Key Insights

The United Kingdom real-time payments market is experiencing robust growth, driven by the increasing adoption of digital payment methods and the rising demand for faster and more efficient transaction processing. The market's Compound Annual Growth Rate (CAGR) of 11.45% from 2019 to 2024 suggests a significant expansion, projected to continue into the forecast period (2025-2033). Key drivers include the increasing penetration of smartphones and mobile banking applications, coupled with government initiatives promoting digital financial inclusion. The shift towards cashless transactions and the growing prevalence of e-commerce are further fueling market expansion. P2P (person-to-person) payments are a major segment, benefiting from the widespread use of social media and mobile messaging platforms for transferring funds. The P2B (person-to-business) segment is also experiencing growth, driven by the increasing adoption of online bill payments and digital wallets. Major players like Visa, Mastercard, PayPal, and Apple Pay are actively shaping market dynamics through continuous innovation and strategic partnerships. Competition is intense, with companies focused on enhancing user experience, security features, and expanding their global reach.

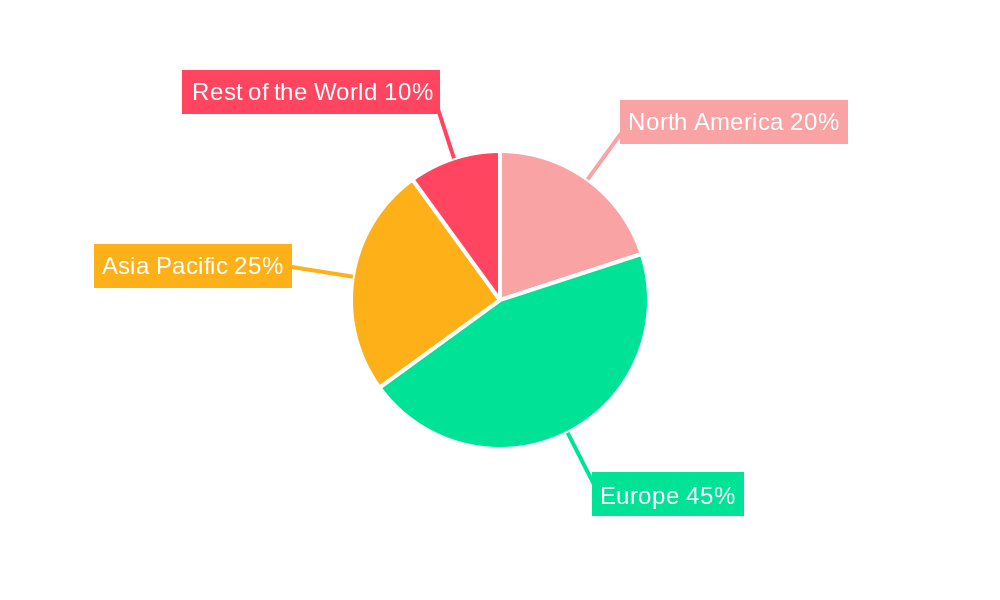

The market segmentation by payment type (P2P and P2B) provides valuable insights into consumer preferences and business strategies. Regional analysis reveals that while the UK market is robust, growth is also expected across Europe and the Asia-Pacific regions, indicating a broader global trend towards real-time payments. While regulatory changes and security concerns can act as potential restraints, the overall outlook for the UK real-time payments market remains positive. The continued investment in technology infrastructure, coupled with rising consumer demand, is likely to sustain this high growth trajectory throughout the forecast period. The market size in 2025 is estimated at a substantial figure based on the provided CAGR and market trends, indicating significant opportunities for both established players and new entrants.

United Kingdom Real Time Payments Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United Kingdom's real-time payments market, offering invaluable insights for industry professionals, investors, and strategists. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report delivers a complete picture of market dynamics, trends, and future prospects. The analysis incorporates data from the historical period (2019-2024) and presents estimated figures for 2025.

United Kingdom Real Time Payments Market Structure & Innovation Trends

This section analyzes the competitive landscape of the UK real-time payments market, examining market concentration, innovation drivers, regulatory frameworks, and key industry activities. The market is characterized by a moderately concentrated structure, with major players like Visa, Mastercard, and PayPal holding significant market share (xx%). However, the emergence of fintech companies and the increasing adoption of mobile payment solutions are driving increased competition.

- Market Concentration: The top 5 players command approximately xx% of the market share in 2025, indicating moderate concentration.

- Innovation Drivers: The push for faster, more secure, and convenient payment solutions is driving innovation, particularly in areas like mobile payments and embedded finance.

- Regulatory Frameworks: The UK's regulatory environment plays a crucial role in shaping market dynamics, impacting both security and innovation. Compliance with PSD2 and other regulations is a key factor for all market participants.

- Product Substitutes: Traditional payment methods like checks and bank transfers pose some level of competition, however, their usage is declining rapidly due to the efficiency and convenience offered by real-time payments.

- End-User Demographics: The market is driven primarily by digitally savvy consumers and businesses. Increased smartphone penetration and digital literacy are major growth drivers.

- M&A Activities: The market has seen significant M&A activity in recent years, with deal values exceeding £xx Million in the past five years. This consolidation is likely to continue as companies seek to expand their market share and capabilities. Examples include (xx number) acquisitions in the past 5 years, totaling xx Million.

United Kingdom Real Time Payments Market Market Dynamics & Trends

The UK real-time payments market is experiencing robust growth, driven by several key factors. The increasing adoption of mobile devices and the rising popularity of e-commerce are fueling the demand for faster and more convenient payment methods. Technological advancements, such as the development of new payment platforms and improved security measures, are further accelerating market growth. Consumer preferences are shifting towards real-time payments due to their speed and convenience, which is driving increased market penetration. Competitive dynamics are intense, with both established players and new entrants vying for market share. This intense competition is leading to innovation and improvements in services, benefiting consumers. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033.

Dominant Regions & Segments in United Kingdom Real Time Payments Market

The market demonstrates significant regional variations, with the London and South East regions leading in terms of adoption and transaction volume. This dominance stems from higher levels of digital literacy and a more concentrated business environment. The P2P (person-to-person) segment currently dominates the market, fueled by the widespread adoption of mobile payment apps. However, P2B (person-to-business) transactions are also showing strong growth.

- Key Drivers of P2P Segment Dominance:

- High smartphone penetration.

- Ease of use of mobile payment apps.

- Growing popularity of peer-to-peer lending and borrowing platforms.

- Key Drivers of P2B Segment Growth:

- Increased e-commerce adoption.

- Growing demand for faster payment processing in businesses.

- Government initiatives promoting digital payments.

United Kingdom Real Time Payments Market Product Innovations

The UK real-time payments market is characterized by continuous product innovation, driven primarily by advancements in mobile technology and improved security measures. New payment platforms and applications are constantly emerging, enhancing user experience and expanding the capabilities of real-time payment systems. The integration of biometric authentication and AI-powered fraud detection are key trends, improving both security and convenience. These innovations are driving market fit by enabling faster, more secure, and more convenient transactions.

Report Scope & Segmentation Analysis

This report segments the UK real-time payments market based on the type of payment:

P2P (Person-to-Person): This segment is expected to maintain its dominant position, driven by increasing smartphone penetration and the popularity of mobile payment apps. The market size for P2P payments is projected to reach xx Million by 2033, with a CAGR of xx%. Competition in this segment is intense, with established players and new entrants constantly vying for market share.

P2B (Person-to-Business): This segment is experiencing significant growth, fueled by the rising adoption of e-commerce and the demand for faster payment processing in businesses. The market size is projected to reach xx Million by 2033, with a CAGR of xx%. The competitive landscape is dynamic, with both established payment processors and fintech companies offering solutions.

Key Drivers of United Kingdom Real Time Payments Market Growth

The growth of the UK real-time payments market is driven by a confluence of factors, including:

- Technological advancements: The development of new payment platforms, improved security measures, and the integration of mobile devices are fueling market expansion.

- Government regulations: Favorable regulations encouraging digital payments are boosting market adoption.

- Economic factors: The growth of e-commerce and increasing digital literacy are key contributors.

Challenges in the United Kingdom Real Time Payments Market Sector

Several challenges hinder the growth of the UK real-time payments market, including:

- Security concerns: Ensuring the security of transactions remains a crucial challenge. The risk of fraud and data breaches necessitates robust security measures.

- Regulatory hurdles: Complex regulatory compliance requirements can hinder market expansion.

- Interoperability issues: Ensuring seamless interoperability between different payment systems is crucial for wide-scale adoption.

Emerging Opportunities in United Kingdom Real Time Payments Market

The UK real-time payments market presents numerous emerging opportunities, including:

- Open banking: The increasing adoption of open banking technologies will create opportunities for innovative payment solutions.

- Embedded finance: The integration of payment functionalities within other applications will expand the market reach.

- Growth of the digital economy: The continuous expansion of e-commerce and the digital economy will create significant market potential.

Leading Players in the United Kingdom Real Time Payments Market Market

- VISA Inc

- Fiserv Inc

- Apple Inc (Apple Pay)

- Diners Club International

- Google LLC (Google Pay)

- Mastercard Inc

- ACI Worldwide Inc

- Paypal Holdings Inc

- Finastra Limite

- Samsung Electronics (UK) Limited (Samsung Pay)

Key Developments in United Kingdom Real Time Payments Market Industry

- June 2022: Apple announces its 'Pay Later' service for the UK and Europe, incorporating Apple IDs for fraud detection and minimizing losses. The creation of Apple Financing LLC demonstrates a move towards greater control over the service. This development signals a significant shift in the "buy now, pay later" market and the increasing competition in the financial technology sector.

Future Outlook for United Kingdom Real Time Payments Market Market

The UK real-time payments market is poised for continued robust growth, driven by technological innovations, increased consumer adoption, and favourable regulatory frameworks. Opportunities in open banking, embedded finance, and the expansion of the digital economy will further accelerate market expansion. Strategic partnerships and investments in advanced security measures will be key to navigating the competitive landscape and capitalizing on future market potential. The market is projected to reach xx Million by 2033, offering significant opportunities for businesses in the sector.

United Kingdom Real Time Payments Market Segmentation

-

1. Type of Payment

- 1.1. P2P

- 1.2. P2B

United Kingdom Real Time Payments Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Real Time Payments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Internet Penetration; Decreasing Traditional Banking trend; Growing Requirement of Convenient Payment Options

- 3.3. Market Restrains

- 3.3.1. Operational Challenges Involving Cross-border Payments

- 3.4. Market Trends

- 3.4.1. Growing Requirement of Convenient Payment Options

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Real Time Payments Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Payment

- 5.1.1. P2P

- 5.1.2. P2B

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Type of Payment

- 6. North America United Kingdom Real Time Payments Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1. undefined

- 7. Europe United Kingdom Real Time Payments Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1. undefined

- 8. Asia Pacific United Kingdom Real Time Payments Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1. undefined

- 9. Rest of the World United Kingdom Real Time Payments Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1. undefined

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 VISA Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Fiserv Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Apple Inc (Apple Pay)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Diners Club International

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Google LLC (Google Pay)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mastercard Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 ACI Worldwide Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Paypal Holdings Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Finastra Limite

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Samsung Electronics (UK) Limited (Samsung Pay)

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 VISA Inc

List of Figures

- Figure 1: United Kingdom Real Time Payments Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Real Time Payments Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Real Time Payments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Real Time Payments Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: United Kingdom Real Time Payments Market Revenue Million Forecast, by Type of Payment 2019 & 2032

- Table 4: United Kingdom Real Time Payments Market Volume K Unit Forecast, by Type of Payment 2019 & 2032

- Table 5: United Kingdom Real Time Payments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United Kingdom Real Time Payments Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: United Kingdom Real Time Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United Kingdom Real Time Payments Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Real Time Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Kingdom Real Time Payments Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United Kingdom Real Time Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United Kingdom Real Time Payments Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: United Kingdom Real Time Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Real Time Payments Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: United Kingdom Real Time Payments Market Revenue Million Forecast, by Type of Payment 2019 & 2032

- Table 16: United Kingdom Real Time Payments Market Volume K Unit Forecast, by Type of Payment 2019 & 2032

- Table 17: United Kingdom Real Time Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Real Time Payments Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Real Time Payments Market?

The projected CAGR is approximately 11.45%.

2. Which companies are prominent players in the United Kingdom Real Time Payments Market?

Key companies in the market include VISA Inc, Fiserv Inc, Apple Inc (Apple Pay), Diners Club International, Google LLC (Google Pay), Mastercard Inc, ACI Worldwide Inc, Paypal Holdings Inc, Finastra Limite, Samsung Electronics (UK) Limited (Samsung Pay).

3. What are the main segments of the United Kingdom Real Time Payments Market?

The market segments include Type of Payment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Internet Penetration; Decreasing Traditional Banking trend; Growing Requirement of Convenient Payment Options.

6. What are the notable trends driving market growth?

Growing Requirement of Convenient Payment Options.

7. Are there any restraints impacting market growth?

Operational Challenges Involving Cross-border Payments.

8. Can you provide examples of recent developments in the market?

June 2022: In the United Kingdom and Europe, Apple's 'Pay Later' service will reportedly use Apple IDs to help detect fraudulent transactions and minimize the chance of losses. As most financial firms that provide "buy now, pay later" services use third-party credit reports to judge whether they can afford to offer credit to new and existing customers. For Apple Pay Later, a subsidiary has been created called Apple Financing LLC, giving Apple more direct control over the service.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Real Time Payments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Real Time Payments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Real Time Payments Market?

To stay informed about further developments, trends, and reports in the United Kingdom Real Time Payments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence