Key Insights

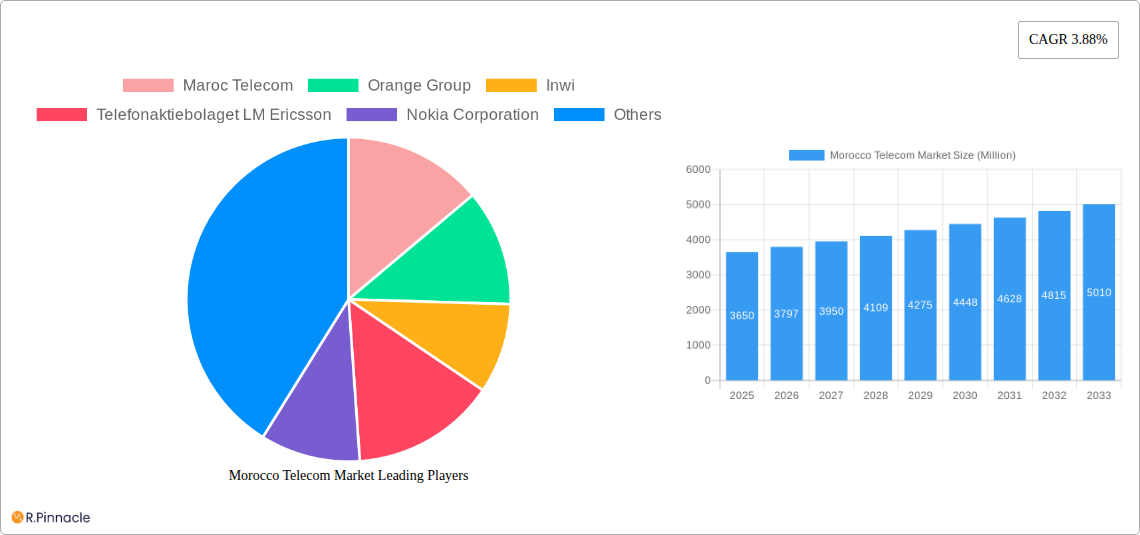

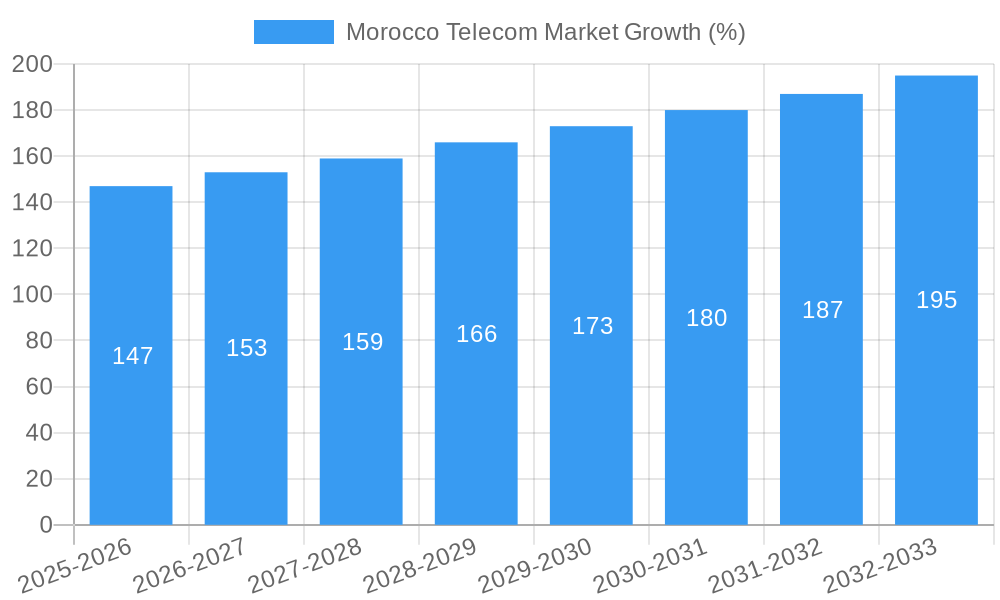

The Morocco telecom market, valued at $3.65 billion in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.88% from 2025 to 2033. This growth is driven by increasing smartphone penetration, rising data consumption fueled by the proliferation of mobile internet services, and the government's ongoing investments in digital infrastructure. Key players like Maroc Telecom, Orange Group, and Inwi are actively investing in expanding their 4G and 5G networks, enhancing their service offerings, and exploring innovative solutions such as IoT and cloud services to cater to the evolving needs of Moroccan consumers and businesses. The market is also witnessing a surge in demand for high-speed internet access, particularly in urban areas, stimulating competition and pushing providers to offer competitive pricing and attractive data packages. However, challenges remain, including the digital divide in rural areas and the need for further infrastructure development to ensure consistent connectivity across the country. Furthermore, regulatory changes and increasing competition could impact market dynamics in the coming years. The presence of global players like Ericsson and Nokia highlights the market's attractiveness and potential for technological advancements. The forecast period of 2025-2033 will see a significant increase in market value driven by the factors outlined above, potentially reaching approximately $5 billion by 2033, based on the projected CAGR.

The segmentation within the Morocco telecom market encompasses various service types, including mobile voice, mobile data, fixed-line services, and broadband internet. The mobile segment is expected to dominate, driven by increasing smartphone adoption and the preference for mobile-based communication and data access. The fixed-line segment, while smaller, is also expected to see some growth due to the increasing demand for reliable broadband connections for both residential and commercial use. The competitive landscape is characterized by established players vying for market share through strategic partnerships, network upgrades, and innovative service offerings. Continuous improvement in network infrastructure and expanding 5G coverage are likely to further drive the market's expansion. The ongoing efforts to bridge the digital divide through targeted investments in rural infrastructure development are expected to contribute to overall market growth, broadening the consumer base and extending services to previously underserved populations.

Morocco Telecom Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Morocco Telecom Market, offering valuable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, key players, and future outlook. Leveraging extensive data and expert analysis, the report helps you navigate the complexities of this dynamic market and make informed decisions.

Morocco Telecom Market Market Structure & Innovation Trends

The Moroccan telecom market exhibits a moderately concentrated structure, dominated by Maroc Telecom, Orange Group, and Inwi. Maroc Telecom holds the largest market share, estimated at xx%, followed by Orange Group at xx% and Inwi at xx% in 2025. Innovation is driven by increasing demand for high-speed internet, mobile data, and digital services. The regulatory framework, overseen by the National Agency for Regulatory Telecommunications (ANRT), plays a crucial role in shaping market competition and investment. The market experiences limited product substitution, primarily from alternative communication methods (e.g., VoIP). The end-user demographics are diverse, ranging from urban professionals to rural populations with varying levels of digital literacy. M&A activity has been relatively limited in recent years, with the most significant deals totaling approximately xx Million in value over the historical period (2019-2024).

- Market Share (2025): Maroc Telecom (xx%), Orange Group (xx%), Inwi (xx%)

- M&A Deal Value (2019-2024): xx Million

Morocco Telecom Market Market Dynamics & Trends

The Moroccan telecom market is experiencing robust growth, driven by rising smartphone penetration, increasing internet usage, and government initiatives promoting digital inclusion. The Compound Annual Growth Rate (CAGR) for revenue is projected at xx% during the forecast period (2025-2033). Market penetration for mobile broadband services is expected to reach xx% by 2033. Technological disruptions, such as the adoption of 5G and fiber optics, are reshaping the competitive landscape. Consumer preferences are shifting towards higher data allowances, bundled services, and superior customer experience. Competitive dynamics are characterized by intense price competition, strategic partnerships, and investments in network infrastructure.

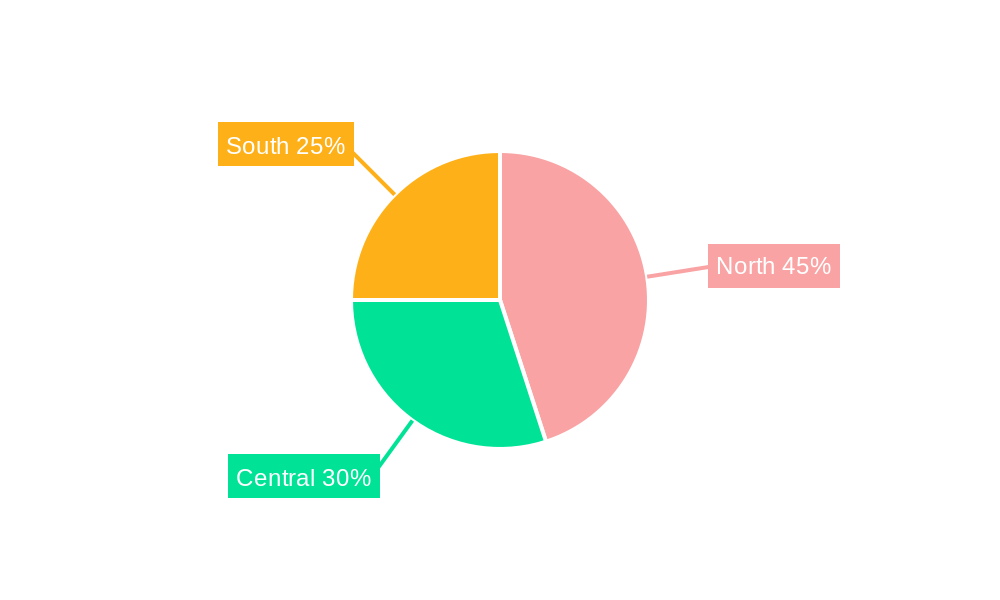

Dominant Regions & Segments in Morocco Telecom Market

The urban areas of Morocco, particularly Casablanca, Rabat, and Marrakech, represent the most dominant regions in the telecom market. This dominance is attributable to higher population density, greater economic activity, and advanced infrastructure.

- Key Drivers of Urban Dominance:

- Higher population density

- Robust economic activity

- Advanced telecommunications infrastructure

- Greater disposable income among consumers

The detailed dominance analysis further highlights the strong correlation between economic development and telecom penetration in urban centers.

Morocco Telecom Market Product Innovations

Recent product innovations include the expansion of 4G and 5G networks, the introduction of innovative data packages tailored to specific consumer needs, and the growth of value-added services such as mobile money and cloud-based solutions. These innovations reflect technological trends and aim to enhance market fit by catering to evolving consumer demands and competitive pressures.

Report Scope & Segmentation Analysis

This report segments the Morocco telecom market based on technology (2G, 3G, 4G, 5G, Fiber), service type (mobile, fixed-line, broadband), and end-user (residential, enterprise). Each segment exhibits unique growth characteristics and competitive dynamics. For example, the 5G segment is expected to witness significant growth driven by government initiatives and investments.

Key Drivers of Morocco Telecom Market Growth

Several factors contribute to the market's growth: increasing smartphone penetration, rising internet usage, government initiatives promoting digital inclusion (such as the recent initiative to connect 1800 rural communities), expanding 4G and 5G networks, and the increasing adoption of mobile financial services. These drivers create opportunities for telecom operators and technology providers.

Challenges in the Morocco Telecom Market Sector

Challenges include maintaining profitability in a price-competitive environment, ensuring network coverage in remote areas, managing infrastructure investments, and addressing cybersecurity risks. Regulatory changes and limitations in spectrum availability also create challenges. The total impact of these challenges on market growth is estimated to be a reduction of xx% in overall growth.

Emerging Opportunities in Morocco Telecom Market

Opportunities exist in expanding broadband penetration in rural areas, developing innovative digital services for businesses, and deploying Internet of Things (IoT) technologies. Growth in the mobile money sector and cloud computing also present significant opportunities for market expansion.

Leading Players in the Morocco Telecom Market Market

- Maroc Telecom

- Orange Group

- Inwi

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- Verizon Communications Inc

- Cambium Network

Key Developments in Morocco Telecom Market Industry

- June 2024: Liquid Intelligent Technologies partnered with Medi Telecom to expand network coverage and services in Morocco.

- May 2024: Morocco launched an initiative to connect 1,800 rural communities to the internet, expanding on a previous phase that connected 10,740 communities.

Future Outlook for Morocco Telecom Market Market

The Moroccan telecom market is poised for continued growth, driven by increasing digitalization, government support for infrastructure development, and the rising demand for advanced telecommunication services. Strategic partnerships, investments in next-generation technologies, and focusing on customer experience will be crucial for success in this evolving market.

Morocco Telecom Market Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and Messaging Services

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Morocco Telecom Market Segmentation By Geography

- 1. Morocco

Morocco Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.88% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Mobile and Internet Penetration; Digital Transformation Initiatives

- 3.3. Market Restrains

- 3.3.1. Increasing Mobile and Internet Penetration; Digital Transformation Initiatives

- 3.4. Market Trends

- 3.4.1. The Demand for Mobile Broadband is Increasing in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Morocco Telecom Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and Messaging Services

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Morocco

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Maroc Telecom

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Orange Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Inwi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Telefonaktiebolaget LM Ericsson

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nokia Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Verizon Communications Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cambium Network

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Maroc Telecom

List of Figures

- Figure 1: Morocco Telecom Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Morocco Telecom Market Share (%) by Company 2024

List of Tables

- Table 1: Morocco Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Morocco Telecom Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Morocco Telecom Market Revenue Million Forecast, by Services 2019 & 2032

- Table 4: Morocco Telecom Market Volume Billion Forecast, by Services 2019 & 2032

- Table 5: Morocco Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Morocco Telecom Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: Morocco Telecom Market Revenue Million Forecast, by Services 2019 & 2032

- Table 8: Morocco Telecom Market Volume Billion Forecast, by Services 2019 & 2032

- Table 9: Morocco Telecom Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Morocco Telecom Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Morocco Telecom Market?

The projected CAGR is approximately 3.88%.

2. Which companies are prominent players in the Morocco Telecom Market?

Key companies in the market include Maroc Telecom, Orange Group, Inwi, Telefonaktiebolaget LM Ericsson, Nokia Corporation, Verizon Communications Inc, Cambium Network.

3. What are the main segments of the Morocco Telecom Market?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Mobile and Internet Penetration; Digital Transformation Initiatives.

6. What are the notable trends driving market growth?

The Demand for Mobile Broadband is Increasing in the Country.

7. Are there any restraints impacting market growth?

Increasing Mobile and Internet Penetration; Digital Transformation Initiatives.

8. Can you provide examples of recent developments in the market?

June 2024: Liquid Intelligent Technologie announced its collaboration with Medi Telecom in Morocco. Through this partnership, both companies will extend network coverage and enhanced services to Liquid Dataport clients in Morocco. Liquid will supply a full range of its digital services in Morocco, eliminating the need for multiple supplier networks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Morocco Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Morocco Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Morocco Telecom Market?

To stay informed about further developments, trends, and reports in the Morocco Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence