Key Insights

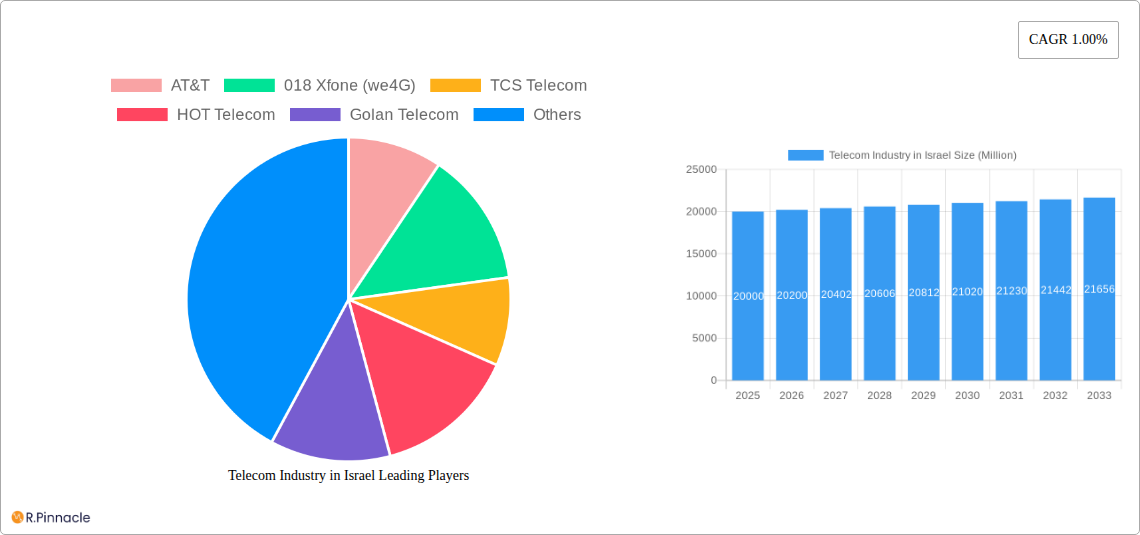

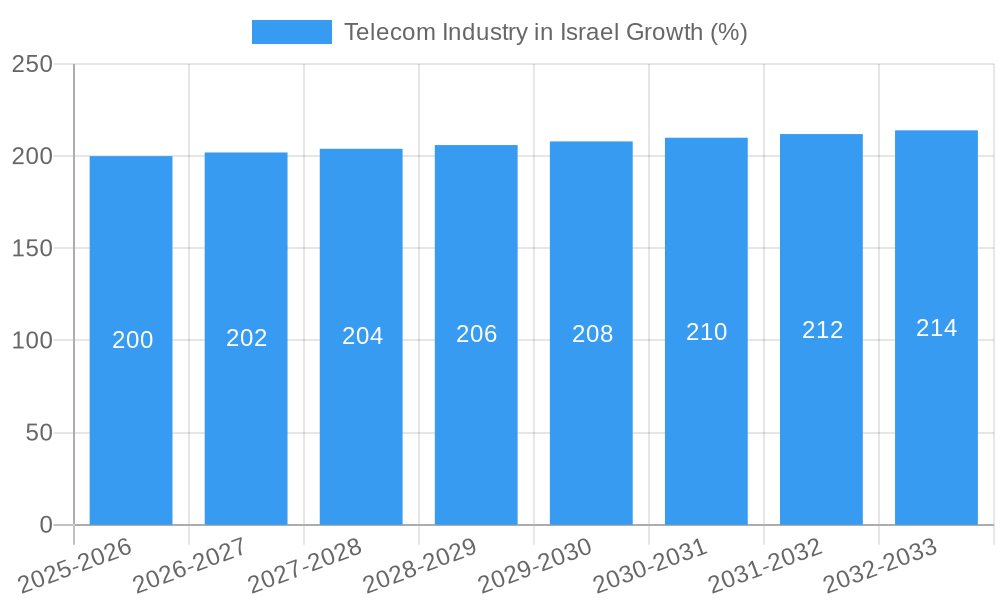

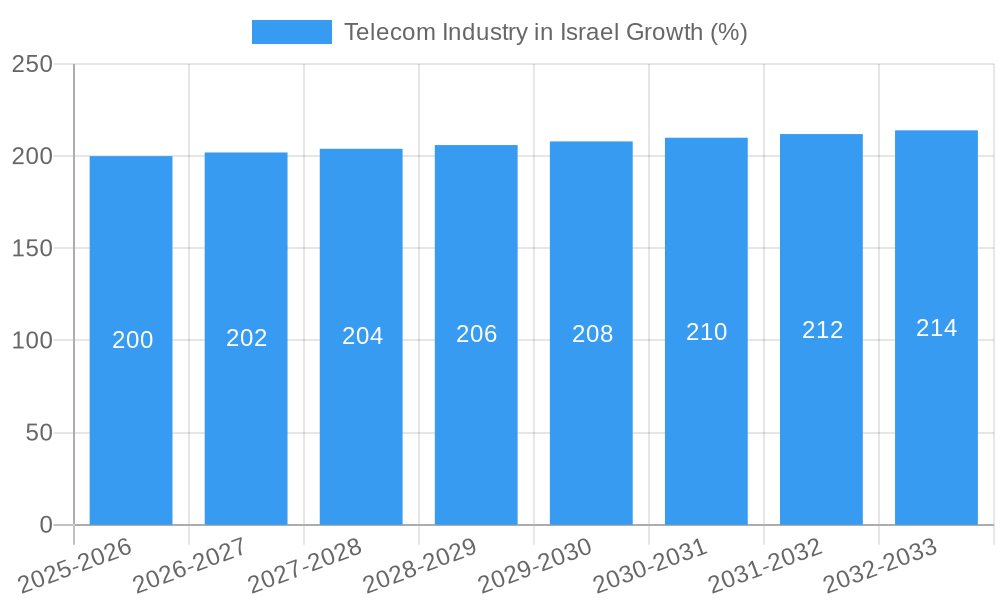

The Israeli telecom market, valued at approximately $X billion in 2025, exhibits a modest but steady Compound Annual Growth Rate (CAGR) of 1.00%. This growth is driven by increasing mobile data consumption fueled by the rise of streaming services, IoT devices, and a digitally-savvy population. Key trends include the expansion of 5G networks, increasing demand for bundled packages combining voice, data, and OTT services, and the competitive landscape shaped by established players like Cellcom, Bezeq, and Pelephone alongside smaller, more agile competitors like Golan Telecom and HOT Telecom. While the market demonstrates resilience, constraints such as regulatory hurdles, infrastructure limitations in certain regions, and price competition influence overall growth. The segment breakdown reveals a significant focus on data and messaging services, with substantial revenue generation from internet and handset data packages and bundled discounts. The competitive landscape compels providers to innovate with tailored offerings and competitive pricing strategies, leading to ongoing market consolidation and strategic partnerships. The forecast period (2025-2033) anticipates a gradual market expansion, driven by continued 5G rollout and evolving consumer demands for higher bandwidth and faster speeds. The continued growth in OTT and PayTV services also contributes to this sustained, albeit moderate, expansion.

The dominance of established players like Cellcom, Bezeq, and Pelephone is challenged by smaller providers' ability to offer niche services and competitive pricing. This forces larger companies to adopt more agile strategies and focus on value-added services to retain market share. The success of these providers depends on their ability to adapt to changing consumer preferences, leveraging the growing demand for data-intensive applications while efficiently managing network infrastructure and addressing regulatory requirements. Future growth will hinge on effective 5G deployment and the development of innovative services catering to the evolving needs of the Israeli consumer market. Investment in digital infrastructure and a focus on customer experience will be critical for players looking to maintain a competitive edge in this dynamic market environment.

Telecom Industry in Israel: Market Analysis & Forecast 2019-2033

This comprehensive report provides a detailed analysis of the Israeli telecom industry, covering market structure, dynamics, key players, and future outlook. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for telecom operators, investors, and industry professionals seeking to understand the evolving landscape of the Israeli telecom market. Discover actionable insights and strategic opportunities within this dynamic sector.

Telecom Industry in Israel Market Structure & Innovation Trends

The Israeli telecom market is characterized by a moderately concentrated structure, with several major players vying for market share. Bezeq and Cellcom historically held significant dominance, but competition from other operators like Pelephone, HOT Telecom, and Golan Telecom has intensified. Market share fluctuates, with Bezeq maintaining a substantial presence in fixed-line services, while Cellcom and Pelephone lead in mobile. The market exhibits significant innovation driven by technological advancements (5G deployment, fiber optics expansion), increasing data consumption, and government regulatory changes aimed at promoting competition and infrastructure improvements.

- Market Concentration: Bezeq and Cellcom combined hold approximately xx% of the market (Estimate 2025).

- Innovation Drivers: 5G rollout, fiber optic infrastructure expansion, rising demand for high-speed data.

- Regulatory Framework: Aimed at fostering competition and promoting infrastructure investment.

- Product Substitutes: Over-the-top (OTT) services like WhatsApp, Skype, and Netflix pose challenges to traditional telecom revenues.

- End-User Demographics: A tech-savvy population with high smartphone penetration drives demand for data services.

- M&A Activity: The recent partnership between Partner Communications and HOT Mobile, and the deal between Pelephone and PHI Networks reflects a trend towards infrastructure sharing and consolidation. Total M&A deal value over the past five years is estimated at xx Million USD.

Telecom Industry in Israel Market Dynamics & Trends

The Israeli telecom market is experiencing robust growth, driven primarily by increased data consumption fueled by rising smartphone penetration and the adoption of data-intensive applications. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected to be xx%, significantly impacted by the ongoing 5G deployment and the expansion of fiber-optic networks. Market penetration for mobile broadband services is already high, exceeding xx% in 2025, further growth is anticipated in fixed broadband and the adoption of new technologies like Internet of Things (IoT). Consumer preferences are shifting towards bundled packages offering data, voice, and OTT services. Competitive dynamics are characterized by intense price wars and aggressive marketing strategies, pushing margins downward for the players in the market.

Dominant Regions & Segments in Telecom Industry in Israel

While Israel is a relatively small country, population density and economic concentration lead to relative uniformity in market dynamics across regions. However, the Tel Aviv metropolitan area displays consistently higher data consumption and a more saturated market compared to other parts of the country.

By Services:

- Voice Services: While voice revenues are declining, it remains a vital component of bundled packages, maintaining moderate growth.

- Wireless Data and Messaging Services: This segment is the primary growth driver, with high demand for mobile internet and data packages.

- OTT and PayTV Services: Competition is fierce in this segment, with significant growth expected but varying operator performance.

Key Drivers: A strong economy, high internet penetration, supportive government policies, investment in infrastructure.

Dominance Analysis: The market leaders continue to be Bezeq, Cellcom, and Pelephone, but their dominance is challenged by new entrants and the rapid evolution of the sector.

Telecom Industry in Israel Product Innovations

The Israeli telecom market is witnessing significant product innovation, largely driven by 5G deployment and the growing adoption of cloud-based services. Operators are offering increasingly sophisticated data packages tailored to consumer needs, such as family bundles and unlimited data plans. The integration of IoT solutions and the development of advanced network management tools will further drive market innovation, enhancing overall network reliability and efficiency. Furthermore, there is increasing focus on bundled services that combine fixed and mobile connectivity with OTT platforms and other digital services.

Report Scope & Segmentation Analysis

This report segments the Israeli telecom market by service type: Voice Services, Wireless Data & Messaging Services (including internet and handset data packages), and OTT & PayTV Services. Each segment is analyzed based on revenue, market share, growth projections, and competitive dynamics. The report also considers the impact of technological advancements, regulatory changes, and consumer behavior on each segment. Detailed forecast data is provided for each segment for the forecast period 2025-2033.

Key Drivers of Telecom Industry in Israel Growth

The Israeli telecom sector's growth is driven by several factors, including rising smartphone penetration, increasing demand for high-speed internet access, government initiatives to expand digital infrastructure, and the proliferation of data-intensive applications. 5G technology is set to play a crucial role in the industry's future growth trajectory, unlocking new capabilities and use cases while driving further demand for data services. The favorable regulatory environment, encouraging investment in network infrastructure, is also supporting the industry growth.

Challenges in the Telecom Industry in Israel Sector

The Israeli telecom industry faces challenges including intense competition, pressure on pricing, and the need for continuous investment in infrastructure upgrades to support growing data demand. The regulatory environment, while supportive, also imposes compliance costs. Attracting and retaining skilled workforce is another challenge for continued growth. Finally, the rapid evolution of technological advancements adds to the challenge of staying ahead of the competition, especially in areas like 5G adoption and the integration of new technologies into the network.

Emerging Opportunities in Telecom Industry in Israel

Significant opportunities exist in the Israeli telecom sector, particularly in the expansion of 5G networks, the adoption of IoT technologies, and the provision of advanced digital services. The growing demand for high-speed broadband access across sectors such as government, healthcare, and education presents an important opportunity. The development of innovative service bundles that cater to the specific needs of businesses and households represent a further opportunity for industry leaders. Furthermore, exploring new revenue streams through the integration of cloud-based services and the expansion of services into new markets will drive expansion.

Leading Players in the Telecom Industry in Israel Market

- AT&T

- 018 Xfone (we4G)

- TCS Telecom

- HOT Telecom

- Golan Telecom

- Orange

- Pelephone

- Telefonica

- Cellcom

- Bezeq

Key Developments in Telecom Industry in Israel Industry

- July 2022: CYTA's participation in the USD 850 Million East Med Corridor (EMC) submarine cable system significantly enhances Israel's international connectivity and boosts its capacity for data transmission.

- August 2022: The passive infrastructure cooperation deal between Pelephone and PHI Networks, followed by the joint venture between Partner Communications and HOT Mobile, demonstrates a strategic shift towards infrastructure sharing and cost optimization within the industry.

Future Outlook for Telecom Industry in Israel Market

The future of the Israeli telecom market is bright, driven by the continued expansion of 5G, growth in data consumption, and the emergence of new technologies like IoT. Opportunities abound for operators that can effectively leverage these trends, offering innovative services and investing strategically in network infrastructure. The focus will continue to be on the implementation of 5G networks, the creation of comprehensive digital services bundles, and the successful integration of new technologies that support the industry growth. The sustained economic growth and government support will pave the way for continued market growth.

Telecom Industry in Israel Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Telecom Industry in Israel Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Telecom Industry in Israel REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising demand for 5G; Growth of IoT usage in Telecom

- 3.3. Market Restrains

- 3.3.1. Lack of Human Expertise and Empathy; Nascency of the Technology

- 3.4. Market Trends

- 3.4.1. Rising demand for fixed broadband services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Telecom Industry in Israel Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. North America Telecom Industry in Israel Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Services

- 6.1.1. Voice Services

- 6.1.1.1. Wired

- 6.1.1.2. Wireless

- 6.1.2. Data and

- 6.1.3. OTT and PayTV Services

- 6.1.1. Voice Services

- 6.1. Market Analysis, Insights and Forecast - by Services

- 7. South America Telecom Industry in Israel Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Services

- 7.1.1. Voice Services

- 7.1.1.1. Wired

- 7.1.1.2. Wireless

- 7.1.2. Data and

- 7.1.3. OTT and PayTV Services

- 7.1.1. Voice Services

- 7.1. Market Analysis, Insights and Forecast - by Services

- 8. Europe Telecom Industry in Israel Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Services

- 8.1.1. Voice Services

- 8.1.1.1. Wired

- 8.1.1.2. Wireless

- 8.1.2. Data and

- 8.1.3. OTT and PayTV Services

- 8.1.1. Voice Services

- 8.1. Market Analysis, Insights and Forecast - by Services

- 9. Middle East & Africa Telecom Industry in Israel Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Services

- 9.1.1. Voice Services

- 9.1.1.1. Wired

- 9.1.1.2. Wireless

- 9.1.2. Data and

- 9.1.3. OTT and PayTV Services

- 9.1.1. Voice Services

- 9.1. Market Analysis, Insights and Forecast - by Services

- 10. Asia Pacific Telecom Industry in Israel Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Services

- 10.1.1. Voice Services

- 10.1.1.1. Wired

- 10.1.1.2. Wireless

- 10.1.2. Data and

- 10.1.3. OTT and PayTV Services

- 10.1.1. Voice Services

- 10.1. Market Analysis, Insights and Forecast - by Services

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 AT&T

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 018 Xfone (we4G)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TCS Telecom

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HOT Telecom

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Golan Telecom

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Orange

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pelephone

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Telefonica

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cellcom

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bezeq

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 AT&T

List of Figures

- Figure 1: Global Telecom Industry in Israel Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Israel Telecom Industry in Israel Revenue (Million), by Country 2024 & 2032

- Figure 3: Israel Telecom Industry in Israel Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Telecom Industry in Israel Revenue (Million), by Services 2024 & 2032

- Figure 5: North America Telecom Industry in Israel Revenue Share (%), by Services 2024 & 2032

- Figure 6: North America Telecom Industry in Israel Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Telecom Industry in Israel Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Telecom Industry in Israel Revenue (Million), by Services 2024 & 2032

- Figure 9: South America Telecom Industry in Israel Revenue Share (%), by Services 2024 & 2032

- Figure 10: South America Telecom Industry in Israel Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Telecom Industry in Israel Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Telecom Industry in Israel Revenue (Million), by Services 2024 & 2032

- Figure 13: Europe Telecom Industry in Israel Revenue Share (%), by Services 2024 & 2032

- Figure 14: Europe Telecom Industry in Israel Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe Telecom Industry in Israel Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa Telecom Industry in Israel Revenue (Million), by Services 2024 & 2032

- Figure 17: Middle East & Africa Telecom Industry in Israel Revenue Share (%), by Services 2024 & 2032

- Figure 18: Middle East & Africa Telecom Industry in Israel Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa Telecom Industry in Israel Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Telecom Industry in Israel Revenue (Million), by Services 2024 & 2032

- Figure 21: Asia Pacific Telecom Industry in Israel Revenue Share (%), by Services 2024 & 2032

- Figure 22: Asia Pacific Telecom Industry in Israel Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Telecom Industry in Israel Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Telecom Industry in Israel Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Telecom Industry in Israel Revenue Million Forecast, by Services 2019 & 2032

- Table 3: Global Telecom Industry in Israel Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Telecom Industry in Israel Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Global Telecom Industry in Israel Revenue Million Forecast, by Services 2019 & 2032

- Table 6: Global Telecom Industry in Israel Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Telecom Industry in Israel Revenue Million Forecast, by Services 2019 & 2032

- Table 11: Global Telecom Industry in Israel Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Telecom Industry in Israel Revenue Million Forecast, by Services 2019 & 2032

- Table 16: Global Telecom Industry in Israel Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United Kingdom Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Spain Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Russia Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Benelux Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Nordics Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Telecom Industry in Israel Revenue Million Forecast, by Services 2019 & 2032

- Table 27: Global Telecom Industry in Israel Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Turkey Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Israel Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: GCC Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: North Africa Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: South Africa Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Middle East & Africa Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Telecom Industry in Israel Revenue Million Forecast, by Services 2019 & 2032

- Table 35: Global Telecom Industry in Israel Revenue Million Forecast, by Country 2019 & 2032

- Table 36: China Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: India Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: South Korea Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: ASEAN Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Oceania Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Asia Pacific Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Telecom Industry in Israel?

The projected CAGR is approximately 1.00%.

2. Which companies are prominent players in the Telecom Industry in Israel?

Key companies in the market include AT&T, 018 Xfone (we4G), TCS Telecom, HOT Telecom, Golan Telecom, Orange, Pelephone, Telefonica, Cellcom, Bezeq.

3. What are the main segments of the Telecom Industry in Israel?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising demand for 5G; Growth of IoT usage in Telecom.

6. What are the notable trends driving market growth?

Rising demand for fixed broadband services.

7. Are there any restraints impacting market growth?

Lack of Human Expertise and Empathy; Nascency of the Technology.

8. Can you provide examples of recent developments in the market?

August 2022: The Ministry of Communications (MoC) approved a passive infrastructure cooperation deal between the cellco, Pelephone, and PHI Networks. Later, it would begin the joint venture partnership between Partner Communications and HOT Mobile. This deal aimed to expand its passive infrastructure cooperation at cell sites.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Telecom Industry in Israel," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Telecom Industry in Israel report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Telecom Industry in Israel?

To stay informed about further developments, trends, and reports in the Telecom Industry in Israel, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence