Key Insights

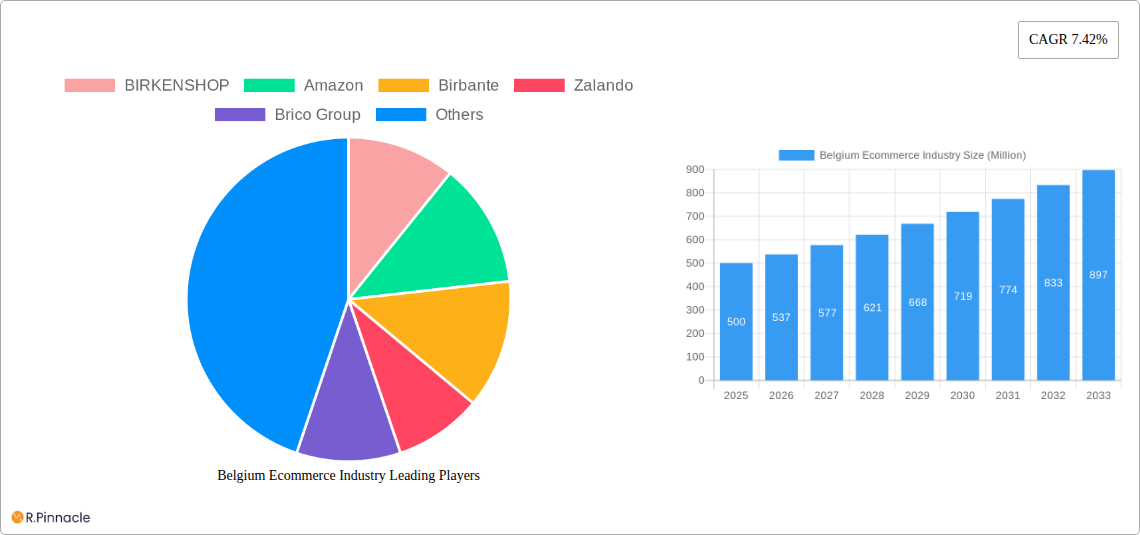

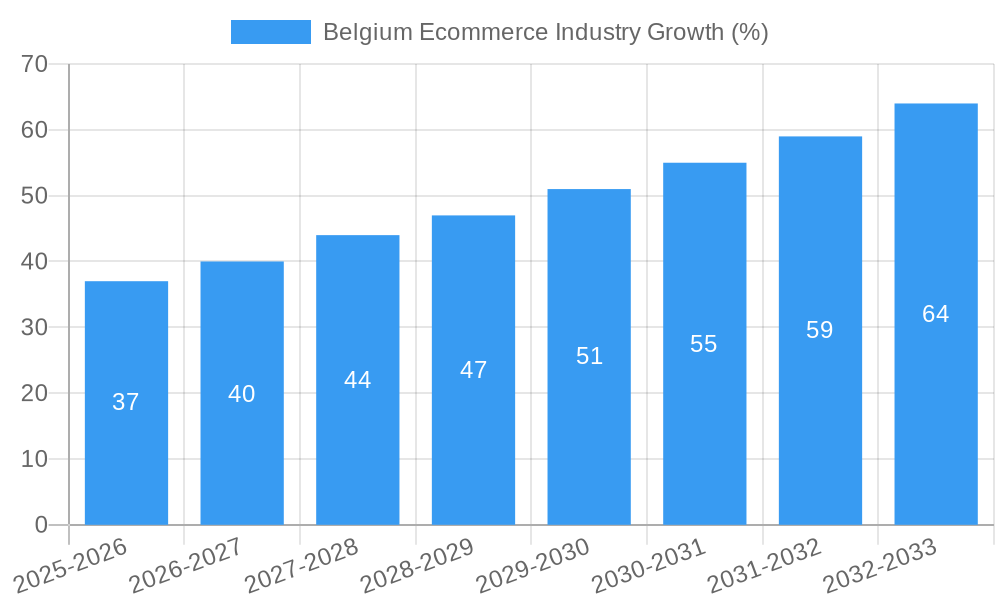

The Belgian e-commerce market, currently exhibiting robust growth, is projected to maintain a significant upward trajectory. With a Compound Annual Growth Rate (CAGR) of 7.42% from 2019 to 2024, the market demonstrates consistent expansion. This growth is fueled by increasing internet and smartphone penetration, a burgeoning young and digitally savvy population, and a rising preference for convenient online shopping experiences. Key players like BIRKENSHOP, Amazon, Zalando, and bol.com are driving this expansion, offering diverse product categories and leveraging sophisticated logistics to cater to consumer demand. The increasing adoption of mobile commerce and the rise of omnichannel strategies, which seamlessly integrate online and offline shopping, are further contributing factors. While challenges like concerns about online security and delivery delays exist, the overall market outlook remains positive. The market's segmentation by application indicates diverse growth opportunities across various product categories, potentially influenced by evolving consumer preferences and technological advancements, such as improved payment gateways and personalized shopping recommendations. Future growth will likely be driven by continued investment in e-commerce infrastructure and innovative marketing strategies.

The forecast period from 2025 to 2033 suggests continued market expansion, building upon the established trends. While precise market size figures for 2025 are not explicitly provided, extrapolating from the historical CAGR and considering the ongoing market dynamics, a reasonable estimate would place the 2025 market size in the hundreds of millions (assuming a value unit of millions of Euros). The continued growth will be shaped by factors including improved logistics, the expansion of online marketplaces, and the increasing adoption of e-commerce by small and medium-sized enterprises (SMEs). Competition among major players is expected to intensify, leading to innovative service offerings and price optimization. Government initiatives promoting digitalization could also further stimulate market growth. Furthermore, focus on personalized experiences and enhanced customer service will become increasingly important factors in maintaining competitive advantage.

Belgium Ecommerce Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Belgium ecommerce industry, covering market structure, dynamics, trends, and future outlook from 2019 to 2033. It's an essential resource for industry professionals, investors, and anyone seeking to understand this rapidly evolving market. The report leverages extensive data analysis, incorporating key developments and insights to offer actionable strategies for success. The base year for this report is 2025, with a forecast period extending to 2033, building upon historical data from 2019-2024. Expected market value during the estimated year (2025) is predicted to be XX Million.

Belgium Ecommerce Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Belgian ecommerce market, examining market concentration, innovation drivers, regulatory influences, and market dynamics. The report delves into the role of mergers and acquisitions (M&A), providing insights into deal values and their impact on market share. Key players like Amazon, Zalando, and Coolblue significantly influence market concentration. The report estimates the combined market share of these top 5 players to be approximately XX Million in 2025. Innovation is driven by factors such as increasing consumer demand for convenience, technological advancements in logistics and payments, and supportive regulatory frameworks. The estimated value of M&A deals in the Belgian ecommerce sector between 2019 and 2024 reached approximately XX Million, signifying considerable consolidation and investment.

- Market Concentration: Analysis of market share held by major players (e.g., Amazon, Zalando, Coolblue).

- Innovation Drivers: Technological advancements, consumer behavior shifts, and regulatory changes influencing market innovation.

- Regulatory Framework: Impact of Belgian and EU regulations on ecommerce businesses and market dynamics.

- Product Substitutes: Examination of alternative channels or platforms impacting ecommerce growth.

- End-User Demographics: Analysis of consumer segments and their purchasing behavior within the Belgian ecommerce market.

- M&A Activities: Overview of significant mergers and acquisitions, their impact on market structure, and deal values.

Belgium Ecommerce Industry Market Dynamics & Trends

This section provides a detailed analysis of the Belgium ecommerce industry’s growth drivers, technological disruptions, consumer preferences, and competitive dynamics. We explore the Compound Annual Growth Rate (CAGR) and market penetration rate, providing a comprehensive overview of the market’s dynamic evolution. The Belgian ecommerce market is experiencing significant growth fueled by rising internet penetration, increasing smartphone usage, and a shift towards online shopping among consumers. The CAGR for the period 2025-2033 is projected at XX%, reflecting the strong growth momentum. Market penetration, currently at XX%, is expected to reach XX% by 2033. Key factors influencing growth include advancements in logistics, improved payment gateways, and increasing adoption of omnichannel strategies by retailers.

Dominant Regions & Segments in Belgium Ecommerce Industry

This section identifies the leading regions and segments within the Belgian ecommerce market. The analysis focuses on market segmentation by application, examining key drivers such as economic policies and infrastructure. While specific regional data may vary, the Flanders region is generally considered a dominant ecommerce hub due to its strong infrastructure, high internet penetration, and thriving business environment.

Key Drivers for Dominant Regions:

- Stronger infrastructure (logistics, internet connectivity).

- Higher disposable income and consumer spending.

- Favorable government policies supporting e-commerce growth.

- Presence of major ecommerce players and distribution centers.

Dominance Analysis: Detailed analysis of market share and growth potential across different regions within Belgium.

Belgium Ecommerce Industry Product Innovations

The Belgian ecommerce sector is witnessing significant product innovation driven by technological advancements, such as AI-powered recommendation engines, personalized shopping experiences, and improved mobile commerce capabilities. These innovations enhance customer experience, leading to increased sales and customer loyalty. Companies are focusing on optimizing their product offerings to suit diverse consumer needs and preferences, resulting in a more dynamic and competitive market.

Report Scope & Segmentation Analysis

This report provides a comprehensive overview of the Belgium ecommerce market, focusing on Market Segmentation - by Application. Each segment’s growth projection, market size, and competitive dynamics are analyzed. This detailed segmentation allows for a granular understanding of the market’s diverse aspects. (Specific segment details require further data to be added here.)

Key Drivers of Belgium Ecommerce Industry Growth

Several key factors are driving the growth of the Belgium ecommerce industry. These include increasing internet and smartphone penetration, rising disposable incomes, and the government’s supportive policies towards digitalization. The development of robust logistics infrastructure and the adoption of innovative technologies further contribute to the sector's expansion.

Challenges in the Belgium Ecommerce Industry Sector

The Belgian ecommerce sector faces challenges such as increasing competition, concerns regarding data privacy and security, and the need for efficient logistics solutions. Maintaining competitiveness in a rapidly evolving market requires continuous innovation and adaptation. Supply chain disruptions, especially noticeable in recent years, also pose a significant hurdle.

Emerging Opportunities in Belgium Ecommerce Industry

The Belgian ecommerce market presents several emerging opportunities, including the growth of mobile commerce, the increasing adoption of personalized marketing strategies, and the expansion into new product categories. The utilization of advanced analytics and AI-powered tools offers further scope for optimization and enhanced customer experience.

Leading Players in the Belgium Ecommerce Industry Market

- BIRKENSHOP

- Amazon

- Birbante

- Zalando

- Brico Group

- Coolblue

- Veepee

- Qpon

- Vanden Borre NV

- bol.com

Key Developments in Belgium Ecommerce Industry

- February 2022: Amazon announced plans to build its first fulfillment center in Antwerp, boosting local delivery capacity.

- April 2022: ViaEurope launched a fully automated sorting belt in Liege, significantly enhancing logistics efficiency (handling over 3,500 parcels per hour).

Future Outlook for Belgium Ecommerce Industry Market

The Belgium ecommerce market is poised for continued growth, driven by technological advancements, changing consumer behavior, and supportive government policies. Strategic investments in logistics, digital marketing, and customer service will be crucial for companies to maintain their competitive edge. The expanding use of omnichannel strategies and the rise of social commerce present significant future opportunities.

Belgium Ecommerce Industry Segmentation

-

1. B2C E-commerce

- 1.1. Market size (GMV) for the period of 2017-2027

-

1.2. Market Segmentation - by Application

- 1.2.1. Beauty & Personal Care

- 1.2.2. Consumer Electronics

- 1.2.3. Fashion & Apparel

- 1.2.4. Food & Beverage

- 1.2.5. Furniture & Home

- 1.2.6. Others (Toys, DIY, Media, etc.)

- 2. Market size (GMV) for the period of 2017-2027

-

3. Application

- 3.1. Beauty & Personal Care

- 3.2. Consumer Electronics

- 3.3. Fashion & Apparel

- 3.4. Food & Beverage

- 3.5. Furniture & Home

- 3.6. Others (Toys, DIY, Media, etc.)

- 4. Beauty & Personal Care

- 5. Consumer Electronics

- 6. Fashion & Apparel

- 7. Food & Beverage

- 8. Furniture & Home

- 9. Others (Toys, DIY, Media, etc.)

-

10. B2B E-commerce

- 10.1. Market size for the period of 2017-2027

Belgium Ecommerce Industry Segmentation By Geography

- 1. Belgium

Belgium Ecommerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.42% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Internet Penetration Across the Country; Increased Adoption of Smartphones

- 3.3. Market Restrains

- 3.3.1. Low Light Sensing Capabilities Act as a Restraining Factor; Low-cost Sensors are Increasing the Threat to Scale Down the Quality

- 3.4. Market Trends

- 3.4.1. Increase in Internet Penetration Across the Country is Fueling the Growth of the Market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Belgium Ecommerce Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 5.1.1. Market size (GMV) for the period of 2017-2027

- 5.1.2. Market Segmentation - by Application

- 5.1.2.1. Beauty & Personal Care

- 5.1.2.2. Consumer Electronics

- 5.1.2.3. Fashion & Apparel

- 5.1.2.4. Food & Beverage

- 5.1.2.5. Furniture & Home

- 5.1.2.6. Others (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Market size (GMV) for the period of 2017-2027

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Beauty & Personal Care

- 5.3.2. Consumer Electronics

- 5.3.3. Fashion & Apparel

- 5.3.4. Food & Beverage

- 5.3.5. Furniture & Home

- 5.3.6. Others (Toys, DIY, Media, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Beauty & Personal Care

- 5.5. Market Analysis, Insights and Forecast - by Consumer Electronics

- 5.6. Market Analysis, Insights and Forecast - by Fashion & Apparel

- 5.7. Market Analysis, Insights and Forecast - by Food & Beverage

- 5.8. Market Analysis, Insights and Forecast - by Furniture & Home

- 5.9. Market Analysis, Insights and Forecast - by Others (Toys, DIY, Media, etc.)

- 5.10. Market Analysis, Insights and Forecast - by B2B E-commerce

- 5.10.1. Market size for the period of 2017-2027

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. Belgium

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 BIRKENSHOP

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amazon

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Birbante

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zalando

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Brico Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Coolblue

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Veepee*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Qpon

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Vanden Borre NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 bol com

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BIRKENSHOP

List of Figures

- Figure 1: Belgium Ecommerce Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Belgium Ecommerce Industry Share (%) by Company 2024

List of Tables

- Table 1: Belgium Ecommerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Belgium Ecommerce Industry Revenue Million Forecast, by B2C E-commerce 2019 & 2032

- Table 3: Belgium Ecommerce Industry Revenue Million Forecast, by Market size (GMV) for the period of 2017-2027 2019 & 2032

- Table 4: Belgium Ecommerce Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Belgium Ecommerce Industry Revenue Million Forecast, by Beauty & Personal Care 2019 & 2032

- Table 6: Belgium Ecommerce Industry Revenue Million Forecast, by Consumer Electronics 2019 & 2032

- Table 7: Belgium Ecommerce Industry Revenue Million Forecast, by Fashion & Apparel 2019 & 2032

- Table 8: Belgium Ecommerce Industry Revenue Million Forecast, by Food & Beverage 2019 & 2032

- Table 9: Belgium Ecommerce Industry Revenue Million Forecast, by Furniture & Home 2019 & 2032

- Table 10: Belgium Ecommerce Industry Revenue Million Forecast, by Others (Toys, DIY, Media, etc.) 2019 & 2032

- Table 11: Belgium Ecommerce Industry Revenue Million Forecast, by B2B E-commerce 2019 & 2032

- Table 12: Belgium Ecommerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 13: Belgium Ecommerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Belgium Ecommerce Industry Revenue Million Forecast, by B2C E-commerce 2019 & 2032

- Table 15: Belgium Ecommerce Industry Revenue Million Forecast, by Market size (GMV) for the period of 2017-2027 2019 & 2032

- Table 16: Belgium Ecommerce Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Belgium Ecommerce Industry Revenue Million Forecast, by Beauty & Personal Care 2019 & 2032

- Table 18: Belgium Ecommerce Industry Revenue Million Forecast, by Consumer Electronics 2019 & 2032

- Table 19: Belgium Ecommerce Industry Revenue Million Forecast, by Fashion & Apparel 2019 & 2032

- Table 20: Belgium Ecommerce Industry Revenue Million Forecast, by Food & Beverage 2019 & 2032

- Table 21: Belgium Ecommerce Industry Revenue Million Forecast, by Furniture & Home 2019 & 2032

- Table 22: Belgium Ecommerce Industry Revenue Million Forecast, by Others (Toys, DIY, Media, etc.) 2019 & 2032

- Table 23: Belgium Ecommerce Industry Revenue Million Forecast, by B2B E-commerce 2019 & 2032

- Table 24: Belgium Ecommerce Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Belgium Ecommerce Industry?

The projected CAGR is approximately 7.42%.

2. Which companies are prominent players in the Belgium Ecommerce Industry?

Key companies in the market include BIRKENSHOP, Amazon, Birbante, Zalando, Brico Group, Coolblue, Veepee*List Not Exhaustive, Qpon, Vanden Borre NV, bol com.

3. What are the main segments of the Belgium Ecommerce Industry?

The market segments include B2C E-commerce, Market size (GMV) for the period of 2017-2027, Application, Beauty & Personal Care, Consumer Electronics, Fashion & Apparel, Food & Beverage, Furniture & Home, Others (Toys, DIY, Media, etc.), B2B E-commerce.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Internet Penetration Across the Country; Increased Adoption of Smartphones.

6. What are the notable trends driving market growth?

Increase in Internet Penetration Across the Country is Fueling the Growth of the Market..

7. Are there any restraints impacting market growth?

Low Light Sensing Capabilities Act as a Restraining Factor; Low-cost Sensors are Increasing the Threat to Scale Down the Quality.

8. Can you provide examples of recent developments in the market?

April 2022 - ViaEurope, an e-commerce logistics company, has launched a fully automatic sorting belt in its Liege E-Hub. This new system can handle over 3.500 parcels per hour, scan barcodes on five sides of the package, weigh it, measure it, and capture pictures. This system launch was according to the company's commitment to operational safety and efficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Belgium Ecommerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Belgium Ecommerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Belgium Ecommerce Industry?

To stay informed about further developments, trends, and reports in the Belgium Ecommerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence