Key Insights

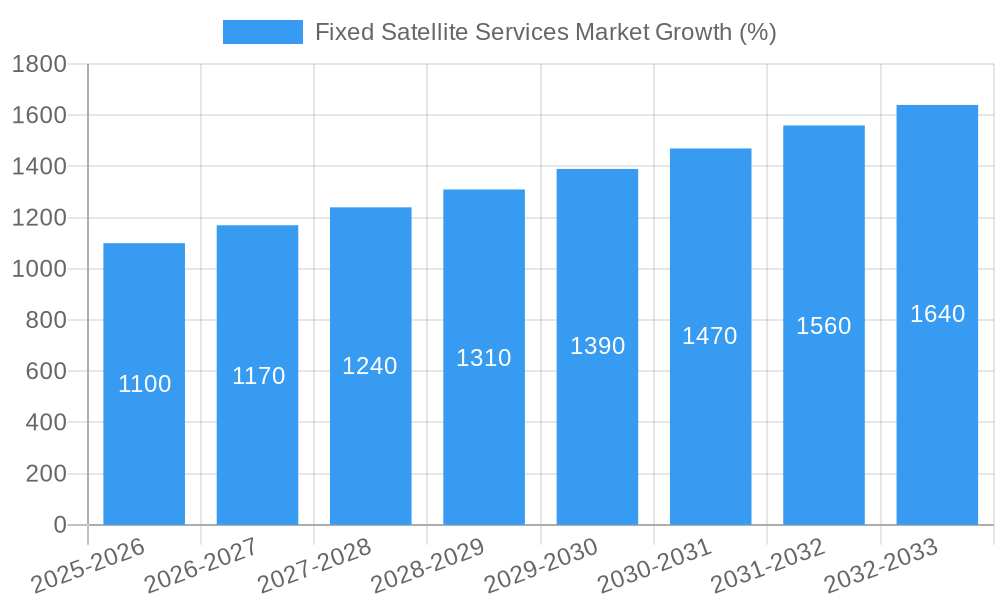

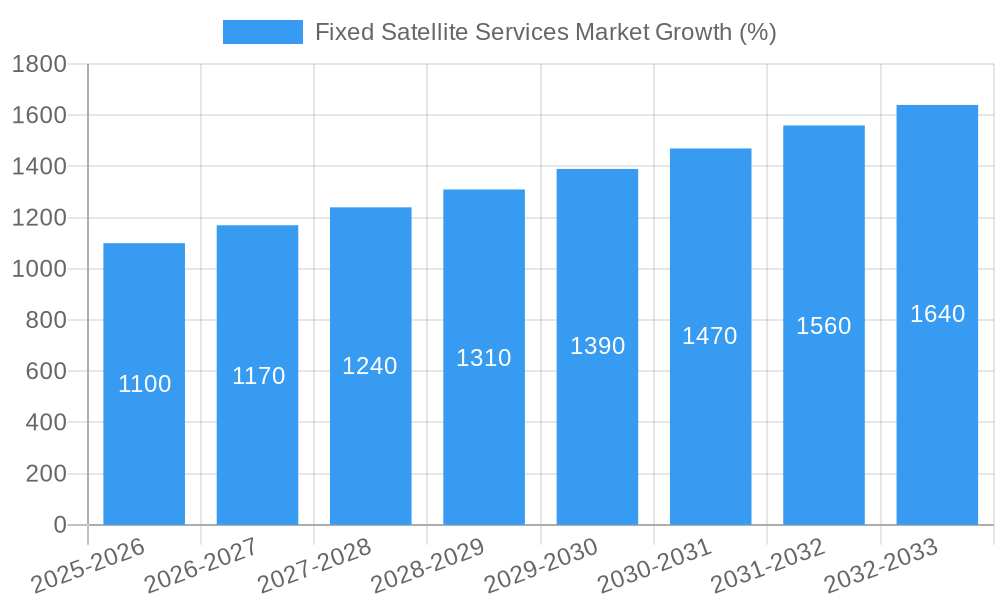

The Fixed Satellite Services (FSS) market, currently valued at approximately $XX million (assuming a reasonable market size based on industry trends and comparable sectors), is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.48% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for high-bandwidth connectivity in underserved regions, particularly in emerging economies across Asia Pacific and the Middle East, fuels significant market growth. Government initiatives promoting digital infrastructure development, coupled with the expanding adoption of satellite-based broadband services for both commercial and residential applications, are major contributors. Furthermore, the growth of the aerospace and defense sectors, reliant on secure and reliable satellite communication, is significantly impacting market expansion. The rising adoption of managed services, offering scalable and cost-effective solutions, also contributes to market dynamism. However, challenges remain, including the competitive landscape with terrestrial fiber optic networks and the high initial investment costs associated with satellite infrastructure.

The segmentation of the FSS market reveals key opportunities. The transponder agreements segment, providing dedicated satellite capacity, is likely to dominate initially, while the managed services segment, offering flexibility and cost optimization, is poised for significant growth over the forecast period. Among end-user verticals, the government and commercial sectors currently lead, but the aerospace and defense, as well as media sectors, represent significant growth areas driven by their increasing reliance on satellite communication technologies for strategic operations and content delivery. Leading players like Telesat Holdings, Intelsat SA, and SES SA are actively shaping market dynamics through strategic partnerships, technological advancements, and expansion into new geographical markets. Regional growth will vary, with Asia Pacific and the Middle East likely to outperform others given their expanding infrastructure projects and increasing demand for communication services. The market's future hinges on continued technological innovation, such as the development of high-throughput satellites and improved network efficiency, to overcome cost barriers and improve accessibility.

This comprehensive report provides a detailed analysis of the Fixed Satellite Services market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by end-user vertical (Government, Commercial, Aerospace and Defense, Media, Other End-users Verticals) and type of service (Transponder Agreements, Managed Services). The report projects a market size of xx Million by 2033, driven by significant technological advancements and expanding global connectivity needs.

Fixed Satellite Services Market Structure & Innovation Trends

This section analyzes the competitive landscape, including market concentration, innovation drivers, and regulatory frameworks impacting the Fixed Satellite Services market. Key players such as Telesat Holdings, Arab Satellite Communications Organization, Singapore Telecommunications Ltd (Singtel), Nigerian Communications Satellites Ltd, Telenor Satellite Broadcasting, Hispasat SA, SES SA, Intelsat SA, Embratel Star One, Thaicom Public Company Ltd, and Eutelsat Communications are examined for their market share and strategic initiatives.

Market Concentration: The market exhibits a moderately concentrated structure, with a few major players holding significant market share. The xx Million market is primarily dominated by the top 5 players, holding approximately xx% of the market share collectively.

Innovation Drivers: Technological advancements like High Throughput Satellites (HTS) and advancements in Very Small Aperture Terminals (VSAT) technology are driving innovation, leading to improved bandwidth, reduced latency, and increased efficiency. Investment in Low Earth Orbit (LEO) satellite constellations is also influencing the market.

Regulatory Frameworks: Government regulations concerning spectrum allocation, licensing, and international collaborations significantly impact market growth. Variations in regulatory environments across different regions create both opportunities and challenges.

Product Substitutes: Terrestrial fiber optic networks and other wireless technologies represent key substitutes, impacting market penetration in specific regions and applications.

End-User Demographics: The increasing demand for reliable and high-speed connectivity across various sectors is a critical growth driver. Government initiatives and commercial investments are significantly expanding the user base.

M&A Activities: The Fixed Satellite Services market has witnessed significant M&A activity in recent years, with deal values exceeding xx Million in the last five years, demonstrating consolidation and strategic growth strategies among key players. These activities are reshaping the competitive landscape and driving innovation.

Fixed Satellite Services Market Dynamics & Trends

This section delves into the market dynamics, including growth drivers, technological disruptions, consumer preferences, and competitive dynamics within the Fixed Satellite Services market. The report highlights the significant influence of technological advancements, particularly the shift towards HTS and LEO constellations.

The market is witnessing a CAGR of xx% during the forecast period (2025-2033), fueled by increasing demand for broadband services in remote areas, growing adoption of satellite-based internet services, and the expansion of government and commercial applications. Market penetration is expected to increase significantly in developing economies due to infrastructure limitations and growing internet adoption. Technological disruptions, such as the emergence of LEO satellite constellations, are transforming the market, offering greater capacity and lower latency. Consumer preferences are increasingly shifting towards higher bandwidth and more reliable connectivity, driving demand for advanced satellite technologies. Intense competition among existing players and the emergence of new entrants further shape the market dynamics.

Dominant Regions & Segments in Fixed Satellite Services Market

This section identifies the leading regions and segments within the Fixed Satellite Services market. North America and Europe currently dominate the market, driven by high technological adoption and established infrastructure. However, the Asia-Pacific region is expected to witness significant growth in the coming years due to expanding infrastructure investments and increasing demand for connectivity.

By End-user Vertical:

- Government: Government agencies utilize fixed satellite services for various applications, including national security, disaster relief, and public safety.

- Commercial: The commercial sector is a major consumer of fixed satellite services, using it for applications including enterprise networks, telecommunications, and broadcasting.

- Aerospace and Defense: This segment benefits from high-bandwidth, low-latency communications provided by satellite services for critical operations.

- Media: Media companies rely heavily on satellite services for broadcasting and content distribution.

- Other End-users Verticals: This segment includes various industries like energy, maritime, and transportation, utilizing satellite services for communication and data transmission.

By Type of Services:

- Transponder Agreements: This remains a significant revenue stream for satellite operators, providing dedicated bandwidth to customers.

- Managed Services: Managed services offer comprehensive solutions, incorporating network management, technical support, and other value-added services, driving higher revenue per user.

The key drivers for the dominance of certain regions include favorable economic policies, robust infrastructure development, and high government spending on telecommunications infrastructure. The competitive intensity within each segment varies, with some segments experiencing higher competition than others.

Fixed Satellite Services Market Product Innovations

Recent product innovations focus on enhancing capacity, lowering latency, and improving overall efficiency. The emergence of HTS and the expansion of LEO satellite constellations are key examples, providing increased bandwidth and better coverage. These innovations aim to address the limitations of traditional satellite technology and improve the market fit of satellite-based services in various industries. Advanced technologies such as laser-based inter-satellite communication are emerging, further revolutionizing satellite network performance.

Report Scope & Segmentation Analysis

The report provides a comprehensive market segmentation analysis across both end-user verticals and service types. Each segment's growth projections, market size, and competitive dynamics are examined in detail. The market size for each segment is projected based on historical data, current market trends, and future growth forecasts, creating a comprehensive picture of the overall market landscape. The report thoroughly analyzes the competitive dynamics within each segment, highlighting key players, their market share, and their competitive strategies.

Key Drivers of Fixed Satellite Services Market Growth

Key growth drivers include technological advancements in satellite technology, increasing demand for broadband services in underserved areas, growing adoption of satellite-based internet of things (IoT) applications, government initiatives to support satellite infrastructure development, and the expansion of commercial satellite applications.

Challenges in the Fixed Satellite Services Market Sector

Challenges include high capital expenditure for satellite infrastructure, intense competition from terrestrial networks, regulatory hurdles related to spectrum allocation, and technological limitations impacting signal reliability and latency, especially in challenging geographic areas. The impact of these challenges can be quantified by the slower growth rate in certain regions experiencing stricter regulations or limited infrastructure investments.

Emerging Opportunities in Fixed Satellite Services Market

Emerging opportunities include the expansion of high-throughput satellite systems, the growth of the space-based internet of things (IoT) market, the development of new satellite-based applications in areas such as autonomous vehicles and precision agriculture, and the emergence of new business models for satellite-based services.

Leading Players in the Fixed Satellite Services Market Market

- Telesat Holdings

- Arab Satellite Communications Organization

- Singapore Telecommunications Ltd (Singtel)

- Nigerian Communications Satellites Ltd

- Telenor Satellite Broadcasting

- Hispasat SA

- SES SA

- Intelsat SA

- Embratel Star One

- Thaicom Public Company Ltd

- Eutelsat Communications

Key Developments in Fixed Satellite Services Market Industry

- January 2023: Launch of a new high-throughput satellite by SES SA, significantly expanding its capacity.

- June 2022: Partnership between Telesat Holdings and a major telecom provider to offer enhanced broadband services.

- October 2021: Acquisition of a smaller satellite operator by Intelsat SA, bolstering its market position.

- Further key developments will be included in the full report.

Future Outlook for Fixed Satellite Services Market Market

The Fixed Satellite Services market is poised for robust growth, driven by continuous technological innovations, expanding connectivity demands, and increased government and commercial investments. Strategic partnerships, M&A activity, and the adoption of innovative business models will shape the future competitive landscape, leading to further market consolidation and enhanced service offerings. The market's future potential lies in the expansion of new applications, improved network performance, and greater accessibility across various regions and demographics.

Fixed Satellite Services Market Segmentation

-

1. Type of Services

- 1.1. Transponder Agreements

- 1.2. Managed Services

-

2. End-user Vertical

- 2.1. Government

- 2.2. Commercial

- 2.3. Aerospace and Defense

- 2.4. Media

- 2.5. Other End-users Verticals

Fixed Satellite Services Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Fixed Satellite Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.48% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing DTH Subscriptions; Increasing Demand from Corporate Enterprise and Growing use of Transponders in the Media and Entertainment Industry

- 3.3. Market Restrains

- 3.3.1. ; High Capital Investment and Increasing Use of Fiber Optic Transmission Cables; Regulatory Constraints and Limited Orbital Locations

- 3.4. Market Trends

- 3.4.1. Increasing 5G Penetration to Stimulate the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fixed Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Services

- 5.1.1. Transponder Agreements

- 5.1.2. Managed Services

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Government

- 5.2.2. Commercial

- 5.2.3. Aerospace and Defense

- 5.2.4. Media

- 5.2.5. Other End-users Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type of Services

- 6. North America Fixed Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type of Services

- 6.1.1. Transponder Agreements

- 6.1.2. Managed Services

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Government

- 6.2.2. Commercial

- 6.2.3. Aerospace and Defense

- 6.2.4. Media

- 6.2.5. Other End-users Verticals

- 6.1. Market Analysis, Insights and Forecast - by Type of Services

- 7. Europe Fixed Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type of Services

- 7.1.1. Transponder Agreements

- 7.1.2. Managed Services

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Government

- 7.2.2. Commercial

- 7.2.3. Aerospace and Defense

- 7.2.4. Media

- 7.2.5. Other End-users Verticals

- 7.1. Market Analysis, Insights and Forecast - by Type of Services

- 8. Asia Pacific Fixed Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type of Services

- 8.1.1. Transponder Agreements

- 8.1.2. Managed Services

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Government

- 8.2.2. Commercial

- 8.2.3. Aerospace and Defense

- 8.2.4. Media

- 8.2.5. Other End-users Verticals

- 8.1. Market Analysis, Insights and Forecast - by Type of Services

- 9. Latin America Fixed Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type of Services

- 9.1.1. Transponder Agreements

- 9.1.2. Managed Services

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Government

- 9.2.2. Commercial

- 9.2.3. Aerospace and Defense

- 9.2.4. Media

- 9.2.5. Other End-users Verticals

- 9.1. Market Analysis, Insights and Forecast - by Type of Services

- 10. Middle East Fixed Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type of Services

- 10.1.1. Transponder Agreements

- 10.1.2. Managed Services

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Government

- 10.2.2. Commercial

- 10.2.3. Aerospace and Defense

- 10.2.4. Media

- 10.2.5. Other End-users Verticals

- 10.1. Market Analysis, Insights and Forecast - by Type of Services

- 11. North America Fixed Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Fixed Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Fixed Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Fixed Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East Fixed Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Telesat Holdings

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Arab Satellite Communications Organization

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Singapore Telecommunications Ltd (Singtel)

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Nigerian Communications Satellites Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Telenor Satellite Broadcasting

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Hispasat SA

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 SES SA

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Intelsat SA

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Embratel Star One

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Thaicom Public Company Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Eutelsat Communications

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Telesat Holdings

List of Figures

- Figure 1: Global Fixed Satellite Services Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Fixed Satellite Services Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Fixed Satellite Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Fixed Satellite Services Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Fixed Satellite Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Fixed Satellite Services Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Fixed Satellite Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Fixed Satellite Services Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Fixed Satellite Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Fixed Satellite Services Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Fixed Satellite Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Fixed Satellite Services Market Revenue (Million), by Type of Services 2024 & 2032

- Figure 13: North America Fixed Satellite Services Market Revenue Share (%), by Type of Services 2024 & 2032

- Figure 14: North America Fixed Satellite Services Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 15: North America Fixed Satellite Services Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 16: North America Fixed Satellite Services Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Fixed Satellite Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Fixed Satellite Services Market Revenue (Million), by Type of Services 2024 & 2032

- Figure 19: Europe Fixed Satellite Services Market Revenue Share (%), by Type of Services 2024 & 2032

- Figure 20: Europe Fixed Satellite Services Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 21: Europe Fixed Satellite Services Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 22: Europe Fixed Satellite Services Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Fixed Satellite Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Fixed Satellite Services Market Revenue (Million), by Type of Services 2024 & 2032

- Figure 25: Asia Pacific Fixed Satellite Services Market Revenue Share (%), by Type of Services 2024 & 2032

- Figure 26: Asia Pacific Fixed Satellite Services Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 27: Asia Pacific Fixed Satellite Services Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 28: Asia Pacific Fixed Satellite Services Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Fixed Satellite Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Fixed Satellite Services Market Revenue (Million), by Type of Services 2024 & 2032

- Figure 31: Latin America Fixed Satellite Services Market Revenue Share (%), by Type of Services 2024 & 2032

- Figure 32: Latin America Fixed Satellite Services Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 33: Latin America Fixed Satellite Services Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 34: Latin America Fixed Satellite Services Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Fixed Satellite Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East Fixed Satellite Services Market Revenue (Million), by Type of Services 2024 & 2032

- Figure 37: Middle East Fixed Satellite Services Market Revenue Share (%), by Type of Services 2024 & 2032

- Figure 38: Middle East Fixed Satellite Services Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 39: Middle East Fixed Satellite Services Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 40: Middle East Fixed Satellite Services Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East Fixed Satellite Services Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Fixed Satellite Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Fixed Satellite Services Market Revenue Million Forecast, by Type of Services 2019 & 2032

- Table 3: Global Fixed Satellite Services Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: Global Fixed Satellite Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Fixed Satellite Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Fixed Satellite Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Fixed Satellite Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Fixed Satellite Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Fixed Satellite Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Fixed Satellite Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Fixed Satellite Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Fixed Satellite Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Fixed Satellite Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Fixed Satellite Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Fixed Satellite Services Market Revenue Million Forecast, by Type of Services 2019 & 2032

- Table 16: Global Fixed Satellite Services Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 17: Global Fixed Satellite Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Fixed Satellite Services Market Revenue Million Forecast, by Type of Services 2019 & 2032

- Table 19: Global Fixed Satellite Services Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 20: Global Fixed Satellite Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Fixed Satellite Services Market Revenue Million Forecast, by Type of Services 2019 & 2032

- Table 22: Global Fixed Satellite Services Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 23: Global Fixed Satellite Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Fixed Satellite Services Market Revenue Million Forecast, by Type of Services 2019 & 2032

- Table 25: Global Fixed Satellite Services Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 26: Global Fixed Satellite Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Fixed Satellite Services Market Revenue Million Forecast, by Type of Services 2019 & 2032

- Table 28: Global Fixed Satellite Services Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 29: Global Fixed Satellite Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fixed Satellite Services Market?

The projected CAGR is approximately 5.48%.

2. Which companies are prominent players in the Fixed Satellite Services Market?

Key companies in the market include Telesat Holdings, Arab Satellite Communications Organization, Singapore Telecommunications Ltd (Singtel), Nigerian Communications Satellites Ltd, Telenor Satellite Broadcasting, Hispasat SA, SES SA, Intelsat SA, Embratel Star One, Thaicom Public Company Ltd, Eutelsat Communications.

3. What are the main segments of the Fixed Satellite Services Market?

The market segments include Type of Services, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing DTH Subscriptions; Increasing Demand from Corporate Enterprise and Growing use of Transponders in the Media and Entertainment Industry.

6. What are the notable trends driving market growth?

Increasing 5G Penetration to Stimulate the Market Growth.

7. Are there any restraints impacting market growth?

; High Capital Investment and Increasing Use of Fiber Optic Transmission Cables; Regulatory Constraints and Limited Orbital Locations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fixed Satellite Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fixed Satellite Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fixed Satellite Services Market?

To stay informed about further developments, trends, and reports in the Fixed Satellite Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence