Key Insights

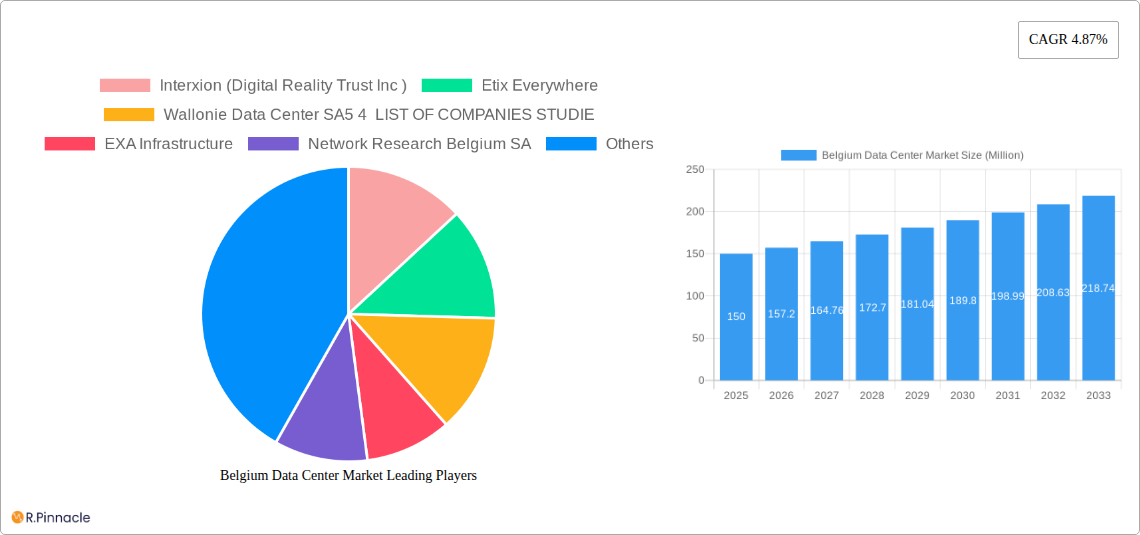

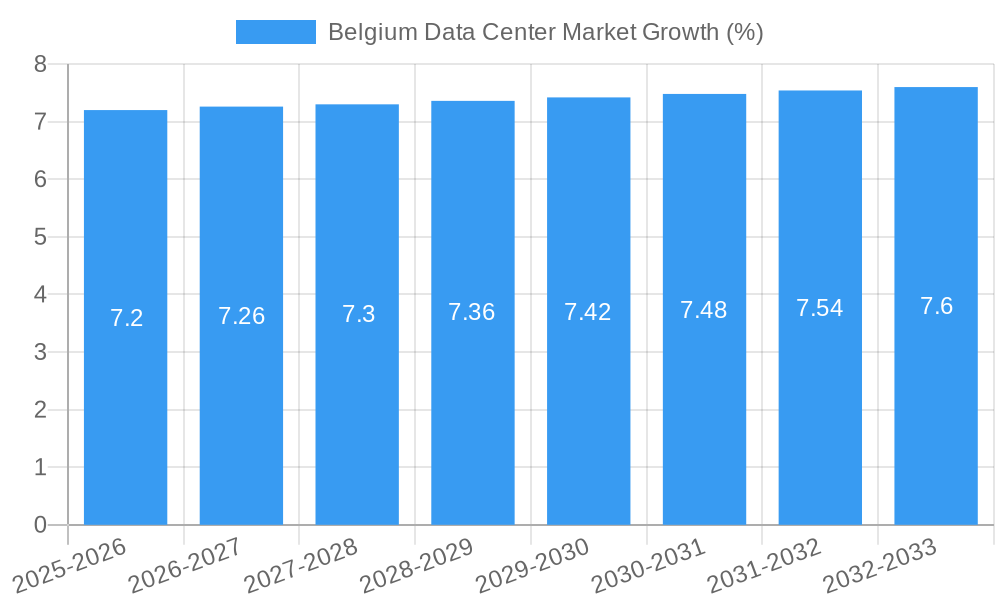

The Belgium data center market, valued at approximately €[Estimate based on Market Size XX and Value Unit Million - Let's assume XX = 150 for illustrative purposes. This would need to be replaced with the actual value]. million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.87% from 2025 to 2033. This expansion is fueled by several key factors. Increasing digitalization across various sectors, including finance, healthcare, and government, necessitates greater data storage and processing capabilities. Furthermore, the rise of cloud computing and the increasing adoption of edge computing strategies are contributing significantly to demand. Belgium's strategic location within Europe, coupled with its robust digital infrastructure and supportive government policies, further enhances its attractiveness as a data center hub. The market is segmented by absorption (utilized and non-utilized space), hotspot locations (Brussels and the rest of Belgium), data center size (small, medium, mega, massive, large), and tier type (Tier 1, Tier 2, Tier 3, Tier 4). Competition within the market is intense, with established players like Interxion (Digital Realty Trust Inc.), Etix Everywhere, and Proximus S.A. vying for market share alongside newer entrants.

The market's growth trajectory is not without challenges. Potential restraints include the rising costs associated with energy consumption and land acquisition. Furthermore, ensuring sufficient skilled labor to manage and maintain these sophisticated facilities remains crucial for sustained growth. However, the ongoing investment in renewable energy sources and government initiatives aimed at fostering digital innovation are expected to mitigate these challenges. The forecast period (2025-2033) offers significant opportunities for companies specializing in data center construction, management, and related services. Focus on sustainable practices, advanced security measures, and flexible solutions will be critical for success within this dynamic and competitive landscape. The continued expansion of cloud services and the increasing demand for low-latency applications will further drive growth in the coming years.

Belgium Data Center Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Belgium data center market, offering crucial insights for industry professionals, investors, and strategists. Covering the period from 2019 to 2033, with a focus on 2025, this report delivers actionable intelligence on market size, segmentation, key players, and future trends. The report leverages extensive data analysis and expert insights to unveil opportunities and challenges within this dynamic sector.

Belgium Data Center Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory aspects of the Belgian data center market. We examine market concentration, identifying key players and their respective market shares. The report also explores M&A activities, providing insights into deal values and their impact on market dynamics. Furthermore, we delve into the regulatory framework, technological innovation driving market growth, and the influence of product substitutes and end-user demographics.

- Market Concentration: The Belgian data center market exhibits a [xx]% market concentration, with [xx] major players controlling a significant share.

- Innovation Drivers: Increased cloud adoption, the rise of 5G, and growing demand for edge computing are driving innovation.

- M&A Activities: Significant M&A activity has been observed, with deals totaling an estimated xx Million in the past [xx] years. Examples include the TINC investment in Datacenter United (detailed in the Key Developments section).

- Regulatory Framework: The Belgian government's policies regarding data privacy and infrastructure development significantly impact the market.

- Product Substitutes: The emergence of alternative solutions, such as cloud-based services, presents a challenge to traditional data centers.

Belgium Data Center Market Market Dynamics & Trends

This section examines the factors influencing market growth, including technological advancements, evolving consumer preferences, and competitive dynamics. We analyze the Compound Annual Growth Rate (CAGR) and market penetration rates, providing a clear picture of market evolution. We also consider the impact of macroeconomic factors and government policies on market trajectory. Specific factors driving market growth will be explored in detail, including the increasing demand for data storage and processing, the expansion of digital services across diverse sectors, and the rising adoption of cloud computing solutions. Technological disruptions, such as the introduction of new hardware and software technologies, are evaluated for their impact on the market dynamics. Competitive dynamics, encompassing pricing strategies, partnerships, and technological advancements employed by leading companies, are analyzed.

Dominant Regions & Segments in Belgium Data Center Market

This section identifies the leading regions and segments within the Belgium data center market. We analyze the key drivers for dominance, including economic policies, infrastructure development, and consumer preferences.

- Leading Region: Brussels, due to its concentration of businesses and advanced infrastructure.

- Data Center Size: Large and Mega data centers dominate the market, driven by the needs of large enterprises and hyperscalers.

- Tier Type: Tier III and Tier IV data centers hold a significant market share due to their reliability and resilience.

- Absorption: Utilized capacity significantly outweighs non-utilized capacity, indicating strong demand.

- End User: The Other End User segment shows significant growth, driven by the increasing digital transformation across various sectors.

The detailed analysis will illustrate the factors contributing to the dominance of each segment, providing actionable insights for strategic planning.

Belgium Data Center Market Product Innovations

This section provides a concise overview of recent product developments and technological advancements within the Belgium data center market. We highlight innovative solutions that enhance efficiency, scalability, and security. This involves exploring advancements in cooling technologies, power management systems, and network infrastructure. The competitive advantages offered by these innovations will be examined, along with their impact on market share and consumer adoption rates.

Report Scope & Segmentation Analysis

This report segments the Belgium data center market by Absorption (Utilized, Non-Utilized), Hotspot (Brussels, Rest of Belgium), Data Center Size (Small, Medium, Mega, Large, Massive), and Tier Type (Tier I, Tier II, Tier III, Tier IV). Each segment's growth projections, market size (in Millions), and competitive dynamics will be provided.

- Absorption: Detailed analysis of utilized vs. non-utilized capacity, with projections for future growth in each segment.

- Hotspot: Comparative analysis of market size and growth in Brussels versus the Rest of Belgium.

- Data Center Size: Market size and growth projections for each data center size category.

- Tier Type: Assessment of the market share and growth prospects for different tier levels.

Key Drivers of Belgium Data Center Market Growth

Several factors contribute to the growth of the Belgium data center market. These include:

- Government Initiatives: Support for digital infrastructure development and investment incentives.

- Technological Advancements: The adoption of advanced technologies such as AI and IoT increases data center demand.

- Economic Growth: A robust economy drives investment in IT infrastructure.

Challenges in the Belgium Data Center Market Sector

The Belgium data center market faces several challenges, including:

- Energy Costs: High energy prices can impact the profitability of data centers.

- Land Availability: Finding suitable land for large-scale data center construction can be challenging.

- Competition: The presence of established players and new entrants creates a competitive landscape.

Emerging Opportunities in Belgium Data Center Market

This sector presents several opportunities, including:

- Edge Computing: The growth of edge computing presents new opportunities for deploying smaller data centers closer to users.

- Sustainable Data Centers: Growing demand for environmentally friendly data centers creates a niche market.

- Specialized Data Centers: Demand for specialized data centers catering to specific industries is rising.

Leading Players in the Belgium Data Center Market Market

- Interxion (Digital Realty Trust Inc)

- Etix Everywhere

- Wallonie Data Center SA

- EXA Infrastructure

- Network Research Belgium SA

- ANTWERP DATACENTER (Datacenter United)

- Proximus S A

- LCL Belgium n v

- AtlasEdge Data Centres

- Lumen Technologies Inc

- KevlinX Belgium BVBA

- VPS House Technology Group LLC

Key Developments in Belgium Data Center Market Industry

- January 2022: Datacenter United expands its data center portfolio to six after acquiring DC Star.

- November 2021: Colt Data Centre Services sells its Belgium facility to AtlasEdge Data Centres.

- September 2021: HCL partners with Proximus to manage its private cloud infrastructure.

Future Outlook for Belgium Data Center Market Market

The Belgium data center market is poised for continued growth, driven by increasing digitalization, robust economic conditions, and government support for infrastructure development. Strategic investments in sustainable technologies and expansion into edge computing will shape future market dynamics. The growing demand for cloud services and the adoption of advanced technologies will further fuel market expansion in the coming years.

Belgium Data Center Market Segmentation

-

1. Hotspot

- 1.1. Brussels

- 1.2. Rest of Belgium

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

4.2. By Colocation Type

- 4.2.1. Hyperscale

- 4.2.2. Retail

- 4.2.3. Wholesale

-

4.3. By End User

- 4.3.1. BFSI

- 4.3.2. Cloud

- 4.3.3. E-Commerce

- 4.3.4. Government

- 4.3.5. Manufacturing

- 4.3.6. Media & Entertainment

- 4.3.7. Telecom

- 4.3.8. Other End User

Belgium Data Center Market Segmentation By Geography

- 1. Belgium

Belgium Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Automation in the Security Screening Industry

- 3.2.2 Especially to Detect Advanced Threats

- 3.2.3 etc.; Upsurge in Terror Activities Across the Region; Increasing Government Initiatives on Security Inspection in Schools and Colleges; Increasing Government Initiatives for Smart Cities

- 3.3. Market Restrains

- 3.3.1 Supply Chain Issues Caused By Geopolitical Scenario and the COVID-19 Pandemic

- 3.3.2 etc.; High Installation and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Belgium Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Brussels

- 5.1.2. Rest of Belgium

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.4.2. By Colocation Type

- 5.4.2.1. Hyperscale

- 5.4.2.2. Retail

- 5.4.2.3. Wholesale

- 5.4.3. By End User

- 5.4.3.1. BFSI

- 5.4.3.2. Cloud

- 5.4.3.3. E-Commerce

- 5.4.3.4. Government

- 5.4.3.5. Manufacturing

- 5.4.3.6. Media & Entertainment

- 5.4.3.7. Telecom

- 5.4.3.8. Other End User

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Belgium

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Interxion (Digital Reality Trust Inc )

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Etix Everywhere

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wallonie Data Center SA5 4 LIST OF COMPANIES STUDIE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EXA Infrastructure

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Network Research Belgium SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ANTWERP DATACENTER (Datacenter United)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Proximus S A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 LCL Belgium n v

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AtlasEdge Data Centres

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lumen Technologies Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 KevlinX Belgium BVBA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 VPS House Technology Group LLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Interxion (Digital Reality Trust Inc )

List of Figures

- Figure 1: Belgium Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Belgium Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Belgium Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Belgium Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 3: Belgium Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 4: Belgium Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 5: Belgium Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 6: Belgium Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Belgium Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Belgium Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 9: Belgium Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 10: Belgium Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 11: Belgium Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 12: Belgium Data Center Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Belgium Data Center Market?

The projected CAGR is approximately 4.87%.

2. Which companies are prominent players in the Belgium Data Center Market?

Key companies in the market include Interxion (Digital Reality Trust Inc ), Etix Everywhere, Wallonie Data Center SA5 4 LIST OF COMPANIES STUDIE, EXA Infrastructure, Network Research Belgium SA, ANTWERP DATACENTER (Datacenter United), Proximus S A, LCL Belgium n v, AtlasEdge Data Centres, Lumen Technologies Inc, KevlinX Belgium BVBA, VPS House Technology Group LLC.

3. What are the main segments of the Belgium Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Automation in the Security Screening Industry. Especially to Detect Advanced Threats. etc.; Upsurge in Terror Activities Across the Region; Increasing Government Initiatives on Security Inspection in Schools and Colleges; Increasing Government Initiatives for Smart Cities.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Supply Chain Issues Caused By Geopolitical Scenario and the COVID-19 Pandemic. etc.; High Installation and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

January 2022: Belgian infrastructure investment firm TINC has invested in local data center firm Datacenter United to fund its acquisition of DC Star. Datacenter United has increased the number of data centers it manages to six. In addition to the three existing locations in Antwerp and Brussels, the three DC Star data centers in Burcht, Ghent and Oostkamp are now also part of the Datacenter United ecosystem.November 2021: Colt Data Centre Services (DCS) announced selling 12 colocation sites across Europe with AtlasEdge Data Centres, including the Belgium facility.September 2021: HCL signed partnership to run Proximus’ private cloud infrastructure. The partnership will be fully operational as of February 2022 and wfter which, Proximus’ IT infrastructure will be managed by HCL but remain in Proximus data centers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Belgium Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Belgium Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Belgium Data Center Market?

To stay informed about further developments, trends, and reports in the Belgium Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence