Key Insights

The Malaysian data center market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 10% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of cloud computing, digital transformation initiatives by businesses across various sectors (finance, e-commerce, government), and the burgeoning demand for high-speed internet and data storage are significant contributors. Furthermore, the strategic location of Malaysia within Southeast Asia, coupled with government initiatives promoting digital infrastructure development, creates a favorable environment for investment and expansion within the data center sector. The Cyberjaya-Kuala Lumpur hotspot is a primary driver of this growth, attracting significant investment from both domestic and international players. While the market faces challenges such as potential power shortages and competition from established regional players, the overall outlook remains positive. The segmentation by data center size (small, medium, mega, massive) and tier type (Tier 1, Tier 2, Tier 3) reflects a market catering to diverse needs, from small businesses to large-scale enterprises requiring high availability and redundancy. The presence of established players like HDC Data Centre, Zenlayer, and YTL Data Center, along with emerging companies, points to a dynamic and competitive landscape. The market's growth trajectory indicates significant opportunities for data center providers, investors, and related technology companies in the coming years.

The continued expansion of the Malaysian data center market is expected to be fueled by several factors. The rise of 5G technology will significantly increase demand for data storage and processing capabilities. Government investments in digital infrastructure and supportive regulatory frameworks further encourage growth. The development of edge data centers, strategically placed closer to end-users, will optimize data transfer speeds and latency, improving overall performance. Furthermore, increasing cybersecurity concerns are driving demand for robust and secure data center solutions, leading to investments in advanced security technologies. Competition among various providers is driving innovation and price optimization, making data center services more accessible to a wider range of businesses. However, the market will need to navigate potential challenges, such as ensuring a stable power supply to support the growing energy demands of data centers and attracting and retaining skilled technical professionals. A focus on sustainability and energy-efficient solutions will also be crucial for the long-term success of the Malaysian data center market.

Malaysia Data Center Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Malaysia data center market, offering crucial insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, growth drivers, competitive landscapes, and future projections, all backed by robust data and analysis. The Malaysian data center market is poised for significant growth, driven by increasing digitalization, cloud adoption, and government initiatives. This report will equip you with the knowledge to navigate this dynamic landscape.

Malaysia Data Center Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Malaysian data center market, examining market concentration, innovation drivers, regulatory frameworks, and mergers and acquisitions (M&A) activities. The market is characterized by a mix of large multinational corporations and local players. Market share is distributed amongst these key players, with some holding a larger share than others depending on their established footprint and investment in infrastructure.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few dominant players and numerous smaller providers. The top five players account for approximately xx% of the market revenue in 2025.

- Innovation Drivers: Government initiatives promoting digitalization, increasing cloud adoption by enterprises, and the growth of the e-commerce sector are key innovation drivers. The demand for higher bandwidth and improved connectivity fuels investments in advanced technologies.

- Regulatory Frameworks: Government regulations concerning data sovereignty and cybersecurity play a significant role in shaping the market. These frameworks influence investment decisions and operational strategies for data center operators.

- Product Substitutes: While physical data centers remain the dominant model, cloud computing and edge computing are emerging as significant substitutes. This competitive pressure necessitates continuous innovation and investment in advanced technologies.

- End-User Demographics: The major end-users include telecommunication companies, government agencies, financial institutions, and cloud service providers. The growing number of SMEs is also driving the demand for colocation services.

- M&A Activities: The M&A landscape has seen a moderate level of activity, with deal values averaging around xx Million in recent years. These activities reflect the consolidation and expansion strategies of major players.

Malaysia Data Center Market Dynamics & Trends

This section delves into the market’s growth trajectory, technological advancements, consumer preferences, and competitive dynamics, including detailed analysis on market size, growth rates, and penetration levels. The Malaysian data center market has witnessed considerable growth over the past few years, fueled by the rapid expansion of digital infrastructure.

The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected to be xx%. This growth is primarily driven by:

- Increasing demand for cloud services and colocation facilities, particularly in Cyberjaya-Kuala Lumpur.

- Growing adoption of 5G and IoT technologies, fueling the need for more robust data center infrastructure.

- Government initiatives to improve digital infrastructure and attract foreign investment.

- The rise of hyperscale data centers and their impact on market capacity.

- Market penetration is expected to increase significantly in the coming years.

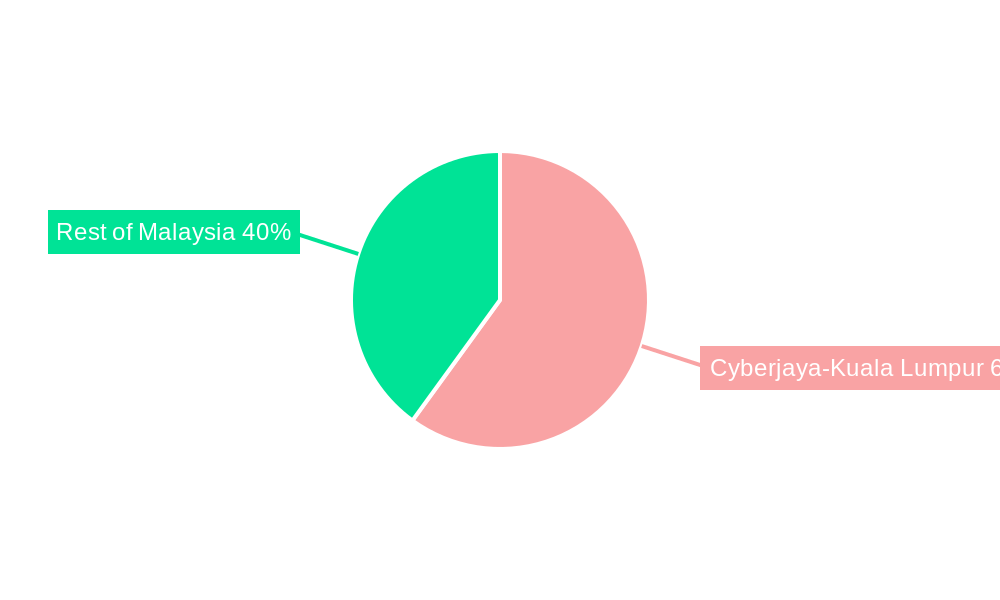

Dominant Regions & Segments in Malaysia Data Center Market

The Malaysian data center market is experiencing significant growth, driven by a confluence of factors impacting regional dominance and segment performance. This analysis examines key regions and segments based on absorption rates (utilized and non-utilized), geographical location (Cyberjaya-Kuala Lumpur and Rest of Malaysia), data center size (small, medium, large, mega, hyperscale), and tier type (Tier 1, Tier 2, Tier 3, and Tier 4).

Key Regional and Segmental Drivers:

- Cyberjaya-Kuala Lumpur Metropolitan Area: This region remains the undisputed leader, benefiting from a well-established digital infrastructure, a concentration of major businesses and government agencies, a skilled workforce, and supportive government policies. Its strategic location facilitates connectivity and reduces latency.

- Large, Mega, and Hyperscale Data Centers: These segments are exhibiting the most robust growth, driven by economies of scale, the increasing demands of hyperscale cloud providers, and the ability to offer competitive pricing and services.

- High Utilized Absorption Rates: The consistently high utilization rates across various segments underscore the strong demand for data center services in Malaysia, indicating a healthy and expanding market.

Dominance Analysis:

The Cyberjaya-Kuala Lumpur region's dominance is reinforced by its superior digital infrastructure, access to a skilled talent pool, and its position as a key business hub. The preference for larger data centers reflects the cost-efficiency and scalability advantages they offer. The high utilization rates signal a market where demand consistently outpaces supply, particularly for high-tier facilities.

Malaysia Data Center Market Product Innovations

The Malaysian data center market is witnessing significant product innovations, driven by the need for higher efficiency, scalability, and security. This includes the adoption of advanced technologies such as AI-powered monitoring, improved cooling systems, and increased focus on sustainability. These innovations provide competitive advantages by improving operational efficiency and reducing environmental impact. The market is seeing a shift towards modular data centers, facilitating faster deployment and easier scalability. This addresses the need for agile and responsive data center solutions.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the Malaysian data center market, analyzing key parameters to understand market dynamics:

- Absorption: Detailed analysis of utilized and non-utilized capacity provides insights into market demand and supply imbalances. The utilized segment consistently demonstrates higher growth potential, highlighting the strong demand for data center services.

- Geographic Hotspot: A comparative analysis of Cyberjaya-Kuala Lumpur and the Rest of Malaysia reveals significant regional disparities in growth and development. Cyberjaya-Kuala Lumpur's advanced infrastructure and strategic location solidify its leading position.

- Data Center Size: A granular breakdown of small, medium, large, mega, and hyperscale data centers illuminates the diverse range of facilities and their respective growth trajectories. The mega and hyperscale segments are expected to show the most significant future growth.

- Tier Type: The report analyzes Tier 1, Tier 2, Tier 3, and Tier 4 data centers, highlighting the variations in infrastructure quality, reliability, and redundancy. Tier 1 and Tier 4 data centers represent premium segments with higher associated costs but also superior performance.

The report offers detailed growth projections, market sizing, and competitive landscape analysis for each segment, providing a nuanced understanding of the Malaysian data center market.

Key Drivers of Malaysia Data Center Market Growth

The Malaysian data center market's expansion is fueled by a combination of factors:

- Government Initiatives: The Malaysian government's proactive policies promoting digitalization, attracting foreign investment, and fostering technological innovation are creating a favorable environment for data center development.

- Technological Advancements: The increasing adoption of 5G, cloud computing, artificial intelligence (AI), and the Internet of Things (IoT) is driving exponential growth in data generation and storage needs, fueling demand for data center capacity.

- Economic Growth and Diversification: Malaysia's sustained economic growth and diversification across key sectors are creating a robust demand for advanced digital infrastructure, including data centers.

- Growing Digital Economy: The expanding e-commerce sector, increasing digital adoption by businesses, and the rise of digital services are contributing significantly to data center demand.

Challenges in the Malaysia Data Center Market Sector

Despite its growth potential, the Malaysian data center market faces challenges:

- Land Availability and Costs: Securing suitable land for data center construction, particularly in strategic locations, can be challenging and expensive, impacting development timelines and costs.

- Energy Costs and Sustainability: High energy costs can significantly impact operational expenses. Balancing energy consumption with sustainability initiatives is a key challenge for data center operators.

- Competition and Market Saturation: Increasing competition among data center providers necessitates strategic differentiation and competitive pricing strategies to attract and retain clients.

- Skilled Workforce Availability: The demand for skilled professionals in data center operations and management is increasing, requiring targeted training and talent acquisition initiatives.

Emerging Opportunities in Malaysia Data Center Market

The Malaysian data center market presents several promising opportunities:

- Edge Computing Deployment: The expanding need for low-latency applications is driving the growth of edge data centers, presenting opportunities for providers to offer localized services.

- Hyperscale Data Center Development: The increasing demand from hyperscale cloud providers will continue to drive the construction of large-scale data centers.

- Sustainability and Green Initiatives: Data center operators are increasingly focusing on sustainable practices, creating opportunities for the adoption of energy-efficient technologies and renewable energy sources.

- Colocation Services Expansion: The rising demand for colocation services from businesses seeking flexible and cost-effective solutions presents a significant opportunity for data center providers.

Leading Players in the Malaysia Data Center Market Market

- HDC Data Centre SDN BHD (HDC)

- Zenlayer Inc

- IPServerOne

- Csf Group

- YTL Data Center Holdings Pte Ltd (YTL Power International Berhad)

- TelcoHubeXchange

- VADS BERHAD (TM One)

- Open DC SDN BHD

- AIMS DATA CENTRE SDN BHD

- Keppel DC REIT Management Pte Ltd

- Bridge Data Center (Chindata Group)

- NTT Ltd

Key Developments in Malaysia Data Center Market Industry

- October 2022: Zenlayer partnered with Megaport to enhance global network connectivity.

- September 2022: NTT Ltd. commenced construction of its sixth data center in Cyberjaya, investing over USD 50 Million.

- April 2022: Open DC partnered with the Malaysian government to build a data center in northern Malaysia.

Future Outlook for Malaysia Data Center Market Market

The Malaysian data center market is poised for continued growth, driven by increasing digitalization, cloud adoption, and government support. Strategic investments in infrastructure, coupled with technological advancements, will further enhance the market's potential. The focus on sustainability and the adoption of innovative solutions will shape the future of the industry. The market is expected to experience robust growth over the forecast period, driven by strong demand and increasing investment.

Malaysia Data Center Market Segmentation

-

1. Hotspot

- 1.1. Cyberjaya-Kuala Lumpur

- 1.2. Rest of Malaysia

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Media & Entertainment

- 6.7. Telecom

- 6.8. Other End User

Malaysia Data Center Market Segmentation By Geography

- 1. Malaysia

Malaysia Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness of Energy Consumption Control

- 3.3. Market Restrains

- 3.3.1. High Risk Associated with Data

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Cyberjaya-Kuala Lumpur

- 5.1.2. Rest of Malaysia

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Media & Entertainment

- 5.6.7. Telecom

- 5.6.8. Other End User

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 HDC Data Centre SDN BHD (HDC)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Zenlayer Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IPServerOne

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Csf Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 YTL Data Center Holdings Pte Ltd (YTL Power International Berhad)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TelcoHubeXchange

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 VADS BERHAD (TM One)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Open DC SDN BHD

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AIMS DATA CENTRE SDN BHD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Keppel DC REIT Management Pte Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bridge Data Center (Chindata Group)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 NTT Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 HDC Data Centre SDN BHD (HDC)

List of Figures

- Figure 1: Malaysia Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Malaysia Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Malaysia Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Malaysia Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Malaysia Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 4: Malaysia Data Center Market Volume K Unit Forecast, by Hotspot 2019 & 2032

- Table 5: Malaysia Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 6: Malaysia Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 7: Malaysia Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 8: Malaysia Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 9: Malaysia Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 10: Malaysia Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 11: Malaysia Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 12: Malaysia Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 13: Malaysia Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Malaysia Data Center Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 15: Malaysia Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 16: Malaysia Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 17: Malaysia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Malaysia Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Malaysia Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 20: Malaysia Data Center Market Volume K Unit Forecast, by Hotspot 2019 & 2032

- Table 21: Malaysia Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 22: Malaysia Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 23: Malaysia Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 24: Malaysia Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 25: Malaysia Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 26: Malaysia Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 27: Malaysia Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 28: Malaysia Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 29: Malaysia Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 30: Malaysia Data Center Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 31: Malaysia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Malaysia Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Data Center Market?

The projected CAGR is approximately 10.00%.

2. Which companies are prominent players in the Malaysia Data Center Market?

Key companies in the market include HDC Data Centre SDN BHD (HDC), Zenlayer Inc , IPServerOne, Csf Group, YTL Data Center Holdings Pte Ltd (YTL Power International Berhad), TelcoHubeXchange, VADS BERHAD (TM One), Open DC SDN BHD, AIMS DATA CENTRE SDN BHD, Keppel DC REIT Management Pte Ltd, Bridge Data Center (Chindata Group), NTT Ltd.

3. What are the main segments of the Malaysia Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness of Energy Consumption Control.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Risk Associated with Data.

8. Can you provide examples of recent developments in the market?

October 2022: Zenlayer entered into a joint venture with Megaport to strengthen and expand its presence globally. The partnership is aimed at providing enhanced services such as improved network connectivity, real time provisioning, and on demand private connectivity for its clients around the globe.September 2022: NTT Ltd announced the commencement of the construction of its sixth data centre in Cyberjaya. NTT plans to initially invest over USD 50 million in the sixth data centre, which is also known as Cyberjaya 6 (CBJ6). Further, CBJ6 and CBJ5 will have a total facility load of 22MW, spanning a combined 200,000 sq ft.April 2022: Malaysian data center firm Open DC aanounced that they are partnering with the Malaysian government to build a data center in the north of the country. The company aim to improve the Internet development at the northern border, to emulate the existing neighboring Internet Exchange (IX) via the Malaysia-Singapore border.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Data Center Market?

To stay informed about further developments, trends, and reports in the Malaysia Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence