Key Insights

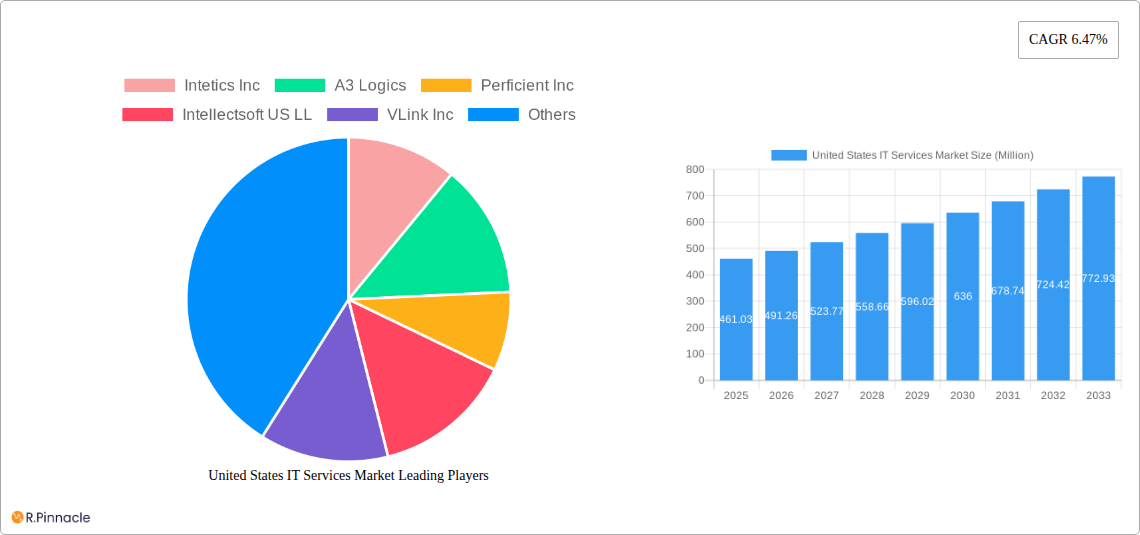

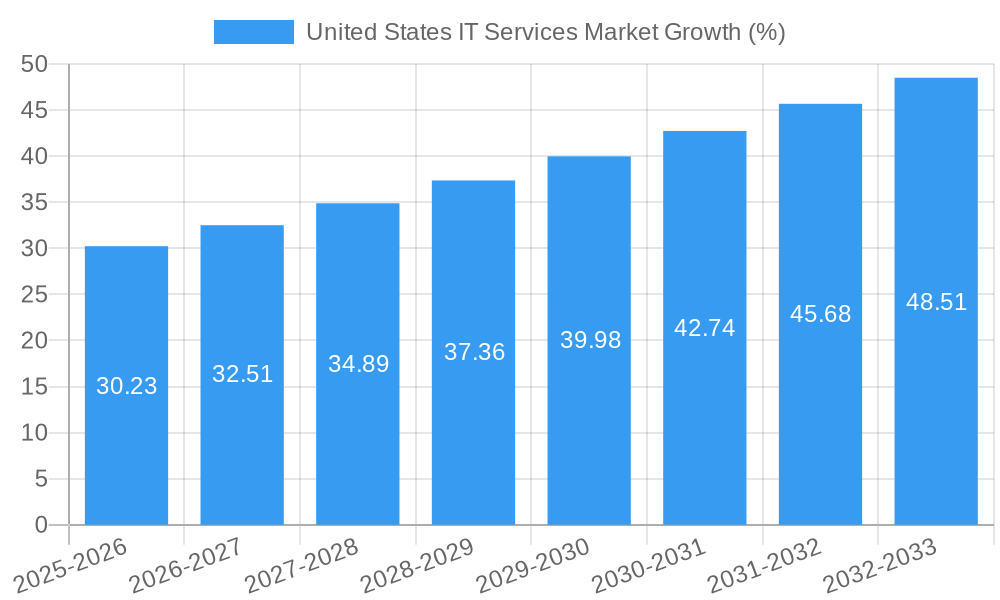

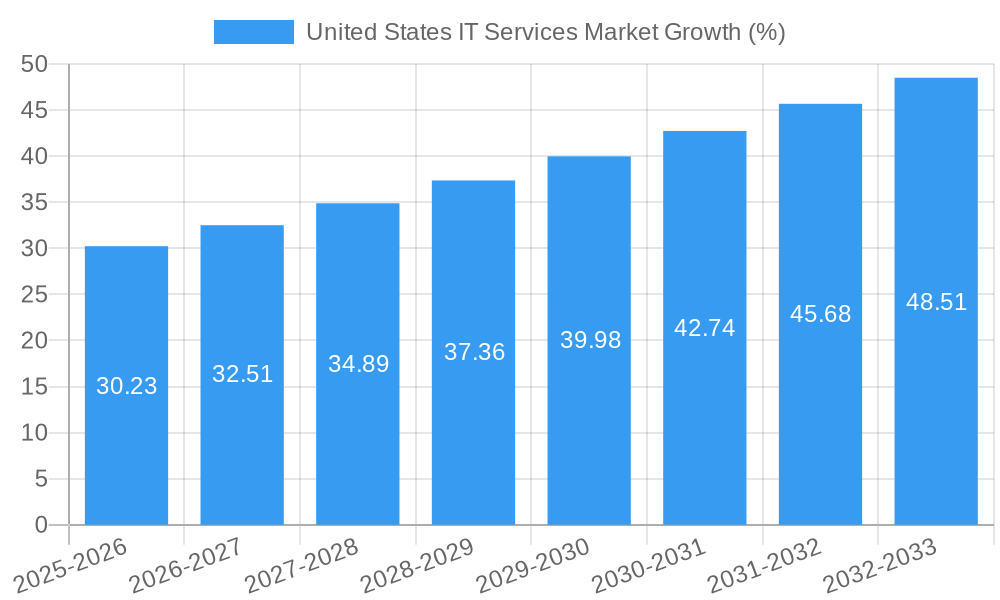

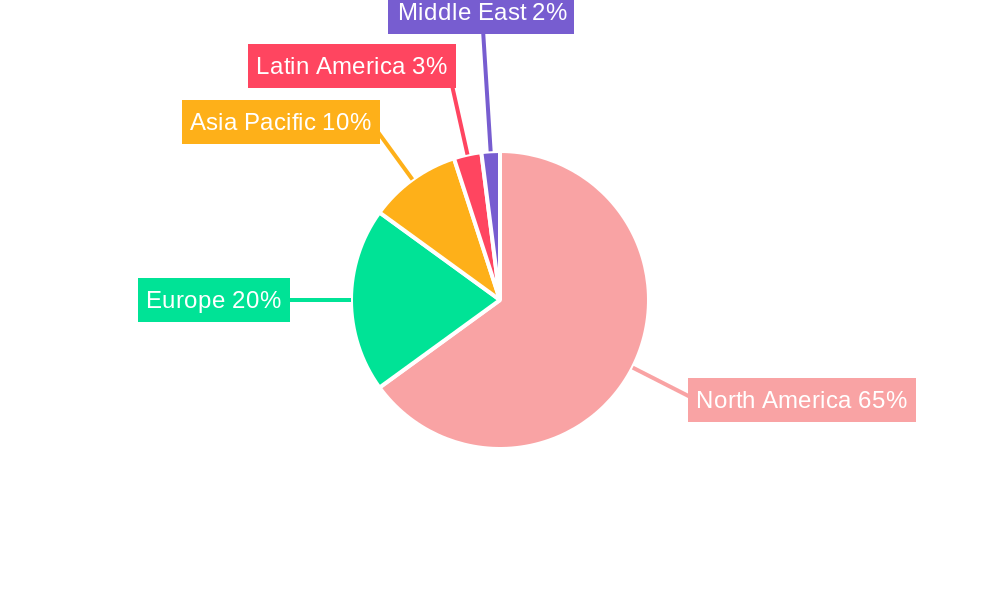

The United States IT services market, valued at $461.03 million in 2025, is projected to experience robust growth, driven by increasing digital transformation initiatives across diverse sectors and the escalating demand for cloud-based solutions and cybersecurity measures. The market's Compound Annual Growth Rate (CAGR) of 6.47% from 2025 to 2033 indicates a significant expansion over the forecast period. Key drivers include the growing adoption of artificial intelligence (AI), machine learning (ML), and big data analytics across industries like BFSI (Banking, Financial Services, and Insurance), healthcare, and manufacturing. Furthermore, the increasing reliance on IT outsourcing and business process outsourcing (BPO) to improve efficiency and reduce operational costs fuels market expansion. While the market faces restraints such as cybersecurity threats and the skills gap in the IT workforce, the ongoing technological advancements and the increasing investments in digital infrastructure are expected to mitigate these challenges. The segmentation by type (IT Consulting & Implementation, IT Outsourcing, BPO, etc.) and end-user (Manufacturing, Government, BFSI, etc.) provides insights into specific market opportunities and growth potential within each segment. North America is expected to retain a dominant market share due to its advanced technological infrastructure and high adoption rate of IT services.

The competitive landscape is highly fragmented, with numerous players ranging from large multinational corporations like Accenture and Infosys to smaller specialized firms. The presence of both global giants and niche players indicates the market’s maturity and diverse service offerings. Companies are focusing on strategic partnerships, mergers, and acquisitions to expand their service portfolios and market reach. The continuous innovation in areas such as cloud computing, cybersecurity, and data analytics will significantly influence the market’s trajectory. The market is expected to witness a shift towards more integrated and customized solutions, catering to the unique needs of various industries. Government initiatives promoting digitalization and investments in infrastructure projects further contribute to the market's positive outlook. Predicting precise regional breakdowns requires further data, but the North American market is expected to be the largest due to its strong technology sector and high spending on IT.

United States IT Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States IT services market, covering the period from 2019 to 2033. It offers actionable insights for industry professionals, investors, and stakeholders seeking to understand market dynamics, key players, and future growth opportunities. The report leverages extensive data analysis and expert insights to present a clear and concise overview of this rapidly evolving sector. The market is expected to reach xx Million by 2033.

United States IT Services Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment of the US IT services market. The market is characterized by a mix of large multinational corporations and smaller specialized firms. Market concentration is moderate, with a few dominant players holding significant market share, while numerous smaller companies compete in niche segments. The estimated market share of the top 5 players is approximately 40%, while the remaining market share is spread among several hundred companies.

Key aspects covered:

- Market Concentration: Analysis of market share held by leading players like Accenture PLC, IBM Corporation, Infosys Limited, and Wipro Limited, revealing the competitive intensity. The report will delve into the strategies employed by these players, including organic growth, acquisitions, and strategic partnerships.

- Innovation Drivers: Exploration of factors driving innovation, such as the increasing adoption of cloud computing, artificial intelligence (AI), big data analytics, and cybersecurity solutions. This section explores how these technologies shape the IT services landscape.

- Regulatory Frameworks: Examination of relevant regulations, compliance standards (e.g., HIPAA, GDPR), and their impact on market growth and technological adoption.

- Product Substitutes: Discussion of substitute products and services, including open-source solutions and the potential impact of these alternatives on market dynamics.

- End-User Demographics: Analysis of end-user segments and their influence on market demand, considering factors such as industry-specific needs and technological adoption rates.

- M&A Activities: Overview of significant mergers and acquisitions (M&A) in the IT services sector, examining deal values and strategic implications. For example, an analysis of the average deal value in the period 2019-2024, showing a trend of xx Million per deal.

United States IT Services Market Market Dynamics & Trends

This section provides a detailed examination of the market's growth trajectory, technological disruptions, evolving consumer preferences, and the competitive dynamics influencing the US IT services sector. The market has shown consistent growth over the past five years, driven by increasing digital transformation initiatives across various industries.

The report analyzes factors driving market growth, including:

- Technological Disruptions: Impact of emerging technologies like AI, machine learning, blockchain, and IoT on IT service offerings and business models.

- Consumer Preferences: Shifting preferences of businesses toward cloud-based solutions, managed services, and outcome-based pricing models.

- Competitive Dynamics: Analysis of the competitive landscape, including pricing strategies, product differentiation, and strategic alliances.

- Market Growth Drivers: Increased demand for digital transformation, cybersecurity solutions, and data analytics services fuels market growth.

- CAGR & Market Penetration: The report will provide data on the compound annual growth rate (CAGR) for the historical period (2019-2024) and forecast period (2025-2033). It will also quantify market penetration rates for key IT services segments, such as cloud computing and cybersecurity.

Dominant Regions & Segments in United States IT Services Market

This section identifies the leading regions and segments within the US IT services market, analyzing their growth drivers and competitive dynamics. The report will identify the dominant region (e.g., California, New York) based on revenue generated and market size. Similarly, the leading segments by type (e.g., IT Consulting and Implementation) and by end-user (e.g., BFSI) will be highlighted.

Key Drivers by Segment:

- By Type:

- IT Consulting and Implementation: Driven by increased demand for digital transformation strategies and technology implementation expertise.

- IT Outsourcing: Fueled by cost optimization initiatives and the need for access to specialized skills.

- Business Process Outsourcing (BPO): Driven by the need for improved efficiency and reduced operational costs.

- Other Types: Includes niche services like data analytics, cloud security, etc.

- By End-User:

- Manufacturing: Driven by automation, IoT adoption, and supply chain optimization needs.

- Government: Driven by the need for secure and efficient IT infrastructure, cyber security and modernization initiatives.

- BFSI (Banking, Financial Services, and Insurance): Driven by regulatory compliance, fraud prevention, and the need for advanced analytics.

- Healthcare: Driven by the need for secure data management, telehealth solutions, and improved patient care.

- Retail and Consumer Goods: Driven by the need for e-commerce platforms, personalization, and supply chain optimization.

- Logistics: Driven by the need for efficient supply chain management, real-time tracking, and data analytics.

- Other End-Users: This includes various other industries with increasing IT needs.

United States IT Services Market Product Innovations

The US IT services market is constantly evolving, with new products and services emerging to meet changing business needs. Recent innovations include advanced AI-powered solutions for data analysis, enhanced cybersecurity measures, and the integration of blockchain technology for secure data management. These innovations provide competitive advantages by improving efficiency, security, and decision-making capabilities for clients. These developments demonstrate a strong emphasis on providing tailored, outcome-focused solutions.

Report Scope & Segmentation Analysis

This report segments the US IT services market by type (IT Consulting and Implementation, IT Outsourcing, Business Process Outsourcing, Other Types) and by end-user (Manufacturing, Government, BFSI, Healthcare, Retail and Consumer Goods, Logistics, Other End-Users). Each segment is analyzed in terms of market size, growth projections, and competitive dynamics, providing a comprehensive understanding of the market's structure and future potential. The report will provide detailed market size (in Millions) for each segment for both the base year (2025) and the forecast period (2025-2033).

Key Drivers of United States IT Services Market Growth

Several factors are driving the growth of the US IT services market. The increasing adoption of cloud computing, AI, and big data analytics is transforming businesses across various sectors, leading to a surge in demand for IT services. Government initiatives promoting digital transformation and cybersecurity also contribute significantly. Furthermore, the growing need for enhanced security and data privacy measures fuels the demand for specialized IT services. Economic growth and increased investment in technology across sectors further contribute to market expansion.

Challenges in the United States IT Services Market Sector

Despite significant growth opportunities, the US IT services market faces several challenges. These include the need for skilled IT professionals, intense competition, and the complexity of regulatory compliance, particularly around data privacy and security. Supply chain disruptions can affect the availability of hardware and software, impacting service delivery. Furthermore, the rapid evolution of technology necessitates continuous investment in training and upskilling to remain competitive.

Emerging Opportunities in United States IT Services Market

The US IT services market offers several emerging opportunities. The growing adoption of edge computing, 5G technology, and the metaverse presents new avenues for growth. Businesses are increasingly focusing on sustainability and responsible AI, leading to demand for IT services supporting these initiatives. The increasing focus on cybersecurity and data privacy also presents significant opportunities for specialized service providers. Finally, the expansion of cloud-based services and the adoption of AI and machine learning across various sectors creates a continuously expanding market.

Leading Players in the United States IT Services Market Market

- Intetics Inc

- A3 Logics

- Perficient Inc

- Intellectsoft US LL

- VLink Inc

- MAS Global Consulting

- Kanda Software

- Infosys Limited

- Wipro Limited

- Edafio Technology Partners

- Accenture PLC

- Innowise Group

- Algoworks Solutions Inc

- Intersog

- IBM Corporation

- Premier BPO LLC

- TATA Consultancy Services Limited

- Ardem Incorporated

- Accedia

- Capgemini SE

- Peak Support LLC

- Synoptek LLC

- Sphere Partners LLC

- Centricsit LLC

- Microsoft Corporation

- Integris

- VATES S A

- Fingent Corp

- Wave Access USA

- Unity Communications

- Velvetech LLC

- Bottle Rocket LLC

- DevDigital LLC

- Atos SE

- Progent Corporation

- Icreon Holdings Inc

- Leidos Holdings Inc

- Galaxy Weblinks LTD

- Slalom Inc

- Sumerge

- CHI Software

- Simform

- Computer Solution East Inc

- HCL Technologies Limited

- Sciencesoft USA Corporation

Key Developments in United States IT Services Market Industry

- June 2023: Genpact partners with Walmart to support its North American finance and accounting operations, boosting Genpact's growth and contributing to the overall expansion of the US IT services market.

- March 2023: Virtusa Corporation partners with Aecon Group Inc. for cloud migration services, showcasing the growing demand for cloud-based solutions in the US market.

Future Outlook for United States IT Services Market Market

The future of the US IT services market is bright, driven by continued digital transformation across all sectors. The increasing adoption of new technologies, along with a growing need for cybersecurity and data analytics, will fuel market growth. Strategic partnerships, mergers, and acquisitions will further consolidate the market and lead to innovative service offerings. The market is poised for sustained growth, with opportunities for both established players and new entrants.

United States IT Services Market Segmentation

-

1. Type

- 1.1. IT Consulting and Implementation

- 1.2. IT Outsourcing

- 1.3. Business Process Outsourcing

- 1.4. Other Types

-

2. End-User

- 2.1. Manufacturing

- 2.2. Government

- 2.3. BFSI

- 2.4. Healthcare

- 2.5. Retail and Consumer Goods

- 2.6. Logistics

- 2.7. Other End-Users

United States IT Services Market Segmentation By Geography

- 1. United States

United States IT Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.47% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Acceleration of Digital Transformation Across Industries and Adoption of New Technologies; Growing Emphasis on Leveraging the Core Competencies by Outsourcing Non-core Operations

- 3.3. Market Restrains

- 3.3.1 Data Security

- 3.3.2 Customization

- 3.3.3 and Data Migration

- 3.4. Market Trends

- 3.4.1. IT Outsourcing to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States IT Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. IT Consulting and Implementation

- 5.1.2. IT Outsourcing

- 5.1.3. Business Process Outsourcing

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Manufacturing

- 5.2.2. Government

- 5.2.3. BFSI

- 5.2.4. Healthcare

- 5.2.5. Retail and Consumer Goods

- 5.2.6. Logistics

- 5.2.7. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America United States IT Services Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United States IT Services Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United States IT Services Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Latin America United States IT Services Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East United States IT Services Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Intetics Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 A3 Logics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Perficient Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Intellectsoft US LL

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 VLink Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MAS Global Consulting

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kanda Software

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Infosys Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Wipro Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Edafio Technology Partners

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Accenture PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Innowise Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Algoworks Solutions Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Intersog

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 IBM Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Premier BPO LLC

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 TATA Consultancy Services Limited

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Ardem Incorporated

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Accedia

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Capgemini SE

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Peak Support LLC

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Synoptek LLC

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Sphere Partners LLC

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Centricsit LLC

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Microsoft Corporation

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Integris

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 VATES S A

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 Fingent Corp

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 Wave Access USA

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 Unity Communications

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.31 Velvetech LLC

- 11.2.31.1. Overview

- 11.2.31.2. Products

- 11.2.31.3. SWOT Analysis

- 11.2.31.4. Recent Developments

- 11.2.31.5. Financials (Based on Availability)

- 11.2.32 Bottle Rocket LLC

- 11.2.32.1. Overview

- 11.2.32.2. Products

- 11.2.32.3. SWOT Analysis

- 11.2.32.4. Recent Developments

- 11.2.32.5. Financials (Based on Availability)

- 11.2.33 DevDigital LLC

- 11.2.33.1. Overview

- 11.2.33.2. Products

- 11.2.33.3. SWOT Analysis

- 11.2.33.4. Recent Developments

- 11.2.33.5. Financials (Based on Availability)

- 11.2.34 Atos SE

- 11.2.34.1. Overview

- 11.2.34.2. Products

- 11.2.34.3. SWOT Analysis

- 11.2.34.4. Recent Developments

- 11.2.34.5. Financials (Based on Availability)

- 11.2.35 Progent Corporation

- 11.2.35.1. Overview

- 11.2.35.2. Products

- 11.2.35.3. SWOT Analysis

- 11.2.35.4. Recent Developments

- 11.2.35.5. Financials (Based on Availability)

- 11.2.36 Icreon Holdings Inc

- 11.2.36.1. Overview

- 11.2.36.2. Products

- 11.2.36.3. SWOT Analysis

- 11.2.36.4. Recent Developments

- 11.2.36.5. Financials (Based on Availability)

- 11.2.37 Leidos Holdings Inc

- 11.2.37.1. Overview

- 11.2.37.2. Products

- 11.2.37.3. SWOT Analysis

- 11.2.37.4. Recent Developments

- 11.2.37.5. Financials (Based on Availability)

- 11.2.38 Galaxy Weblinks LTD

- 11.2.38.1. Overview

- 11.2.38.2. Products

- 11.2.38.3. SWOT Analysis

- 11.2.38.4. Recent Developments

- 11.2.38.5. Financials (Based on Availability)

- 11.2.39 Slalom Inc

- 11.2.39.1. Overview

- 11.2.39.2. Products

- 11.2.39.3. SWOT Analysis

- 11.2.39.4. Recent Developments

- 11.2.39.5. Financials (Based on Availability)

- 11.2.40 Sumerge

- 11.2.40.1. Overview

- 11.2.40.2. Products

- 11.2.40.3. SWOT Analysis

- 11.2.40.4. Recent Developments

- 11.2.40.5. Financials (Based on Availability)

- 11.2.41 CHI Software

- 11.2.41.1. Overview

- 11.2.41.2. Products

- 11.2.41.3. SWOT Analysis

- 11.2.41.4. Recent Developments

- 11.2.41.5. Financials (Based on Availability)

- 11.2.42 Simform

- 11.2.42.1. Overview

- 11.2.42.2. Products

- 11.2.42.3. SWOT Analysis

- 11.2.42.4. Recent Developments

- 11.2.42.5. Financials (Based on Availability)

- 11.2.43 Computer Solution East Inc

- 11.2.43.1. Overview

- 11.2.43.2. Products

- 11.2.43.3. SWOT Analysis

- 11.2.43.4. Recent Developments

- 11.2.43.5. Financials (Based on Availability)

- 11.2.44 HCL Technologies Limited

- 11.2.44.1. Overview

- 11.2.44.2. Products

- 11.2.44.3. SWOT Analysis

- 11.2.44.4. Recent Developments

- 11.2.44.5. Financials (Based on Availability)

- 11.2.45 Sciencesoft USA Corporation

- 11.2.45.1. Overview

- 11.2.45.2. Products

- 11.2.45.3. SWOT Analysis

- 11.2.45.4. Recent Developments

- 11.2.45.5. Financials (Based on Availability)

- 11.2.1 Intetics Inc

List of Figures

- Figure 1: United States IT Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States IT Services Market Share (%) by Company 2024

List of Tables

- Table 1: United States IT Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States IT Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: United States IT Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: United States IT Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United States IT Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: United States IT Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United States IT Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United States IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United States IT Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United States IT Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: United States IT Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: United States IT Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 17: United States IT Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States IT Services Market?

The projected CAGR is approximately 6.47%.

2. Which companies are prominent players in the United States IT Services Market?

Key companies in the market include Intetics Inc, A3 Logics, Perficient Inc, Intellectsoft US LL, VLink Inc, MAS Global Consulting, Kanda Software, Infosys Limited, Wipro Limited, Edafio Technology Partners, Accenture PLC, Innowise Group, Algoworks Solutions Inc, Intersog, IBM Corporation, Premier BPO LLC, TATA Consultancy Services Limited, Ardem Incorporated, Accedia, Capgemini SE, Peak Support LLC, Synoptek LLC, Sphere Partners LLC, Centricsit LLC, Microsoft Corporation, Integris, VATES S A, Fingent Corp, Wave Access USA, Unity Communications, Velvetech LLC, Bottle Rocket LLC, DevDigital LLC, Atos SE, Progent Corporation, Icreon Holdings Inc, Leidos Holdings Inc, Galaxy Weblinks LTD, Slalom Inc, Sumerge, CHI Software, Simform, Computer Solution East Inc, HCL Technologies Limited, Sciencesoft USA Corporation.

3. What are the main segments of the United States IT Services Market?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 461.03 Million as of 2022.

5. What are some drivers contributing to market growth?

Acceleration of Digital Transformation Across Industries and Adoption of New Technologies; Growing Emphasis on Leveraging the Core Competencies by Outsourcing Non-core Operations.

6. What are the notable trends driving market growth?

IT Outsourcing to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Data Security. Customization. and Data Migration.

8. Can you provide examples of recent developments in the market?

June 2023: Genpact, an IT service firm dedicated to driving transformative outcomes for businesses, proudly revealed its new partnership with Walmart. This strategic collaboration will see Genpact continue its unwavering support for Walmart's North American finance and accounting operations, with a particular focus on the USA market. This initiative is poised to not only propel Genpact's growth in the IT service sector but also contribute significantly to the overall expansion of the IT service market in the USA.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States IT Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States IT Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States IT Services Market?

To stay informed about further developments, trends, and reports in the United States IT Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence