Key Insights

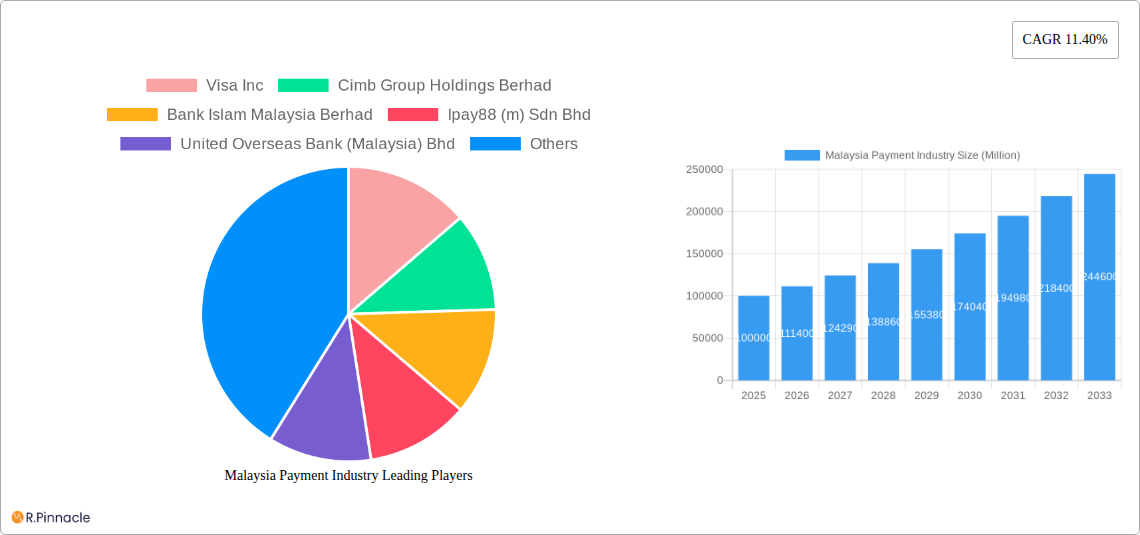

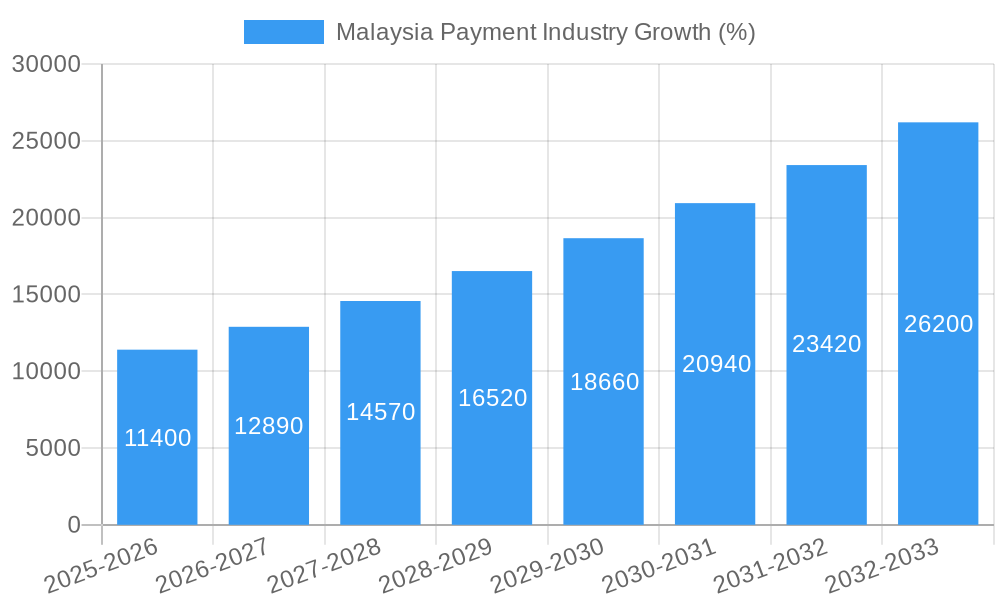

The Malaysian payment industry, valued at approximately RM 100 Billion (assuming a market size "XX" represents a substantial value in the billions, given the CAGR and listed companies) in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 11.40% from 2025 to 2033. This surge is driven by several key factors. The increasing adoption of e-commerce and digital transactions, fueled by a young and tech-savvy population, is a significant contributor. Furthermore, government initiatives promoting financial inclusion and digitalization are accelerating the shift away from cash-based transactions. The expansion of mobile payment solutions, spearheaded by players like GrabPay and other fintech companies, alongside established players like Visa and Mastercard, is further propelling market growth. The diverse segments, encompassing retail, entertainment, healthcare, and hospitality, all contribute to the industry's dynamism. The rise of online sales, as a mode of payment, is a particularly powerful trend.

However, the industry also faces challenges. Security concerns surrounding online transactions and the need for robust cybersecurity infrastructure remain critical considerations. Regulatory hurdles and the need for wider financial literacy among the population could potentially impede growth. Nevertheless, the overall trajectory is positive, with the market poised for significant expansion over the forecast period. The competitive landscape, featuring both international giants and local players, ensures ongoing innovation and adaptation to evolving consumer preferences. The Malaysian payment industry’s future depends heavily on addressing security concerns, bolstering digital literacy, and fostering a supportive regulatory environment. This will ensure the sustained growth and widespread adoption of digital payment methods across various sectors of the Malaysian economy.

Malaysia Payment Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the Malaysian payment industry, offering invaluable insights for industry professionals, investors, and strategists. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive data to project future market trends and opportunities. The Malaysian payment landscape is dissected across key segments, revealing market dynamics, innovation drivers, and competitive landscapes, with a focus on market size (in Millions) and growth projections.

Malaysia Payment Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Malaysian payment industry, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The report delves into the influence of key players such as Visa Inc, CIMB Group Holdings Berhad, Maybank, and others, assessing their respective market shares and contributions to industry innovation. We explore the impact of regulatory changes on market dynamics and the role of technological advancements in shaping the industry's future. The analysis also includes a detailed assessment of the end-user demographics, identifying key consumer segments and their payment preferences. Finally, the report quantifies M&A activities within the industry, providing an overview of deal values (in Millions) and their impact on market consolidation. This section presents metrics like market share (xx%), average deal value (xx Million), and the number of M&A deals (xx) during the historical period. For example, the increasing adoption of digital payments is driving innovation in areas such as mobile wallets and contactless payments. The regulatory environment, while supportive of fintech growth, also presents challenges related to data security and consumer protection.

Malaysia Payment Industry Market Dynamics & Trends

This section provides a deep dive into the market's growth drivers, technological disruptions, consumer preferences, and competitive dynamics. We analyze the Compound Annual Growth Rate (CAGR) and market penetration rates for various payment methods. We examine the impact of factors like increasing smartphone penetration, rising e-commerce adoption, and government initiatives promoting financial inclusion on the industry's growth trajectory. The competitive landscape is analyzed, highlighting the strategies employed by key players to gain market share and the emergence of new entrants. This analysis considers factors such as consumer preference for speed and convenience, the increasing demand for secure payment options, and the ongoing development of new payment technologies. The predicted CAGR for the forecast period is xx%, with market penetration of digital payments expected to reach xx% by 2033.

Dominant Regions & Segments in Malaysia Payment Industry

This section identifies the leading regions and segments within the Malaysian payment industry, based on data from 2019-2024. We analyze both the By End-user Industry (Retail, Entertainment, Healthcare, Hospitality, Other End-user Industries) and By Mode of Payment (Point of Sale, Online Sale) segments.

- Key Drivers:

- Retail: High consumer spending, growth of e-commerce, increasing adoption of contactless payments.

- Online Sale: Rapid growth of e-commerce, improved internet infrastructure, increasing consumer trust in online transactions.

- Point of Sale: Wide acceptance among merchants, convenience for consumers, government initiatives promoting cashless transactions.

The analysis highlights the dominant regions and segments, detailing the factors contributing to their leading positions. For example, the retail segment is expected to remain a major driver of growth due to high consumer spending and the rising adoption of digital payments. The Klang Valley region consistently shows higher adoption rates than other regions due to higher urbanization and internet penetration.

Malaysia Payment Industry Product Innovations

This section summarizes recent product developments and technological trends driving innovation within the Malaysian payment industry. The focus is on new payment methods, such as mobile wallets and contactless payments, and their competitive advantages. We analyze how these innovations are improving customer experience, increasing efficiency for merchants, and enhancing the security of transactions. The increasing integration of technologies such as blockchain and Artificial Intelligence (AI) are also considered in terms of their potential impact on future payment systems. For instance, the rise of Buy Now Pay Later (BNPL) services reflects changing consumer preferences for flexible payment options.

Report Scope & Segmentation Analysis

This report covers the Malaysian payment industry across various segments, including:

By End-user Industry: Retail, Entertainment, Healthcare, Hospitality, Other End-user Industries. Each segment's market size (in Millions) in 2025, growth projections for 2025-2033, and competitive dynamics are detailed.

By Mode of Payment: Point of Sale, Online Sale. Each segment's market size (in Millions) in 2025, growth projections for 2025-2033, and competitive dynamics are detailed.

The report provides a granular view of the market, allowing for a precise understanding of the growth opportunities within each segment.

Key Drivers of Malaysia Payment Industry Growth

The growth of the Malaysian payment industry is fueled by several key factors:

Technological advancements: The widespread adoption of smartphones and the expansion of internet access are driving the growth of digital payments. New technologies, such as biometric authentication and AI-powered fraud detection, enhance security and convenience.

Economic growth: A growing middle class and increasing disposable incomes are contributing to higher consumer spending and the adoption of convenient payment methods.

Government initiatives: Government policies supporting digitalization and financial inclusion are creating a favorable environment for the industry's expansion. The promotion of cashless transactions is further accelerating market growth.

Challenges in the Malaysia Payment Industry Sector

The Malaysian payment industry faces certain challenges:

Regulatory hurdles: The evolving regulatory landscape can create uncertainty and compliance costs for businesses.

Cybersecurity concerns: The increasing reliance on digital payments raises concerns about data security and fraud. The need for robust security measures increases operating costs.

Competition: Intense competition among established players and new fintech entrants puts pressure on profit margins. Competition drives innovation but also increases pressure on pricing.

Emerging Opportunities in Malaysia Payment Industry

The Malaysian payment industry presents exciting opportunities:

Growth of e-commerce: The continuing growth of e-commerce creates a significant market for online payment solutions.

Financial inclusion: Expanding access to financial services in underserved areas presents opportunities for innovative payment solutions.

Cross-border payments: Increasing cross-border trade and tourism present opportunities for international payment services.

Leading Players in the Malaysia Payment Industry Market

- Visa Inc

- CIMB Group Holdings Berhad

- Bank Islam Malaysia Berhad

- Ipay88 (m) Sdn Bhd

- United Overseas Bank (Malaysia) Bhd

- Huawei Pay (Huawei Technologies Co Ltd)

- Grab Pay (Grab Holdings Limited)

- Paypal Holdings Inc

- Maybank

- Samsung Pay (Samsung Electronics Co Ltd)

Key Developments in Malaysia Payment Industry

May 2023: Maybank launched its cross-border QR payment service, enabling cashless payments between Malaysia, Singapore, Indonesia, and Thailand. This enhances cross-border transaction efficiency and convenience.

January 2023: Xoom (PayPal) introduced debit card deposit for cross-border money transfers, offering faster and more accessible remittance services. This improves the speed and accessibility of international money transfers.

Future Outlook for Malaysia Payment Industry Market

The future of the Malaysian payment industry looks promising. Continued technological advancements, coupled with supportive government policies and a growing digital economy, are expected to drive significant growth. The increasing adoption of digital payments, the expansion of e-commerce, and the rising demand for convenient and secure payment solutions will create numerous opportunities for industry players. The industry is poised for further consolidation, with potential for strategic partnerships and mergers and acquisitions. The forecast period is expected to witness substantial growth, driven by an increase in mobile and online transactions.

Malaysia Payment Industry Segmentation

-

1. Mode of Payment

-

1.1. Point of Sale

- 1.1.1. Card Payments

- 1.1.2. Digital Wallets

- 1.1.3. Cash

- 1.1.4. Other Point-of-sale Payments

-

1.2. Online Sale

- 1.2.1. Other Online Sale Payments

-

1.1. Point of Sale

-

2. End-user Industry

- 2.1. Retail

- 2.2. Entertainment

- 2.3. Healthcare

- 2.4. Hospitality

- 2.5. Other End-user Industries

Malaysia Payment Industry Segmentation By Geography

- 1. Malaysia

Malaysia Payment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 E-commerce Growth

- 3.2.2 Rising Basket Spend

- 3.2.3 and Rise in Digitally-aware Population; Adoption of Card-based Payments

- 3.3. Market Restrains

- 3.3.1. Challenges Faced by Small Retailers and Street Vendors while Adapting to the Cashless Payment Ecosystem

- 3.4. Market Trends

- 3.4.1. Card Payments to Witness the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Payment Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 5.1.1. Point of Sale

- 5.1.1.1. Card Payments

- 5.1.1.2. Digital Wallets

- 5.1.1.3. Cash

- 5.1.1.4. Other Point-of-sale Payments

- 5.1.2. Online Sale

- 5.1.2.1. Other Online Sale Payments

- 5.1.1. Point of Sale

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Entertainment

- 5.2.3. Healthcare

- 5.2.4. Hospitality

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Visa Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cimb Group Holdings Berhad

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bank Islam Malaysia Berhad

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ipay88 (m) Sdn Bhd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 United Overseas Bank (Malaysia) Bhd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Huawei Pay (Huawei Technologies Co Ltd)*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Grab Pay (Grab Holdings Limited)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Paypal Holdings Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Maybank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Samsung Pay (Samsung Electronics Co Ltd)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Visa Inc

List of Figures

- Figure 1: Malaysia Payment Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Malaysia Payment Industry Share (%) by Company 2024

List of Tables

- Table 1: Malaysia Payment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Malaysia Payment Industry Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 3: Malaysia Payment Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Malaysia Payment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Malaysia Payment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Malaysia Payment Industry Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 7: Malaysia Payment Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Malaysia Payment Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Payment Industry?

The projected CAGR is approximately 11.40%.

2. Which companies are prominent players in the Malaysia Payment Industry?

Key companies in the market include Visa Inc, Cimb Group Holdings Berhad, Bank Islam Malaysia Berhad, Ipay88 (m) Sdn Bhd, United Overseas Bank (Malaysia) Bhd, Huawei Pay (Huawei Technologies Co Ltd)*List Not Exhaustive, Grab Pay (Grab Holdings Limited), Paypal Holdings Inc, Maybank, Samsung Pay (Samsung Electronics Co Ltd).

3. What are the main segments of the Malaysia Payment Industry?

The market segments include Mode of Payment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Growth. Rising Basket Spend. and Rise in Digitally-aware Population; Adoption of Card-based Payments.

6. What are the notable trends driving market growth?

Card Payments to Witness the Growth.

7. Are there any restraints impacting market growth?

Challenges Faced by Small Retailers and Street Vendors while Adapting to the Cashless Payment Ecosystem.

8. Can you provide examples of recent developments in the market?

May 2023: Maybank launched its cross-border QR payment service for Maybank customers traveling to Singapore, Indonesia, and Thailand, as they can now make cashless and instant payment transactions via the MAE app. Similarly, incoming tourists from these countries can make cashless payments with Maybank QRPay merchants in Malaysia. The new offering will enable Malaysians visiting the respective countries to enjoy a cheaper, faster, and more convenient payment option through the MAE app.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Payment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Payment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Payment Industry?

To stay informed about further developments, trends, and reports in the Malaysia Payment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence