Key Insights

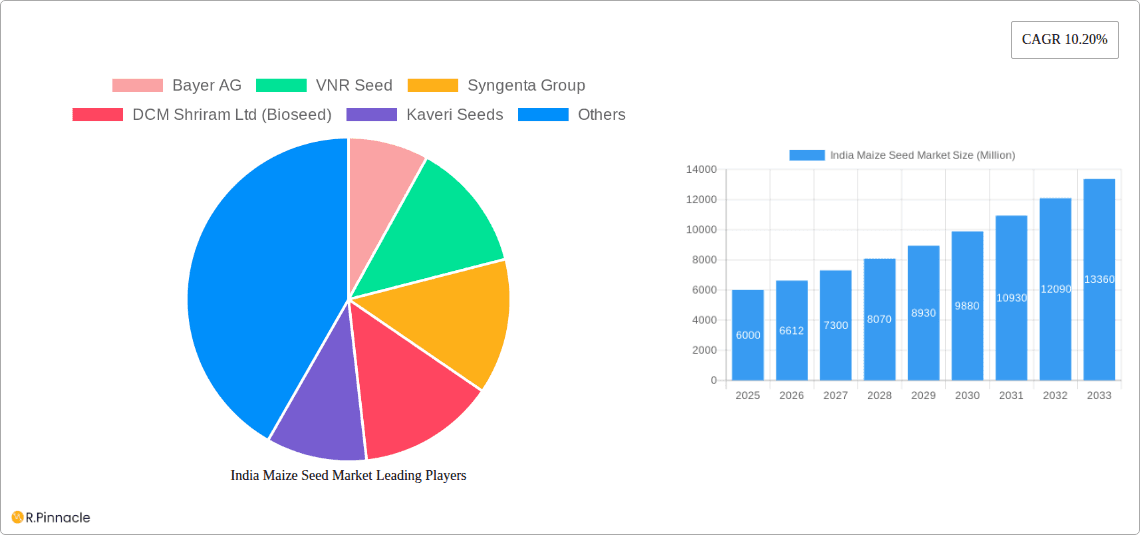

The Indian maize seed market, projected at 359.48 million in 2025, is forecast to grow at a Compound Annual Growth Rate (CAGR) of 5.74% from 2025 to 2033. This growth is propelled by escalating demand for maize in food and animal feed sectors, driven by population increase and rising disposable incomes. Advancements in breeding technologies, particularly hybrid seeds, are enhancing crop yields and quality, further stimulating market expansion. Government initiatives supporting agricultural modernization also contribute to this positive trajectory. Key restraints include climate variability, fluctuating input costs, and dependence on monsoonal rainfall. Geographically, South and West India exhibit higher growth potential due to favorable agricultural conditions. Major market participants, including global and local entities, are fostering innovation and product diversification amidst fierce competition. The hybrid seed segment dominates due to its superior yield performance.

India Maize Seed Market Market Size (In Million)

The forecast period (2025-2033) indicates sustained market growth, presenting significant opportunities for investment in research and development of high-performance maize seed varieties. Strategic collaborations with farmers, robust distribution channels, and targeted marketing are critical for success. Addressing climate resilience and sustainable practices, alongside meeting the demand for quality seeds, will shape the market's future. Tailoring offerings to regional agricultural needs will be paramount for optimizing market penetration and share.

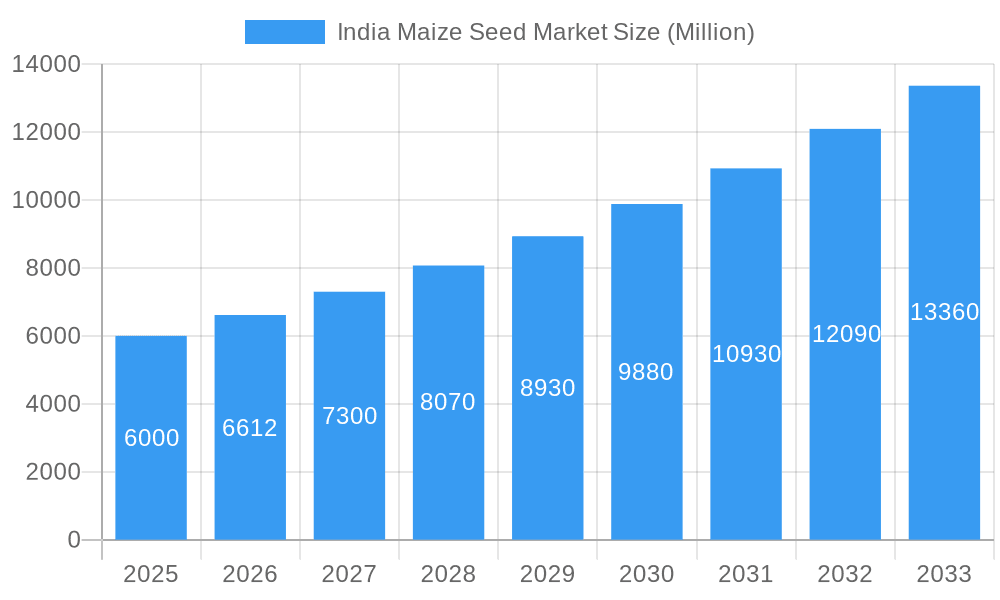

India Maize Seed Market Company Market Share

India Maize Seed Market: Comprehensive Analysis (2025-2033)

This report delivers a comprehensive analysis of the India maize seed market, providing actionable intelligence for industry stakeholders. Covering the period from 2025 to 2033, with 2025 as the base year, the study utilizes extensive market research and data analysis. Market values are presented in millions.

India Maize Seed Market Market Structure & Innovation Trends

The Indian maize seed market exhibits a moderately concentrated structure, with key players like Bayer AG, Syngenta Group, and Corteva Agriscience holding significant market share. However, regional players like Kaveri Seeds and Nuziveedu Seeds Ltd also contribute substantially, creating a dynamic competitive landscape. Market share estimations for 2025 indicate Bayer AG holds approximately 18%, Syngenta at 15%, and Corteva at 12%, with the remaining share distributed amongst other national and regional players. Innovation is driven by the increasing demand for high-yielding, disease-resistant hybrids, fueled by advancements in breeding technologies such as gene editing and marker-assisted selection. Regulatory frameworks, including seed certification and intellectual property rights, influence market dynamics. The market also witnesses considerable M&A activity, with deal values in recent years ranging from xx Million to xx Million. These activities aim to consolidate market share, expand product portfolios, and enhance technological capabilities.

India Maize Seed Market Market Dynamics & Trends

The Indian maize seed market is characterized by a robust growth trajectory, driven by factors such as rising maize consumption, government support for agricultural development, and the increasing adoption of hybrid seeds. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). This growth is further fueled by technological advancements in seed breeding, resulting in improved crop yields and stress tolerance. Consumer preferences are shifting towards high-quality, high-yielding seeds with enhanced disease resistance and better adaptability to diverse agro-climatic conditions. Competitive dynamics are intense, with companies investing heavily in research and development to create innovative seed varieties and enhance their market position. Market penetration of hybrid seeds is estimated to be around 65% in 2025, projected to increase to approximately 75% by 2033.

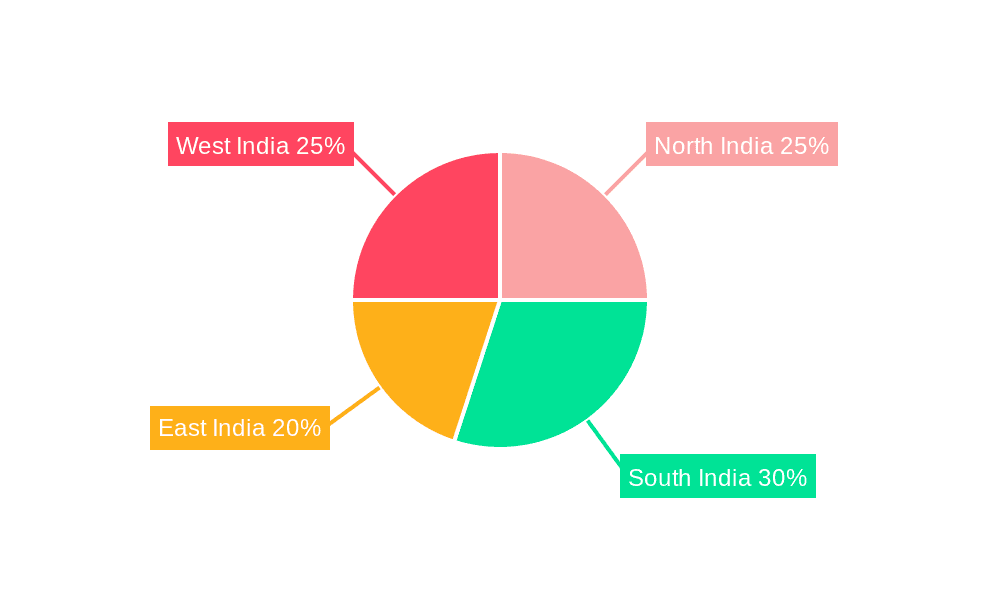

Dominant Regions & Segments in India Maize Seed Market

Leading States: Maharashtra, Madhya Pradesh, Uttar Pradesh, and Karnataka are the dominant states in the Indian maize seed market due to favorable climatic conditions and large-scale maize cultivation. These states account for approximately 60% of the total market. Other significant states include Andhra Pradesh, Telangana, and Bihar. Key drivers include favorable government policies promoting maize cultivation, well-established irrigation infrastructure, and supportive farmer networks.

Breeding Technology: Hybrid seeds dominate the market, accounting for around 80% of the total sales in 2025. The preference for hybrids stems from their superior yield potential compared to open-pollinated varieties. Non-transgenic hybrids and open-pollinated varieties hold a smaller but steadily growing segment, driven by consumer demand for organically produced maize. The market share for non-transgenic hybrids is projected to reach approximately 15% by 2033.

India Maize Seed Market Product Innovations

Recent product innovations in the Indian maize seed market focus on developing hybrids with enhanced resistance to pests, diseases, and abiotic stresses like drought and heat. Companies are leveraging advanced breeding technologies like marker-assisted selection and gene editing to create superior seed varieties tailored to specific agro-climatic conditions. These innovations are aimed at enhancing crop productivity, improving farmer profitability, and ensuring food security. The introduction of new hybrid varieties with improved yield potential, disease resistance, and stress tolerance is shaping competitive dynamics.

Report Scope & Segmentation Analysis

The report provides a comprehensive segmentation of the Indian maize seed market based on state and breeding technology. Key states considered include Andhra Pradesh, Bihar, Karnataka, Madhya Pradesh, Maharashtra, Rajasthan, Tamil Nadu, Telangana, Uttar Pradesh, West Bengal, and Other States. Breeding technologies include Hybrids, Non-Transgenic Hybrids (including Open Pollinated Varieties and Hybrid Derivatives). Growth projections, market sizes, and competitive landscapes are detailed for each segment, projecting significant growth across all segments, particularly in hybrid seeds.

Key Drivers of India Maize Seed Market Growth

The growth of the Indian maize seed market is primarily driven by factors such as increasing maize consumption, government support for agricultural development through subsidies and extension services, and advancements in breeding technologies leading to higher-yielding and stress-tolerant hybrid varieties. Furthermore, improved agricultural infrastructure, including irrigation facilities and better access to credit, positively impacts market expansion.

Challenges in the India Maize Seed Market Sector

The Indian maize seed market faces challenges such as fluctuating weather patterns impacting yields, the high cost of seed production and distribution, and the prevalence of counterfeit seeds. Furthermore, dependence on monsoons and inconsistent irrigation systems poses significant risks to seed production. These factors create volatility and uncertainty, affecting the overall market growth.

Emerging Opportunities in India Maize Seed Market

Emerging opportunities lie in the development of climate-resilient maize hybrids, utilizing gene editing and other advanced breeding techniques. Furthermore, the growing demand for organic maize and the increased focus on sustainable agriculture practices present significant opportunities for companies. Expanding into underserved regions and leveraging digital technologies for seed distribution and precision agriculture are key areas for future growth.

Leading Players in the India Maize Seed Market Market

- Bayer AG

- VNR Seed

- Syngenta Group

- DCM Shriram Ltd (Bioseed)

- Kaveri Seeds

- Groupe Limagrain

- Rasi Seeds Private Limited

- Advanta Seeds - UPL

- Corteva Agriscience

- Nuziveedu Seeds Ltd

Key Developments in India Maize Seed Market Industry

- March 2023: Corteva Agriscience introduced gene-editing technology for enhanced disease resistance in corn hybrids.

- March 2023: Pioneer Seeds (Corteva Agriscience) launched 44 new corn seed hybrid varieties with Vorceed Enlist technology for corn rootworm management.

- October 2022: Bayer AG launched the "DKC80-23 Mzati the Pillar" corn seed variety in Malawi (though not directly impacting the Indian market, it showcases technological advancements).

Future Outlook for India Maize Seed Market Market

The future of the Indian maize seed market appears bright, with continued growth fueled by technological advancements, increasing demand, and supportive government policies. The focus on developing climate-resilient and high-yielding varieties will drive market expansion, along with opportunities in organic and sustainable agriculture. Strategic partnerships and investments in research and development will play a crucial role in shaping the future competitive landscape.

India Maize Seed Market Segmentation

-

1. Breeding Technology

-

1.1. Hybrids

- 1.1.1. Non-Transgenic Hybrids

- 1.2. Open Pollinated Varieties & Hybrid Derivatives

-

1.1. Hybrids

-

2. State

- 2.1. Andhra Pradesh

- 2.2. Bihar

- 2.3. Karnataka

- 2.4. Madhya Pradesh

- 2.5. Maharashtra

- 2.6. Rajasthan

- 2.7. Tamil Nadu

- 2.8. Telangana

- 2.9. Uttar Pradesh

- 2.10. West Bengal

- 2.11. Other States

-

3. Breeding Technology

-

3.1. Hybrids

- 3.1.1. Non-Transgenic Hybrids

- 3.2. Open Pollinated Varieties & Hybrid Derivatives

-

3.1. Hybrids

-

4. State

- 4.1. Andhra Pradesh

- 4.2. Bihar

- 4.3. Karnataka

- 4.4. Madhya Pradesh

- 4.5. Maharashtra

- 4.6. Rajasthan

- 4.7. Tamil Nadu

- 4.8. Telangana

- 4.9. Uttar Pradesh

- 4.10. West Bengal

- 4.11. Other States

India Maize Seed Market Segmentation By Geography

- 1. India

India Maize Seed Market Regional Market Share

Geographic Coverage of India Maize Seed Market

India Maize Seed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs

- 3.3. Market Restrains

- 3.3.1. Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Maize Seed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 5.1.1. Hybrids

- 5.1.1.1. Non-Transgenic Hybrids

- 5.1.2. Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1. Hybrids

- 5.2. Market Analysis, Insights and Forecast - by State

- 5.2.1. Andhra Pradesh

- 5.2.2. Bihar

- 5.2.3. Karnataka

- 5.2.4. Madhya Pradesh

- 5.2.5. Maharashtra

- 5.2.6. Rajasthan

- 5.2.7. Tamil Nadu

- 5.2.8. Telangana

- 5.2.9. Uttar Pradesh

- 5.2.10. West Bengal

- 5.2.11. Other States

- 5.3. Market Analysis, Insights and Forecast - by Breeding Technology

- 5.3.1. Hybrids

- 5.3.1.1. Non-Transgenic Hybrids

- 5.3.2. Open Pollinated Varieties & Hybrid Derivatives

- 5.3.1. Hybrids

- 5.4. Market Analysis, Insights and Forecast - by State

- 5.4.1. Andhra Pradesh

- 5.4.2. Bihar

- 5.4.3. Karnataka

- 5.4.4. Madhya Pradesh

- 5.4.5. Maharashtra

- 5.4.6. Rajasthan

- 5.4.7. Tamil Nadu

- 5.4.8. Telangana

- 5.4.9. Uttar Pradesh

- 5.4.10. West Bengal

- 5.4.11. Other States

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bayer AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 VNR Seed

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Syngenta Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DCM Shriram Ltd (Bioseed)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kaveri Seeds

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Groupe Limagrain

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rasi Seeds Private Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Advanta Seeds - UPL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Corteva Agriscience

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nuziveedu Seeds Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bayer AG

List of Figures

- Figure 1: India Maize Seed Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Maize Seed Market Share (%) by Company 2025

List of Tables

- Table 1: India Maize Seed Market Revenue million Forecast, by Breeding Technology 2020 & 2033

- Table 2: India Maize Seed Market Revenue million Forecast, by State 2020 & 2033

- Table 3: India Maize Seed Market Revenue million Forecast, by Breeding Technology 2020 & 2033

- Table 4: India Maize Seed Market Revenue million Forecast, by State 2020 & 2033

- Table 5: India Maize Seed Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: India Maize Seed Market Revenue million Forecast, by Breeding Technology 2020 & 2033

- Table 7: India Maize Seed Market Revenue million Forecast, by State 2020 & 2033

- Table 8: India Maize Seed Market Revenue million Forecast, by Breeding Technology 2020 & 2033

- Table 9: India Maize Seed Market Revenue million Forecast, by State 2020 & 2033

- Table 10: India Maize Seed Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Maize Seed Market?

The projected CAGR is approximately 5.74%.

2. Which companies are prominent players in the India Maize Seed Market?

Key companies in the market include Bayer AG, VNR Seed, Syngenta Group, DCM Shriram Ltd (Bioseed), Kaveri Seeds, Groupe Limagrain, Rasi Seeds Private Limited, Advanta Seeds - UPL, Corteva Agriscience, Nuziveedu Seeds Ltd.

3. What are the main segments of the India Maize Seed Market?

The market segments include Breeding Technology, State, Breeding Technology, State.

4. Can you provide details about the market size?

The market size is estimated to be USD 359.48 million as of 2022.

5. What are some drivers contributing to market growth?

Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers.

8. Can you provide examples of recent developments in the market?

March 2023: Corteva Agriscience introduced gene-editing technology for added protection to corn hybrids, which helps in providing resistance to multiple diseases.March 2023: Pioneer Seeds, a subsidiary of Corteva Agriscience, launched 44 new corn seed hybrid varieties with new Vorceed Enlist corn technology to help manage corn rootworms.October 2022: Bayer AG launched an early maturity and high-performance corn seed variety, "DKC80-23 Mzati the Pillar," in the Malawi region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Maize Seed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Maize Seed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Maize Seed Market?

To stay informed about further developments, trends, and reports in the India Maize Seed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence