Key Insights

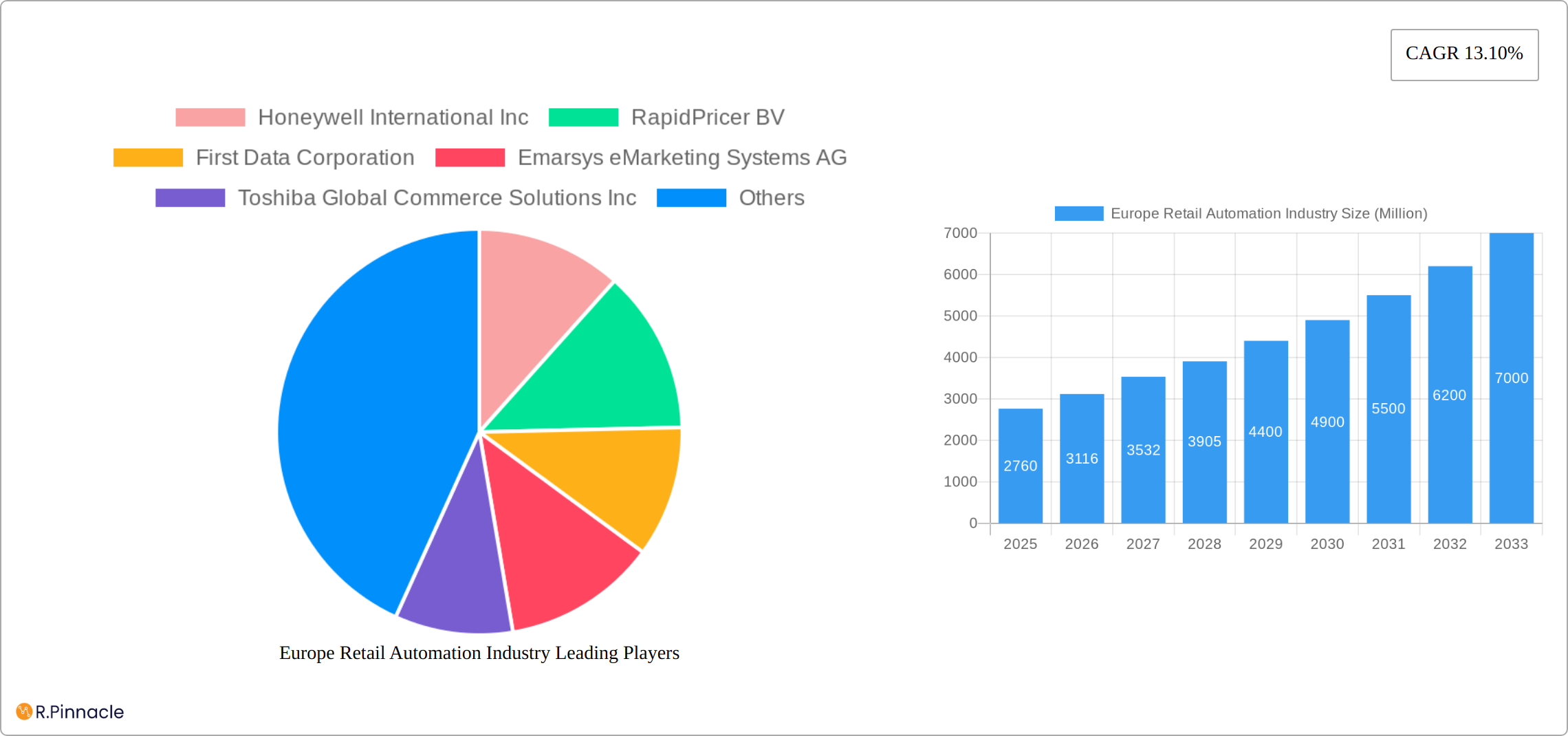

The European retail automation market, valued at €2.76 billion in 2025, is projected to experience robust growth, driven by the increasing adoption of technology to enhance operational efficiency, improve customer experience, and gain a competitive edge. The Compound Annual Growth Rate (CAGR) of 13.10% from 2025 to 2033 indicates a significant expansion, with the market expected to exceed €8 billion by 2033. This growth is fueled by several key factors. Firstly, the rising demand for optimized inventory management and supply chain solutions, particularly within the grocery and general merchandise sectors, is pushing retailers to invest in automation technologies like self-checkout kiosks and automated warehousing systems. Secondly, the hospitality sector is embracing automation to streamline operations, improve order accuracy, and personalize the customer experience through solutions like point-of-sale (POS) systems and robotic process automation (RPA). Finally, technological advancements, including the development of more sophisticated and affordable automation solutions, are making these technologies accessible to a wider range of retailers, regardless of size. The market segmentation shows strong growth across key regions like the United Kingdom, Germany, and France, and significant potential in other European countries. Hardware, including POS systems and scanners, constitutes a major share of the market, but the software segment is experiencing rapid growth, driven by the increasing need for data analytics and integrated retail management solutions.

Competition in the European retail automation market is intense, with established players like Honeywell, NCR, and Toshiba competing alongside smaller, specialized firms. The continued integration of artificial intelligence (AI) and machine learning (ML) into retail automation solutions will further drive market expansion. Challenges to growth include high initial investment costs for some technologies, the need for robust cybersecurity measures, and potential workforce displacement concerns. However, the long-term benefits of increased efficiency, reduced costs, and improved customer satisfaction are expected to outweigh these challenges, ensuring continued market expansion throughout the forecast period. The market's dynamism suggests a future where automated solutions become increasingly integrated into the everyday operations of European retail businesses, shaping the industry's trajectory for years to come.

Europe Retail Automation Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe Retail Automation Industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, and future outlook. The report leverages extensive data and analysis to provide actionable intelligence, forecasting a market valued at XX Million by 2033.

Europe Retail Automation Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the European retail automation market. The market is moderately concentrated, with key players holding significant but not dominant market shares. Honeywell International Inc, NCR Corporation, and Zebra Technologies Corp. are among the leading players, collectively holding an estimated xx% market share in 2025. Innovation is driven by the need for enhanced efficiency, improved customer experience, and the adoption of advanced technologies like AI and robotics. Regulatory frameworks, particularly concerning data privacy and worker displacement, play a significant role. The industry is witnessing increasing M&A activity, with deal values exceeding XX Million in the past five years. This consolidation reflects the desire for scale, technology acquisition, and broader market reach.

- Market Concentration: Moderately concentrated with key players holding significant shares.

- Innovation Drivers: Efficiency gains, enhanced customer experience, AI, and robotics.

- Regulatory Framework: Data privacy, worker displacement concerns.

- M&A Activity: Significant activity with deal values exceeding XX Million in recent years.

- Product Substitutes: Limited direct substitutes, but competition exists from alternative efficiency-enhancing solutions.

- End-User Demographics: Shifting towards digitally savvy consumers demanding seamless experiences.

Europe Retail Automation Industry Market Dynamics & Trends

The European retail automation market exhibits strong growth dynamics, fueled by several key factors. The market is experiencing a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by factors such as increasing labor costs, the demand for personalized shopping experiences, and the ongoing digital transformation within the retail sector. Technological advancements, particularly in AI, robotics, and cloud computing, are disrupting traditional retail operations. Consumer preferences are shifting towards convenience and personalized service, further boosting the demand for automated solutions. Competitive dynamics are characterized by both collaboration and competition among established players and emerging startups. Market penetration for automation solutions within the European retail sector is expected to reach xx% by 2033.

Dominant Regions & Segments in Europe Retail Automation Industry

The United Kingdom holds the largest market share within Europe, driven by strong adoption rates and advanced technological infrastructure. Germany and France follow closely, exhibiting substantial growth potential. The grocery segment is the largest end-user segment, followed by general merchandise and hospitality. Hardware solutions currently dominate the market by type, but software is expected to witness significant growth.

- Leading Region: United Kingdom (strong adoption rates and advanced infrastructure)

- Leading Country: United Kingdom

- Leading Segment (End User): Grocery (high volume and efficiency needs)

- Leading Segment (Type): Hardware (established solutions and immediate impact)

Key Drivers (United Kingdom):

- Robust e-commerce sector and digital adoption.

- Favorable government policies supporting technological advancements.

- Well-developed logistics infrastructure.

Europe Retail Automation Industry Product Innovations

Recent product developments are focused on enhancing customer experience through robotics and AI-powered solutions. Robots are increasingly used for tasks such as inventory management, customer assistance, and delivery. AI-driven solutions optimize pricing, personalize recommendations, and provide predictive analytics. These innovations offer competitive advantages by improving efficiency, reducing costs, and enhancing customer engagement.

Report Scope & Segmentation Analysis

This report segments the market by end-user (Grocery, General Merchandise, Hospitality), country (United Kingdom, Germany, France, Rest of Europe), and type (Hardware, Software). Each segment exhibits unique growth trajectories and competitive dynamics. The grocery segment is projected to maintain the largest market share throughout the forecast period. The UK market is expected to be the largest within Europe. Hardware solutions will continue to hold a significant market share, though software's market share is expected to increase substantially.

Key Drivers of Europe Retail Automation Industry Growth

The growth of the European retail automation industry is driven by several factors: rising labor costs, increasing pressure to enhance efficiency and reduce operational expenses, the need for improved customer experience, and the growing adoption of advanced technologies such as AI and robotics. Government initiatives promoting digitalization and automation further contribute to market growth.

Challenges in the Europe Retail Automation Industry Sector

The industry faces challenges such as high initial investment costs for automation technologies, concerns about job displacement due to automation, and the need for robust cybersecurity measures to protect sensitive data. Supply chain disruptions and the integration of new technologies into existing systems also present challenges. Regulatory complexities and the need for skilled workforce to manage and maintain automated systems are significant hurdles.

Emerging Opportunities in Europe Retail Automation Industry

Emerging opportunities lie in the adoption of advanced technologies like AI, the expansion into new market segments such as smaller retailers and personalized experiences, and the development of sustainable and energy-efficient automation solutions. The growing demand for seamless omnichannel retail experiences also presents significant growth opportunities.

Leading Players in the Europe Retail Automation Industry Market

- Honeywell International Inc

- RapidPricer BV

- First Data Corporation

- Emarsys eMarketing Systems AG

- Toshiba Global Commerce Solutions Inc

- NCR Corporation

- Fujitsu Limited

- Zebra Technologies Corp

- Diebold Nixdorf Incorporated

- Datalogic SpA

Key Developments in Europe Retail Automation Industry Industry

- November 2022: Adapta Robotics partnered with Carrefour to launch ERIS, a retail robot for inventory management in Romania.

- November 2022: Pudu Robotics and Carrefour trialled BellaBot (dubbed "Kerfu") for delivery services in Poland, significantly impacting sales and customer engagement.

- January 2023: Currys partnered with UX Global to trial KettyBot, a customer assistance robot in the UK.

Future Outlook for Europe Retail Automation Industry Market

The future of the European retail automation market is bright. Continued technological advancements, increased consumer demand for personalized experiences, and favorable government policies will drive sustained growth. The market is poised for significant expansion, particularly in areas like AI-powered solutions and robotics, creating lucrative opportunities for businesses and investors.

Europe Retail Automation Industry Segmentation

-

1. Type

-

1.1. Hardware

- 1.1.1. POS System

- 1.1.2. Self-checkout System

- 1.1.3. RFID and Barcode Scanners

- 1.1.4. Other Hardware Types

- 1.2. Software

-

1.1. Hardware

-

2. End User

- 2.1. Grocery

- 2.2. General Merchandise

- 2.3. Hospitality

Europe Retail Automation Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Retail Automation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Quality and Fast Service; Automated Technologies Being More Widely Used in the Retail Business

- 3.3. Market Restrains

- 3.3.1. Technical and Security Concerns

- 3.4. Market Trends

- 3.4.1. Grocery Retailers are Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Retail Automation Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.1.1. POS System

- 5.1.1.2. Self-checkout System

- 5.1.1.3. RFID and Barcode Scanners

- 5.1.1.4. Other Hardware Types

- 5.1.2. Software

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Grocery

- 5.2.2. General Merchandise

- 5.2.3. Hospitality

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Retail Automation Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Retail Automation Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Retail Automation Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Retail Automation Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Retail Automation Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Retail Automation Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Retail Automation Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Honeywell International Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 RapidPricer BV

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 First Data Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Emarsys eMarketing Systems AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Toshiba Global Commerce Solutions Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 NCR Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Fujitsu Limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Zebra Technologies Corp

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Diebold Nixdorf Incorporated

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Datalogic SpA

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe Retail Automation Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Retail Automation Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Retail Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Retail Automation Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Retail Automation Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Europe Retail Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Retail Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Retail Automation Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Europe Retail Automation Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 15: Europe Retail Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Retail Automation Industry?

The projected CAGR is approximately 13.10%.

2. Which companies are prominent players in the Europe Retail Automation Industry?

Key companies in the market include Honeywell International Inc, RapidPricer BV, First Data Corporation, Emarsys eMarketing Systems AG, Toshiba Global Commerce Solutions Inc, NCR Corporation, Fujitsu Limited, Zebra Technologies Corp, Diebold Nixdorf Incorporated, Datalogic SpA.

3. What are the main segments of the Europe Retail Automation Industry?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.76 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Quality and Fast Service; Automated Technologies Being More Widely Used in the Retail Business.

6. What are the notable trends driving market growth?

Grocery Retailers are Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Technical and Security Concerns.

8. Can you provide examples of recent developments in the market?

January 2023 - Currys, the UK-based retailer, partnered with a digital display specialist UX Global (UXG), to trial KettyBot, the robot for customer assistance. China's Pudu Robotics develops KettyBot. The robot will significantly help customers who know what they want but need a little assistance finding it in the store. This way, customers will save time while enhancing their in-store experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Retail Automation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Retail Automation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Retail Automation Industry?

To stay informed about further developments, trends, and reports in the Europe Retail Automation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence