Key Insights

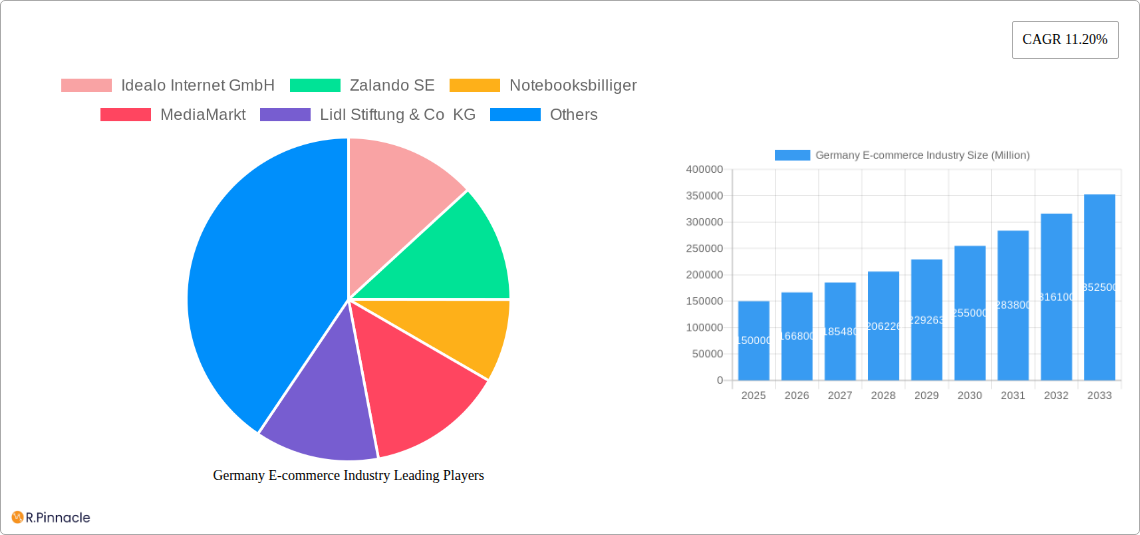

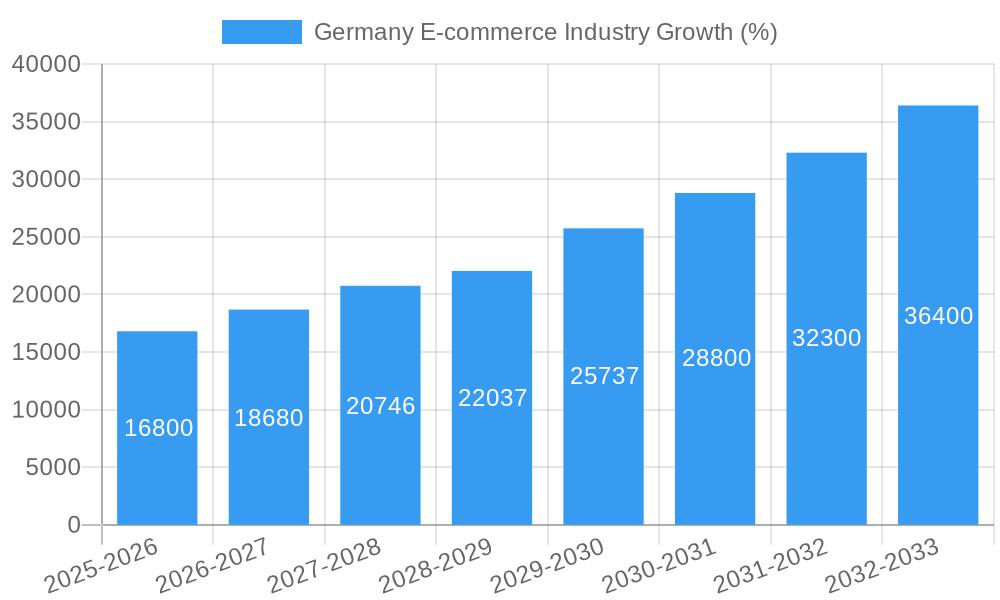

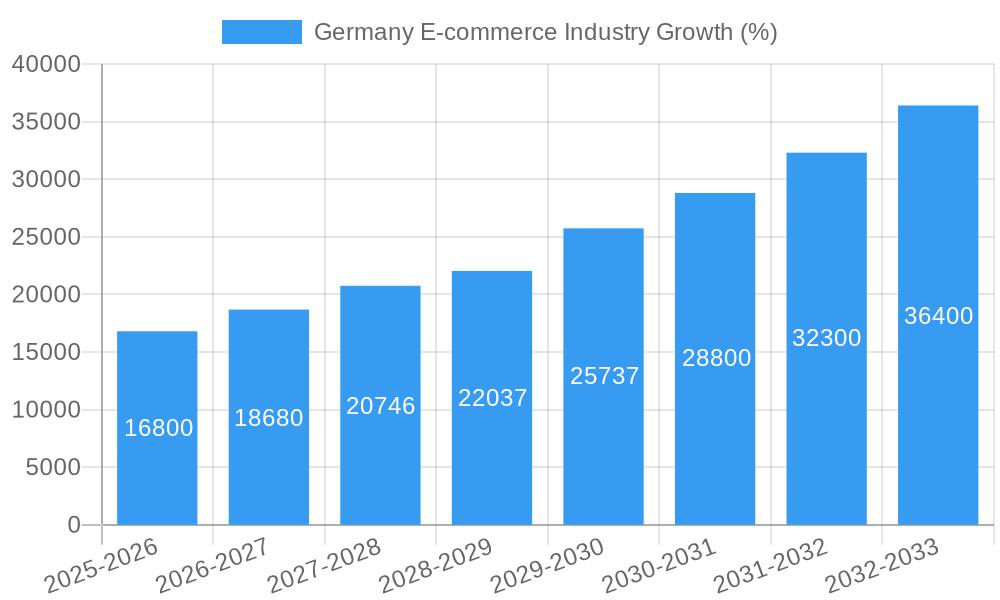

The German e-commerce market, a robust and dynamic sector, is experiencing significant growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 11.20% from 2025 to 2033. This expansion is fueled by several key drivers. Rising internet and smartphone penetration, coupled with increasing consumer preference for online shopping convenience and wider product selection, significantly contribute to this upward trajectory. Furthermore, the strong logistics infrastructure and the widespread adoption of digital payment methods within Germany bolster the industry's growth. Successful German e-commerce players, including Amazon.de, eBay.de, Zalando, and Otto, are constantly innovating, offering personalized experiences, and expanding their product catalogs to cater to evolving consumer demands. This competitiveness drives market efficiency and continuous improvement. While regulatory changes and potential economic downturns could act as restraints, the overall growth outlook remains positive, driven by the inherent strengths of the German digital economy and the enduring consumer shift toward online transactions.

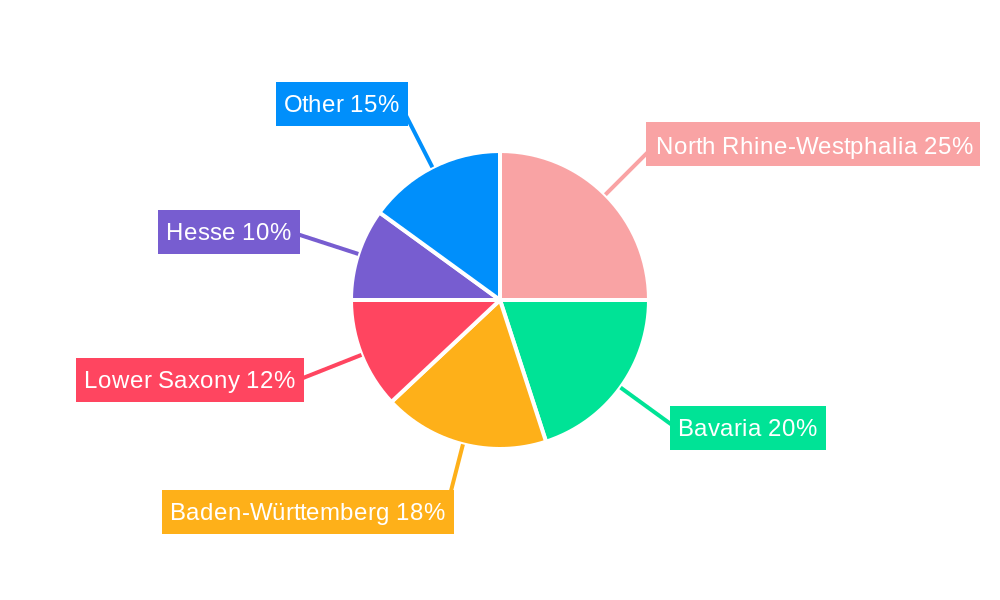

The regional distribution of e-commerce activity in Germany mirrors the population density and economic strength of its states. North Rhine-Westphalia, Bavaria, and Baden-Württemberg, being the most populous and economically active, likely represent the largest share of the market. However, the strong digital infrastructure across the country ensures that even less populous states experience robust e-commerce growth. The segmentation by application is crucial. While general merchandise and apparel remain dominant sectors, niche markets like electronics and specialized goods demonstrate rapid expansion, reflecting a diverse and dynamic consumer landscape. The success of companies like Notebooksbilliger and Thomann GmbH underscores the opportunity within focused e-commerce segments. The continued development of innovative business models, improved customer service, and personalized shopping experiences will be key to success in this competitive yet expanding market.

Germany E-commerce Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the German e-commerce industry, covering market structure, dynamics, trends, and future outlook from 2019 to 2033. Leveraging extensive data and expert insights, this report is essential for industry professionals, investors, and strategists seeking to navigate this dynamic market. The study period covers 2019–2033, with 2025 as the base and estimated year. The forecast period spans 2025–2033, and the historical period encompasses 2019–2024.

Germany E-commerce Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the German e-commerce market, focusing on market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities. The German e-commerce market exhibits a high level of concentration, with several key players dominating various segments.

Market Concentration: Amazon de, Zalando SE, and Otto GmbH command significant market share, estimated at xx%, xx%, and xx% respectively in 2025. Other significant players include eBay de, MediaMarkt, and Lidl Stiftung & Co KG. The market share of smaller players is estimated at xx%.

Innovation Drivers: Technological advancements such as AI-powered personalization, improved logistics, and mobile commerce are key drivers of innovation. The increasing adoption of omnichannel strategies and the rise of social commerce also contribute to market dynamism.

Regulatory Framework: German e-commerce is governed by strict data privacy regulations (GDPR) and consumer protection laws, impacting business strategies and operational costs.

Product Substitutes: The increasing popularity of physical stores offering click-and-collect services and the growth of social commerce platforms pose a moderate threat to traditional online retailers.

End-User Demographics: The German e-commerce market caters to a diverse demographic, with significant growth seen in older age groups adopting online shopping.

M&A Activities: While specific M&A deal values for the period are unavailable (xx Million), several significant acquisitions and mergers have reshaped the market landscape. These transactions have focused on expanding product portfolios, enhancing logistics capabilities, and gaining access to new customer segments.

Germany E-commerce Industry Market Dynamics & Trends

This section explores the growth drivers, technological disruptions, consumer preferences, and competitive dynamics shaping the German e-commerce market. The market is projected to experience significant growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration is expected to reach xx% by 2033, driven by increasing internet and smartphone penetration, rising disposable incomes, and shifting consumer preferences towards online shopping. Key growth drivers include:

Technological Disruptions: The widespread adoption of mobile commerce, AI-powered personalization, and the growth of marketplaces are significantly impacting market dynamics.

Consumer Preferences: Consumers increasingly prioritize convenience, fast delivery, and personalized shopping experiences, driving retailers to invest in technology and logistics.

Competitive Dynamics: Intense competition among major players is leading to price wars, increased investment in marketing and technology, and a focus on customer experience differentiation.

Dominant Regions & Segments in Germany E-commerce Industry

This section identifies the leading regions and segments within the German e-commerce market. While detailed regional breakdown data is unavailable (xx), it's expected that major metropolitan areas like Berlin, Munich, and Hamburg exhibit higher e-commerce penetration due to higher internet usage and disposable incomes.

- Key Drivers of Regional Dominance:

- High Internet and Smartphone Penetration: Ubiquitous internet and smartphone access fuel online shopping adoption.

- Developed Logistics Infrastructure: Efficient delivery networks are essential for online retail success.

- Strong Economic Growth: Higher disposable incomes lead to increased spending on online goods.

Germany E-commerce Industry Product Innovations

The German e-commerce landscape is witnessing constant product innovation, driven by technological advancements and evolving consumer preferences. We see a rise in personalized product recommendations, augmented reality applications enhancing the online shopping experience, and the integration of various payment gateways for enhanced convenience. These innovations aim to improve customer experience and drive sales conversion rates, leading to enhanced market competitiveness.

Report Scope & Segmentation Analysis

This report segments the German e-commerce market by application (data unavailable for specific segments - xx). Each segment presents unique growth opportunities and competitive dynamics. Further analysis of available data would provide more specific details on projected growth for each segment.

Key Drivers of Germany E-commerce Industry Growth

Several factors are driving the growth of the German e-commerce industry. These include:

Technological Advancements: The increasing adoption of mobile commerce, AI, and big data analytics are enhancing efficiency and customer experience.

Economic Growth: A stable economy and increasing disposable incomes fuel higher online spending.

Favorable Regulatory Environment: While strict, the regulatory environment fosters consumer confidence and protects their rights.

Challenges in the Germany E-commerce Industry Sector

Despite its growth, the German e-commerce industry faces challenges:

Intense Competition: High market concentration leads to price wars and pressure on profit margins.

Logistics Costs: Efficient and cost-effective logistics are crucial for success, particularly in a geographically diverse market like Germany.

Data Privacy Regulations: Compliance with GDPR adds operational complexity and cost.

Emerging Opportunities in Germany E-commerce Industry

The German e-commerce industry offers exciting opportunities:

Growth in Niche Markets: Untapped niche markets present potential for specialized e-commerce businesses.

Adoption of New Technologies: Blockchain and other technologies can improve supply chain transparency and security.

Expansion into Rural Areas: Reaching underserved rural populations presents a significant growth opportunity.

Leading Players in the Germany E-commerce Industry Market

- Idealo Internet GmbH

- Zalando SE

- Notebooksbilliger

- MediaMarkt

- Lidl Stiftung & Co KG

- eBay Kleinanzeigen

- Amazon de

- eBay de

- Otto GmbH

- Thomann GmbH

Key Developments in Germany E-commerce Industry

September 2021: Amazon announces plans to build eight new logistics buildings in Germany by the first half of 2022, showcasing significant investment and job creation.

January 2022: Zalando expands its product assortment to include Apple and Beats products, broadening its appeal and market reach.

February 2022: Amazon opens a new logistics center in Kaiserslautern, creating over 1,000 jobs and further strengthening its German logistics network.

Future Outlook for Germany E-commerce Industry Market

The German e-commerce market is poised for continued growth, driven by technological innovation, increasing consumer adoption, and favorable economic conditions. Strategic opportunities exist for players focusing on personalized experiences, sustainable practices, and efficient logistics solutions. The market is expected to witness further consolidation through M&A activities, as companies seek to expand their market share and enhance their competitive position.

Germany E-commerce Industry Segmentation

-

1. Product category

- 1.1. Fashion & apparel

- 1.2. Electronics & media

- 1.3. Food & beverages

- 1.4. Furniture & home

- 1.5. Beauty & personal care

-

2. Region

- 2.1. Germany

- 2.2. Austria

- 2.3. Switzerland

Germany E-commerce Industry Segmentation By Geography

- 1. Germany

Germany E-commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend Towards Making Purchases Through Smartphones; High Internet Penetration to Boost Market Growth

- 3.3. Market Restrains

- 3.3.1. Privacy and security concerns

- 3.4. Market Trends

- 3.4.1. Rising Adoption of M-commerce

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany E-commerce Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product category

- 5.1.1. Fashion & apparel

- 5.1.2. Electronics & media

- 5.1.3. Food & beverages

- 5.1.4. Furniture & home

- 5.1.5. Beauty & personal care

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.2.2. Austria

- 5.2.3. Switzerland

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Product category

- 6. North Rhine-Westphalia Germany E-commerce Industry Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany E-commerce Industry Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany E-commerce Industry Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany E-commerce Industry Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany E-commerce Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Idealo Internet GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zalando SE

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Notebooksbilliger

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 MediaMarkt

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lidl Stiftung & Co KG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 eBay Kleinanzeigen

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Amazon de

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 eBay de

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Otto GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Thomann GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Idealo Internet GmbH

List of Figures

- Figure 1: Germany E-commerce Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany E-commerce Industry Share (%) by Company 2024

List of Tables

- Table 1: Germany E-commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany E-commerce Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Germany E-commerce Industry Revenue Million Forecast, by Product category 2019 & 2032

- Table 4: Germany E-commerce Industry Volume K Unit Forecast, by Product category 2019 & 2032

- Table 5: Germany E-commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Germany E-commerce Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Germany E-commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Germany E-commerce Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Germany E-commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany E-commerce Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: North Rhine-Westphalia Germany E-commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North Rhine-Westphalia Germany E-commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Bavaria Germany E-commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Bavaria Germany E-commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Baden-Württemberg Germany E-commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Baden-Württemberg Germany E-commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Lower Saxony Germany E-commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Lower Saxony Germany E-commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Hesse Germany E-commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Hesse Germany E-commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Germany E-commerce Industry Revenue Million Forecast, by Product category 2019 & 2032

- Table 22: Germany E-commerce Industry Volume K Unit Forecast, by Product category 2019 & 2032

- Table 23: Germany E-commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 24: Germany E-commerce Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 25: Germany E-commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Germany E-commerce Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany E-commerce Industry?

The projected CAGR is approximately 11.20%.

2. Which companies are prominent players in the Germany E-commerce Industry?

Key companies in the market include Idealo Internet GmbH, Zalando SE, Notebooksbilliger, MediaMarkt, Lidl Stiftung & Co KG, eBay Kleinanzeigen, Amazon de, eBay de, Otto GmbH, Thomann GmbH.

3. What are the main segments of the Germany E-commerce Industry?

The market segments include Product category, Region.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend Towards Making Purchases Through Smartphones; High Internet Penetration to Boost Market Growth.

6. What are the notable trends driving market growth?

Rising Adoption of M-commerce.

7. Are there any restraints impacting market growth?

Privacy and security concerns.

8. Can you provide examples of recent developments in the market?

February 2022 - Amazon announced opening a new German logistics center in Kaiserslautern, Rhineland-Palatinate, which is scheduled to start operations in autumn 2022. With the new logistics center, Amazon will create more than 1,000 attractive jobs within the first year of operation and offer competitive wages and benefits. Amazon continues to expand its German logistics network to meet customer demand and expand product selection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany E-commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany E-commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany E-commerce Industry?

To stay informed about further developments, trends, and reports in the Germany E-commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence