Key Insights

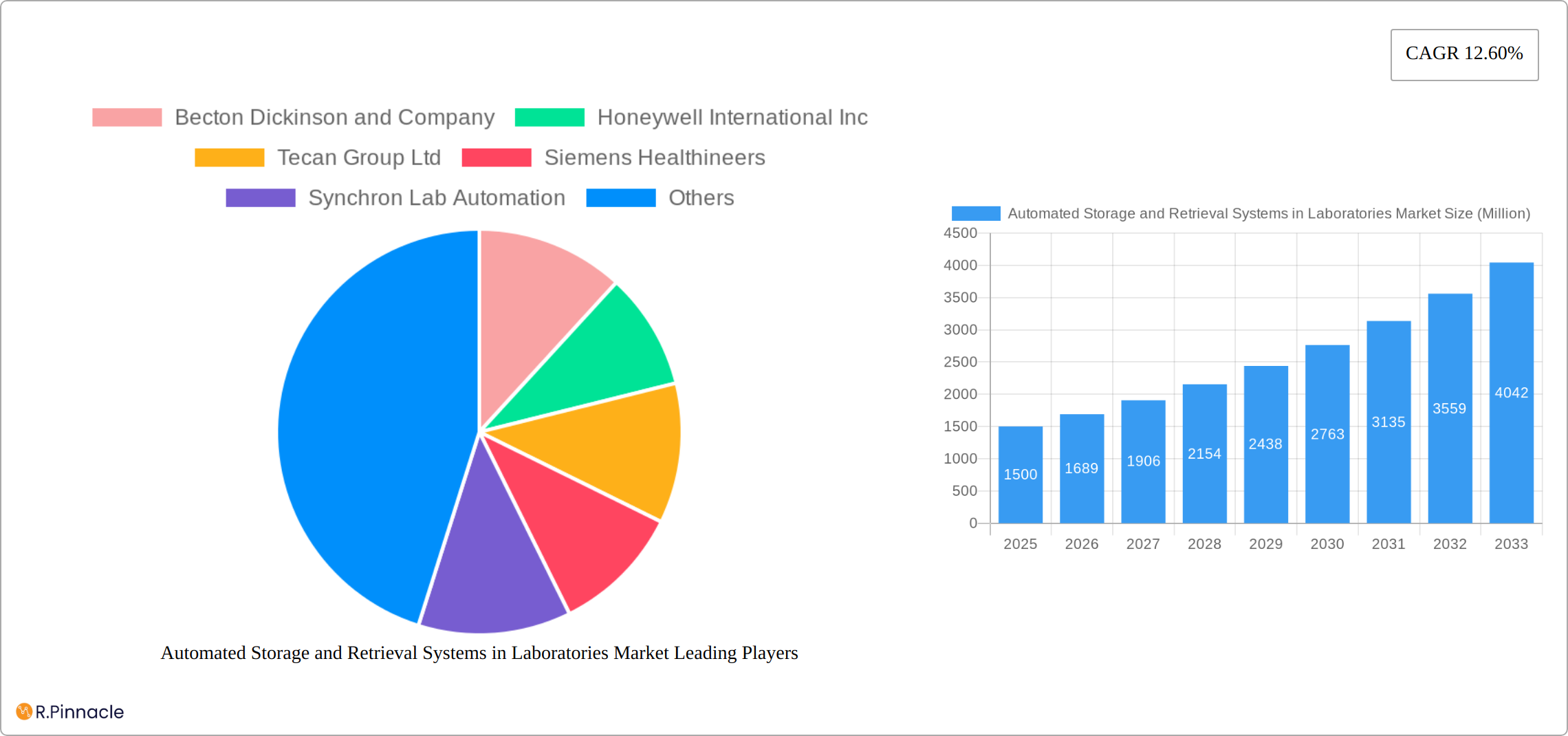

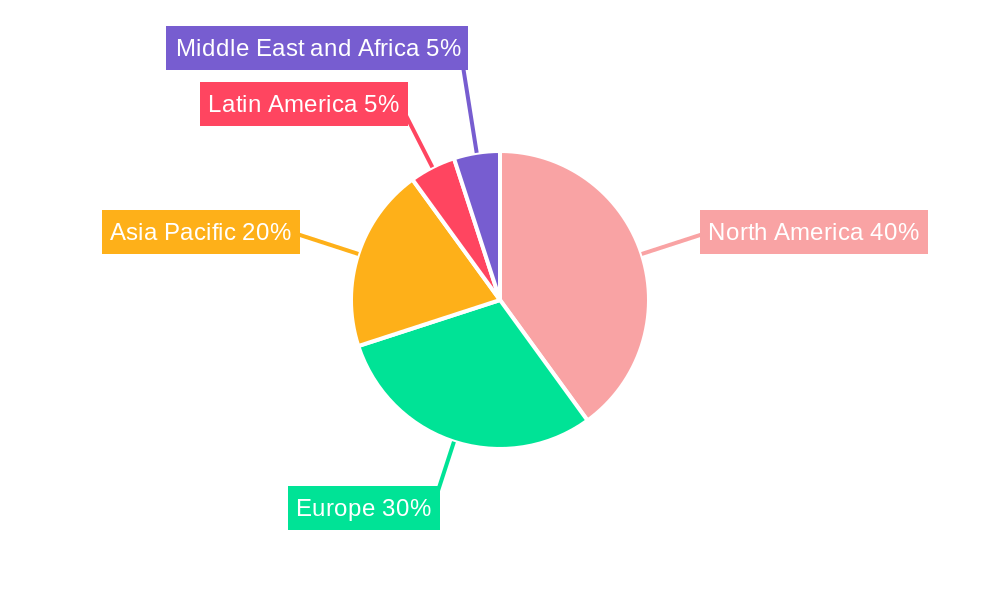

The Automated Storage and Retrieval Systems (ASRS) in Laboratories market is experiencing robust growth, driven by the increasing demand for efficient sample management, high-throughput screening, and automation in various laboratory settings. The market, valued at approximately $XX million in 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of 12.60% from 2025 to 2033, reaching an estimated value of $YY million (This value is calculated based on the provided CAGR and 2025 market size. The exact figure requires the initial 2025 market size value). This expansion is fueled by several key factors. Firstly, the rising adoption of automation in research and development (R&D) labs, particularly within the pharmaceutical, biotechnology, and healthcare sectors, is significantly impacting market growth. Secondly, the increasing complexity and volume of samples handled in laboratories are demanding more efficient storage and retrieval solutions. Furthermore, the growing emphasis on minimizing human error and maximizing laboratory throughput are driving the adoption of ASRS technology. The market is segmented by product type, including fixed aisle systems, carousels, and vertical lift modules, each catering to specific laboratory needs and workflow requirements. While the North American market currently holds a significant share, the Asia-Pacific region is poised for substantial growth driven by increasing investments in healthcare infrastructure and R&D activities.

However, certain restraints are also influencing market dynamics. High initial investment costs associated with implementing ASRS and the need for specialized personnel to operate and maintain these systems can limit adoption, particularly in smaller laboratories with limited budgets. Nevertheless, the long-term benefits of improved efficiency, reduced operational costs, and enhanced sample security are expected to offset these challenges, continuing to fuel market expansion. The leading companies in this market – including Becton Dickinson, Honeywell, Tecan, Siemens Healthineers, and others – are focusing on innovation and strategic partnerships to capitalize on the growing market opportunities. This includes the development of advanced software solutions for inventory management, improved system integration capabilities, and the expansion of their product portfolios to address diverse laboratory requirements. Future growth will likely be driven by further technological advancements, such as artificial intelligence (AI) integration for enhanced sample tracking and robotic automation for streamlined workflows.

Automated Storage and Retrieval Systems in Laboratories Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Automated Storage and Retrieval Systems (AS/RS) in Laboratories market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report delves into market dynamics, technological advancements, competitive landscapes, and future growth projections, providing actionable intelligence to navigate this rapidly evolving sector. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Automated Storage and Retrieval Systems in Laboratories Market Market Structure & Innovation Trends

This section analyzes the market structure, including concentration levels, innovation drivers, and regulatory influences. Market share is highly fragmented, with no single company dominating. However, key players like Becton Dickinson and Company, Honeywell International Inc, and Thermo Fisher Scientific Inc hold significant positions. The market witnesses frequent M&A activities, with deal values averaging xx Million annually over the past five years. Innovation is driven by the need for higher throughput, improved accuracy, and enhanced integration with laboratory information management systems (LIMS). Regulatory compliance, particularly in healthcare and pharmaceutical sectors, significantly impacts AS/RS adoption. Product substitutes, such as manual storage and retrieval methods, are being phased out due to inefficiency. The end-user demographics are primarily research laboratories, pharmaceutical companies, hospitals, and diagnostic centers.

- Market Concentration: Moderately fragmented.

- Innovation Drivers: Increased throughput needs, improved accuracy, LIMS integration.

- Regulatory Frameworks: Stringent regulations in healthcare and pharmaceuticals.

- Product Substitutes: Manual handling systems (declining).

- End-User Demographics: Research labs, pharmaceuticals, hospitals, diagnostics.

- M&A Activities: Frequent, with average deal values of xx Million annually (2019-2024).

Automated Storage and Retrieval Systems in Laboratories Market Market Dynamics & Trends

The AS/RS in Laboratories market is experiencing robust growth, driven by factors such as increasing automation in laboratories, the rising demand for high-throughput screening, and the growing adoption of personalized medicine. Technological advancements, such as the integration of artificial intelligence (AI) and robotics, are further accelerating market expansion. The preference for efficient sample management and reduced human error is propelling market penetration. However, high initial investment costs and the need for specialized technical expertise can pose challenges. Competitive dynamics are shaped by innovation, pricing strategies, and the ability to provide comprehensive solutions. The market shows a significant shift towards cloud-based solutions and integration with other laboratory equipment.

- Market Growth Drivers: Increasing lab automation, demand for high-throughput screening, personalized medicine.

- Technological Disruptions: AI and robotics integration, cloud-based solutions.

- Consumer Preferences: Efficiency, accuracy, reduced human error, data integration.

- Competitive Dynamics: Innovation, pricing, comprehensive solutions.

Dominant Regions & Segments in Automated Storage and Retrieval Systems in Laboratories Market

North America currently dominates the AS/RS in Laboratories market due to high R&D spending, advanced infrastructure, and a large number of pharmaceutical and biotechnology companies. Within the product type segments, the Fixed Aisle System holds the largest market share, followed by Carousel and Vertical Lift Module systems.

- Key Drivers for North America Dominance:

- High R&D spending

- Advanced laboratory infrastructure

- Large pharmaceutical and biotechnology presence

- Favorable regulatory environment

- Segment Analysis:

- Fixed Aisle System: High capacity, suitable for large laboratories.

- Carousel System: Efficient for smaller spaces, easier integration.

- Vertical Lift Module: Space-saving, high-density storage.

Automated Storage and Retrieval Systems in Laboratories Market Product Innovations

Recent innovations focus on enhancing speed, accuracy, and integration capabilities. Manufacturers are developing systems with advanced software for real-time tracking and inventory management, incorporating AI for predictive maintenance, and integrating with LIMS for seamless data flow. These innovations are improving efficiency, reducing errors, and enhancing overall laboratory workflow. The market is witnessing a move towards modular and scalable systems that can be adapted to changing laboratory needs.

Report Scope & Segmentation Analysis

This report segments the AS/RS in Laboratories market by product type: Fixed Aisle System, Carousel, and Vertical Lift Module. Each segment is analyzed in terms of market size, growth projections, and competitive dynamics. The Fixed Aisle System segment is anticipated to experience significant growth owing to its suitability for large-scale laboratories. The Carousel system segment is projected to show moderate growth due to its space-saving design. The Vertical Lift Module segment is expected to exhibit steady growth, driven by demand for high-density storage in laboratories with limited space. The report also provides detailed regional analysis.

Key Drivers of Automated Storage and Retrieval Systems in Laboratories Market Growth

Several factors are driving market growth, including the increasing demand for high-throughput screening in drug discovery and development, the rise of personalized medicine requiring efficient sample management, and ongoing technological advancements. Government regulations and initiatives promoting automation in laboratories also contribute to market expansion. The growing need for improved data management and reduced human error in laboratories further fuels market growth.

Challenges in the Automated Storage and Retrieval Systems in Laboratories Market Sector

High initial investment costs and the requirement for skilled personnel to operate and maintain these systems represent significant challenges. Integration complexities with existing laboratory infrastructure can also hinder adoption. The intense competition among established players and the emergence of new entrants add to the competitive pressures. Supply chain disruptions may cause delays in procurement and installation.

Emerging Opportunities in Automated Storage and Retrieval Systems in Laboratories Market

The integration of AI and machine learning capabilities offers significant growth opportunities. The growing adoption of cloud-based solutions for data management and remote monitoring enhances market potential. Expansion into emerging markets with developing laboratory infrastructure presents further opportunities. The increasing focus on digitalization and automation in laboratories creates fertile ground for innovation and growth.

Leading Players in the Automated Storage and Retrieval Systems in Laboratories Market Market

- Becton Dickinson and Company

- Honeywell International Inc

- Tecan Group Ltd

- Siemens Healthineers

- Synchron Lab Automation

- Thermo Fisher Scientific Inc

- Eppendorf AG

- BioRad Laboratories Inc

- Shimadzu Corp

- Agilent Technologies Inc

- PerkinElmer Inc

- Hudson Robotics Inc

- Roche Holding AG

- Danaher Corp

- Aurora Biomed Inc

- List Not Exhaustive

Key Developments in Automated Storage and Retrieval Systems in Laboratories Market Industry

- October 2022: Thermofisher Scientific Inc. revealed the Gibco CTS DynaCellect Magnetic Separation System (DynaCellect), streamlining cell therapy manufacturing.

- January 2023: Azenta, Inc. launched EZ2 Connect MDx for diagnostic labs, addressing fluctuating sample volumes and diverse sample types.

- February 2023: Biosero, Inc. partnered with Analytik Jena to integrate their automation technologies, accelerating scientific research.

Future Outlook for Automated Storage and Retrieval Systems in Laboratories Market Market

The future of the AS/RS in Laboratories market looks promising, driven by continuous technological advancements and the growing need for efficient laboratory operations. The increasing adoption of automation across various laboratory settings and the development of innovative solutions will fuel market expansion. Strategic partnerships and collaborations among industry players will further accelerate growth. The market is poised for significant expansion in the coming years.

Automated Storage and Retrieval Systems in Laboratories Market Segmentation

-

1. Product Type

- 1.1. Fixed Aisle System

- 1.2. Carousel

- 1.3. Vertical Lift Module

- 2. Application

Automated Storage and Retrieval Systems in Laboratories Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Automated Storage and Retrieval Systems in Laboratories Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Product Innovation

- 3.2.2 Differentiation

- 3.2.3 and Branding; Rising Per Capita Income Positively Impacting Purchase Power

- 3.3. Market Restrains

- 3.3.1. Fluctuating Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Increased Emphasis on Value of Development

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automated Storage and Retrieval Systems in Laboratories Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fixed Aisle System

- 5.1.2. Carousel

- 5.1.3. Vertical Lift Module

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Automated Storage and Retrieval Systems in Laboratories Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Fixed Aisle System

- 6.1.2. Carousel

- 6.1.3. Vertical Lift Module

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Automated Storage and Retrieval Systems in Laboratories Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Fixed Aisle System

- 7.1.2. Carousel

- 7.1.3. Vertical Lift Module

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Automated Storage and Retrieval Systems in Laboratories Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Fixed Aisle System

- 8.1.2. Carousel

- 8.1.3. Vertical Lift Module

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Latin America Automated Storage and Retrieval Systems in Laboratories Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Fixed Aisle System

- 9.1.2. Carousel

- 9.1.3. Vertical Lift Module

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Automated Storage and Retrieval Systems in Laboratories Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Fixed Aisle System

- 10.1.2. Carousel

- 10.1.3. Vertical Lift Module

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. North America Automated Storage and Retrieval Systems in Laboratories Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Automated Storage and Retrieval Systems in Laboratories Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Automated Storage and Retrieval Systems in Laboratories Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Automated Storage and Retrieval Systems in Laboratories Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Automated Storage and Retrieval Systems in Laboratories Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Becton Dickinson and Company

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Honeywell International Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Tecan Group Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Siemens Healthineers

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Synchron Lab Automation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Thermo Fisher Scientific Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Eppendorf AG

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 BioRad Laboratories Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Shimadzu Corp

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Agilent Technologies Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 PerkinElmer Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Hudson Robotics Inc

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Roche Holding AG

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Danaher Corp

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Aurora Biomed Inc *List Not Exhaustive

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Automated Storage and Retrieval Systems in Laboratories Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Automated Storage and Retrieval Systems in Laboratories Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Automated Storage and Retrieval Systems in Laboratories Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Automated Storage and Retrieval Systems in Laboratories Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Automated Storage and Retrieval Systems in Laboratories Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million), by Product Type 2024 & 2032

- Figure 13: North America Automated Storage and Retrieval Systems in Laboratories Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: North America Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Automated Storage and Retrieval Systems in Laboratories Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Automated Storage and Retrieval Systems in Laboratories Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million), by Product Type 2024 & 2032

- Figure 19: Europe Automated Storage and Retrieval Systems in Laboratories Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: Europe Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe Automated Storage and Retrieval Systems in Laboratories Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Automated Storage and Retrieval Systems in Laboratories Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million), by Product Type 2024 & 2032

- Figure 25: Asia Pacific Automated Storage and Retrieval Systems in Laboratories Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 26: Asia Pacific Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million), by Application 2024 & 2032

- Figure 27: Asia Pacific Automated Storage and Retrieval Systems in Laboratories Market Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Automated Storage and Retrieval Systems in Laboratories Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million), by Product Type 2024 & 2032

- Figure 31: Latin America Automated Storage and Retrieval Systems in Laboratories Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 32: Latin America Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million), by Application 2024 & 2032

- Figure 33: Latin America Automated Storage and Retrieval Systems in Laboratories Market Revenue Share (%), by Application 2024 & 2032

- Figure 34: Latin America Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Automated Storage and Retrieval Systems in Laboratories Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Middle East and Africa Automated Storage and Retrieval Systems in Laboratories Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Middle East and Africa Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million), by Application 2024 & 2032

- Figure 39: Middle East and Africa Automated Storage and Retrieval Systems in Laboratories Market Revenue Share (%), by Application 2024 & 2032

- Figure 40: Middle East and Africa Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Automated Storage and Retrieval Systems in Laboratories Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Automated Storage and Retrieval Systems in Laboratories Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 22: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 25: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Application 2019 & 2032

- Table 26: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 28: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global Automated Storage and Retrieval Systems in Laboratories Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automated Storage and Retrieval Systems in Laboratories Market?

The projected CAGR is approximately 12.60%.

2. Which companies are prominent players in the Automated Storage and Retrieval Systems in Laboratories Market?

Key companies in the market include Becton Dickinson and Company, Honeywell International Inc, Tecan Group Ltd, Siemens Healthineers, Synchron Lab Automation, Thermo Fisher Scientific Inc, Eppendorf AG, BioRad Laboratories Inc, Shimadzu Corp, Agilent Technologies Inc, PerkinElmer Inc, Hudson Robotics Inc, Roche Holding AG, Danaher Corp, Aurora Biomed Inc *List Not Exhaustive.

3. What are the main segments of the Automated Storage and Retrieval Systems in Laboratories Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Product Innovation. Differentiation. and Branding; Rising Per Capita Income Positively Impacting Purchase Power.

6. What are the notable trends driving market growth?

Increased Emphasis on Value of Development.

7. Are there any restraints impacting market growth?

Fluctuating Raw Material Prices.

8. Can you provide examples of recent developments in the market?

February 2023 - Biosero, Inc., developer of laboratory automation solutions, signed an agreement with Analytik Jena to promote applications of their combined laboratory automation technologies that will enable customers to accelerate and optimize their scientific research. Analytik Jena offers innovative laboratory platforms like CyBioFeliX, famous for liquid handling in automated laboratory setups and suitable for applications such as screening preparation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automated Storage and Retrieval Systems in Laboratories Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automated Storage and Retrieval Systems in Laboratories Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automated Storage and Retrieval Systems in Laboratories Market?

To stay informed about further developments, trends, and reports in the Automated Storage and Retrieval Systems in Laboratories Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence