Key Insights

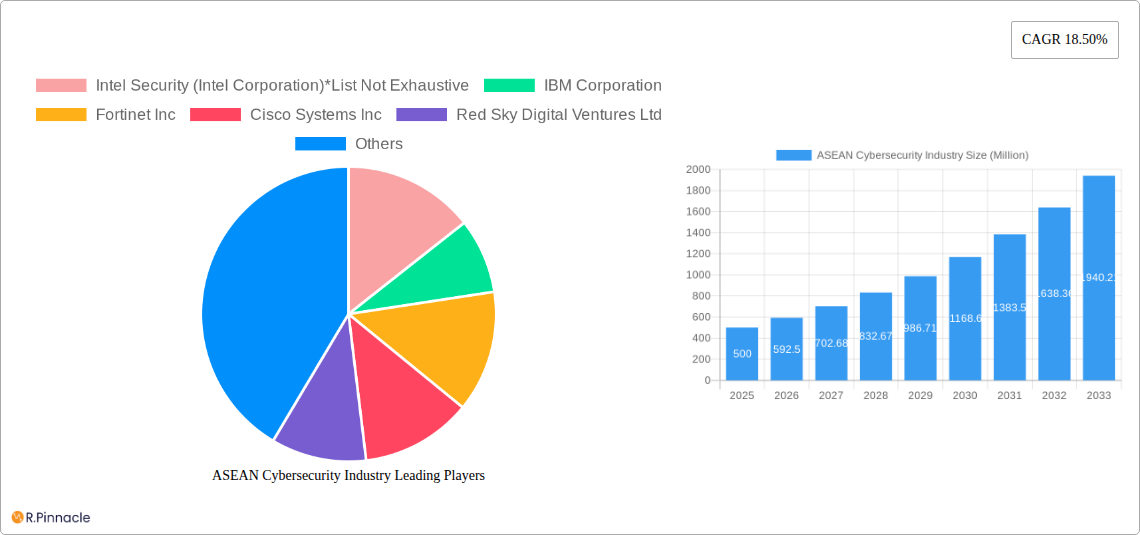

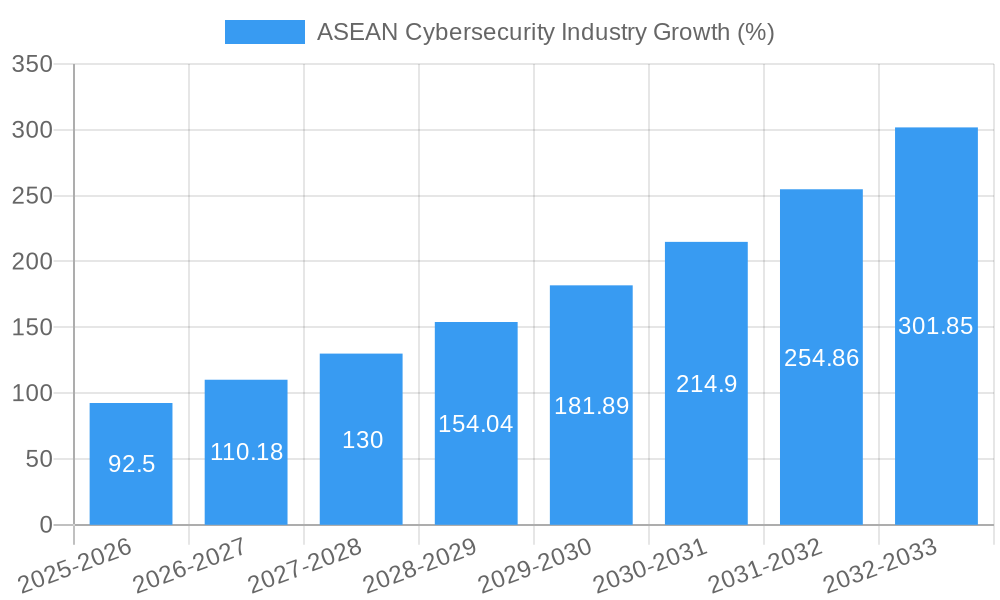

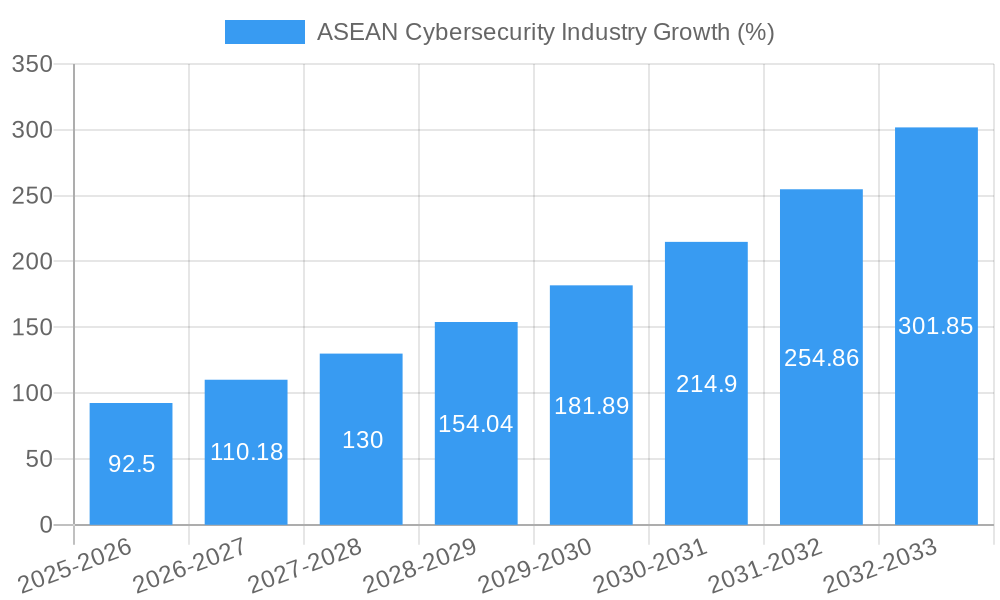

The ASEAN cybersecurity market presents a significant growth opportunity, driven by increasing digitalization, rising cyber threats, and stringent government regulations. With a Compound Annual Growth Rate (CAGR) of 18.50% from 2019 to 2033, the market is expected to experience substantial expansion. The market size in 2025 is estimated to be in the hundreds of millions of dollars (a precise figure cannot be provided without the missing "XX" value, but considering similar regional markets and the provided CAGR, a reasonable estimate would place it within the range of $300 million to $700 million). Key drivers include the proliferation of connected devices, the expanding adoption of cloud computing, and the increasing sophistication of cyberattacks targeting financial institutions, healthcare providers, and government agencies. The growth is further fueled by rising awareness of cybersecurity risks among businesses and consumers, leading to increased investments in security solutions. Market segments such as cloud-based security and services are expected to show particularly strong growth, exceeding the overall market CAGR. However, challenges remain, including a shortage of skilled cybersecurity professionals, a lack of cybersecurity awareness among some users and organizations, and the evolving nature of cyber threats, which constantly requires adaptation and investment.

The market's segmentation reflects diverse needs across various sectors. The BFSI (Banking, Financial Services, and Insurance) sector, owing to its sensitive data, leads in cybersecurity spending. Healthcare, manufacturing, and government & defense sectors follow closely, with significant investments driven by data protection and regulatory compliance requirements. The IT and Telecommunication sector's contribution is also considerable due to their crucial role in managing digital infrastructure. Companies like Intel Security, IBM, Fortinet, Cisco, and others are actively competing in this dynamic market, offering a range of solutions from security software and hardware to consulting services. The geographical focus on Belgium, Netherlands, and Luxembourg within the broader ASEAN context suggests a possible focus on a specific region within ASEAN or a data reporting limitation; a fuller regional breakdown across all ASEAN nations would provide a more complete picture.

ASEAN Cybersecurity Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the ASEAN cybersecurity industry, projecting robust growth from 2025 to 2033. It offers invaluable insights for investors, industry professionals, and policymakers seeking to navigate this rapidly evolving landscape. The report covers market sizing, segmentation, key players, technological innovations, and future growth projections, all based on rigorous research and data analysis. With a focus on actionable intelligence, this report is your essential guide to understanding and succeeding in the ASEAN cybersecurity market. The study period spans 2019-2033, with 2025 serving as both the base and estimated year.

ASEAN Cybersecurity Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the ASEAN cybersecurity market, covering market concentration, innovation drivers, regulatory frameworks, and M&A activities from 2019 to 2024. The market is characterized by a mix of large multinational corporations and smaller specialized firms. While precise market share data for individual companies is proprietary, the market appears moderately concentrated, with a few major players holding significant influence.

- Market Concentration: Moderately concentrated, with major players like IBM Corporation, Fortinet Inc, Cisco Systems Inc, and Intel Security (Intel Corporation) holding substantial market share. Exact figures are not publicly available and require further research but are estimated at xx Million.

- Innovation Drivers: Increasing cyber threats, rising digital adoption, and supportive government policies are key drivers. The development of quantum-safe technologies is a significant emerging trend.

- Regulatory Frameworks: Vary across ASEAN nations, impacting market dynamics. Harmonization efforts are ongoing, but inconsistencies remain.

- M&A Activities: Several M&A deals have taken place within the period, involving xx Million in deal values (estimated). The exact number and value of deals require extensive further research.

- Product Substitutes: Limited direct substitutes for specialized cybersecurity solutions, but some overlap with general IT services exists.

- End-User Demographics: BFSI, government & defense, and IT & telecommunication segments are major consumers of cybersecurity products and services.

ASEAN Cybersecurity Industry Market Dynamics & Trends

This section delves into the market's dynamic forces. The ASEAN cybersecurity market exhibits significant growth potential, driven by factors including rising internet and mobile penetration, increasing adoption of cloud technologies, and a growing awareness of cybersecurity risks across various sectors. The market is expected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration is still relatively low in certain segments, indicating considerable untapped potential for growth. Competitive dynamics are influenced by technological advancements, pricing strategies, and service differentiation. Specific metrics regarding consumer preferences and technological disruption in this period require further research. The total market size is estimated to be xx Million in 2025.

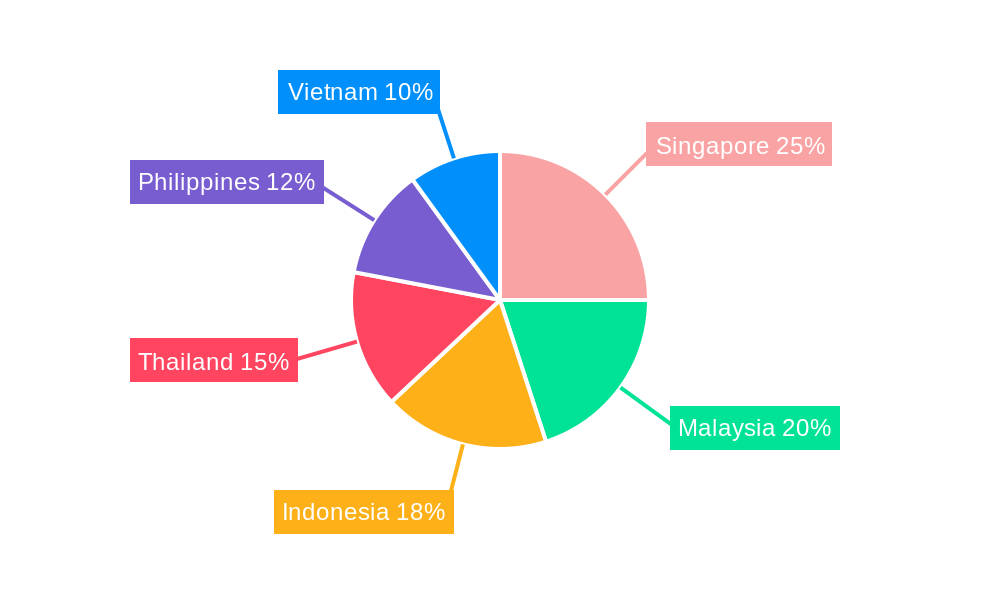

Dominant Regions & Segments in ASEAN Cybersecurity Industry

This section identifies the leading regions and segments within the ASEAN cybersecurity market. While precise market share data for each segment is proprietary, a qualitative assessment can be made:

Leading Region: Singapore, due to its advanced digital infrastructure and robust regulatory framework.

Leading Country: Singapore and other countries are expected to show high growth.

By Offering: Security Type: Endpoint security is likely to hold a significant share, followed by network security. The "Other Types: Services" segment includes managed security services, consulting, and training, which could demonstrate robust growth. More specific details require further market research.

By Deployment: Cloud-based security solutions are likely to witness increased adoption due to scalability and cost-effectiveness. However, on-premise solutions will continue to be relevant for critical infrastructure and data centers.

By End-User: The BFSI sector and the government & defense sector are expected to be the most significant end-users of cybersecurity solutions due to their critical data and sensitivity to cyberattacks.

Key Drivers (Examples):

- Singapore: Strong government support for cybersecurity initiatives and a highly developed IT infrastructure.

- Other Regions: Increasing digitalization, economic growth, and government regulations promoting cybersecurity adoption. These regional differences require more detailed research.

ASEAN Cybersecurity Industry Product Innovations

The ASEAN cybersecurity market is witnessing rapid product innovation, with vendors constantly enhancing existing solutions and introducing new products to address evolving threats. This includes advanced threat detection, AI-powered security analytics, and cloud-native security solutions. The market is characterized by a strong focus on integration and interoperability to create comprehensive security ecosystems. These innovations improve overall security posture while addressing specific market needs, leading to increased adoption and market expansion.

Report Scope & Segmentation Analysis

This report segments the ASEAN cybersecurity market by offering (security type, services), deployment (cloud, on-premise), and end-user (BFSI, healthcare, manufacturing, government & defense, IT & telecommunication, others). Each segment's market size, growth projections, and competitive dynamics are thoroughly analyzed. For example, the Cloud segment is projected to experience significant growth due to its scalability and cost-effectiveness.

Key Drivers of ASEAN Cybersecurity Industry Growth

Several factors drive growth in the ASEAN cybersecurity industry. These include:

- Technological advancements: AI, machine learning, and automation enhance threat detection and response capabilities.

- Economic growth: Increased digital adoption across various sectors fuels demand for cybersecurity solutions.

- Stringent government regulations: Governments are implementing stricter cybersecurity mandates, pushing organizations towards stronger security measures.

Challenges in the ASEAN Cybersecurity Industry Sector

The ASEAN cybersecurity industry faces challenges such as:

- Regulatory hurdles: Inconsistencies across national regulations create complexities for businesses operating regionally.

- Skills shortage: A lack of skilled cybersecurity professionals hinders effective implementation and management of security solutions.

- Supply chain vulnerabilities: Dependencies on global supply chains expose the region to potential disruptions and security risks.

Emerging Opportunities in ASEAN Cybersecurity Industry

The ASEAN cybersecurity market presents several opportunities, including:

- Growing demand for managed security services: Organizations are increasingly outsourcing security functions to specialized providers.

- Expansion into niche sectors: Untapped opportunities exist in sectors with less mature cybersecurity practices.

- Development of quantum-resistant cryptography: This addresses emerging threats from quantum computing.

Leading Players in the ASEAN Cybersecurity Industry Market

- Intel Security (Intel Corporation)

- IBM Corporation

- Fortinet Inc

- Cisco Systems Inc

- Red Sky Digital Ventures Ltd

- Fujitsu Thailand Co Ltd

- Dell Technologies Inc

- Info Security Consultant Co Ltd

- CGA Group Co Ltd

Key Developments in ASEAN Cybersecurity Industry

- March 2022: Thailand's dtac launched a new cloud-based cybersecurity service, offering protection against various cyber threats.

- February 2022: Singapore's Quantum Engineering Programme (QEP) initiated nationwide trials of quantum-safe communication technologies.

Future Outlook for ASEAN Cybersecurity Industry Market

The ASEAN cybersecurity market is poised for continued growth, driven by increasing digitalization, government initiatives, and evolving threat landscapes. Strategic partnerships, technological innovations, and proactive risk management will be crucial for success in this dynamic market. The market size is expected to reach xx Million by 2033, signifying substantial potential for growth and investment.

ASEAN Cybersecurity Industry Segmentation

-

1. Offering

-

1.1. Security Type

- 1.1.1. Cloud Security

- 1.1.2. Data Security

- 1.1.3. Identity Access Management

- 1.1.4. Network Security

- 1.1.5. Consumer Security

- 1.1.6. Infrastructure Protection

- 1.1.7. Other Types

- 1.2. Services

-

1.1. Security Type

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premise

-

3. End User

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Manufacturing

- 3.4. Government & Defense

- 3.5. IT and Telecommunication

- 3.6. Other End Users

ASEAN Cybersecurity Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

ASEAN Cybersecurity Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Demand for Digitalization and Scalable IT Infrastructure; Need to tackle risks from various trends such as third-party vendor risks

- 3.2.2 the evolution of MSSPs

- 3.2.3 and adoption of cloud-first strategy

- 3.3. Market Restrains

- 3.3.1. Lack of Cybersecurity Professionals; High Reliance on Traditional Authentication Methods and Low Preparedness

- 3.4. Market Trends

- 3.4.1. Cloud Expected to Witness Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Security Type

- 5.1.1.1. Cloud Security

- 5.1.1.2. Data Security

- 5.1.1.3. Identity Access Management

- 5.1.1.4. Network Security

- 5.1.1.5. Consumer Security

- 5.1.1.6. Infrastructure Protection

- 5.1.1.7. Other Types

- 5.1.2. Services

- 5.1.1. Security Type

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Manufacturing

- 5.3.4. Government & Defense

- 5.3.5. IT and Telecommunication

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. North America ASEAN Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. Security Type

- 6.1.1.1. Cloud Security

- 6.1.1.2. Data Security

- 6.1.1.3. Identity Access Management

- 6.1.1.4. Network Security

- 6.1.1.5. Consumer Security

- 6.1.1.6. Infrastructure Protection

- 6.1.1.7. Other Types

- 6.1.2. Services

- 6.1.1. Security Type

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. Cloud

- 6.2.2. On-premise

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. BFSI

- 6.3.2. Healthcare

- 6.3.3. Manufacturing

- 6.3.4. Government & Defense

- 6.3.5. IT and Telecommunication

- 6.3.6. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. South America ASEAN Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. Security Type

- 7.1.1.1. Cloud Security

- 7.1.1.2. Data Security

- 7.1.1.3. Identity Access Management

- 7.1.1.4. Network Security

- 7.1.1.5. Consumer Security

- 7.1.1.6. Infrastructure Protection

- 7.1.1.7. Other Types

- 7.1.2. Services

- 7.1.1. Security Type

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. Cloud

- 7.2.2. On-premise

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. BFSI

- 7.3.2. Healthcare

- 7.3.3. Manufacturing

- 7.3.4. Government & Defense

- 7.3.5. IT and Telecommunication

- 7.3.6. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. Europe ASEAN Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. Security Type

- 8.1.1.1. Cloud Security

- 8.1.1.2. Data Security

- 8.1.1.3. Identity Access Management

- 8.1.1.4. Network Security

- 8.1.1.5. Consumer Security

- 8.1.1.6. Infrastructure Protection

- 8.1.1.7. Other Types

- 8.1.2. Services

- 8.1.1. Security Type

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. Cloud

- 8.2.2. On-premise

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. BFSI

- 8.3.2. Healthcare

- 8.3.3. Manufacturing

- 8.3.4. Government & Defense

- 8.3.5. IT and Telecommunication

- 8.3.6. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Middle East & Africa ASEAN Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. Security Type

- 9.1.1.1. Cloud Security

- 9.1.1.2. Data Security

- 9.1.1.3. Identity Access Management

- 9.1.1.4. Network Security

- 9.1.1.5. Consumer Security

- 9.1.1.6. Infrastructure Protection

- 9.1.1.7. Other Types

- 9.1.2. Services

- 9.1.1. Security Type

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. Cloud

- 9.2.2. On-premise

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. BFSI

- 9.3.2. Healthcare

- 9.3.3. Manufacturing

- 9.3.4. Government & Defense

- 9.3.5. IT and Telecommunication

- 9.3.6. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. Asia Pacific ASEAN Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 10.1.1. Security Type

- 10.1.1.1. Cloud Security

- 10.1.1.2. Data Security

- 10.1.1.3. Identity Access Management

- 10.1.1.4. Network Security

- 10.1.1.5. Consumer Security

- 10.1.1.6. Infrastructure Protection

- 10.1.1.7. Other Types

- 10.1.2. Services

- 10.1.1. Security Type

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. Cloud

- 10.2.2. On-premise

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. BFSI

- 10.3.2. Healthcare

- 10.3.3. Manufacturing

- 10.3.4. Government & Defense

- 10.3.5. IT and Telecommunication

- 10.3.6. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 11. Belgium ASEAN Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Netherlands ASEAN Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Luxembourg ASEAN Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Intel Security (Intel Corporation)*List Not Exhaustive

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 IBM Corporation

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Fortinet Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Cisco Systems Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Red Sky Digital Ventures Ltd

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Fujitsu Thailand Co Ltd

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Dell Technologies Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Info Security Consultant Co Ltd

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 CGA Group Co Ltd

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.1 Intel Security (Intel Corporation)*List Not Exhaustive

List of Figures

- Figure 1: Global ASEAN Cybersecurity Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Belgium ASEAN Cybersecurity Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: Belgium ASEAN Cybersecurity Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Netherlands ASEAN Cybersecurity Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Netherlands ASEAN Cybersecurity Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Luxembourg ASEAN Cybersecurity Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Luxembourg ASEAN Cybersecurity Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: North America ASEAN Cybersecurity Industry Revenue (Million), by Offering 2024 & 2032

- Figure 9: North America ASEAN Cybersecurity Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 10: North America ASEAN Cybersecurity Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 11: North America ASEAN Cybersecurity Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 12: North America ASEAN Cybersecurity Industry Revenue (Million), by End User 2024 & 2032

- Figure 13: North America ASEAN Cybersecurity Industry Revenue Share (%), by End User 2024 & 2032

- Figure 14: North America ASEAN Cybersecurity Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America ASEAN Cybersecurity Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: South America ASEAN Cybersecurity Industry Revenue (Million), by Offering 2024 & 2032

- Figure 17: South America ASEAN Cybersecurity Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 18: South America ASEAN Cybersecurity Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 19: South America ASEAN Cybersecurity Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 20: South America ASEAN Cybersecurity Industry Revenue (Million), by End User 2024 & 2032

- Figure 21: South America ASEAN Cybersecurity Industry Revenue Share (%), by End User 2024 & 2032

- Figure 22: South America ASEAN Cybersecurity Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: South America ASEAN Cybersecurity Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe ASEAN Cybersecurity Industry Revenue (Million), by Offering 2024 & 2032

- Figure 25: Europe ASEAN Cybersecurity Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 26: Europe ASEAN Cybersecurity Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 27: Europe ASEAN Cybersecurity Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 28: Europe ASEAN Cybersecurity Industry Revenue (Million), by End User 2024 & 2032

- Figure 29: Europe ASEAN Cybersecurity Industry Revenue Share (%), by End User 2024 & 2032

- Figure 30: Europe ASEAN Cybersecurity Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe ASEAN Cybersecurity Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Middle East & Africa ASEAN Cybersecurity Industry Revenue (Million), by Offering 2024 & 2032

- Figure 33: Middle East & Africa ASEAN Cybersecurity Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 34: Middle East & Africa ASEAN Cybersecurity Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 35: Middle East & Africa ASEAN Cybersecurity Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 36: Middle East & Africa ASEAN Cybersecurity Industry Revenue (Million), by End User 2024 & 2032

- Figure 37: Middle East & Africa ASEAN Cybersecurity Industry Revenue Share (%), by End User 2024 & 2032

- Figure 38: Middle East & Africa ASEAN Cybersecurity Industry Revenue (Million), by Country 2024 & 2032

- Figure 39: Middle East & Africa ASEAN Cybersecurity Industry Revenue Share (%), by Country 2024 & 2032

- Figure 40: Asia Pacific ASEAN Cybersecurity Industry Revenue (Million), by Offering 2024 & 2032

- Figure 41: Asia Pacific ASEAN Cybersecurity Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 42: Asia Pacific ASEAN Cybersecurity Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 43: Asia Pacific ASEAN Cybersecurity Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 44: Asia Pacific ASEAN Cybersecurity Industry Revenue (Million), by End User 2024 & 2032

- Figure 45: Asia Pacific ASEAN Cybersecurity Industry Revenue Share (%), by End User 2024 & 2032

- Figure 46: Asia Pacific ASEAN Cybersecurity Industry Revenue (Million), by Country 2024 & 2032

- Figure 47: Asia Pacific ASEAN Cybersecurity Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 3: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 13: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 14: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 15: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 20: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 21: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 22: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Argentina ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of South America ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 27: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 28: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 29: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United Kingdom ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Germany ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: France ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Italy ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Spain ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Russia ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Benelux ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Nordics ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 40: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 41: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 42: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Turkey ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Israel ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: GCC ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: North Africa ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East & Africa ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 50: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 51: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 52: Global ASEAN Cybersecurity Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: India ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Japan ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: South Korea ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: ASEAN ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Oceania ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Rest of Asia Pacific ASEAN Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Cybersecurity Industry?

The projected CAGR is approximately 18.50%.

2. Which companies are prominent players in the ASEAN Cybersecurity Industry?

Key companies in the market include Intel Security (Intel Corporation)*List Not Exhaustive, IBM Corporation, Fortinet Inc, Cisco Systems Inc, Red Sky Digital Ventures Ltd, Fujitsu Thailand Co Ltd, Dell Technologies Inc, Info Security Consultant Co Ltd, CGA Group Co Ltd.

3. What are the main segments of the ASEAN Cybersecurity Industry?

The market segments include Offering, Deployment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Digitalization and Scalable IT Infrastructure; Need to tackle risks from various trends such as third-party vendor risks. the evolution of MSSPs. and adoption of cloud-first strategy.

6. What are the notable trends driving market growth?

Cloud Expected to Witness Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Cybersecurity Professionals; High Reliance on Traditional Authentication Methods and Low Preparedness.

8. Can you provide examples of recent developments in the market?

March 2022 - Thailand's dtac launched new Cloud-based Cyber Security Service, for dtac subscribers that provides security against increasingly widespread cyber threats in the booming digital era. It offers cloud-based security against a wide range of cyber threats, including malware, viruses, phishing, ransomware, botnets, and command & control attacks on compromised servers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Cybersecurity Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Cybersecurity Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Cybersecurity Industry?

To stay informed about further developments, trends, and reports in the ASEAN Cybersecurity Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence