Key Insights

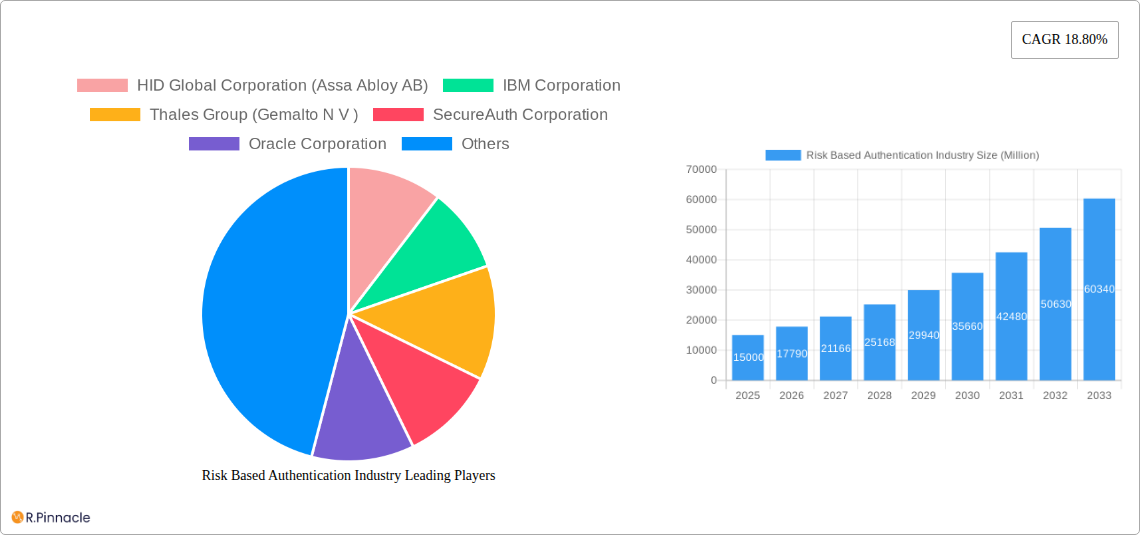

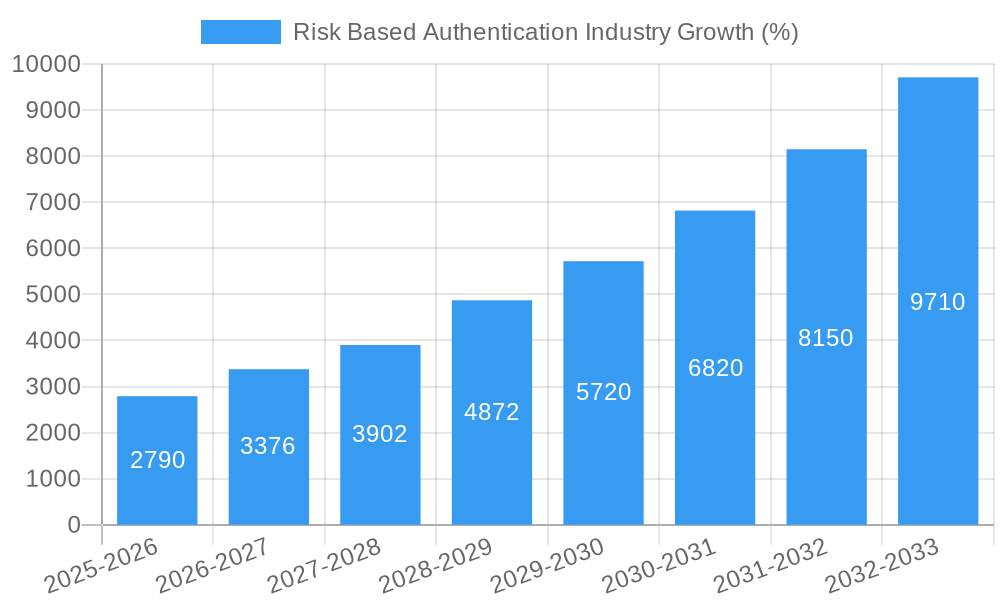

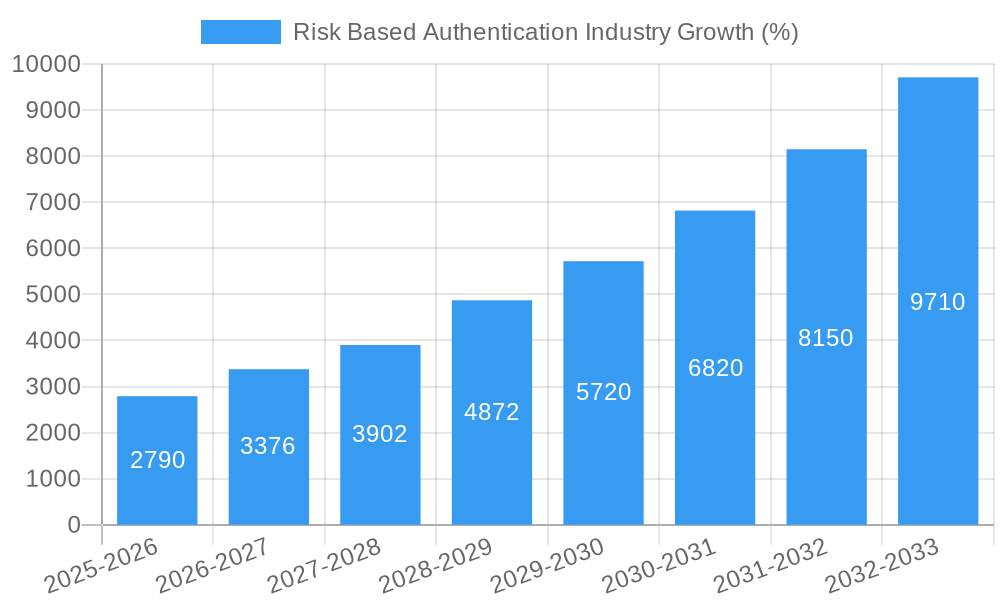

The Risk-Based Authentication (RBA) market is experiencing robust growth, projected to reach a substantial size driven by the escalating need for enhanced online security and the increasing frequency of cyberattacks. The market's Compound Annual Growth Rate (CAGR) of 18.80% from 2019 to 2024 indicates a significant upward trajectory. This growth is fueled by several key factors. The rising adoption of cloud-based solutions and the increasing reliance on mobile devices for accessing sensitive information are major drivers. Furthermore, stringent government regulations concerning data privacy and security, like GDPR and CCPA, are compelling organizations across various sectors – including Banking and Financial Services (BFSI), Retail, IT and Telecommunications, and Healthcare – to implement robust authentication mechanisms. The BFSI sector is expected to remain a dominant player due to its sensitive nature and high risk of financial fraud. The shift towards cloud deployment offers scalability and cost-effectiveness, further accelerating market expansion. However, the complexity of implementing RBA solutions and concerns regarding their potential impact on user experience pose challenges to broader adoption. The market is segmented by offering (solution and service), deployment (on-premise and cloud), and end-user vertical, allowing for specialized solutions tailored to unique organizational needs. Leading players such as HID Global, IBM, Thales, Okta, and RSA Security are actively shaping market dynamics through innovation and strategic acquisitions. Future growth will likely be influenced by advancements in artificial intelligence (AI) and machine learning (ML) for enhanced threat detection and personalized authentication experiences.

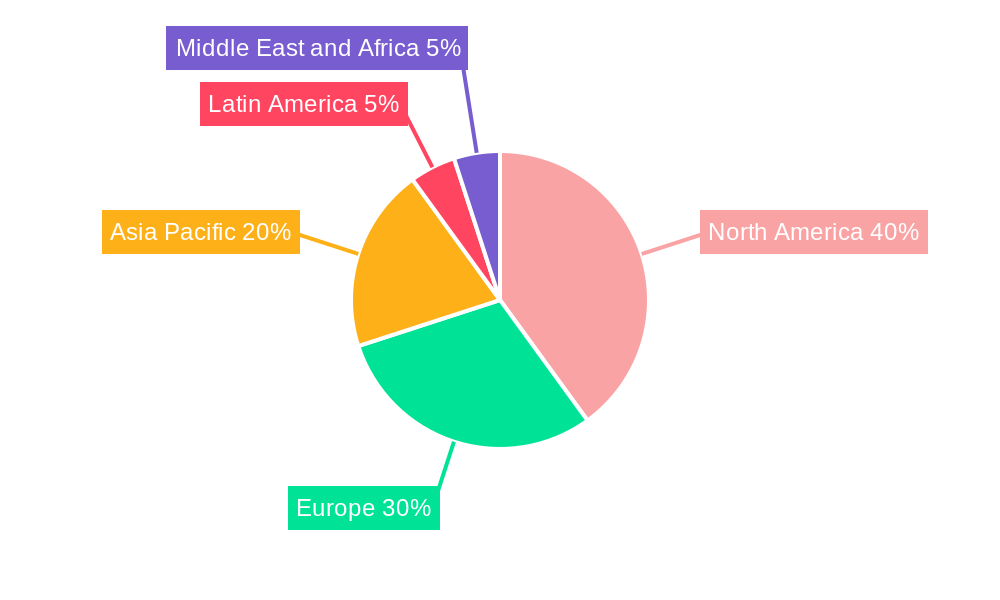

The projected market value for 2025, considering the provided CAGR and a plausible starting point, would be significant. Continuing this growth trajectory through 2033 suggests a substantial market size by the end of the forecast period. While precise figures require more detailed financial data, the current trends indicate a highly lucrative and expanding market for Risk-Based Authentication solutions. Competition is expected to intensify as more companies enter the market, driving innovation and potentially lowering costs for end-users. Continued investment in research and development will be vital for players seeking to maintain a competitive edge in this rapidly evolving landscape. The geographical distribution will likely see North America and Europe maintaining strong market shares, but with significant growth opportunities arising in the Asia-Pacific region as digital adoption accelerates.

Risk-Based Authentication Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Risk-Based Authentication (RBA) industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report projects a market valued at xx Million by 2033, demonstrating significant growth potential. This report examines market structure, dynamics, key players, and future trends to help you navigate this rapidly evolving landscape.

Risk Based Authentication Industry Market Structure & Innovation Trends

The Risk-Based Authentication market is characterized by a moderately consolidated structure with several key players holding significant market share. While exact figures are proprietary to the full report, HID Global Corporation (Assa Abloy AB), IBM Corporation, Thales Group (Gemalto N V), and Okta Inc. are amongst the major players, though the specific market share distribution is detailed in the full report. Mergers and acquisitions (M&A) activity has played a role in shaping the market landscape, with deal values in the xx Million range observed during the historical period (2019-2024). Innovation is driven by increasing cyber threats, regulatory pressures (e.g., GDPR, CCPA), and the growing adoption of cloud-based solutions. The market is also witnessing a shift towards AI-powered and behavioral biometrics solutions, enhancing the accuracy and effectiveness of authentication processes. Product substitutes include traditional password-based systems, but the increasing need for robust security is steadily decreasing their market share.

- Market Concentration: Moderately consolidated, with a few dominant players.

- Innovation Drivers: Cybersecurity threats, regulatory compliance, cloud adoption, AI & behavioral biometrics.

- M&A Activity: Significant deals valued at xx Million during 2019-2024. Further analysis of completed and projected deals is available in the full report.

- End-User Demographics: Diverse across multiple verticals, with a significant focus on BFSI and government sectors.

Risk Based Authentication Industry Market Dynamics & Trends

The RBA market is experiencing robust growth, driven by the increasing adoption of cloud-based applications and a rising need for enhanced security measures in the face of escalating cyber threats. The compound annual growth rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. Technological advancements, such as the incorporation of artificial intelligence (AI) and machine learning (ML) algorithms for risk scoring, are further accelerating market growth. Consumer preference for seamless and secure authentication experiences is driving the demand for advanced RBA solutions. Intense competition among vendors is pushing innovation and lowering prices, benefitting end users. Market penetration is also increasing as more organizations recognize the importance of implementing strong authentication measures. The full report offers a detailed analysis of these factors and projections for various segments.

Dominant Regions & Segments in Risk Based Authentication Industry

The North American region currently holds a dominant position in the RBA market, largely due to the high adoption rate of advanced technologies and robust cybersecurity regulations. However, the Asia-Pacific region is predicted to exhibit the fastest growth rate in the coming years.

By End-user Vertical:

- Banking and Financial Services (BFSI): Strong growth driven by strict regulatory compliance and the need to protect sensitive customer data.

- Government: High adoption due to stringent security requirements and the increasing digitization of government services.

- Healthcare: Growing adoption to protect patient health information.

By Offering:

- Solution: Dominant segment due to its comprehensive security features.

- Service: Significant growth expected due to rising demand for managed security services.

By Deployment:

- Cloud: Rapid growth driven by scalability, cost-effectiveness, and ease of deployment.

- On-premise: Maintaining a significant share due to security concerns and legacy systems.

Risk Based Authentication Industry Product Innovations

Recent innovations in RBA include the integration of behavioral biometrics, contextual awareness, and advanced analytics to create more sophisticated risk scoring models. The market is seeing a shift toward frictionless authentication methods that prioritize user experience without compromising security. The incorporation of AI and ML helps improve accuracy, reduce false positives, and adapt to evolving threat landscapes, solidifying the market fit for advanced RBA solutions.

Report Scope & Segmentation Analysis

This report segments the RBA market by end-user vertical (BFSI, Retail, IT & Telecommunication, Government, Healthcare, Other), offering (Solution, Service), and deployment (On-premise, Cloud). Each segment’s growth projections, market size (in Millions), and competitive dynamics are analyzed in detail within the full report. For example, the BFSI segment is expected to hold a significant share due to stringent security regulations. The cloud deployment segment is experiencing rapid growth due to its scalability and cost-effectiveness.

Key Drivers of Risk Based Authentication Industry Growth

The RBA market's growth is primarily driven by several factors: the increasing prevalence of sophisticated cyberattacks, stringent data privacy regulations (e.g., GDPR, CCPA), growing adoption of cloud-based services, and the increasing demand for seamless user experiences that don't compromise security. Technological advancements in AI, ML, and biometrics are also significant contributors to market expansion.

Challenges in the Risk Based Authentication Industry Sector

Challenges within the RBA industry include the high cost of implementation, the complexity of integrating RBA solutions with existing systems, and the potential for false positives impacting user experience. Maintaining a balance between strong security and a frictionless user experience presents a constant challenge. Supply chain complexities and the ever-evolving threat landscape also pose significant hurdles for market players. Quantifiable impacts on these challenges are detailed further in the full report.

Emerging Opportunities in Risk Based Authentication Industry

Emerging opportunities lie in the integration of RBA with other security technologies, such as Zero Trust Architecture. The growing adoption of IoT devices presents new challenges and opportunities for RBA solutions designed to secure these connected ecosystems. Furthermore, expanding into untapped markets, particularly in developing economies, represents a significant growth potential.

Leading Players in the Risk Based Authentication Industry Market

- HID Global Corporation (Assa Abloy AB)

- IBM Corporation

- Thales Group (Gemalto N V)

- SecureAuth Corporation

- Oracle Corporation

- Equifax Inc

- Financial Software Systems Inc

- Okta Inc

- RSA Security LLC

- Micro Focus International plc (NetIQ)

- Broadcom Inc (CA Technologies Inc)

Key Developments in Risk Based Authentication Industry Industry

- July 2021: RSA released the SecurID App 3.0, improving user experience and accessibility.

- July 2021: Broadcom Inc. announced the integration of CA Adapter with CA Strong Authentication and CA Risk Authentication, enhancing on-premise solutions.

Future Outlook for Risk Based Authentication Industry Market

The RBA market is poised for continued strong growth, fueled by the increasing adoption of digital technologies and the persistent need for robust cybersecurity measures. Strategic partnerships, technological innovation, and expansion into new markets will be crucial for success in this dynamic industry. The report offers a detailed forecast, outlining the significant market potential and various strategic opportunities for both established players and new entrants.

Risk Based Authentication Industry Segmentation

-

1. Offering

- 1.1. Solution

- 1.2. Service

-

2. Deployment

- 2.1. On-premise

- 2.2. Cloud

-

3. End-user Vertical

- 3.1. Banking and Financial Services (BFSI)

- 3.2. Retail

- 3.3. IT and Telecommunication

- 3.4. Government

- 3.5. Healthcare

- 3.6. Other End-user Verticals

Risk Based Authentication Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Risk Based Authentication Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Data Breaches and Cyber Attacks across Key End-user Verticals; Adoption of BYOD Trends in Enterprises

- 3.3. Market Restrains

- 3.3.1. Growing Pressure to Update Risk Scores in line With Evolving Cyber-security Threats

- 3.4. Market Trends

- 3.4.1. Banking and Financial Services Hold the Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Risk Based Authentication Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Solution

- 5.1.2. Service

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Banking and Financial Services (BFSI)

- 5.3.2. Retail

- 5.3.3. IT and Telecommunication

- 5.3.4. Government

- 5.3.5. Healthcare

- 5.3.6. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. North America Risk Based Authentication Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. Solution

- 6.1.2. Service

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. On-premise

- 6.2.2. Cloud

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. Banking and Financial Services (BFSI)

- 6.3.2. Retail

- 6.3.3. IT and Telecommunication

- 6.3.4. Government

- 6.3.5. Healthcare

- 6.3.6. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. Europe Risk Based Authentication Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. Solution

- 7.1.2. Service

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. On-premise

- 7.2.2. Cloud

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. Banking and Financial Services (BFSI)

- 7.3.2. Retail

- 7.3.3. IT and Telecommunication

- 7.3.4. Government

- 7.3.5. Healthcare

- 7.3.6. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. Asia Pacific Risk Based Authentication Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. Solution

- 8.1.2. Service

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. On-premise

- 8.2.2. Cloud

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. Banking and Financial Services (BFSI)

- 8.3.2. Retail

- 8.3.3. IT and Telecommunication

- 8.3.4. Government

- 8.3.5. Healthcare

- 8.3.6. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Latin America Risk Based Authentication Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. Solution

- 9.1.2. Service

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. On-premise

- 9.2.2. Cloud

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. Banking and Financial Services (BFSI)

- 9.3.2. Retail

- 9.3.3. IT and Telecommunication

- 9.3.4. Government

- 9.3.5. Healthcare

- 9.3.6. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. Middle East and Africa Risk Based Authentication Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 10.1.1. Solution

- 10.1.2. Service

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. On-premise

- 10.2.2. Cloud

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. Banking and Financial Services (BFSI)

- 10.3.2. Retail

- 10.3.3. IT and Telecommunication

- 10.3.4. Government

- 10.3.5. Healthcare

- 10.3.6. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 11. North America Risk Based Authentication Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Risk Based Authentication Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Risk Based Authentication Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Risk Based Authentication Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Risk Based Authentication Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 HID Global Corporation (Assa Abloy AB)

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 IBM Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Thales Group (Gemalto N V )

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 SecureAuth Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Oracle Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Equifax Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Financial Software Systems Inc *List Not Exhaustive

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Okta Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 RSA Security LLC

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Micro Focus International plc (NetIQ)

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Broadcom Inc (CA Technologies Inc )

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 HID Global Corporation (Assa Abloy AB)

List of Figures

- Figure 1: Global Risk Based Authentication Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Risk Based Authentication Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Risk Based Authentication Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Risk Based Authentication Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Risk Based Authentication Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Risk Based Authentication Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Risk Based Authentication Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Risk Based Authentication Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Risk Based Authentication Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Risk Based Authentication Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Risk Based Authentication Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Risk Based Authentication Industry Revenue (Million), by Offering 2024 & 2032

- Figure 13: North America Risk Based Authentication Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 14: North America Risk Based Authentication Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 15: North America Risk Based Authentication Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 16: North America Risk Based Authentication Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 17: North America Risk Based Authentication Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 18: North America Risk Based Authentication Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Risk Based Authentication Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Risk Based Authentication Industry Revenue (Million), by Offering 2024 & 2032

- Figure 21: Europe Risk Based Authentication Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 22: Europe Risk Based Authentication Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 23: Europe Risk Based Authentication Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 24: Europe Risk Based Authentication Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 25: Europe Risk Based Authentication Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 26: Europe Risk Based Authentication Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Risk Based Authentication Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Risk Based Authentication Industry Revenue (Million), by Offering 2024 & 2032

- Figure 29: Asia Pacific Risk Based Authentication Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 30: Asia Pacific Risk Based Authentication Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 31: Asia Pacific Risk Based Authentication Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 32: Asia Pacific Risk Based Authentication Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 33: Asia Pacific Risk Based Authentication Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 34: Asia Pacific Risk Based Authentication Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Risk Based Authentication Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Risk Based Authentication Industry Revenue (Million), by Offering 2024 & 2032

- Figure 37: Latin America Risk Based Authentication Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 38: Latin America Risk Based Authentication Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 39: Latin America Risk Based Authentication Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 40: Latin America Risk Based Authentication Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 41: Latin America Risk Based Authentication Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 42: Latin America Risk Based Authentication Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Risk Based Authentication Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Risk Based Authentication Industry Revenue (Million), by Offering 2024 & 2032

- Figure 45: Middle East and Africa Risk Based Authentication Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 46: Middle East and Africa Risk Based Authentication Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 47: Middle East and Africa Risk Based Authentication Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 48: Middle East and Africa Risk Based Authentication Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 49: Middle East and Africa Risk Based Authentication Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 50: Middle East and Africa Risk Based Authentication Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Risk Based Authentication Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Risk Based Authentication Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Risk Based Authentication Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 3: Global Risk Based Authentication Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: Global Risk Based Authentication Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 5: Global Risk Based Authentication Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Risk Based Authentication Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Risk Based Authentication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Risk Based Authentication Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Risk Based Authentication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Risk Based Authentication Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Risk Based Authentication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Risk Based Authentication Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Risk Based Authentication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Risk Based Authentication Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Risk Based Authentication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Risk Based Authentication Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 17: Global Risk Based Authentication Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 18: Global Risk Based Authentication Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 19: Global Risk Based Authentication Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Risk Based Authentication Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 21: Global Risk Based Authentication Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 22: Global Risk Based Authentication Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 23: Global Risk Based Authentication Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Risk Based Authentication Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 25: Global Risk Based Authentication Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 26: Global Risk Based Authentication Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 27: Global Risk Based Authentication Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Risk Based Authentication Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 29: Global Risk Based Authentication Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 30: Global Risk Based Authentication Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 31: Global Risk Based Authentication Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Risk Based Authentication Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 33: Global Risk Based Authentication Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 34: Global Risk Based Authentication Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 35: Global Risk Based Authentication Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Risk Based Authentication Industry?

The projected CAGR is approximately 18.80%.

2. Which companies are prominent players in the Risk Based Authentication Industry?

Key companies in the market include HID Global Corporation (Assa Abloy AB), IBM Corporation, Thales Group (Gemalto N V ), SecureAuth Corporation, Oracle Corporation, Equifax Inc, Financial Software Systems Inc *List Not Exhaustive, Okta Inc, RSA Security LLC, Micro Focus International plc (NetIQ), Broadcom Inc (CA Technologies Inc ).

3. What are the main segments of the Risk Based Authentication Industry?

The market segments include Offering, Deployment, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Data Breaches and Cyber Attacks across Key End-user Verticals; Adoption of BYOD Trends in Enterprises.

6. What are the notable trends driving market growth?

Banking and Financial Services Hold the Major Share.

7. Are there any restraints impacting market growth?

Growing Pressure to Update Risk Scores in line With Evolving Cyber-security Threats.

8. Can you provide examples of recent developments in the market?

July 2021 - RSA released the SecurID App 3.0 to deliver a next-generation end-user experience for iOS and Android users with multiple software tokens into a single, easy-to-use SecurID App. The SecurID App also provides greater accessibility with voice-over and talk back for visually impaired users.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Risk Based Authentication Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Risk Based Authentication Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Risk Based Authentication Industry?

To stay informed about further developments, trends, and reports in the Risk Based Authentication Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence