Key Insights

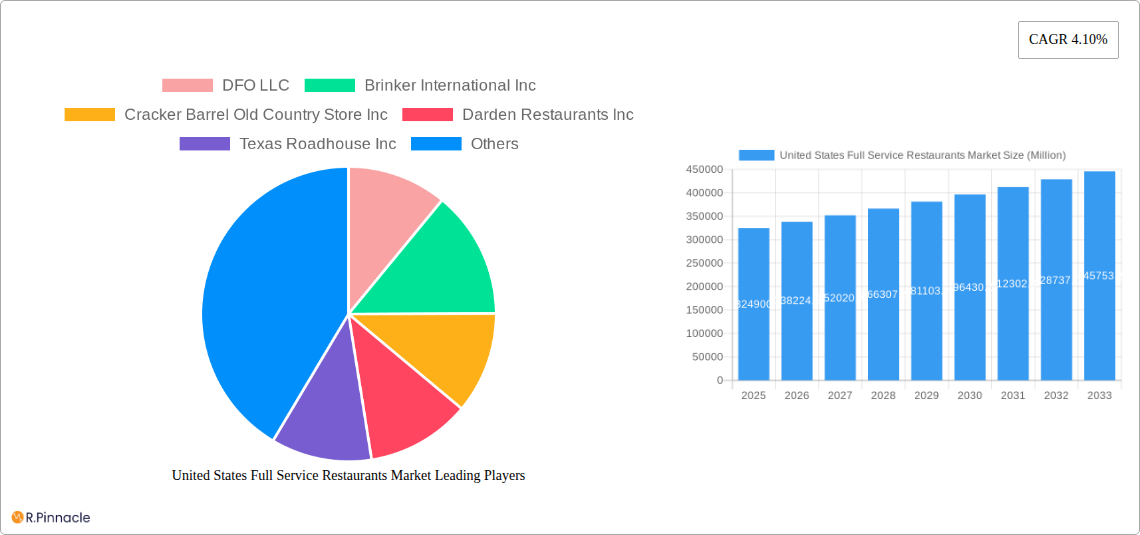

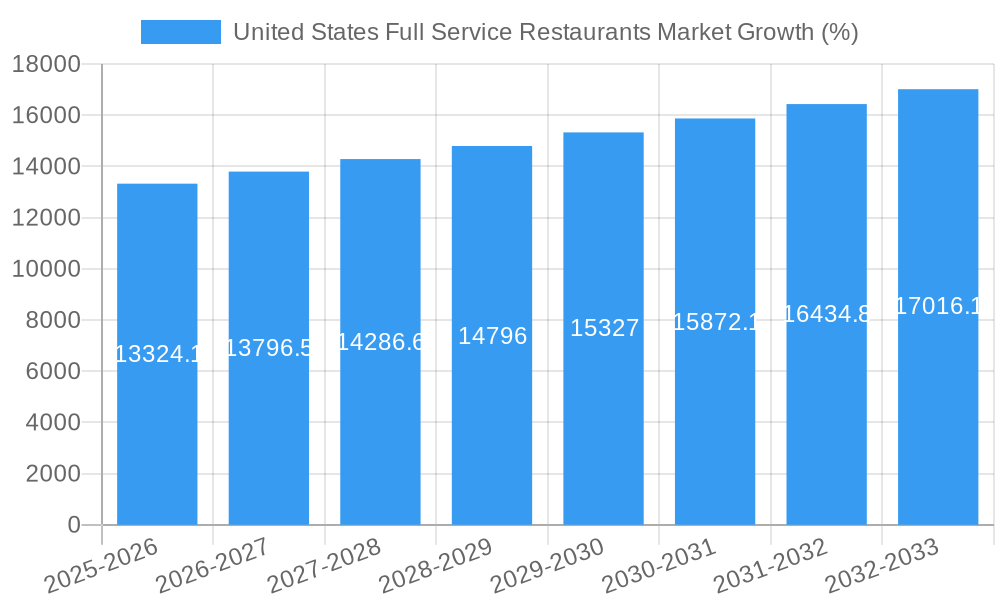

The United States Full Service Restaurant (FSR) market, valued at $324.9 billion in 2025, is projected to experience steady growth, driven by several key factors. Increasing disposable incomes, a growing preference for dining out experiences, and the diversification of culinary offerings across various cuisines (Asian, European, Latin American, Middle Eastern, and North American) are significant contributors to this expansion. The market is segmented by outlet type (chained and independent), location (leisure, lodging, retail, standalone, and travel), and cuisine, allowing for targeted market penetration strategies. While challenges exist, such as rising food costs and labor shortages, the resilience of the FSR sector is evident in its continued adaptation to evolving consumer preferences and technological advancements. The integration of online ordering, delivery services, and loyalty programs are key strategies employed by leading players like DFO LLC, Brinker International Inc, and The Cheesecake Factory Restaurants Inc to enhance customer engagement and drive sales. The robust presence of both national chains and independent restaurants across diverse geographic locations ensures market saturation and resilience to external economic pressures. The projected Compound Annual Growth Rate (CAGR) of 4.10% indicates a positive outlook for the market over the forecast period (2025-2033). Competition is fierce, necessitating continuous innovation and strategic marketing to retain market share.

Growth within specific segments is expected to vary. The chained outlet segment is likely to maintain a dominant position due to economies of scale and established brand recognition. However, independent outlets, often specializing in unique or niche cuisines, will continue to attract a loyal customer base, contributing to the overall market diversity. Location-wise, the leisure and lodging segments are anticipated to benefit from increased tourism and business travel, while the retail and standalone segments will depend on local demographics and economic conditions. Geographic variations within the United States are also expected, with urban areas exhibiting higher growth potential than rural areas due to higher population density and consumer spending. The continued success of the US FSR market hinges on addressing operational challenges while capitalizing on consumer preferences for convenience, quality, and diverse culinary experiences.

United States Full Service Restaurants Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Full Service Restaurants (FSR) market, covering the period 2019-2033. It delves into market structure, dynamics, dominant segments, key players, and future outlook, offering valuable insights for industry professionals, investors, and strategic decision-makers. The report leverages extensive data analysis and incorporates recent industry developments to provide a current and relevant perspective on this dynamic sector. Key findings include projected market size, CAGR, dominant segments, and leading companies' market share.

United States Full Service Restaurants Market Structure & Innovation Trends

This section analyzes the competitive landscape of the US FSR market, examining market concentration, innovation drivers, regulatory influences, and M&A activity. The report reveals the market share held by key players such as DFO LLC, Brinker International Inc, Cracker Barrel Old Country Store Inc, Darden Restaurants Inc, Texas Roadhouse Inc, The Cheesecake Factory Restaurants Inc, Red Lobster Hospitality LLC, Dine Brands Global Inc, Bloomin' Brands Inc, and BJ's Restaurants Inc. The analysis incorporates M&A deal values and identifies key trends shaping market consolidation.

- Market Concentration: The US FSR market exhibits a moderately concentrated structure, with the top 10 players accounting for approximately xx% of the market share in 2024.

- Innovation Drivers: Menu innovation, technological advancements (e.g., online ordering, delivery platforms), and enhanced customer experience are key drivers of market growth.

- Regulatory Framework: Federal and state regulations concerning food safety, labor laws, and alcohol service significantly impact market operations.

- Product Substitutes: Fast-casual dining and meal delivery services present significant competition to traditional FSRs.

- End-User Demographics: Millennials and Gen Z are shaping consumer preferences, driving demand for diverse cuisines, healthy options, and personalized experiences.

- M&A Activity: Recent years have witnessed significant M&A activity, driven by companies seeking expansion, diversification, and improved market positioning. For instance, the acquisition of Fuzzy's Taco Shop by Dine Brands Global in December 2022 for USD 80 Million highlights this trend.

United States Full Service Restaurants Market Dynamics & Trends

This section explores the key factors driving the growth and evolution of the US FSR market. The analysis covers market growth drivers, technological disruptions, evolving consumer preferences, and competitive dynamics. The report provides a detailed assessment of the CAGR and market penetration rates for various segments. Key factors influencing market dynamics are examined, including shifts in consumer spending patterns, the rising popularity of specific cuisines, and the impact of technological advancements. The report provides a comprehensive overview of the market's trajectory, including challenges and opportunities. The projected CAGR for the forecast period (2025-2033) is estimated to be xx%.

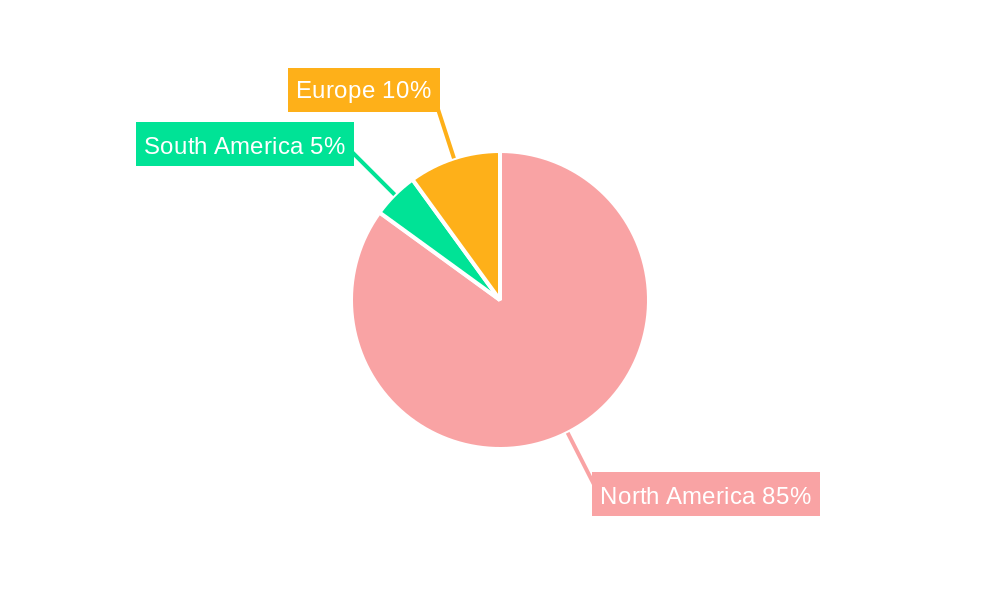

Dominant Regions & Segments in United States Full Service Restaurants Market

This section identifies the leading regions, countries, and segments within the US FSR market. The analysis considers cuisine type (Asian, European, Latin American, Middle Eastern, North American, Other FSR Cuisines), outlet type (Chained Outlets, Independent Outlets), and location (Leisure, Lodging, Retail, Standalone, Travel).

- Dominant Cuisine: North American cuisine continues to dominate, followed by Asian and other cuisines, exhibiting varying growth rates across regions.

- Dominant Outlet Type: Chained outlets hold a significant market share due to brand recognition, consistent quality, and effective marketing strategies.

- Dominant Location: Standalone restaurants continue to be the dominant location type, although the growth of FSRs within lodging and leisure sectors is noticeable.

Key Drivers:

- Economic Policies: Government regulations, tax policies, and economic stability directly influence consumer spending and investment in the FSR sector.

- Infrastructure: The availability of adequate infrastructure, including transportation and logistics, is crucial for the efficient operation of FSRs.

United States Full Service Restaurants Market Product Innovations

This section summarizes recent product developments and technological advancements in the US FSR market. The focus is on innovations that improve operational efficiency, enhance customer experience, and create competitive advantages. Key innovations include the adoption of online ordering systems, mobile payment options, and personalized menu recommendations based on customer preferences. The integration of technology has greatly impacted customer experience and operational efficiency, making these innovations crucial for success in the modern FSR landscape.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation of the US FSR market across various parameters:

- Cuisine: The report analyzes market size and growth projections for each cuisine type, highlighting competitive dynamics within each segment.

- Outlet: The analysis includes market size, growth projections, and competitive dynamics for chained and independent outlets.

- Location: The report examines the market size and growth potential of FSRs in different locations, considering their unique characteristics and competitive landscape.

Key Drivers of United States Full Service Restaurants Market Growth

The US FSR market's growth is driven by several key factors: increasing disposable incomes, changing lifestyles and dining habits, technological advancements facilitating convenience and efficiency, and the growing popularity of diverse culinary experiences. Government policies promoting tourism and hospitality also contribute to the market’s expansion.

Challenges in the United States Full Service Restaurants Market Sector

The US FSR market faces several challenges: rising operating costs, labor shortages, intense competition, fluctuating food prices, and stringent regulatory requirements. These factors put pressure on profitability and require operators to implement efficient strategies to maintain competitiveness.

Emerging Opportunities in United States Full Service Restaurants Market

Emerging opportunities include the expansion of delivery and takeout services, the growing popularity of specialized and niche cuisines, the adoption of technology to enhance the customer experience, and the development of sustainable and ethical sourcing practices. These trends offer significant potential for growth and innovation within the sector.

Leading Players in the United States Full Service Restaurants Market Market

- DFO LLC

- Brinker International Inc

- Cracker Barrel Old Country Store Inc

- Darden Restaurants Inc

- Texas Roadhouse Inc

- The Cheesecake Factory Restaurants Inc

- Red Lobster Hospitality LLC

- Dine Brands Global Inc

- Bloomin' Brands Inc

- BJ's Restaurants Inc

Key Developments in United States Full Service Restaurants Market Industry

- January 2023: Applebee’s announced the return of its USD 6 Smoocho Mucho Sips, aiming to boost customer traffic and engagement.

- December 2022: Dine Brands Global Inc. acquired Fuzzy's Taco Shop for USD 80 Million, expanding its portfolio and market reach.

- November 2022: Brinker International launched Chili's first to-go-only location, highlighting the growing importance of off-premise dining.

Future Outlook for United States Full Service Restaurants Market Market

The US FSR market is poised for continued growth, driven by evolving consumer preferences, technological advancements, and strategic initiatives by leading players. The market's future success will depend on adapting to changing consumer demands, embracing technological innovations, and effectively managing operational challenges. Strategic partnerships, diversification, and menu innovation will be key factors driving growth in the coming years.

United States Full Service Restaurants Market Segmentation

-

1. Cuisine

- 1.1. Asian

- 1.2. European

- 1.3. Latin American

- 1.4. Middle Eastern

- 1.5. North American

- 1.6. Other FSR Cuisines

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

United States Full Service Restaurants Market Segmentation By Geography

- 1. United States

United States Full Service Restaurants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1 A significant rise in tourist arrivals is driving the market growth

- 3.4.2 capitalizing on the opportunities presented by the influx of visitors

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 5.1.1. Asian

- 5.1.2. European

- 5.1.3. Latin American

- 5.1.4. Middle Eastern

- 5.1.5. North American

- 5.1.6. Other FSR Cuisines

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 6. North America United States Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 6.1.3 Mexico

- 7. South America United States Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 Brazil

- 7.1.2 Argentina

- 7.1.3 Rest of South America

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2024

- 8.2. Company Profiles

- 8.2.1 DFO LLC

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Brinker International Inc

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Cracker Barrel Old Country Store Inc

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Darden Restaurants Inc

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Texas Roadhouse Inc

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 The Cheesecake Factory Restaurants Inc

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Red Lobster Hospitality LLC

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Dine Brands Global Inc

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Bloomin' Brands Inc

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 BJ's Restaurants Inc

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.1 DFO LLC

List of Figures

- Figure 1: United States Full Service Restaurants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Full Service Restaurants Market Share (%) by Company 2024

List of Tables

- Table 1: United States Full Service Restaurants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Full Service Restaurants Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 3: United States Full Service Restaurants Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: United States Full Service Restaurants Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: United States Full Service Restaurants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States United States Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada United States Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico United States Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Brazil United States Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Argentina United States Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of South America United States Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States Full Service Restaurants Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 15: United States Full Service Restaurants Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 16: United States Full Service Restaurants Market Revenue Million Forecast, by Location 2019 & 2032

- Table 17: United States Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Full Service Restaurants Market?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the United States Full Service Restaurants Market?

Key companies in the market include DFO LLC, Brinker International Inc, Cracker Barrel Old Country Store Inc, Darden Restaurants Inc, Texas Roadhouse Inc, The Cheesecake Factory Restaurants Inc, Red Lobster Hospitality LLC, Dine Brands Global Inc, Bloomin' Brands Inc, BJ's Restaurants Inc.

3. What are the main segments of the United States Full Service Restaurants Market?

The market segments include Cuisine, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD 324,900 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

A significant rise in tourist arrivals is driving the market growth. capitalizing on the opportunities presented by the influx of visitors.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

January 2023: Applebee’s announced the return of its USD 6 Smoocho Mucho Sips.December 2022: Dine Brands Global Inc. acquired Fuzzy's Taco Shop® ("Fuzzy's") from Experiential Brands LLC, a wholly-owned subsidiary of NRD Holding Company, for USD 80 million in cash.November 2022: Brinker International announced that its brand Chili's Grill & Bar launched its first to-go-only location nationwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Full Service Restaurants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Full Service Restaurants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Full Service Restaurants Market?

To stay informed about further developments, trends, and reports in the United States Full Service Restaurants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence