Key Insights

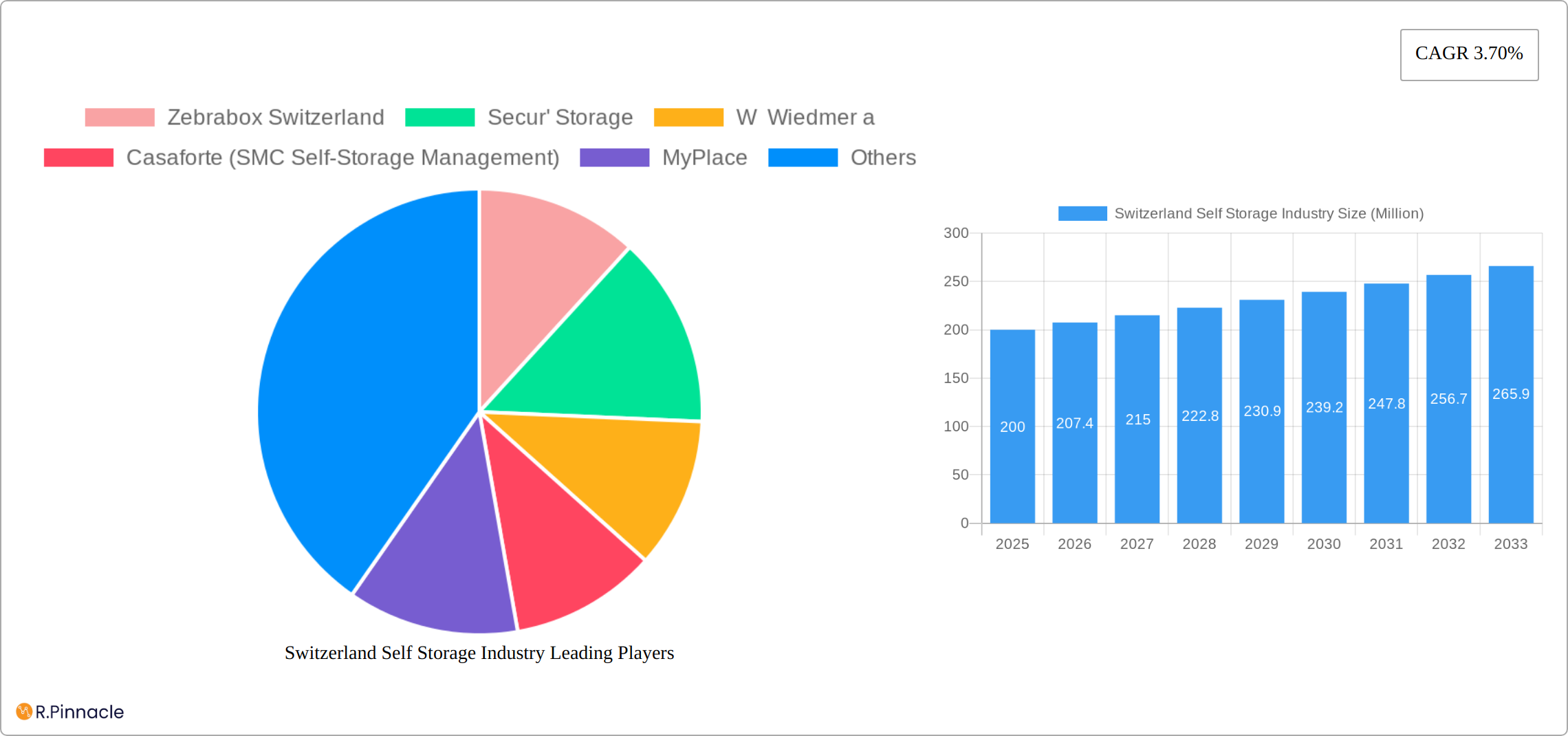

The Swiss self-storage market, valued at approximately CHF 200 million in 2025, is projected to experience steady growth, driven by several key factors. The increasing urbanization of Swiss cities, coupled with a rise in smaller living spaces and a growing trend of flexible lifestyles, is fueling demand for secure, off-site storage solutions for both consumers and businesses. E-commerce expansion also contributes significantly, as businesses require more storage for inventory management and distribution. Furthermore, the Swiss economy’s continued stability and a robust real estate market support the industry's growth trajectory. The market is segmented into consumer and business storage, with both segments exhibiting promising growth potential. While precise market share figures for each segment are unavailable, it's reasonable to assume that consumer self-storage currently constitutes a larger portion of the market due to the aforementioned lifestyle factors. However, business self-storage is anticipated to experience faster growth in the coming years, driven by the dynamism of the Swiss economy and e-commerce trends.

The projected 3.70% Compound Annual Growth Rate (CAGR) suggests a consistent, albeit moderate, expansion of the market through 2033. Competitive factors, including the presence of established players like Zebrabox Switzerland, Secur' Storage, and others, suggest a relatively mature market characterized by ongoing competition and innovation in storage solutions and service offerings. Potential restraints could include land scarcity and associated rising construction costs in prime urban locations, as well as regulatory hurdles concerning zoning and building permits. However, the sustained demand and the players' ability to adapt to these challenges should mitigate these potential risks, contributing to the continued growth of the Swiss self-storage sector. Further research into specific consumer and business usage patterns would enhance the understanding of the market's segmentation dynamics and future projections.

Switzerland Self Storage Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Switzerland self-storage industry, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, growth drivers, competitive landscapes, and future opportunities within this dynamic sector. The report values are expressed in Millions.

Switzerland Self Storage Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Swiss self-storage market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The report explores the market share of key players like Zebrabox Switzerland, Secur' Storage, W Wiedmer a, Casaforte (SMC Self-Storage Management), MyPlace, and Homebox Switzerland. We delve into the impact of technological advancements, such as enhanced security systems (as exemplified by Casaforte's "Hotel of Things" facility), on market dynamics. The report also assesses the influence of regulatory frameworks on market growth and identifies potential substitutes for self-storage solutions. We quantify market share for each major player (xx% for Zebrabox, xx% for Secur' Storage, xx% for W Wiedmer a, xx% for Casaforte, xx% for MyPlace, xx% for Homebox Switzerland) and analyze M&A deal values (estimated at $xx Million in total over the historical period). The end-user demographics – consumer vs. business – are profiled, showing the percentage split of the market between these two segments (xx% consumer, xx% business).

Switzerland Self Storage Industry Market Dynamics & Trends

This section examines the key market drivers, trends, and challenges shaping the Swiss self-storage industry. We analyze market growth, projected at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), and discuss factors influencing market penetration. Technological disruptions, such as online booking platforms and automated access systems, are assessed. Changing consumer preferences, including increased demand for secure, flexible, and technologically advanced storage solutions, are explored. The competitive dynamics, including pricing strategies, service offerings, and expansion plans of key players, are examined in detail. The analysis incorporates an assessment of the overall market size, reaching an estimated $xx Million in 2025 and projected to reach $xx Million by 2033.

Dominant Regions & Segments in Switzerland Self Storage Industry

The Swiss self-storage market exhibits regional and segmental variations in dominance. This analysis identifies key areas and user groups driving market growth, considering factors like population density, economic strength, infrastructure, and specific consumer and business needs. We delve into the unique characteristics and growth drivers of each segment, providing a comprehensive understanding of the market landscape.

Key Factors Contributing to Regional Dominance:

- Urban Concentration: High population density in major Swiss cities creates significant demand for storage solutions.

- Economic Prosperity: Strong economic activity and high disposable incomes fuel the demand for convenient storage options.

- Advanced Infrastructure: Well-developed transportation networks and logistics systems facilitate efficient self-storage operations.

- Accessibility: Proximity to major transportation hubs and residential areas influences facility location and market share.

Key Factors Contributing to Segmental Dominance:

- Consumer Segment: Driven by increasing urbanization, a rise in mobility, downsizing trends, and the need for flexible storage solutions for personal belongings. This includes students, expats, and individuals undergoing life transitions.

- Business Segment: Fueled by the booming e-commerce sector, the growth of flexible workspaces requiring inventory storage, and the need for efficient inventory management solutions by businesses of all sizes. This includes archiving needs and seasonal storage for retailers.

Our detailed analysis provides insights into the market share of leading regions and segments, projecting the market size for both consumer and business segments in 2025 (Consumer: CHF xx Million; Business: CHF xx Million). (Note: Replace "CHF xx Million" with actual projected figures.)

Switzerland Self Storage Industry Product Innovations

This section focuses on recent product developments and technological advancements within the Swiss self-storage industry. We highlight the integration of smart technologies, like automated access systems and enhanced security features, into self-storage facilities. The report analyzes how these innovations enhance customer experience, improve operational efficiency, and provide a competitive advantage. The emphasis is on the market fit of these innovations and their alignment with evolving consumer preferences.

Report Scope & Segmentation Analysis

This report segments the Swiss self-storage market into two key categories: Consumer and Business.

Consumer Segment: This segment caters to individuals' storage needs, driven by factors like lifestyle changes, relocation, and home renovations. We project a market size of $xx Million in 2025 and $xx Million by 2033 for this segment, with competitive dynamics shaped by convenience, security, and price points.

Business Segment: This segment focuses on the storage needs of businesses, including warehousing, inventory management, and archival storage. We forecast a market size of $xx Million in 2025 and $xx Million by 2033 for this segment, with competition based on scalability, security, and specialized services.

Key Drivers of Switzerland Self Storage Industry Growth

Several key factors contribute to the growth of the Swiss self-storage industry. These include:

- Increasing Urbanization: A rising urban population leads to a greater demand for space-saving solutions.

- E-commerce Boom: The growth of online retail increases the need for efficient warehousing and logistics.

- Economic Growth: A strong economy fuels greater disposable income, potentially leading to increased consumer spending on self-storage.

Challenges in the Switzerland Self Storage Industry Sector

The Swiss self-storage industry faces several significant challenges that impact profitability and expansion:

- High Real Estate Costs: Acquiring suitable land and constructing facilities in Switzerland's expensive real estate market represents a major hurdle.

- Stringent Regulations: Navigating complex building codes, environmental regulations, and zoning laws adds to operational complexity and costs.

- Intense Competition: A growing number of established players and new entrants create a fiercely competitive landscape.

- Labor Costs: Switzerland's high labor costs significantly impact operational expenses.

- Insurance and Security: Maintaining comprehensive insurance coverage and robust security measures to protect stored goods is crucial but expensive.

Emerging Opportunities in Switzerland Self Storage Industry

The Swiss self-storage market presents several promising opportunities, including:

- Technological Advancements: Integration of smart technologies can enhance efficiency and customer experience.

- Specialized Storage Solutions: Catering to niche markets, such as climate-controlled storage for sensitive goods.

- Expansion into Underserved Regions: Targeting areas with limited self-storage options.

Leading Players in the Switzerland Self Storage Industry Market

- Zebrabox Switzerland

- Secur' Storage

- W Wiedmer AG

- Casaforte (SMC Self-Storage Management)

- MyPlace

- Homebox Switzerland

- (Add other significant players here)

Key Developments in Switzerland Self Storage Industry Industry

- April 2020: Casaforte launches its innovative "Hotel of Things" facility, incorporating advanced security features like video surveillance and personal access codes. This development significantly enhances the security and convenience of self-storage services, potentially driving market growth and attracting new customers.

Future Outlook for Switzerland Self Storage Industry Market

The Swiss self-storage market is poised for continued growth, fueled by ongoing urbanization, the expansion of e-commerce, and the adoption of new technologies. Opportunities exist for innovation in service offerings, facility design, and operational efficiency. Companies that strategically invest in technology, enhance customer experience, and adapt to evolving market demands will be best positioned for success. The market's robust growth trajectory is expected to persist, driven by underlying demographic trends and technological advancements. Further consolidation within the industry is also anticipated.

Switzerland Self Storage Industry Segmentation

-

1. Self-storage Type

- 1.1. Consumer

- 1.2. Business

Switzerland Self Storage Industry Segmentation By Geography

- 1. Switzerland

Switzerland Self Storage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Favorable Demographic Trends Such as High Tourist Footfalls

- 3.2.2 High-income Population

- 3.2.3 Demand in Urban Areas and Growing Market Concentration; Steady Rise in Demand From the Consumer Segment

- 3.3. Market Restrains

- 3.3.1. Development of Alternate Labeling Methods

- 3.4. Market Trends

- 3.4.1 Increased Urbanization

- 3.4.2 Coupled with Smaller Living Spaces is Expected to Drive the Self-Storage Demand in the Coming Years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Switzerland Self Storage Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Self-storage Type

- 5.1.1. Consumer

- 5.1.2. Business

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Switzerland

- 5.1. Market Analysis, Insights and Forecast - by Self-storage Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Zebrabox Switzerland

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Secur' Storage

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 W Wiedmer a

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Casaforte (SMC Self-Storage Management)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MyPlace

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Homebox Switzerland

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Zebrabox Switzerland

List of Figures

- Figure 1: Switzerland Self Storage Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Switzerland Self Storage Industry Share (%) by Company 2024

List of Tables

- Table 1: Switzerland Self Storage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Switzerland Self Storage Industry Revenue Million Forecast, by Self-storage Type 2019 & 2032

- Table 3: Switzerland Self Storage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Switzerland Self Storage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Switzerland Self Storage Industry Revenue Million Forecast, by Self-storage Type 2019 & 2032

- Table 6: Switzerland Self Storage Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Switzerland Self Storage Industry?

The projected CAGR is approximately 3.70%.

2. Which companies are prominent players in the Switzerland Self Storage Industry?

Key companies in the market include Zebrabox Switzerland, Secur' Storage, W Wiedmer a, Casaforte (SMC Self-Storage Management), MyPlace, Homebox Switzerland.

3. What are the main segments of the Switzerland Self Storage Industry?

The market segments include Self-storage Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Favorable Demographic Trends Such as High Tourist Footfalls. High-income Population. Demand in Urban Areas and Growing Market Concentration; Steady Rise in Demand From the Consumer Segment.

6. What are the notable trends driving market growth?

Increased Urbanization. Coupled with Smaller Living Spaces is Expected to Drive the Self-Storage Demand in the Coming Years.

7. Are there any restraints impacting market growth?

Development of Alternate Labeling Methods.

8. Can you provide examples of recent developments in the market?

In April 2020, Casaforte, the self-storage company which has a significant presence in Switzerland and has developed the 'Hotel of Things' facility in a European country. Casaforte's 'Hotel of Things' is under video surveillance and integrated with alarm systems. The customers can access the self-storage rooms in full privacy by using a personal code.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Switzerland Self Storage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Switzerland Self Storage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Switzerland Self Storage Industry?

To stay informed about further developments, trends, and reports in the Switzerland Self Storage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence