Key Insights

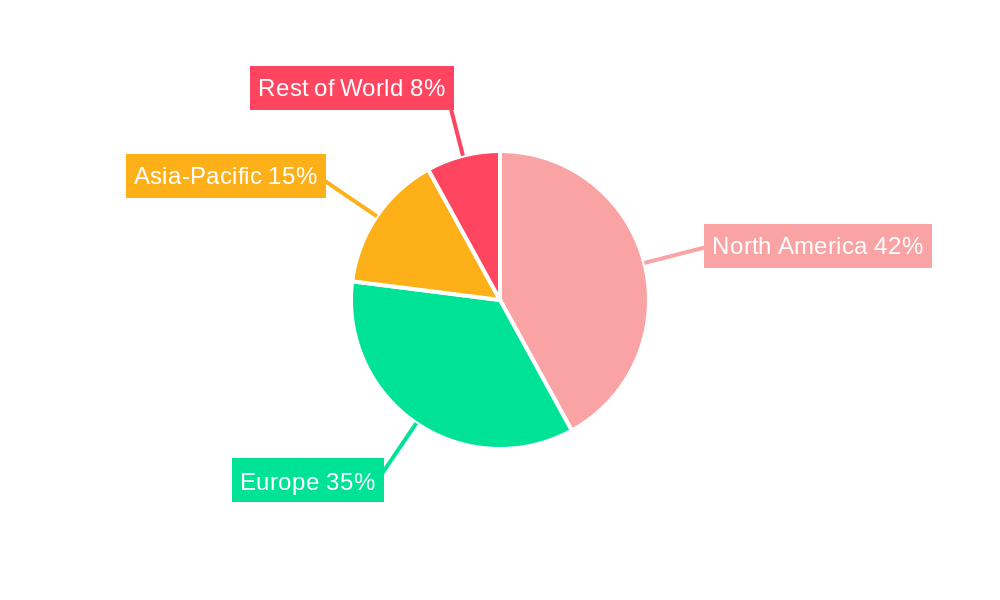

The North American and European vending machine markets are experiencing robust growth, driven by increasing urbanization, busy lifestyles, and the expanding demand for convenient food and beverage options. The global market, valued at $14.10 billion in 2025, exhibits a compound annual growth rate (CAGR) of 8.97%, projecting significant expansion through 2033. Within this context, North America and Europe represent substantial portions of this global market. North America, benefiting from a strong economy and high consumer spending, likely holds a larger market share than Europe, potentially exceeding 40%. Factors such as the widespread adoption of cashless payment systems and the increasing integration of smart vending technologies are fueling this growth. The prevalence of office spaces, institutions, and other high-traffic areas provide ample opportunities for vending machine placement, particularly in densely populated urban centers. While the precise market size for North America and Europe is not explicitly provided, a logical estimation, based on the global market size and considering the regional economic strengths and market maturity, suggests North America's market size could be around $6 billion in 2025, and Europe's around $4 billion, respectively.

The European market, while potentially smaller than North America's, demonstrates considerable growth potential, particularly in countries like Germany, France, and the UK, where vending machine penetration is already relatively high. However, regulatory changes concerning food safety and hygiene standards, along with the increasing competition from quick-service restaurants and food delivery services, could pose some challenges. The market segmentation within both regions is similar, with office/commercial locations dominating, followed by institutional settings (schools, universities, hospitals), and others (healthcare facilities, amusement parks, etc.). Beverage sales likely represent the largest portion of revenue across both continents, with packaged food and other product categories showing sustained growth as consumer preferences evolve. Key players in these markets include both multinational corporations and specialized vending machine operators, indicating a highly competitive landscape demanding continuous innovation and efficient operations. The continued trend toward healthier options and technologically advanced machines will likely shape the future of the vending machine industry in both regions.

North America and Europe Vending Machine Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America and Europe vending machine industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, growth drivers, challenges, and future opportunities. The report leverages extensive market research and data analysis to provide actionable intelligence for navigating the evolving landscape of this dynamic sector.

North America and Europe Vending Machine Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the North America and Europe vending machine market. The market is moderately concentrated, with key players holding significant market share. However, the emergence of smaller, specialized vendors is increasing competition.

- Market Concentration: The top five players (Honeywell International Inc, Fuji Electric Co Ltd, Crane Merchandising Systems Inc, Azkoyen Group, and Evoca Group) hold an estimated xx% of the market share in 2025. The remaining share is distributed among numerous smaller players.

- Innovation Drivers: Technological advancements, such as cashless payment systems, IoT integration, and smart vending machines, are driving innovation. Consumer demand for healthier options and personalized experiences is further fueling this trend.

- Regulatory Framework: Regulations concerning food safety, hygiene, and payment security vary across regions, impacting operational costs and market entry strategies. Compliance requirements represent a significant challenge for smaller operators.

- Product Substitutes: Online food delivery services and convenience stores pose increasing competition. However, the vending machine industry’s convenience and accessibility remain strong competitive advantages.

- End-User Demographics: The target customer base spans diverse demographics, ranging from office workers and students to travelers and entertainment venue patrons. Trends indicate a shift towards healthier food and beverage options within vending machines.

- M&A Activities: The industry has witnessed significant M&A activity in the historical period (2019-2024), with a total estimated deal value of $xx Million. This activity is driven by consolidation efforts and expansion into new markets.

North America and Europe Vending Machine Industry Market Dynamics & Trends

The North America and Europe vending machine market exhibits robust growth, driven by factors such as increasing urbanization, rising disposable incomes, and evolving consumer preferences. Technological innovations are transforming the industry, and competition is intense.

The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), reaching a market size of $xx Million by 2033. Market penetration varies across regions and segments, with the office/commercial sector leading in adoption. Consumer preference for healthier choices and contactless payment options is reshaping the product mix and operational strategies. The increasing adoption of smart vending machines with IoT integration enhances operational efficiency and provides valuable data for inventory management and targeted marketing. Competitive intensity is high, characterized by both price competition and product differentiation strategies.

Dominant Regions & Segments in North America and Europe Vending Machine Industry

The North American market currently holds a larger share compared to Europe, driven by factors such as higher disposable incomes and a strong office/commercial sector. Within Europe, Germany and the UK represent significant markets.

- By Location:

- Office/Commercial: This segment dominates, driven by high employee density and the need for quick and convenient food and beverage access.

- Institutional: Schools, hospitals, and government buildings represent a substantial segment with specific requirements for hygiene and safety standards.

- Others (Healthcare Facilities, Amusement Parks, Sports Venues, Transportation Facilities): This segment is experiencing significant growth, fueled by the increasing focus on enhanced customer experiences in these locations.

- By Type:

- Beverage: This remains the largest segment, reflecting the sustained demand for convenience in procuring beverages.

- Packaged Food: This sector shows notable growth, supported by the increasing availability of healthier and more diverse snack options.

- Others: This includes items such as personal care products, electronics, and other convenience goods, and shows potential for expansion.

Key drivers include favorable economic policies, well-developed infrastructure, and high consumer spending power.

North America and Europe Vending Machine Industry Product Innovations

Recent innovations include smart vending machines with cashless payments, customized product selections based on consumer data, and advanced inventory management systems. These enhancements enhance operational efficiency, improve customer experience, and enable targeted marketing. The integration of IoT technologies enables remote monitoring, predictive maintenance, and improved inventory control. The growing demand for healthier options is leading to the introduction of vending machines offering fresh produce, organic snacks, and healthier beverages.

Report Scope & Segmentation Analysis

This report segments the North America and Europe vending machine market by location (Office/Commercial, Institutional, Others) and by type (Beverage, Packaged Food, Others). Each segment's market size, growth projections, and competitive dynamics are analyzed. The Office/Commercial segment is expected to witness the highest growth rate, driven by the increasing number of workplaces and the growing preference for convenient food and beverage options. The Beverage segment dominates by market size, although the Packaged Food segment shows faster growth, driven by rising health consciousness among consumers. The "Others" segment represents an emerging area, with potential for significant expansion.

Key Drivers of North America and Europe Vending Machine Industry Growth

Several factors contribute to the industry's growth. Technological advancements such as contactless payment systems and smart vending machines improve efficiency and convenience. Increasing urbanization and high consumer spending power in major cities fuel demand. Government initiatives promoting healthy eating and workplace wellness also contribute positively. The expanding adoption of cashless transactions is also a significant driver.

Challenges in the North America and Europe Vending Machine Industry Sector

The industry faces challenges including high initial investment costs for advanced vending machines, volatile raw material prices impacting profitability, and intense competition from online food delivery services. Stringent food safety regulations and supply chain disruptions also create operational hurdles. These factors, if not effectively managed, can impact profitability and market share.

Emerging Opportunities in North America and Europe Vending Machine Industry

The increasing adoption of IoT-enabled vending machines presents opportunities for enhanced data analytics, personalized marketing, and predictive maintenance. Expanding into new market segments, such as healthcare facilities and transportation hubs, also offers growth potential. Moreover, offering healthier and more sustainable product options aligns with evolving consumer preferences and environmental concerns.

Leading Players in the North America and Europe Vending Machine Industry Market

- Honeywell International Inc

- Fuji Electric Co Ltd

- Continental Vending

- Aramark Corporation

- Azkoyen Group

- Crane Merchandising Systems Inc

- Bulk Vending Systems

- Sanden Holdings Corporation

- CompassGroup Plc

- Evoca Group

- Automated Merchandising Systems

- Azkoyen Vending Systems

- Selecta Compass Group

- American Vending Machines

Key Developments in North America and Europe Vending Machine Industry Industry

- September 2021: Glory launched an IoT-enabled vending solution with Deutsche Bahn in Germany, offering fresh, locally sourced produce accessible via a web app.

- April 2022: Lush Cosmetics launched a 24-hour vending machine in London, expanding access to its products.

Future Outlook for North America and Europe Vending Machine Industry Market

The North America and Europe vending machine market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and expansion into new market segments. Strategic investments in smart vending technology, data analytics, and healthier product offerings will be critical for success in this dynamic and competitive landscape. The market's future hinges on companies’ ability to adapt to changing consumer expectations and leverage technological innovations to enhance operational efficiency and customer experience.

North America and Europe Vending Machine Industry Segmentation

-

1. Type

- 1.1. Beverage

- 1.2. Packaged Food

- 1.3. Others

-

2. Location

- 2.1. Office/Commercial

- 2.2. Institutional

- 2.3. Others

North America and Europe Vending Machine Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

North America and Europe Vending Machine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.97% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Connecting/Improving Connectivity to Rural Areas; Improving and Catering to Increasing Data Needs

- 3.3. Market Restrains

- 3.3.1. ; High Initial Investment and Cost of Maintenance

- 3.4. Market Trends

- 3.4.1. Food Vending Machines are Expected to Witness a High Market Growth.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America and Europe Vending Machine Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Beverage

- 5.1.2. Packaged Food

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Location

- 5.2.1. Office/Commercial

- 5.2.2. Institutional

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America North America and Europe Vending Machine Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Beverage

- 6.1.2. Packaged Food

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Location

- 6.2.1. Office/Commercial

- 6.2.2. Institutional

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe North America and Europe Vending Machine Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Beverage

- 7.1.2. Packaged Food

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Location

- 7.2.1. Office/Commercial

- 7.2.2. Institutional

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Germany North America and Europe Vending Machine Industry Analysis, Insights and Forecast, 2019-2031

- 9. France North America and Europe Vending Machine Industry Analysis, Insights and Forecast, 2019-2031

- 10. Italy North America and Europe Vending Machine Industry Analysis, Insights and Forecast, 2019-2031

- 11. United Kingdom North America and Europe Vending Machine Industry Analysis, Insights and Forecast, 2019-2031

- 12. Netherlands North America and Europe Vending Machine Industry Analysis, Insights and Forecast, 2019-2031

- 13. Sweden North America and Europe Vending Machine Industry Analysis, Insights and Forecast, 2019-2031

- 14. Rest of Europe North America and Europe Vending Machine Industry Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Honeywell International Inc

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Fuji Electric Co Ltd

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Continental Vending

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Aramark Corporation

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Azkoyen Group

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Crane Merchandising Systems Inc

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Bulk Vending Systems

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Sanden Holdings Corporation

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 CompassGroupPlc

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Evoca Group

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 Automated Merchandising Systems

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.12 Azkoyen Vending Systems

- 15.2.12.1. Overview

- 15.2.12.2. Products

- 15.2.12.3. SWOT Analysis

- 15.2.12.4. Recent Developments

- 15.2.12.5. Financials (Based on Availability)

- 15.2.13 Selecta Compass Group

- 15.2.13.1. Overview

- 15.2.13.2. Products

- 15.2.13.3. SWOT Analysis

- 15.2.13.4. Recent Developments

- 15.2.13.5. Financials (Based on Availability)

- 15.2.14 American Vending Machines

- 15.2.14.1. Overview

- 15.2.14.2. Products

- 15.2.14.3. SWOT Analysis

- 15.2.14.4. Recent Developments

- 15.2.14.5. Financials (Based on Availability)

- 15.2.1 Honeywell International Inc

List of Figures

- Figure 1: North America and Europe Vending Machine Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America and Europe Vending Machine Industry Share (%) by Company 2024

List of Tables

- Table 1: North America and Europe Vending Machine Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America and Europe Vending Machine Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America and Europe Vending Machine Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America and Europe Vending Machine Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: North America and Europe Vending Machine Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 6: North America and Europe Vending Machine Industry Volume K Unit Forecast, by Location 2019 & 2032

- Table 7: North America and Europe Vending Machine Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America and Europe Vending Machine Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: North America and Europe Vending Machine Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America and Europe Vending Machine Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Germany North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: France North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Italy North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Netherlands North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Netherlands North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Sweden North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Sweden North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: North America and Europe Vending Machine Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 26: North America and Europe Vending Machine Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 27: North America and Europe Vending Machine Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 28: North America and Europe Vending Machine Industry Volume K Unit Forecast, by Location 2019 & 2032

- Table 29: North America and Europe Vending Machine Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: North America and Europe Vending Machine Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: United States North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: United States North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Canada North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Canada North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Mexico North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: North America and Europe Vending Machine Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 38: North America and Europe Vending Machine Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 39: North America and Europe Vending Machine Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 40: North America and Europe Vending Machine Industry Volume K Unit Forecast, by Location 2019 & 2032

- Table 41: North America and Europe Vending Machine Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: North America and Europe Vending Machine Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: Germany North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Germany North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: United Kingdom North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: United Kingdom North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: France North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: France North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Italy North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Italy North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Spain North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Spain North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Rest of Europe North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Europe North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America and Europe Vending Machine Industry?

The projected CAGR is approximately 8.97%.

2. Which companies are prominent players in the North America and Europe Vending Machine Industry?

Key companies in the market include Honeywell International Inc, Fuji Electric Co Ltd, Continental Vending, Aramark Corporation, Azkoyen Group, Crane Merchandising Systems Inc, Bulk Vending Systems, Sanden Holdings Corporation, CompassGroupPlc, Evoca Group, Automated Merchandising Systems, Azkoyen Vending Systems, Selecta Compass Group, American Vending Machines.

3. What are the main segments of the North America and Europe Vending Machine Industry?

The market segments include Type, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Connecting/Improving Connectivity to Rural Areas; Improving and Catering to Increasing Data Needs.

6. What are the notable trends driving market growth?

Food Vending Machines are Expected to Witness a High Market Growth..

7. Are there any restraints impacting market growth?

; High Initial Investment and Cost of Maintenance.

8. Can you provide examples of recent developments in the market?

April 2022 - Lush, the British cosmetics company, established a 24-hour vending machine where customers can buy its goods anytime or at night. The vending machine is located in London's Coal Drop's Yard, just a ten-minute walk from King's Cross Station, one of the city's busiest rail stations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America and Europe Vending Machine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America and Europe Vending Machine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America and Europe Vending Machine Industry?

To stay informed about further developments, trends, and reports in the North America and Europe Vending Machine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence