Key Insights

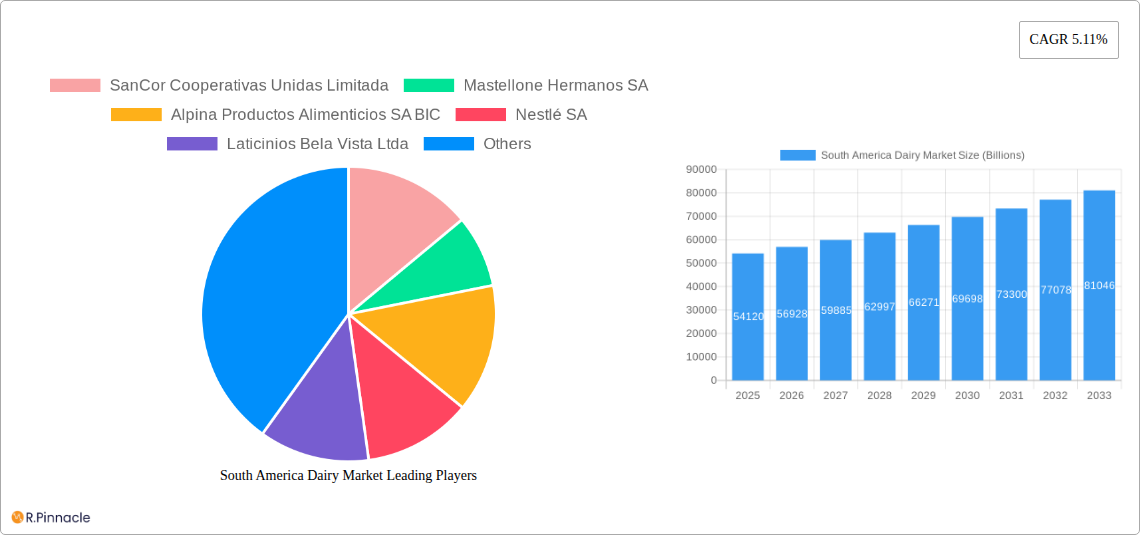

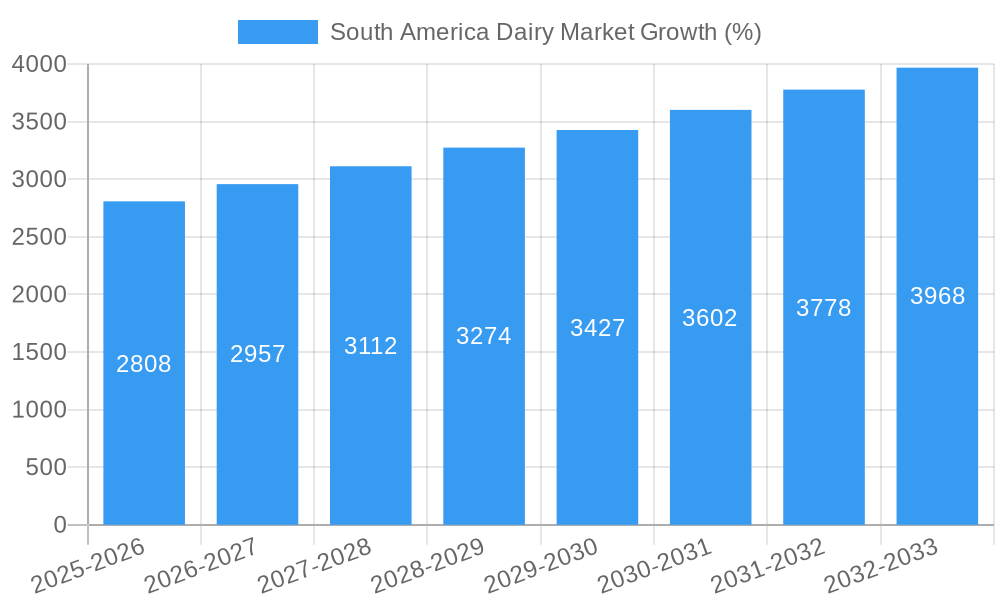

The South American dairy market, valued at $54.12 billion in 2025, is projected to experience robust growth, driven by increasing consumption, particularly in rapidly urbanizing areas of Brazil and Argentina. A compound annual growth rate (CAGR) of 5.11% is anticipated from 2025 to 2033, indicating a significant expansion of the market over the forecast period. Key drivers include rising disposable incomes, changing dietary habits favoring dairy products, and increasing demand for convenience and value-added dairy items like yogurt and cheese. The off-trade distribution channel (supermarkets, grocery stores) currently dominates, but the on-trade segment (restaurants, cafes) is showing promising growth potential, particularly in urban centers. While Brazil and Argentina represent the largest markets, the "Rest of South America" region presents opportunities for future expansion, given rising populations and increasing consumer awareness of the nutritional benefits of dairy. Potential restraints include fluctuations in milk production due to climate change and the economic volatility inherent in some South American nations. However, the overall market outlook remains positive, driven by strong consumer demand and increasing investment in dairy processing and distribution infrastructure. Major players like SanCor, Mastellone, and Nestlé are well-positioned to capitalize on this growth, competing through product innovation, brand building, and efficient supply chains. The increasing popularity of functional dairy products, organic options, and plant-based alternatives, will also shape the market dynamics in the coming years. Competitive intensity is moderate to high, with a mix of both large multinational corporations and smaller local players.

The continued growth of the South American dairy market hinges on several factors. Successful navigation of economic uncertainty within the region, proactive management of supply chain challenges, and strategic investments in marketing and product development by key players are crucial for sustained expansion. Furthermore, addressing concerns around sustainability and ethical sourcing within the industry will become increasingly important as consumer preferences evolve. The increasing focus on healthy and nutritious food choices will fuel the demand for premium dairy products, creating additional opportunities for both established and emerging brands. The potential for increased regional trade and integration also presents a significant opportunity for market expansion and efficiency improvements. The dairy sector in South America holds a promising future, provided these considerations are addressed effectively.

This comprehensive report provides an in-depth analysis of the South America dairy market, offering invaluable insights for industry professionals, investors, and strategic planners. With a focus on Argentina, Brazil, and the Rest of South America, the report covers the period from 2019 to 2033, offering a detailed historical overview (2019-2024), current market assessment (Base Year: 2025, Estimated Year: 2025), and future projections (Forecast Period: 2025-2033). The market is segmented by category (Butter), distribution channels (Off-Trade, On-Trade - including warehouse clubs and gas stations), and key players. The total market size is predicted to reach Billions by 2033.

South America Dairy Market Market Structure & Innovation Trends

This section analyzes the South American dairy market's structure, highlighting key trends and influential factors. Market concentration is moderate, with several large players holding significant shares but facing competition from smaller, regional brands. SanCor Cooperativas Unidas Limitada, Mastellone Hermanos SA, and Nestlé SA are among the leading players, each commanding a significant but not dominant market share in specific segments. The xx% market share held by the top 5 players indicates a relatively competitive landscape, with opportunities for both established firms and new entrants.

Innovation is driven by consumer demand for healthier, more convenient products, as well as the need for sustainable and environmentally friendly packaging. Regulatory frameworks related to food safety and labeling influence product development, while the rising cost of raw materials and fluctuating exchange rates are key challenges. Product substitutes, such as plant-based alternatives, pose a growing competitive threat, though dairy remains a significant part of consumer diets. M&A activity is relatively high. Recent deals, though with undisclosed values, highlight consolidation and strategic expansion efforts within the sector. For instance, Lactalis' acquisition of assets in Brazil reflects a push for market dominance.

- Market Concentration: Moderate, top 5 players hold xx% market share.

- Innovation Drivers: Healthier products, convenience, sustainable packaging.

- Regulatory Frameworks: Food safety and labeling regulations.

- Product Substitutes: Plant-based alternatives are growing in popularity.

- M&A Activity: Significant, driven by consolidation and expansion. Example: Lactalis acquisition of assets in Brazil.

South America Dairy Market Market Dynamics & Trends

The South American dairy market exhibits dynamic growth, influenced by factors like rising disposable incomes, population growth, and changing consumption patterns. The CAGR from 2025 to 2033 is projected to be xx%, driven primarily by increasing demand for dairy products in urban areas and growing adoption of value-added products like flavored yogurt and cheese spreads. Technological disruptions, such as automation in production and precision farming techniques, are enhancing efficiency and reducing costs.

Consumer preferences shift toward healthier, organic, and sustainably produced dairy products, creating opportunities for companies offering premium and specialized options. Competitive dynamics are shaped by intense rivalry among established players and the emergence of new entrants. Price competition, product innovation, and brand building are critical for success in this market. The market penetration rate of certain products, particularly specialized dairy products like organic butter, is still low but is showing rapid growth.

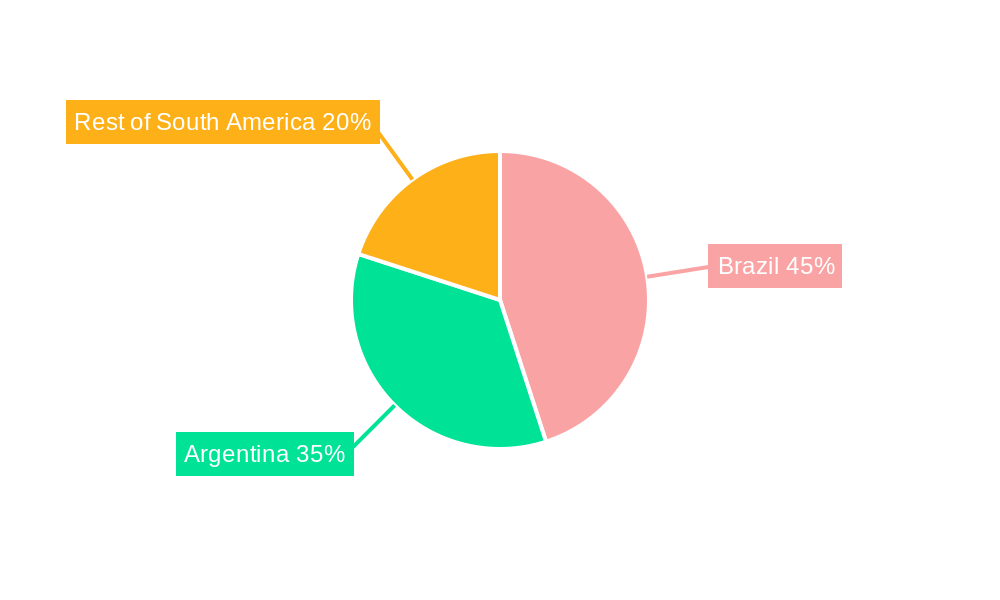

Dominant Regions & Segments in South America Dairy Market

Brazil is the dominant region in the South American dairy market, accounting for approximately xx% of the total market value in 2025. This dominance is attributable to a large population, strong economic growth, and well-established dairy production infrastructure. Argentina holds a significant position as well. The Rest of South America exhibits a lower but increasingly significant market size, driven by factors such as urbanization and changing consumer diets.

Within the distribution channels, the Off-Trade segment holds the largest share, reflecting the prominence of supermarkets and retail outlets. The On-Trade segment, while smaller, exhibits strong growth potential due to increasing out-of-home consumption. Butter remains a dominant category in the market, showing steady demand across all regions.

- Key Drivers of Brazil's Dominance: Large population, strong economy, well-developed dairy infrastructure.

- Key Drivers of Argentina's Significance: Established dairy sector, significant export market.

- Off-Trade Dominance: Driven by supermarket and retail store sales.

- On-Trade Growth Potential: Fueled by increased out-of-home consumption.

- Butter Category Dominance: Reflecting consistent consumer preference.

South America Dairy Market Product Innovations

Product innovation focuses on enhancing convenience, health benefits, and sustainability. Companies are introducing value-added products such as flavored yogurts, functional dairy beverages, and convenient single-serve options. Technological advancements, such as improved preservation techniques and packaging solutions, are extending product shelf life and enhancing quality. The emphasis on sustainability is driving the adoption of eco-friendly packaging and production practices. The market is receptive to products that cater to specific dietary needs and preferences, like lactose-free and organic dairy.

Report Scope & Segmentation Analysis

This report segments the South American dairy market by country (Argentina, Brazil, Rest of South America), distribution channel (Off-Trade, On-Trade), and product category (Butter). Each segment is analyzed based on market size, growth projections, and competitive dynamics. The report provides detailed information on the market share of key players within each segment. Growth projections indicate strong expansion across all segments, with Brazil and the Off-Trade channel exhibiting the most significant growth potential. Competitive dynamics are characterized by both intense rivalry among established players and opportunities for new entrants.

Key Drivers of South America Dairy Market Growth

Several factors drive the growth of the South American dairy market. Rising disposable incomes and a growing population, particularly in urban areas, fuel increased demand for dairy products. Changing consumer preferences toward convenient, value-added products create opportunities for innovation. The development of improved dairy farming practices and technology enhances production efficiency and quality. Government policies supporting the dairy sector create a positive environment for investment and growth.

Challenges in the South America Dairy Market Sector

The South American dairy market faces certain challenges. Fluctuations in raw material prices and exchange rates impact profitability. Maintaining consistent product quality and safety across a geographically diverse market can be challenging. Competition from substitute products, like plant-based alternatives, exerts downward pressure on prices. Regulatory hurdles and logistical issues can create complexities in distribution and operations.

Emerging Opportunities in South America Dairy Market

The South American dairy market presents significant opportunities for growth. Increasing demand for organic and sustainable dairy products creates a niche market for premium offerings. The expansion of e-commerce and online grocery platforms presents new distribution channels. The adoption of advanced technologies in production and processing can boost efficiency and reduce costs. Targeting specific consumer segments with tailored products will drive market penetration.

Leading Players in the South America Dairy Market Market

- SanCor Cooperativas Unidas Limitada

- Mastellone Hermanos SA

- Alpina Productos Alimenticios SA BIC

- Nestlé SA

- Laticinios Bela Vista Ltda

- Danone SA

- Sucesores de Alfredo Williner S

- Lacteos Betania SA

- Groupe Lactalis

Key Developments in South America Dairy Market Industry

- April 2021: Lactalis acquired assets in Brazil belonging to Cativa and signed a long-term milk supply contract with the cooperative, expanding its presence and securing milk supply.

- May 2021: Nestlé switched to sustainable packaging for MILO® and KLIM®, reducing plastic waste and CO2 emissions, showcasing commitment to environmentally friendly practices.

- January 2022: Alpina launched Alpina Snacks, a dried cheese snack brand, in Colombia, diversifying its product portfolio and targeting a growing snack market.

Future Outlook for South America Dairy Market Market

The South American dairy market is poised for sustained growth, driven by increasing demand, product innovation, and investments in sustainable practices. Strategic opportunities exist for companies focusing on value-added products, organic options, and convenient formats. The market's expansion will be shaped by the evolving consumer preferences and technological advancements, leading to a dynamic and competitive landscape.

South America Dairy Market Segmentation

-

1. Category

-

1.1. Butter

-

1.1.1. By Product Type

- 1.1.1.1. Cultured Butter

- 1.1.1.2. Uncultured Butter

-

1.1.1. By Product Type

-

1.2. Cheese

- 1.2.1. Natural Cheese

- 1.2.2. Processed Cheese

-

1.3. Cream

- 1.3.1. Double Cream

- 1.3.2. Single Cream

- 1.3.3. Whipping Cream

- 1.3.4. Others

-

1.4. Dairy Desserts

- 1.4.1. Cheesecakes

- 1.4.2. Frozen Desserts

- 1.4.3. Ice Cream

- 1.4.4. Mousses

-

1.5. Milk

- 1.5.1. Condensed milk

- 1.5.2. Flavored Milk

- 1.5.3. Fresh Milk

- 1.5.4. Powdered Milk

- 1.5.5. UHT Milk

- 1.6. Sour Milk Drinks

-

1.7. Yogurt

- 1.7.1. Flavored Yogurt

- 1.7.2. Unflavored Yogurt

-

1.1. Butter

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Retail

- 2.1.3. Specialist Retailers

- 2.1.4. Supermarkets and Hypermarkets

- 2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 2.2. On-Trade

-

2.1. Off-Trade

South America Dairy Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Dairy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products

- 3.3. Market Restrains

- 3.3.1. Presence of Preservatives in Ready Meals may Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Dairy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Butter

- 5.1.1.1. By Product Type

- 5.1.1.1.1. Cultured Butter

- 5.1.1.1.2. Uncultured Butter

- 5.1.1.1. By Product Type

- 5.1.2. Cheese

- 5.1.2.1. Natural Cheese

- 5.1.2.2. Processed Cheese

- 5.1.3. Cream

- 5.1.3.1. Double Cream

- 5.1.3.2. Single Cream

- 5.1.3.3. Whipping Cream

- 5.1.3.4. Others

- 5.1.4. Dairy Desserts

- 5.1.4.1. Cheesecakes

- 5.1.4.2. Frozen Desserts

- 5.1.4.3. Ice Cream

- 5.1.4.4. Mousses

- 5.1.5. Milk

- 5.1.5.1. Condensed milk

- 5.1.5.2. Flavored Milk

- 5.1.5.3. Fresh Milk

- 5.1.5.4. Powdered Milk

- 5.1.5.5. UHT Milk

- 5.1.6. Sour Milk Drinks

- 5.1.7. Yogurt

- 5.1.7.1. Flavored Yogurt

- 5.1.7.2. Unflavored Yogurt

- 5.1.1. Butter

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Retail

- 5.2.1.3. Specialist Retailers

- 5.2.1.4. Supermarkets and Hypermarkets

- 5.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Brazil South America Dairy Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Dairy Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Dairy Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 SanCor Cooperativas Unidas Limitada

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Mastellone Hermanos SA

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Alpina Productos Alimenticios SA BIC

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Nestlé SA

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Laticinios Bela Vista Ltda

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Danone SA

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Sucesores de Alfredo Williner S

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Lacteos Betania SA

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Groupe Lactalis

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 SanCor Cooperativas Unidas Limitada

List of Figures

- Figure 1: South America Dairy Market Revenue Breakdown (Billions, %) by Product 2024 & 2032

- Figure 2: South America Dairy Market Share (%) by Company 2024

List of Tables

- Table 1: South America Dairy Market Revenue Billions Forecast, by Region 2019 & 2032

- Table 2: South America Dairy Market Volume Liters Forecast, by Region 2019 & 2032

- Table 3: South America Dairy Market Revenue Billions Forecast, by Category 2019 & 2032

- Table 4: South America Dairy Market Volume Liters Forecast, by Category 2019 & 2032

- Table 5: South America Dairy Market Revenue Billions Forecast, by Distribution Channel 2019 & 2032

- Table 6: South America Dairy Market Volume Liters Forecast, by Distribution Channel 2019 & 2032

- Table 7: South America Dairy Market Revenue Billions Forecast, by Region 2019 & 2032

- Table 8: South America Dairy Market Volume Liters Forecast, by Region 2019 & 2032

- Table 9: South America Dairy Market Revenue Billions Forecast, by Country 2019 & 2032

- Table 10: South America Dairy Market Volume Liters Forecast, by Country 2019 & 2032

- Table 11: Brazil South America Dairy Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 12: Brazil South America Dairy Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 13: Argentina South America Dairy Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 14: Argentina South America Dairy Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 15: Rest of South America South America Dairy Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America South America Dairy Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 17: South America Dairy Market Revenue Billions Forecast, by Category 2019 & 2032

- Table 18: South America Dairy Market Volume Liters Forecast, by Category 2019 & 2032

- Table 19: South America Dairy Market Revenue Billions Forecast, by Distribution Channel 2019 & 2032

- Table 20: South America Dairy Market Volume Liters Forecast, by Distribution Channel 2019 & 2032

- Table 21: South America Dairy Market Revenue Billions Forecast, by Country 2019 & 2032

- Table 22: South America Dairy Market Volume Liters Forecast, by Country 2019 & 2032

- Table 23: Brazil South America Dairy Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 24: Brazil South America Dairy Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 25: Argentina South America Dairy Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 26: Argentina South America Dairy Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 27: Chile South America Dairy Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 28: Chile South America Dairy Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 29: Colombia South America Dairy Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 30: Colombia South America Dairy Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 31: Peru South America Dairy Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 32: Peru South America Dairy Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 33: Venezuela South America Dairy Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 34: Venezuela South America Dairy Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 35: Ecuador South America Dairy Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 36: Ecuador South America Dairy Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 37: Bolivia South America Dairy Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 38: Bolivia South America Dairy Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 39: Paraguay South America Dairy Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 40: Paraguay South America Dairy Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 41: Uruguay South America Dairy Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 42: Uruguay South America Dairy Market Volume (Liters) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Dairy Market?

The projected CAGR is approximately 5.11%.

2. Which companies are prominent players in the South America Dairy Market?

Key companies in the market include SanCor Cooperativas Unidas Limitada, Mastellone Hermanos SA, Alpina Productos Alimenticios SA BIC, Nestlé SA, Laticinios Bela Vista Ltda, Danone SA, Sucesores de Alfredo Williner S, Lacteos Betania SA, Groupe Lactalis.

3. What are the main segments of the South America Dairy Market?

The market segments include Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 54.12 Billions as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of Preservatives in Ready Meals may Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

January 2022: Alpina launched Alpina Snacks, a dried cheese snack brand, in Colombia.May 2021: Nestlé switched from plastic to paper straws and box covers for its MILO® and KLIM® products, preventing the use of 13 metric tons of plastic and the emission of 19.5 metric tons of CO2 annually.April 2021: Lactalis acquired assets in Brazil belonging to Cativa and also signed a long-term milk supply contract with the cooperative. The new deal in Brazil for Lactalis is involved in the production of milk, cream, butter, cheese, and dairy ingredients under the brands Parmalat, Galbani, and Président.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billions and volume, measured in Liters.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Dairy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Dairy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Dairy Market?

To stay informed about further developments, trends, and reports in the South America Dairy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence