Key Insights

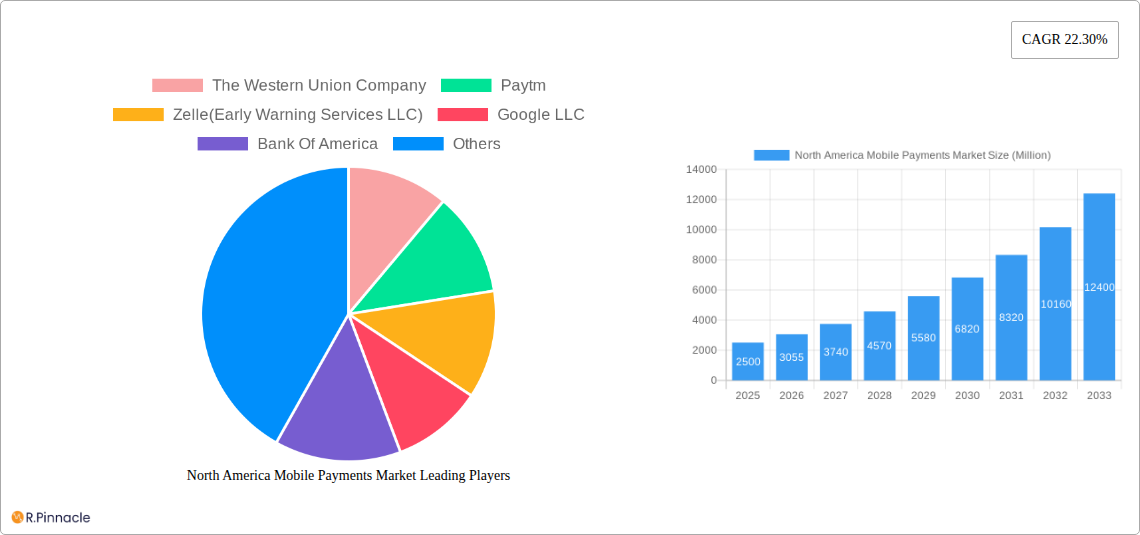

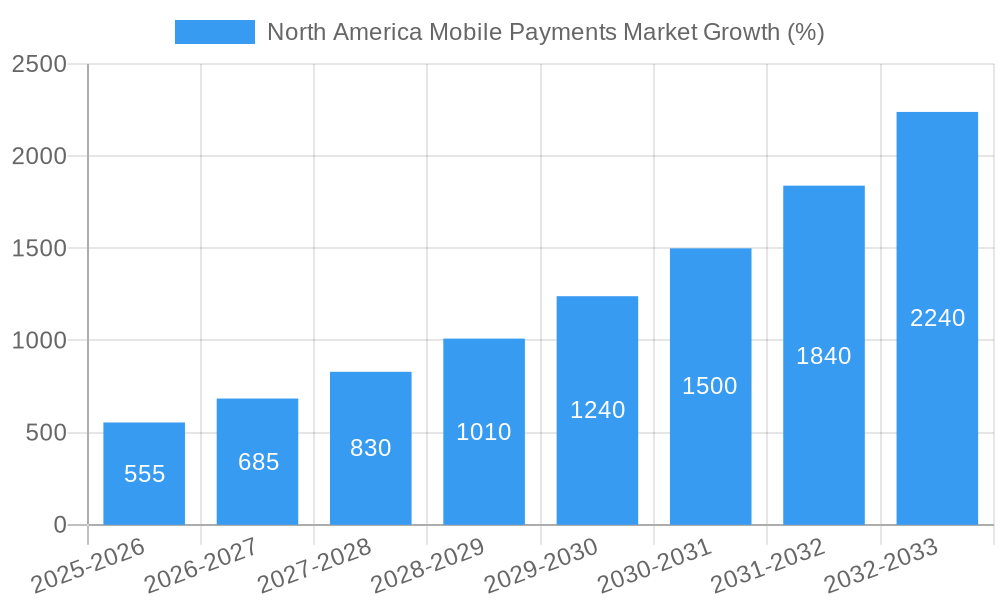

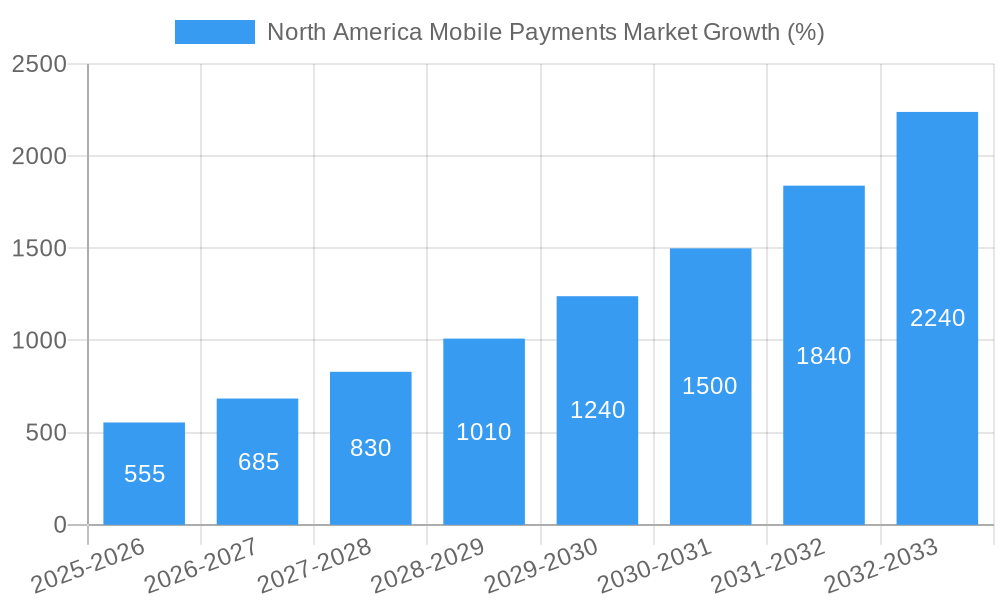

The North American mobile payments market is experiencing robust growth, fueled by the increasing adoption of smartphones, expanding e-commerce activities, and a shift towards cashless transactions. The market's Compound Annual Growth Rate (CAGR) of 22.30% from 2019 to 2024 indicates a significant upward trajectory. This growth is driven by factors such as the convenience and speed offered by mobile payment solutions, coupled with enhanced security features and the widespread availability of near-field communication (NFC) technology. The market is segmented into proximity and remote payment methods, with proximity payments, such as Apple Pay and Google Pay, currently dominating due to their seamless integration with point-of-sale systems. However, remote payments, facilitated by platforms like PayPal and Zelle, are also experiencing substantial growth driven by the rise of online shopping and peer-to-peer (P2P) money transfers. Key players like PayPal, Apple, Google, and established financial institutions like Bank of America are actively competing to capture market share through technological innovations, strategic partnerships, and aggressive marketing campaigns. The increasing adoption of mobile wallets, coupled with government initiatives promoting digital financial inclusion, are expected to further propel market expansion.

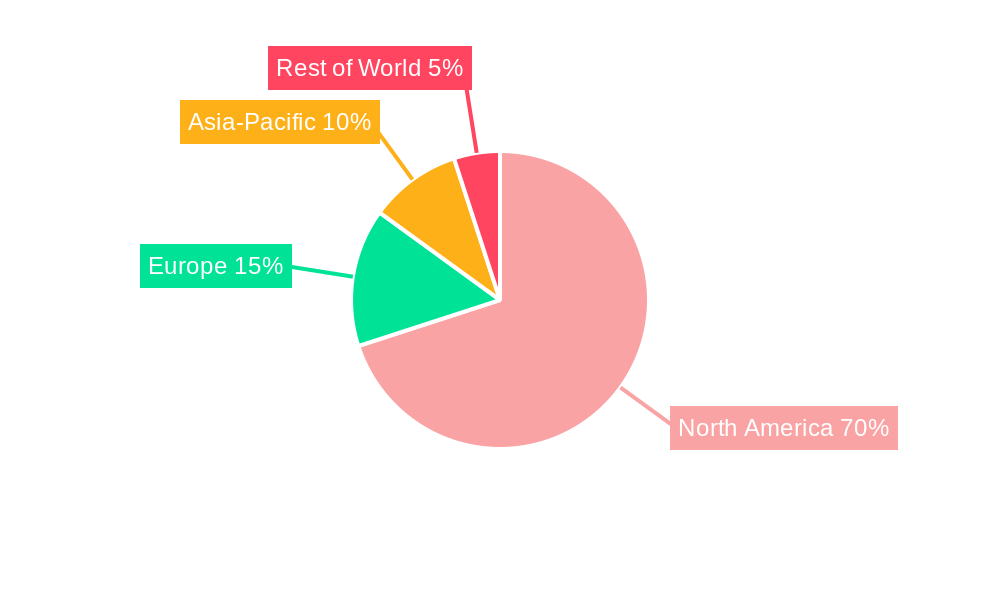

The North American market, specifically focusing on the United States, Canada, and Mexico, represents a significant portion of the global mobile payments landscape. The substantial technological infrastructure and high smartphone penetration in this region contribute to this dominance. While the market faces certain restraints, such as security concerns and the need for improved digital literacy, these challenges are being addressed through advancements in fraud prevention technologies and ongoing educational initiatives. The forecast period of 2025-2033 suggests a continuation of this positive growth trend, with potential for even higher CAGRs as new technologies emerge and consumer adoption accelerates. The strong presence of major players like Western Union, Paytm, and Alipay further strengthens the competitiveness and innovation within the market, driving its sustained expansion. Further segmentation analysis focusing on demographics, transaction types, and specific application use cases will yield a deeper understanding of the market's evolving dynamics.

North America Mobile Payments Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America mobile payments market, covering the period from 2019 to 2033. With a focus on actionable insights and leveraging key industry trends, this report is essential for industry professionals, investors, and anyone seeking a deep understanding of this dynamic market. The report utilizes data from the base year 2025 and provides detailed forecasts until 2033, drawing on historical data from 2019-2024. The market is projected to reach xx Million by 2033, exhibiting a significant CAGR of xx% during the forecast period.

North America Mobile Payments Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the North America mobile payments market. We examine market concentration, identifying key players and their respective market shares. The report also delves into the impact of mergers and acquisitions (M&A) activities, assessing deal values and their influence on market dynamics. Furthermore, we explore the role of technological advancements, regulatory frameworks, and the presence of substitute products in shaping the market's trajectory. The analysis includes:

- Market Concentration: The North America mobile payment market exhibits a [Describe level of concentration - e.g., moderately concentrated] structure, with key players holding a significant [Percentage] market share. This is influenced by [Explain reasons for concentration, e.g., network effects, brand recognition, first-mover advantages].

- Innovation Drivers: The market is driven by continuous innovation in areas such as biometric authentication (as seen with Mastercard's facial and palm recognition technology), enhanced security features, and the integration of mobile payments with other financial services, as exemplified by PayPal's super app launch.

- Regulatory Frameworks: Regulatory bodies such as [Mention specific regulatory bodies] play a crucial role in shaping market development by [Explain regulatory impact, e.g., setting data privacy standards, promoting interoperability].

- Product Substitutes: The primary substitutes for mobile payments are [List substitute payment methods e.g., traditional credit/debit cards, cash]. However, the increasing convenience and security of mobile payments are gradually reducing the market share of these substitutes.

- End-User Demographics: The market is largely driven by [Describe target demographics e.g., millennials and Gen Z], who exhibit high adoption rates of mobile technologies and are more comfortable with digital transactions.

- M&A Activities: Significant M&A activities have been observed in the market, with deal values totaling [Estimated value in Millions] in the past [Time period]. These activities have primarily focused on [Explain rationale behind M&A e.g., expanding service offerings, enhancing technological capabilities].

North America Mobile Payments Market Market Dynamics & Trends

This section explores the key growth drivers, technological disruptions, consumer preferences, and competitive dynamics shaping the market's evolution. The analysis encompasses:

[This section requires detailed market data and analysis to fill 600 words. It should include specifics on CAGR, market penetration rates for different payment methods, the impact of technological advancements like NFC and QR codes, changing consumer preferences for contactless payments, and competitive pressures from various market participants. Include data and insights illustrating trends and growth projections.] For example: The market is experiencing robust growth, driven by increasing smartphone penetration, rising e-commerce adoption, and growing consumer preference for contactless payments. The shift toward digital wallets and the integration of mobile payment solutions into various applications is further propelling market expansion. The CAGR for the period 2025-2033 is estimated to be xx%, with market penetration expected to reach xx% by 2033. Competitive pressures are intense, with established players like PayPal and newer entrants vying for market share through strategic partnerships, innovative product offerings, and aggressive marketing campaigns.

Dominant Regions & Segments in North America Mobile Payments Market

This section identifies the leading regions and segments within the North America mobile payments market, focusing on payment modes: Proximity Payment and Remote Payment. The analysis will highlight the key drivers contributing to the dominance of specific regions or segments.

Proximity Payment: [Discuss the leading region/country for Proximity Payment. Explain its dominance using factors such as high smartphone penetration, robust infrastructure, favorable regulatory environment and consumer behavior. This should be supported by data and evidence]

- Key Drivers:

- Extensive Point-of-Sale (POS) infrastructure supporting NFC technology.

- High smartphone penetration and mobile internet usage.

- Growing consumer preference for contactless payment options.

- Supportive government policies and initiatives.

- Key Drivers:

Remote Payment: [Discuss the leading region/country for Remote Payment. Explain its dominance using factors such as robust e-commerce infrastructure, high internet penetration, and strong online banking adoption. This should be supported by data and evidence]

- Key Drivers:

- High e-commerce penetration rates and a growing preference for online shopping.

- Widespread internet and mobile internet accessibility.

- Strong digital banking infrastructure and customer adoption of online banking services.

- Increasing consumer trust and familiarity with online payment platforms.

- Key Drivers:

[This section needs approximately 600 words of detailed analysis to meet the requirement.]

North America Mobile Payments Market Product Innovations

The North America mobile payments market is witnessing rapid innovation, characterized by the integration of biometric authentication (like Mastercard's facial and palm scan technology), advanced security features to combat fraud, and the convergence of mobile payment platforms with other financial services, as seen with PayPal's super app. These advancements enhance user experience, improve security, and expand the functionality of mobile payment systems. This creates a market where convenience and security are paramount, driving adoption and fostering competition amongst providers.

Report Scope & Segmentation Analysis

This report segments the North America mobile payments market primarily by payment mode:

Proximity Payment: This segment encompasses payments made using technologies such as Near Field Communication (NFC) at point-of-sale terminals. The market size for proximity payments is estimated at xx Million in 2025, projected to grow to xx Million by 2033, with a CAGR of xx%. The competitive landscape is characterized by [describe competitive dynamics e.g., intense competition among mobile network operators, payment processors, and financial institutions].

Remote Payment: This segment covers payments made remotely through various digital channels, including online platforms, mobile apps, and other digital means. The market size for remote payments is estimated at xx Million in 2025, projected to reach xx Million by 2033, with a CAGR of xx%. The competitive landscape is marked by [describe competitive dynamics e.g., a mix of established players and emerging fintech companies].

Key Drivers of North America Mobile Payments Market Growth

The growth of the North America mobile payments market is propelled by several factors: The widespread adoption of smartphones and mobile internet access, coupled with the rising popularity of e-commerce and online shopping, is a key driver. The increasing demand for convenient and secure payment methods further fuels the market's expansion. Moreover, supportive government policies and initiatives promoting digital payments, along with continuous technological innovations like biometric authentication and enhanced security features, contribute significantly to market growth.

Challenges in the North America Mobile Payments Market Sector

The North America mobile payments market faces several challenges, including concerns about data security and privacy, the need for robust fraud prevention measures, and the potential for regulatory hurdles regarding data protection and consumer rights. Additionally, ensuring seamless interoperability between different payment systems and platforms remains a challenge, as does the need to address concerns about financial inclusion and digital literacy among certain population segments. These factors can potentially hinder market growth and adoption if not appropriately addressed.

Emerging Opportunities in North America Mobile Payments Market

The market presents several emerging opportunities, including the integration of mobile payments with other financial services to create comprehensive financial ecosystems. The expansion into new market segments, such as micro-transactions and peer-to-peer (P2P) payments, holds significant potential. Furthermore, the adoption of innovative technologies like blockchain and artificial intelligence (AI) can enhance security, efficiency, and personalization, providing new avenues for growth.

Leading Players in the North America Mobile Payments Market Market

- The Western Union Company

- Paytm

- Zelle(Early Warning Services LLC)

- Google LLC

- Bank Of America

- Intuit Pay

- PayPal

- Boku

- Alipay

- Apple Inc

Key Developments in North America Mobile Payments Market Industry

- September 2021: PayPal launched its super app, integrating payments, savings, bill pay, cryptocurrency, and shopping features. This significantly expanded PayPal's service offerings and strengthened its competitive position.

- May 2022: Mastercard introduced biometric checkout technology using facial or palm scans, enhancing payment speed and security while potentially disrupting existing payment methods.

Future Outlook for North America Mobile Payments Market Market

The North America mobile payments market is poised for continued growth, driven by technological advancements, increasing smartphone penetration, and the growing preference for contactless and digital payment solutions. Strategic partnerships between financial institutions, technology companies, and retailers will further accelerate market expansion. The focus on enhanced security features and the integration of mobile payments into broader financial ecosystems will be key drivers of future growth, presenting significant opportunities for innovation and market expansion.

North America Mobile Payments Market Segmentation

-

1. Payment Mode

- 1.1. Proximity Payment

- 1.2. Remote Payment

-

2. Geography

-

2.1. North America

- 2.1.1. United States

- 2.1.2. Canada

-

2.1. North America

North America Mobile Payments Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

North America Mobile Payments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 22.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of the Digitalization; Rise of Personal Financial Apps

- 3.3. Market Restrains

- 3.3.1. Security of the Data can Hinder the Growth of the Market

- 3.4. Market Trends

- 3.4.1. The Rise of Contactless Payments in the U.S

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Mobile Payments Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Payment Mode

- 5.1.1. Proximity Payment

- 5.1.2. Remote Payment

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. North America

- 5.2.1.1. United States

- 5.2.1.2. Canada

- 5.2.1. North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Payment Mode

- 6. United States North America Mobile Payments Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Mobile Payments Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Mobile Payments Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Mobile Payments Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 The Western Union Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Paytm

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Zelle(Early Warning Services LLC)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Google LLC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Bank Of America

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Intuit Pay

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 PayPal

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Boku

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Alipay

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Apple Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 The Western Union Company

List of Figures

- Figure 1: North America Mobile Payments Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Mobile Payments Market Share (%) by Company 2024

List of Tables

- Table 1: North America Mobile Payments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Mobile Payments Market Revenue Million Forecast, by Payment Mode 2019 & 2032

- Table 3: North America Mobile Payments Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: North America Mobile Payments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Mobile Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Mobile Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Mobile Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Mobile Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Mobile Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Mobile Payments Market Revenue Million Forecast, by Payment Mode 2019 & 2032

- Table 11: North America Mobile Payments Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: North America Mobile Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Mobile Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Mobile Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Mobile Payments Market?

The projected CAGR is approximately 22.30%.

2. Which companies are prominent players in the North America Mobile Payments Market?

Key companies in the market include The Western Union Company, Paytm, Zelle(Early Warning Services LLC), Google LLC, Bank Of America, Intuit Pay, PayPal, Boku, Alipay, Apple Inc.

3. What are the main segments of the North America Mobile Payments Market?

The market segments include Payment Mode, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of the Digitalization; Rise of Personal Financial Apps.

6. What are the notable trends driving market growth?

The Rise of Contactless Payments in the U.S.

7. Are there any restraints impacting market growth?

Security of the Data can Hinder the Growth of the Market.

8. Can you provide examples of recent developments in the market?

May 2022 - Users can pay using Mastercard's biometric checkout technology by scanning their face or palm. Mastercard is testing new technology that allows shoppers to pay at the checkout with just their face or hand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Mobile Payments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Mobile Payments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Mobile Payments Market?

To stay informed about further developments, trends, and reports in the North America Mobile Payments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence