Key Insights

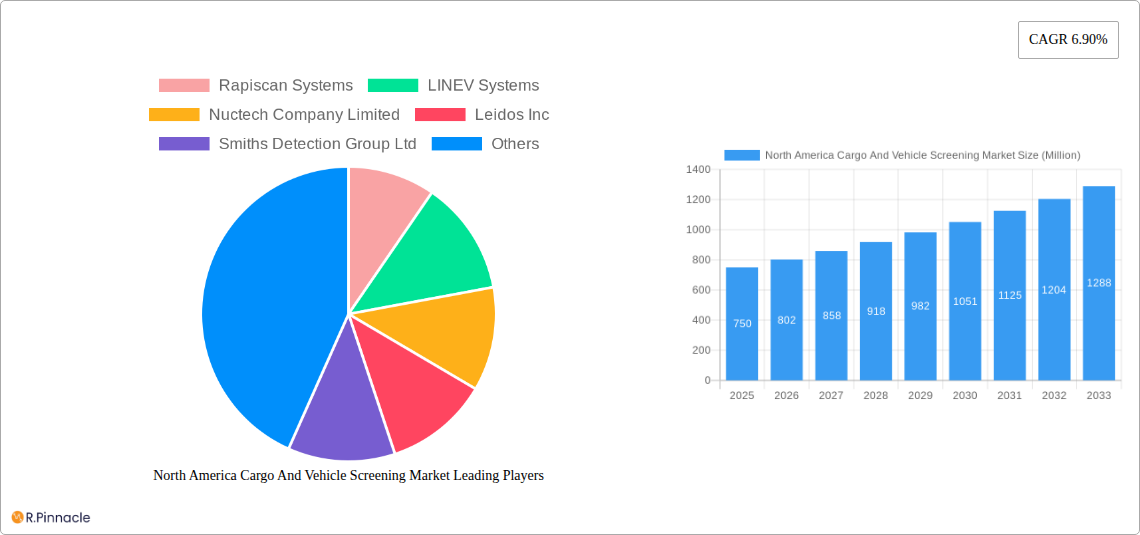

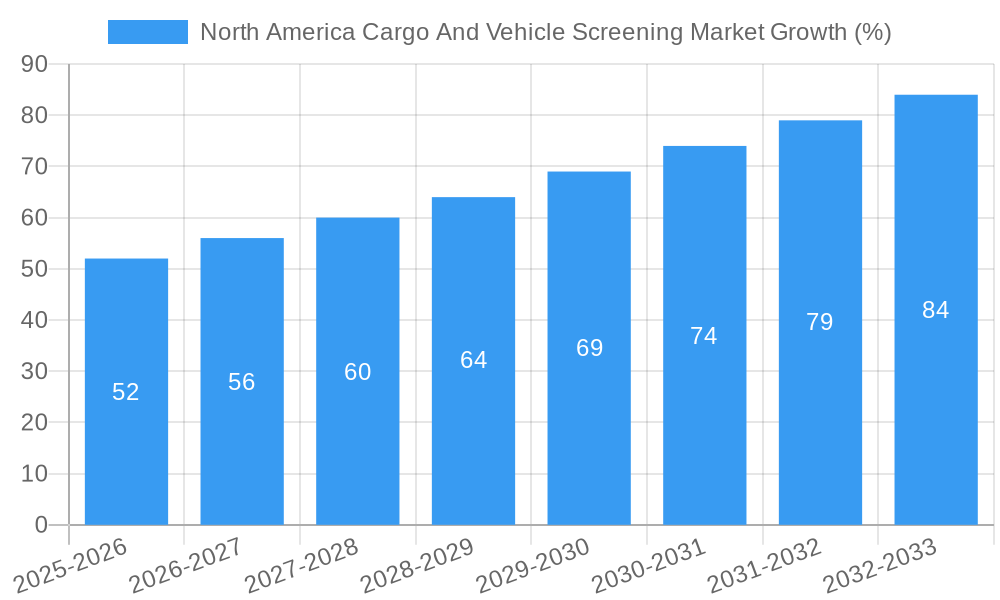

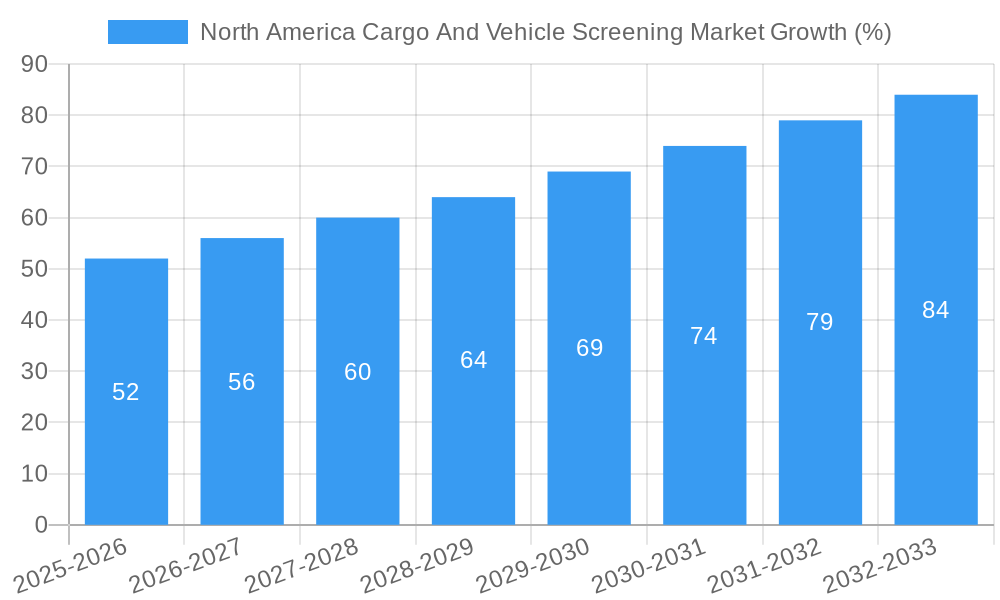

The North America cargo and vehicle screening market, valued at approximately $750 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.90% from 2025 to 2033. This expansion is fueled by several key drivers. Increased cross-border trade necessitates heightened security measures, driving demand for advanced screening technologies. The rising prevalence of terrorism and organized crime necessitates more sophisticated detection capabilities for both cargo and vehicles entering the region. Furthermore, government regulations mandating improved security protocols across transportation networks significantly contribute to market growth. Technological advancements in screening systems, such as the development of AI-powered solutions and improved non-intrusive inspection (NII) techniques, are enhancing detection accuracy and efficiency, further stimulating market expansion. The market is segmented by technology type (X-ray, millimeter-wave, etc.), application (airports, seaports, border crossings), and end-user (government agencies, private security companies). Leading players like Rapiscan Systems, Nuctech, and Smiths Detection are actively investing in R&D and strategic partnerships to strengthen their market positions.

Competition is fierce, with established players vying for market share against emerging companies offering innovative solutions. While the market exhibits significant growth potential, challenges remain. High initial investment costs associated with advanced screening technologies can present a barrier to entry for smaller companies. Moreover, concerns about the accuracy and reliability of certain technologies, as well as the need for skilled personnel to operate and maintain these systems, may hinder widespread adoption. Despite these challenges, the long-term outlook for the North America cargo and vehicle screening market remains positive, driven by continuous technological advancements, increasing security concerns, and supportive government policies. The market is expected to see significant growth across various segments and regions within North America, with continued innovation and consolidation anticipated in the coming years.

North America Cargo and Vehicle Screening Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America cargo and vehicle screening market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, growth drivers, challenges, and future opportunities. The study includes detailed segmentation, competitive landscape analysis, and key player profiles, providing a 360-degree view of this critical sector.

North America Cargo And Vehicle Screening Market Market Structure & Innovation Trends

The North American cargo and vehicle screening market exhibits a moderately concentrated structure, with key players like Rapiscan Systems, LINEV Systems, Nuctech Company Limited, Leidos Inc, Smiths Detection Group Ltd, Vantage Security, Intertek Group plc, OSI Systems, UVeye Inc, and ASTROPHYSICS INC holding significant market share. However, the presence of several smaller, specialized players indicates a dynamic competitive landscape. Market share estimates for 2025 indicate Rapiscan Systems holding approximately xx% market share, followed by Smiths Detection Group Ltd at xx% and OSI Systems at xx%. These figures are subject to change based on ongoing market dynamics.

Innovation is driven by stringent security regulations, increasing cross-border trade, and the need for faster, more efficient screening processes. The market is witnessing advancements in technologies such as AI-powered threat detection, advanced imaging techniques (millimeter-wave, X-ray), and automated systems. Regulatory frameworks, including TSA regulations in the US and similar bodies in Canada and Mexico, play a crucial role in shaping market demand and technological advancements. Product substitutes are limited, primarily focusing on alternative inspection methods, but the core need for reliable security screening remains constant. End-users include government agencies, transportation companies, ports, airports, and private security firms. M&A activity in recent years has been moderate, with deal values averaging approximately $xx million per transaction, primarily focusing on enhancing technological capabilities and expanding market reach.

North America Cargo And Vehicle Screening Market Market Dynamics & Trends

The North American cargo and vehicle screening market is experiencing robust growth, driven by heightened security concerns, the expansion of e-commerce, and increasing regulatory scrutiny. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, such as the adoption of AI and advanced imaging, are significantly enhancing screening accuracy and efficiency. Consumer preferences are shifting towards faster, non-intrusive screening methods, driving demand for innovative solutions. Competitive dynamics are marked by both technological innovation and strategic partnerships, with companies focusing on enhancing their product portfolios and expanding their geographic reach. Market penetration for advanced screening technologies is steadily rising, expected to reach xx% by 2033, driven by increasing adoption in critical infrastructure facilities and logistics hubs.

Dominant Regions & Segments in North America Cargo And Vehicle Screening Market

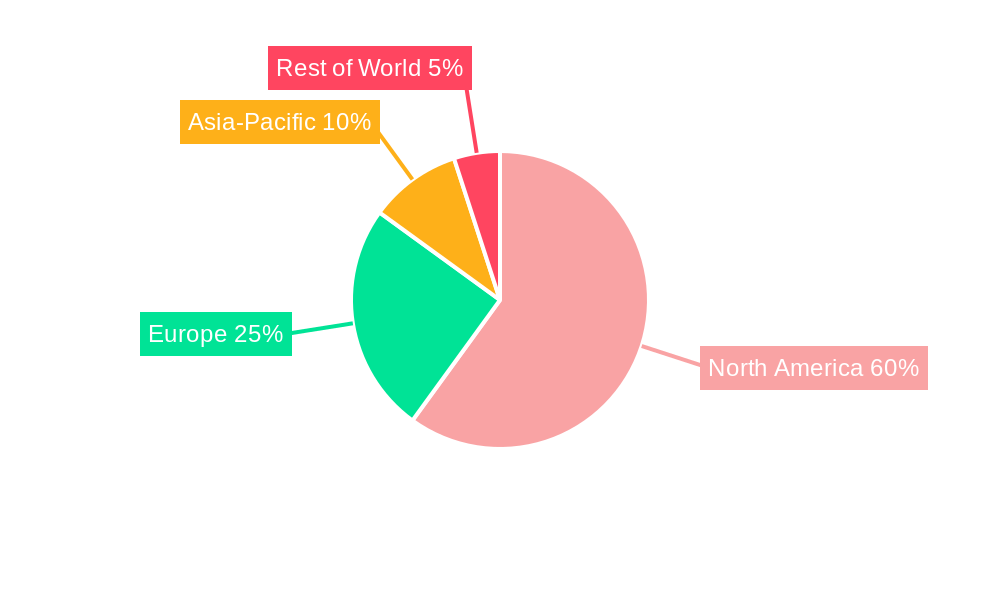

The US dominates the North American cargo and vehicle screening market, accounting for approximately xx% of the total market value in 2025, followed by Canada and Mexico.

Key Drivers of US Dominance:

- High volume of cross-border trade and international air travel.

- Stringent security regulations and robust enforcement mechanisms.

- Significant investment in port and airport infrastructure.

- Large number of security agencies and private security firms.

Detailed analysis indicates a higher concentration of screening systems deployed in major US ports and airports compared to Canada and Mexico. While Canada and Mexico exhibit growth potential, the higher volume of freight and passenger traffic in the US drives stronger market demand.

North America Cargo And Vehicle Screening Market Product Innovations

Recent product innovations include the integration of AI and machine learning algorithms for enhanced threat detection, miniaturization of screening systems for improved portability and ease of deployment, and the development of radiation-free screening technologies to improve safety. These advancements are improving screening efficiency, accuracy, and reducing operational costs, significantly impacting market fit and competitive advantage.

Report Scope & Segmentation Analysis

The report segments the market based on technology (X-ray, millimeter-wave, explosives trace detection), application (cargo screening, vehicle screening), end-user (government agencies, private security firms, transportation companies), and geography (US, Canada, Mexico). Each segment displays unique growth projections based on factors such as adoption rates, regulatory changes, and technological advancements. For example, the X-ray segment is expected to dominate due to established infrastructure, while the millimeter-wave segment exhibits strong growth potential due to its non-invasive nature.

Key Drivers of North America Cargo And Vehicle Screening Market Growth

Several factors drive the market's growth. Increasing security concerns post-9/11 and other global events necessitate robust screening systems. E-commerce boom leads to a surge in cargo shipments, demanding efficient and reliable screening solutions. Stringent regulatory compliance mandates from government agencies necessitate the adoption of advanced screening technologies. Technological advancements such as AI-powered systems and improved imaging are enhancing detection capabilities.

Challenges in the North America Cargo And Vehicle Screening Market Sector

Significant challenges include the high initial investment cost of advanced screening systems, which can be a barrier for smaller companies. Supply chain disruptions can impact the availability of components and lead to delays in project implementation. Intense competition from established players and emerging market entrants creates pressure on pricing and profit margins. Regulatory hurdles and varying standards across different jurisdictions can create complexities for manufacturers and operators.

Emerging Opportunities in North America Cargo And Vehicle Screening Market

Emerging opportunities include the growing demand for automated and integrated screening solutions, the increasing adoption of AI-powered threat detection systems, and the expansion of screening applications into new sectors like critical infrastructure protection and private logistics. Focus on radiation-free and environmentally friendly technologies presents opportunities for market differentiation. The growing need for improved cybersecurity and data management within screening systems represents an additional area of innovation and market expansion.

Leading Players in the North America Cargo And Vehicle Screening Market Market

- Rapiscan Systems

- LINEV Systems

- Nuctech Company Limited

- Leidos Inc

- Smiths Detection Group Ltd

- Vantage Security

- Intertek Group plc

- OSI Systems

- UVeye Inc

- ASTROPHYSICS INC

Key Developments in North America Cargo And Vehicle Screening Market Industry

- March 2024: OSI Systems, Inc. secured a $100 million international contract for cargo and vehicle inspection systems, maintenance, and training. This signifies significant market expansion and validates the growing demand for advanced screening solutions.

- February 2024: The CVSA's International Roadcheck (May 14-16) emphasizes regulatory compliance and the importance of efficient commercial vehicle screening. This initiative highlights the continued need for robust screening technologies and enforcement across North America.

Future Outlook for North America Cargo And Vehicle Screening Market Market

The future outlook for the North American cargo and vehicle screening market is positive, driven by sustained growth in e-commerce, increasing security concerns, and technological advancements. The market is expected to witness continuous innovation in screening technologies, with a focus on AI, automation, and improved detection capabilities. Strategic partnerships and M&A activities will further shape the competitive landscape, driving market consolidation and creating opportunities for growth. Expansion into new sectors and regions presents significant potential for market expansion and increased adoption of advanced screening solutions.

North America Cargo And Vehicle Screening Market Segmentation

-

1. Type of Screening System

- 1.1. Stationary Screening

- 1.2. Mobile Screening

-

2. End User Vertical

- 2.1. Airports

- 2.2. Ports and Borders

- 2.3. Government and Defense

- 2.4. Critical Infrastructure

- 2.5. Commercial

North America Cargo And Vehicle Screening Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Cargo And Vehicle Screening Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Advanced Screening and Inspection Systems at Borders; Expanding International Trade

- 3.3. Market Restrains

- 3.3.1. Increasing Demand For Advanced Screening and Inspection Systems at Borders; Expanding International Trade

- 3.4. Market Trends

- 3.4.1. Adoption of Advancing Technologies For Screening Promotes Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Cargo And Vehicle Screening Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Screening System

- 5.1.1. Stationary Screening

- 5.1.2. Mobile Screening

- 5.2. Market Analysis, Insights and Forecast - by End User Vertical

- 5.2.1. Airports

- 5.2.2. Ports and Borders

- 5.2.3. Government and Defense

- 5.2.4. Critical Infrastructure

- 5.2.5. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type of Screening System

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Rapiscan Systems

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LINEV Systems

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nuctech Company Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Leidos Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Smiths Detection Group Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vantage Security

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Intertek Group plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 OSI Systems

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 UVeye Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ASTROPHYSICS INC*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rapiscan Systems

List of Figures

- Figure 1: North America Cargo And Vehicle Screening Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Cargo And Vehicle Screening Market Share (%) by Company 2024

List of Tables

- Table 1: North America Cargo And Vehicle Screening Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Cargo And Vehicle Screening Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: North America Cargo And Vehicle Screening Market Revenue Million Forecast, by Type of Screening System 2019 & 2032

- Table 4: North America Cargo And Vehicle Screening Market Volume Billion Forecast, by Type of Screening System 2019 & 2032

- Table 5: North America Cargo And Vehicle Screening Market Revenue Million Forecast, by End User Vertical 2019 & 2032

- Table 6: North America Cargo And Vehicle Screening Market Volume Billion Forecast, by End User Vertical 2019 & 2032

- Table 7: North America Cargo And Vehicle Screening Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Cargo And Vehicle Screening Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: North America Cargo And Vehicle Screening Market Revenue Million Forecast, by Type of Screening System 2019 & 2032

- Table 10: North America Cargo And Vehicle Screening Market Volume Billion Forecast, by Type of Screening System 2019 & 2032

- Table 11: North America Cargo And Vehicle Screening Market Revenue Million Forecast, by End User Vertical 2019 & 2032

- Table 12: North America Cargo And Vehicle Screening Market Volume Billion Forecast, by End User Vertical 2019 & 2032

- Table 13: North America Cargo And Vehicle Screening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: North America Cargo And Vehicle Screening Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: United States North America Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States North America Cargo And Vehicle Screening Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: Canada North America Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada North America Cargo And Vehicle Screening Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: Mexico North America Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico North America Cargo And Vehicle Screening Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Cargo And Vehicle Screening Market?

The projected CAGR is approximately 6.90%.

2. Which companies are prominent players in the North America Cargo And Vehicle Screening Market?

Key companies in the market include Rapiscan Systems, LINEV Systems, Nuctech Company Limited, Leidos Inc, Smiths Detection Group Ltd, Vantage Security, Intertek Group plc, OSI Systems, UVeye Inc, ASTROPHYSICS INC*List Not Exhaustive.

3. What are the main segments of the North America Cargo And Vehicle Screening Market?

The market segments include Type of Screening System, End User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.75 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Advanced Screening and Inspection Systems at Borders; Expanding International Trade.

6. What are the notable trends driving market growth?

Adoption of Advancing Technologies For Screening Promotes Growth.

7. Are there any restraints impacting market growth?

Increasing Demand For Advanced Screening and Inspection Systems at Borders; Expanding International Trade.

8. Can you provide examples of recent developments in the market?

March 2024 -OSI Systems, Inc. has announced today that its Security division, a premier global provider of security and inspection systems, has secured an international contract award valued at approximately $100 million to provide cargo and vehicle inspection systems, as well as ongoing maintenance services and training.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Cargo And Vehicle Screening Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Cargo And Vehicle Screening Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Cargo And Vehicle Screening Market?

To stay informed about further developments, trends, and reports in the North America Cargo And Vehicle Screening Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence