Key Insights

The Spain luxury brand market is projected to reach €4.8 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 3.62% from 2025 to 2033. This growth is propelled by an expanding affluent consumer base in key cities like Madrid and Barcelona, coupled with rising disposable incomes and a strong aspiration for premium products. International tourism also significantly contributes to sales, driving demand across apparel and accessories. Furthermore, the digital transformation of luxury retail, with the proliferation of online stores, is enhancing brand accessibility and expanding market reach.

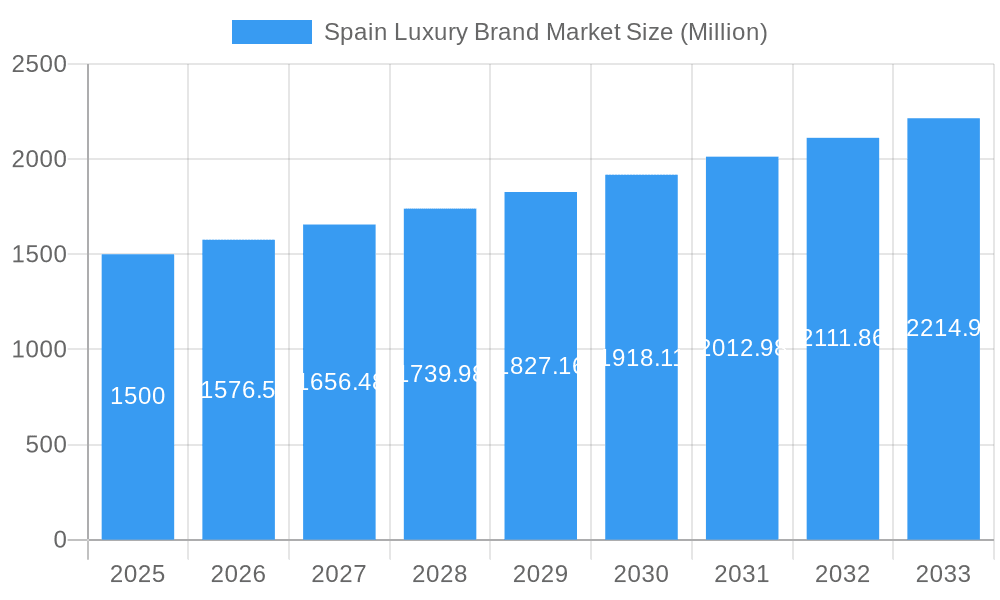

Spain Luxury Brand Market Market Size (In Billion)

Despite promising growth, the market faces economic volatility and geopolitical uncertainties that can impact consumer spending. Intense competition from established and emerging luxury brands necessitates continuous innovation and strategic differentiation to foster brand loyalty. The online sales channel is expected to experience the most rapid expansion, aligning with evolving consumer preferences for digital purchasing. Clothing and apparel, alongside jewelry and watches, are leading product categories, indicating diversified spending habits within the Spanish luxury market. Addressing these challenges will be crucial for capitalizing on future growth opportunities.

Spain Luxury Brand Market Company Market Share

Spain Luxury Brand Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Spain Luxury Brand Market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, and future potential. We delve into key segments, dominant players, and emerging trends, equipping you with actionable data for informed decision-making.

Spain Luxury Brand Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Spanish luxury market, encompassing market concentration, innovation drivers, regulatory influences, product substitution, consumer demographics, and mergers & acquisitions (M&A) activity. The market is characterized by a high level of concentration, with key players holding significant market share. The estimated market size in 2025 is xx Million.

- Market Concentration: LVMH Moët Hennessy Louis Vuitton, Kering Group, and other luxury conglomerates hold a substantial market share, estimated at xx%. Smaller, niche brands also contribute significantly to market diversity.

- Innovation Drivers: Sustainability initiatives, technological advancements (e.g., personalized experiences, digital marketing), and evolving consumer preferences drive innovation.

- Regulatory Framework: Spanish regulations concerning luxury goods labeling, taxation, and consumer protection significantly influence market operations.

- Product Substitutes: The presence of accessible luxury and fast fashion brands poses a competitive challenge to established luxury players.

- End-User Demographics: Affluent consumers, particularly in major cities like Madrid and Barcelona, drive demand. The growing middle class also contributes to market expansion.

- M&A Activities: The historical period (2019-2024) witnessed xx M&A deals, with a total value estimated at xx Million. This activity reflects consolidation and expansion strategies within the market. Examples include the acquisition of Hoss Intropia by Tendam in 2019.

Spain Luxury Brand Market Market Dynamics & Trends

This section examines the key factors shaping the evolution of the Spain Luxury Brand Market. The market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Market penetration is expected to reach xx% by 2033. Several factors drive market growth:

The rise of e-commerce, particularly with Amazon's entry into the luxury market in 2022, is reshaping distribution channels. Changing consumer preferences, including increased demand for sustainability and personalization, are also significant drivers. Competitive dynamics are intense, with established brands facing challenges from both new entrants and substitute products. Technological disruptions, such as the use of AI in personalized marketing and the rise of metaverse experiences, will further transform the market. The increasing popularity of experiences over material possessions presents a challenge and an opportunity for luxury brands to adapt their offerings.

Dominant Regions & Segments in Spain Luxury Brand Market

This section identifies the leading regions and segments within the Spain Luxury Brand Market.

By Distribution Channel:

- Single-brand Stores: Remain the dominant distribution channel due to brand control, premium experience, and exclusivity. Key drivers include strategic store locations in prime areas and strong brand image management.

- Multi-brand Stores: Offer diverse luxury brands under one roof and cater to broader consumer segments, but with potentially reduced brand control and less tailored customer experience.

- Online Stores: Increasingly important due to technological advancements and shifting consumer behavior. Amazon's entry is a major catalyst here. Key drivers include convenience, expanded reach, and targeted advertising capabilities.

- Other Distribution Channels: Include department stores, travel retail, and other specialized channels.

By Type:

- Watches and Jewelry: High-value luxury products with strong brand heritage and a loyal customer base. This segment's consistent demand contributes to overall market stability.

- Clothing and Apparel: A diverse and competitive segment with significant market share and continual innovation in design and materials. This sector also often embraces trends such as conscious luxury and eco-friendly fashion.

- Bags: High-demand luxury goods with a wide range of styles and prices. This segment demonstrates both consistent growth and the influence of fashion trends.

- Footwear: Another competitive segment, influenced by seasonal trends and fashion styles. Comfort and innovation in materials play a significant role in consumer choice.

- Other Luxury Goods: Includes accessories, perfumes, cosmetics, and other luxury items. This often showcases emerging trends and a potential for niche brands to gain traction.

Spain Luxury Brand Market Product Innovations

The Spanish luxury market showcases continuous product development, driven by technological advancements, material innovations, and evolving consumer preferences. Brands are leveraging technological trends such as personalization through AI and sustainable materials to enhance product appeal and differentiation. These innovations are helping luxury brands address the increasing consumer preference for ethical and environmentally responsible products.

Report Scope & Segmentation Analysis

This report comprehensively segments the Spain Luxury Brand Market by distribution channel (single-brand stores, multi-brand stores, online stores, other channels) and product type (clothing and apparel, footwear, jewelry, watches, bags, other luxury goods). Each segment's growth projections, market size (in Millions), and competitive dynamics are analyzed in detail. For example, the online segment is projected to experience rapid growth, driven by increased e-commerce penetration.

Key Drivers of Spain Luxury Brand Market Growth

Several factors drive the growth of the Spain Luxury Brand Market. These include the increasing affluence of the Spanish population, the growing popularity of luxury goods, and the expansion of e-commerce. Tourism plays a significant role, with visitors contributing substantially to luxury purchases. Furthermore, government initiatives supporting the luxury sector and the country's strong brand reputation in fashion and design contribute to market expansion.

Challenges in the Spain Luxury Brand Market Sector

The Spain Luxury Brand Market faces challenges such as economic fluctuations impacting consumer spending, increasing competition, and maintaining brand exclusivity in the face of online retail expansion. Supply chain disruptions and counterfeiting remain concerns, impacting profitability and brand reputation.

Emerging Opportunities in Spain Luxury Brand Market

Emerging opportunities include capitalizing on the rising popularity of sustainable and ethical luxury, catering to the growing demand for personalized experiences, and leveraging technological advancements to enhance customer engagement. Expansion into new market segments, such as experiential luxury and metaverse offerings, also presents significant potential.

Leading Players in the Spain Luxury Brand Market Market

Key Developments in Spain Luxury Brand Market Industry

- June 2022: Amazon launches its luxury fashion vertical in Spain, significantly impacting online distribution.

- July 2021: Carner Barcelona launches a new hair perfume collection, showcasing product innovation within a niche segment.

- February 2021: Hoss Intropia relaunches, demonstrating brand revitalization strategies within the market.

Future Outlook for Spain Luxury Brand Market Market

The Spain Luxury Brand Market is poised for continued growth, driven by increasing affluence, tourism, and technological advancements. Strategic opportunities exist in personalized luxury experiences, sustainable product development, and leveraging digital channels. Brands that adapt to evolving consumer preferences and embrace innovation will be best positioned for success.

Spain Luxury Brand Market Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Jewellery

- 1.4. Watches

- 1.5. Bags

- 1.6. Other Luxury Goods

-

2. Distribution Channel

- 2.1. Single-brand Store

- 2.2. Multi-brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Spain Luxury Brand Market Segmentation By Geography

- 1. Spain

Spain Luxury Brand Market Regional Market Share

Geographic Coverage of Spain Luxury Brand Market

Spain Luxury Brand Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Prevalence of Obesity Among Consumers; Demand for Online and Hybrid Models with Customization and Personalization

- 3.3. Market Restrains

- 3.3.1. High Operational Costs and Competitive Pricing of Memberships

- 3.4. Market Trends

- 3.4.1. Rise in Fashion and Cultural Tourism

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Luxury Brand Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Jewellery

- 5.1.4. Watches

- 5.1.5. Bags

- 5.1.6. Other Luxury Goods

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Single-brand Store

- 5.2.2. Multi-brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Prada Holding S P A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Audemars Piguet Holding SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hermes International S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Giorgio Armani*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PUIG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chanel SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rolex SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kering Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Patek Philippe

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LVMH Moët Hennessy Louis Vuitton

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Prada Holding S P A

List of Figures

- Figure 1: Spain Luxury Brand Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Spain Luxury Brand Market Share (%) by Company 2025

List of Tables

- Table 1: Spain Luxury Brand Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Spain Luxury Brand Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Spain Luxury Brand Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Spain Luxury Brand Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Spain Luxury Brand Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Spain Luxury Brand Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Luxury Brand Market?

The projected CAGR is approximately 3.62%.

2. Which companies are prominent players in the Spain Luxury Brand Market?

Key companies in the market include Prada Holding S P A, Audemars Piguet Holding SA, Hermes International S A, Giorgio Armani*List Not Exhaustive, PUIG, Chanel SA, Rolex SA, Kering Group, Patek Philippe, LVMH Moët Hennessy Louis Vuitton.

3. What are the main segments of the Spain Luxury Brand Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Prevalence of Obesity Among Consumers; Demand for Online and Hybrid Models with Customization and Personalization.

6. What are the notable trends driving market growth?

Rise in Fashion and Cultural Tourism.

7. Are there any restraints impacting market growth?

High Operational Costs and Competitive Pricing of Memberships.

8. Can you provide examples of recent developments in the market?

In June 2022, Amazon launches its luxury fashion vertical in Spain. The e-commerce platform will include luxury fashion and beauty labels such as Christopher Kane, Dundas, Mira Mikati, Rianna+Nina and Altuzarra.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Luxury Brand Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Luxury Brand Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Luxury Brand Market?

To stay informed about further developments, trends, and reports in the Spain Luxury Brand Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence