Key Insights

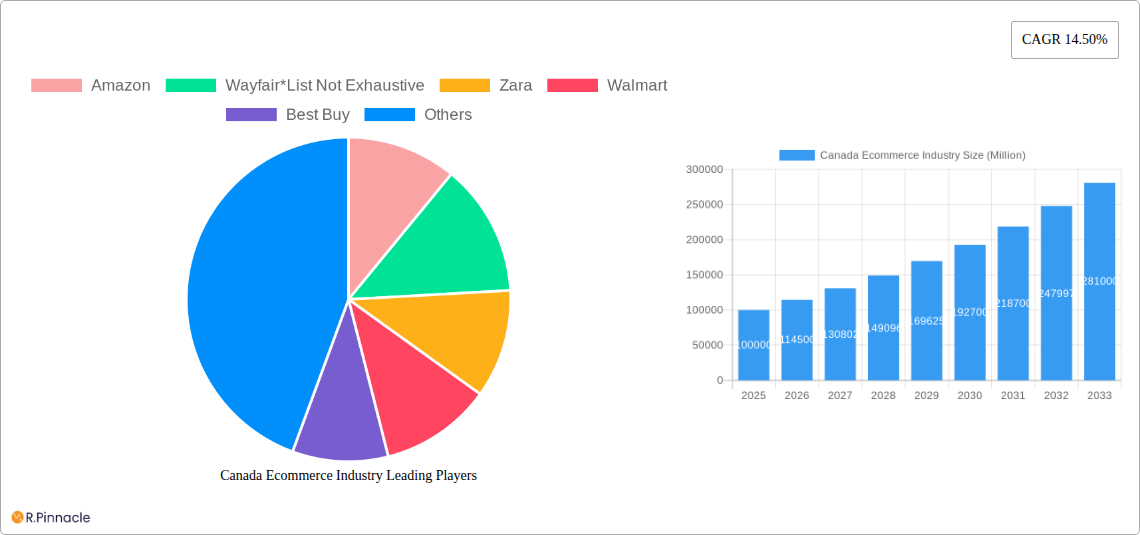

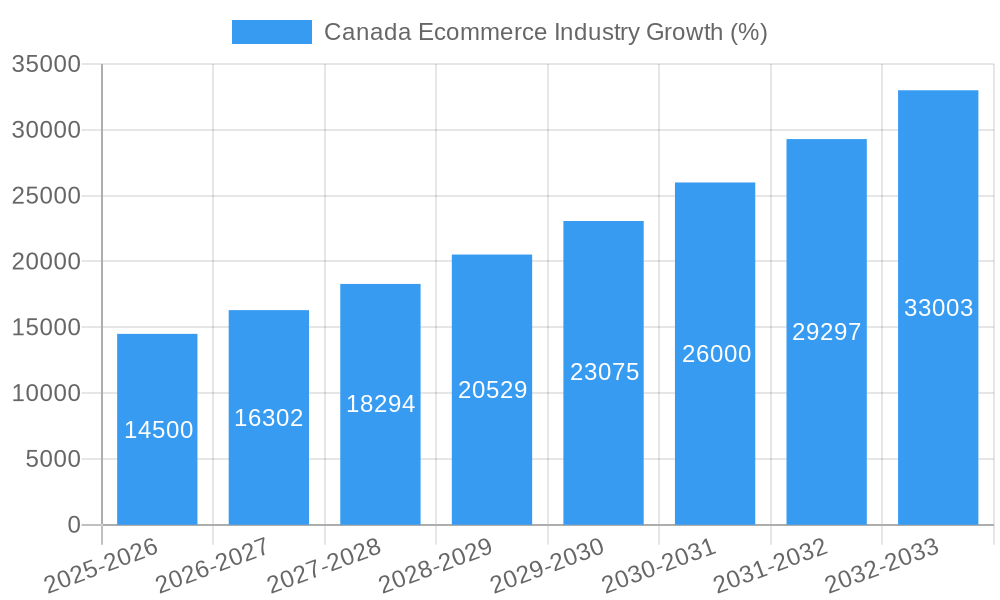

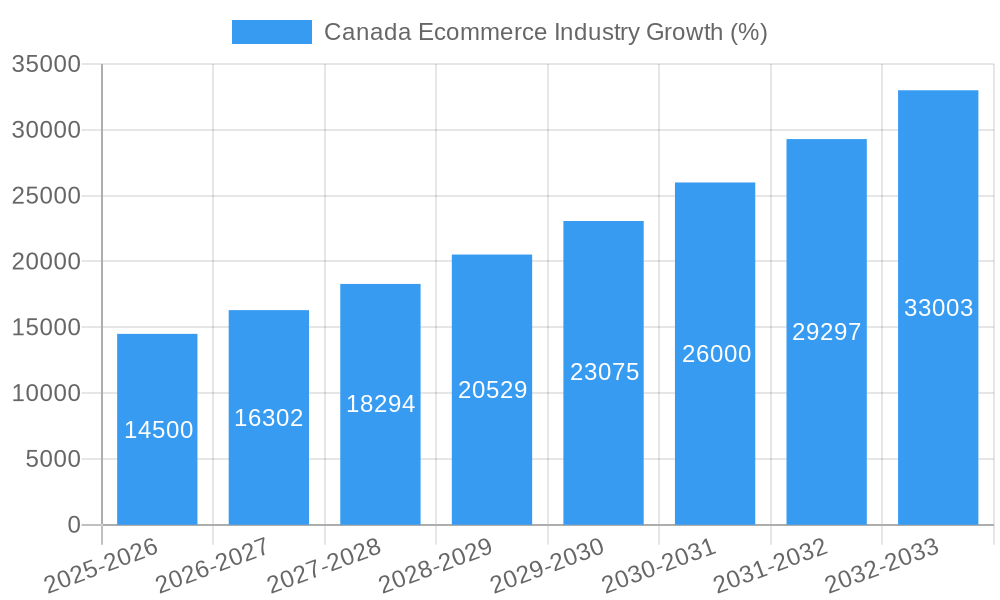

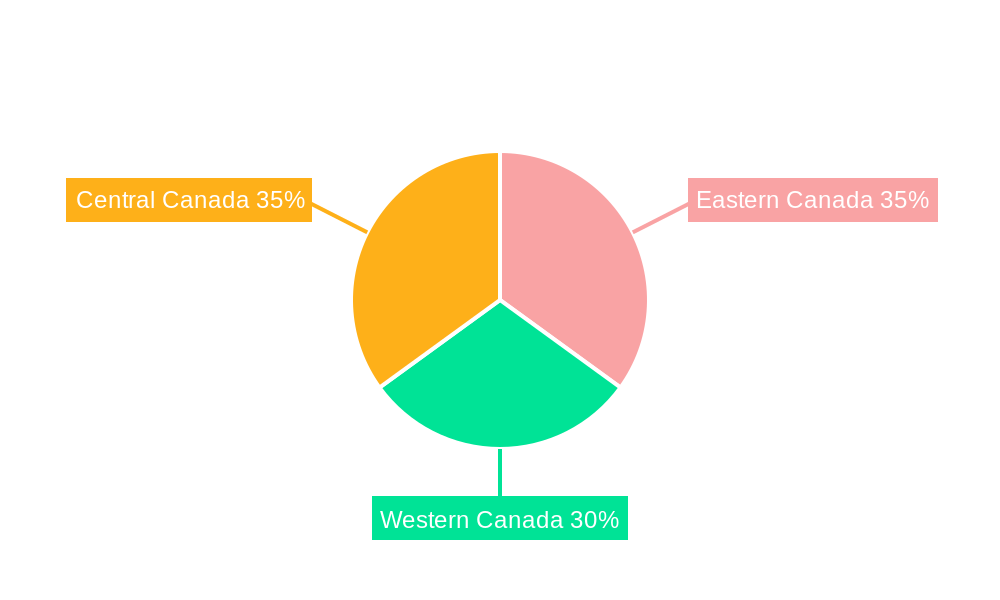

The Canadian e-commerce market, currently experiencing robust growth, is projected to reach a substantial size over the forecast period (2025-2033). Driven by increasing internet and smartphone penetration, a growing preference for online shopping convenience, and the expanding adoption of digital payment methods, the sector demonstrates a Compound Annual Growth Rate (CAGR) of 14.50%. Key players such as Amazon, Wayfair, Walmart, and others are strategically investing in enhanced logistics, personalized shopping experiences, and omnichannel strategies to capture market share. Segmentation by application reveals strong growth in categories like apparel, electronics, and home goods, reflecting evolving consumer preferences. Regional variations exist within Canada, with Eastern, Western, and Central regions exhibiting differing growth trajectories depending on factors like population density, infrastructure, and consumer spending habits. While challenges remain, such as the need for improved rural internet access and concerns about cybersecurity, the overall outlook for the Canadian e-commerce market remains positive. The continued expansion of digital infrastructure, coupled with innovative business models and evolving consumer behavior, will be critical determinants of future market growth.

The competitive landscape is dynamic, with both established international players and homegrown businesses vying for dominance. The historical period (2019-2024) provides a foundation for understanding the market’s trajectory, revealing valuable insights into consumer behavior and market trends. Analyzing this historical data alongside current market drivers and restraints allows for a more accurate forecast. The study period (2019-2033), with a base and estimated year of 2025, provides a comprehensive overview of the market's evolution. Understanding regional nuances is crucial for successful market penetration, requiring tailored strategies to address the specific needs and preferences of consumers across different regions of Canada. The forecast period reveals substantial growth opportunities for businesses capable of adapting to the evolving demands of the Canadian e-commerce landscape.

Canada Ecommerce Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the Canadian ecommerce market, offering invaluable insights for industry professionals, investors, and strategists. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. We delve into market structure, dynamics, dominant segments, innovation trends, and future outlook, providing actionable intelligence for navigating this rapidly evolving landscape. The report quantifies market size in Millions and offers critical analysis of leading players like Amazon, Wayfair, Zara, Walmart, Best Buy, Home Depot, Kroger, Costco, Target, and Apple.

Canada Ecommerce Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Canadian ecommerce market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities from 2019 to 2024. We explore the impact of product substitutes and end-user demographics on market dynamics.

Market Concentration: The Canadian ecommerce market exhibits a moderate level of concentration, with a few dominant players controlling a significant market share, though this is subject to change with consistent M&A activity. Amazon and Walmart currently hold substantial shares. Estimates suggest Amazon holds approximately xx% of the market share in 2024, while Walmart holds approximately xx%. Other significant players have a combined xx% share.

Innovation Drivers: Key innovation drivers include advancements in logistics, AI-powered personalization, and the increasing adoption of omnichannel strategies. The rising popularity of mobile commerce and the expansion of e-commerce into previously underserved markets are also significant drivers.

Regulatory Frameworks: Canadian ecommerce is governed by various regulations related to consumer protection, data privacy, and taxation. These regulations impact market operations and the competitive landscape.

M&A Activities: The Canadian ecommerce sector has witnessed considerable M&A activity in recent years, with deal values exceeding xx Million in the period between 2019 and 2024. These mergers and acquisitions have reshaped market dynamics and competition.

Canada Ecommerce Industry Market Dynamics & Trends

This section provides a detailed examination of the market's growth trajectory, technological disruptions, consumer preferences, and competitive dynamics. The Canadian ecommerce market experienced significant growth during 2019-2024.

The Compound Annual Growth Rate (CAGR) is estimated at xx% during the historical period (2019-2024). Market penetration also increased significantly from xx% in 2019 to xx% in 2024, driven by factors such as increasing internet and smartphone penetration, rising consumer confidence, and favourable economic conditions. We project a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, particularly in areas like AI and automation, are reshaping the sector, fostering intense competition and impacting consumer preferences.

Dominant Regions & Segments in Canada Ecommerce Industry

This section identifies the leading regions and market segments within the Canadian ecommerce industry, analyzing their growth drivers and dominance. Market Segmentation is analyzed through Application based segments.

Key Drivers:

- Economic Policies: Government initiatives promoting digitalization and e-commerce have played a crucial role in market growth.

- Infrastructure: Investments in improved logistics and digital infrastructure are supporting expansion in various regions.

- Consumer Preferences: The growing preference for online shopping and the convenience it offers is a major driver.

Dominance Analysis: Ontario and British Columbia currently represent the most significant regions for ecommerce activity, benefitting from high population density, strong digital infrastructure and purchasing power. However, other provinces are witnessing significant growth driven by improved infrastructure and government support. Within Application based segments, the xx segment currently holds the largest market share due to xx, followed by the xx segment, driven by xx.

Canada Ecommerce Industry Product Innovations

This section highlights recent product developments, applications, and competitive advantages within the Canadian ecommerce landscape. The adoption of innovative technologies such as AI-powered recommendation engines, personalized shopping experiences, and improved logistics solutions are shaping the market. The integration of augmented reality (AR) and virtual reality (VR) technologies is also becoming more prominent, enhancing the online shopping experience and leading to competitive advantages for early adopters.

Report Scope & Segmentation Analysis

This report segments the Canadian ecommerce market based on Application. Each segment's growth projections, market size, and competitive dynamics are analyzed separately. Detailed breakdowns of specific segment sizes and growth projections are provided within the full report.

Key Drivers of Canada Ecommerce Industry Growth

The growth of the Canadian ecommerce industry is fueled by several key factors:

- Technological advancements: Improvements in mobile technology, faster internet speeds, and the rise of innovative payment solutions are significantly boosting online shopping.

- Economic growth: A stable economy leads to increased consumer spending, which benefits the ecommerce sector.

- Favorable regulatory environment: Government policies promoting digital commerce and reducing barriers to entry have fostered growth.

Challenges in the Canada Ecommerce Industry Sector

The Canadian ecommerce sector faces challenges including:

- High logistics costs: Shipping costs and distances in Canada can impact the profitability of ecommerce businesses.

- Cybersecurity threats: Protecting sensitive customer data and preventing online fraud is a growing concern.

- Competition from established retailers: Existing brick-and-mortar stores are increasingly adopting online strategies, intensifying the competitive landscape.

Emerging Opportunities in Canada Ecommerce Industry

Several emerging opportunities exist for Canadian ecommerce businesses:

- Expansion into rural markets: Reaching underserved communities presents a significant market potential.

- Growth of specialized ecommerce platforms: Niches like sustainable products or locally-sourced goods are experiencing rapid growth.

- Adoption of innovative technologies: Using technologies like blockchain for supply chain transparency can create new opportunities.

Leading Players in the Canada Ecommerce Industry Market

Key Developments in Canada Ecommerce Industry

- April 2022: Amazon opened its most advanced technological supply chain in Canada and announced plans to open three more Ontario facilities in 2023. This significantly expands its logistics capabilities and strengthens its market position.

- April 2022: The Home Depot Canada Foundation announced a $125 Million increase in investment to prevent youth homelessness. While not directly impacting ecommerce sales, this demonstrates a strong commitment to Canadian communities and positive brand image.

- April 2022: Walmart Canada partnered with Stingray Retail Media Network for in-store digital audio advertising. This move expands its revenue streams and showcases an innovative approach to advertising.

Future Outlook for Canada Ecommerce Industry Market

The Canadian ecommerce market is poised for continued growth, driven by increasing internet penetration, rising consumer confidence, and technological advancements. The expansion of e-commerce into rural areas, the adoption of innovative technologies, and the growth of specialized ecommerce platforms present significant opportunities for growth and expansion in the coming years. The continued investment by key players in logistics and technology will be pivotal to this growth.

Canada Ecommerce Industry Segmentation

-

1. B2C E-commerce

- 1.1. Market size (GMV) for the period of 2017-2027

-

1.2. Market Segmentation - by Application

- 1.2.1. Beauty & Personal Care

- 1.2.2. Consumer Electronics

- 1.2.3. Fashion & Apparel

- 1.2.4. Food & Beverage

- 1.2.5. Furniture & Home

- 1.2.6. Others (Toys, DIY, Media, etc.)

- 2. Market size (GMV) for the period of 2017-2027

-

3. Application

- 3.1. Beauty & Personal Care

- 3.2. Consumer Electronics

- 3.3. Fashion & Apparel

- 3.4. Food & Beverage

- 3.5. Furniture & Home

- 3.6. Others (Toys, DIY, Media, etc.)

- 4. Beauty & Personal Care

- 5. Consumer Electronics

- 6. Fashion & Apparel

- 7. Food & Beverage

- 8. Furniture & Home

- 9. Others (Toys, DIY, Media, etc.)

-

10. B2B E-commerce

- 10.1. Market size for the period of 2017-2027

Canada Ecommerce Industry Segmentation By Geography

- 1. Canada

Canada Ecommerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Contactless Forms of Payment; Rise in Cross-Border Online Shopping; Penetration of Internet and Smartphone Usage

- 3.3. Market Restrains

- 3.3.1. Operational Compatibility Due to Growing Brand Value

- 3.4. Market Trends

- 3.4.1. Increasing internet users in Canada

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Ecommerce Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 5.1.1. Market size (GMV) for the period of 2017-2027

- 5.1.2. Market Segmentation - by Application

- 5.1.2.1. Beauty & Personal Care

- 5.1.2.2. Consumer Electronics

- 5.1.2.3. Fashion & Apparel

- 5.1.2.4. Food & Beverage

- 5.1.2.5. Furniture & Home

- 5.1.2.6. Others (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Market size (GMV) for the period of 2017-2027

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Beauty & Personal Care

- 5.3.2. Consumer Electronics

- 5.3.3. Fashion & Apparel

- 5.3.4. Food & Beverage

- 5.3.5. Furniture & Home

- 5.3.6. Others (Toys, DIY, Media, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Beauty & Personal Care

- 5.5. Market Analysis, Insights and Forecast - by Consumer Electronics

- 5.6. Market Analysis, Insights and Forecast - by Fashion & Apparel

- 5.7. Market Analysis, Insights and Forecast - by Food & Beverage

- 5.8. Market Analysis, Insights and Forecast - by Furniture & Home

- 5.9. Market Analysis, Insights and Forecast - by Others (Toys, DIY, Media, etc.)

- 5.10. Market Analysis, Insights and Forecast - by B2B E-commerce

- 5.10.1. Market size for the period of 2017-2027

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 6. Eastern Canada Canada Ecommerce Industry Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Ecommerce Industry Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Ecommerce Industry Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Amazon

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Wayfair*List Not Exhaustive

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Zara

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Walmart

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Best Buy

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Home Depot

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Kroger

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Costco

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Target

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Apple

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Amazon

List of Figures

- Figure 1: Canada Ecommerce Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Ecommerce Industry Share (%) by Company 2024

List of Tables

- Table 1: Canada Ecommerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Ecommerce Industry Revenue Million Forecast, by B2C E-commerce 2019 & 2032

- Table 3: Canada Ecommerce Industry Revenue Million Forecast, by Market size (GMV) for the period of 2017-2027 2019 & 2032

- Table 4: Canada Ecommerce Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Canada Ecommerce Industry Revenue Million Forecast, by Beauty & Personal Care 2019 & 2032

- Table 6: Canada Ecommerce Industry Revenue Million Forecast, by Consumer Electronics 2019 & 2032

- Table 7: Canada Ecommerce Industry Revenue Million Forecast, by Fashion & Apparel 2019 & 2032

- Table 8: Canada Ecommerce Industry Revenue Million Forecast, by Food & Beverage 2019 & 2032

- Table 9: Canada Ecommerce Industry Revenue Million Forecast, by Furniture & Home 2019 & 2032

- Table 10: Canada Ecommerce Industry Revenue Million Forecast, by Others (Toys, DIY, Media, etc.) 2019 & 2032

- Table 11: Canada Ecommerce Industry Revenue Million Forecast, by B2B E-commerce 2019 & 2032

- Table 12: Canada Ecommerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 13: Canada Ecommerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Eastern Canada Canada Ecommerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Western Canada Canada Ecommerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Central Canada Canada Ecommerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada Ecommerce Industry Revenue Million Forecast, by B2C E-commerce 2019 & 2032

- Table 18: Canada Ecommerce Industry Revenue Million Forecast, by Market size (GMV) for the period of 2017-2027 2019 & 2032

- Table 19: Canada Ecommerce Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Canada Ecommerce Industry Revenue Million Forecast, by Beauty & Personal Care 2019 & 2032

- Table 21: Canada Ecommerce Industry Revenue Million Forecast, by Consumer Electronics 2019 & 2032

- Table 22: Canada Ecommerce Industry Revenue Million Forecast, by Fashion & Apparel 2019 & 2032

- Table 23: Canada Ecommerce Industry Revenue Million Forecast, by Food & Beverage 2019 & 2032

- Table 24: Canada Ecommerce Industry Revenue Million Forecast, by Furniture & Home 2019 & 2032

- Table 25: Canada Ecommerce Industry Revenue Million Forecast, by Others (Toys, DIY, Media, etc.) 2019 & 2032

- Table 26: Canada Ecommerce Industry Revenue Million Forecast, by B2B E-commerce 2019 & 2032

- Table 27: Canada Ecommerce Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Ecommerce Industry?

The projected CAGR is approximately 14.50%.

2. Which companies are prominent players in the Canada Ecommerce Industry?

Key companies in the market include Amazon, Wayfair*List Not Exhaustive, Zara, Walmart, Best Buy, Home Depot, Kroger, Costco, Target, Apple.

3. What are the main segments of the Canada Ecommerce Industry?

The market segments include B2C E-commerce, Market size (GMV) for the period of 2017-2027, Application, Beauty & Personal Care, Consumer Electronics, Fashion & Apparel, Food & Beverage, Furniture & Home, Others (Toys, DIY, Media, etc.), B2B E-commerce.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Contactless Forms of Payment; Rise in Cross-Border Online Shopping; Penetration of Internet and Smartphone Usage.

6. What are the notable trends driving market growth?

Increasing internet users in Canada.

7. Are there any restraints impacting market growth?

Operational Compatibility Due to Growing Brand Value.

8. Can you provide examples of recent developments in the market?

May 2022- The robotics facility, which Amazon called (new window) its most advanced technological supply chain in Canada, opened in April 2022. In April, the company announced its plans to open three more Ontario facilities in 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Ecommerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Ecommerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Ecommerce Industry?

To stay informed about further developments, trends, and reports in the Canada Ecommerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence