Key Insights

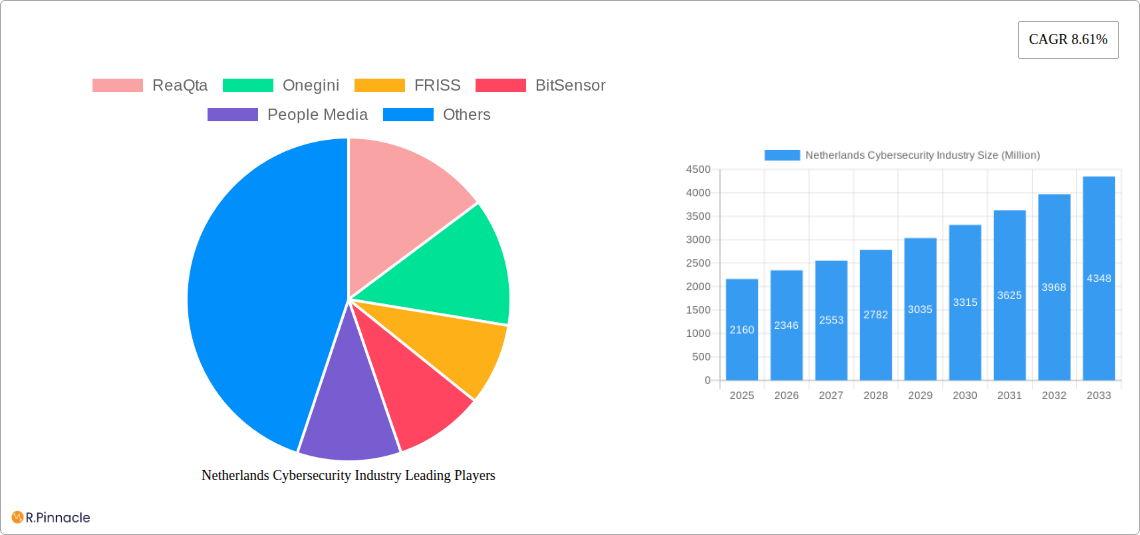

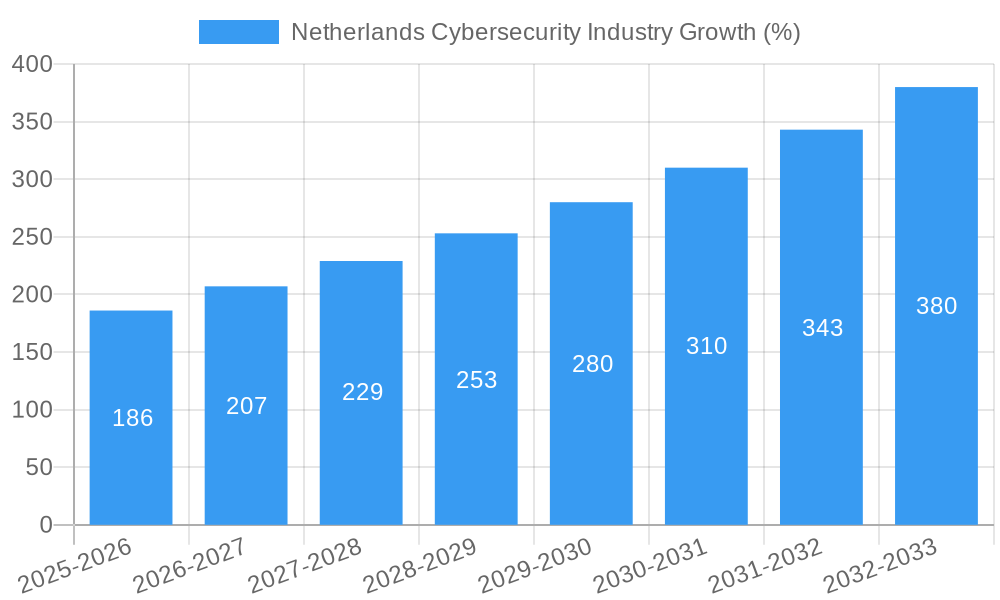

The Netherlands cybersecurity market, valued at €2.16 billion in 2025, is poised for robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.61% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing digitalization across sectors like BFSI (Banking, Financial Services, and Insurance), healthcare, and manufacturing necessitates robust cybersecurity solutions to mitigate escalating cyber threats. Government and defense initiatives focused on bolstering national cybersecurity infrastructure also contribute significantly to market growth. The rising adoption of cloud-based security solutions, driven by their scalability and cost-effectiveness, further fuels market expansion. However, the market faces certain restraints, including the skills gap in cybersecurity professionals and the evolving nature of cyberattacks, requiring continuous adaptation and investment in advanced security technologies. The market is segmented by offering (security type and services), deployment (cloud and on-premise), and end-user (BFSI, healthcare, manufacturing, government & defense, IT & telecommunications, and others). The "security type" segment likely dominates, given the diverse nature of cyber threats requiring specialized solutions. The cloud deployment model is anticipated to experience faster growth than on-premise solutions due to its inherent advantages. Companies like ReaQta, Onegini, and FRISS are key players shaping the competitive landscape.

The Netherlands' strategic location within Europe and its strong digital economy make it a prime target for cyberattacks. Consequently, businesses and government entities are actively investing in strengthening their cybersecurity postures. The demand for advanced threat detection, incident response services, and data privacy solutions is particularly high. This trend is projected to drive further market growth in the coming years. While the skills gap remains a challenge, the increased awareness of cybersecurity risks and the rising government investments in training and education programs should gradually alleviate this constraint. The evolving nature of cyber threats demands ongoing innovation, prompting companies to develop and deploy cutting-edge solutions, fostering market dynamism and continued growth.

Netherlands Cybersecurity Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Netherlands cybersecurity market, offering actionable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report delves into market structure, dynamics, leading players, and future trends. The report leverages extensive data analysis, including market sizing and growth projections (in Millions), to provide a holistic understanding of this rapidly evolving sector.

Netherlands Cybersecurity Industry Market Structure & Innovation Trends

The Netherlands cybersecurity market exhibits a moderately concentrated structure, with a few dominant players alongside numerous smaller, specialized firms. Innovation is driven by increasing cyber threats, stringent government regulations (like GDPR), and the growing adoption of cloud technologies and IoT devices. The market is characterized by frequent mergers and acquisitions (M&A) activity, reflecting the consolidation and expansion strategies of major players. For example, Thales' €100 Million acquisition of OneWelcome in July 2022 significantly impacted the Customer Identity and Access Management (CIAM) segment. The average M&A deal value in the period 2019-2024 was approximately €xx Million. Market share data for individual companies remains proprietary. Product substitutes primarily involve legacy security solutions and in-house developed systems. End-user demographics show a significant concentration in BFSI, Government & Defense, and IT & Telecommunication sectors, with increasing demand from Healthcare and Manufacturing.

Netherlands Cybersecurity Industry Market Dynamics & Trends

The Netherlands cybersecurity market is experiencing robust growth, driven by factors such as rising digitalization, increasing cyberattacks, stringent data privacy regulations, and government initiatives promoting cybersecurity awareness. Technological disruptions like AI and advanced threat intelligence are transforming the landscape, fostering innovative solutions. Consumer preferences are shifting towards cloud-based, managed security services, reflecting a demand for cost-effectiveness and scalability. The market is characterized by intense competition, with both established players and emerging startups vying for market share. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, leading to a market size of xx Million by 2033. Market penetration for cloud-based security solutions is anticipated to reach xx% by 2033.

Dominant Regions & Segments in Netherlands Cybersecurity Industry

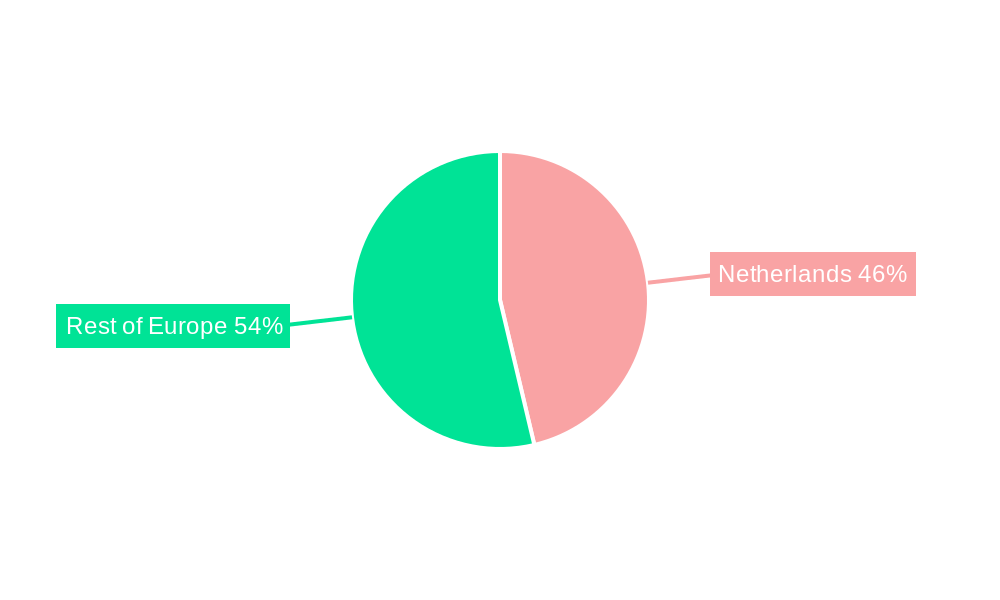

While the Netherlands itself is the dominant region, the market shows a concentration across key segments:

- By Offering: Security services represent the largest market share, driven by increasing demand for managed security services and threat intelligence. The number of users for security services is estimated at xx Million in 2025, while other types of offerings account for xx Million users.

- By Deployment: Cloud-based deployments are gaining significant traction due to scalability and cost efficiency, accounting for xx% of the market in 2025. On-premise deployments are expected to remain relevant, particularly in sectors with stringent data security requirements.

- By End User: The BFSI (Banking, Financial Services, and Insurance) sector is the largest end-user segment, closely followed by the Government & Defense sector. Growth in other sectors, such as Healthcare and Manufacturing, is expected to accelerate due to increased digitalization and rising cyber threats. This concentration is fueled by the high value of data held by these sectors and increased regulatory scrutiny.

Netherlands Cybersecurity Industry Product Innovations

The Netherlands cybersecurity market is witnessing rapid product innovation, with a focus on AI-powered threat detection, automated security response, and advanced threat intelligence solutions. Cloud-native security platforms are gaining popularity, offering enhanced scalability and agility. These innovations improve threat detection capabilities, streamline security operations, and enhance the overall security posture of organizations, providing strong competitive advantages to early adopters.

Report Scope & Segmentation Analysis

This report segments the Netherlands cybersecurity market by Offering (Security Type, Services), Deployment (Cloud, On-premise), and End User (BFSI, Healthcare, Manufacturing, Government & Defense, IT & Telecommunication, Other End Users). Each segment is thoroughly analyzed, including market size, growth projections (with the projected 2025 market size for each segment specified), and competitive dynamics. Significant growth is anticipated across all segments, driven by the factors highlighted in this report. However, specific market size projections for each segment in 2025 are considered proprietary data in this report.

Key Drivers of Netherlands Cybersecurity Industry Growth

The Netherlands cybersecurity market's growth is fueled by several key factors: the increasing adoption of digital technologies, the rising number and sophistication of cyberattacks, the implementation of stringent data privacy regulations (such as GDPR), and significant government investments in cybersecurity infrastructure. These factors collectively create a strong demand for robust cybersecurity solutions, driving market expansion.

Challenges in the Netherlands Cybersecurity Industry Sector

The Netherlands cybersecurity sector faces challenges such as a shortage of skilled cybersecurity professionals, the complexity of managing evolving cyber threats, and the need for continuous adaptation to technological changes. Supply chain vulnerabilities also represent a significant challenge, potentially impacting the availability and reliability of cybersecurity products and services. The cost of implementation can also act as a restraint, particularly for smaller businesses.

Emerging Opportunities in Netherlands Cybersecurity Industry

Emerging opportunities lie in the growing adoption of cloud-based security solutions, the increasing demand for managed security services, and the development of advanced threat intelligence platforms. The expansion of IoT devices and the rise of AI-driven cybersecurity solutions create further opportunities for growth and innovation. New markets, such as the increasingly digitalized healthcare and manufacturing sectors, provide additional avenues for expansion.

Leading Players in the Netherlands Cybersecurity Industry Market

- ReaQta

- Onegini

- FRISS

- BitSensor

- People Media

- LogSentinel

- RedSocks

- EclecticIQ

- SecurityMatters

- eharmony Inc (Note: This is a global link as eharmony's cybersecurity focus isn't specified regionally.)

- Madaster

- Praesidion Smart Security Solutions

- Keezel

Key Developments in Netherlands Cybersecurity Industry

- July 2022: Thales acquires OneWelcome for €100 Million, expanding its identity and access management capabilities and strengthening its position in the European cybersecurity market. This acquisition demonstrates the ongoing consolidation in the sector.

Future Outlook for Netherlands Cybersecurity Industry Market

The Netherlands cybersecurity market is poised for continued strong growth, driven by persistent digital transformation, heightened cyber threats, and increasing regulatory pressure. Strategic opportunities abound for companies offering innovative solutions and services that address evolving security challenges. The market's future growth will be further shaped by technological advancements and emerging market trends, including the adoption of AI and cloud-based security. Continued M&A activity is anticipated, leading to further market consolidation.

Netherlands Cybersecurity Industry Segmentation

-

1. Offer

-

1.1. Security Type

- 1.1.1. Cloud Security

- 1.1.2. Data Security

- 1.1.3. Identity Access Management

- 1.1.4. Network Security

- 1.1.5. Consumer Security

- 1.1.6. Infrastructure Protection

- 1.1.7. Other Types

- 1.2. Services

-

1.1. Security Type

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premise

-

3. End User

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Manufacturing

- 3.4. Government & Defense

- 3.5. IT and Telecommunication

- 3.6. Other End Users

Netherlands Cybersecurity Industry Segmentation By Geography

- 1. Netherlands

Netherlands Cybersecurity Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.61% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Cyberattacks in Different Industry; Growing Need of Identity Access Management

- 3.3. Market Restrains

- 3.3.1. Lack of Infrastructure

- 3.4. Market Trends

- 3.4.1. The Netherlands Introduces Legislation to Make Working from Home a Legal Right

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offer

- 5.1.1. Security Type

- 5.1.1.1. Cloud Security

- 5.1.1.2. Data Security

- 5.1.1.3. Identity Access Management

- 5.1.1.4. Network Security

- 5.1.1.5. Consumer Security

- 5.1.1.6. Infrastructure Protection

- 5.1.1.7. Other Types

- 5.1.2. Services

- 5.1.1. Security Type

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Manufacturing

- 5.3.4. Government & Defense

- 5.3.5. IT and Telecommunication

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Offer

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ReaQta

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Onegini

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FRISS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BitSensor

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 People Media

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 LogSentinel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 RedSocks

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 EclecticIQ

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SecurityMatters

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 eharmony Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Madaster

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Praesidion Smart Security Solutions

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Keezel

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 ReaQta

List of Figures

- Figure 1: Netherlands Cybersecurity Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Netherlands Cybersecurity Industry Share (%) by Company 2024

List of Tables

- Table 1: Netherlands Cybersecurity Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Netherlands Cybersecurity Industry Revenue Million Forecast, by Offer 2019 & 2032

- Table 3: Netherlands Cybersecurity Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: Netherlands Cybersecurity Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Netherlands Cybersecurity Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Netherlands Cybersecurity Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Netherlands Cybersecurity Industry Revenue Million Forecast, by Offer 2019 & 2032

- Table 8: Netherlands Cybersecurity Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 9: Netherlands Cybersecurity Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 10: Netherlands Cybersecurity Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Cybersecurity Industry?

The projected CAGR is approximately 8.61%.

2. Which companies are prominent players in the Netherlands Cybersecurity Industry?

Key companies in the market include ReaQta, Onegini, FRISS, BitSensor, People Media, LogSentinel, RedSocks, EclecticIQ, SecurityMatters, eharmony Inc, Madaster, Praesidion Smart Security Solutions, Keezel.

3. What are the main segments of the Netherlands Cybersecurity Industry?

The market segments include Offer, Deployment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.16 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Cyberattacks in Different Industry; Growing Need of Identity Access Management.

6. What are the notable trends driving market growth?

The Netherlands Introduces Legislation to Make Working from Home a Legal Right.

7. Are there any restraints impacting market growth?

Lack of Infrastructure.

8. Can you provide examples of recent developments in the market?

July 2022 - As part of its cybersecurity expansion strategy, Thales has signed an agreement to acquire OneWelcome, a European leader in the rapidly growing market of Customer Identity and Access Management market, for €100 million. Thales' existing Identity services (secure credential enrollment, issuance, and management, Know Your Customer, and so on) will be supplemented by OneWelcome's strong digital identity lifecycle management capabilities to provide the industry's most comprehensive Identity Platform.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Cybersecurity Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Cybersecurity Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Cybersecurity Industry?

To stay informed about further developments, trends, and reports in the Netherlands Cybersecurity Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence