Key Insights

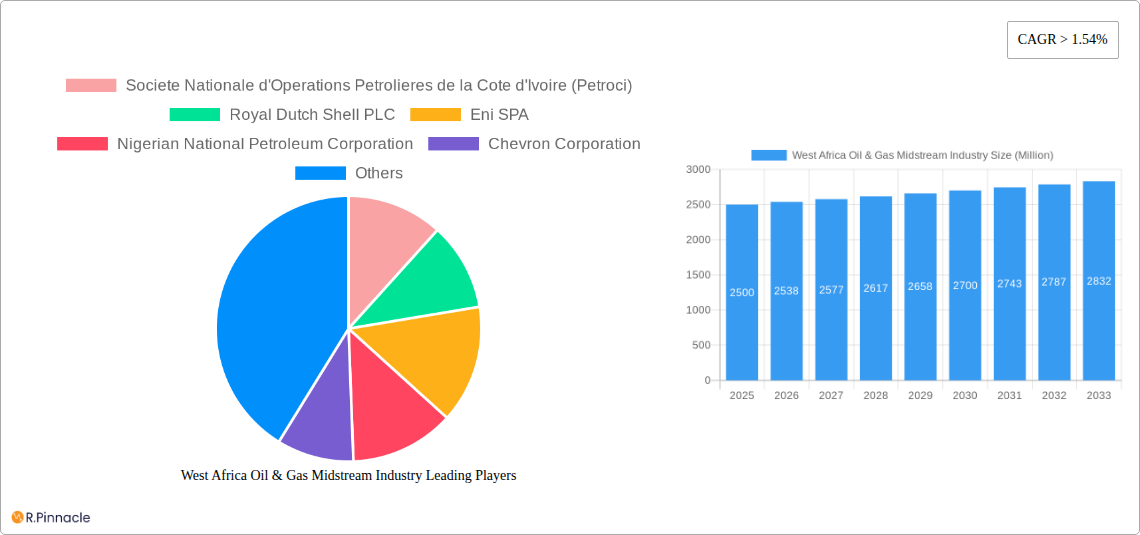

The West African Oil & Gas Midstream industry, encompassing transportation and storage, particularly LNG terminals, presents a robust growth trajectory. Driven by increasing domestic energy demand across nations like Nigeria, Angola, and Ghana, coupled with burgeoning export opportunities to global markets, the sector is projected to experience significant expansion. The market size, currently estimated at approximately $XX million in 2025 (assuming a reasonable figure based on the CAGR and other market reports on similar regions), is poised for considerable growth, fueled by substantial investments in infrastructure development. Key players like Société Nationale d'Opérations Pétrolières de la Côte d'Ivoire (Petroci), Royal Dutch Shell, Eni, and Chevron are actively shaping the market landscape, strategically positioning themselves to capitalize on the region's evolving energy dynamics. Growth is further accelerated by the ongoing expansion of LNG export facilities to cater to the increasing global demand for cleaner energy sources. While challenges such as geopolitical instability and infrastructure limitations exist, the overall outlook for the West African midstream sector remains positive, with substantial opportunities for growth and development over the forecast period.

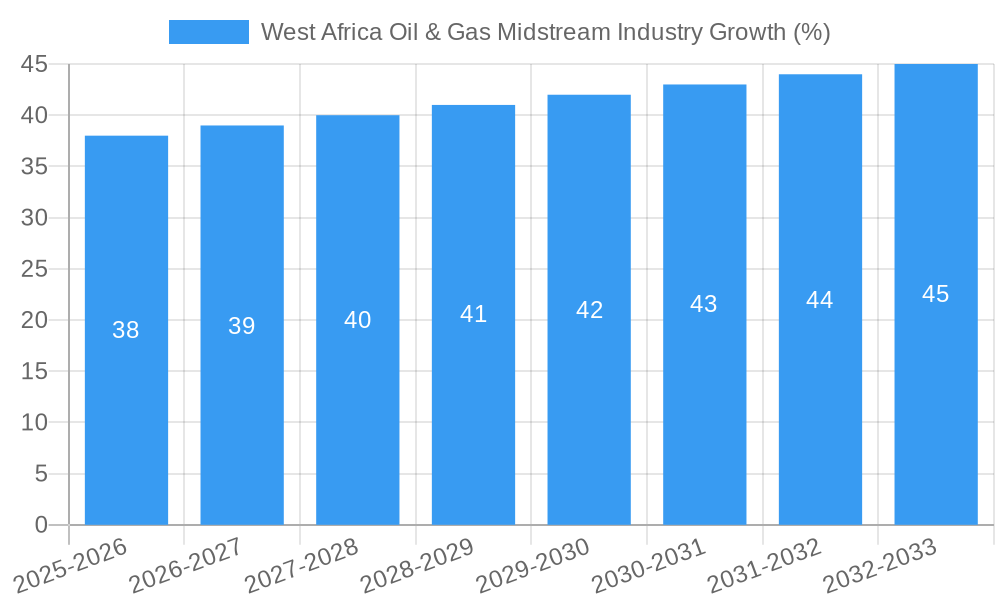

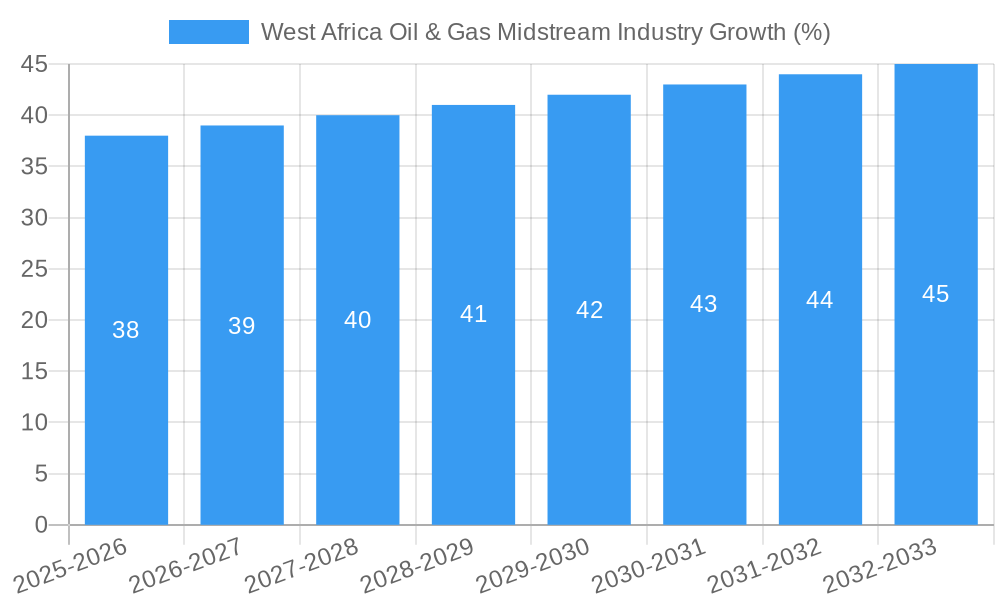

The forecast period of 2025-2033 offers substantial growth potential, with a compound annual growth rate (CAGR) exceeding 1.54%. This growth is primarily attributed to several factors, including government initiatives aimed at improving energy infrastructure, increasing investment in upstream oil and gas exploration, and the expansion of LNG production and export facilities. The expansion of regional pipelines, improved storage capacity, and the emergence of new LNG terminals will contribute to this growth. However, challenges such as regulatory uncertainties, funding limitations for certain infrastructure projects, and the need for technological advancements to enhance efficiency remain. Despite these challenges, the long-term prospects for the West African Oil & Gas Midstream market remain strong, driven by the region's vast energy reserves and growing demand both domestically and internationally. Strategic partnerships between international oil companies and local entities will further accelerate market growth.

West Africa Oil & Gas Midstream Industry Report: 2019-2033

Unlocking Growth Potential in West Africa's Dynamic Midstream Sector

This comprehensive report provides an in-depth analysis of the West Africa Oil & Gas Midstream industry, covering the period 2019-2033, with a focus on the critical year 2025. It offers invaluable insights for industry professionals, investors, and stakeholders seeking to navigate this dynamic market. The report leverages extensive data analysis and expert perspectives to illuminate key trends, challenges, and opportunities across transportation, storage, and LNG terminals. Expect detailed market sizing, CAGR projections, and competitive landscape analysis, ensuring you're well-equipped to make strategic decisions in this evolving sector.

West Africa Oil & Gas Midstream Industry Market Structure & Innovation Trends

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities within the West African oil and gas midstream sector. The study period (2019-2024) reveals a moderately concentrated market, with key players such as Royal Dutch Shell PLC, Eni SPA, Chevron Corporation, Nigerian National Petroleum Corporation, and Societe Nationale d'Operations Petrolieres de la Cote d'Ivoire (Petroci) holding significant market share. Estimated 2025 market share for Shell is xx%, Eni is xx%, Chevron is xx%, NNPC is xx%, and Petroci is xx%.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for 2025 is estimated at xx, indicating a moderately concentrated market.

- Innovation Drivers: Government initiatives promoting infrastructure development and investments in LNG export facilities are key innovation drivers.

- Regulatory Frameworks: Varying regulatory landscapes across West African nations impact investment decisions and operational efficiency.

- M&A Activity: The total value of M&A deals in the midstream sector between 2019 and 2024 reached approximately $xx Million, with an average deal size of $xx Million.

West Africa Oil & Gas Midstream Industry Market Dynamics & Trends

The West African oil and gas midstream market exhibits a complex interplay of factors driving its growth trajectory. From 2019 to 2024, the market experienced a CAGR of xx%, primarily fueled by rising oil and gas production, increasing demand for energy, and investments in infrastructure projects. Technological disruptions, such as the adoption of digitalization and automation in pipeline management and storage facilities, are reshaping operational efficiency and enhancing safety standards. However, competitive dynamics remain intense, with established players and emerging entrants vying for market share. Consumer preferences, while indirectly influencing demand, are largely shaped by energy prices and overall economic growth. The forecast period (2025-2033) projects continued growth, though at a potentially moderated pace, reaching a market value of $xx Million by 2033. This projection takes into account various factors such as fluctuating global energy prices, geopolitical stability, and evolving regulatory landscapes. The projected CAGR from 2025 to 2033 is estimated at xx%.

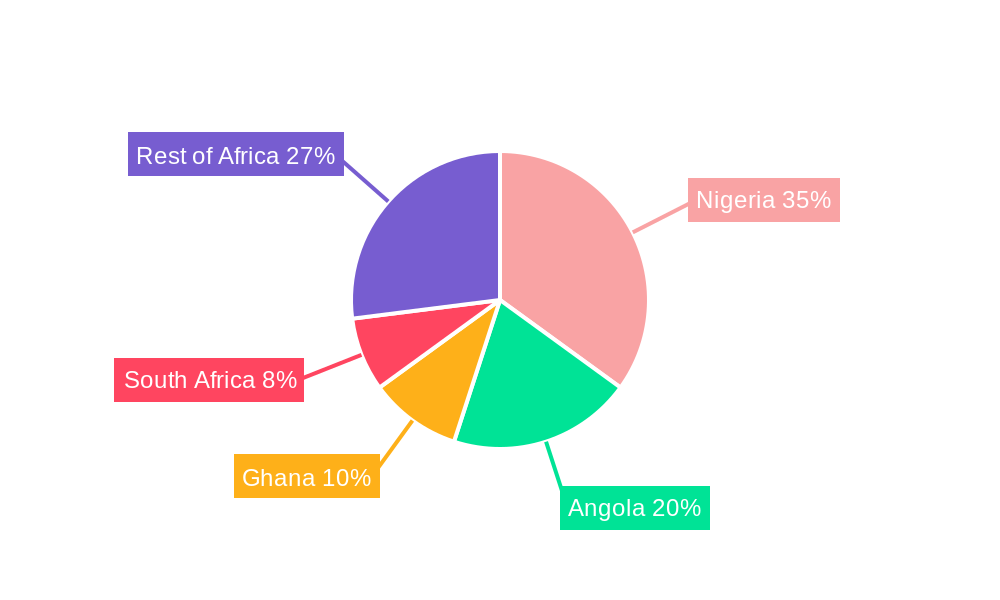

Dominant Regions & Segments in West Africa Oil & Gas Midstream Industry

Nigeria and Angola consistently lead the West African oil & gas midstream market, driven by their substantial hydrocarbon reserves and substantial investments in infrastructure development.

- Nigeria: Key drivers include its robust oil and gas production, substantial investment in LNG infrastructure, and favorable government policies, leading to significant market share in both transportation and storage segments.

- Angola: Angola's significant oil reserves and ongoing investments in midstream infrastructure have established it as a major player in the transportation segment.

- Transportation Segment: This segment dominates the market due to the extensive network of pipelines and other transportation infrastructure.

- Storage Segment: The storage segment displays significant growth potential, especially with increased LNG production and export capabilities.

- LNG Terminals: The development of new LNG terminals is contributing significantly to the growth of the midstream sector, primarily in Nigeria and Angola. This is driven by the rising global demand for LNG and the strategic location of these countries.

West Africa Oil & Gas Midstream Industry Product Innovations

Technological advancements are revolutionizing the West African oil and gas midstream sector. The integration of advanced analytics and artificial intelligence (AI) in pipeline monitoring and management enhances safety and operational efficiency. Similarly, the adoption of automation in storage facilities minimizes operational costs and improves asset utilization. These innovations align with the growing emphasis on sustainability and environmental responsibility within the industry, contributing to a competitive edge for companies adopting them.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation analysis of the West African oil & gas midstream market, covering:

- Transportation: This segment includes pipelines, trucks, and rail, with pipelines accounting for the largest share. Projected growth is xx% CAGR over the forecast period, driven by increased production and export capacity. Competitive dynamics are shaped by existing infrastructure and expansion plans.

- Storage: This encompasses onshore and offshore storage facilities, with onshore storage holding a larger share currently. The CAGR for the forecast period is projected at xx%, driven by increasing production and demand for storage facilities. Competition centers on storage capacity and location advantages.

- LNG Terminals: This segment is expected to experience significant growth, with a projected CAGR of xx% during the forecast period. Growth is fueled by rising global demand for LNG and the development of new export facilities. The market is currently dominated by a few key players, creating a relatively concentrated competitive landscape.

Key Drivers of West Africa Oil & Gas Midstream Industry Growth

The growth of the West African oil & gas midstream sector is propelled by several key factors, including substantial hydrocarbon reserves, growing domestic and export demand, and government-led initiatives to improve infrastructure. Further, increasing investments in LNG export facilities are fueling significant growth, especially in Nigeria and Angola. Strategic partnerships between international oil companies and local entities contribute to the overall growth momentum.

Challenges in the West Africa Oil & Gas Midstream Industry Sector

The sector faces significant challenges, including regulatory inconsistencies across different countries, inadequate infrastructure in some areas, and security concerns affecting pipeline operations. These factors can lead to delays in project implementation and increase operational costs. Furthermore, competition from emerging midstream players poses a challenge to established companies.

Emerging Opportunities in West Africa Oil & Gas Midstream Industry

The sector presents several exciting opportunities. The growing demand for natural gas, especially LNG, opens up lucrative avenues for investment in new infrastructure projects. The adoption of advanced technologies in pipeline management and storage is expected to boost efficiency and profitability. Finally, partnerships with local companies can foster collaborative growth and market expansion.

Leading Players in the West Africa Oil & Gas Midstream Industry Market

- Royal Dutch Shell PLC

- Eni SPA

- Chevron Corporation

- Nigerian National Petroleum Corporation

- Societe Nationale d'Operations Petrolieres de la Cote d'Ivoire (Petroci)

Key Developments in West Africa Oil & Gas Midstream Industry Industry

- 2022 Q3: Shell announces a significant investment in expanding its LNG export facilities in Nigeria.

- 2023 Q1: Eni completes the construction of a new pipeline connecting Angola’s oil fields to its storage facilities.

- 2024 Q2: A major pipeline project is initiated in Nigeria, aimed at enhancing the transportation of oil and gas across the country. This project is expected to increase Nigeria's midstream capacity and enhance operational efficiency.

Future Outlook for West Africa Oil & Gas Midstream Industry Market

The future of the West African oil and gas midstream sector is bright, propelled by consistent growth in oil and gas production, increased investment in infrastructure, and growing global demand for energy. Strategic partnerships between international and local companies are crucial to unlock the region's full potential and ensure sustainable growth. Technological advancements, particularly in pipeline management and storage, offer significant opportunities for enhancing operational efficiency, optimizing resource utilization, and mitigating environmental impacts. The market is poised for continued expansion, driven by these positive factors.

West Africa Oil & Gas Midstream Industry Segmentation

-

1. Type

-

1.1. Transportation

-

1.1.1. Overview

- 1.1.1.1. Existing Infrastructure

- 1.1.1.2. Projects in Pipeline

- 1.1.1.3. Upcoming Projects

-

1.1.1. Overview

- 1.2. Storage

- 1.3. LNG Terminals

-

1.1. Transportation

-

2. Geography

- 2.1. Nigeria

- 2.2. Ghana

- 2.3. Rest of West Africa

West Africa Oil & Gas Midstream Industry Segmentation By Geography

- 1. Nigeria

- 2. Ghana

- 3. Rest of West Africa

West Africa Oil & Gas Midstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.54% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Demand for Increaing Refinening Capacity4.; Increasing Investment in Downstream Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Fluctuating Price of Crude Oil May Impede the Development of the Downstream Sector

- 3.4. Market Trends

- 3.4.1. Pipeline Sector to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. West Africa Oil & Gas Midstream Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Transportation

- 5.1.1.1. Overview

- 5.1.1.1.1. Existing Infrastructure

- 5.1.1.1.2. Projects in Pipeline

- 5.1.1.1.3. Upcoming Projects

- 5.1.1.1. Overview

- 5.1.2. Storage

- 5.1.3. LNG Terminals

- 5.1.1. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Nigeria

- 5.2.2. Ghana

- 5.2.3. Rest of West Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Nigeria

- 5.3.2. Ghana

- 5.3.3. Rest of West Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Nigeria West Africa Oil & Gas Midstream Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Transportation

- 6.1.1.1. Overview

- 6.1.1.1.1. Existing Infrastructure

- 6.1.1.1.2. Projects in Pipeline

- 6.1.1.1.3. Upcoming Projects

- 6.1.1.1. Overview

- 6.1.2. Storage

- 6.1.3. LNG Terminals

- 6.1.1. Transportation

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Nigeria

- 6.2.2. Ghana

- 6.2.3. Rest of West Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Ghana West Africa Oil & Gas Midstream Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Transportation

- 7.1.1.1. Overview

- 7.1.1.1.1. Existing Infrastructure

- 7.1.1.1.2. Projects in Pipeline

- 7.1.1.1.3. Upcoming Projects

- 7.1.1.1. Overview

- 7.1.2. Storage

- 7.1.3. LNG Terminals

- 7.1.1. Transportation

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Nigeria

- 7.2.2. Ghana

- 7.2.3. Rest of West Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of West Africa West Africa Oil & Gas Midstream Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Transportation

- 8.1.1.1. Overview

- 8.1.1.1.1. Existing Infrastructure

- 8.1.1.1.2. Projects in Pipeline

- 8.1.1.1.3. Upcoming Projects

- 8.1.1.1. Overview

- 8.1.2. Storage

- 8.1.3. LNG Terminals

- 8.1.1. Transportation

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Nigeria

- 8.2.2. Ghana

- 8.2.3. Rest of West Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South Africa West Africa Oil & Gas Midstream Industry Analysis, Insights and Forecast, 2019-2031

- 10. Sudan West Africa Oil & Gas Midstream Industry Analysis, Insights and Forecast, 2019-2031

- 11. Uganda West Africa Oil & Gas Midstream Industry Analysis, Insights and Forecast, 2019-2031

- 12. Tanzania West Africa Oil & Gas Midstream Industry Analysis, Insights and Forecast, 2019-2031

- 13. Kenya West Africa Oil & Gas Midstream Industry Analysis, Insights and Forecast, 2019-2031

- 14. Rest of Africa West Africa Oil & Gas Midstream Industry Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Societe Nationale d'Operations Petrolieres de la Cote d'Ivoire (Petroci)

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Royal Dutch Shell PLC

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Eni SPA

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Nigerian National Petroleum Corporation

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Chevron Corporation

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.1 Societe Nationale d'Operations Petrolieres de la Cote d'Ivoire (Petroci)

List of Figures

- Figure 1: West Africa Oil & Gas Midstream Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: West Africa Oil & Gas Midstream Industry Share (%) by Company 2024

List of Tables

- Table 1: West Africa Oil & Gas Midstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: West Africa Oil & Gas Midstream Industry Volume Million Forecast, by Region 2019 & 2032

- Table 3: West Africa Oil & Gas Midstream Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: West Africa Oil & Gas Midstream Industry Volume Million Forecast, by Type 2019 & 2032

- Table 5: West Africa Oil & Gas Midstream Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: West Africa Oil & Gas Midstream Industry Volume Million Forecast, by Geography 2019 & 2032

- Table 7: West Africa Oil & Gas Midstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: West Africa Oil & Gas Midstream Industry Volume Million Forecast, by Region 2019 & 2032

- Table 9: West Africa Oil & Gas Midstream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: West Africa Oil & Gas Midstream Industry Volume Million Forecast, by Country 2019 & 2032

- Table 11: South Africa West Africa Oil & Gas Midstream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Africa West Africa Oil & Gas Midstream Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 13: Sudan West Africa Oil & Gas Midstream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sudan West Africa Oil & Gas Midstream Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 15: Uganda West Africa Oil & Gas Midstream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Uganda West Africa Oil & Gas Midstream Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 17: Tanzania West Africa Oil & Gas Midstream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Tanzania West Africa Oil & Gas Midstream Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 19: Kenya West Africa Oil & Gas Midstream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya West Africa Oil & Gas Midstream Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Africa West Africa Oil & Gas Midstream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Africa West Africa Oil & Gas Midstream Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 23: West Africa Oil & Gas Midstream Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 24: West Africa Oil & Gas Midstream Industry Volume Million Forecast, by Type 2019 & 2032

- Table 25: West Africa Oil & Gas Midstream Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: West Africa Oil & Gas Midstream Industry Volume Million Forecast, by Geography 2019 & 2032

- Table 27: West Africa Oil & Gas Midstream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: West Africa Oil & Gas Midstream Industry Volume Million Forecast, by Country 2019 & 2032

- Table 29: West Africa Oil & Gas Midstream Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 30: West Africa Oil & Gas Midstream Industry Volume Million Forecast, by Type 2019 & 2032

- Table 31: West Africa Oil & Gas Midstream Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: West Africa Oil & Gas Midstream Industry Volume Million Forecast, by Geography 2019 & 2032

- Table 33: West Africa Oil & Gas Midstream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: West Africa Oil & Gas Midstream Industry Volume Million Forecast, by Country 2019 & 2032

- Table 35: West Africa Oil & Gas Midstream Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 36: West Africa Oil & Gas Midstream Industry Volume Million Forecast, by Type 2019 & 2032

- Table 37: West Africa Oil & Gas Midstream Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: West Africa Oil & Gas Midstream Industry Volume Million Forecast, by Geography 2019 & 2032

- Table 39: West Africa Oil & Gas Midstream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: West Africa Oil & Gas Midstream Industry Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the West Africa Oil & Gas Midstream Industry?

The projected CAGR is approximately > 1.54%.

2. Which companies are prominent players in the West Africa Oil & Gas Midstream Industry?

Key companies in the market include Societe Nationale d'Operations Petrolieres de la Cote d'Ivoire (Petroci), Royal Dutch Shell PLC, Eni SPA, Nigerian National Petroleum Corporation, Chevron Corporation.

3. What are the main segments of the West Africa Oil & Gas Midstream Industry?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Demand for Increaing Refinening Capacity4.; Increasing Investment in Downstream Sector.

6. What are the notable trends driving market growth?

Pipeline Sector to Witness Growth.

7. Are there any restraints impacting market growth?

4.; Fluctuating Price of Crude Oil May Impede the Development of the Downstream Sector.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "West Africa Oil & Gas Midstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the West Africa Oil & Gas Midstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the West Africa Oil & Gas Midstream Industry?

To stay informed about further developments, trends, and reports in the West Africa Oil & Gas Midstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence