players like ABB Ltd, Toshiba Corporation, General Electric Company, and Siemens AG holding significant market share (estimated at xx% combined in 2025). Smaller, regional players such as Electric Industries Company, The Saudi Transformers Company Ltd, and United Transformers Electric Company also contribute significantly.

Market share fluctuations are driven by factors including technological advancements, government policies favoring domestic manufacturers, and the success of M&A activities. While precise M&A deal values are not publicly available for all transactions, recent deals indicate significant investment in the sector. The regulatory framework, while supportive of infrastructure development, necessitates compliance with stringent safety and quality standards, impacting product development and market entry. The market also faces pressure from substitute technologies in niche applications. However, the overall demand for transformers remains robust, driven by the nation's large-scale infrastructure projects and industrial growth.

- Market Concentration: Moderately concentrated, with a few major players and several regional competitors.

- Innovation Drivers: Government initiatives promoting renewable energy and smart grid technologies.

- Regulatory Framework: Stringent safety and quality standards.

- Product Substitutes: Limited, but some niche applications explore alternative technologies.

- End-User Demographics: Primarily utilities, industrial facilities, and commercial construction.

- M&A Activity: Significant investment, with deal values varying depending on the asset and strategic objectives.

Saudi Arabia Transformer Market Dynamics & Trends

The Saudi Arabia transformer market is experiencing robust growth, driven by substantial investments in infrastructure development, particularly within the power sector. The Compound Annual Growth Rate (CAGR) is projected at xx% during the forecast period (2025-2033), exceeding the global average. This growth is fueled by several key factors: increased electricity demand due to population growth and industrial expansion, government initiatives promoting renewable energy integration, and the ongoing modernization of the national grid. Technological disruptions, including the adoption of smart grid technologies and advanced transformer designs, are also impacting market dynamics. Consumer preference shifts toward energy-efficient and digitally enabled solutions are further accelerating market evolution. Competitive dynamics are shaped by both established multinational players and regional companies, leading to varied pricing strategies and innovation levels. Market penetration of advanced technologies remains relatively low, with significant potential for growth in areas like smart grid integration and condition monitoring systems.

Dominant Regions & Segments in Saudi Arabia Transformer Market

The Eastern Province consistently ranks as the dominant region, driven primarily by the concentration of petrochemical industries and major power generation facilities. However, other regions like Riyadh and the Western Province are experiencing substantial growth due to ongoing urbanization and industrial development. Within transformer types, the power transformer segment commands the largest market share (approximately xx Million USD in 2025), reflecting the scale of power generation and transmission projects. The distribution transformer segment, though smaller, is experiencing faster growth, driven by expansion in residential, commercial, and industrial sectors.

- Key Drivers for Eastern Province Dominance: High concentration of industrial activity, significant power generation capacity, and ongoing infrastructure development.

- Key Drivers for Power Transformer Segment Dominance: Large-scale power generation and transmission projects, driven by the expanding national grid.

- Key Drivers for Distribution Transformer Segment Growth: Residential, commercial, and industrial expansion across the country.

Saudi Arabia Transformer Market Product Innovations

The market witnesses continuous product innovation, with a focus on energy efficiency, enhanced reliability, and advanced monitoring capabilities. Key trends include the development of high-efficiency transformers, smart transformers with integrated sensors and communication capabilities, and the increased use of environmentally friendly materials. These innovations cater to the growing demand for sustainable and efficient power distribution solutions, enabling utilities to optimize grid performance and reduce operational costs. Manufacturers are striving to differentiate their products by offering advanced features, superior reliability, and customized solutions.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation analysis of the Saudi Arabia transformer market, categorized by transformer type.

Power Transformers: This segment encompasses high-voltage transformers used in power generation and transmission applications. Market size in 2025 is estimated at xx Million USD, projecting to reach xx Million USD by 2033. Growth is fueled by large-scale infrastructure projects and renewable energy integration. Competitive dynamics are shaped by leading international and national players.

Distribution Transformers: This segment includes lower-voltage transformers used for distribution networks and industrial applications. The 2025 market size is projected at xx Million USD, expected to grow to xx Million USD by 2033. Growth is driven by expanding residential, commercial, and industrial sectors. Competition is intense, with both global and local players vying for market share.

Key Drivers of Saudi Arabia Transformer Market Growth

Several key factors propel the growth of the Saudi Arabia transformer market. First, the nation's ambitious Vision 2030 strategy is driving massive infrastructure development, necessitating significant investment in power generation and distribution infrastructure. Second, the ongoing diversification of the economy, particularly into renewable energy, is leading to increased demand for transformers compatible with solar and wind power systems. Third, government initiatives to improve energy efficiency are fostering the adoption of advanced, high-efficiency transformer technologies.

Challenges in the Saudi Arabia Transformer Market Sector

The Saudi Arabia transformer market faces several challenges. Supply chain disruptions, particularly in the procurement of raw materials, can lead to production delays and cost increases. Intense competition from both domestic and international players exerts pressure on pricing and profitability. Stringent regulatory compliance requirements add complexity to product development and market entry. Furthermore, fluctuations in global commodity prices impact production costs and project profitability.

Emerging Opportunities in Saudi Arabia Transformer Market

Several opportunities exist within the Saudi Arabia transformer market. The growing adoption of smart grid technologies presents significant opportunities for manufacturers of advanced transformers with integrated monitoring and control capabilities. The expansion of renewable energy sources, particularly solar and wind, necessitates the deployment of transformers specifically designed for these applications. Furthermore, the government's focus on energy efficiency creates a growing demand for high-efficiency transformers with advanced cooling systems and optimized designs.

Leading Players in the Saudi Arabia Transformer Market Market

- Electric Industries Company

- ABB Ltd

- Toshiba Corporation

- The Saudi transformers Company Ltd

- United Transformers Electric Company

- Rawafid System

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric

- General Electric Company

Key Developments in Saudi Arabia Transformer Market Industry

- April 2022: Hitachi ABB Power Grids secured a contract for a 3,000 MW electricity interconnection between Saudi Arabia and Egypt, representing a significant boost to high-voltage DC interconnection projects in the region.

- February 2022: Alfanar Construction awarded a USD 175 Million contract to construct a 380kV substation and expand three existing substations, highlighting continued investment in grid infrastructure upgrades.

Future Outlook for Saudi Arabia Transformer Market Market

The future outlook for the Saudi Arabia transformer market remains positive. Continued investments in infrastructure, coupled with the nation's commitment to renewable energy and energy efficiency, will drive sustained market growth. Strategic partnerships between international and domestic companies will play a crucial role in shaping technological advancements and market penetration. The focus on smart grid technologies and digitalization presents significant opportunities for innovative product development and market expansion.

Saudi Arabia Transformer Market Segmentation

-

1. Transformer Type

- 1.1. Power Transformer

- 1.2. Distribution Transformer

Saudi Arabia Transformer Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Transformer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Shift toward Renewable Energy

- 3.4. Market Trends

- 3.4.1. Distribution Transformers Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Transformer Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Transformer Type

- 5.1.1. Power Transformer

- 5.1.2. Distribution Transformer

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Transformer Type

- 6. Central Saudi Arabia Transformer Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Transformer Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Transformer Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Transformer Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Electric Industries Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ABB Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Toshiba Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 The Saudi transformers Company Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 United Transformers Electric Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Rawafid System

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Mitsubishi Electric Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Siemens AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Schneider Electric

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 General Electric Company

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Electric Industries Company

List of Figures

- Figure 1: Saudi Arabia Transformer Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Transformer Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Transformer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Transformer Market Volume K Units Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia Transformer Market Revenue Million Forecast, by Transformer Type 2019 & 2032

- Table 4: Saudi Arabia Transformer Market Volume K Units Forecast, by Transformer Type 2019 & 2032

- Table 5: Saudi Arabia Transformer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Saudi Arabia Transformer Market Volume K Units Forecast, by Region 2019 & 2032

- Table 7: Saudi Arabia Transformer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Saudi Arabia Transformer Market Volume K Units Forecast, by Country 2019 & 2032

- Table 9: Central Saudi Arabia Transformer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Central Saudi Arabia Transformer Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 11: Eastern Saudi Arabia Transformer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Eastern Saudi Arabia Transformer Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 13: Western Saudi Arabia Transformer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Western Saudi Arabia Transformer Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: Southern Saudi Arabia Transformer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Southern Saudi Arabia Transformer Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: Saudi Arabia Transformer Market Revenue Million Forecast, by Transformer Type 2019 & 2032

- Table 18: Saudi Arabia Transformer Market Volume K Units Forecast, by Transformer Type 2019 & 2032

- Table 19: Saudi Arabia Transformer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Saudi Arabia Transformer Market Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Transformer Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Saudi Arabia Transformer Market?

Key companies in the market include Electric Industries Company, ABB Ltd, Toshiba Corporation, The Saudi transformers Company Ltd, United Transformers Electric Company, Rawafid System, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric, General Electric Company.

3. What are the main segments of the Saudi Arabia Transformer Market?

The market segments include Transformer Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development.

6. What are the notable trends driving market growth?

Distribution Transformers Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Shift toward Renewable Energy.

8. Can you provide examples of recent developments in the market?

In April 2022, Hitachi ABB Power Grids was awarded a contract to construct an electricity interconnection by the Saudi Electricity Company and the Egyptian Electricity Transmission Company. The interconnection will facilitate Saudi Arabia and Egypt to exchange up to 3,000 MW of power. It is the first large-scale high-voltage direct current interconnection link project in the Middle East and North Africa. The project will cover the distance of a 1,350 km route using overhead power lines and a subsea cable across the Red Sea.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Transformer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Transformer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Transformer Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Transformer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence