Key Insights

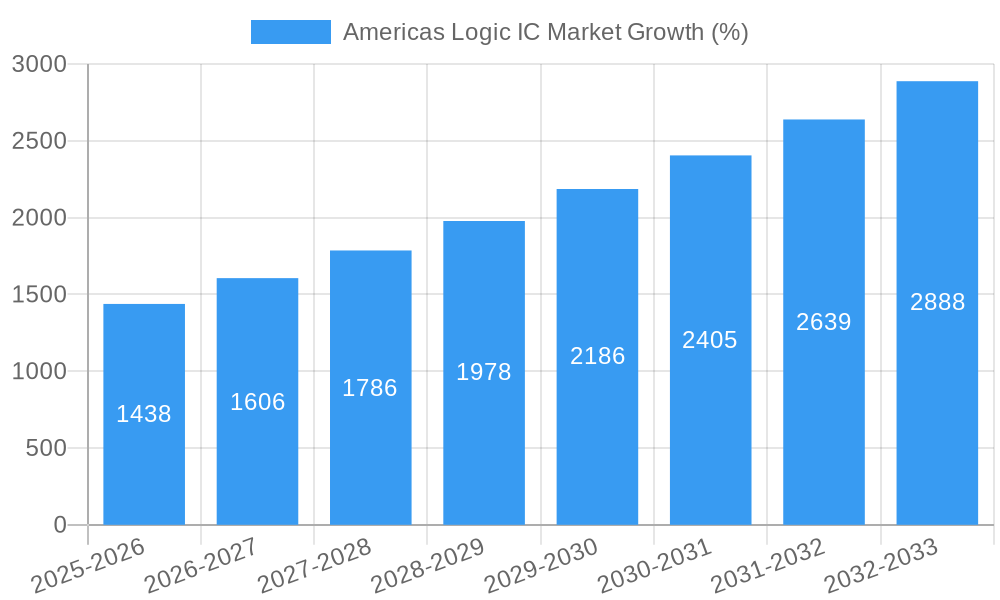

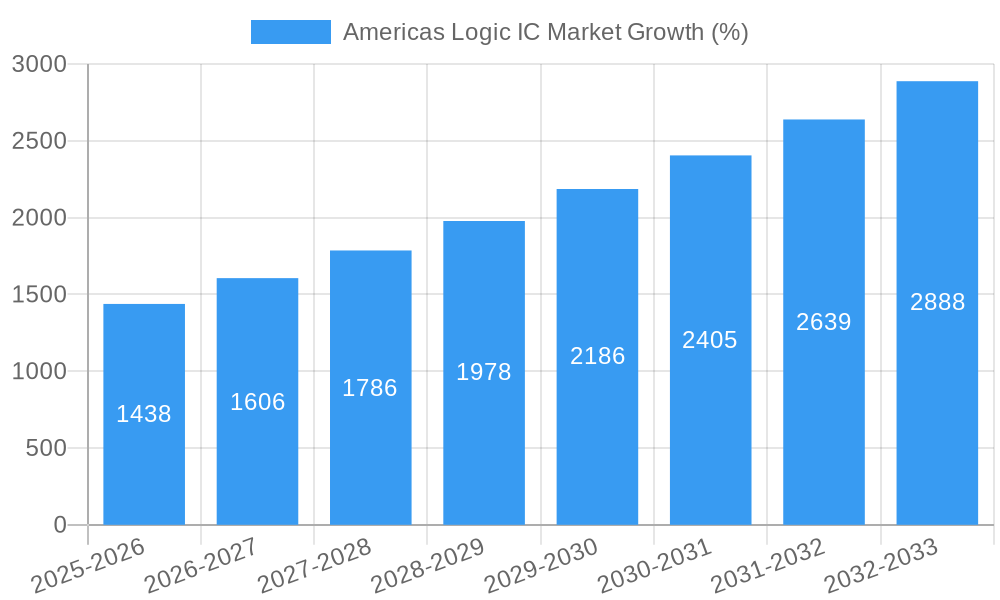

The Americas Logic IC market, encompassing North and South America, exhibits robust growth, driven by the increasing demand for sophisticated electronics across diverse sectors. The market's Compound Annual Growth Rate (CAGR) of 9.69% from 2019 to 2024 indicates a significant upward trajectory. This expansion is fueled by several key factors: the proliferation of consumer electronics, particularly smartphones and wearable devices, requiring advanced logic integrated circuits (ICs); the rapid growth of the automotive industry's adoption of advanced driver-assistance systems (ADAS) and electric vehicles (EVs), demanding high-performance logic ICs; and the continuous expansion of IT and telecommunications infrastructure, necessitating a wider array of logic chips for data processing and communication. Furthermore, the manufacturing and automation sectors are experiencing increasing automation and digitalization, bolstering demand for specialized logic ICs for industrial applications. Key players like Analog Devices, Microchip Technology, and Texas Instruments are leveraging technological advancements like smaller node sizes and advanced packaging to cater to this growing demand.

While the market enjoys considerable growth, certain constraints exist. Supply chain disruptions, particularly the global semiconductor shortage experienced in recent years, can significantly impact production and availability. Fluctuations in raw material costs and geopolitical factors can also influence pricing and market stability. However, the long-term outlook remains positive, with the ongoing technological advancements in the semiconductor industry and increasing application diversity offering significant growth opportunities within the Americas region, particularly in the high-growth segments like automotive and industrial automation. The market segmentation across product types (ASIC, ASSP, PLD), applications (consumer electronics, automotive, IT & Telecom), and logic types (standard, MOS special purpose) allows for a nuanced understanding of future trends, providing opportunities for targeted market penetration and innovative product development. The projected market size for 2025 provides a solid foundation for forecasting further growth in the coming years.

Americas Logic IC Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Americas Logic IC market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market trends, competitive dynamics, and future growth potential. We delve into key segments, including ASIC, ASSP, and PLD product types, across diverse applications such as consumer electronics, automotive, IT & telecommunications, and manufacturing. The report also examines the impact of significant industry developments, including the CHIPS Act and new export controls, shaping the future of this crucial sector.

Americas Logic IC Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences impacting the Americas Logic IC market. We examine market concentration, identifying key players and their respective market shares. The report explores the role of mergers and acquisitions (M&A) activities, quantifying deal values and their impact on market consolidation. Innovation drivers, including technological advancements and evolving end-user demands, are discussed alongside regulatory frameworks and their implications. Finally, the analysis considers the influence of product substitutes and end-user demographics on market dynamics.

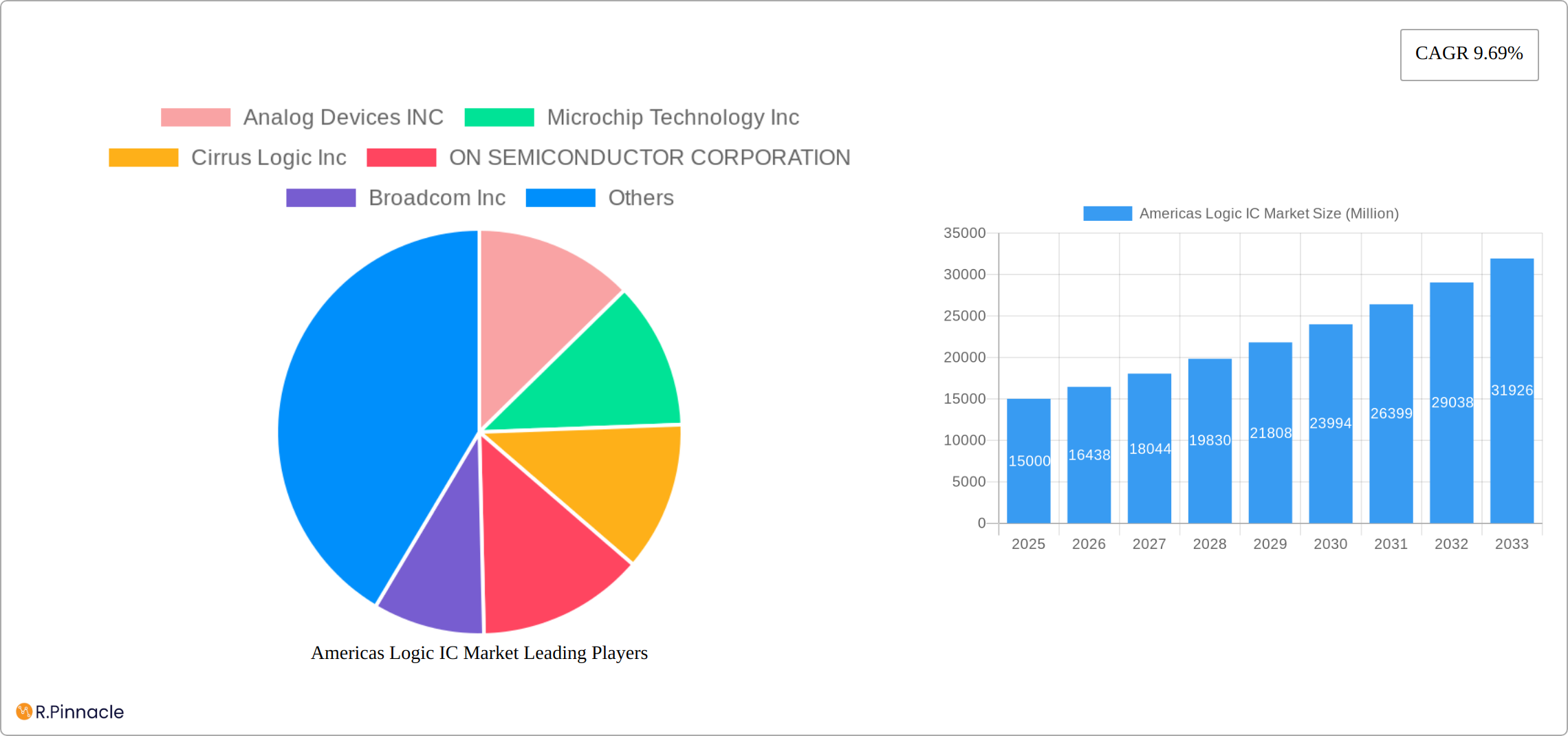

- Market Concentration: The market is moderately concentrated, with Analog Devices INC, Microchip Technology Inc, Cirrus Logic Inc, ON SEMICONDUCTOR CORPORATION, Broadcom Inc, Integrated Silicon Solution Inc ( ISSI), Advanced Micro Devices Inc, Texas Instruments Incorporated, Bourns Inc, and Intel Corporation holding significant market share. The exact percentage breakdown will be provided in the full report. Market share fluctuations over the historical period (2019-2024) are analyzed to establish trends.

- M&A Activity: The report details completed M&A transactions within the study period (2019-2024), analyzing deal values (in Millions) and their strategic rationale. Further projections on M&A activity in the forecast period (2025-2033) are presented. Examples include [specific deals if available, otherwise xx Million in value].

- Innovation Drivers: Key innovation drivers include advancements in miniaturization, low-power consumption technologies, and improved performance.

- Regulatory Frameworks: Regulations concerning data security and environmental compliance significantly influence market players.

Americas Logic IC Market Dynamics & Trends

This section analyzes market growth drivers, technological disruptions, consumer preferences, and competitive dynamics shaping the Americas Logic IC market. The analysis uses qualitative and quantitative data to illustrate market trends, including the Compound Annual Growth Rate (CAGR) and market penetration rates across various segments. Detailed explanations of market growth drivers and challenges are provided, with specific examples of disruptive technologies and changing consumer behavior. Competitive dynamics are analyzed, highlighting strategies employed by market leaders and emerging competitors. The analysis provides a comprehensive understanding of the factors that drive market growth and evolution.

The market is expected to experience a CAGR of xx% during the forecast period (2025-2033), driven by [Specific factors, e.g., increasing demand in the automotive sector, rising adoption of IoT devices]. Technological disruptions, such as the emergence of new materials and manufacturing processes, will further influence the market landscape. Changes in consumer preferences, including demand for smaller, more energy-efficient devices, will also contribute to market evolution. Competitive dynamics will remain intense, with major players vying for market share through product innovation and strategic partnerships.

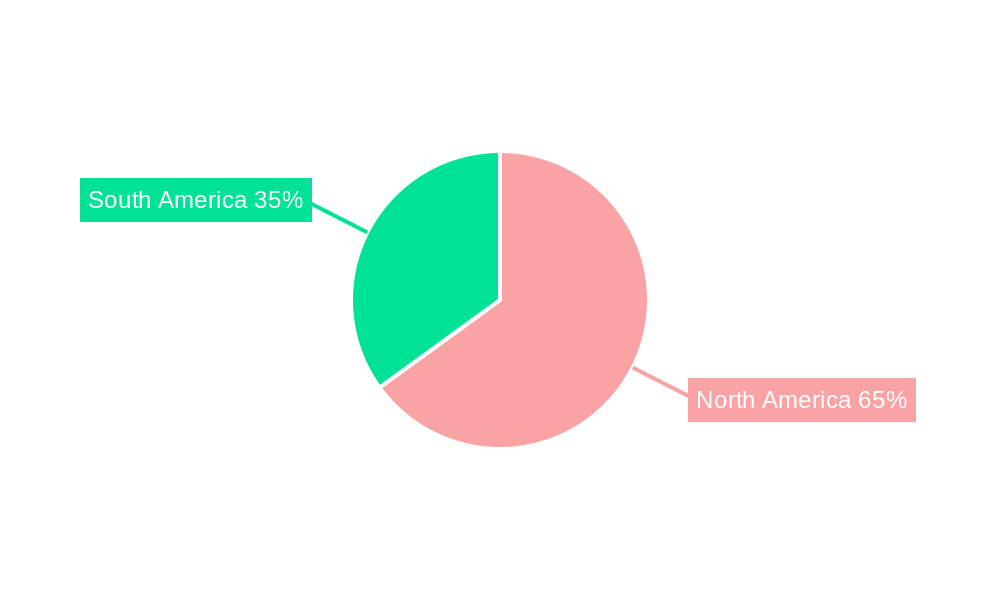

Dominant Regions & Segments in Americas Logic IC Market

This section identifies the leading regions, countries, and market segments within the Americas Logic IC market. A detailed analysis of each dominant segment (by Product Type, Application, and Type) is presented. The analysis highlights key factors driving segment dominance, including economic policies, infrastructure development, and consumer preferences. The report offers a deep dive into each segment's market size and growth projections, providing critical insights for strategic decision-making.

- Leading Region: The [Specific region, e.g., United States] is expected to dominate the Americas Logic IC market due to [Reasons, e.g., strong domestic semiconductor industry, substantial government investments in R&D].

- Dominant Product Types:

- ASIC: Strong growth driven by [Specific reasons, e.g., increasing demand for customized solutions].

- ASSP: High market share attributed to [Specific reasons, e.g., broad applications across multiple sectors].

- PLD: Moderate growth expected due to [Specific reasons, e.g., cost-effectiveness for programmable logic].

- Leading Applications:

- Consumer Electronics: [Reasons for dominance e.g., high volume production, diverse range of applications]

- Automotive: [Reasons for dominance e.g., increasing demand for advanced driver-assistance systems]

- IT & Telecommunications: [Reasons for dominance e.g., high demand for high-speed data processing]

- Dominant Type:

- Logic Standard: [Reasons for dominance e.g., widespread applicability across many segments]

- MOS Special Purpose Logic: [Reasons for dominance e.g., niche applications with high performance]

Americas Logic IC Market Product Innovations

Recent product innovations have focused on enhancing performance, reducing power consumption, and increasing integration levels. Companies are developing advanced logic ICs with higher speeds, lower latency, and improved reliability. New applications for logic ICs are emerging in areas like artificial intelligence and high-performance computing. These innovations are driving market growth and shaping competitive dynamics.

Report Scope & Segmentation Analysis

This report segments the Americas Logic IC market by Product Type (ASIC, ASSP, PLD), Application (Consumer Electronics, Automotive, IT & Telecommunications, Manufacturing and Automation, Other End-user Industries), and Type (Logic Standard, MOS Special Purpose Logic). Each segment's market size, growth projections, and competitive dynamics are analyzed, providing a granular understanding of market structure and opportunities.

- Product Type: Each product type is analyzed regarding its market size (in Millions), growth rate, and key players.

- Application: Each application segment's market size, growth projections, and associated trends are assessed.

- Type: Analysis of market size, growth projections, and competitive landscape for each type of logic IC.

Key Drivers of Americas Logic IC Market Growth

Several factors drive the growth of the Americas Logic IC market. Technological advancements, particularly in miniaturization and low-power consumption, are key drivers. Strong demand from end-use sectors like consumer electronics, automotive, and IT & telecommunications fuels market expansion. Government initiatives like the CHIPS Act, aiming to boost domestic semiconductor production, further stimulate market growth.

Challenges in the Americas Logic IC Market Sector

The Americas Logic IC market faces challenges including supply chain disruptions, increased competition from Asian manufacturers, and regulatory hurdles related to trade and technology transfer. These factors can impact production costs, timelines, and profitability, necessitating strategic adaptations by market players.

Emerging Opportunities in Americas Logic IC Market

Emerging opportunities exist in areas like the Internet of Things (IoT), artificial intelligence (AI), and autonomous vehicles. These technological advancements create demand for advanced logic ICs with enhanced capabilities. Expansion into new markets and strategic partnerships offer further growth potential.

Leading Players in the Americas Logic IC Market Market

- Analog Devices INC

- Microchip Technology Inc

- Cirrus Logic Inc

- ON SEMICONDUCTOR CORPORATION

- Broadcom Inc

- Integrated Silicon Solution Inc ( ISSI)

- Advanced Micro Devices Inc

- Texas Instruments Incorporated

- Bourns Inc

- Intel Corporation

Key Developments in Americas Logic IC Market Industry

- September 2022: The US Department of Commerce unveiled its strategy to implement the CHIPS Act, allocating USD 50 Billion to boost domestic semiconductor manufacturing and reduce reliance on Asian manufacturers. This significantly impacts the market by encouraging domestic production and potentially shifting supply chains.

- October 2022: The Biden administration imposed new export controls restricting China's access to certain semiconductor chips made using US equipment. This development alters the global supply chain and influences demand for logic ICs within the Americas.

Future Outlook for Americas Logic IC Market Market

The Americas Logic IC market exhibits robust growth potential, driven by technological advancements, increasing demand from various sectors, and supportive government policies. Strategic investments in research and development, along with collaborations to optimize supply chains, present significant opportunities for market players to capitalize on the expanding market.

Americas Logic IC Market Segmentation

-

1. Type

- 1.1. Logic Standard

- 1.2. MOS Special Purpose Logic

-

2. Product Type

- 2.1. ASIC

- 2.2. ASSP

- 2.3. PLD

-

3. Application

- 3.1. Consumer Electronics

- 3.2. Automotive

- 3.3. IT & Telecommunications

- 3.4. Manufacturing and Automation

- 3.5. Other En

Americas Logic IC Market Segmentation By Geography

-

1. Americas

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Brazil

- 1.5. Argentina

- 1.6. Chile

- 1.7. Colombia

- 1.8. Peru

Americas Logic IC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.69% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Focus on Integration of Devices; Rising Capital Spending by Fabs to Increase Production Capacities

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations; Lack of Skilled Radiation Professionals

- 3.4. Market Trends

- 3.4.1. Growing Adoption of Logic IC in Automotive Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Americas Logic IC Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Logic Standard

- 5.1.2. MOS Special Purpose Logic

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. ASIC

- 5.2.2. ASSP

- 5.2.3. PLD

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Consumer Electronics

- 5.3.2. Automotive

- 5.3.3. IT & Telecommunications

- 5.3.4. Manufacturing and Automation

- 5.3.5. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Americas

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Latin America Americas Logic IC Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 Mexico

- 6.1.2 Brazil

- 7. North America Americas Logic IC Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 United States

- 7.1.2 Canada

- 7.1.3 Mexico

- 8. South America Americas Logic IC Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 Brazil

- 8.1.2 Argentina

- 8.1.3 Rest of South America

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Analog Devices INC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Microchip Technology Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Cirrus Logic Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 ON SEMICONDUCTOR CORPORATION

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Broadcom Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Integrated Silicon Solution Inc ( ISSI)

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Advanced Micro Devices Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Texas Instruments Incorporated

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Bourns Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Intel Corporation

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Analog Devices INC

List of Figures

- Figure 1: Americas Logic IC Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Americas Logic IC Market Share (%) by Company 2024

List of Tables

- Table 1: Americas Logic IC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Americas Logic IC Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Americas Logic IC Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Americas Logic IC Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Americas Logic IC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Americas Logic IC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Mexico Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Brazil Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Americas Logic IC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United States Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Canada Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Mexico Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Americas Logic IC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Americas Logic IC Market Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Americas Logic IC Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Americas Logic IC Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Americas Logic IC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United States Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Canada Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Mexico Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Brazil Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Argentina Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Chile Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Colombia Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Peru Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Americas Logic IC Market?

The projected CAGR is approximately 9.69%.

2. Which companies are prominent players in the Americas Logic IC Market?

Key companies in the market include Analog Devices INC, Microchip Technology Inc, Cirrus Logic Inc, ON SEMICONDUCTOR CORPORATION, Broadcom Inc, Integrated Silicon Solution Inc ( ISSI), Advanced Micro Devices Inc, Texas Instruments Incorporated, Bourns Inc, Intel Corporation.

3. What are the main segments of the Americas Logic IC Market?

The market segments include Type, Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Focus on Integration of Devices; Rising Capital Spending by Fabs to Increase Production Capacities.

6. What are the notable trends driving market growth?

Growing Adoption of Logic IC in Automotive Industries.

7. Are there any restraints impacting market growth?

Stringent Government Regulations; Lack of Skilled Radiation Professionals.

8. Can you provide examples of recent developments in the market?

October 2022: The Biden administration issued a new set of export controls. As per the new set of regulations, the US would be cutting China off from certain semiconductor chips made anywhere in the world with US equipment to slow down Beijing's technological and military advances. Such regulations are expected to further influence the demand for Logic ICs in the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Americas Logic IC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Americas Logic IC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Americas Logic IC Market?

To stay informed about further developments, trends, and reports in the Americas Logic IC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence